(2008, AN INVESTMENT BANK AND MY FINANCIAL EDUCATIONAL JOURNEY)

July 28, 2023

Hello everyone,

Today, I want to tell you a story about how I came to manage my own funds.

It’s something everybody should learn to do, as it’s your money at stake. I learned the hard way to realize the importance of this, and by sharing my experience, I am hoping to save some of you a lot of money and emotional turmoil.

Before I joined John’s product and began working for his company, a lot of my funds were managed by an investment bank. (I did have and still do have a private personal portfolio I managed myself). I paid this bank $30,000 per year to manage my funds. This was pre-2008. I paid this for a couple of years but became quite suspicious of their tactics and processes when it became clear to me that they weren’t really investing the funds so I would make money in the long term, but rather were buying and selling the shares I owned several times a year, so they made brokerage commission from the entries and exits. So, as well as paying the bank for managing my funds they were also making money from me on the brokerage side. (My personal portfolio was unaffected by this as it was kept separate).

Just prior to the 2008 crash, I received a letter from the investment bank saying they planned to have me fully invested in the market by mid 2008. Call it intuition, but that made me feel very uncomfortable and unsettled, so I decided to visit the Sydney office of the investment bank and told them that I would no longer need their service. I was promptly given a few documents to sign and I then left their office very happily free of their clutches. From that day onwards, I have been the manager of my own funds.

I carefully went through all the stocks and bonds the investment bank had me invested in and made some immediate adjustments to the portfolio. I sold all the high-risk investments and made sure I had a balanced portfolio of good quality stocks in the financial, commodity, and property sectors. Though most of these stocks fell heavily in the 2008 crash. I was able to invest more into these stocks at a very cheap price as the companies sent share offers to customers to purchase more shares in early 2009 free of brokerage costs. I took up the opportunity on many of these share offers.

This investment bank had no clue that the 2008 crash was coming. They had all their clients fully invested at the time of the crash.

Investment bank marketing makes managing your own money look overwhelming and very difficult. Originally, I was presented with several glossy graphs and long-term growth projections and other written data that were neatly presented in ring binders with lots of colour photos and fancy financial language. At the time, it made me feel out of my depth, and I was convinced that I would need to take a financial degree to develop the knowledge needed to manage my funds. How could I be made to feel like this? I already had my MBA by then and yet this is how the “salesman” or so-called financial analyst of this investment bank made me feel at this time – completely bereft of any financial savvy at all. I fell for it at the beginning of my financial journey, but very quickly became wise to what was happening.

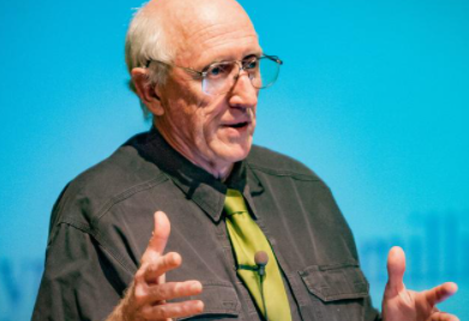

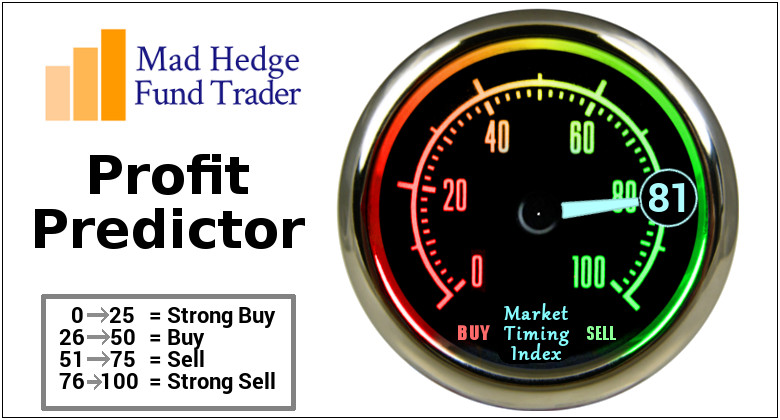

With my funds safely invested and regular consistent investments made, and my bank accounts in place, I began searching online for a quality financial advisor who would not charge an arm and a leg. I came across John Thomas, who originally worked under the umbrella of Macro Millionaire. I joined his product and watched him for a year or more before I did anything. He then ventured out as Mad Hedge Fund Trader creating his own product leaving the Macro Millionaire company behind. He was consistent with his profits, and he provided helpful education to the average investor or to those who wanted to get started. He was also accessible and eager to help. Furthermore, his background as a trader at Morgan Stanley gave me more confidence in his abilities and longevity. Many other investment letters at the time fell by the wayside as they couldn’t compete with John’s results.

What I have learned from John Thomas has been priceless.

Brokers exist to make money for themselves and their company.

Learn to trade how the professionals do and you will never have to work again.

Invest in yourself – in your financial education - and never doubt your ability.

Invest small amounts consistently to build a portfolio of stocks for the long term.

Wishing you all a wonderful weekend.

Be healthy, wealthy, and wise.

Cheers,

Jacquie