When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Technology Letter

March 11, 2024

Fiat Lux

Featured Trade:

(MICROSTRATEGY STRATEGIZES TO PROFITS)

(MSTR), ($BTC)

There has been one tech company that has tied its fortunes directly to the price of Bitcoin ($BTC) and that is MicroStrategy (MSTR).

Gutsy is a word that would describe this direction, and some would even say it’s full out irresponsible.

The daring company has had to deal with fallout when bitcoin crashes and it was brutal in the PR world.

Yet as Bitcoin soars in price today, the co-founder of MSTR Michael Saylor should take a victory lap.

Saylor was on the receiving end of a great deal of scorn and criticism as Bitcoin tanked to $15,000 per coin.

Now the company is levering up some more to go bigger.

MSTR bought another 12,000 Bitcoin for $821.7 million, the second-largest purchase by the enterprise software maker since it began acquiring the cryptocurrency almost four years ago.

The fresh hoard raised MicroStrategy’s total Bitcoin holdings to around 205,000 tokens, or to more than $14 billion.

Saylor started buying Bitcoin in 2020 as an inflation hedge and alternative to holding cash. MicroStrategy has already spent more than $1 billion in Bitcoin in the first three months of 2024, more than half of last year’s total buying. The cryptocurrency is up around 675% since Saylor began buying.

The shift into Bitcoin has led to a revival in the share price of MicroStrategy, which has surged more than 1,000% since Saylor’s pivot.

The company’s market capitalization has increased to around $25.7 billion, topping the level that it previously peaked at in March 2000. MicroStrategy reached a settlement in December 2000 with the SEC over accounting fraud allegations.

The average price for the total holding is $33,706, according to the filing. Bitcoin reached a record high of more than $72,000.

The company also presides over a real software business and they believe that the combination of an operating structure including a bitcoin strategy will succeed.

MSTR’s focus on technology innovation provides a unique opportunity for value creation.

Being an operating company, MSTR’s software business remains a core revenue and cash flow generator.

In addition, it also enables them to acquire bitcoin through the use of excess cash or proceeds from equity capital raises or corporate debt capital raises and to pursue software innovations that leverage the bitcoin blockchain.

They’ve deployed these levers to increase bitcoin holdings in a manner that has created shareholder value.

Bitcoin development includes its Bitcoin acquisition strategy and Bitcoin advocacy initiatives.

MSTR’s software development includes BI, AI, Cloud, or Bitcoin and Lightning-related software development.

In 2024, they are hell-bent to shift focus to grow in AI plus BI, while accelerating a sharp transition to a cloud-centric operating model.

Key strategic goals are to grow cloud, innovate with AI, and increase profitability.

In December, they successfully deployed Google Cloud platform integration, furthering multi-cloud capabilities, and providing greater optionality to their customers.

I won’t say that MSTR’s software and cloud business will compete with the Silicon Valley Magnificent 7, but its existence is to support a risky Bitcoin strategy which is actually working effectively as we speak.

Sometimes risky bets pay off well.

Shares in this company will either skyrocket or go to zero depending on what Bitcoin does.

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

(THE MARKET IS HUMMING ALONG, BUT IS RIPE FOR A PULLBACK)

March 11, 2024

Hello everyone,

Week ahead calendar

Monday, March 11, 2024

Earnings: Oracle

Tuesday, March 12, 2024

8:30 am Consumer Price Index (February)

2:00 pm Treasury Budget (February)

Wednesday, March 13, 2024

Earnings: Dollar Tree, Lennar

Thursday, March 14, 2024

8:30 am Producer Price Index (February)

8:30 am Retail sales (February)

10 am Business Inventories (January)

Earnings: Dollar General, Adobe, Ulta Beauty.

Friday, March 15, 2024

8:30 am Export Price Index (February)

8:30 am Import Price Index (February)

8:30 am Empire State Index (March)

9:15 am Capacity Utilization (February)

9:15 am Industrial Production (February)

9:15 am Manufacturing Production (February)

10 am Michigan Sentiment preliminary (March)

Earnings: Progressive

February’s consumer inflation data this week comes after January’s surprisingly hot report put a spanner in the works for investors, puncturing hopes that the last mile to the Fed’s 2% inflation target will be a walk in the park.

On a monthly basis, headline CPI is expected to have risen a little from the prior month – even though the year-over-year gain remains the same. Economists polled by FactSet are anticipating a 0.4% increase, up from a previous gain of 0.3%. On a yearly basis, it’s expected to have risen by 3.1%.

