When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Tech (QQQ) earnings turned out to produce some positive performances.

Dominant companies can produce dominant earnings even in troubled times.

So what is the problem?

The sales outlook underwhelmed as the American consumer and business keep getting stretched to the limit.

I believe that traders shouldn’t expect a quick turnaround of sales projections for 2024 unless there are some material structural improvements in the business and consumer environment.

No savior is coming for 2024.

All signs point to more uncertainty and not less and rightly so as high inflation has only been replaced by a decrease in the rate of inflation.

Things are still expensive and that means less opportunity for tech to build a growth story.

Apple, Alphabet, Meta, and Tesla all gave investors reason to rub smiles off faces.

From Apple’s unimpressive holiday outlook to Alphabet’s tepid cloud computing sales results, a recurring theme for the group was weakness.

Meta warned that the year ahead is looking less predictable, while Tesla raised concerns that demand for electric cars is starting to weaken.

Despite Tesla's missing earnings, the group is poised to surpass the 36% increase estimates called for before earnings season began.

The tech sector in the S&P 500 still carries a nearly 36% premium to the index on a forward price-to-earnings basis, per data compiled by Bloomberg Intelligence.

There’s a lot of AI hype, but not every company is market-ready.

Everything can change in a heartbeat if there is economic or geopolitical upheaval, which would directly impact stocks.

The market is still pricing in no spreading of military activity as it looks through it as a self-contained area.

Therefore, the pendulum has swung the completely opposite direction as the U.S. 10-year treasury yield has dropped from 5% to 4.6%.

The strength in treasuries could be short-lived, because several have told me that traders are jumping back into the short-term trade which would signal higher for longer.

The Fed Futures show that the first 25 basis rate is forecasted for May 2024 with 2 more consecutive .25% rate cuts following the first.

The American consumer just might have enough juice for one more splurge that would then push back rate cuts from May to somewhere closer to July or August.

Therefore, it’s easy for me to see how this 6.5% surge has a little longer follow through only to soon clash with a “higher for longer” narrative.

The true tailwind for tech stocks here is that much of the bad news has been priced in and any violent surge in treasury yields seems like a low probability for the last 7 weeks of the year, unless another global conflict breaks out.

Seasonal buying could mean that November is more positive than negative for tech stocks and any big draw down should be bought in a quality tech name. December could be a harder slog for tech.

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

(CAN WE NOW TURN THE PAGE ON THE FED’S INTEREST-RAISING CYCLE?)

November 6, 2023

Hello everyone,

The year has dashed by.

Only about eight weeks until Christmas.

The question on everyone’s lips is: Will the market rally continue into year-end?

In crystal ball gazing, it is entirely possible. As long as we don’t keep getting battered by events out of left field. But you know what the market is like. It can climb a wall of worry very well as it is forward-looking.

It has been a mixed bag with earnings results. Some good, some not so good, and didn’t the market let those companies know when they missed the mark. An overreaction in some cases.

Earnings season is winding down. However, there are still some important reports out this week.

Nov. 6, 2023, Monday

Australia Interest Rate Decision

Previous: 4.1%

Time: 10:30 pm ET

Nov. 7, 2023, Tuesday

8:30 a.m. D.R. Horton

Switzerland Unemployment Rate

Previous: 2%

Time: 1:45am ET

Nov. 8, 2023, Wednesday

8:00 a.m. Biogen

8:00 a.m. Warner Bros.

4:30 p.m. Disney

5:00 p.m. MGM Resorts

China Inflation Rate

Previous: 0%

Time: 8:30 pm ET

Nov. 9, 2023, Thursday

US Initial Jobless Claims

Previous: 210K

Time: 8:30am ET

Nov. 10, 2023, Friday

US Consumer Sentiment

Previous: 63.8

Time: 10:00am ET

The market is working against a backdrop of conflict in different parts of the world. It seems the world is never entirely free of conflict at any one time. Religion, race, and land are at the basis of many wars/conflicts, but these explanations simplify complex underlying issues, and we mostly have to delve into history to highlight important points to gain a thorough understanding of where we are today. Though I do not have the luxury of time or space here to give a history lesson, I will draw your attention to two giants of Wall Street, who believe the world is at its “most precarious since 1938.” Jamie Dimon (JPMorgan) and Larry Fink (BlackRock) are both expressing concern about the nature of the world we live in. “Scary and unpredictable” – this is the language these giants of Wall Street are using to describe our times. At stake is the future of our world as we know it: freedom, democracy, food, energy, and immigration.

The Middle East accounts for 48% of global energy reserves and produced 33% of the world’s oil last year.

Geopolitical risk is arguably shaping all our lives. Rising fear impacts consumers. It can create a withdrawal from consumption, or it can sometimes see consumers spend more. In the long term, fear is a drag on the consumer and can ultimately lead to recessions.

Last week the Fed left rates on hold for the second time in a row after 11 hikes since March last year. Powell was unsure whether the Fed had done enough to bring inflation down to its 2% target but highlighted that it would proceed carefully. The knock-on effect of the Fed’s language was enough to bring the yield down on the 10-year U.S. Treasury bills down to less than 4.7%.

Both Dimon and Fink believe there may be long-term forces that are still inflationary at play and are conscious of the fact that rates could possibly go up from these levels. Dimon points out that there is interest rate exposure in a lot of things. And these current rates are stressing certain assets, which the market, up until now, has mostly taken in its stride. But if rates go up another 100 basis points, it will stress a wider variety of things including real estate and even some banks. Both Fink and Dimon aren’t ruling out 6% or 7% rates.

The U.S. government’s ability to finance itself in the medium term is also causing concern. After the financial crisis in 2008, the market for government debt was underpinned by huge waves of quantitative easing (QE) as the Federal Reserve bought assets including Treasuries to boost the economy. The programme was revisited during Covid but came to an end in March 2022. The withdrawal of QE together with a flat appetite for Treasuries among US banks and international investors such as China, could force the government to pay higher prices at a time of near-record borrowing. The US has issued $1.8 trillion of debt this year, the second-highest amount ever other than in the early stages of Covid. Stanley Druckenmiller and Ray Dalio have also sounded the alarm recently over the deficit. Going forward, there may be considerable headwinds the US government may have to face.

The US economy has been showing strong growth, but recent data – jobs report & manufacturing data - may now suggest that the economy is finally slowing. The Biden administration has been pumping stimulus into the system via big pieces of legislation – Inflation Reduction Act, the Chips Act, and the Infrastructure Act – which are about $970 billion of stimulus. These are designed to accelerate America’s adoption of renewables, rebuild its semiconductor industry, and increase its spending on roads, bridges, and broadband. Fink and Dimon argue that this stimulus coupled with unions negotiating 25% labour increases are inflationary. High growth, government stimulus and two wars, which are threatening to become a broader crisis – all are inflationary. So, Fink and Dimon caution us not to turn the page on the rate-rising cycle just yet – it may prove premature.

Inflation, interest rates, and the economy

Cheers,

Jacquie

Global Market Comments

November 6, 2023

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or VINDICATION WEEK)

(SPY), (QQQ), (IWM), (NVDA), (BRK/B), (TLT)

It was truly vindication week for the bulls. All major Indexes clocked their best week of the year

The patience was rewarded. The S&P 500 (SPY) gained an impressive 6.09%, the NASDAQ ETF (QQQ) 7.35%, and the small-cap Russell 2000 (IWM) 8.64%. A recent favorite of mine, mortgage REIT lender Anally Capital Management (NLY) soared by an amazing 21%

Better yet, all of my Mad Hedge forecasts came true. Big tech led the charge, with our long in NVIDIA (NVDA) up a gob-smacking 16.67%. Another long in Berkshire Hathaway (BRK/B) gained 7.5%. And our long in US Treasury bonds (TLT) picked up a welcome $6.00, dropping ten-year yield from 5.0% to 4.52%.

The 60/40 stock and bond/portfolio came back with a vengeance. This time, everything went up.

The harder I work, the luckier I get.

The markets accomplished these feats against a geopolitical background that couldn’t be worse. The Gaza War is lurching from one tragedy to the next. The Ukraine War grinds on (but without me). Saber rattling continues in China.

It just goes to show how far out on a limb the shorts had gotten and the extent of buying demand that was pent up.

It all sets up a nice year-end rally. We may not reach the $4,800 target I expected at the beginning of 2023. But a $4,600 hit is within range. Don’t expect a straight line move there. The world is still a pretty unsettled place. It's definitely going to be a stock pickers market (NVDA), (BRK/B), and (TLT) and not an index one.

Particularly fascinating is how Berkshire Hathaway absolutely Knocked it Out of the Park, with a 41% gain in operating earnings from companies like BNSF Railroad, Geico, and Precision Castparts. But Warren Buffet was noted in his weekend earnings report more from what he didn’t own than what he did.

The Oracle of Omaha unloaded $5 billion worth of global stocks in Q3, taking his cash position up to a record $157 billion. He can now earn a staggering $8.6 billion in interest in the coming year. His explanation is that stocks never really got cheap this year and high rates were just too attractive. Keep buying (BRK/B) on dips. And buy the things he buys.

And with the number of new investment opportunities and sectors to chase that almost can’t be counted, I will prompt you to look at some oldies buy goodies.

PC stocks are back in play, namely Dell Computer (DELL) and Hewlett Packard (HPQ). How about those for a blast from the past? I think it’s been 30 years since I touched these legacy tech companies.

The fact is that AI is rapidly moving downstream as far down as your humble PC, which in the meantime has gotten cheaper and much more powerful. PCs are now the dumb end of a link that can access the AI superheroes of the day, like ChatGPT. It’s a lot like the old Quotron used to be the access point to the New York Stock Exchange mainframes for current price information.

Dell shares have already outperformed, up 57% in just six months, while HP is just getting started. You might take a look.

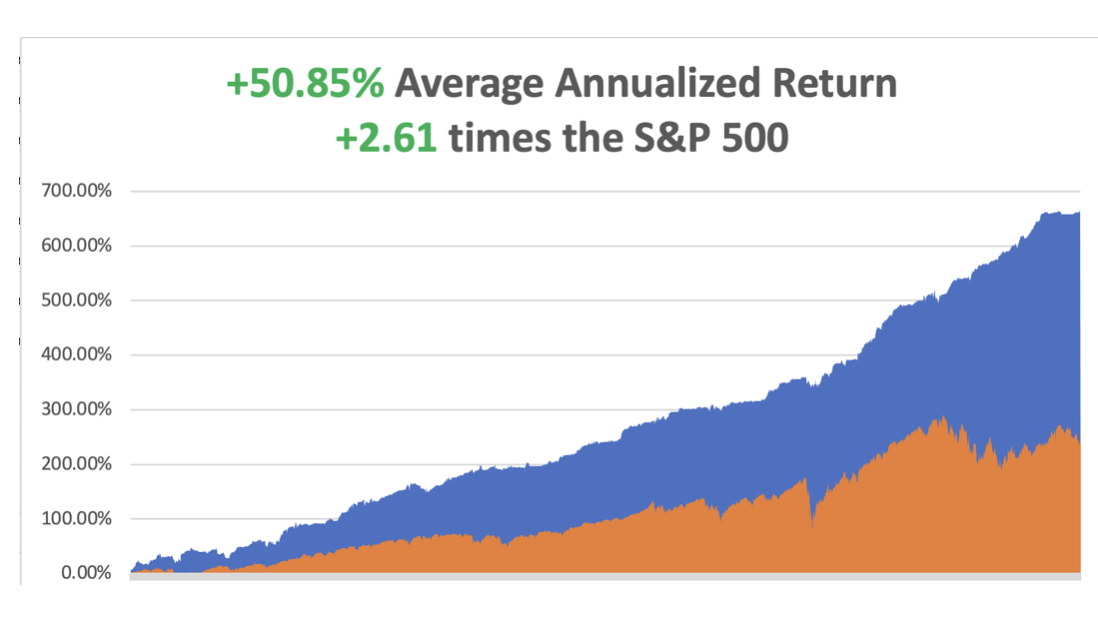

So far in November, we are up +1.97%. My 2023 year-to-date performance is still at an eye-popping +68.15%. The S&P 500 (SPY) is up +14.21% so far in 2023. My trailing one-year return reached +75.21% versus +25.62% for the S&P 500.

That brings my 15-year total return to +665.34%. My average annualized return has rocketed to +50.85%, another new high, some 2.61 times the S&P 500 over the same period. I am at maximum profit on all positions and am looking to add more on a dip.

Some 47 of my 52 trades this year have been profitable.

Fed Leaves Rates Unchanged. It’s not the end of high rates, nor the end of the beginning, but the beginning of the end. Powell may contemplate actual rate CUTS in six months, driven by the certain slowing of growth and inflation in the current quarter. Markets will start discounting that now as seen by the 30-basis point back off in rates this week. No surprise then that there is a short covering buying panic across the entire fixed income front today.

Palantir Rockets on New AI Demand, up 20% at the opening, even though its substantial government business slowed. The company announced the fourth consecutive quarter of profitability and highest earnings since its founding 20 years ago. The Denver-based data analysis company said Thursday it expects 2023 revenue of about $2.22 billion. Buy (PLTR) on dips.

Buying Panic Hits All Fixed Income Markets, with falling Fed interest rates appearing on the distant horizon. (TLT) is up $1.60, (JNK) $0.80, and (NLY) REITS up $0.45. This could be the trade of the decade, with (TLT) targeting $110 by early 2024.

Homebuyers are Pouring into ARMs, or adjustable-rate mortgages, shunning 30-year fixed rates at a mind-numbing 8.0%. ARMs could be had at 6.77% last week. Overall, mortgage applications are down 22% YOY.

Panasonic Says EV Demand is Sluggish, taking Tesla Shares down 5%, and off 35% from the recent high. Elon Musk says the Cybertruck will take a year to 18 months before it is a significant positive cash flow contributor. Full disclosure: I am on the waiting list. The Street expects Tesla to hit 2.3 million vehicle deliveries next year, an increase of about 500,000 year over year. Buy (TSLA) on dips.

Bank of Japan Eases Grip on Bond Yields, ending its unlimited buying operation to keep interest rates down. Japan is the last country to allow rates to rise. Expect the Japanese yen to take off like a rocket.

Hedge Fund Pour into Uranium, as the nuclear renaissance gains steam. Prices have gained 125% in three years. The International Energy Agency says demand will double by 2050. There are 440 nuclear power plants in the world that represent a non-carbon source of energy and China plans another 100 coming on line. Buy (CCJ) on dips.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. The economy decarbonizing and technology hyper-accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, November 6 at 8:30 PM EST, the US Loan Officer Survey is out.

On Tuesday, November 7 at 2:30 PM, the US Imports and Exports are released.

On Wednesday, November 8 at 3:15 PM, the Fed Chair Jay Powell Speaks.

On Thursday, November 9 at 8:30 AM, the Weekly Jobless Claims are announced.

On Friday, November 10 at 2:30 PM, the University of Michigan Consumer Sentiment is published. At 2:00 PM the Baker Hughes Rig Count is printed.

As for me, I have been doing a lot of high-altitude winter mountain climbing lately, and with the warm spring weather, the risk of avalanches is ever-present. It takes me back to the American Bicentennial Everest Expedition, which I joined in 1976.

It was led by my old friend, instructor, and climbing mentor Jim Whitaker, who pulled an ice ax out of my nose on Mt. Rainer in 1967 (you can still see the scar). Jim was the first American to summit the world’s highest mountain. I tried to break a high-speed fall and an ice ax kicked back and hit me square in the face. If I hadn’t been wearing goggles I would have been blinded.

I made it up to 22,000 feet on Everest, to Base Camp II without oxygen because there were only a limited number of canisters reserved for those planning to summit. At that altitude, you take two steps and then break to catch your breath.

There is a surreal thing about that trip that I remember. One day, a block of ice the size of a skyscraper shifted on the Khumbu Ice Fall, and out of the bottom popped a body. It was a man who went missing on the 1962 American expedition. Everyone recognized him as he hadn’t aged a day in 15 years, since he was frozen solid.

I boiled my drinking water but at that altitude, water can’t get hot enough to purify it. So I walked 100 miles back to Katmandu with amoebic dysentery. By the time I got there, I’d lost 50 pounds, taking my weight to 120 pounds.

Jim was an Eagle Scout, the first full-time employee of Recreational Equipment Inc. (REI), and last climbed Everest when he was 61. Today, he is 92 and lives in Seattle, WA.

Jim reaffirms my belief that daily mountain climbing is a great life extension strategy, if not an aphrodisiac.

Mount Everest 1976

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

In the era of the digital age, the explosion of data has created a unique challenge and opportunity. The sheer volume of information generated by individuals, organizations, and interconnected devices is overwhelming, making it increasingly difficult to extract meaningful insights. This is where Artificial Intelligence (AI) is emerging as a game-changer, particularly in the realm of advanced pattern recognition. With the ability to analyze, identify, and interpret intricate patterns in data, AI is ushering in a new era of innovation across various industries.

The Unseen Patterns in Data

In almost every sector, data is the lifeblood that flows through the veins of an organization. The challenge lies in deciphering this data to gain actionable insights and make informed decisions. Traditional analytics and human-driven approaches fall short when dealing with colossal datasets.

This is where AI steps in. Machine learning and deep learning algorithms enable computers to process vast datasets and uncover hidden patterns. It's like having an extra set of eyes capable of seeing connections and trends that might go unnoticed by humans. From financial markets to healthcare, advanced pattern recognition is transforming the landscape.

Financial Markets: Predicting Trends and Anomalies

In the fast-paced world of financial markets, milliseconds can make a difference. AI-driven algorithms are now used to identify trends, anomalies, and trading opportunities with unprecedented speed and accuracy. High-frequency trading firms, for example, rely on AI to process massive datasets, analyze trading patterns, and execute trades in real time. This technology can detect subtle market signals and make split-second decisions, minimizing risks and maximizing profits.

Healthcare: Early Disease Detection and Personalized Medicine

In healthcare, AI is revolutionizing diagnosis and treatment. Advanced pattern recognition can analyze medical imaging data such as X-rays, MRIs, and CT scans to detect diseases at earlier stages. Moreover, it can tailor treatments by analyzing genetic data to match patients with the most effective therapies. This not only saves lives but also reduces healthcare costs.

Retail: Customer Insights and Inventory Management

Retailers are utilizing AI to gain a competitive edge. AI can recognize consumer buying patterns and preferences by analyzing vast datasets of purchasing history and online behavior. This data helps businesses provide personalized recommendations, optimize inventory management, and predict sales trends.

Manufacturing: Predictive Maintenance and Quality Control

AI is transforming manufacturing through predictive maintenance and quality control. Machines can analyze sensor data to detect patterns indicative of impending equipment failures, allowing for maintenance before breakdowns occur. In quality control, AI can inspect products and identify defects more accurately than human workers.

