When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Biotech and Healthcare Letter

March 14, 2024

Fiat Lux

Featured Trade:

(TIPPING THE SCALE)

(NVO), (LLY), (VKTX), (PFE), (TSLA)

Imagine, if you will, me sitting down for my morning coffee, flipping through the latest in the biotechnology and healthcare world, when I stumble upon a story that's about as juicy as they come in the world of pharmaceuticals.

The headline? Novo Nordisk's (NVO) stock is on a joyride to the moon, courtesy of their latest heavyweight champ in the weight-loss drug arena, Amycretin.

And let me tell you, this isn’t some minor upgrade. This new candidate is like Wegovy's bigger, bolder cousin.

Now, for those of you who've been tracking the pulse of the market with me, you know I've got a soft spot for stories like these. It's not every day you see a drug come out swinging, making Wegovy look like it's been skipping gym sessions.

As for Novo, the stock didn't just jump following the reports about Amycretin’s performance. It practically did a backflip, soaring over 7% in Copenhagen. And Stateside? We're talking an 8.4% leap to a whopping $135.28. Yes, my friends, that's record-breaking territory.

Let me put this into perspective. Novo Nordisk, with this surge, practically eyeballed Tesla's (TSLA) market value and said, "Hold my beer."

We're talking about a market cap north of $560 billion. Makes you wonder if Elon's feeling the heat, doesn't it?

But this isn’t the last time we’ll hear about Wegovy. Novo’s former golden child of weight loss hasn't been kicked to the curb yet. Far from it.

In fact, the US Food and Drug Administration (FDA) recently stamped it with a seal of approval for reducing heart attack and stroke risks.

This is huge. Why? Because it cracks the door wide open for Medicare coverage. And considering more than 40% of American adults are wrestling with obesity, that's no small target market.

Now, I hear you asking, "But isn't Wegovy's price tag a bit... steep?" Sure, at over $16,000 annually, it's not chump change.

Still, this approval could shift the entire healthcare chessboard. Imagine, medications that once were shrugged off by insurers now potentially becoming mainstays in treatment plans. More importantly, this decision could lead to a surge in demand like never before.

Let me explain why. Prior to this FDA approval, insurers were practically turning their noses up at coughing up the cash for these types of meds. Despite that, folks were clamoring for Wegovy like it was the last slice of pizza at a party.

What do you suppose happens now that Wegovy's got the golden ticket for conditions that insurance can't help but cover? I mean, we're about to see demand go from "Please, sir, I want some more" to a full-blown Oliver Twist riot.

Given this demand, it’s no longer surprising that the scene is getting crowded with competitors itching for a piece of the pie.

Eli Lilly's (LLY) not sitting this dance out, with Zepbound and Mounjaro drawing eyes and opening wallets. Actually, analysts are already placing bets, with some forecasts shooting as high as $60 billion by 2030 across various applications.

Aside from the established names in this niche, there are also up-and-comers like Viking Therapeutics (VKTX) with its impressive trial results for VK2735. Then there's Pfizer (PFE), fumbling a bit with orforglipron but not out of the game yet.

For all of us watching all these unfold, this is the kind of narrative we live for. Novo Nordisk's Amycretin and the bustling competition in the obesity drug market are not just stories of medical innovation; they're tales of market intrigue, investment opportunities, and, yes, a bit of drama.

Before getting in the fray, I suggest you wait for the dip. For now, just grab your popcorn (low-cal, of course) and stay tuned. This biotech thriller is just getting started, and something tells me the plot twists are going to be worth the price of admission.

Global Market Comments

March 14, 2024

Fiat Lux

Featured Trade:

(The Mad MARCH traders & Investors Summit is ON!)

(TRADING FOR THE NON-TRADER),

(ROM), (UXI), (UCC), (UYG)

The Fed has stopped raising interest rates, inflation is falling, and tech stocks are on fire!

What should you do about it?

Attend the Mad Hedge Traders & Investors Summit from March 12-14. Learn from 28 of the best professionals in the market with decades of experience and the track records to prove it.

Every strategy and asset class will be covered, including stocks, bonds, foreign exchange, precious metals, commodities, energy, and real estate.

Get the tools to build an outstanding performance for your own portfolio.

Best of all, by signing up you will automatically have a chance to win up to $100,000 in prizes.

Usually, access to an exclusive conference like this costs thousands of dollars. You can attend for free!

Listening to this webinar will change your life! To register, please click here.

(AMD), (NVDA), (MSFT), (META)

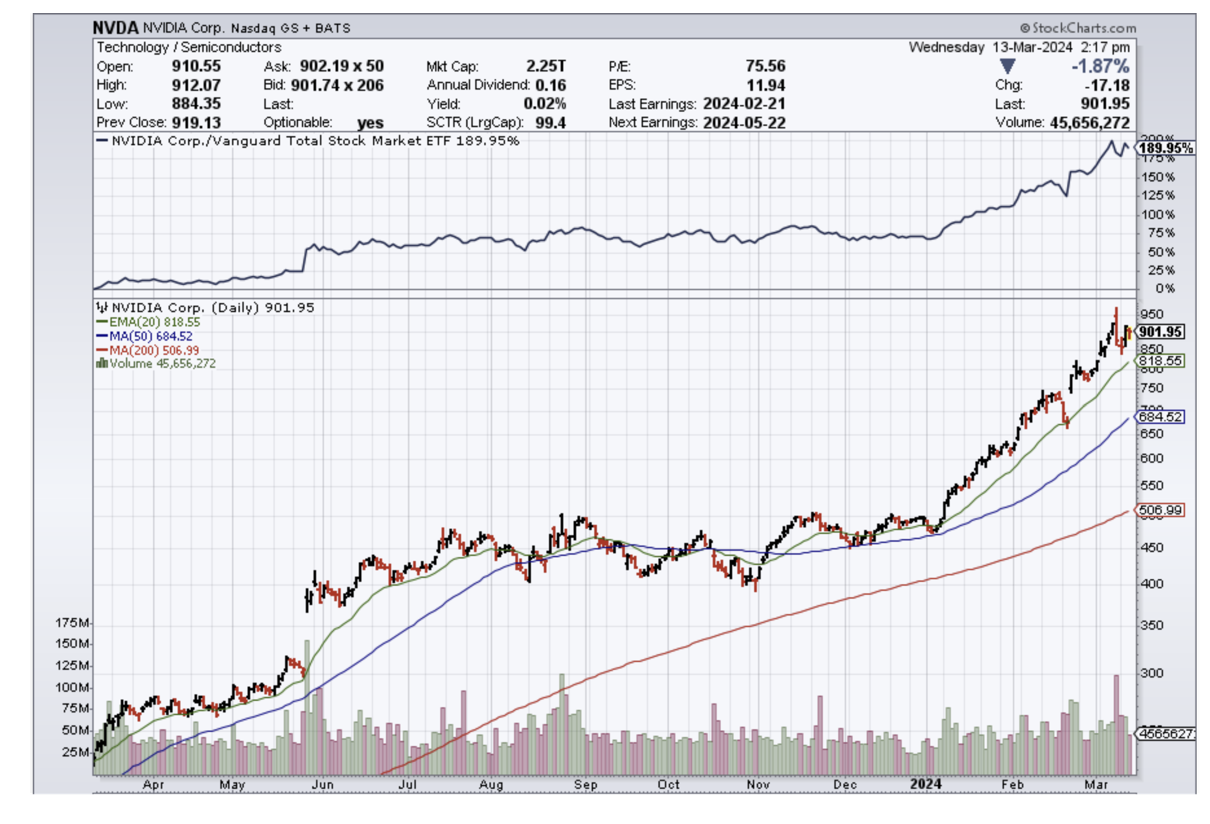

Let me lay it out straight – the AI game is getting hotter by the minute, and while NVIDIA (NVDA) has been hogging the limelight with its fancy AI chips, Advanced Micro Devices (AMD) is quietly sneaking up with a strategy that might just give it a leg up. It's like the tortoise and the hare, but with an AI twist.

AMD has this new AI silicon, the MI300X, and while it's chalking up sales, the real cherry on top is its ROCm software platform. After all, it's not just about having the shiniest chip on the block; it’s the brains behind it that count.

Now, I've heard some folks whispering that AMD might be lagging in this race, especially when you stack it up against Nvidia’s CUDA software stronghold.

But, AMD’s last earnings call threw a curveball that’s got me tipping my hat to them. They’re not just in the game; they’re looking to shake things up with their "Instinct" AI accelerators and their software game.

Here’s why AMD might just be the dark horse in the AI derby.

First, it might be helpful to think of Nvidia and AMD’s head-to-head as the battle of the software: closed vs open source.

Think of Nvidia’s CUDA as the Fort Knox of software – closed, secure, and the gold standard for optimizing GPU performance. It’s been around the block, setting the pace since 2006.

Then, suddenly, here comes AMD, swaggering in with its ROCm software platform, and flipping the script by making it open source. They’re basically throwing open the doors and inviting every coder in the land to tinker with it.

This is a bold move from AMD, with the company aiming to democratize the space and maybe, just maybe, outmaneuver Nvidia’s grip on the market.

And what’s AMD’s ace? They’re betting big on avoiding that dreaded "vendor lock-in" – you know, when you’re so tied to one company’s tech that you can't so much as sneeze without asking their permission.

By making ROCm open source, AMD is playing the long game, aiming to win over those who value flexibility and hate being backed into a corner.

Now, let’s take a look at how generative AI is involved in AMD’s open-source gambit.

Reviewing their strategy, it’s clear that AMD’s not just throwing darts in the dark here. They’ve got their sights set on generative AI, and their open-source ROCm is the weapon of choice.

It seems as if AMD is building a playground and inviting all the cool kids (developers) to come play.

In fact, AMD’s vision has been manifested by Microsoft (MSFT) getting GPT-4 up and running on MI300X faster than you can say "AI revolution."

It also has partnerships with Hugging Face, one of the fastest-growing machine learning org, to get a slew of AI models running smoothly on AMD GPUs.

Even Meta’s (META) throwing its weight behind AMD’s MI300X.

The message is clear: AMD’s not just selling chips; they’re building ecosystems.

But before you start counting your chickens, remember that the tech world is fickle, and AMD’s strategy, while slick, isn’t without its hurdles.

NVIDIA’s not sitting on its laurels; its CUDA platform is a behemoth, with a developer community that’s growing faster than a weed in the spring.

And let's not forget the DIY crowd – big data center operators like Microsoft Azure who prefer rolling out their own chips and software.

AMD’s got its work cut out, but if they play their cards right, they could carve out a nice piece of the AI pie for themselves.

In the cutthroat tech world, AMD’s making a play that’s as bold as it is smart. By betting on open source and targeting generative AI, they’re not just aiming to catch up; they’re looking to set the pace.

Sure, the road’s going to be bumpy, and NVIDIA’s not exactly going to roll out the red carpet for them, but AMD’s strategy has got a certain flair that’s hard to ignore. So, here’s my two cents: Keep an eye on AMD. They might just surprise us all.

Mad Hedge Technology Letter

March 13, 2024

Fiat Lux

Featured Trade:

(COGNITION AI IS THE TALK OF THE TOWN)

(AI), (NVDA)

The AI war is heating up thanks to the new kid on the block Cognition AI.

They have certainly one-upped the competition.

Cognition AI’s team has a new type of technology called Devin.

Devin is a software development assistant in the vein of Copilot, which was built by GitHub, Microsoft, and OpenAI, but, like, a next-level software development assistant.

Instead of just offering coding suggestions and auto-completing some tasks, Devin can take on and finish an entire software project on its own.

The technology can even create websites within seconds. No coder will ever be able to compete with this.

As it works, Devin shows all the tasks it’s performing and finds and fixes bugs on its own as it tests the code being written.

The founders of Cognition AI are Scott Wu, its chief executive officer; Steven Hao, the chief technology officer; and Walden Yan, the chief product officer.

One of the big breakthroughs claims they can force a computer to reason with stunning efficiency.

Reasoning in AI-speak means that a system can go beyond predicting the next word in a sentence or the next snippet in a line of code, toward something more akin to thinking and rationalizing its way around problems.

It’s possible to give Devin jobs to do with natural language commands, and it will set off and accomplish them.

As Devin works, it tells you about its plan and then displays the commands and code it’s using. If something doesn’t look quite right, you can give the AI a prompt to go fix the issue, and Devin will incorporate the feedback midstream.

Most current AI systems go haywire soon after it veers away from the script. Off-schedule variables usually are hard for current AI to stomach.

What does this mean for the tech sector and the future of work?

A naïve person would say this will free developers from the drudgery of mundane tasks and let them focus on more creative jobs.

However, the smart crowd understands this will be a great excuse to cut staffing costs to the bone.

This will allow many non-coders to join in the game and totally bypass going through software developers who more often than not lack common sense.

Remember when the Chinese consumer went from cash to paying with QR codes via smartphones, they skipped over the credit card and America is still stuck on the plastic card.

People will be able to create 1-man tech companies and do the job of 100 people in no time.

This certainly is a winner-takes-all scenario and the mid-term future is quite bleak for software developers.

It’s looking highly likely and I would say ironic that the software developers creating AI are about to do a disservice to their colleagues and rid the economy of 99% of software developers.

Of course, AI isn’t that good yet, but the path is being laid and the countdown has been initiated.

With a few years of furious development of high-quality AI, this will usher in a golden age of tech stocks, because they will finally be able to fire most of the staff.

The advancement of AI can guarantee higher tech shares no matter what and many might say stocks like Nvidia are cheap because this trend is still in the early innings.

“There are a thousand ways to be smart.” – Said Founder of Amazon Jeff Bezos

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.