Core CPI – which excludes food and energy prices – is expected to show a slight moderation in inflation. Economists’ forecasts increase by 0.3% and 3.8% on a monthly and yearly basis. That’s down from respective gains of 0.4% and 3.9% in January’s report.

Wall Street’s focus will be where inflation has proved to be stubborn. Those sectors include medical expenses, transportation, airline fares, food (takeout), and shelter.

Do we have healthy consumers?

This week will also highlight the health of the consumer. Rising credit delinquencies have some investors wringing their hands and pacing the floorboards.

The corporate earnings season has been stronger than expected, with the S&P500 profits tracking to have risen by 4.1% in the fourth quarter, according to FactSet data.

But all the euphoria around the potential for artificial intelligence has not been seen in consumer-oriented companies, perhaps offering us a cautionary narrative that positive sentiment is not felt by all.

Nordstrom shares dropped 18% after the department store chain warned of a potential sales drop this year, even after beating fourth-quarter expectations. Who physically shops in department stores anymore or even online? The competition now is fierce for the consumer’s dollar, and I believe department stores fall last in line when consumers want to part with their pennies.

Used, second-hand, pre-loved – whatever you want to call it – is very “modern” these days. More and more of these stores are popping up online and consumers are migrating to these stores on mass.

Many consumers are also shopping in various charity shops and are finding absolute bargains. I, for one, have picked up some incredible finds in various charity shops over the years, some of which I have on sold and some of them I am still wearing. Shoes that sell for a retail price of $400, I picked up for $25.00, and jeans that retail for around $120, I bought for $12.00.

But these items are still probably going on credit cards. And that’s becoming a big problem.

Credit card delinquencies last year were shown to have risen by more than 50%, with consumer debt expanding to $17.5 trillion – signalling “financial stress.”

Any rise in inflation combined with this financial hardship puts pressure on the consumer. You can read the narrative as a domino effect. If the economy starts to slow and inflation ticks higher, then the consumer may start to tighten the reins and limit spending, which can feed into the markets as well.

On Thursday, Wall Street receives sales data for February. So, we will see how healthy the consumer really is. A healthy consumer equals sunny days in the weeks ahead.

Everything is humming along nicely now, but…

The economy is motoring along, earnings have surprised to the upside, investor sentiment remains bullish, and the consumer remains resilient.

But with high valuations, a pullback is not far away. So, what do you do? You can take profits here and allocate that money to stocks in underperforming sectors, or you can take half off the table and let the other half run, or you can ride out any pullback – meaning just leave it.

A pullback is healthy and lets the market breathe and take stock.

IN BRIEF:

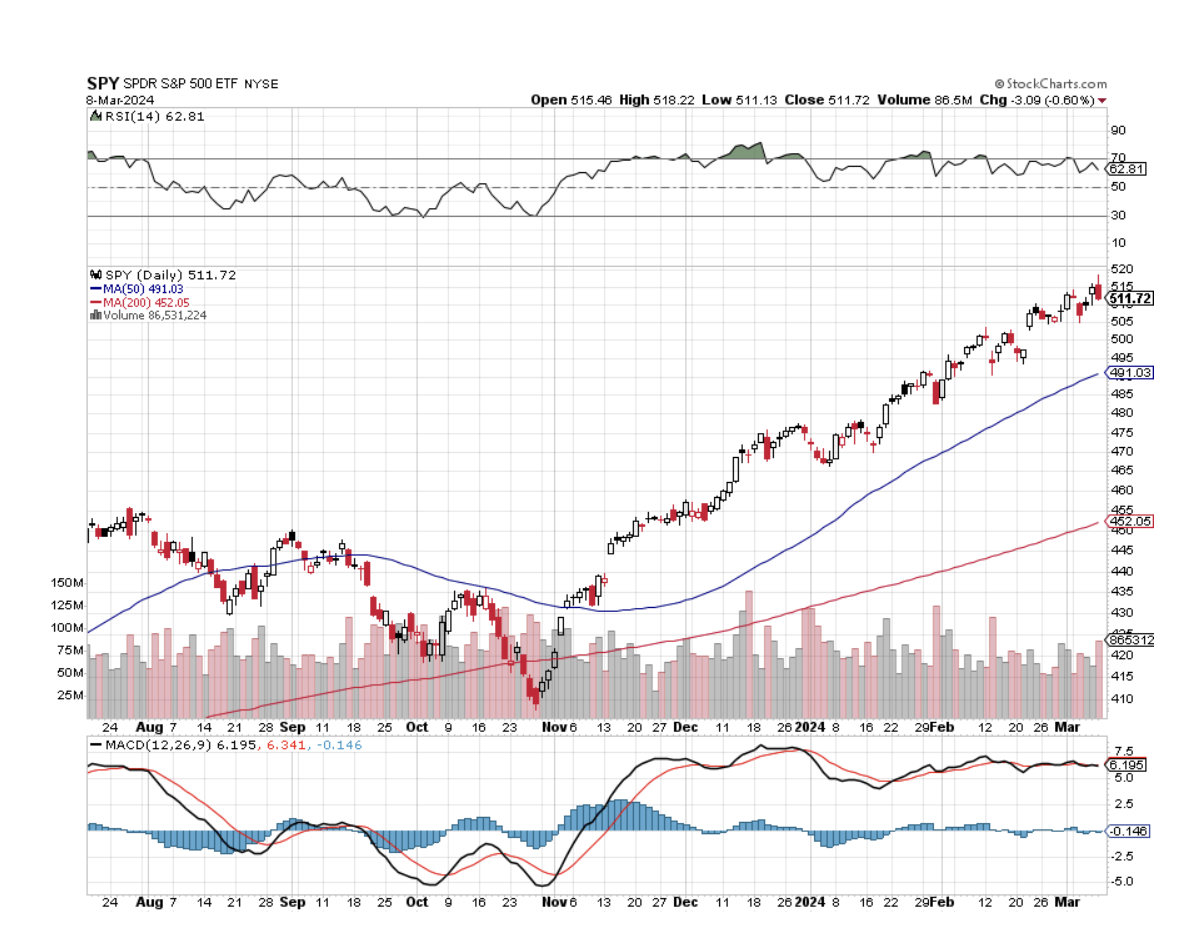

U.S. STOCK MARKET (S&P500)

We are in for a correction, but please note this is not the death of the bull market. Support lies at around 5040, and any lower should contain around 4,950. Our ‘Big Picture’ target is still around 5,750.

GOLD

The yellow metal broke out of its symmetrical triangle and has rallied well. Support lies around $2,120, which will enable another rally toward $2,250 level. Medium-term target is $2,530.

SILVER

Rally is well underway. Potential inverse head and shoulders target = around $34.90

BITCOIN

Uptrend in progress. Support lies around $66,000/$63,000/$60,000. Next target is around $77,500 level.

If you are following Ethereum, the rally will continue in this crypto coin as well. Medium-term target is around $8,700.

BONDS

TLT should continue to rally, and yields will continue to fall for the medium term.

Cheers,

Jacquie

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

March 11, 2024

Fiat Lux

Featured Trade:

(The Mad MARCH traders & Investors Summit is ON!)

(MARKET OUTLOOK FOR THE WEEK AHEAD, or HIGHER HIGHS)

(NVDA), (META), (IWM), (AMZN), (RIVN), (SNOW), (GLD), (GOLD), (NEM), (FXI), DELL), (AAPL), (TSLA), (CCJ), ($NIKK), (USO), (GOLD)

I was all ready to write another hyper-bullish report for the week. That was at least until noon EST on Friday. That’s when NVIDIA (NVDA) Peaked at $955 and then free fell $100 to $855. New all-time and then a new intraday low on huge volume and that is the textbook definition of a market top.

Not that we should be complaining. At the high, (NVDA) was up an unimaginable 105% so far this year. I spent my week buying back short put options for 50 cents that I initially sold for $20. With a quarterly quadruple witching due this Friday, anything can happen.

By the end of February, more than half of all analyst 2024 yearend targets were met. The response was a rush to raise yearend targets, triggering the current melt-up.

It always ends in tears.

And I’m about to tell you something that you will absolutely love to hear. Lower interest rates dramatically increase corporate stock buybacks, already set at $1.25 trillion for 2024. That’s because of the lower cost of capital.

What do more share buybacks automatically bring? High stock prices, especially for large positive cash flow companies like big tech.

As much as the permabears hate to admit it, good news really is good news.

With all of the media obsession with NVIDIA (NVDA), my largest holding, and Meta (META), the fact is that the rally is broadening out. More than half of all industrial stocks are trading at all-time highs. Long-forgotten small caps (IWM) are also approaching 2021 all-time highs.

Going into this week managers were either overweight big tech and extremely nervous or out of big tech and kicking themselves. The urge to rotate is strong. But your standby rotation sectors, industrials, biotech, and banking have also seen big moves.

Which brings us to the subject of gold (GLD).

