When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Biotech and Healthcare Letter

February 29, 2024

Fiat Lux

Featured Trade:

(A LEAN, MEAN, HEALTHCARE MACHINE)

(MDT)

I admit that predicting where the S&P 500 will land in the next six months is a bit like guessing the next flavor of the month at your local ice cream shop — exciting but wildly unpredictable.

However, history has shown us that over a decade, it's more like betting on the sun rising in the east — pretty darn reliable for those looking to fatten their wallets.

Now, I'm not suggesting you throw your hard-earned cash at just any company that pops up in your stock app. No sir, we’re here for the smart picks.

And who's on my radar today? None other than Medtronic (MDT).

Let’s talk about why this healthcare giant could be the golden goose of your investment portfolio for the next decade.

Imagine a company that’s pretty much the Swiss Army knife of the medical device world, simplifying the lives of patients in 150 countries and tackling over 70 health conditions. Sounds like a dream, right? That’s Medtronic for you.

Sadly, it hasn’t been all sunshine and rainbows for this medical device company. Recently, Medtronic's growth has been more sluggish than a snail on a leisurely stroll, with revenues dipping ever so slightly in the latest fiscal year.

Blame it on COVID-19, people dodging doctor visits, or supply chain snafus; the healthcare sector has been through the wringer.

But, just when you thought it was all doom and gloom, Medtronic surprises everyone with a 4.7% revenue bump in its latest quarter.

With new gizmos and gadgets rolling out and an aging population that’s only going to need more medical attention, Medtronic is poised for a comeback.

Looking at the company’s trajectory and portfolio, I’m inclined to agree with optimists singing tunes of a 5.9% compound annual growth rate for the global medical device market till the decade's end. Considering that Medtronic is positioned in front of this segment, it doesn’t take much convincing that this stock is set for growth in the next years.

That’s not all though. Medtronic is trimming the fat by saying sayonara to its ventilator business, embracing a leaner, meaner approach.

Specifically, it plans to merge the remaining gems of its patient monitoring and respiratory interventions segment into a dazzling new business unit: acute care and monitoring.

Ultimately, the goal is to beef up organic revenue growth and buff up those financials. As they gracefully exit stage left from the ventilator biz, any lingering revenue from these machines will play a cameo in the “other” section of its financials, starting next quarter.

And let’s talk numbers for additional context, because who doesn’t love a good success story?

Over the last three quarters, Medtronic has been strutting its stuff with earnings just north of $3 billion on a revenue runway of $23.8 billion, flaunting a profit margin of 12.6%.

Not too bad, right? Still, there’s room to grow those figures, and a beefier profit margin means a happier ending for investors, with the stock potentially hitting new highs.

Can Medtronic truly follow through with a growth story? Well, its history says yes.

Medtronic's revenue has ballooned by 88% over the last decade, a feat that's as impressive as fitting into your high school jeans.

A significant chunk of this growth spurt came from its $42.9 billion acquisition of Covidien in 2015, which did more than just add a few zeros to its balance sheet — it catapulted Medtronic’s product portfolio and European presence into the stratosphere.

After that, the company continued to expand through a series of mergers, acquisitions, and good old-fashioned organic growth.

Peering into the crystal ball, there’s a strong potential that Medtronic will keep the growth party going at a steady clip of 4% annually in the medium term.

Let’s also not forget about dividends. Medtronic is the kind of company that keeps the dividend party going, having increased its payout for an impressive 45 years. Despite a modest bump this year, the future looks bright for dividend lovers.

So, should you buy Medtronic stock?

If you’re in it for the long haul, Medtronic seems like it's gearing up for an exciting journey. With a leaner, meaner approach and a market ripe for the taking, Medtronic's future looks bright. I suggest you buy the dip.

Global Market Comments

February 29, 2024

Fiat Lux

Featured Trade:

(The Mad MARCH traders & Investors Summit is ON!)

