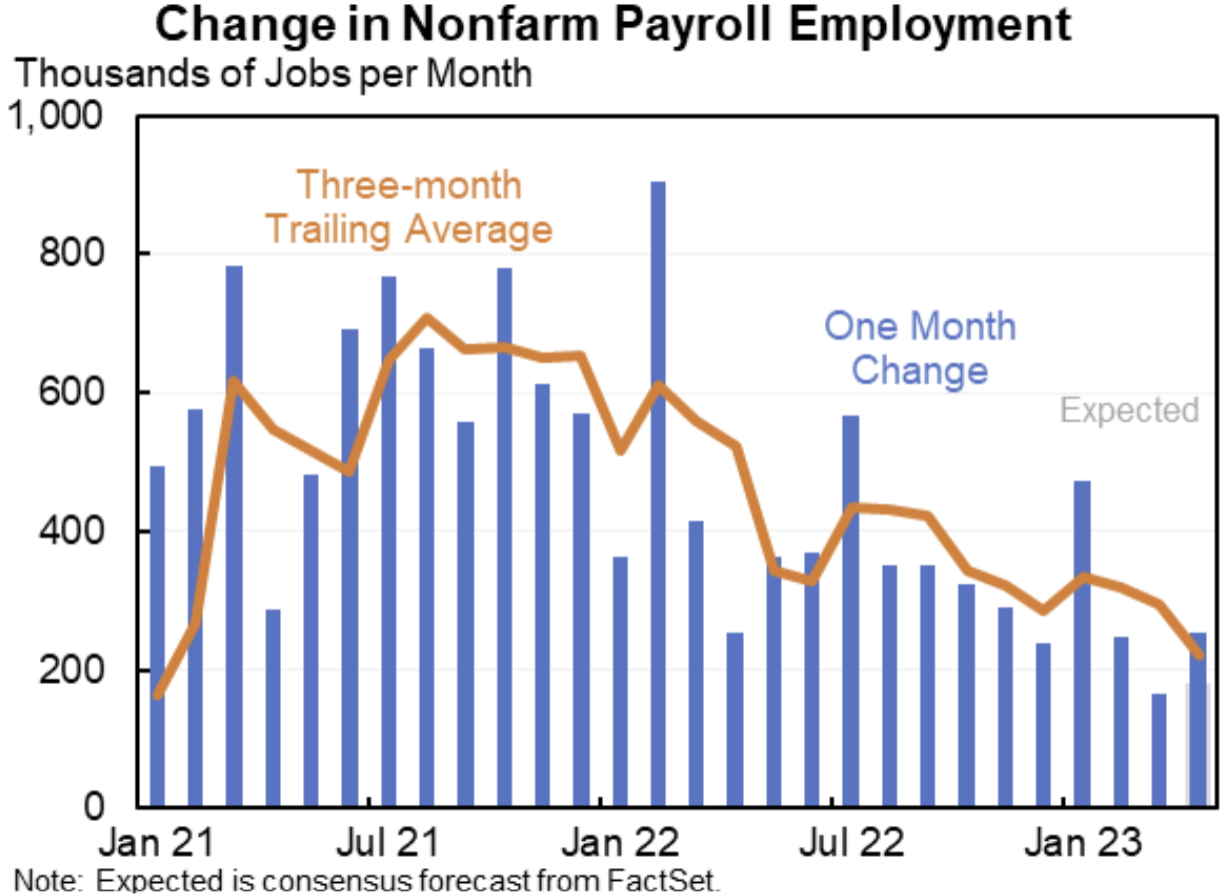

Non-farm payroll matters.

The job numbers have serious consequences for the tech sector - the biggest being there will be no recession in 2023 because everybody has a job.

Not only does everyone have jobs, they are also getting double the wage gains the Fed forecasted at 0.5% annualized to 6% year over year.

The tech sector has gotten rid of many good-paying jobs, many of those jobs were fake jobs that were absorbed to hoard talent when rates were at 0%.

It’s interesting that many of these tech stocks have exploded to the upside upon announcing job cuts, meaning investors don’t view the cuts through the prism of lost revenue but rather increasing productivity and delivering added efficiency.

Now, the entire bond investing complex is waiting on a Fed cut, which is why as of yesterday, 4 quarter percent rate cuts were priced in.

Fast forward 1 day and Fed future pricing is now pricing in 3-quarter percent rate cuts as investors believe we will stay higher for longer.

Higher for longer is bad for tech shares.

This extinguishes any hope of reducing inflation in the medium term.

It could be that we only get 1-2 quarter-point rate cuts in 2023 if the bond market is correct.

The Nasdaq has performed exquisitely in 2023 gaining 15% so far amid a souring backdrop of shrinking margins, increasing interest rates, federal government mismanagement on an epic level, domestic banking contagion from regional banks, and geopolitical strife.

The not so bad – not so good situation in tech stocks has manifested itself in the best tech stock Apple, which reported earnings yesterday.

Apple’s earnings report validated what I am seeing in the data.

The report was nothing special but good enough to believe that tech will narrowly avoid a recession in 2023.

The balance sheet is so ironclad that Apple even initiated a stock buyback of $90 billion.

Not too shabby.

Granted, there are few that can wield a strong balance sheet in the ways CEO Tim Cook can, but that’s not taking anything away from him.

Apple also told us about the 975 million paying subscribers to their services and that’s 150 million more than one year ago.

The takeaway is that Apple has a highly loyal customer base that continues to drive its dollars into the ecosystem.

Customer retention is incredibly high because they deliver products customers want.

Even their flagship product the iPhone and its revenue was up 2% year over year and beat forecast by $2.5 billion coming in at $51.33 billion when overall revenue decreased year over year.

iPhone revenue is just over half of Apple’s revenue.

A recession data point would be one in which to expect negative growth from iPhone revenue, so low single digits are fine.

The bottom line is that the US economy added 253,000 jobs to the overall job market and the unemployment rate is defying gravity.

US consumers keep spending, spending, and spending more.

Tech has turned into a 7 stock market and generous shareholder returns.

I admit that 2% iPhone revenue growth isn’t eye-popping, but that is where we are at this point in a late economic cycle.

Squeeze the juice out of the iPhone before the next big pivot to the next technology.

Similar can be said about the job market, everyone is trying to make their last buck before this whole thing gets a reset with 0% Fed fund interest rates.

Many even wish that 0% rates were already here.

Tech stocks will grind up as investors will bid up tech stocks, because they believe the Fed will cut sooner than initially thought. We’ll go back to that narrative for better or worse.