After a tedious one-year sideways consolidation, the barbarous relic blasted out to the upside above $2,200 an ounce, a new all-time high. After soaking up as much gold as they could over the past decade, China and Russia have finally taken the gold market net short, which is why we saw such dramatic price action.

With interest rates in the US soon to fall, the opportunity cost of owning non-yielding gold is about to shrink. That will cut the knees out from under the US dollar prompting a stampede into precious metals and Bitcoin.

Except this time, it’s different.

Gold miners usually outperform the yellow metal by four to one to the upside. Not so this time. Barrick Gold (GOLD) and Newmont Mining (NEM) were barely able to keep pace with the barbarous relic. That’s because inflation has boosted their costs and cut profit margins. After all, they are stock first and gold plays second.

Still, if gold reaches my $3,000 target in 2025 the LEAPS I sent out for (GOLD) last June should easily hit its maximum profit point of 298%.

That other weak dollar play, oil (USO) may not deliver the joys of past cycles and may in fact be trapped in a fairly narrow $60-$80 range. The futures markets are saying that the price of Texas tea will be lower in a year.

The US is now the world’s top oil producer at 13 million barrels/day and that is rising (thanks to enormously generous tax breaks), capping prices. Non-OPEC+ production is increasing, especially from Brazil and Canada. China, the world’s largest oil importer is missing in action. But low inventories, especially at the American Strategic Petroleum Reserve, are preventing a crash as well. Shale production is growing.

Still, even a $20 rally can have a dramatic impact on the share prices of the big US producers, like Exxon (XOM) and Occidental Petroleum (OXY), some 25% of which is now owned by Warren Buffet. Even without some sexy price action, this sector pays some of the highest dividend yields in the markets.

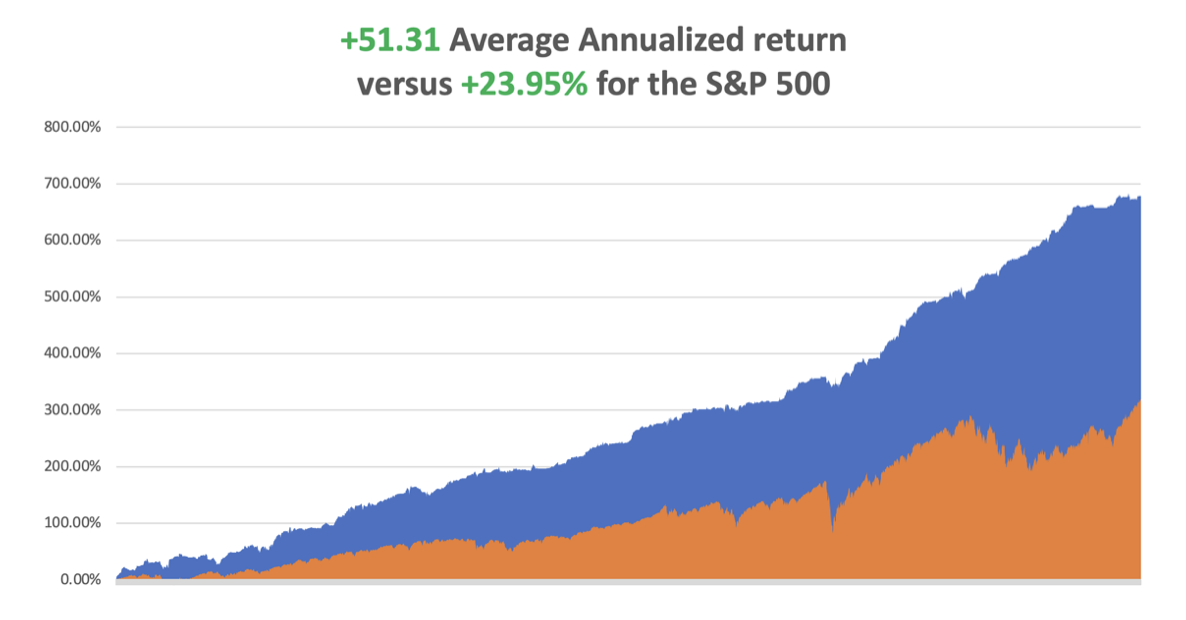

In February we closed up +7.42%. So far in March, we are up +0.70%. My 2024 year-to-date performance is at +3.21%. The S&P 500 (SPY) is up +7.11% so far in 2024. My trailing one-year return reached +54.28% versus +40.94% for the S&P 500.

That brings my 16-year total return to +689.74%. My average annualized return has recovered to +52.05%.

Some 63 of my 70 trades last year were profitable in 2023. Some 11 of 15 trades have been profitable so far in 2024.

