Global Market Comments

March 7, 2024

Fiat Lux

Featured Trade:

(REMEMBERING THE OLD DAYS AT MORGAN STANLEY),

(MS), (GS), (GLD), (FCX), (FXE), (FXY), (CCJ)

Global Market Comments

March 7, 2024

Fiat Lux

Featured Trade:

(REMEMBERING THE OLD DAYS AT MORGAN STANLEY),

(MS), (GS), (GLD), (FCX), (FXE), (FXY), (CCJ)

As we stand here in early 2024, it's clear that the application of artificial intelligence to financial markets has gone through a massive revolution compared to just a year ago. 2023 saw some interesting applications of AI start to take hold, but 2024 has seen a tidal wave of adoption and disruption sweep across the entire financial services industry. From hedge funds to banks, exchanges to fintech startups, AI is now deeply embedded into almost every nook and cranny of global financial markets.

In 2023, we saw the first hedge funds start to use large language models like GPT-3 and more specialized financial AI models to generate investment reports, conduct due diligence on companies, and even generate some basic trading strategies. However, these applications were relatively rudimentary and limited compared to what would follow just a year later.

The Real AI Arms Race Kicked Off in 2024

What kicked the 2024 AI revolution in finance into an entirely new gear was the introduction of more advanced large language models with multi-modal capabilities that could understand diverse data inputs like text, images, videos, and data tables. This new AI was also combined with vastly more powerful reasoning, coding, and mathematical skills that allowed it to build extremely complex models.

Leading financial firms quickly realized that having access to this new breed of general intelligence AI could provide a massive competitive advantage in an industry where being even a tiny step ahead of the competition is worth billions. This sparked a frantic AI arms race as funds raced to acquire the best AI technology and the key personnel to build production-grade AI systems customized for finance.

Virtually every major player, from huge institutions like BlackRock, JP Morgan, and Goldman Sachs to upstart AI-first hedge funds and quant shops doubled or tripled their AI budgets and went on hiring sprees for AI talent that has been dubbed the "AI Draft" of finance's best and brightest technical minds.

Billion Dollar AI Hedge Funds Ascendant

One of the biggest stories of 2024 so far has been the astronomical rise of a new breed of pure AI-driven hedge funds that completely disrupted the traditional investment landscape. These agile funds built from the ground up around large language models and dense neural networks were able to ingest and process a firehose of diverse data far exceeding what any human could consume.

They developed entirely novel trading strategies by combining the multi-modal reasoning of the new AI with advanced models trained on massive datasets of financial data, news, SEC filings, social media, and more. A number of these pure AI funds like Skynet Capital and DeepMind Money racked up staggering returns of over 100% seemingly out of nowhere and instantly became some of the most successful launches in hedge fund history.

Traditional titans of finance were caught completely flat-footed as these AI upstarts rapidly grew assets under management by tens of billions using novel, AI-driven approaches that gave them an information advantage by processing and modeling entirely new data sources traditional funds simply couldn't access or understand.

Banks Turn to AI for Consumer Finance

While hedge funds and asset managers grabbed the AI headlines, some of the biggest AI shifts so far in 2024 come in consumer banking and retail finance as lenders and fintechs scrambled to roll out personalized, AI-driven services to customers.

The largest banks and fintech lenders began deploying AI that could understand an individual's full financial picture and circumstances by being trained on data like income statements, spending habits, employment status, news about their employer, social media activity, investable assets, tax filings, and much more.

With this multi-modal understanding, banks utilized large language models and other AI to provide individually customized financial advice, automated investing services, tax optimization, tailored mortgages, customized lines of credit, and personalized ways to cut costs or increase savings. Banks found consumers placed immense trust in AI-generated advice as it was bespoke for their situation and provided explanations in easy-to-understand natural language.

Beyond just banks, startups and established fintech players made huge strides with AI-powered fintechs for areas like lending decisions, personal financial planning, real estate purchases, insurance plan selection, and more. Big winners were companies that could leverage the combination of specific domain knowledge and advanced AI to provide more personalized experiences tuned to individuals.

