During 2023, the market spent the entire year climbing the proverbial wall of worry. The question is how much we have to give back from deferred tax selling from the profitable 2023 trades before 2024 can start anew.

It could be weeks. It could be months.

Last year was the Year of the Magnificent Seven. So far this year, it is looking like the Year of the Magnificent 493, when everything else goes up.

Which brings me to the most important topic of the day.

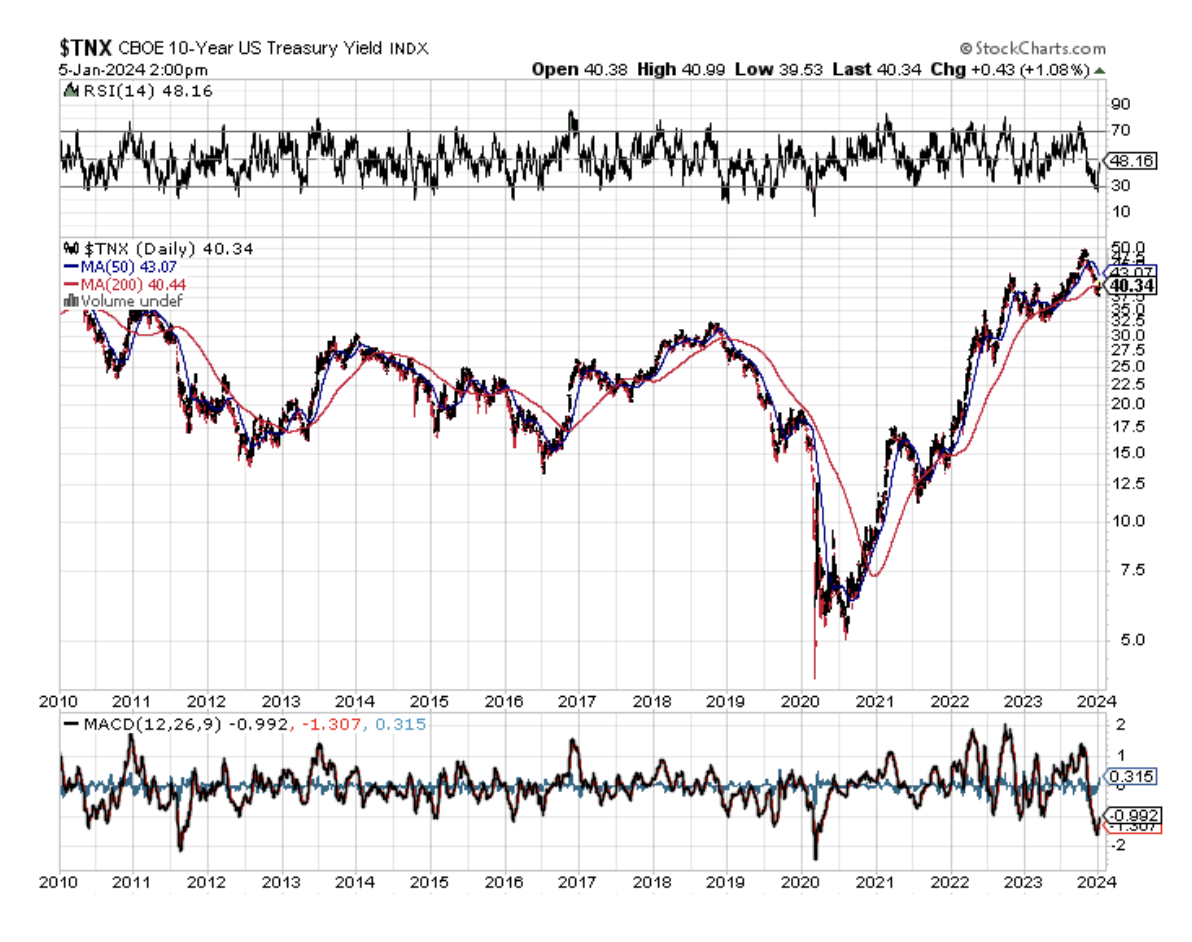

The best trade out there this year may be the most boring one of all, the ten-year US Treasury notes, now yielding 4.10%.