I used the ballistic move in (NVDA) to take profits in my double long there. I am maintaining longs in (AMZN) and Snowflake (SNOW). I am both long and short the bond market (TLT) and I am 60% in cash given the elevated level of the stock markets.

Nonfarm Payroll Report Rose 275,000 in February. The Headline Unemployment Rate rose to 3.9%, a two-year high. The report illustrates a labor market that is gradually downshifting, with more moderate job and pay gains that suggest the economy will keep expanding without much risk of a reacceleration in inflation. These are very Fed friendly numbers.

JOLTS Job Openings Report Rises by 140,000 to 8,890,000, less than expected. Leisure and hospitality led with 41,000 new jobs, construction added 28,000 and trade, transportation and utilities contributed 24,000. Growth was concentrated among larger companies, as establishments with fewer than 50 employees contributed just 13,000 to the total.

Rivian Shares Soar, on news it is halting plans to build a new $2.25 billion factory in Georgia, an abrupt reversal aimed at cutting costs while the company prepares to launch a cheaper electric vehicle. Shifting planned production of the forthcoming R2 model to an existing facility in Illinois will allow Rivian to begin deliveries in the first half of 2026, earlier than expected. Buy (RIVN) on dips.

New York Community Bancorp Bailed Out, with a cash infusion led by former Treasury secretary Steve Mnuchin. The shares soared from $2 to $3.41. That takes the heat off the sector….until the next one. The US is shrinking from 4236 banks to only six banks. Who says politics doesn’t pay?

Europe Moves Towards Interest Rate Cuts, igniting a global bond market rally. Staff projections now see economic growth of 0.6% in 2024, from a previous forecast of 0.8%. They presented a more positive picture of inflation, with the forecast for the year brought to an average 2.3% from 2.7%. Market bets increased on rate cuts taking place as early as June, with the euro trading 0.35% lower against the British pound following the news.

Beige Book Comes in Moderate, saying "labor market tightness eased further," in February but noted "difficulties persisted attracting workers for highly skilled positions." The Beige Book is a review of economic conditions across all 12 Fed districts. Fed Chair Jerome Powell told Congress on Wednesday that the U.S central bank expected "inflation to come down, the economy to keep growing," but shied away from committing to any timetable for interest rate cuts.

China Targets 5% Growth for 2024, but nobody buys it for a second. A covid hangover, residential real estate crisis triggering a financial crisis, and constant invasion threats over Taiwan, make this target a pipe dream. Avoid (FXI) and all Middle Kingdom plays.

Gold Hits New All-Time High, at $2,141 an ounce on expectations of imminent rate cuts by the Fed. Gold, often used as a safe store of value during times of political and financial uncertainty, has climbed over $300 dollars since the start of the Israel-Hamas war. Buy (GLD), (GOLD), and (NEM) on dips.

Dell (DELL) Becomes an AI Stock, sending the shares up 47% in a Day. That’s been changing over the past year, as Dell has been reporting strong orders of servers designed to power generative AI workloads—many of which use chips supplied by AI kingmaker Nvidia. The company’s fourth quarter results convinced any doubters. Can Apple (AAPL) do the same?

Tesla Plunges on Poor China Sales, down $14.50 on sales data dimmed the outlook for Tesla's global deliveries, at a time when the top EV maker is battling a decline in demand and is weighed down by a lack of entry-level vehicles and the age of its product line-up. Not the time to be in EVs or solar. Buy (TSLA) on bigger dip.

US National Debt is Rising by $1 Trillion Every 100 Days. A trillion here, a trillion there, sooner or later that adds up to a lot of money. Eventually, someone is going to have to do something about this. The US national debt stands at $34.5 trillion, or $104,545 per person.

The Uranium Shortage is Getting Extreme, with yellow cake up 112% in a year. Owners of left-for-dead uranium mines are restarting operations to capitalize on rising demand for the nuclear fuel. Most of those American mines were idled in the aftermath of Fukushima when uranium prices crashed and countries like Germany and Japan initiated plans to phase out nuclear reactors. Now, with governments turning to nuclear power to meet emissions targets and top uranium producers struggling to satisfy demand, prices of the silvery-white metal are surging. Buy (Cameco (CCJ) on dips.

Japan’s Nikkei ($NIKK) Tops 40,000, a new 34-year high. The ultra-weak Japanese economy is giving the economy there a free lunch, but better hedge your currency exposure. Good thing I missed a dead market for 34 years.

