When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Biotech and Healthcare Letter

February 28, 2023

Fiat Lux

Featured Trade:

(NO REST FOR THE WEARY)

(PFE), (BNTX), (SGEN), (MRK)

Pfizer (PFE), along with its partner BioNTech (BNTX), developed one of the first COVID-19 vaccines to receive emergency use authorization from regulatory bodies worldwide. The Pfizer-BioNTech vaccine has been highly effective in preventing COVID-19 infection and has played a significant role in the global effort to curb the pandemic.

In addition to its vaccine, Pfizer also developed a COVID-19 treatment called Xeljanz, which has shown promising results in clinical trials. Xeljanz, originally developed to treat rheumatoid arthritis, is an oral medication that works by blocking a molecule involved in the immune response, which can reduce the risk of severe illness and death in some COVID-19 patients.

The Pfizer-BioNTech vaccine and Xeljanz have contributed to the company's financial success during the COVID-19 pandemic. In fact, this lineup made up the bulk of Pfizer’s operational growth of an impressive 30% year over year, pushing the company’s sales in 2022 to a whopping $100 billion.

But now that the pandemic has come to an end, Pfizer faces a massive revenue hit. With its boatload of cash, however, the company is in excellent shape and position to make an acquisition.

The latest name under Pfizer’s radar is Seagen (SGEN).

This is the second time Seagen has found itself the center of acquisition reports. In 2022, the biotech was said to be in serious discussion with Merck (MRK). At one point, Merck reportedly offered $200 per share, but the talks fell apart because neither party was happy with the final price.

Now it’s Pfizer’s turn to pitch its offer. The Big Pharma company is said to be in discussions to buy the cancer-focused biotech for a deal worth more than $30 billion.

This deal could prove to be a boon for Pfizer as the company sustains its momentum and continue to boost its portfolio and late-stage programs. Aside from the waning sales of its COVID products, it also faces a patent cliff as some of its blockbuster drugs will soon lose their exclusivity.

Seagen focuses on a group of cancer therapies called antibody-drug conjugates, or ADCs.

Basically, ADCs are a type of cancer treatment that combines the specificity of antibodies with the potency of chemotherapy. ADCs consist of three components: an antibody that targets a specific cancer cell marker, a cytotoxic drug that kills the cancer cell, and a linker that connects the two components.

Once the ADC is administered to the patient, the antibody portion of the ADC selectively binds to the cancer cell surface marker. Then the entire ADC is internalized into the cancer cell. Once inside the cancer cell, the linker is degraded, and the cytotoxic drug is released, killing the cancer cell.

The advantage of ADCs over traditional chemotherapy is that they are more selective and can target cancer cells more precisely while minimizing damage to healthy cells. ADCs have shown promising results in clinical trials and are currently approved for the treatment of several types of cancer.

In 2019, Seagen received FDA approval for its ADC named Padcev. The treatment raked in $451 million in 2022, but sales are projected to reach $2.4 billion in 2027.

Since Merck has been working on its own ADCs, a Pfizer acquisition of the sought-after Seagen seems likely as it would not attract anti-trust investigations.

One of the main reasons Big Pharma names are fighting over Seagen is the biotech’s revenue forecasts. By 2026, Seagen is projected to rake in $5 billion in revenue and peak at $9 billion by 2030.

Aside from Padcev’s current indication, Seagen has been working on how it could be used as a combo treatment alongside Merck’s top-selling Keytruda to target bladder cancer. The company also queued the drug for several trials. These would boost the company’s $2 billion annual revenue and $30.1 billion market value if approved.

Pfizer has been sitting on a massive war chest thanks to the success of its COVID programs. Despite its impressive cash flow, the company has no time to rest as it scrambles to ride the momentum and ensure that all its progress doesn’t go to waste.

Since then, the company has been aggressive in striking deals, including its $11.6 billion purchase of Biohaven Pharmaceuticals, which came with a top-selling migraine treatment, and its $5.4 billion agreement with Global Blood Therapeutics, which brought with its rare hematological therapies.

