When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

October 28, 2022

Fiat Lux

Featured Trade:

(QUEEN MARY II SEMINAR AT SEA)

Hello everyone.

Well, he’s finally done it! Musk now owns Twitter and has already set about the cleansing process by firing the CEO and other top executives. Apparently, he also has the intention of cleaning up the content of Twitter. Musk has updated his Twitter description to “Chief Twit.”

Musk tells us the reason he bought Twitter is because it is “important to the future of civilization to have a common digital town square, where a wide range of beliefs can be debated in a healthy manner, without resorting to violence. He went on to say in his tweet that “there is currently great danger that social media will splinter into the far right-wing and far left-wing echo chambers that generate more hate and divide our society.”

Musk added that he did not buy Twitter “to make more money. I did it to try to help humanity, whom I love.”

Musk says that Twitter must be “warm and welcoming to all….”

In reporting season, Amazon disappoints.

Third quarter results were reported today, and they missed analysts’ estimates. The forecast is for a disappointing fourth quarter too. The macroeconomic headwinds - inflation, high interest rates, etc, - have resulted in a slowdown in Amazon’s core retail business as consumers returned to shopping in stores. This does not bode well for the holiday shopping season coming up. According to Adobe, online sales are expected to grow just 2.5%.

But Apple was solid and remains a stock to own. Revenue rose 8% year-over-year to $90.1 billion, exceeding expectations of $88.9 billion and marking a September quarter record. Earnings of $1.29 per share came in ahead of the consensus $1.27.

Could there be a turnaround in Treasury Bonds in 2023?

Two and half centuries of market history tell us that this is a possibility.

Bonds have been crushed this year. 2022 has been part of a two-year losing streak which hasn’t happened since 1958-59. The bond ETF, the $24 billion iShares 20+ Year Treasury Bond (TLT) fund is down more than 34% year to date and about 38% from where it started in 2021. By comparison, the S&P 500 is down just 18%, which is considerably better than the bond market returns.

John has stopped sending bear put spread trade alerts on the TLT. He thinks the rich uncle has paid his dues. Clients/subscribers have made a small fortune trading the TLT in the last couple of years just by following John’s trade alerts.

Bank of America explains that the last time Treasuries fell more than 5% and were negative the following year happened in 1861. And interestingly, the last time government bonds posted negative returns for three straight years? Never.

As Bank of America points out 250 years of history is something we should all heed. Keep your eye on bonds in 2023 and wait for those trade alerts from John.

Nancy Pelosi’s husband assaulted

The assailant broke into their San Francisco home early Friday morning reportedly looked for the speaker – Nancy Pelosi. Paul Pelosi was taken to hospital and is expected to make a full recovery. Police arrested David Depape and he will be charged with attempted homicide, assault with a deadly weapon, elder abuse and burglary.

For my Australian readers, what do you miss about Australia when you go overseas for a holiday or for work?

For those readers, who are not from Australia, I ask you the same question. What do you miss most about your own country when you travel away from home?

Have a great weekend.

Cheers,

Jacque

Believe you can and you’re halfway there.

Theodore Roosevelt

Mad Hedge Biotech and Healthcare Letter

October 27, 2022

Fiat Lux

Featured Trade:

(A HIDDEN TREASURE IN THESE TURBULENT TIMES)

(BMY), (AMGN)

Biotechnology and healthcare companies are not exactly the thrilling investments that tech stocks or other growth-centered businesses tend to be described as.

Nonetheless, one of the reasons I find this sector attractive is that the companies can offer steady growth in extensively diverse markets.

From biopharmaceutical treatments to household items, the products these businesses develop are the kinds people tend to need and use regularly constantly.

While the biotechnology and healthcare sector doesn’t always beat the general market, the combo of steady growth, resilient returns, and reliable dividends generally make it an incredibly attractive option for investors.

Among the companies in this segment, one of the names you can buy and hold in the long run is Bristol Myers Squibb (BMY).

BMY is hailed as the seventh-biggest biopharmaceutical company across the globe in terms of sales. In 2021, the business recorded $46.4 billion in total revenue, which was up by 9% from 2020.

More than half of BMY’s revenue last year was generated from sales of three of its best-selling treatments: multiple myeloma drug Revlimid, Eliquis, and cancer treatment Opdivo.

The full-year revenue for all three drugs jumped that year, with Revlimid climbing by 6% to reach $12.8 billion, blood thinning medication Eliquis rising by 17% to hit $10.8 billion, and Opdivo increasing by 8% to record $7.5 billion.

