(PLTR), (MSFT)

Remember the talk about a new breed of AI that's been keeping tech forums and Wall Street chats abuzz for the past year?

Well, this new generation is said to be a leap forward, empowering systems to draft documents, summarize extensive data, tweak computer code, and even whip up presentations from scratch. It's like having a digital Da Vinci at your fingertips, only this artist is also a scribe, a coder, and an analyst.

Now, Bill Gates, a name that needs no introduction in tech circles, dropped some pearls of wisdom recently. He predicts that AI is about to flip the tech world on its head, especially how we interact with computers.

The father of Microsoft (MSFT) believes that in the next five years, AI "agents" might be handling tasks that would've seemed like a pipe dream a decade ago. In fact, Gates' crystal ball predictions put the economic jackpot of generative AI at a cool $1 trillion. And that's just for starters.

This is where Palantir Technologies (PLTR), the “godfather” of AI, comes in.

With roots planted by Peter Thiel of PayPal (PYPL) fame in the shadow of 9/11, Palantir initially set out to make sense of the data chaos for United States intelligence and law enforcement, spotting the baddies before they could act.

At the time, the CIA's venture capital segment, In-Q-Tel, emerged as one of the first investors in Palantir. The company’s AI systems later attracted more investors, expanding their reach to many government agencies in the US, including the FBI and the Department of Defense.

Fast forward, and Palantir's AI tools have grown up, now flexing their muscles not only across various government agencies but also into the corporate world.

Since it’s a pioneer in the AI movement, it came as no surprise that Palantir also became one of the first to explore generative AI. With its ability to offer productivity leaps that can save businesses big bucks, it's no wonder everyone from startups to conglomerates is paying attention to this technology.

Estimates are all over the place, but let's just say the potential market could hit $1.3 trillion by 2032, with some even whispering about a $13 trillion impact.

In short, it's a big deal, and Palantir is smack in the middle of it. Let’s take a closer look.