(THE GOVERNMENT’S WAR ON MONEY)

Nvidia, a titan in the world of graphics processing units (GPUs) and artificial intelligence (AI), has been making significant moves in recent years. One notable strategic investment is its interest in SoundHound AI, a company specializing in voice-enabled AI and conversational intelligence technologies. This move underscores a growing recognition of the transformative potential of voice AI and how it intersects with Nvidia's core competencies.

In this article, we'll delve into the reasons behind Nvidia's strategic interest in SoundHound AI, examining the benefits for both companies and the implications for the broader AI landscape.

Understanding SoundHound AI's Technology

SoundHound AI has established itself as a leader in the field of voice AI. The company provides two key technology offerings:

- Houndify: An independent voice AI platform enabling developers to integrate customized voice assistants that retain their own brand identity. It offers a comprehensive suite of features including natural language understanding, speech recognition, and speech synthesis.

- SoundHound App: A music recognition and discovery application that lets users identify songs by humming or singing. This app serves as a showcase for the capabilities of SoundHound's underlying technology platform.

The key advantages of SoundHound AI's technology lie in its accuracy, speed, and ability to understand complex, nuanced language. This makes its solutions ideal for building highly engaging voice-powered experiences for users.

The Synergy: Nvidia and SoundHound

Nvidia's interest in SoundHound AI highlights several areas of powerful synergy:

- Accelerating AI Development: Nvidia's GPUs are renowned for their ability to accelerate computationally intensive AI workloads. By collaborating with SoundHound AI, Nvidia can optimize its GPUs for voice AI applications, ensuring smooth, seamless, and highly responsive voice experiences.

- Hardware-Software Integration: Nvidia's investment in SoundHound AI facilitates vertical integration of their respective technologies. This translates into the development of purpose-built hardware and software solutions tailored to power the next generation of voice AI applications.

- Edge Computing Advantage: Voice AI is rapidly finding its way into edge devices like smartphones, smart speakers, and vehicles. Nvidia's expertise in edge computing platforms positions them to collaborate with SoundHound to develop efficient voice AI solutions for these resource-constrained environments.

- Generative AI Revolution: Advancements in generative AI, like ChatGPT and large language models, have the potential to revolutionize how we interact with voice assistants. Nvidia's leadership in AI, combined with SoundHound's conversational intelligence platform, could lead to the creation of even more intelligent and personalized virtual assistants.

The Competitive Landscape

While Nvidia and SoundHound AI have a promising path ahead, the voice AI market remains intensely competitive, dominated by tech giants like:

- Amazon (Alexa): Alexa's widespread adoption makes it a default choice in the smart home space.

- Google (Google Assistant): Google Assistant leverages the company's vast search capabilities and integration with its suite of products.

- Apple (Siri): Siri boasts seamless integration with Apple's devices and ecosystem.

SoundHound AI and Nvidia will need to differentiate themselves from the competition. A focus on customizable, brand-agnostic voice experiences and partnerships within specific industries could give them an edge.

Market Opportunities

Nvidia's strategic investment in SoundHound AI signals their belief in the immense growth potential of voice AI across various sectors.:

- Automotive: Voice AI is rapidly becoming an essential feature in vehicles. Intuitive voice commands for navigation, entertainment, and vehicle settings can improve driver safety and overall convenience.

- Smart Home: Voice-enabled smart speakers and appliances promise hands-free control of lighting, thermostats, and entertainment systems.

- Customer Service: Voice AI-powered chatbots can provide 24/7 customer support and address routine queries, freeing up human agents to handle more complex issues.

- Healthcare: Voice assistants can aid in remote patient monitoring, medication reminders, and even virtual consultations, increasing healthcare accessibility.

- Enterprise: Integrating voice AI into enterprise workflows can facilitate easier access to information, streamline meeting scheduling, and automate repetitive tasks.

Implications and Future Outlook Nvidia's partnership with SoundHound AI has both immediate and far-reaching implications for the technology sector:

- Voice AI Democratization: The collaboration could accelerate the adoption of voice AI across a wider range of devices and applications.