Despite the impressive performance of these top-selling products, BMY has been diversifying its portfolio to cover a vast lineup of candidates in the fields of immunology, hematology, and, of course, oncology.

The healthcare giant has also grown, in part, through acquisitions, and part of its 2021 revenue of $46 billion, which was twice more than its 2018 revenue of $23 billion, came from these efforts. Moreover, BMY has reported a free cash flow of roughly $13 billion for two consecutive years.

In 2022, BMY reported a lackluster third-quarter performance. While the company’s revenue slid by 3% to $11.2 billion, the stock still climbed 2.31%.

This could be attributed to the fact that BMY managed to beat expectations as analysts predicted a more significant drop due to foreign exchange impacts.

Aside from these, Revlimid has been dealing with increased competition worldwide in the past months. Specifically, this bone marrow cancer drug has been facing “generic erosion” thanks to the emergence of cheaper alternatives in the market.

Picking up the slack from Revlimid is Eliquis, which has become the company’s top performer in terms of revenue and projected growth. Sales for this drug rose by 10% in the third quarter to reach $2.66 billion.

Meanwhile, sales of BMY’s newly launched products jumped 61% to record $553 million.

Future growth is anticipated to be led by Sotyktu, an oral drug for moderate to severe plaque psoriasis that recently gained FDA approval.

In the US alone, roughly 7.5 million individuals suffer from psoriasis. This is a promising market for BMY, which has been aggressively searching for products to rejuvenate its portfolio.

Since it was only recently approved, Sotyktu’s contribution to BMY’s revenue has yet to be proven. However, the drug recorded better results than Amgen’s (AMGN) blockbuster drug Otezla, which raked in $2.25 billion in sales in 2021.

Given the released data, target market, and more promising results from Sotyktu, BMY’s drug is estimated to reach peak sales at $4.2 billion by 2028.

Overall, BMY is an excellent bet during these turbulent times. In the past 10 years, the company has generated total returns, including dividends, of 190%.

This isn’t far from the 223% returns recorded by the S&P 500. Moreover, if BMY sustains its recent performance, then it’s only a matter of time before it successfully shrinks that gap. I suggest that long-term investors buy the dip.

Mad Hedge Bitcoin Letter

October 27, 2022

Fiat Lux

Featured Trade:

(SILVER LININGS)

(BTC), (GOOGL), (GENZ)

With all the Dr. Dooms out there, and you know there are plenty, it might seem like a broken record.

Crypto’s been kicked around, mocked, and left for dead so many times, you’d think it owed Wall Street money. With all the criticism hurled its way lately, you'd be forgiven for thinking it has no future. But I wouldn't bet on that.

The road ahead for crypto is lined with silver linings. Not obvious to the casual observer, perhaps, but impossible for any sharp-eyed investor to ignore.

Let’s talk Google or Alphabet, if you want to be formal about it. Their latest earnings didn’t mention crypto by name, but the subtext was loud and clear. The advertising landscape is shifting. Payments are evolving. And guess who's still lingering in the machinery? Crypto.

In 2025 alone, the blockchain-in-media and advertising market clocked in at a cool $2.68 billion. That’s not chump change. It’s proof that crypto-related ad spend hasn’t vanished but simply changed costumes. The industry didn’t disappear. Instead, it adapted.

So when a behemoth like Google starts missing its growth targets, part of that slowdown reflects a deeper truth: money is moving differently now. And crypto, along with its Web3 cousins, is very much a part of that evolution.

Meanwhile, financial firms are still splashing ad dollars across every media channel that can spell ROI. And while not every banner screams Bitcoin, the underlying infrastructure - wallets, exchanges, DeFi platforms - is still feeding the ecosystem. Big media still wants those clicks, and crypto still delivers the eyeballs.

But forget ad dollars for a second. The more important asset is the audience.

Let’s not kid ourselves. Plenty of retail traders got torched during the last cycle. Some won’t touch crypto again if you paid them in Ethereum. Despite that, the appetite among younger investors is as strong as ever.

Case in point: Gemini’s 2024–2025 survey showed over 51% of Gen Z respondents worldwide have owned, or still own, some form of crypto. In the U.S., that number held steady.

Meanwhile, a separate US investment trends report found that 48% of Gen Z investors are using crypto exchanges. That’s more than those using traditional financial advisors.

This shouldn’t come as a surprise though. After years of arbitrary lockdowns and enough inflation to make your grocery bill look like a car payment, younger generations are rethinking everything. They find traditional retirement plans suspicious. They think the US financial system is rigged. These folks have gone from skeptical to cynical.

