Below please find subscribers’ Q&A for the September 20 Mad Hedge Fund Trader Global Strategy Webinar, broadcast from Silicon Valley, CA.

Q: How do we know when interest rates have peaked?

A: Well, that's easy—the Fed announces it and they start cutting interest rates. The first hint of that is they don’t raise interest rates when they have the opportunity to do so. That will be today as it was in July. So we’re at the top now, and they’ll probably go sideways for 6 months or even longer before they start cutting. Markets will start to discount this 6-9 months in advance, or about now.

Q: Year-end target for the S&P 500? What about Amazon (AMZN)?

A: 5,000. For the (SPX). For Amazon, I think we could easily tack on another 20-25%.

Q: Does the Mad Hedge Global Trading Dispatch include tech trade alerts?

A: It does, but only the higher quality, lower risk trades. Pure Tech traders are a much higher-risk bunch of people, and they want more aggressive trade alerts in smaller companies. As for me, with Global Trading Dispatch I try to stick to a 90% success rate, and the only way to do that is to avoid tech when it flatlines and not try to catch any falling knives.

Q: Any hope of recovery for the iShares 20 Plus Year Treasury Bond ETF (TLT)?

A: Yes; as I said, the Fed will start cutting interest rates next year, and markets discount 6-9 months in advance, so that gives us 3 months for our January 2024 $100/$105 call spreads to expire at max profit. So yes, it is entirely possible, if not likely, that we will see those numbers by January.

Q: Can you help me jump the line for a Cybertruck from Tesla (TSLA)?

A: Well, if I was going to help anyone get a Cybertruck, it would be me! And I can't get one. Back in the old days, Tesla people would fall down on their knees crying “thank you!” when you bought one of their cars. Now, I think I’m number 2 million on the waiting list. You’re on your own on that one.

Q: Is Disney (DIS) a good LEAP stock?

A: No, Disney has some major problems with their streaming business, and the parks have maxed out. That is why the stock seems immune to good news—unless you know something I don’t. So go for it if you’re ready for that risk.