NVIDIA Replaces Tesla as Top Traded Stock, with volumes migrating to the options market as well. Blockbuster profits are catnip for traders, while EV price wars aren’t. Tesla is down 52% from its all-time high two years ago and is one of the biggest percentage decliners in the Nasdaq 100 Index this year.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. The economy decarbonizing and technology hyper accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, March 11 at 7:00 AM EST, the Consumer Inflation Expectations are announced.

On Tuesday, March 12 at 8:30 AM, Inflation Rate for February is released.

On Wednesday, March 13 at 2:00 PM, MBA Mortgage Applications are published

On Thursday, March 14 at 8:30 AM, the Weekly Jobless Claims are announced. We also get the Producer Price Index.

On Friday, March 15 at 2:30 PM, the University of Michigan Consumer Sentiment is published. At 2:00 PM the Baker Hughes Rig Count is printed.

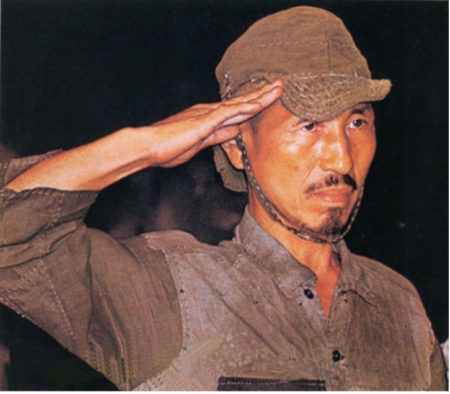

As for me, I have met many interesting people over a half-century of interviews, but it is tough to beat Corporal Hiroshi Onoda of the Japanese Army, the last man to surrender in WWII.

I had heard of Onoda while working as a foreign correspondent in Tokyo. So, I convinced my boss at The Economist magazine in London that it was time to do a special report on the Philippines and interview President Ferdinand Marcos. That accomplished, I headed for Lubang island where Onoda was said to be hiding, taking a launch from the main island of Luzon.

I hiked to the top of the island in the blazing heat, consuming two full army canteens of water (plastic bottles hadn’t been invented yet). No luck. But I had a strange feeling that someone was watching me.

When the Philippines fell in 1945, Onoda’s commanding officer ordered the remaining men to fight on to the last man. Four stayed behind, continuing a 30-year war.

As a massive American military presence and growing international trade raised Philippine standards of living, the locals eventually were able to buy their own guns and kill off Onoda’s companions one by one. By 1972 he was alone, but he kept fighting.

The Japanese government knew about Onoda from the 1950s onward and made every effort to bring him back. They hired search crews, tracking dogs, and even helicopters with loudspeakers, but to no avail. Frustrated, they left a one-year supply of the main Tokyo newspaper and a stockpile of food and returned to Japan. This continued for 20 years.

Onoda read the papers with great interest, believing some parts but distrusting others. His worldview became increasingly bizarre. He learned of the enormous exports of Japanese automobiles to the US, so he concluded that while still at war, the two countries were conducting trade.

But when he came to the classified ads, he found the salaries wildly out of touch with reality. Lowly secretaries were earning an incredible 50,000 yen a year, while a salesman could earn an obscene 200,000 yen.

Before the war, there was one Japanese yen to the US dollar. In the hyperinflation that followed the yen fell to 800, and then only recovered to 360. Onoda took this as proof that all the newspapers were faked by the clueless Americans who had no idea of true Japanese salary levels.

So he kept fighting. By 1974 he had killed 17 Philippino civilians.

After I left Lubang island, a Japanese hippy named Norio Suzuki with long hair, beads, and sandals followed me, also looking for Onoda. Onoda tracked him as he had me but was so shocked by his appearance that he decided not to kill him. The hippy spent two days with Onoda explaining the modern world.

Then Suzuki finally asked the obvious question: what would it take to get Onoda to surrender? Onoda said it was very simple, a direct order from his commanding officer. Suzuki made a beeline straight for the Japanese embassy in Manila and the wheels started turning.

A nationwide search was conducted to find Onoda’s last commanding officer and a doddering 80-year-old was turned up working in an obscure bookstore. Then the government custom-tailored a prewar Imperial Japanese Army uniform and flew him down to the Philippines.

The man gave the order and Onoda handed over his samurai sword and rifle, or at least what was left of it. Rats had eaten most of the wooden parts. You can watch the surrender ceremony by clicking here on YouTube.

When Onoda returned to Japan, he was a sensation. He displayed prewar mannerisms and values like filial piety and emperor worship that had been long forgotten. Emperor Hirohito was still alive.