And who can blame them? The stock market got clobbered in 2022, and it hasn’t exactly been a parade since. Bonds didn’t offer much comfort either. This might be yet another year where both stocks and bonds disappoint - a double whammy that laughs in the face of your grandpa’s 60/40 portfolio.

Ah, yes, the sacred 60/40 split. Sixty percent in stocks, forty in bonds. Supposed to give you growth with a safety net. Well, in today’s market, that safety net has more holes than ever.

It’s time for a reset.

Wealth-building isn’t what it used to be. When both stocks and bonds are sagging - and when the Fed spent years flooding the economy with Monopoly money - there are no free lunches left.

Many upper-middle-class families thought they were cruising toward retirement on autopilot. Instead, they’ve been shoved back into the workforce, legs flailing, as everyday costs spike anywhere from 8% to 50%, depending on your zip code.

Now, some people are still parroting the old “crypto is on life support” line. That was maybe true two years ago. Today? Please. Forget survival. In 2025, crypto was on the offensive.

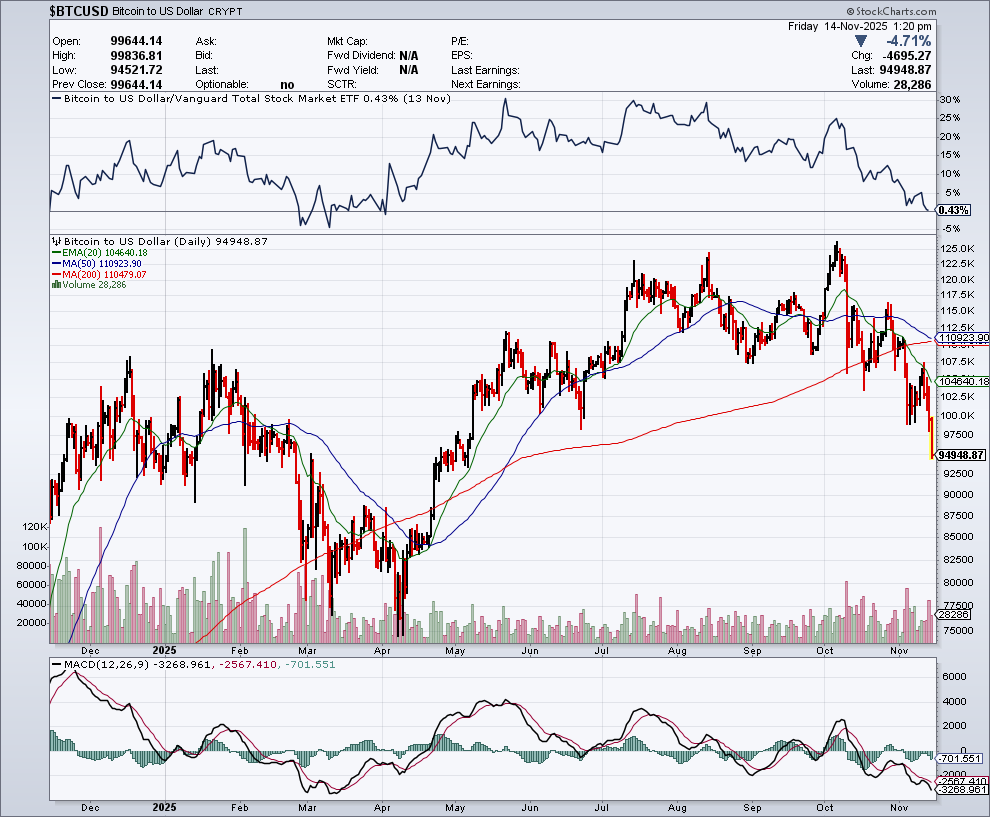

Bitcoin cracked the $100,000 barrier in November. Not on some fantasy of a future Fed pivot, but on the back of actual, real-deal monetary easing that started in late 2023.

We’re no longer guessing about the pivot. It happened. Now the conversation is about stability, and crypto has shown it can handle that just fine.

The idea that Bitcoin rises or falls based purely on Jerome Powell’s caffeine intake is dated. This market has grown up. With spot Bitcoin ETFs, regulated U.S. exchanges, and serious institutional muscle, crypto now has more than just a pulse. It has infrastructure, credibility, and momentum.

That said, the biggest threat to crypto remains the same as always: the people in it. The panic sellers. The hype chasers. The ones who buy the top and sell the bottom. The space could use fewer influencers and more investors.