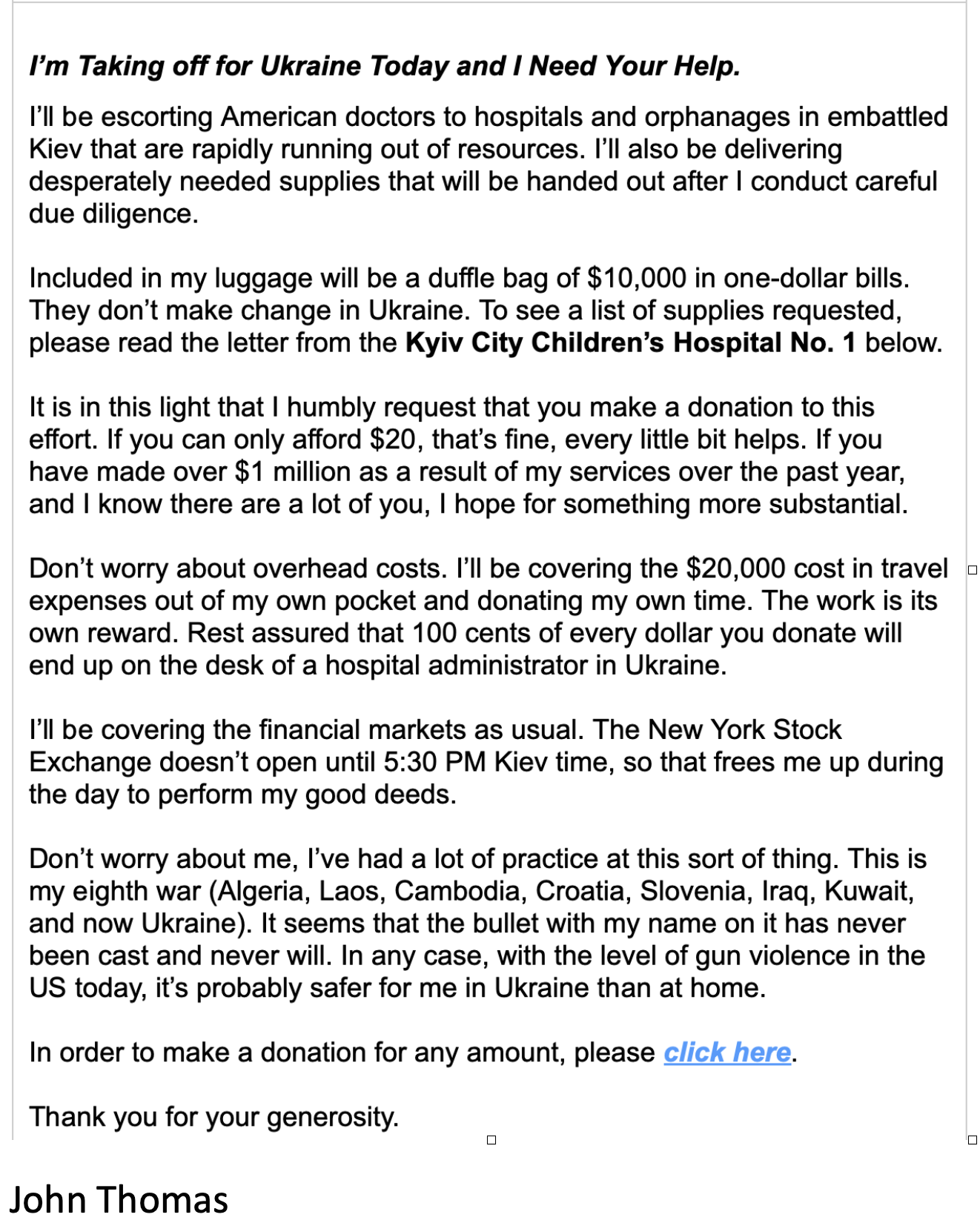

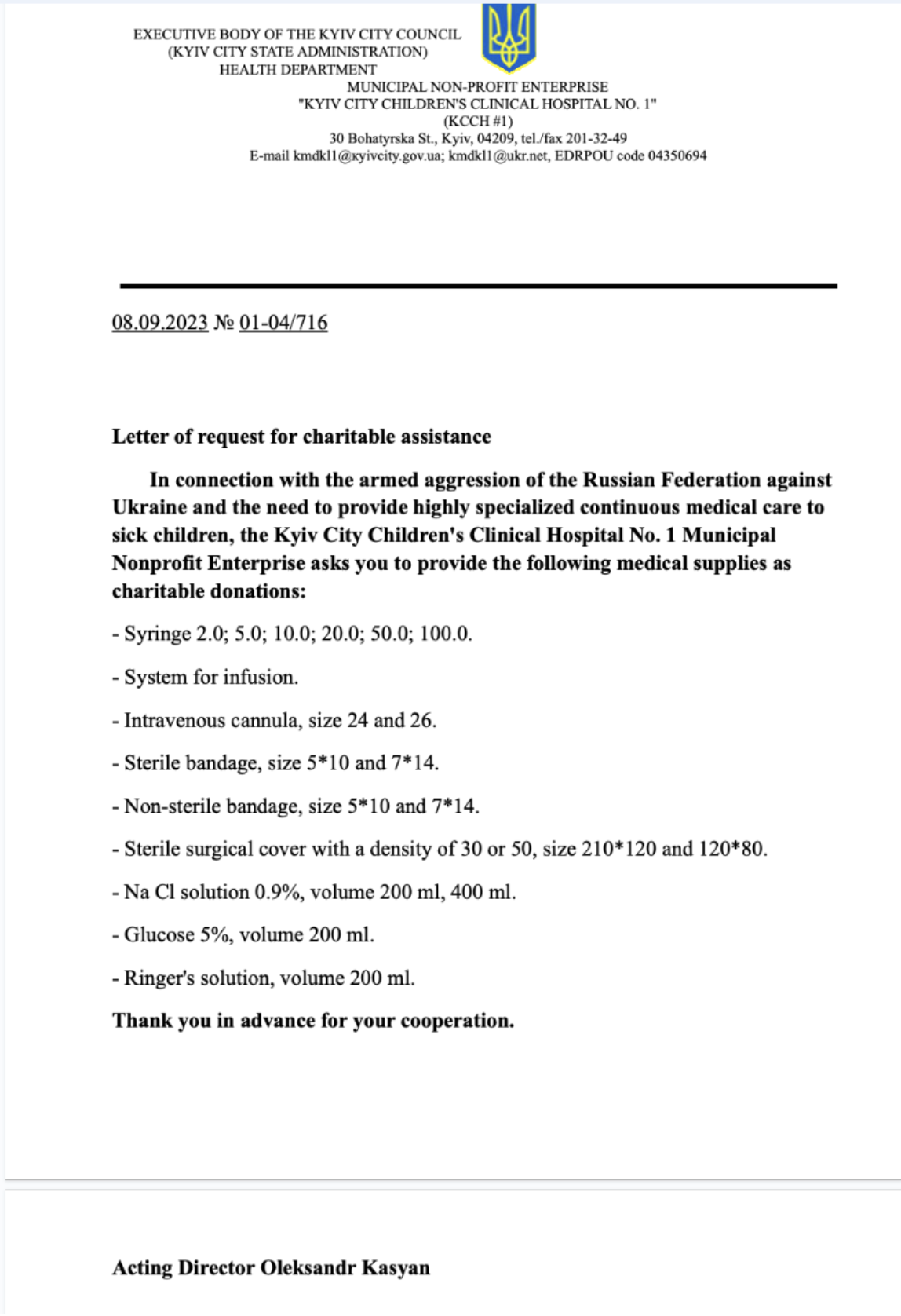

Q: What is your fact-finding trip to Ukraine all about?

A: Nothing beats research on the ground for finding out what really happened. Second, Ukraine got a lot of aid from other countries when the war started, but it’s since run out and we know that hospitals and orphanages in Ukraine are in trouble and running out of money. So, nothing beats showing up with US dollar cash in that situation. So that is why I’m going. This’ll be my eighth war. I guess the war correspondent in me never left. I’ll also be escorting American doctors to Ukrainian hospitals who don’t know how to do this. There’s more to life than just making money.

Q: Should I buy the dip in homebuilders like Lennar Homes (LEN), D.R. Horton (DHI), and KB Homes (KBH)?

A: Absolutely, yes—with both hands. Who does better with a falling interest rate cycle than home builders who have to depend on falling mortgage rates for business to boom once again. So yes, any dip in this sector and I would be loading the boat. The next declining interest rate cycle could last 5 or 10 years.

Q: Will the United Auto Workers strikes cause inflation to rocket and feed into higher inflation figures?

A: No, not really. Union membership has declined by 75% over the last 40 years. The UAW itself has declined from 1.6 million members to 400,000, and they really have become too small to affect the general economy. What they will do is accelerate existing trends, like people dumping their ice cars and moving to Tesla and other EV manufacturers. This is sort of like a gift for Tesla, and that's why the stock was up 10% last week. Also, in the long, long run, if they force the car companies to move to Mexico and cut the same deals that Elon Musk got, then it reduces inflation.

Q: Does the recent increase in Chinese ships and warplanes near Taiwan change anything?

A: No, it just shows us how weak the economy in China is. It’s effectively in recession even though they refuse to admit it, and therefore they have to create more distractions. The Chinese have been bluffing on Taiwan for 70 years—why stop now?

Q: What is a good time to buy banks?

A: I would start scaling into (JPM), (BAC), and (C) now. They will be a major beneficiary of an economic recovery next year and falling interest rates; and the prices down here are good. They’re one of the worst performers so far this year—one of the few cheap sectors left in the market.

Q: Should I buy Tesla (TSLA) here?