When I finally interviewed him, Onoda was sympathetic. I had by then been trained in Bushido at karate school and displayed the appropriate level of humility, deference, mannerisms, and reference.

I asked why he didn’t shoot me. He said that after fighting for 30 years he only had a few shells left and wanted to save them for someone more important.

Onoda didn’t last long in the modern Japan, as he could no longer tolerate modern materialism and cold winters. He moved to Brazil to start a school to teach prewar values and survival skills where the weather was similar to that of the Philippines. Onoda died in 2014 at the age of 91. A diet of coconuts and rats had extended his life beyond that of most individuals.

Onoda wasn’t actually the last Japanese to surrender in WWII. I discovered an entire Japanese division in 1975 that had retreated from China into Laos and just blended in with the population. They were prized for their education and hard work and married well.

During the 1990’s a Japanese was discovered in Siberia. He was released locally at the end of the war, got a job, married a Russian woman, and forgot how to speak Japanese. But Onoda was the last to stop fighting.

The Onoda story reminds me of the fact that journalists learn very early in their careers. You can provide all the facts in the world to some people. But if they conflict with their own deeply held beliefs, they won’t buy them for a second.

Hiro Onoda Surrenders

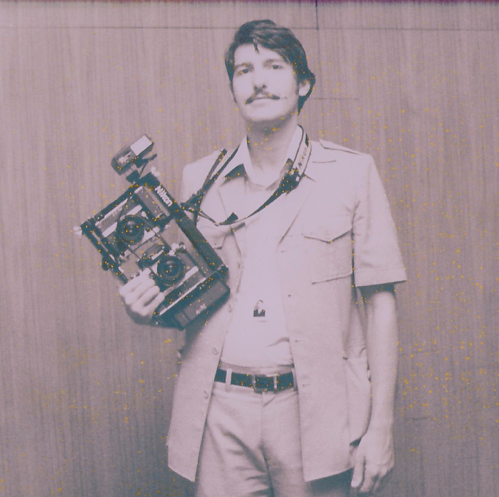

Budding Journalist John Thomas

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

“The January effect has been supercharged this year and needs to be checked for doping,” said Sandy Lincoln from BMO Asset Management.

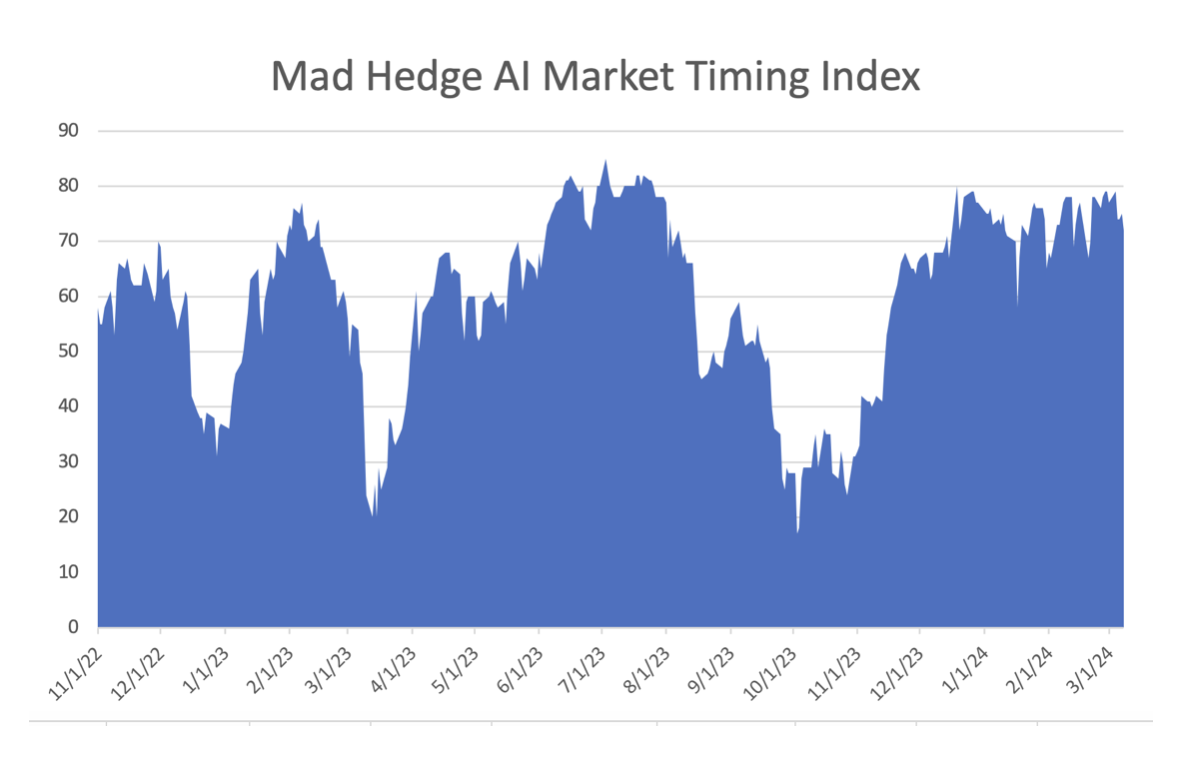

(SUMMARY OF JOHN’S MARCH 6, 2024, WEBINAR)

