When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

April 27, 2023

Fiat Lux

Featured Trade:

(JULY 19 LONDON STRATEGY LUNCHEON)

(WHY TECHNICAL ANALYSIS IS A DISASTER)

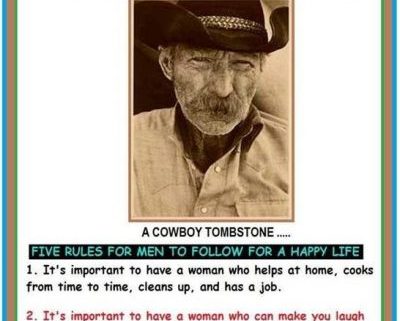

(THE COOLEST TOMBSTONE CONTEST)

(SJB), (JNK), (HYG),

CLICK HERE to download today's position sheet.

To prove that The Diary of a Mad Hedge Fund Trader only deals with the highest quality, top drawer clientele, I want to share the picture below sent in by a subscriber.

“I’d rather wear out than rust out,” said country music singer Dolly Parton, now 74.

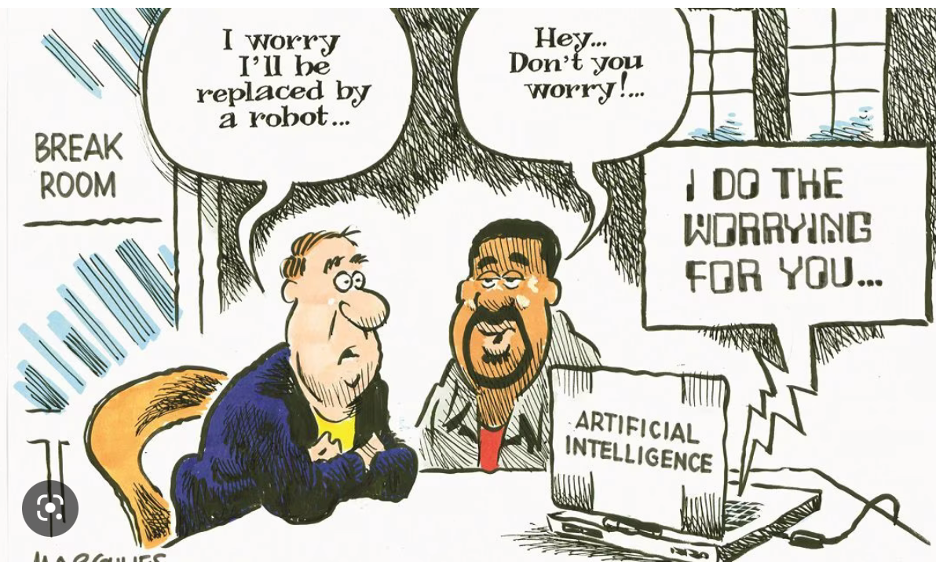

(WHAT TO EXPECT FROM AI AND RETAILERS)

April 26, 2023

Hello everyone,

Artificial Intelligence will transform the retailing industry.

Retail operations may undergo significant change over the next decade as retailers incorporate AI-powered technologies into storefronts and warehouses to increase efficiency and enhance personalization across various sales and marketing channels.

What this means is that the days of mass marketing may be over.

The future of marketing will be all about personalization. And AI will be a big part of that.

AI will enable businesses to identify customers’ needs based on their previous purchases and browsing patterns and create personalized marketing.

So, if you are gift shopping for a special someone and are looking for swimwear, for example, you may just get those types of the latest swimwear options landing in your inbox.

And the best part of all this AI revolution is that you may not have to wait in lines in a store again. Shoppers may be able to go in and out of stores without having to wait online and check out. Warehouse operations can be streamlined and merchandise placement in stores can be optimized. E-commerce should also see a boost with AI driving more retail dollars online.

Amazon is obviously a big winner with the advancements in AI.

When you shop online with Amazon, especially for groceries, you already are offered suggested items you may like, if they are not already in your cart (as you have purchased them previously).

Even the type of language each company uses for each customer will be different. AI will be able to generate a language that resonates with specific individuals and drive them to act.

So, for example, you click on a dress or suit you want to check out in detail online. AI generates that you have “great taste” and a “sense of style”. This all speaks to our sense of self and targets our human emotions.

Eventually AI can help retailers pitch tailored products to each potential customer based on their prior history. That not only can help drive sales, but it can also actually lower costs as well.