A: The thing here that I’m telling my professional money managers is: scale in on a one-month basis. Figure out how much you want to buy, and then buy 1/30th of that amount every day for a month. Then, you’ll scale in, you won’t get the absolute bottom but you’ll get some kind of bottom, and when a turnaround happens, then it goes up 50% or 100%. That’s the way to play Tesla. A lot of the professional money managers and investment advisors who follow me have a problem; they’re getting tons of new customers based on their performance this year. So yes, what do you do when you get money after a great run? You can only scale in.

Q: Is oil (USO) topping and going back to 70 a barrel?

A: I think yes. We saw the run from $70 to $95; it looks like it’ll probably hit $100. After that, Saudi Arabia will start bringing supply back on. What they did is create an artificial short squeeze in oil by taking 5 million barrels off the market with Russia—that got prices up. Any higher than that, and high oil starts to adversely affect Saudi Arabia’s foreign investments. So yes, they do back off when we get over 100; they’re very happy with $100/barrel, as is the American oil industry. So, I’m inclined to take profits if you did the oil trade in June.

Q: Would you buy iShares 20 Plus Year Treasury Bond ETF (TLT) now?

A: No, I’ve been holding back because it seems to want to have a capitulation; that’s why it’s not rallying off the 93 level—it’s been bouncing on the bottom. Some piece of bad news, some kind of high inflation, could trigger a capitulation, which would take us down another 5 points—that's where you buy it. Then, all of a sudden something like a 2024 $85/$90 bull call spread is offering you 100% return one year out.

Q: Do you recommend 4-week T-bills?

A: No, I recommend 4-month T-bills. Those expire in January and take advantage of the cash squeeze in the financial system you always get in New Years. Returns on 4-month T-bills are much higher than 3 month, 2 month, or 1 month. I just bought some before this meeting because I’m not going to do a lot of trading this month, and I got a 5.48% yield. For me to do a trade now, it has to have a very low-risk 20% return. That’s what I need to beat T-bills at 5.48%, which have zero risk and a guaranteed return of money. You need the extra 15% return on a 1-month trade to justify the risk that individual stocks have.

Q: Will the Australian dollar (FXA) stay weak as long as China is weak?

A: Yes, and the flip side is also true: Will the Australian dollar be strong when China recovers? Absolutely. I still see 1 to 1 against the US dollar for the long term.

Q: Why is everyone pouring into short-term options?

A: They’re buying lottery tickets. A lot of people are in the markets not to invest, but to gamble. They have gambling addictions quite often, and nothing beats the instant gratification of a same-day win, even though 80% of the same-day options expire worthless. So, enter that market with caution.

Q: After artificial intelligence destroys 90% of jobs, won’t there be nobody left to buy stocks since stocks won’t go up solely on institutional buying?

A: While AI will destroy a lot of jobs, it’s creating even more jobs—that has always been the case with technology from day one. However, you do get mismatches from the time a job is destroyed to when a new one is created. There are also mismatches in skill levels and that can create turmoil in the economy. Look at the United Auto strike, which is hell-bent on stopping technology and automation—stopping any kind of technology they can. Technology in the long term always destroys jobs, but it also creates more jobs, just moving them from old economies into new industries. I’m sure the same thing went on with the hay and leather industries 120 years ago when we moved from horses to internal combustion cars.

Q: If companies go to a four-day workweek, how will that affect stocks?

A: It’ll probably make them go up. When people go to four-day work weeks, productivity goes up and companies get more output for their dollar of labor costs. That’s why it’s happening and why it’s so popular. People who work at home and get to play with their kids on weekends will work for less money—that is a proven fact.

Q: Any thoughts on when we will see the United States Natural Gas Fund (UNG) turn upward?

A: This winter. (UNG) is priced for perfection, sitting around here at the $7 level. The slightest surprise like a cold winter, for example, which we may get (at least in California we will), and then the thing will spike up.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

2018 On the HMS Victory in Plymouth, England