Nine Options Positions expiring on Friday, April 21, 2023

Wednesday, April 12, 2023

Hello everyone,

I thought I would show you how many positions John has that are expiring on Friday next week and what John says to do about it. Some of you will have all or some of these positions. For those of you who are just watching and learning, these are examples of option trades that will pay you a handsome profit. (Provided, of course, a black swan doesn’t swoop over our heads between now and next Friday).

How to Handle the Friday, April 21 Options Expiration

Followers of the Mad Hedge Fund Trader alert service have the good fortune to own NINE deep in-the-money options positions that expire on Friday, April 21, and I just want to explain to the newbies how to best maximize their profits.

These involve:

Risk On

(TSLA) 4/$130-$140 call spread 20.00%

(BAC) 4/$20-$23 call spread 10.00%

(C) 4/$30-$35 call spread 10.00%

(JPM) 4/$105-$115 call spread 10.00%

(IBKR) 4/$60-$65 call spread 10.00%

(MS) 4/$65-$70 call spread 10.00%

(BRK/B) 4/$260-$270 call spread 10.00%

(FCX) 4/$30-$33 call spread 10.00%

Provided that we don’t have another 2,000-point move up or down in the stock market in the next eight trading days, these positions should expire at their maximum profit points.

So far, so good.

I’ll do the math for you on our deepest in-the-money position, the Tesla April $130-$140 vertical bull call debit spread. Since we are a massive $45.00, or 32% in-the-money with only eight days left until expiration I almost certainly will run into the April 21 option expiration.

Your profit can be calculated as follows:

Profit: $10.00 expiration value - $8.80 cost = $1.20 net profit

(12 contracts X 100 contracts per option X $1.20 profit per option)

= $1,440 or 13.64%.

Many of you have already emailed me asking what to do with these winning positions.

The answer is very simple. You take your left hand, grab your right wrist, pull it behind your neck, and pat yourself on the back for a job well done.

You don’t have to do anything.

Your broker (are they still called that?) will automatically use your long position to cover your short position in your debit spreads, canceling out the total holdings.

The entire profit will be credited to your account on Monday morning April 24 and the margin freed up.

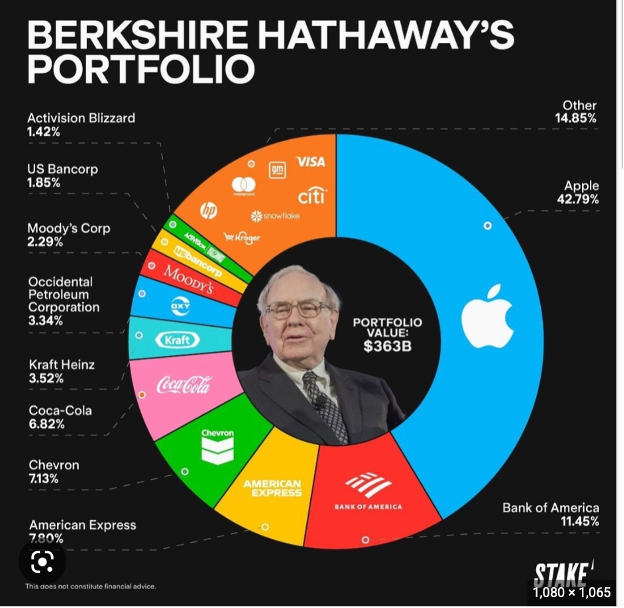

Buffett is investing in Japan.

Why?

The five trading houses – Mitsubishi Corp, Mitsui & Co, Itochu Corp, Marubeni and Sumitomo – seems to check every box of Buffett’s stock picking criteria.

First, they are classic value stocks, with a forward price-to-earnings ratio of 6.8, far lower than the average 12.5 in the MSCI Japan Index.

Second, they have a better-than-expected dividend yield, 5.2% on average, versus 2.7% for the broader Japanese stock market.

Third, the companies produce lots of cash flow.

Additionally, Berkshire can borrow very cheaply in yen and essentially the liability in yen can help hedge the currency exposure of the Japanese stock holdings.

The Japanese trading firms, also known as sogo shosha, are highly diversified companies involved in a wide range of products and services, including energy, machinery, chemicals, food, finance, and banking. They have been vital to the Japanese economy and global trade since they emerged in the post – WWII period.

Trust you are all having a great week. Enjoy the rest of it. Hope it’s extraordinary.

Cheers,

Jacque

“In order to be irreplaceable, one must always be different.” Coco Chanel