When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

December 19, 2022

Fiat Lux

Featured Trade:

(I’M TAKING OFF FOR THE YEAR)

I need a vacation.

I have been working nonstop for years and desperately need a break.

You can tear up your Rolodex card for me, unfriend me on Facebook, designate my email address as SPAM, and block my Twitter account. It won’t do you any good.

If I don’t take some time off, I am going to start raving MAD!

Over the last three years, I have worked the hardest in my entire life.

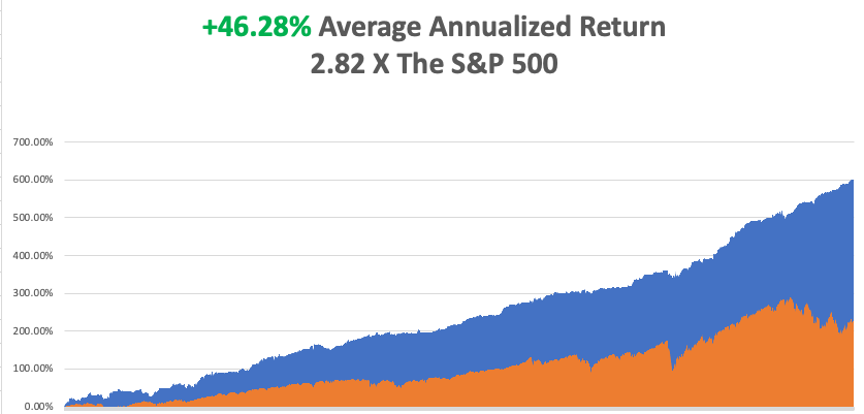

This year, I have brought in a total return of +97.3%, versus -23.7% for the S&P 500, far and away the best of my life and almost certainly yours as well. If you got half of my performance, you beat virtually everyone else in the industry, even the best hedge funds. In other words, I under-promised and over-delivered in spades.

If you wonder why I do this, it’s really very simple. Read my inbox and you would burst into tears.

Every day, I learn tales of mortgages paid off, student loans dealt with, college educations financed, and early retirements launched. I am improving lives by the thousands. That’s far better than any hedge fund bonus could offer me, although I wouldn’t mind owning the Golden State Warriors.

At this late stage in my life, the most valuable thing is to be needed and listened to. If that means becoming a cult leader, that’s fine with me. After all, the last guy to try this route got crucified.

This was one of those once-in-a-century years, like 1968, when absolutely everything happened; the War in Ukraine, an energy crisis, an interest rate spike, and a midterm election. Any One of these could have triggered a bear market. We got all four. To say we had challenges would be putting it mildly.

I had to become a chief medical officer, advising staff in four countries and five US states which vaccine to get and how to get it. Not a single person got sick. Then the US staff all applied for PPP loans and got them.

When the Philippine staff began starving because of severe government lockdown orders, I went to Costco, bought a 50-pound bag of rice, and sent it to Manila by Federal Express. It worked.

When horrific uncontrollable wildfires broke out in California, I flew spotter planes for Cal Fire, holding the stick with one hand and a pair of binoculars with the other, looking for trouble and radioing in coordinates and directing aerial tankers. Nobody can fly wildfires like I can.

I lost access to my Lake Tahoe house when the big fire hit right in the middle of a remodel. All the contractors disappeared chasing much higher-paying insurance work. At least we now have a 20-mile-wide fire break to the southwest of the house.

I have high hopes for next summer, starting with my seminar at sea on the Queen Mary II.

On top of all this, I was on speed dial at the Joint Chiefs and the US Marine Corps. A major? Really? Seems you’re not the only one in desperate need of global macro advice. The sanctions are working great by the way.

So, I will spend the next two weeks reading the deep research, speaking with old hedge fund buddies, and trying to come up with a game plan for 2023. One thing is certain: we will likely make more money this year than next, the setup is so clear.

Instead of sending out urgent trade alerts, emergency news flashes, and more research than you can read, I’ll be playing Monopoly and Risk, practicing my banjo, a catching up on some classic films.

I’ll watch Elf for the millionth time if the kids watch Gary Cooper’s 1949 Task Force, the history of naval aviation (semper fi).

In the meantime, I’ll be running some of my favorite research pieces from the past over the next two weeks. I will not be sending Hot Tips until January 3rd.

We got five feet of snow in Tahoe by last weekend. Boy, do we need it.

So, everyone please have some great holidays, spend your trading profits, and get well rested. We have some serious work to do in 2023.

Merry Christmas and Happy New Year,

John Thomas

CEO and Publisher

The Diary of a Mad Hedge Fund Trader

Sunday evening

December 18, 2022

Hello everyone,

We’re now in the final week before Christmas. The silly season is well and truly underway.

Got up early this morning and watched the World Cup final between France and Argentina. What an amazing game!

Did anyone in Australia brave the wee hours to watch it?

Equities could be in for more pain in early 2023.

BlackRock (BLK) team doesn’t believe equities are fully priced for recession. Corporate earnings expectations have yet to fully reflect even a modest recession, said Vice Chairman Philipp Hildebrand of BlackRock. The Fed has promised it would continue to raise interest rates to rein in inflation in 2023 if necessary. BlackRock analysts have warned that the strategy of “buying the dip” won’t work in this new economic environment. BlackRock believes this macro volatility will be with us for some time. They don’t see a return to conditions that will sustain a joint bull market in stocks and bonds of the kind we experienced in the prior decade.