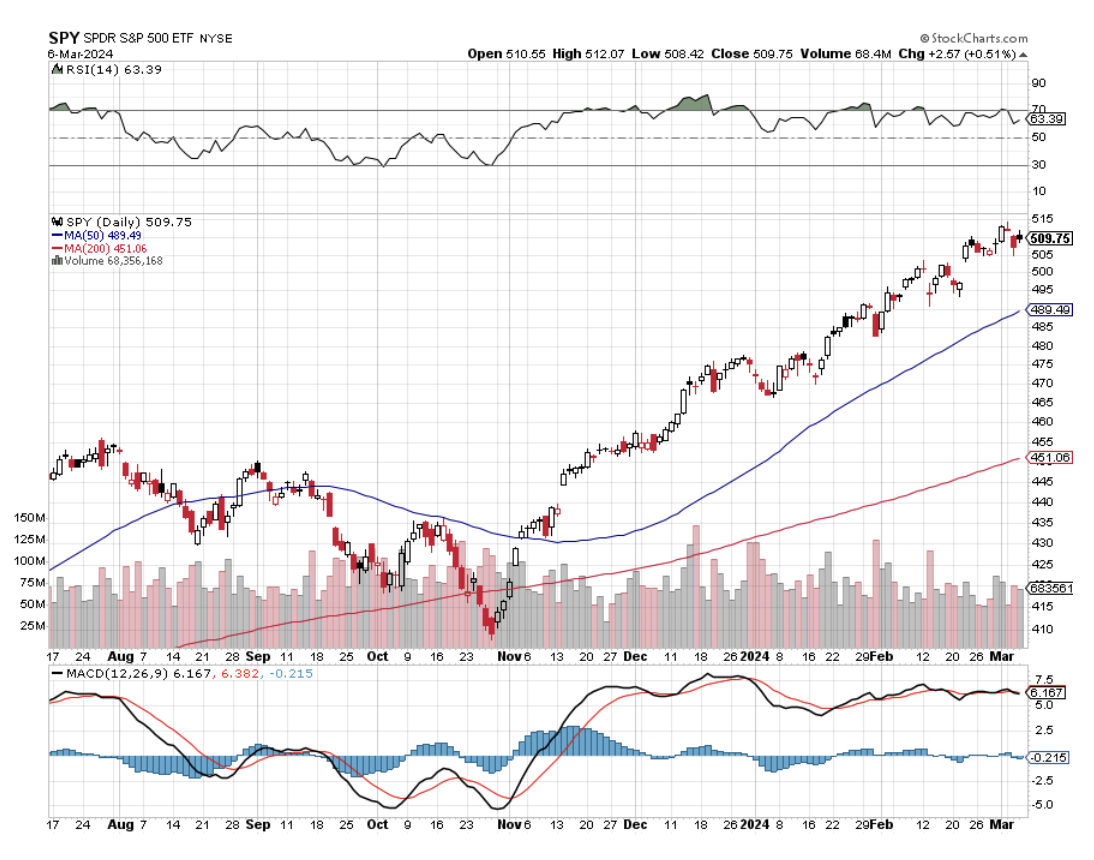

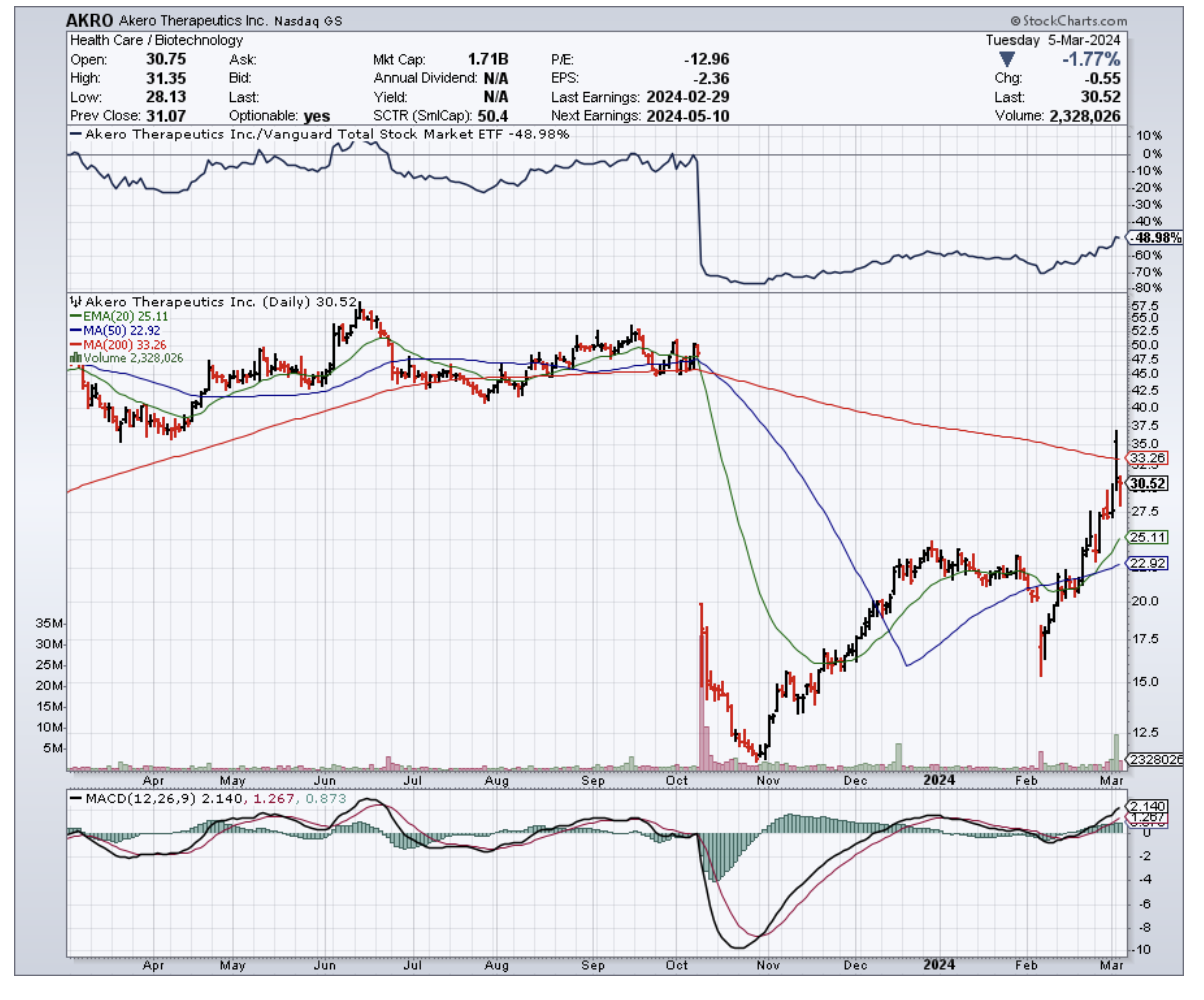

Ever since Palantir wowed us with a knock-your-socks-off fourth-quarter earnings report back last February, its stock has been on a bit of a joyride, leaping nearly 50%.

Why, you ask? Well, these folks saw their revenue balloon by a cool 20% year over year, hitting $608.4 million, with a hefty slice of that growth coming from a 32% spike in their commercial business revenue. It seems like everyone wants a piece of what Palantir's cooking.

Now, don't get me wrong, their government contracts are still bringing home the bacon, up 11% year over year to a tidy $324 million.

But here's the thing: even though Uncle Sam currently pads out 53% of Palantir's revenue pie, it looks like the scales are tipping in favor of commercial clients. And why wouldn't they? This side of the business has room to play with pricing and doesn't get tangled up in as much red tape.

So, what's fueling the fire? You guessed it – generative AI.

Palantir has been enjoying a skyrocketing surge in new sign-ups and growing bonds with the old guard, all thanks to their shiny new toy, the AIP (Artificial Intelligence Platform). It's like they've unleashed a secret weapon, and boy, is it making waves.

AIP isn't your garden-variety software; it's a powerhouse suite juiced up on generative AI. Imagine it as the ultimate data whisperer, pulling in bits and bobs from everywhere – those endless video calls, rapid-fire Slack chats, dense PDFs, snapshots, you name it.