Let’s say the Federal Reserve delivers on its promise to cut interest rates three times in 2024 from 5.5% taking the overnight rate down to 4.75%. The futures markets are giving us a 70% probability this will start in March, but I think that Jay Powell will want to torture us for a few extra months until June to make sure inflation is well and truly dead.

In that case, bond prices (TLT) should rise at least from $96 to $110 by the end of the year, taking the yield down from 4.10% today to 3.60% Add in the current 4.10% yield and that should give you a very low-risk total return for the year of 18% or better.

But what if the 2024 yearend liquidity surge discounts the 3 additional interest rate cuts to take place in 2025? That could add another $10 to this trade, taking the total return for the year up to 28%. Most investors will take an annual return of 28% all day long.

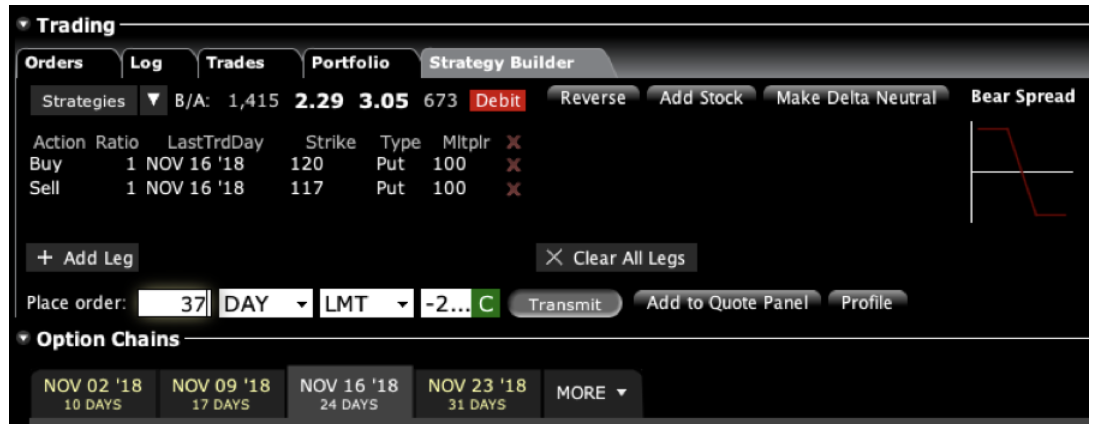

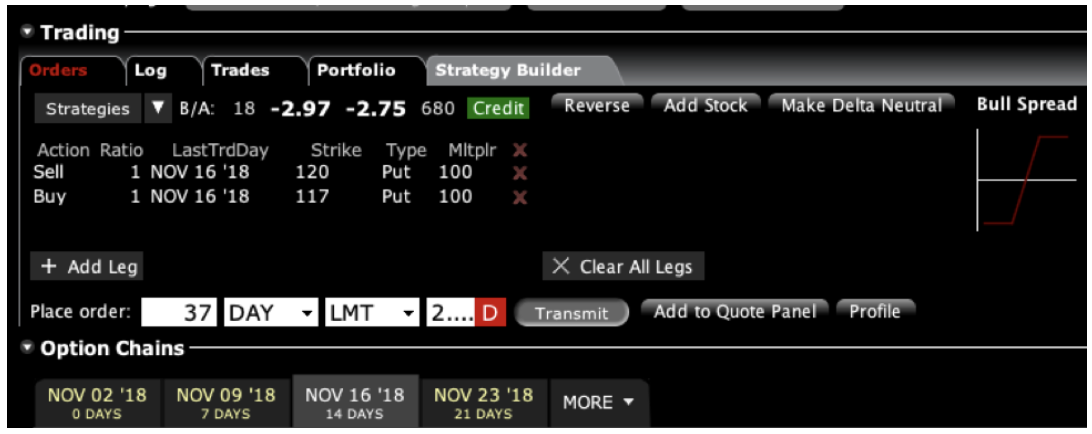

There is in fact a better way to do this.

Don’t buy the (TLT), which has high management and administration costs and wide dealing spreads that probably top 2% a year. Bypass all of that through buying the ten-year US Treasury note directly from your broker. That’s easy to do, has minimal commissions and the bonds trade like water.