What to do if a recession happens?

A stock fund or a mutual fund is a great way to invest during a recession. A fund tends to be less volatile than a portfolio of a few stocks. And a stock fund offers the potential for high long-term returns if you can stomach the short-term volatility. Well diversified funds are a good option for investors who don’t want the hassle and risks of investing in individual stocks. One sound choice is an index fund based on the Standard & Poor’s 500, a well-balanced index that includes hundreds of America’s best companies and has returned about 10% over time. Rather than trying to pick the winners, you own a piece of the market.

If you want a portfolio that may be somewhat less volatile, you could add some dividend stocks. High-quality dividend stocks tend to fluctuate less than other kinds of stocks, meaning your portfolio will bounce around less. Plus, they can offer a cash dividend that ensures you’re getting some income while you’re waiting for the market to turn. If you don’t want to buy individual stocks, you could buy a dividend stock fund and enjoy the reduced risk that comes with diversification and still enjoy a solid dividend yield.

Real estate can be an attractive investment during a recession. You may be able to buy it at a cheaper rate. You also may be able to get a much better mortgage rate.

You could put your funds in a high-yield savings account. Just make sure that inflation doesn’t eat away at your money.

It is important to stay focused on your long-term plan and the better days ahead once the market turns back around. Work to keep your emotions from driving your decision-making in whatever way works best for you.

Wishing you all a wonderful week.

Cheers,

Jacque

"It’s never too late to be what you might’ve been." - George Eliot

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Technology Letter

December 16, 2022

Fiat Lux

Featured Trade:

(AMERICAN SUPER APP)

(APPL), (WECHAT), (META), (GRAB), (RAPPI)

America will never achieve a “super app,” and what does that mean for Silicon Valley?

These “killer apps” thrive in other places but not in America.

WeChat is the super app in China, while there is Careem in the Middle East, Rappi in Latin America, and Grab in Southeast Asia.

Any attempt to move in on that territory has been stymied by Washington.

A Super app is roughly a place where ecommerce, daily and monthly payments, financial management, social chats, social media, and daily services like ride-hailing co-exist in harmony on one app.

American tech companies are getting blocked from incorporating new payments into their apps while legacy payment systems remain.

Facebook’s attempts to build out standalone payment capabilities through the Libra/Diem blockchain project failed, but other apps in its family such as Instagram and WhatsApp are bolting on payment and e-commerce functionality.

As Zuckerberg and his team seem to have noticed, payments are critical to any would-be super app.

Half of US smartphone users are expected to adopt mobile payments as late as 2025, according to eMarketer research.

By contrast, 64% of China's population had made a payment on their phone by the end of 2021, according to a report from China UnionPay, the state-owned financial services firm.

Companies will struggle to generate the volume needed to make a super app work the way WeChat does, which has accumulated more than 1 billion users thanks to its mix of services and payments that ensure people don't have to look elsewhere.

In emerging market countries, payments skipped cards altogether because the infrastructure was weak.

Instead of bank cards, citizens went from cash to paying by phones using their local super app.

This could never happen in America because card payment options are diverse and trustworthy.

America has a reliable network of fragmented services and regulators have become so emboldened that they would never allow a financial payment system on a super app to ever develop.

There's another clear reason why the most successful super app has emerged in China.

Beijing has shut out foreign competitors from offering Chinese consumers any alternative.

Under Lina Khan, the FTC is becoming more sharply focused on competition and user privacy. Creating super apps would almost certainly require aggressive consolidation through acquisitions — a surefire way of attracting scrutiny.

As it stands, American regulators are now hawkish against American tech.

There's also the issue of Apple.

With the iOS system, Apple doesn’t allow the type of access needed to be able to build a super app on an iPhone.

Even if Apple wants to build a super app, there are still plentiful Android users in America that wouldn’t be captured either.

Apple would also need to backtrack on its pledge to safeguard personal data which is very unlikely to happen.

The best bet is probably Elon Musk’s Tesla, Twitter, and Space X combo.

He has two strong elements needed for a super app, but he doesn’t have a payment system and there is almost no chance in this regulatory climate of getting that approved.

The best way forward is tech firms with strong balance sheet picking up the best of breed in tech sub-sectors and eventually, they will all merge together.

However, that’s proved difficult as well with Microsoft’s blocked acquisition of video game firm Activision.

In a high interest rate world, profitable tech firms with strong balance sheets will be rewarded the most if they buy smaller tech companies which will be additive to their profit model.

The cash burners have a tough time competing in a high rate world and zero chance of achieving that super app status.

“You can't just ask customers what they want and then try to give that to them. By the time you get it built, they'll want something new.” – Said Apple Co-Founder Steve Jobs

Global Market Comments

December 16, 2022

Fiat Lux

Featured Trade:

(DECEMBER 14 BIWEEKLY STRATEGY WEBINAR Q&A),

(JPM), (BAC), (C), (WFC), (UNG), (RIVN), (SPY), (TLT), (TBT), (TSLA), (NVDA), (CRM), (FCX)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.