Then, with a sprinkle of AI magic, it sifts through this maze of unstructured data, pulling out nuggets of insight that were hiding in plain sight.

This isn't just handy; it's a game-changer, pushing decision-making into overdrive by weaving new, operationally relevant info into the fabric of enterprise strategies.

The cherry on top? AIP's charm offensive has been nothing short of spectacular, helping Palantir seal the deal on 103 contracts, each ringing in at over a million bucks in annual recurring revenue during the fourth quarter alone.

Talk about expanding the battlefield – AIP's stretching Palantir's reach into markets it probably didn't even dream of tapping into before.

However, Palantir's secret sauce isn't just AIP. Their Bootcamp approach to marketing is like a masterclass in wooing customers. By rolling up their sleeves and showing off AIP's bells and whistles in these hands-on sessions, they've managed to shrink sales cycles down to a blink and turned prospects into paying customers faster than you can say "AI."

It's like watching a magician at work, turning curiosity into contracts with a snap of their fingers.

So, if you're sitting on the fence about diving into Palantir's stock, here's the scoop: with solid financials, a knack for pulling in commercial clients at breakneck speed, and AIP setting the stage for a whole new level of growth, this is a bandwagon you might want to jump on. For the long-haul investors out there, Palantir's shaping up to be the kind of ride that could make the wait worthwhile, offering a front-row seat to the AI revolution.