AI Also Powers Operational Disruption

AI hasn't just disrupted customer-facing products and investment strategies but also automated back-office processes and everyday operations at many financial firms. By combining large language models with custom internal datasets, firms deployed AI to intelligently draft legal contracts, automate significant pieces of due diligence, conduct audits, handle customer service queries, optimize back-office workflows, and more.

Virtually every major institution had a centralized AI hub or "brain" constantly being updated to build an ever-growing institutional knowledge base that encapsulated firm policies, procedures, historical knowledge, and decision patterns. Staff were able to submit queries to the AI across business units to instantly access relevant information or have the AI generate customized reports and analysis, radically accelerating work streams.

While AI promised immense cost-savings through automation, its biggest impact may have been on employee productivity by making information and analysis instantaneously accessible and consumable across the enterprise.

AI Goes Multi-Lingual for Global Finance

Another major AI trend taking shape in 2024 is the rise of multi-lingual AI support for global financial institutions. As firms rush to implement AI across their operations, they quickly discover many of the best AI models are limited by supporting only English.

This prompted a secondary wave of AI initiatives to develop "multi-lingual AI" that could understand and communicate in all of the world's major languages and even less commonly used languages for specific geographic markets.

With traders, analysts, lawyers, bankers, and investors able to naturally communicate with AI in their native language, it opened the door for deploying advanced AI capabilities to every corner of a firm's global operations rather than just English-speaking hubs. This leveled the playing field by giving all employees and customers access to AI-powered services rather than leaving many regions behind.

Regulatory Headaches Emerge Over AI Risks

Of course, not everything around the AI shakeup in 2024 is celebrated across the financial industry and beyond. As AI capabilities explode in scope and scale, serious questions are emerging about the unforeseen risks of these powerful systems and the need for new governance to oversee them.

A few high-profile cases involving hedge funds allegedly using AI to engage in market manipulation through disseminating rumors or misinformation sparked alarm among regulators. There were also issues raised around AI-generated investment advice having inherent conflicts or blindspots that could harm individual investors and employees of major banks making investment decisions based on potentially flawed AI research.

A major incident involving supposedly "air-gapped" models for a large asset manager being compromised and leaking sensitive trading algorithms caused an industry-wide scare over AI security models. More philosophical quandaries spawned debates around issues of bias, privacy, and the inscrutability of how some AI models arrived at decisions impacting portfolios worth trillions.

At any time, government agencies like the SEC, financial industry self-regulatory groups, and even international bodies like the World Bank could quickly mobilize to establish new legal frameworks and guidelines around the use of AI in finance. The primary goals might be around establishing clear rules around transparency, auditing capabilities, and guardrails to prevent misuse of AI that could destabilize markets or lead to systemic risks building up unnoticed.

While most see the need for smart AI governance, the industry clashes over how heavy a hand regulators should take that could stifle innovation or create imbalances favoring incumbents over nimbler startups. The debates around managing AI risk and capture are just getting started in 2024 with consensus still very elusive.

Looking Ahead into 2025 and Beyond

As we look ahead, most prognosticators expect the AI boom in finance to go to even more meta and extreme levels. The leading AI pioneers are already working on models with vastly more advanced reasoning and predictive capabilities around specific domains like legal contracts, investment research, regulation, and more.

It’s early to speculate, but If 2024 sees general language AIs just starting to gain traction, the next few years might be poised to give rise to ultra-specialized AI "savants" that can match or exceed human-level expertise and capabilities across every finance sub-domain. This could increase the speed and scope of automation, optimization, and data-driven strategies by an order of magnitude.

There's also increasing buzz around the possibility of scaling AI to operate relatively autonomously with diminishing human oversight, raising immense ethical questions over sovereignty and control. It's still uncertain whether AI will ultimately be more of an augmentation tool to empower humans or a path toward truly autonomous, self-directed artificial general intelligence.

Regardless of what the future holds, there's no question that 2024 is starting to feel like the year AI firmly planted itself as the prime disruptor and competitive battleground shaping the future of global finance at its very core. Just a year ago, most of these current impacts were unfathomable even to the leading experts. What new realities will emerge in the next 365 days is perhaps the biggest trillion-dollar question facing the entire industry.

Mad Hedge Technology Letter

March 6, 2024

Fiat Lux

Featured Trade:

(CYBER SECURITY IS STILL GROWTH)

(CRWD), (PANW)

Since starting the company, CrowdStrike (CRWD) has brought cybersecurity to the cloud.

They have pioneered AI for cybersecurity, and quickly become the de-facto security platform that disrupts, displaces, and consolidates other vendors.

This stock has been really good to Mad Hedge Tech Letter followers, and we recently took profits in a successful in-the-money bull call spread in CRWD.

Money will flow into enterprise protection as the stakes get higher with hackers looking to strike gold.

When talking about the threat landscape, CrowdStrike pioneered commercial threat intelligence that governments and companies of all sizes depend on.

It's CrowdStrike that delivers billions of new threat detections every month to stop breaches.

It's CrowdStrike that is the search bar of security, where security analysts complete millions of queries daily.

What took hackers hours, has shrunk to minutes and seconds. Attack speeds will only accelerate.

The cloud is increasingly under attack and CRWD exists to protect businesses against these attacks.

CRWD tracked a 75% year-over-year increase in cloud intrusion attempts.

The cloud is today's battleground for cyberattacks.

Generative AI is an adversary force multiplier and the last few years have seen the onboarding of this new force multiplier.

Gen AI puts advanced cybercrime tradecraft in the hands of attackers of all skill levels. Gen AI will dramatically grow the adversary population.

CRWD collects trillions of threat signals daily, creating one of the world's largest and fastest-growing cyberthreat datasets.

From day one, CRWD has been an AI company, training the industry's most effective and accurate AI models to prevent attacks based on data mode.

Embedded in the Falcon platform is a virtuous data cycle where CRWD collects cybersecurity's very best threat intelligence data, builds, and trains robust preventative and generative models, and protects CRWD customers with community immunity.

In today's environment of heightened cyberattacks, the latest SEC breach disclosure regulation only increases the pressure on companies and their boards.

One of the best of breeds and its superior performance are a critical reason to why the share price has moved up in the last few years.

Let’s look at the numbers behind the business model.

Moving to the P&L, total revenue grew 33% year over year to reach $845.3 million.

Subscription revenue grew 33% over Q4 of last year to reach $795.9 million. Professional services revenue was $49.4 million, representing 26% year-over-year growth.

Subscription customers were five or more, six or more, and seven or more modules growing to 64%, 43%, and 27% of subscription customers, respectively.

CRWD is landing bigger with new customers on average adopting 4.9 modules out of the gate, an increase over last year. CRWD’s gross retention rate remained high at 98%.

CRWD is knocking it out of the park.

It’s hard to maintain growth company status in the head of major macro headwinds.

Many enterprise businesses are pulling back spend, but cybersecurity hasn’t been curtailed as of yet.

Tech companies are becoming more efficient and cybercrime hasn’t felt the pain of leaner software budgets.

This bodes well for the future of cyber security and the main players in the industry.

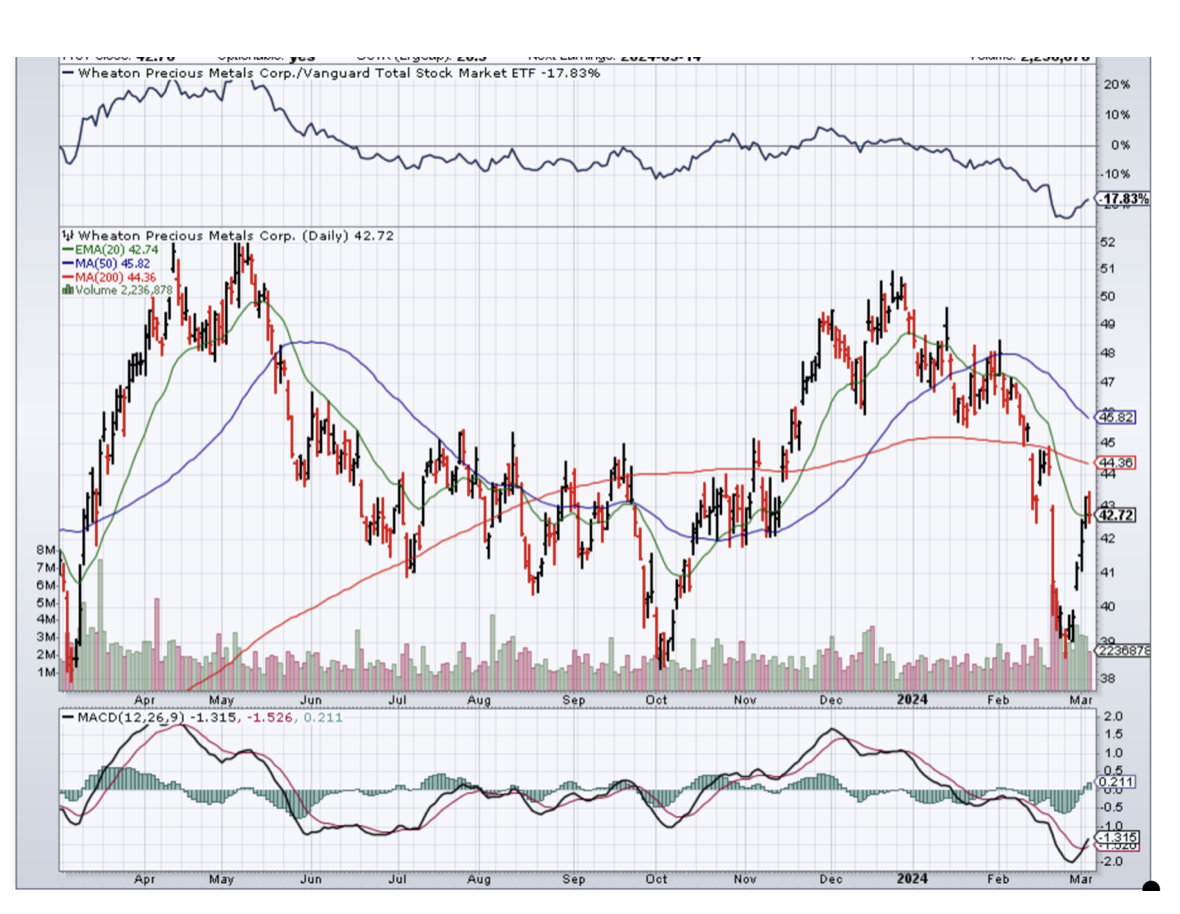

(WHY GOLD WILL SHINE IN 2024)

March 6, 2024

Hello everyone,

The price of gold has surged to a record high, driven by expectations of US interest rate cuts, investors hunting for haven assets and months of prodigious buying by central banks and Chinese investors.

On Tuesday, gold hit $2,141, beating the previous record of $2,135 set in December.

Tuesday’s move represents a continuation of a rally triggered on Friday by growing hopes of a Federal Reserve rate cut in June following weaker economic data. Gold, an asset with no yield, benefits from lower borrowing costs as investors feel they have not missed out so much by not putting their cash into bonds.

Gold’s 16-month rally from just above $1,600 in late 2022 has been primarily supported by record buying by central bank emerging markets after the US weaponised the dollar in its sanctions against Russia for its full invasion of Ukraine.

Chinese consumers have also participated in sending the metal higher as they are seeking a safe place to park their cash after local property and stock markets have tumbled.

Ross Norman, chief executive of Metals Daily, confirms that “Gold continues to flow to the east.”

Gold’s recent surge is still remarkable when you consider that the Fed’s benchmark rate is still at a 22-year high of between 5.25% and 5.5%, a level you would think would take the lustre out of gold’s allure. Seemingly, gold has broken its correlation with real rates and is instead being driven by central banks and Chinese household asset allocation. Furthermore, the expectation for slightly higher inflation trends in the future – higher than the pre-pandemic period - could explain this strong performance by gold. It is possible to interpret that this is a new era for gold which suggests that downside risks may be limited.

However, gold is still some way off its inflation-adjusted all-time high of $3,355.00 reached in 1980 when oil-driven inflation and turmoil in the Middle East capped a nine-year bull run.

Last week, the ISM Manufacturing Purchasing Managers’ Index indicated a far larger than expected contraction in the US manufacturing activity in January.

That propelled gold beyond what the market saw as its ‘triple top’ $2,070 mark, when Covid smashed the US in 2020. Russia invaded Ukraine in 2022 and the US banking crisis erupted last year.

Signs of pain in the US economy were reflected in government bond yields moving lower in the past week. This slowing also raised expectations that the Fed could cut rates in June.

Two-year Treasury yields have fallen by 0.23% points since the start of last week to 4.56%. Traders now place an 85% probability on the Fed delivering its first 0.25% point cut by June, up from 70% early last week.

New entrants in the sector have also contributed to the volatility and gold’s rise. Speculative trading, that is, option traders, have been positioning for bullion prices to rise. With the latter in mind, gold could also fall when trades reach expiration, or are liquidated.

Newmont Mining

Wheaton Precious Metals

Barrick Gold

Cheers,

Jacquie

Global Market Comments

March 6, 2024

Fiat Lux

Featured Trade:

(WHY THE DOW IS GOING TO 240,000)

(X), IBM (IBM), (GM), (MSFT), (INTC), (DELL), (NVDA), (NFLX), (AMZN), (META), (GOOGL), (BITO)

For years, I have been predicting that a new Golden Age was setting up for America, a repeat of the Roaring Twenties. The response I received was that I was a permabull, a nut job, or a conman simply trying to sell more newsletters.

Now some strategists are finally starting to agree with me. They too are recognizing that a ganging up of three generations of investment preferences will combine to drive markets higher during the 2020s, much higher.

How high are we talking? How about a Dow Average of 240,000 by 2035, up another 515% from here? That is a 40-fold gain from the March 2009 bottom.

It’s all about demographics, which are creating an epic structural shortage of stocks. I’m talking about the 80 million Baby Boomers, 65 million from Generation X, and now 85 million Millennials. Add the three generations together and you end up with a staggering 230 million investors chasing stocks, the most in history, perhaps by a factor of two.

Oh, and by the way, the number of shares out there to buy is actually shrinking, thanks to a record $1 trillion or more in corporate stock buybacks for the past decade.

I’m not talking pie-in-the-sky stuff here. Such ballistic moves have happened many times in history. And I am not talking about the 17th-century tulip bubble. They have happened in my lifetime. From August 1982 until April 2000, the Dow Average rose, you guessed it, exactly 20 times, from 600 to 12,000, when the Dotcom bubble popped.

What have the Millennials been buying? I know many, like my kids, their friends, and the many new Millennials who have recently been subscribing to the Diary of a Mad Hedge Fund Trader. Yes, it seems you can learn new tricks from an old dog. But they are a different kind of investor.

Like all of us, they buy companies they know, work for, and are comfortable with. During my dad’s generation that meant loading your portfolio with US Steel (X), IBM (IBM), and General Motors (GM).

For my generation, that meant buying Microsoft (MSFT), Intel (INTC), and Dell Computer (DELL).

For Millennials that means focusing on NVIDIA (NVDA), Netflix (NFLX), Amazon (AMZN), Meta (META), and Alphabet (GOOGL). Oh, and they like Bitcoin too (BITO).

That’s why the Magnificent Seven account for all of the past year’s monster gains.

There is another gale force tailwind pushing stocks up. The enormous profits created by artificial intelligence are essentially replacing the Federal Reserve as an unlimited source of liquidity. If you missed the quantitative easing and the free money of the 2010s, you get another pass at the brass ring. But you have heard me talk about this before so I won’t bore you.

There is one catch to this hyper-bullish scenario. Somewhere on the way to the next market apex at Dow 240,000, we need to squeeze in a recession. Bear markets in stocks historically precede recessions by an average of seven months. But for the time being, it looks like smooth sailing.

When I get a better read on precise dates and market levels, you’ll be the first to know.

“Economists say we’re having 2.5% growth. That’s a lie. The reality is that we have 5% growth for the top 20% of the economy, and 0% growth for the bottom 80% of the economy,” said Arthur Brooks, president of the American Enterprise Institute.

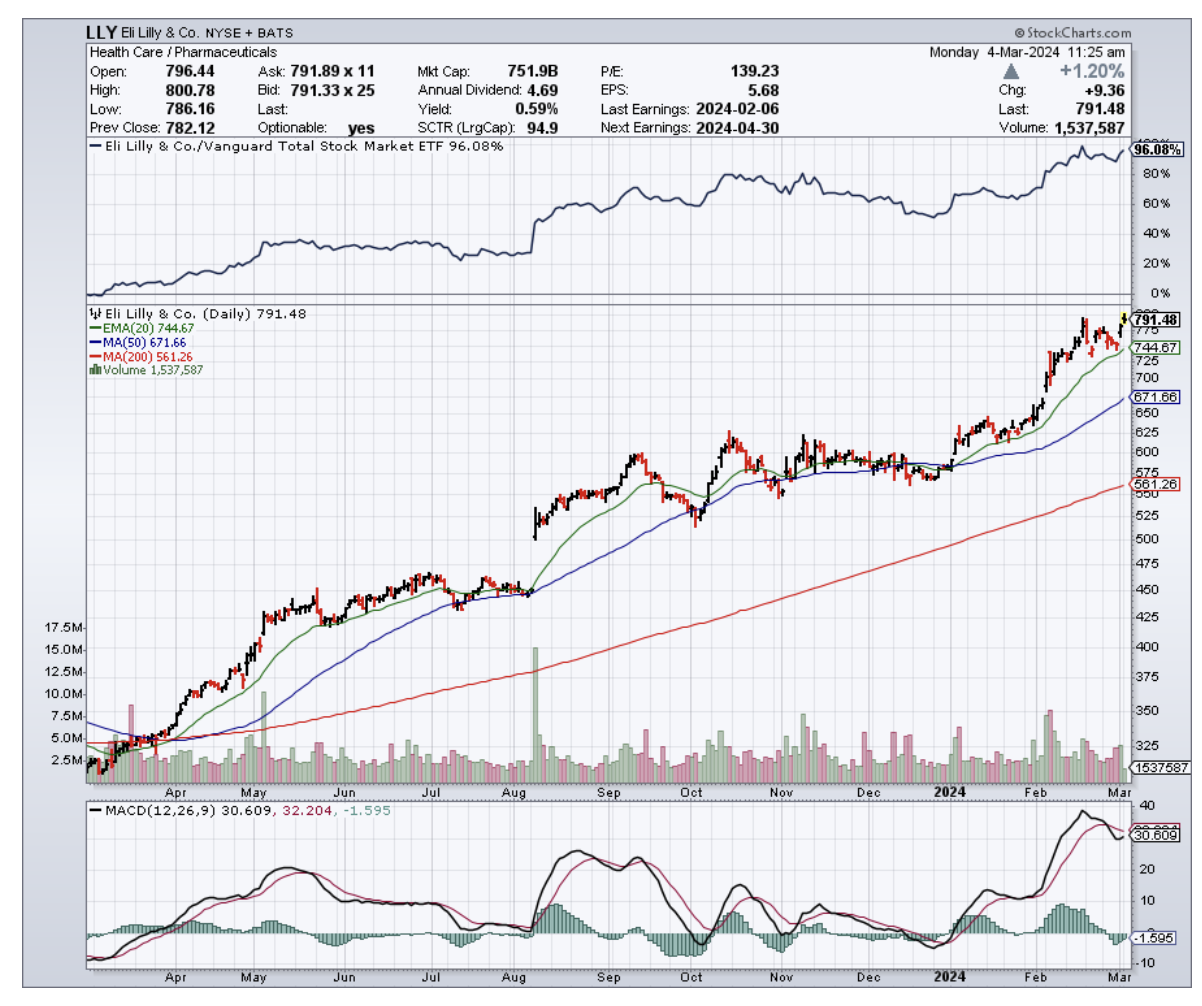

Mad Hedge Biotech and Healthcare Letter

March 5, 2024

Fiat Lux

Featured Trade:

(THE SKINNY ON ECONOMIC GROWTH)

(LLY), (NVO), (AMGN)

What might just give economies a bigger jolt than the frenzy of the Super Bowl or a jampacked Taylor Swift world tour? If you guessed the recent buzz around weight-loss drugs, take a bow. You see, it's not just about slimming waistlines anymore – these breakthrough medications could be a game-changer for the whole economy.

But first, a sobering reality check: health issues have been nibbling away at the U.S. labor force like a sneaky termite over the last 30 years, shaving off two to three percentage points.

Then there's the matter of early departures from this mortal coil, chipping away another 0.2 percentage points from annual labor growth.

Not to mention the legion of unsung heroes caring for the ailing, effectively benched from the workforce, leading to a 3% labor force deficit.

Among all the health issues affecting the labor force, obesity has been identified as a sneaky little gremlin, dragging down productivity and participation in the workforce.

With obesity affecting 40% of the U.S. population, we're talking about a hefty 1% slash in total output.

But what if there was a way to combat this? Enter stage left: Eli Lilly (LLY). Sure, you might know them as a big-league player in the pharma world, but did you know they're the brains behind blockbuster medications like Trulicity, Mounjaro, and cancer-battling Verzenio?

And the story gets even more exciting – it's not just their existing all-star lineup that's sent their stock soaring 180% since 2021. Their latest weight-loss marvel, Zepbound, got the FDA's green light last November. Think of it as Mounjaro's twin, sporting the same molecule but with a different name to keep things clear for their existing diabetes patients.

This breakthrough signals a massive shift in the obesity treatment landscape. The global anti-obesity market is projected to explode to a staggering $100 billion annually by 2030 – a dramatic leap from last year's $6 billion. To put that in perspective, global spending on cancer treatments is estimated at $220 billion this year.

Naturally, Lilly is poised to grab a big slice of that pie. Analysts are predicting a healthy 21.4% revenue boost this year, and nearly 24% by 2025. Talk about a growth spurt.

As for earnings? They're looking at nearly tripling in that timeframe. The future's so bright, Lilly might need shades.

But here's the catch: Lilly's stellar rise has its stock priced at a premium, and then some. We're talking 60 times this year's expected earnings. And while the company's profit train is set to chug along, not every stock can keep up those lofty valuations in the long haul.

And let's not forget about the competition. Novo Nordisk (NVO), with its own contenders Ozempic and Wegovy, is nipping at Lilly's heels, even as Amgen (AMGN) and others are hot on the trail with promising candidates of their own.

Yet, Lilly's not sweating it. With Zepbound (aka Mounjaro for the weight-conscious) already making waves as a go-to for obesity treatment, they're sitting pretty. It's like they've already won half the battle, with doctors and patients already in the know about this not-so-secret weapon.

Still, as tempting as it might be to hop on the Lilly bandwagon after seeing those numbers, we need to do a quick reality check before investing. It's important to remember that every stock has its ups and downs.

For starters, Lilly's stellar rise means their stock is trading at a premium – a hefty 60 times this year's expected earnings. And while the company's profit train is definitely chugging along, that kind of lofty valuation might be a bit too spicy for some investors' taste, especially in the long run.

So, what's the takeaway for those who want in on the action? Lilly's current price tag might give you pause, especially if you're looking for a bargain.

It's been a wild ride for this stock, and sometimes the best moves involve waiting for the market to catch its breath.

However, their dominant position in a rapidly expanding market definitely makes them a player worth watching closely. I suggest to buy on the dip.

Switching gears for a second, let’s take a look at the big picture. It turns out that widespread use of GLP-1 medications like Lilly's could deliver way more than just individual weight loss. We're talking about a potential shot in the arm for the entire U.S. economy.

Think about it: if 30 million Americans hop on the GLP-1 train with drugs like Mounjaro and Zepbound, and a conservative 70% of them see benefits, we could see a 0.4% boost in the U.S. GDP. And that's just the starting line.

In a best-case scenario, where 60 million Americans embrace these treatments and a whopping 90% benefit, the GDP could potentially surge by a full 1%. Even with more modest projections, with 15 million users and a 50% success rate, the economic impact would still be noteworthy.

This isn't just pocket change – it's serious economic muscle. With the right push, these weight-loss drugs could be the breakthrough prescription our economy needs, adding some serious pep to our growth alongside countless individual health transformations. Now, isn't that a story worth following?

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.