- Enhanced User Experiences: Optimized technology solutions can lead to faster, more natural, and personalized voice-driven experiences, driving user satisfaction.

- New Innovation Pathways: Combining Nvidia's AI prowess with SoundHound AI's expertise paves the way for groundbreaking advancements in the voice AI space.

Conclusion

Nvidia's interest in SoundHound AI represents a bold move with significant implications for both companies and the broader technology landscape. By leveraging each other's strengths, they have the potential to not only advance the state-of-the-art in voice AI but also unlock new use cases across diverse industries.

The convergence of Nvidia's computational power and SoundHound's innovative conversational intelligence platforms promises to fuel the development of increasingly sophisticated, intuitive, and ubiquitous voice assistants. As this collaboration matures, we can anticipate a future where seamless voice interactions become the norm, shaping the way we work, live, and interact with technology.

While major players dominate the current voice AI landscape, Nvidia and SoundHound's partnership could carve out a valuable niche – potentially disrupting the market with their focus on performance, efficiency, and customizability. The success of this strategic investment will have a transformative impact on the future of human-computer interaction.

Mad Hedge Technology Letter

February 28, 2024

Fiat Lux

Featured Trade:

(GOOGLE HITS A ROUGH PATCH)

(GOOGL), (MSFT), (OPEN AI)

Google’s stock has felt the pain the last few days.

Why?

Its generative AI has gone wrong or at least producing controversial images as Google’s AI technology produces historical figures in different ethnic races.

The backlash was so bad that Google CEO Sundar Pichai issued a mea culpa.

The incident marks the latest misstep from Google as it scrambles for positioning in the blossoming market for AI products and plays catch up to Microsoft (MSFT) and its AI partner OpenAI ChatGPT.

In a memo to staff on Tuesday, CEO Sundar Pichai said, "I know that some of its responses have offended our users and shown bias — to be clear, that’s completely unacceptable, and we got it wrong."

The underwhelming AI performance means that Google is falling way behind other competition.

All investors care about these days is the trajectory of AI and stocks go up just based on that.

There must be a question of whether the generative AI research they are doing is good enough and if they have the right talent to compete.

Right now it certainly doesn’t look good.

Google is in the unfamiliar position of not being the leader in a core, [machine learning]-driven technology.

Google is trying hard to catch up and now needs to go backward to repair a core technology component while dealing with a major PR blunder.

Google's first AI fumble came a year ago when the company released a demo of its AI chatbot, Bard, a few months after ChatGPT exploded onto the scene.

Google's chatbot spits out an inaccurate response in a promotional video that was widely circulated online. In the immediate aftermath, skittish investors wiped $100 billion from Google's market value just as Microsoft's fortunes climbed.

Google explained in a recent blog post that it tuned its Gemini image generation tool to show a range of people of different ethnicities and other characteristics but that it failed to account for cases that should not depict diversity.

This is setting up for a great buy-the-dip moment for the company.

In the short term, Google investors have been burnt.

The Mad Hedge Tech Letter had a bullish position in GOOGL and it got torched.

However, Google has been a good short-term trade since it became a duopoly with Meta.

The fact is that Silicon Valley is turning into a race for AI and Google are the kings of search using the older generation.

That doesn’t quite mean they possess the correct talent to compete in AI.

Search was never geared towards this one area of technology that has become the newest thing.

Google has dropped 12% since its January highs which is surprising because they have been a solid bet for years to rebound from any weakness.

Now Google has the unenviable task of proving to investors that they have the ability and capacity to go toe to toe at the high levels of the AI race.

We won’t see deteriorating ad numbers soon, but over time, this could become a slow burn of them ceding search share as AI becomes integrated into the search business.

I still believe Google is worth holding long-term, but we are seeing a mild pullback after a great 2023.