After all, the US government has a unique talent for issuing bonds and there are already trillions of dollars’ worth outstanding. That shifts the 2% take of the (TLT) from Wall Street into your pocket.

It gets better.

What are the chances that another pandemic will occur in the next decade? I’d say about 50/50. After all, with a global population of 8 billion and rising, international travel and trade reaccelerating, pandemic risks are rising once again.

If you don’t believe me, just try and get an Airbnb (ABNB) in Florence, Italy, the epicenter of the last breakout in Europe. There are hardly any Italians left in Florence because they can’t compete with tourists on housing costs and can’t afford to live there anymore. So it is now more important to hedge your portfolio from pandemic risks.

It just so happens that there is a way you can do this: buy ten-year US Treasury notes. What happened with the last pandemic (see chart below)? The (TLT) doubled in value from $80 to $165, taking yields from 5.0% all the way down to 0.32%. Back then, investors were worried about return OF capital, not return ON capital, for which the US government has a perfect record.

It turns out that bonds will not only hedge all of your stocks from pandemic risks, but ALL INVESTMENTS OF EVERY KIND, including commodities, the dollar, precious metals, energy, and even your own home.

And with a 4.1% yield, bonds offer an insurance policy that pays you to own it.

Ten-year US Treasury notes are also the perfect position to have during times of inflation. Falling inflation enables more Fed rate cuts, which automatically increase the value of the notes….by a lot.

How do I know inflation is falling? Because I went bowling last week in Incline Village, Nevada. The establishment is under new ownership. They gutted the place, fired all the staff, and remodeled it in a cool sixties motif. Then they hired two people to run the place.

All payments have to take place online, even for video games, where you also now have to reserve your lanes. As a result, instead of casually walking in to take a lane, you have to book them two weeks in advance. The place is always full.

Cut costs, and soaring revenues, you want to own this bowling alley, as you do for the Magnificent 493. This is going on across the entire US economy, like it or not. This is highly deflationary.

Hedge funds are piling into the ten-year US Treasury note trade in record numbers because you only see a low-risk, high-return setup like this once every decade or so.

My bet is that there are maybe four points of downside risk in this trade against a potential gain of 28 points. That’s a risk/reward ratio of 7:1.

I Like it!

I just thought you’d like to know.