March 8, 2024

Hello everyone,

Title: Who Needs the Fed

Performance

March: -0.25%

Since inception: +679.5%

Average annualized return: +51.30% for 16 years

Trades

(AMZN) 3/$155-$160 call spread 10%.

(SNOW) 4/$150-$155 call spread 10%.

(TLT) 4/$87-$90 call spread 10%.

The Method to My Madness

Overheating risk is rising.

Domestic plays have come back to life; is a sector rotation at hand?

It’s been a great week for falling interest rate plays, including bonds, precious metals, energy, and even uranium.

The economic data is showing a global slowdown, except for the U.S. which is in good shape for now.

Buy stocks and bonds but only on substantial dip.

Commodities & industrials are a second half play.

The Global Economy – Heating Up

The soft landing is in the pipeline, according to the G-20 finance ministers in Sao Paulo.

Upside risks include faster-than-expected disinflation.

Core PCE comes in cool, at 2.8%, as expected.

University of Michigan Consumer Sentiment dips, from 79.6 to 76.9 in February.

The Fed may drag out the end of quantitative tightening.

Weekly Jobless claims up 13,000 to 215,000.

Q4 GDP is revised down from 3.3% to 3.2%.

The Conference Board bails on Recession Call.

Stocks – Is the Rotation at Hand?

US stocks now account for 70% of Global Stock Market capitalization, thanks to the ballistic move in big tech.

In his annual letter to Shareholders, Warren Buffett says there is Nothing to Buy.

Analysts are raising their year-end targets. John’s target is now at (SPX) 6000.

Big tech continues to dominate, with NVDA earnings at $22 billion YOY, up 225%.

Regional Bank – New York Community Bancorp, is in trouble.

European companies are flocking to the US to List.

Bonds – A Great Week

The bottom may be in for Bonds.

90-day T-bills at 5.25% still offer an attractive alternative.

Markets are discounting three rate cuts starting around mid-year.

Junk Bond ETFs (JNK) and (HYG) are holding up extremely well with a 6.37% yield.

John is seeing an $18-$28 point gain in (TLT) during 2024.

Buy (TLT) on dips.

Foreign Currencies – On Top Again

US$ holds three-month highs.

Falling interest rates guarantee a falling dollar for 2024.

Buy currencies now to position yourself for a US$ fall.

Energy & Commodities – Range Bound

A global commodity rally has dragged oil up.

Slow Chinese growth still drags on the global oil market.

Natural gas rallies 10% on the week.

US continues to dominate markets with 13 million barrels/day production.

Electrification of the US economy will continue to be a driving theme.

There is a “BUY” setting up here in energy when the global economy reaccelerates on a lower interest rate world. Watch (XOM) and (OXY).

Precious Metals – Signs of Life

Precious metals have a great week on slightly falling rates.

Investors are picking up gold as a hedge for 2024 volatility.

Gold is headed for $3000 by 2025.

Silver is the better play with a higher beta.

Russian and China are also stockpiling gold to sidestep international sanctions.

Real Estate – Getting Ready for the Spring

Existing home sales jump 3% YOY.

Construction spending dives in January in a shocking data release, the worst since October 2022. A jump in mortgage rates from 6.40% back up to a restrictive 7.0% is probably the cause.

New Home Sales weaken.

But demand for new construction remains underpinned by a persistent shortage of previously owned homes.

Toll Brothers rocks, taking the shares up 6% with extremely strong demand for new homes on the horizon. The gale force demographic tailwind continues.

Trade Sheet

Stocks – buy any dips.

Bonds – buy dips.

Commodities – buy dips.

Currencies – sell dollar rallies, buy currencies.

Precious Metals – buy dips.

Energy – buy dips.

Volatility – buy $12.

Real Estate – buy dips.

Next Webinar

12:00 PM EST Wednesday March 20 from Silicon Valley

Cheers,

Jacquie

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.