(The big end of town makes big bucks from the poor in the U.S.)

July 14, 2023

Hello everyone,

The markets are marching higher for now, until the next drama hits.

So, for now, skies are blue and the sun is out.

Come May, it may be a different story.

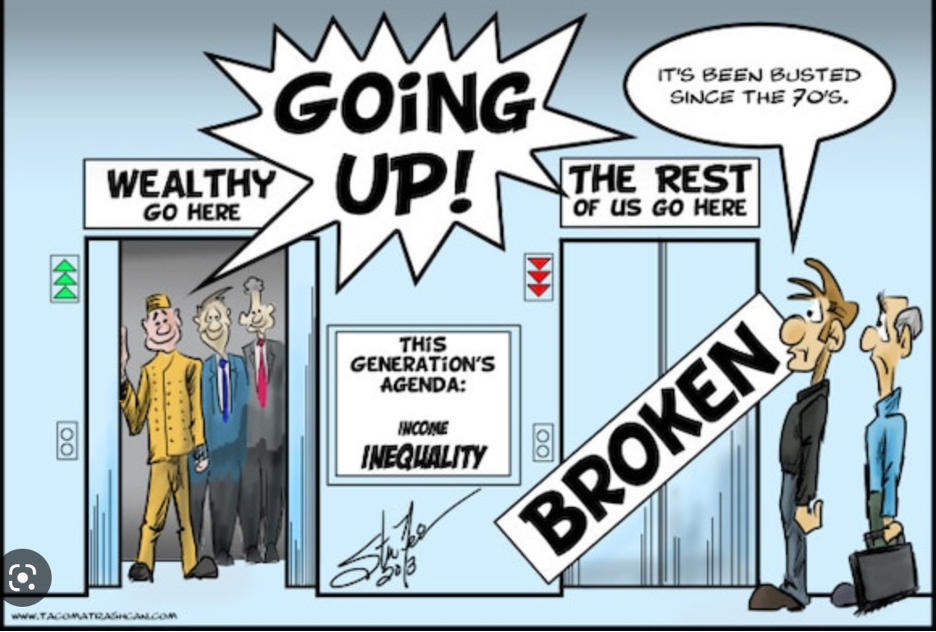

But let’s double down on the state of economic inequality in the U.S. It hasn’t really changed in the last 50 years. Who benefits? Big institutions and corporate America.

Matthew Desmond, a Pulitzer Prize-winning author, has a new book out called Poverty, by America, which explores why the U.S. poverty rate hasn’t improved in half a century. Around 11% of the U.S. population was considered poor in 2019; 12% was considered poor in 1970.

His previous book, Evicted: Poverty and Profit in the American City, won the 2017 Pulitzer Prize for general nonfiction.

In his latest book, Desmond explores the reason for the stagnation in the poverty rate and suggests that many Americans and corporations profit from tens of millions of people having so little. Banks make billions a year in overdraft fees. Companies can pay their workers low wages and save on benefits.

Desmond argues that when you look at inflation-adjusted earnings, ordinary workers have seen their pay tick up just 0.3% a year for several decades. So, in other words, the real wages for many Americans today are roughly what they were 40 years ago.

If you analyse the data from the U.S. Census Bureau and other sources, Desmond shows that 1 in 18 people in the U.S. live in what’s considered “deep poverty” or what he calls “a subterranean level of scarcity.”

In 2020, this included people making less than $6,380 a year, or families of four living on less than $13,100. In 2020, almost 18 million people in America lived in these conditions, including some 5 million children.

The racial wealth gap is just as wide as it was 50 years ago.

In 2019, the median white household had a net worth of $188,200, compared with $24,100 for the median Black household. Desmond writes that “our legacy of systematically denying Black people access to the nation’s land and riches has been passed from generation to generation.”

Overdraft fees are mostly paid by the poor.

In 2019, Desmond found that the largest U.S. banks charged Americans $11.68 billion in overdraft fees. Just 9% of those account holders paid the lion’s share, 84%, of those charges – customers who carried an average balance of less than $350. In other words, the poor were made to pay for their poverty is how Desmond sees it.

With Inflation the way it is – many of us probably feel that our wealth is being chewed up. The volatility will continue throughout the year in the markets, and we will see those without substance and longevity hung out to dry.

Just in: NY grand jury indicts Trump.

Have a great weekend.

Cheers,

Jacque