“Price is what you pay. Value is what you get.” – Said US Investor Warren Buffett

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

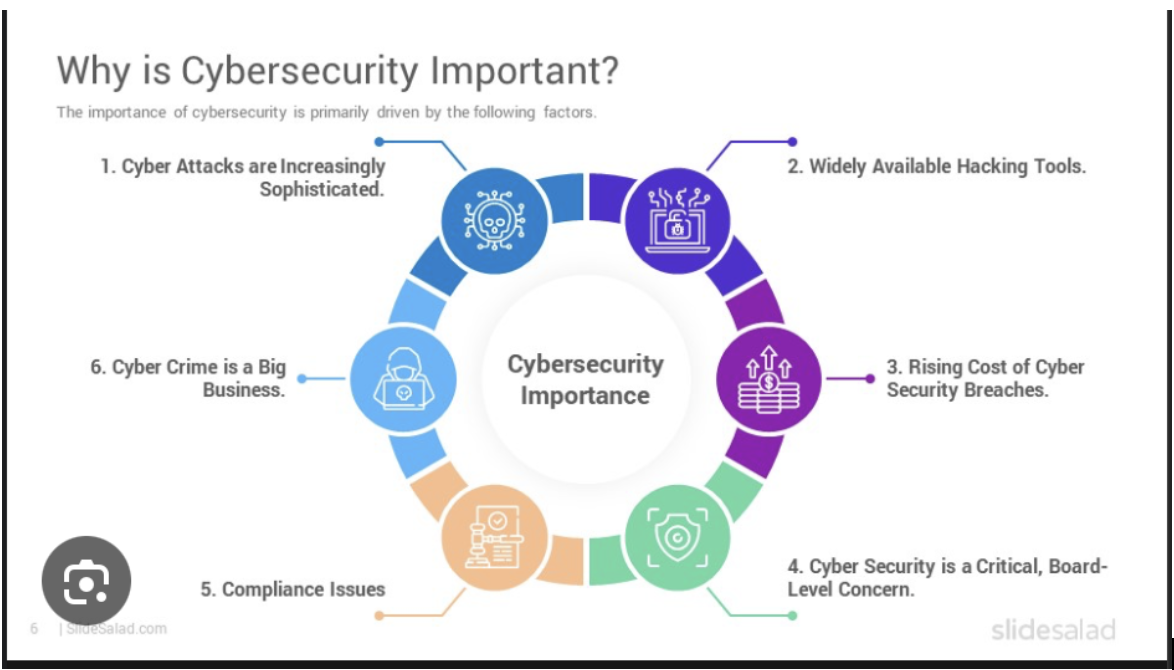

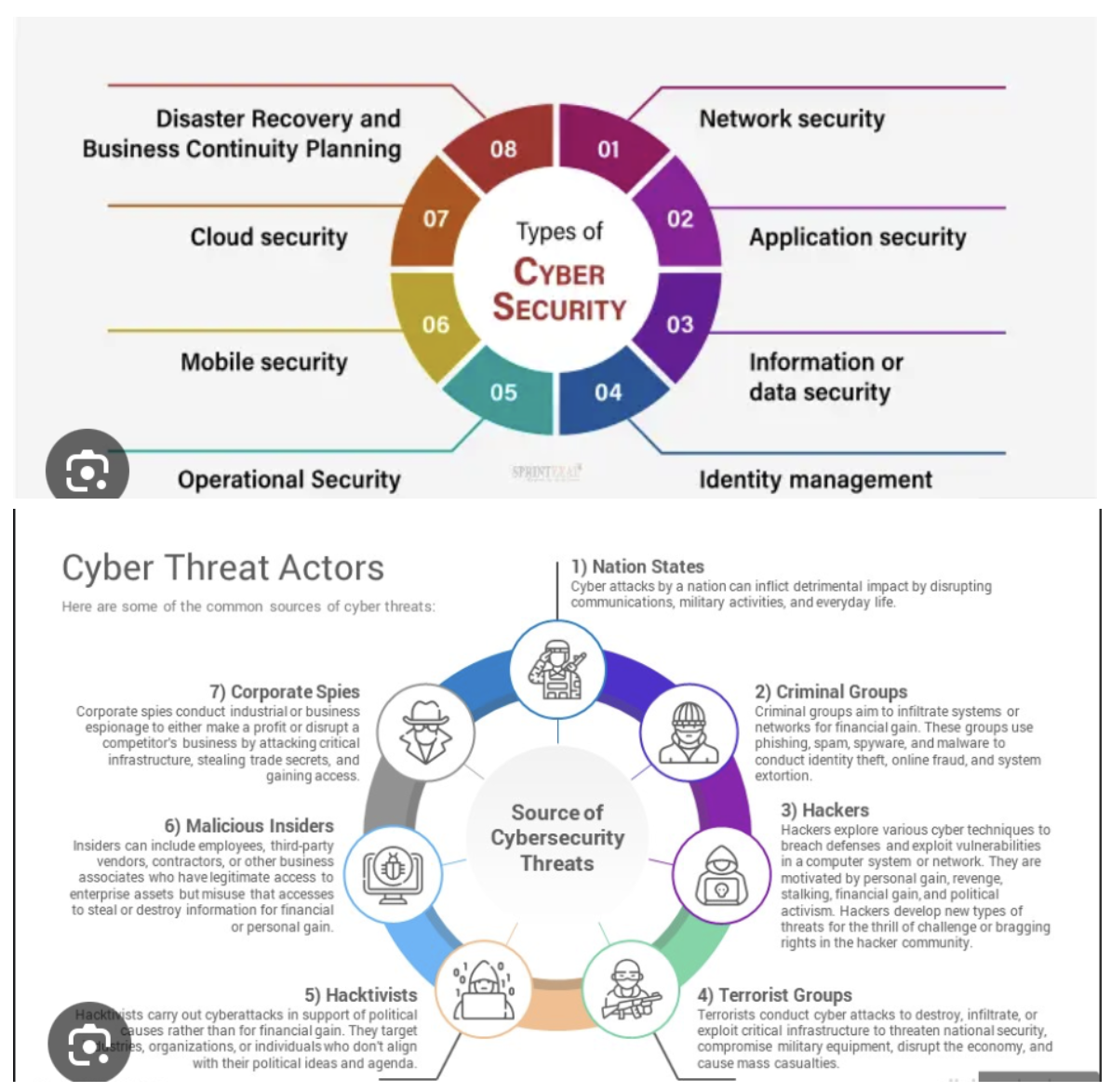

(AI TO THE RESCUE WITH CYBERSECURITY THREATS)

February 28, 2024

Hello everyone,

Globally cybersecurity attacks cost an estimated $8 trillion in 2023. Yes, that’s just one year. And that cost is set to rise to $10.5 trillion by 2025, according to Cybersecurity Ventures.

According to CEO Sundar Pichai, intelligence tools could help governments and companies speed up the detection of – and response to – threats from hostile actors.

With the real possibility of AI getting into the wrong hands, everyone is right to be worried. It is really a two-edged sword because while AI can strengthen defenses against nefarious actors, those same actors can also take advantage of this smart technology and exert pressure on governments and/or companies. It comes down to the fact that if you can run a little bit faster than your adversary you will triumph. Take time away from your opponent. And that is what AI will be designed to do for companies.

Last week, Google announced a new initiative offering AI tools and infrastructure investments designed to boost online security. A free, open-source tool dubbed Magika aims to help users detect malware – malicious software. Pichai said the tools were already being used in the company’s products, such as Google Chrome and Gmail, as well as its internal systems.

Companies are also starting to respond robustly to AI-generated “deepfakes” designed to deceive voters in election years. This can’t come soon enough, in my opinion, as the internet becomes an increasingly important sphere of influence for both individuals and state-backed malicious actors.

Former U.S. Secretary of State Hilary Clinton on Saturday described cyberspace as “a new battlefield.”

A report published last week by Microsoft found that state-backed hackers from Russia, China and Iran have been using its Open AI large language model (LLM) to enhance their efforts to trick targets.

Russian military intelligence, Iran’s Revolutionary Guard, and the Chinese and North Korean governments were all said to have relied on the tools.

Cheers,

Jacquie

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.