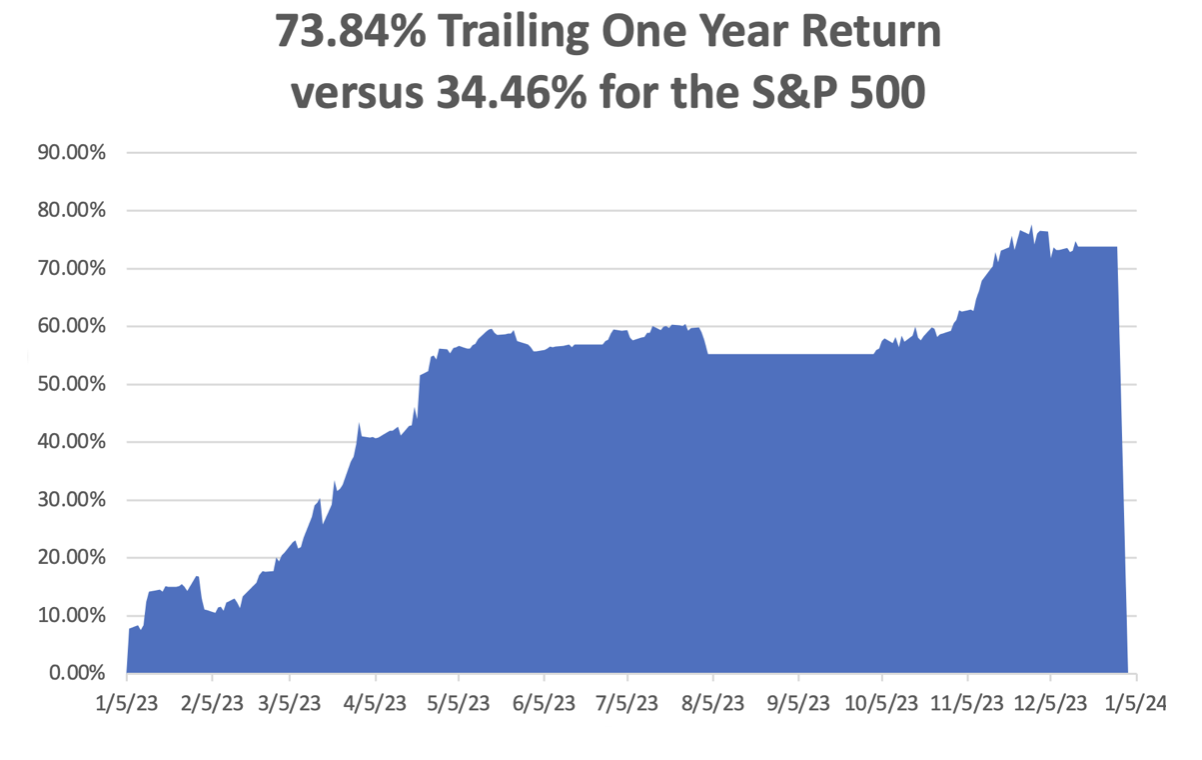

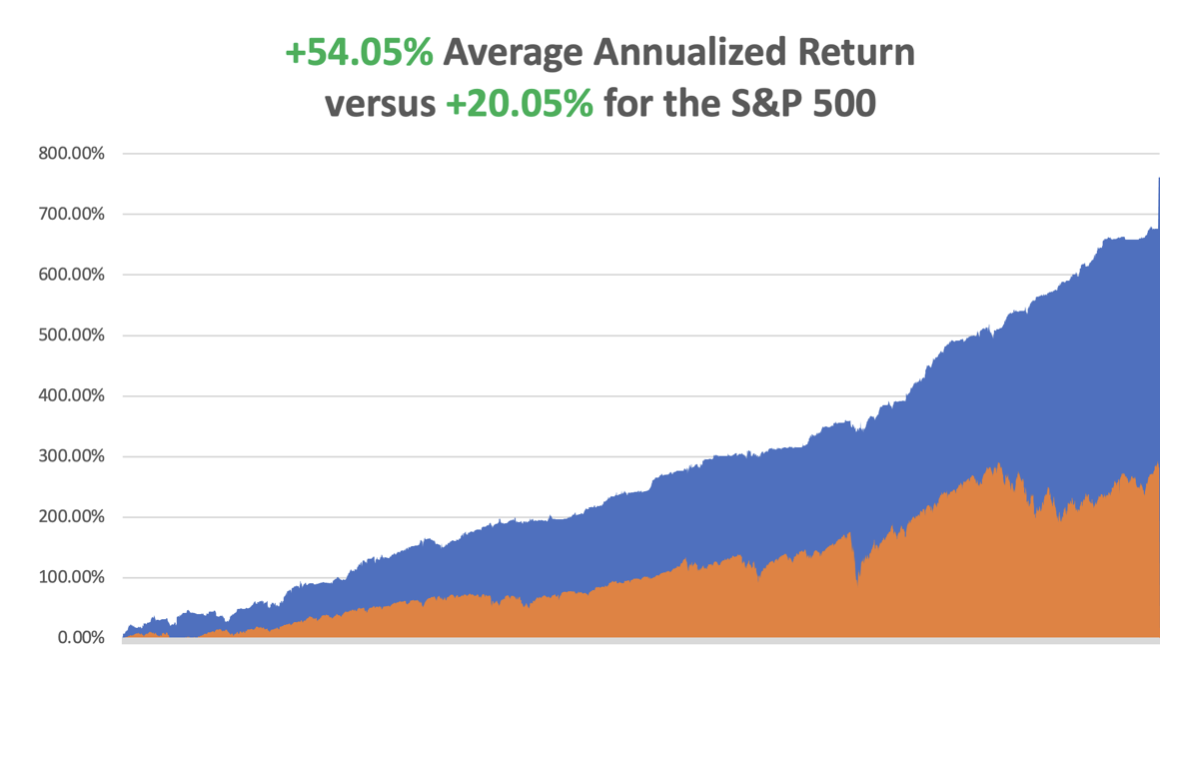

So far in January, we are up 0% since I have done no trades and have a 100% cash position. My 2024 year-to-date performance is also at 0%. The S&P 500 (SPY) is down -2.51% so far in 2024. My trailing one-year return reached +73.94% versus +34.46% for the S&P 500.