Security: Threat Detection and Fraud Prevention

Pattern recognition plays a pivotal role in security. AI-powered systems can identify patterns of suspicious behavior in real-time, making them essential for cybersecurity. For example, they can recognize signs of a cyberattack, fraudulent transactions, or unusual access to a network, thus protecting organizations from threats.

Challenges and Ethical Considerations

While AI has immense potential for pattern recognition, it's not without challenges. Ensuring data privacy, transparency, and avoiding bias are essential. In some cases, the AI models may overfit, meaning they perform exceptionally well on the training data but fail to generalize to new, unseen data.

Moreover, the ethical use of AI in advanced pattern recognition is of paramount importance. AI should be harnessed for the betterment of society and not for intrusive surveillance or harmful purposes.

In conclusion, AI's ability to perform advanced pattern recognition is a technological leap that is redefining industries. From finance to healthcare, retail, manufacturing, and security, the applications are far-reaching. As AI continues to evolve, we can expect even more profound changes, shaping a future where data is not just collected but truly understood. This transformation is not only enhancing productivity and decision-making but also promising to improve the quality of life for individuals and societies worldwide.

Mad Hedge Technology Letter

November 3, 2023

Fiat Lux

Featured Trade:

(THE CATCH UP PLAN)

(GOOGL), (MSFT), (CHATGPT)

The tech industry is quickly morphing into a generative artificial intelligence success story or bust outcome for many involved.

This came pretty much out of nowhere.

December 2022 was the big announcement that ChatGPT went live and everybody in tech has basically been freaking out since then.

Big ideas like the internet and software also had the same type of effect on tech stocks back in the heyday.

What would have Microsoft (MSFT) been without the computer or Windows?

Even more urgent, once perceived growth tech companies like Tesla are starting to cut prices of products because the consumer is tapped out these days.

That means tech corporations can’t sell the current product by adding incremental iterations and passing it off as something “groundbreaking.”

Consumers need something more.

Consumers will spend on the next big thing and generative artificial intelligence still has a long way to go, but stocks participating in generative AI are starting to get those premium multiples that were only reserved for tech royalty.

Everyone is hoping to get in on the action as well as Alphabet.

They are racing to build a new search engine and add artificial intelligence features to its existing products in the face of rapid growth in the field by rivals such as Microsoft Bing.

Google is testing new features called "Magi," with more than 160 people working full-time on the project.

Google's new products will try to predict users' needs, with features such as helping users write software code and display ads in search results, and Google is also exploring mapping technology that allows users to use Google Earth with the help of AI and search music through conversations with chatbots.

Samsung Electronics is reportedly considering replacing Google with Bing, the main search engine on its phones, because of Bing's artificial intelligence capabilities. The Samsung contract is expected to generate $3 billion in annual revenue for Google, a revenue stream that is now in jeopardy. In addition, Google has a $20 billion contract with Apple for a similar default search engine, which is up for renewal this year.

Google’s search engine could be swept into the dustbin of history if they don’t get a move on it pronto.

The ecosystems like Apple and Samsung can easily opt for a better engine if Google falls behind and that is exactly what we are seeing from Samsung.

I would probably say that Google got a little too cocky when they decided to stop developing itself.

They thought that nobody could topple them.

The panoramic views from the ivory tower can look nice from the terrace for a while until somebody builds a bigger ivory tower that obstructs the view.

It’s been quite fascinating to see Google’s sense of urgency lately because it was always assumed they were part of a stable duopoly with Facebook.

Google’s panic indicates that Microsoft’s Bing is a real threat to their revenue stream and at the very minimum, bits and pieces of the new technology will be incorporated into a new version of a search engine that will behave as a supercharged version of the likes we have never seen before.

If Google can catch up then its stock price will go a lot higher from here.

"Life is not fair; get used to it," said the Founder of Microsoft Bill Gates.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.