When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

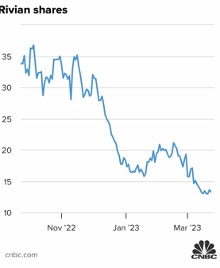

Another Look at Rivian

27 March 2023

Hello everyone,

Welcome to a new week.

Hopefully, the drama surrounding regional banks dies down this week and it’s back to looking at the overall market and digesting some facts.

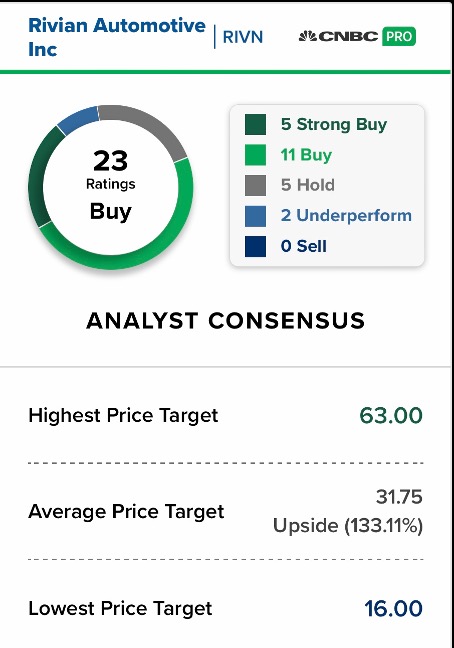

We hear a lot about EVs now and it’s usually all about Tesla. But let’s consider Rivian for a moment.

This year Rivian’s shares have been hitting all-time lows, dipping below $13 per share at some point during March. Its shares are down around 25% year to date. By way of contrast, rival EV maker, Tesla has soared 56% in the same period. So, what gives?

Rivian’s underperformance versus its peers comes after a series of developments this year. Most recently, it said it was in talks with Amazon to adjust an exclusivity clause to produce 100,000 electric trucks for the e-commerce giant. That came as Amazon was underwhelmed with its order numbers.

Rivian shares also plunged after it said it planned to raise $1.3 billion in cash via a sale of convertible bonds.

To ignite its upward trajectory, Morgan Stanley estimates Rivian could spend nearly $6 billion on both operational and capital expenditure this year – which is 1.5 times its full-year 2023 revenues, the bank forecast. Morgan Stanley also highlights Rivian’s aggressive growth rate. Rivian’s spending levels are higher as the company is targeting a much steeper growth rate compared to Tesla’s trajectory in 2015.

Morgan Stanley is giving the stock an overweight rating, and a price target of $26.00 – or nearly 90% upside.

Morgan Stanley’s analysts said Rivian was the only EV start-up name it recommends, apart from Tesla which is also rated overweight.

Chief analyst, Adam Jonas, at Morgan Stanley, says that while the stock offers a rather wide risk/reward skew ($5 bear case to $55 bull case) the firm remains compelled by the company’s differentiated product, scalable end markets, cost-cutting potential, cash balance, and valuation.

Looks like Rivian is a good buy, although the shares may take time to rally. Be patient.

“Trust is the coin of the realm. When trust was in the room, whatever room that was – the family room, the schoolroom, the locker room, the office room, the government room or the military room – good things happened,” said my late friend, US Treasury Secretary George Schultz.

John Thomas and George Schultz

Global Market Comments

March 28, 2023

Fiat Lux

Featured Trade:

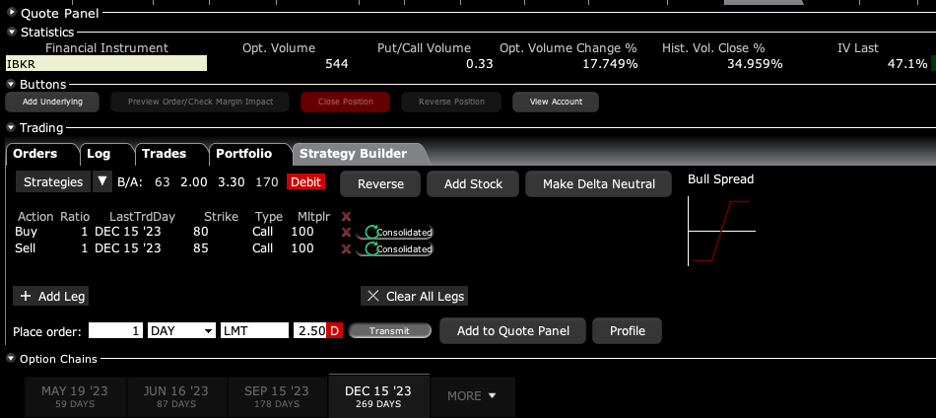

Trade Alert - (IBKR) LEAPS– BUY

(IBKR)

CLICK HERE to download today's position sheet.

BUY the Interactive Brokers (IBKR) December 2023 $80-$85 at-the-money vertical Bull Call debit spread LEAPS at $2.50 or best

Opening Trade

3-28-2023

expiration date: December 15, 2023

Number of Contracts = 1 contract

I just learned from the founder Thomas Peterffy that cash flows into Interactive Brokers have rocketed by 37%, from $4 billion a month to $5.5 billion. The market is essentially treating (IBKR) as a large “too big to fail” bank.

The brokerage sector has been beaten like the proverbial red-headed stepchild this year, with plunging stock market prices and volumes. However, it should be at the core of any long-term LEAPS portfolio.

Traders seem to have put brokerages and regional banks all into the same basket. They are dead wrong.

The best time to pick up this position will be during a market meltdown day and the Volatility Index is over $30.

If you are looking for a lottery ticket, then here is a lottery ticket.

While the chance of winning a real lottery is something like a million to one, this one is more like 10:1 in your favor. And the payoff is 20:1. That is the probability that Interactive Brokers shares will rise by 3.66% over the next nine months.

(IBKR) is one of the top online brokers, with a market capitalization of $34.2 billion. That has far and away one of the most sophisticated and conservative risk control procedures out there. If you don’t believe me, just try and sell a naked put short.

The regional banking crisis has pulled forward any recession and therefore the recovery. The Fed raised interest rates by 25 basis last week because it was already in the mail.

After that, there will be no interest rate rises for a decade. The cuts will start in June and continue rapidly after that. That’s when the economic data catch up with the reality that is happening right now, which is hugely deflationary.

And here is the sweet spot. Fears of a recession have knocked $16, or 17.8% off the recent $90 high in (IBKR) shares this year.

To learn more about the company please visit their website at https://www.interactivebrokers.com/

I am therefore buying the Interactive Brokers (IBKR) December 2023 $80-$85 at-the-money vertical Bull Call debit spread LEAPS at $2.50 or best

Don’t pay more than $3.00 or you’ll be chasing on a risk/reward basis.

The December 2023 is the longest maturity that trades options.

Please note that these options are illiquid, and it may take some work to get in or out. Executing these trades is more an art than a science.

Let’s say the Interactive Brokers (IBKR) December 2023 $80-$85 at-the-money vertical Bull Call debit spread LEAPS are showing a bid/offer spread of $2.00-$3.00, which is typical. Enter an order for one contract at $2.10, another for $2.20, another for $2.30 and so on.

Eventually, you will enter a price that gets filled immediately. That is the real price. Then enter an order for your full position at that real price.

A lot of people ask me about the appropriate size. Remember, if this stock does NOT rise by 3.66% in 9 months, the value of your investment goes to zero.

The way to play this is to buy LEAPS in ten different names. If one out of ten increases ten times, you break even. If two of ten work you double your money, and of only three of ten work you triple your money.

There is another way to cash in. Let’s say we get half of your double in the next three months, which from these low levels is entirely possible. Then you could earn half of the maximum potential profit in months. Then you can decide whether to keep the fivefold return or go for the full ten bagger. It’s a nice problem to have.