Furthermore, improve customization can cut down on waste because shoppers will see items that are a better fit or are closer to what the person was seeking.

This all makes perfect sense. Imagine the efficiency and savings. When you think of all the apparel, footwear and accessories that were returned because they didn’t fit or were unsuitable, this customization is a win-win situation.

Machine learning may also help reimagine how companies sell their merchandise inside their bricks and mortar stores. Machine learning analyses data and identifies patterns, which attempts to imitate how the brain imitates how the brain processes information. Furthermore, ML can identify and track stock-keeping units and can therefore help facilitate automated in-store inventory management and autonomous checkout processes. A 1% improvement in inventory efficiencies can be worth millions of dollars.

Customer service will also benefit from the revolution. Company teams will use AI-enabled chatbots, virtual assistants and virtual idols, as well as text, voice and other applications to improve the customer’s experience.

It will be trial and error for many companies as they work out how best to use AI to add to their bottom line.

Happy mid-week.

Cheers,

Jacque

Mad Hedge Technology Letter

April 26, 2023

Fiat Lux

Featured Trade:

(THE FORTRESS)

(GOOGL), (MSFT), (NVDA), (META), (TSLA), (AAPL), (AMZN)

This is a seven-stock tech market and there is no point to getting exotic and buying something aside from these 7.

That is what the price action is telling us.

Four of the seven are no other than tech overlords Alphabet (GOOGL), Amazon, (AMZN), Microsoft (MSFT), and Meta Platforms (META). These four Big Tech stocks alone account for 41% of the S&P 500's 2023 gain.

The other three are Apple (AAPL), which reports next week, Nvidia (NVDA), and Tesla (TSLA) stock.

These seven account for 86% of the S&P 500's 2023 gain.

These seven Big Tech stocks have essentially made the market this year and everybody else is dragging behind kicking and screaming.

Part of the great performance has to do with the market's oversold nature in 2022.

Rarely does a market operate at the extremes for so long.

These seven have done more than bounce back.

The January Effect is a seasonal increase in stock prices throughout the month of January. The increase in demand for stocks in January is often preceded by a decrease in prices during the month of December, in part due to tax-loss harvesting.

Second, many of these tech companies have been aggressively cutting costs.

I would even say again that Facebook cutting 25% of staff since 2022 is not enough.

Get rid of 80% like Twitter did.

Even more important, the world's most advanced AI models are coming together with the world's most universal user interface - natural language - to create a new era of computing.

Microsoft helped kick off Big Tech's AI obsession with its multi-year, multi-billion dollar investment in ChatGPT developer OpenAI.

MSFT has since implemented versions of OpenAI's technology in its Edge browser, Bing search engine, Microsoft 365 productivity software, and cybersecurity offerings.

Microsoft leading the AI means that rival Alphabet's Google (GOOGL) is playing catch up. Amazon (AMZN), meanwhile, is working to bring generative AI to its services, while Facebook parent Meta (META) is piecing together teams to kick-start its own efforts.

And while Microsoft’s stock has seemingly benefited from both the AI hype and overall market rebound after a rough 2022, the company's main growth driver continues to be its cloud computing efforts in its Azure unit.

But that growth has drastically cratered over the last year. In Q3 2022, Microsoft reported Azure growth of 46% year-over-year. But that's since fallen each quarter, landing at 27% in Q3 2023.

Part of the reason for this decline was large customers pulling back on spending as higher interest rates challenged global growth. Microsoft is also contending with scarce PC sales, as demand from consumers and business customers falls from pandemic-era highs.

It’s easy to say that tech has fared quite well this year.

However, peel back the layers and the lack of participation in this tech rally is highly worrisome.

In a winner take all economy, we have never been reliant on a small group of stocks to save us from collapse.

Interest rates as high as they mean that without a strong balance sheet, it is tough sledding out there for the growth companies.

In the short term, I fully expect tech companies with poor fundamentals to struggle and show minimal price appreciation as recession risks pile up.

These 7 should be a fortress for investors looking to protect their wealth.

“Success can cause people to unlearn the habits that made them successful in the first place.” – Said current CEO of Microsoft Satya Nadella

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

April 26, 2023

Fiat Lux

Featured Trade:

(THE MAD HEDGE TRADERS & INVESTORS SUMMIT VIDEOS ARE UP!)

(IS USA, INC. A SHORT?)

CLICK HERE to download today's position sheet.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.