Meanwhile, the harsh reality is sinking in across America: more families are scrambling to patch together some kind of retirement. And whether you’re 28 or 68, dismissing crypto might not be the smartest move.

According to the 2025 Modern Wealth Survey by Charles Schwab, 41% of Americans now consider crypto a good investment. And 65% of those already in the space say they’re planning to add more.

Here’s the bottom line. If you believe, as I do, that crypto has matured - from a speculative gamble to a legitimate, evolving asset class - then turning your back on it could be the biggest mistake of all.

Position sizing matters. Discipline matters. But the opportunity? Still very much alive.

Global Market Comments

October 27, 2022

Fiat Lux

Featured Trade:

(WHY RIVIAN IS THE NEXT TESLA),

(RIVN), (TSLA)

I had the good fortune to grab a few minutes this week with RJ Scaringe, the founder and CEO of electric truck maker Rivian (RIVN).

Rivian produces three types of EVs: the R1T pickup truck, the R1S SUV, and Amazon's EDV (electric delivery van). Its R1 vehicles start at under $70,000 and can travel more than 300 miles on a single charge. High-end Rivian competitors include Range Rover, Mercedes G Class Gelandewagen, and Tesla Cybertruck. Rivian doesn't manufacture any electric sedans, the focus of other EV competitors.

And here is the key to buying Rivian at this particular time. At 25,000, it is right at the mass production point where Tesla shares went ballistic all those years ago. And it already has an 80% decline in the price in the rearview mirror.

Scaringe has been a car nut his whole life, spending his youth restoring vintage classics in his garage. He is no lightweight. He earned a bachelor’s degree from the famed Rensselaer Polytechnic in upstate New York, and a PhD from MIT in Mechanical Engineering.

Today, he is a billionaire in his own right. It’s nice to know that Rivian has a backup plan. Rivian now has 14,000 employees and boasts a market capitalization of $30.4 billion. Sure, that is down from a peak value of $176 billion in 2020. But that is where the big money is made, buying Cadillacs at Volkswagen prices.

Of course, Rivian’s will be compared with the Tesla (TSLA) Model X, which lacks the ground clearance and towing power of a Rivian. Perhaps a better comparison will be made against the Tesla Cybertruck, due out in 2023.

In 2024, Rivian plans to open its second plant in Georgia. After it fully expands its Illinois plant, it expects its annual production capacity to reach 600,000 vehicles -- but it hasn't set a firm deadline for reaching that milestone yet. Rivian expects to produce 25,000 vehicles in 2022 and has already added a second shift. The company came in with a strong performance, with 4,400 units manufactured in Q2 ending in July.

To say that Rivian is the hot car of the day would be a vast understatement. New cars are trading for double list on the grey market. Owners complain of getting mobbed with gawkers whenever they hit the beach or the ski slopes. The buzz has led to an outstanding order book of an impressive 98,000, or four years of current production. The obvious cool factor allows enormous pricing power.

Rivian just completed deployments of its 600 horsepower, four-wheel drive R1 vehicle across the country to gain operational feedback.

Inflation Reduction Act passed this summer greatly accelerated rollout of the entire EV industry, which created a $7,500 per vehicle tax credit on top of state benefits. Rivian is expanding charging network to accommodate greater traffic.

Looking at the earnings report shows this company is still at the venture capital level. It posted $364 million Q2 revenues but lost $704 million. High material costs, supply chain problems, and $304 million in write-downs on accounting changes added to operating woes. That brought a $1.3 billion total Q2 loss. There should be a $5.45 billion loss for all of 2022.

Scaringe remains optimistic. Rivian has $15 billion in cash to complete its buildout. He sees a clear path to 25% gross profit margin, EBITDA in the high teens, and a 10% free cash flow.

Building four vehicles on two assembly lines is costing it money. As sales ramp up, dedicated model assembly lines become more cost-efficient. Supply chain problems with semiconductors, as with the rest of the EV industry, are inevitable.

Data collection could eventually make the company more valuable than truck manufacturing alone, as is the case with Tesla. Rivians are hard to buy because Amazon (AMZN), a 25% owner of the company, gets first dibs on deliveries.

Yes, this company offers venture capital-type risks. But it offers venture capital type returns as well, up 10X-50X from here.

Mad Hedge Technology Letter

October 26, 2022

Fiat Lux

Featured Trade:

(THE SHINE HAS BEEN WIPED OFF FOR NOW)

(GOOGL)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.