My 15-year total return is +676.63% and my average annualized return is +54.05%.

Some 63 of my 70 trades last year were profitable in 2023.

Did We Just See Another 2009 Bottom? If so, we could be looking at rising stocks for another 13 years, making my own Dow 120,000 forecast look conservative. Certainly, the fundamentals are there, as long as we don’t get another pandemic or 100 other things go wrong.

The Nonfarm Payroll Report Sizzles, at 216,000, better than expected. The headline Unemployment Rate maintained a near 50-year low at 3.7%. December’s payroll gains were driven by three categories: Education/health, leisure/hospitality, and government. The overall level of leisure/hospitality jobs remains below the pre-pandemic high, showing that some parts of the job market are still normalizing after the COVID-19 shock.

JOLTS Falls in December, nudging lower to 8.79 million, about in line with the Dow Jones estimate for 8.8 million and the lowest level since March 2021. The ratio of job openings to available workers fell to 1.4 to 1, still elevated but down sharply from the 2 to 1 level that had been prevalent in 2022.

Weekly Jobless Claims Dropped to 202,000, a two-month low. pointing to underlying labor market strength even as demand for workers is easing. With the report from the Labor Department on Thursday also showing the number of people on unemployment rolls remained elevated towards the end of December, financial markets continued to anticipate that the Federal Reserve would start cutting interest rates in March.

Tesla (TSLA) is Still the World’s Largest EV Maker. BYD (BYDDY) delivered 1.57 million EVs in 2023 compared to 1.8 million for Tesla (TSLA). BYD, which I visited in China 12 years ago when Warren Buffet bought a stake in it, is building factories in Europe, Latin America, and across Asia as part of a broader effort to expand sales across these continents, and its cars and buses are popping up in cities all over the world. They could never meet quality standards in the US. They offer a cheaper, lower margin, lesser quality product, but that is all that is needed in many emerging markets.

Copper (FCX) to Rise 75% in 2024, say industry analysts. Copper is headed for a price spurt over the next two years, as mining supply disruptions coincide with higher demand for the metal. Rising demand driven by the green energy transition and a decline in the U.S. dollar strength come the second half of 2024 will fuel support for copper prices. I’m going to keep telling you this until you buy more copper.

The Auto Business is Booming, at 15.6 million units delivered in 2023, a four-year high. Ford (F) saw a 7.6% increase in sales. Also a sign of a strong economy. The company’s F series pickup trucks remain the best-selling vehicle in America.

Pending Home Sales were Unchanged in November, despite record 30-year fixed-rate mortgages at 8.0%. The underlying real estate is far stronger than people realize. Mortgage rates are now solidly in the mid-6% range, but the supply of homes for sale is still very low. REMAX CEO Nick Baily says the market is short 4.5 to 5 million homes which will take a decade to build.

Gold (GLD) to Hit New High in 2024, with fundamentals of a dovish pivot in U.S. interest rates, continued geopolitical risk, and central bank buying is expected to support the market after a volatile 2023. Spot gold posted a 13% annual rise in 2023, its best year since 2020, trading around $2,060 per ounce.

Nippon Steel Buys US Steel (X) for $55 a Share, or $14.9 billion. That is double the next competing offer from Cleveland Cliffs (CLF). In clearly what is a trophy purchase, the buyer will honor all existing union deals. That certainly puts my December 2025 $20-$23 LEAPS issued last June at its maximum profit of 132%. Sell now if you still have it. There is only downside risk from here.

Home Prices Hit New All-Time Highs, according to S&P Case Shiller, up 0.6% in October and 4.8% YOY. That is nine consecutive months of gains. A 30-year fixed rate mortgage down to 6.7% is a help. Detroit had the biggest increase at 8.1%, followed by San Diego with 7.2% and New York with 7.1%. Portland, Oregon, was the only one of the 20 cities where prices fell year over year. A decade-long bull market has begun.