If Pfizer buys Seagen, it will mark the most significant deal since the Big Pharma’s acquisition of Wyeth for $68 billion back in 2009.

Pfizer disclosed that it plans to add $25 billion to its annual revenue via business development agreements at the end of the decade as it aims to mitigate the projected $17 billion loss from its products going off-patent. Considering that the company would buy Seagen shares at a premium, the deal would be a win-win for both parties.

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

February 28, 2023

Fiat Lux

Featured Trade:

(THE 15-YEAR ANNIVERSARY OF THE MAD HEDGE FUND TRADER)

CLICK HERE to download today's position sheet.

The Diary of a Mad Hedge Fund Trader is now celebrating its 15th year of publication.

During this time, I have religiously pumped out 3,000 words a day, or 15 newsletters a week, of original, independent-minded, hard-hitting, and often wickedly funny research.

I spent my life as a war correspondent, Marine Corps combat pilot, Wall Street trader, and hedge fund manager, and if you can’t laugh after that, something is wrong with you.

I’ve been covering stocks, bonds, commodities, foreign exchange, energy, precious metals, real estate, and even agricultural products.

You’ve been kept up on my travels around the world and listened in on my conversations with those who drive the financial markets.

I also occasionally opine on politics, but only when it has a direct market impact, such as with the recent administration's economic and trade policies. There is no profit in taking a side.

The site now contains over 20 million words, or 30 times the length of Tolstoy’s epic War and Peace.

Unfortunately, it feels like I have written on every possible topic at least 100 times over.

So, I am reaching out to you, the reader, to suggest new areas of research that I may have missed until now that you believe justify further investigation.

Please send any and all ideas directly to me at support@madhedgefundtrader.com, and put “RESEARCH IDEA” in the subject line.

The great thing about running an online business is that I can evolve it to meet your needs on a daily basis.

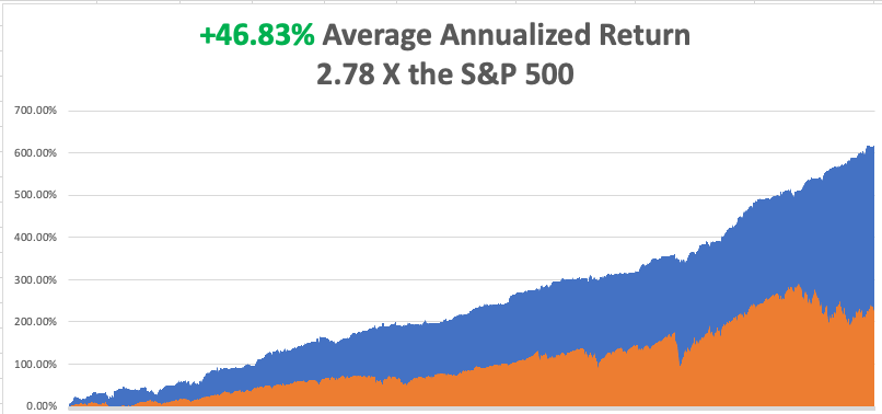

Many of the new products and services that I have introduced since 2008 have come at your suggestion. That has enabled me to improve the product’s quality, to your benefit. Notice how rapidly my trade alert performance is going up, now annualizing at +47% a year.

This originally started out as a daily email to my hedge fund investors giving them an update on fast market-moving events. That was at a time when the financial markets were in free fall, and the end of the world seemed near.

Here’s a good trading rule of thumb: Usually, the world doesn’t end. History doesn’t repeat itself, but it certainly rhymes.

The daily emails gave me the scalability that I so desperately needed. Today’s global mega enterprise grew from there. Today, the Diary of a Mad Hedge Fund Trader and its Global Trading Dispatch is read in over 140 countries by 30,000 followers. The Mad Hedge Technology Letter and the Mad Hedge Biotech & Healthcare Letter also have substantial followings. And Mad Hedge Hot Tips is one of the most widely-read publications in the financial industry.

I’m weak in distribution in North Korea and Mali, in both cases due to the lack of electricity. But that may change.

One can only hope.

If you want to read my first pitiful attempt at a post, please click here for my February 1, 2008 post at

https://www.madhedgefundtrader.com/february-1-2008/

It urged readers to buy gold at $950 (it soared to $1,975), and buy the Euro at $1.50 (it went to $1.60).

Now you know why this letter has become so outrageously popular.

Unfortunately, I also recommended that they sell bonds short. I wasn’t wrong on that one, just early, about eight years too early.

I always get asked how long will I keep doing this?

I am already collecting Social Security, so that deadline came and went. My old friend and early Mad hedge subscriber, Warren Buffet is still working at 92, so that seems like a realistic goal.

Hiking ten miles a day with a 50-pound pack, my doctor tells me I should live forever. He says he spends all day trying to convince his other patients to be like me, and the only one who actually does it is me.

The harsh truth is that I don’t know how to NOT work. Never tried it, never will.

The fact is that thousands of subscribers love me for what I do, pay for me to travel around the world first class to the most exotic destinations, eat in the best restaurants, fly the rarest historical aircraft, then say thank you. I even get presents (keep those pounds of fudge and bottles of bourbon coming!).

Given the absolute blast I have doing this job, I would be Mad to actually retire.

Take a look at the testimonials I get only on an almost daily basis and you’ll see why this business is so hard to walk away from (click here).

In the end, you are going to have to pry my cold dead fingers off of this keyboard to get me to give up.

Fiat Lux (let there be light).

February 25, 2023

Hello everyone.

Have you ever been given a present in the form of a Gift Certificate? Have you always converted it to a physical gift? It seems that in the U.S. there are billions of dollars’ worth of unclaimed Gift Certificates. I presume it is the same in Australia and the world over.

I know my son has a $100 gift certificate that he has not claimed. So, why do we do it?

We’re not interested in the type of gift.

We can’t be bothered to convert it.

Stuck it in the draw and forgot about it.

Threw it out by accident.

Don’t know how to claim the gift.

Whatever it is, companies offering these gifts are doing very well.

Perhaps, we should go back to the cash in the envelope idea. Everybody loves cash, right? Who doesn’t appreciate a $100 or $50 bill in a Christmas/Birthday card?

It might appear that we haven’t given any thought to the gift, or the person is just too difficult to buy for, or we didn’t have time to shop, but remember cash is an asset, and you can do anything you like with that asset. Not so with a Gift Certificate from a particular company. You have to spend it with them.

Anyway, it’s just a suggestion.

To the markets…

And haven’t they been messy of late.

The S&P 500 is in a complex market correction. Corrective weakness can extend towards the area of 3800/3750 before the next bull rally begins.

Gold – the corrective sell-off is still in progress. The same for silver. Likely downside targets in Gold are 1800/1760/1730. Then John will begin sending out trade alerts to buy Gold and Silver.

If you are watching Bitcoin, it is also correcting. We may see the $19,000 area, before the next move up.

The US$ will rally a little more and the Euro, Pound, Aussie, NZ$ will all fall as this takes place. But this move is setting up for a fall in the U.S.$ in the next little while.

It’s been snowing in southern California. How bizarre is that?

And last weekend, I tried my hand at making Sourdough bread without really following a recipe. Not surprisingly, it was not the full quid when it comes to sourdough bread. Too much liquid, I think. So, it’s back to the drawing board, and yes, I will make it by a recipe next time.

The Ukraine/Russia conflict rages on. The one-year anniversary has now passed. Putin – ex-KGB - is into grinding his enemies down. He’s in no hurry. But he knows the consequences of any nuclear attack, and so the war will remain a ground war. It will be a war about access to weaponry, ammunition, about managing mental fatigue, about strategic positioning, and understanding Putin’s perspective beyond Ukraine. We must stay the course.

Britain is in a bit of bother. Supply chains are choking their food supply, so grocery store shelves are starting to appear empty. Vegetables and basics…well…they are just not there. A sad dilemma for a country that was once so great. But still the education system is very good. I cannot argue with that.

Alex, my son, spent five years at an English prep boarding school from 8 years of age to 13 years. He had a ball. The education was fantastic.

Alex coming second on sports day.

Trading cards with a friend.

And you can’t forget about Grub Day on Friday.

Anyway, Happy Monday/Sunday, have a wonderful week.

Cheers,

Jacque

Mad Hedge Technology Letter

February 27, 2023

Fiat Lux

Featured Trade:

(THE UNBEATABLE PARTNERSHIP)

(EMR), (GRMN), (AMBA), (NVDA), (DXCM), (CSCO), (INTC), (QCOM)

Let me introduce to you one of the hottest trends in tech.

They have been on the tip of everyone's lips for years, and that might be an understatement, but the interaction of the internet of things (IoT) and artificial intelligence (AI) offers companies a wide range of advantages.

In order to get the most out of IoT systems and to be able to interpret data, the symbiosis with AI is almost a must.

If the Internet of Things is merged with data analysis based on artificial intelligence, this is referred to as AIoT.

Moving forward, expect this to be the hot new phrase in an industry backdrop where investors love these hot catchphrases and monikers.

What is this used for?

Lower operating costs, shorter response times through automated processes, and helpful insights for business development are just a few of the notable advantages of the Internet of Things.

AI also offers a variety of business benefits: it reduces errors, automates tasks, and supports relevant business decisions. Machine learning as a sub-area of AI also ensures that models – such as neural networks – are adapted to data. Based on the models, predictions and decisions can be made. For example, if sensors deliver new data, they can be integrated into the existing modules.

The Statista research institute assumes that there will be 75 billion networked devices by 2025.

This is exactly where AI comes into play, which generates predictions based on the sensor values received.

However, many companies are still unable to properly benefit from the potential of connecting IoT and AI, or AIoT for short.

They are often skeptical about outsourcing their data - especially in terms of security and communication.

In part because the increased number of networked devices, which requires the connection of IoT and AI, increases the security requirements for infrastructure and communication structure enormously.

It is not surprising that companies are unsettled: Industrial infrastructures have grown historically due to constantly increasing requirements and present companies with completely new challenges, which manifest themselves, for example, in an increasing number of networked devices. With the combination of IoT and AI, many companies are venturing into relatively new territory.

By connecting IoT and AI, a continuous cycle of data collection and analysis is developing.

But companies can no longer deny the advantages of AIoT because this technical combination makes networked devices and objects even more useful.

Based on the insights generated by the models, those responsible can make decisions more easily and reliably predict future events. In this way, a continuous cycle of data collection and analysis develops. With predictive maintenance, for example, production companies can forecast device failures and thus prevent them.

The combination of the two technologies also makes sense from the safety point of view: continuous monitoring and pattern recognition help to identify failure probabilities and possible malfunctions at an early stage – potential gateways can thus be better identified and closed in good time.

The result: companies optimize their processes, avoid costly machine failures, and at the same time reduce maintenance costs and thus increase their operational efficiency.

In this way, IoT and AI represent a profitable fusion: While AI increases the benefit of existing IoT solutions, AI needs IoT data in order to be able to draw any conclusions at all.

AIoT is therefore a real gain for companies of all sizes. They thus optimize processes, are less prone to errors, improve their products and thus ensure their competitiveness in the long term.

Some hardware, software, and semiconductor stocks that will offer exposure into AIoT are Emerson Electric Co. (EMR), Garmin (GRMN), Ambarella (AMBA), Nvidia (NVDA), DexCom (DXCM), Cisco (CSCO), Intel (INTC), and Qualcomm (QCOM).

Global Market Comments

February 27, 2023

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or MAKING A SILK PURSE FROM A SOW’S EAR)

(META), (GOOGL), (MSFT), (AAPL), (AMZN), (NFLX), (TSLA), (SPY), (TLT), (ENPH), (UUP), (GLD), (SLV), (EEM)

CLICK HERE to download today's position sheet.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.