Notice that the day-to-day volatility of LEAPS prices is miniscule since the time value is so great. This means that the day-to-day moves in your P&L will be small. It also means you can buy your position over the course of a month just entering new orders every day. I know this can be tedious but getting screwed by overpaying for a position is even more tedious.

Look at the math below and you will see that a 3.66% rise in (IBKR) shares will generate a 100% profit with this position, such is the wonder of LEAPS. That gives you an implied leverage of 20:1 across the $80-$85 space.

Only use a limit order. DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES. Just enter a limit order and work it.

This is a bet that Interactive Brokers will not fall below $85 by the December 15, 2023 options expiration in 9 months.

Here are the specific trades you need to execute this position:

Buy 1 December 2023 (IBKR) $80 calls at……...…….………$12.00

Sell short 1 December 2023 (IBKR) $85 calls at………………$9.50

Net Cost:………………………….………..……...............…….….....$2.50

Potential Profit: $5.00 - $2.50 = $2.50

(1 X 100 X $2.50) = $250 or 100% in 9 months.

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of Interactive Brokers.

If you are uncertain on how to execute an options spread, please watch my training video on “How to Execute a Vertical Bull Call Debit Spread” by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

“The market is untradeable now. We are one tweet away from a new all-time high, or a 10% correction,” said a hedge fund friend of mine.

Mad Hedge Technology Letter

March 27, 2023

Fiat Lux

Featured Trade:

(SMART MONEY HAS LEFT)

(AAPL), (MSFT), (FRC)

The Federal Reserve is moving deeper into a trapped corner because the Fed is facing inflation that they haven’t fixed yet.

That’s not a problem so far as they are gradually lifting rates to cure it, but what happens when a systemic event occurs and they are forced to pivot when inflation is still at 6%?

This is why I have always championed just doing one big rate raise to get it over with.

The longer the Fed draws it out, the more chance they have to pivot when inflation is still toxic to the consumer.

Why do I care about all this?

The systemic event has arrived and that could mean that precious dollars are steered away from tech shares in April and are funneled over to the banking sector where the smart money is buying the dip in “too big to fail” banking stocks.

Since the beginning of March, three U.S. banks have failed and others — most notably California-based First Republic (FRC) — are teetering on the edge amid deposit outflows.

All else equal, in a banking crisis, investors would expect the Fed to cut rates to ease pressure on the financial system.

Since 1977, the Federal Reserve has worked to fulfill a "dual mandate" of achieving maximum employment and stable prices.

Tech stocks had a strong initial bounce from the banking shock, but that doesn’t mean it will last.

I took profits in some of my tech positions and the pricing action in the last few days has been poor to the upside.

I do believe we could experience a transitory sideways move which might be followed by an earnings scare that could induce a short-term pullback.

Tech has done remarkably well in the first few months of the year and the grind up during the banking crisis has shown resilience.

However, where is the use case for the incremental investor in tech?

Sure, we got some nice bounces from Facebook and Google cutting staff.

Getting leaner is certainly better.

Then there was the OpenAI bounce with artificial intelligence going from a fad to the new buzzword.

Microsoft and Apple have separated themselves from the crowd.

I am concerned about the breadth of the tech sector because many growth companies are starting to dip and dip some more.

It’s true that many investors are on the sidelines because they believe that the banking crisis has just started.

At the end of the day wasn’t it Russia that was supposed to preside over a failing economy susceptible to bank runs?

Ironically enough, by the end of 2021, as a result of high oil prices and a post-pandemic recovery, Russia's annual growth rate exceeded 5%. While the rate was expected to slow down in 2022, prewar forecasters would pin it at around 3 percent.

After the buy-the-dip in banks crowd moved out of the safety tech trade, we could be in for a sideways correction that could lead to some downside risk.

It doesn’t help that the Western financial system has creaky knees and it seems at this point tech might have to navigate around bank blowups in the short term.

The real safety tech trade continues to be Apple and Microsoft because the banking contagion has effectively led to the death of tech startups and small caps.

“Risk comes from not knowing what you're doing.” – Said American Investors Warren Buffett

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.