Core PCE Dives to a 3.2% YOY Rate. Headline Personal Consumption Expectation fell to only 2.6%, closing in on the Fed’s 2.0% target. It’s no longer a question of if the Fed will cut interest rates, but how much and how fast.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age or the next Roaring Twenties. The economy decarbonizing and technology hyper accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, January 8, at 8:30 AM EST, the Consumer Inflation Expectations are out, one of the Fed’s favorite inflation reads.

On Tuesday, January 9 at 8:30 AM, the NFIB Business Optimism Index will be released.

On Wednesday, January 10 at 2:00 PM, the MBA Mortgage Applications will be published.

On Thursday, January 11 at 8:30 AM the Weekly Jobless Claims are announced. We also get the Consumer Price Index for December.

On Friday, January 12 at 2:30 PM, the December Producer Price Index is published. At 2:00 PM the Baker Hughes Rig Count is printed.

As for me, when I drove up to visit my pharmacist in Incline Village, Nevada, I warned him in advance that I had a question he never had heard before: How good is 80-year-old morphine?

He stood back and eyed me suspiciously. Then I explained in detail.

Two years ago, I led an expedition to the South Pacific Solomon Island of Guadalcanal for the US Marine Corps Historical Division (click here for the link). My mission was to recover physical remains and dog tags from the missing in action there from the epic 1942 battle.

Between 1942 and 1944, nearly four hundred Marines vanished in the jungles, seas, and skies of Guadalcanal. They were the victims of enemy ambushes and friendly fire, hard fighting, malaria, dysentery, and poor planning.

They were buried in field graves, in cemeteries as unknowns, if not at all left out in the open where they fell. They were classified as “missing,” “not recovered,” and “presumed dead.”

I managed to accomplish this by hiring an army of kids who knew where the most productive battlefields were, offering a reward of $10 a dog tag, a king's ransom in one of the poorest countries in the world. I recovered about 30 rusted, barely legible oval steel tags.

They also brought me unexploded Japanese hand grenades (please don’t drop), live mortar shells, lots of US 50 caliber and Japanese 7.7 mm Arisaka ammo, and the odd human jawbone, nationality undetermined.

I also chased down a lot of rumors.

There was said to be a fully intact Japanese zero fighter in flying condition hidden in a container at the port for sale to the highest bidder. No luck there.

There was also a just discovered intact B-17 Flying Fortress bomber that crash-landed on a mountain peak with a crew of 11. But that required a four-hour mosquito-infested jungle climb and I figured it wasn’t worth the malaria.

Then, one kid said he knew the location of a Japanese hospital. He led me down a steep, crumbling coral ravine, up a canyon, and into a dark cave. And there it was, a Japanese field hospital untouched since the day it was abandoned in 1943.

The skeletons of Japanese soldiers in decayed but full uniform lay in cots where they died. There was a pile of skeletons in the back of the cave. Rusted bottles of Japanese drugs were strewn about, and yellowed glass sachets of morphine were scattered everywhere. I slowly backed out, fearing a cave-in.

It was creepy.

I sent my finds to the Marine Corps at Quantico, Virginia, who traced and returned them to the families. Often the survivors were the children, or even grandchildren of the MIA’s. What came back were stories of pain and loss that had finally reached closure after eight decades.

Wandering about the island, I often ran into Japanese groups with the same goals as mine. My Japanese is still fluent enough to carry on a decent friendly conversation with the grandchildren of their veterans. It turned out I knew far more about their loved ones than they did. After all, it was our side that wrote the history. They were very grateful.

How many MIAs were they looking for? 30,000! Every year they found hundreds of skeletons and cremated them in a ceremony, one of which I was invited to. The ashes were returned to giant bronze urns at Yasakuni Ginja in Tokyo, the final resting place of hundreds of thousands of their own.

My pharmacist friend thought the morphine I discovered had lost half of its potency. Would he take it himself? No way!

As for me, I was a lucky one. My dad made it back from Guadalcanal, although the malaria and post-traumatic stress bothered him for years. And you never wanted to get in a fight with him….ever.

I can work here and make money in the stock market all day long. But my efforts on Guadalcanal were infinitely more rewarding. I’ll return as soon as I get the chance, now that I know where to look.

True MIA’s, the Ultimate Sacrifice

My Collection of Dog Tags and Morphine

My Army of Scavengers

Dad on Guadalcanal (lower right)

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader