When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

(WHAT WILL KEEP THE AMERICAN ECONOMY HUMMING ALONG IN 2024?)

April 29, 2024

Hello everyone.

Welcome to an eventful week.

Week ahead calendar

Monday, April 29

10:30 a.m. Dallas Fed Index (April)

Germany Inflation Rate

Previous: 2.2%

Time: 8:00 a.m. ET

Earnings: Paramount Global, ON Semiconductor, Domino’s Pizza

Tuesday, April 30

9 a.m. FHFA Home Price Index (February)

9 a.m. S&P/Case-Shiller comp. 20 HPI (February)

9:45 a.m. Chicago PMI (April)

10 a.m. Consumer Confidence (April)

Euro Area Inflation Rate

Previous: 2.4%

Time: 5:00a.m. ET

Earnings: Prudential Financial, Clorox, Advanced Micro Devices, Amazon, Super Micro Computer, Starbucks, Public Storage, Diamondback Energy, Extra Space Storage, Caesars Entertainment, Corning, McDonalds, Archer-Daniels-Midland, Molson Coors Beverage, Coco-Cola, Marathon Petroleum, 3M, Eli Lilly, GE Healthcare Technologies, PayPal.

Wednesday, May 1

8:15 a.m. ADP Employment Survey (April)

9:45 a.m. S&P Global Manufacturing (Final) (April)

10 a.m. ISM Manufacturing (April)

10 a.m. JOLTS Job Openings (March)

2:00 p.m. FOMC Meeting

Previous: 5.5%

2:00 p.m. Fed Funds Target Upper Bound

Earnings: Marathon Oil, MGM Resorts International, Allstate, Etsy, eBay, Qualcomm, MetLife, First Solar, Devon Energy, Albemarle, Norwegian Cruise Line Holdings, Yum! Brands, Marriott International, Kraft Heinz, Pfizer, Estee Lauder Companies, CVS Health, Generac, Mastercard

Thursday, May 2

8:30 a.m. Continuing Jobless Claims (04/20)

8:30 a.m. Initial Claims (04/27)

8:30 a.m. Unit Labour Costs preliminary (Q1)

8:30 a.m. Productivity preliminary (Q1)

8:30 a.m. Trade Balance (March)

10 a.m. Durable Orders final (March)

10 a.m. Factory Orders (March)

Switzerland Inflation Rate

Previous: 1.0%

Time: 2:30 a.m. ET

Earnings: Apple, Live Nation Entertainment, Fortinet, Booking Holdings, Pioneer Natural Resources, Motorola Solutions, Ingersoll Rand, Expedia Group, EOG Resources, Coterra Energy, Dominion Energy, Howmet Aerospace, ConocoPhillips, Moderna, Stanley Black and Decker.

Friday, May 3

8:30 a.m. April Jobs Report

Previous: 303k

Expected: 250k

9:45 a.m. PMI Composite final (April)

9:45 a.m. Markit PMI Services final (April)

10 a.m. ISM Services PMI (April)

Earnings: Hershey

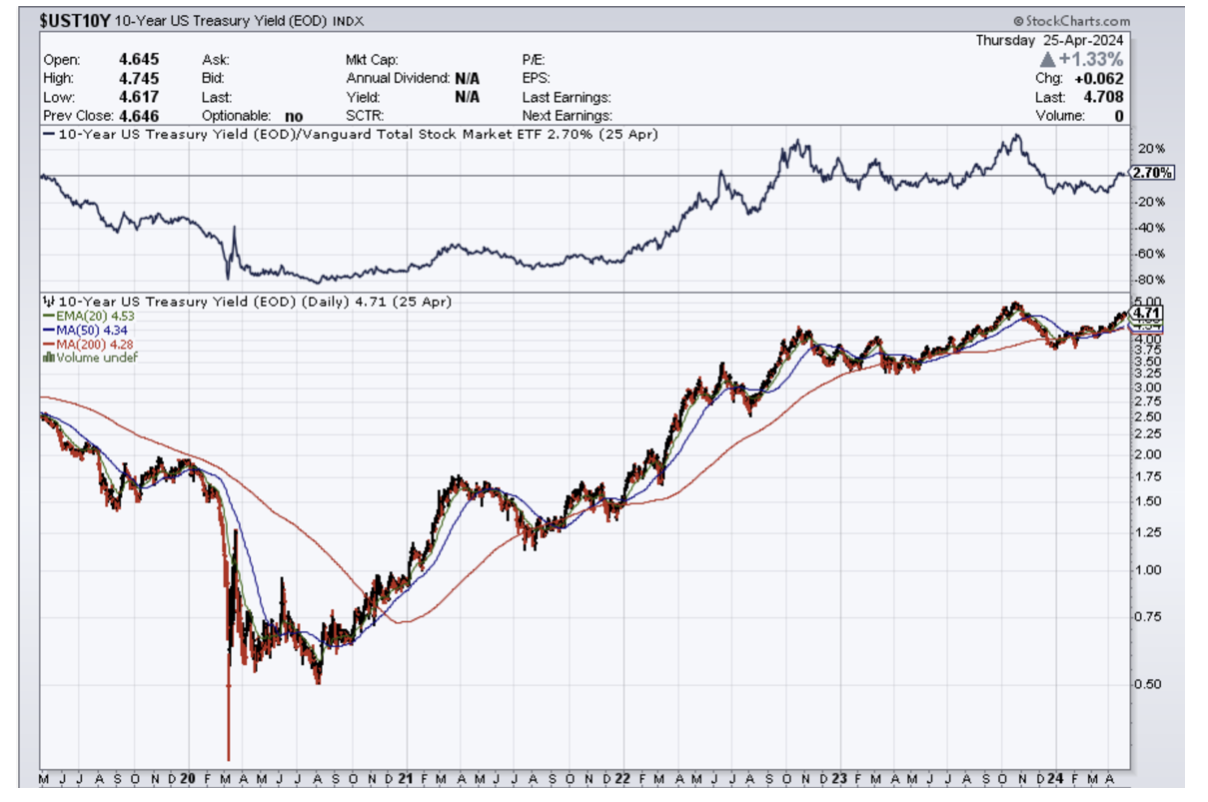

The Fed is set to convene for their third meeting of the year this Wednesday with market consensus anticipating no adjustments in interest rates this month. Amid increasing signs of an economic slowdown paired with sticky inflation, the focus will pivot if Fed Chair Powell intends to adjust their interest rate outlook.

Meanwhile, it’s become a guessing game as to when the Fed might be likely to deliver the first rate cut. September has now come in at good odds as the first likely date, but there has now been a noticeable uptick in the probability (19.6%) of interest rates remaining at 5.25 – 5.5 % throughout 2024.

The latest U.S. jobs market report will be released on Friday.

Additionally, it will be a mega-packed week of earnings reports.

Despite a challenging economic backdrop, the American economy is showing remarkable strength, thus far. But, as the effect of higher rates become fully felt throughout the economy, it would not be surprising to see growth cooling. Above-target inflation and fears of slower growth can lead to stagflation – which no-one wants to see. However, America seems to be equipped with elements that are mitigating the effect of higher rates and helping the economy steer clear of a contraction.

Jose Rasco, chief investment officer of the Americas at HSBC’s wealth division, sees four themes which will insulate the U.S. economy from a downturn. Firstly, he sees growth staying above 1.7% and the unemployment rate pushing moderately higher.

Advancement in technologies is curbing inflation.

Rasco argues that technological disruptions have historically put downward pressure on prices given the potential to streamline inefficiencies and cut back on labour. (We can see this well illustrated in many companies adopting blockchain technology, which cuts out intermediaries, increases efficiency and cuts cost). This can help the path of inflation as the Fed struggles to return price growth to no more than 2%, the central’s banks preferred rate.

Technological health care innovation

Advancements in technology are boosting patient care and health administration. Revolutionary technologies are providing more options for surgery that provide better outcomes and can be cheaper. As I have already pointed out above the use of blockchain can reduce costs as it cuts out the middleman and this is particularly applicable to both billing and insurance costs in the health sector.

On-shoring

Moving production back to or closer to the U.S. spells good news as it is bringing money and investment to the U.S. and to Mexico.

Re-industrialization of the U.S.

A record amount is being spent on research and development in the U.S. Coupled with legislation such as the CHIPS Act, it is not hard to see that an industrial boom is taking place which can boost the entire U.S. economy. Many American companies are spending large amounts investing in technology to become more productive and profitable.

Presidential Election Year

U.S. stocks tend to outperform in presidential election years. As far back as 1926, BlackRock found an average gain of 11.6% in election years, or 1.3 points better than the average 10.3% return in all years.

Rasco notes that HSBC Asset Management oversaw $707 billion in client assets as of the end of 2023.

Brief Market Update

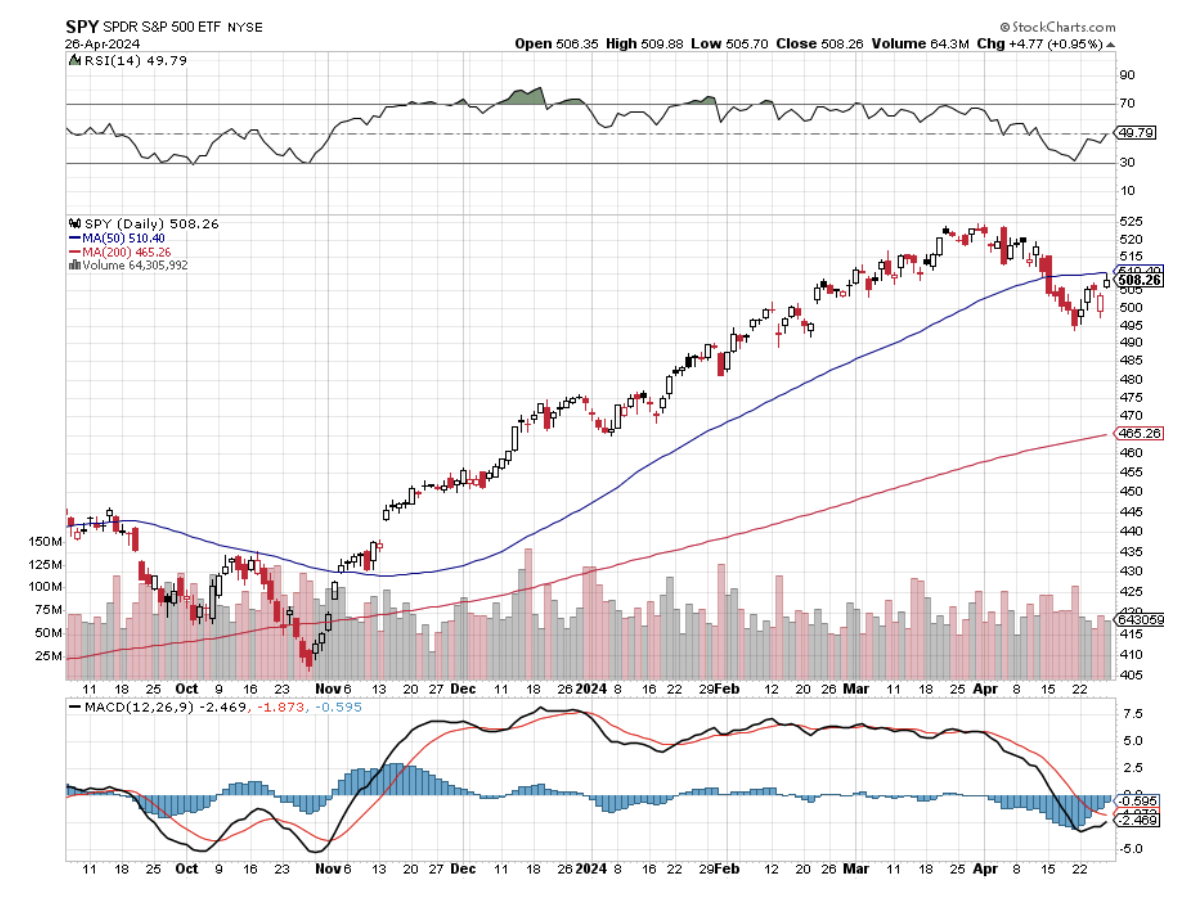

S&P 500 is undergoing a 4th wave correction. Whilst resistance around 5125/5150 contains strength, there is risk of a final sell -off toward the low/mid 4800’s before the uptrend is ready to resume.

Brent Crude is still expected to rally towards $100 over the short to medium term.

Bitcoin chart formation cautions the eventual formation of a Head and Shoulders reversal pattern. From an Elliott Wave perspective this could mean that Bitcoin will correct back to the prior span of support (4th wave) which sits around $49,000 - $38,000.

Resistance $65 - $67,000.

Gold is undergoing a correction and may fall towards $2,260 area before the uptrend resumes.

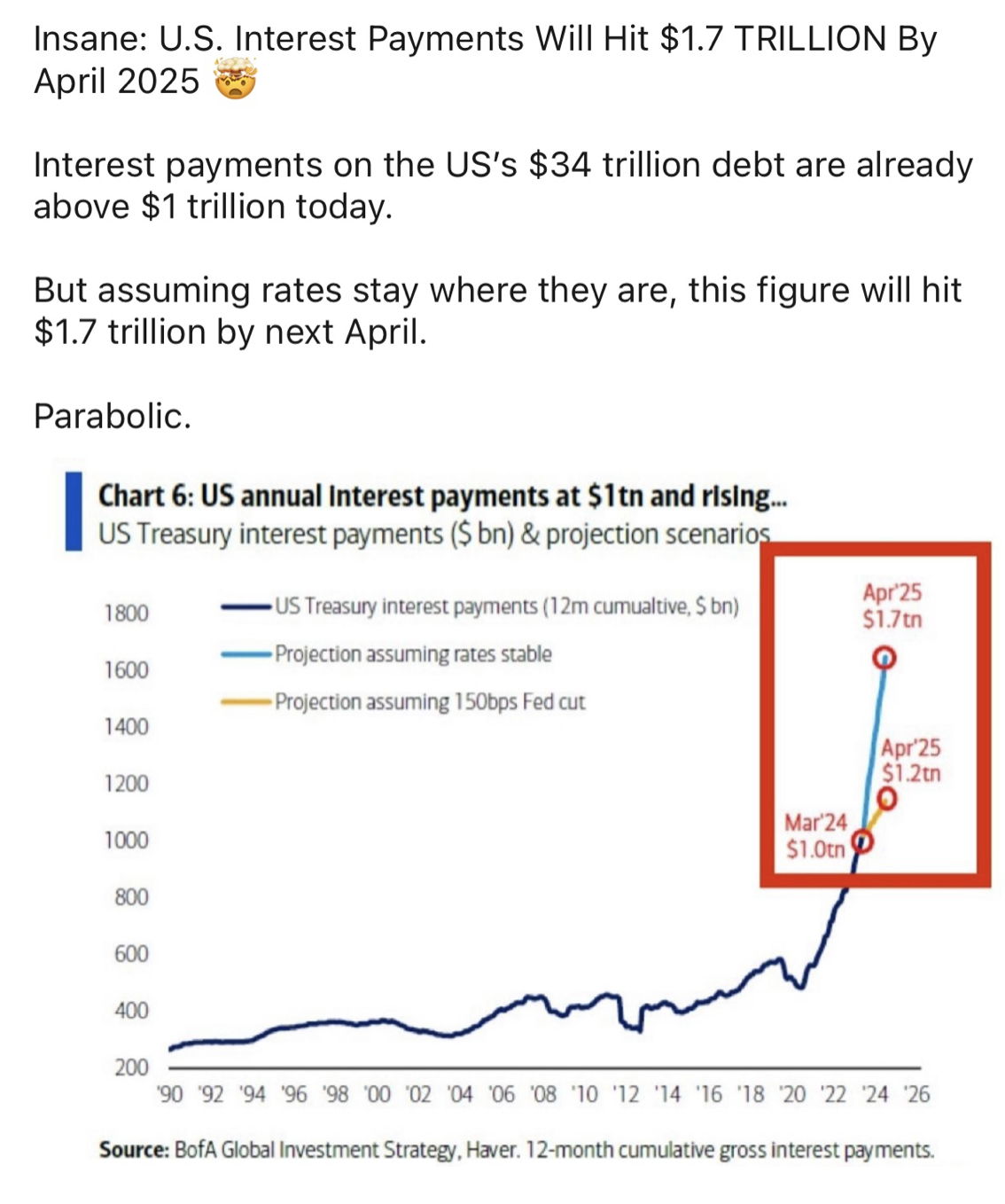

QI Corner (or should I say QA – quite alarming?)

Cheers

Jacquie

Global Market Comments

April 29, 2024

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or DIGESTION TIME)

(NVDA), (FCX), (META), (MSFT), (TLT), (TSLA), (AAPL), (VISA), (FCX), (COPX), (GOOGL),

(A TRIP TO CUBA)

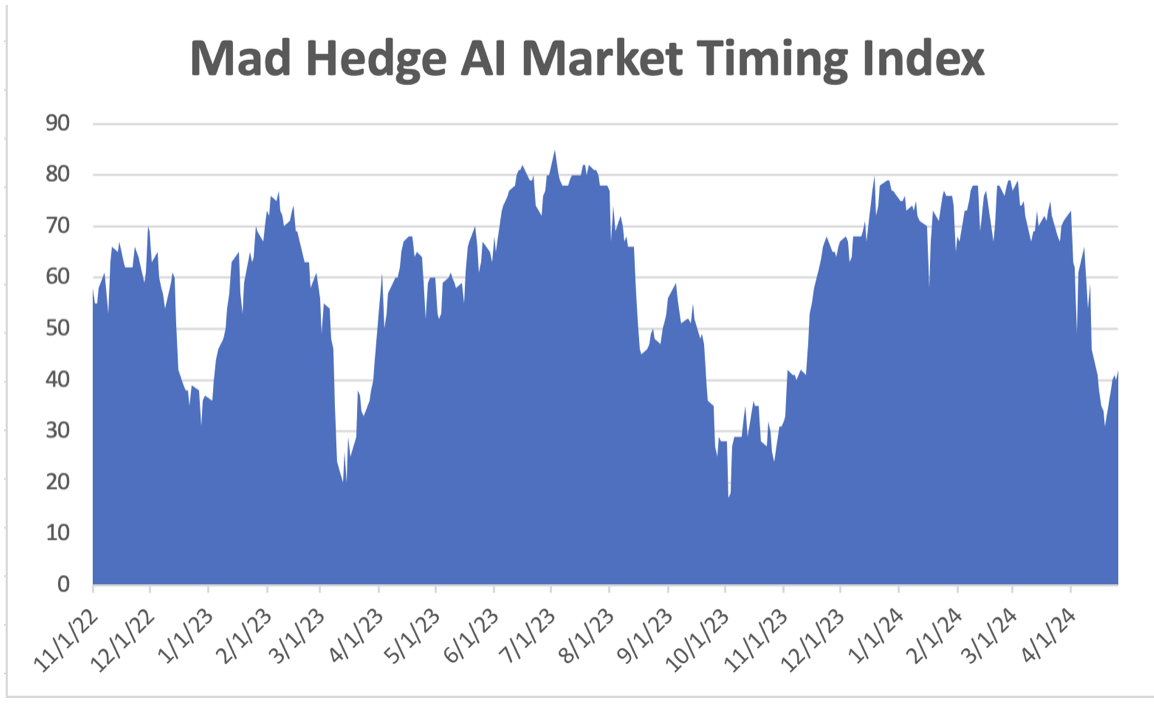

Before you even ask, I’ll give you the answer you’ve all been waiting for: It’s too late to sell and too early to buy.

Stocks may still have some digesting to do having soared by 27% in six months. Nobody wants to look like an idiot by buying a market top. As I have learned over the decades, investors fear looking stupid more than they fear losing money, especially if they are professionals.

Everyone knows the market is eventually going higher so they are not selling in any meaningful way unless they are short-term, algos, or day traders.

This means we may have a whole lot of nothing going on in the coming weeks or months.

That leaves us time to examine the most interesting trends going on in the markets right now, especially the new bull market in commodities. Believe it or not, we are still unwinding the long-term effects of Covid 19 and commodities have only recently come to the fore.

Remember Covid?

Since October, copper prices have risen by 22%, oil by 23%, gold by 34%, and uranium by a gobsmacking 83%. What’s causing this sudden new interest? It’s not a recovering Chinese economy, that’s for sure. Investors have been waiting for a bounce back in the Middle Kingdom seemingly forever. But China remains hobbled by the bitter fruit of a 40-year one-child policy and an ineffective government. History tells us that the United States does not make a great enemy.

So what’s driving the new demand? Remember Covid? Believe it or not, we are still unwinding the long-term effects of Covid 19 and commodities have only recently started to play catch up.

Commodities are unique in that they have such a long lead time to add new supply. It can take 5-10 years, to map out new sites, get government approvals, deliver heavy equipment, and mine, process, refine, and ship the final product.

In the meantime, enormous new demand has arisen. There have been 10 million EVs manufactured in recent years and each one needs 200 pounds of copper. AI means the electric power grid has to double in size quickly. Commodity markets are unable to meet the supply. Therefore, prices can only go up.

That enabled Freeport McMoRan (FCX), the world’s largest copper producer, to handily beat its earnings expectations, helped by higher production and easing costs. The mining giant said its quarterly production of copper rose to 1.1 billion pounds from 965 million pounds a year earlier, helped by a 49% jump in output from its Indonesia operations. (FCX) said it was working with the Indonesian government, which has put a ban on raw material exports, to obtain approvals to continue shipping copper concentrates and anode slimes. Its current license is set to expire in May. Buy (FCX) and (COPX) on dips.

Corporate raiders have taken notice.

Activist Elliot is taking a Run at Mining Giant Anglo American, accumulating a $1 billion stake. BHP, the largest iron ore miner, is also making a takeover bid here on the coattails of which Elliot is trying to ride. It just highlights the global interest in mining shares.

Anglo American plc is a British multinational mining company that is the world's largest producer of platinum, with around 40% of world output, as well as being a major producer of diamonds, copper, nickel, iron ore, polyhalite, and steelmaking coal. On a side note, copper hit a two-year high above $10,000 per metric tonne in the London Market last week.

Needless to say, the commodity boom could continue for another decade.

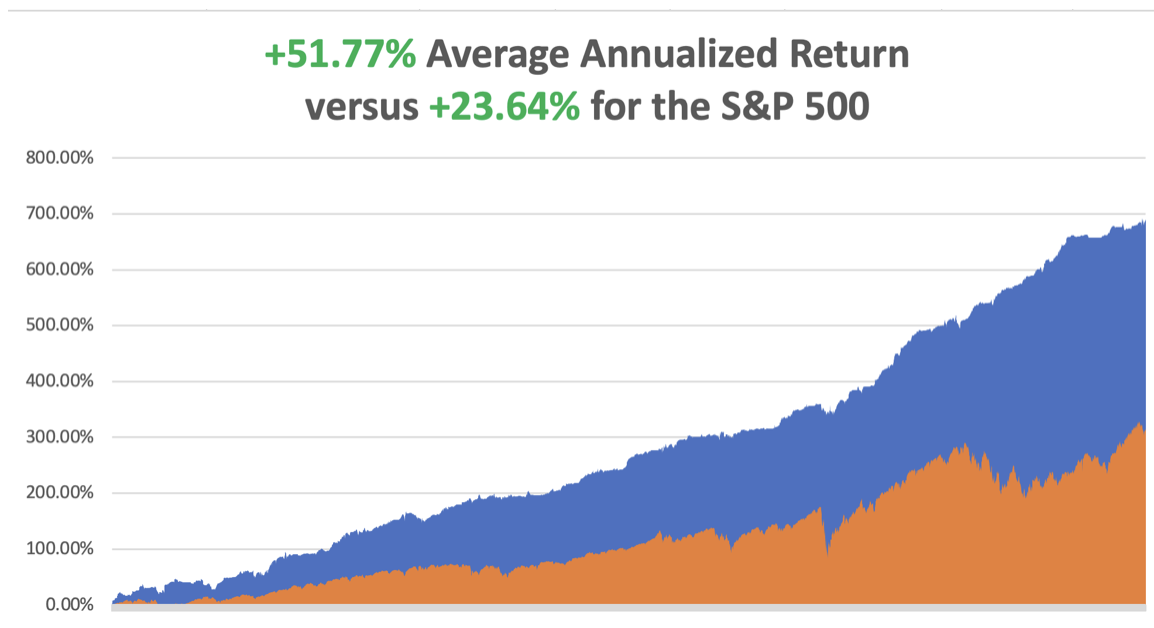

So far in April, we are up +4.24%. My 2024 year-to-date performance is at +13.61%. The S&P 500 (SPY) is up +6.50% so far in 2024. My trailing one-year return reached +32.40% versus +23.14% for the S&P 500.

That brings my 16-year total return to +690.24%. My average annualized return has recovered to +51.77%.

Some 63 of my 70 round trips were profitable in 2023. Some 25 of 33 trades have been profitable so far in 2024.

Tesla Delivers Worst Earnings in 12 Years, with a 9% revenue drop, but the stock rallies big as the disappointment was well telegraphed. Revenue declined from $23.33 billion a year earlier and from $25.17 billion in the fourth quarter. Net income dropped 55% to $1.13 billion, or 34 cents a share, from $2.51 billion, or 73 cents a share, a year ago. The drop in sales was even steeper than the company’s last decline in 2020, which was due to disrupted production during the Covid-19 pandemic. Tesla’s automotive revenue declined 13% year over year to $17.38 billion in the first three months of 2024. I’ll watch (TSLA) from the sidelines from now.

Personal Consumption Expenditures (PCE) Comes in Warm for March, up 2.8% YOY, the same as for February. Service prices led. But the numbers were not as hot as feared so both bonds and stocks rose.

Big Tech Crashes, with all of the Magnificent Seven breaking 50-day moving averages. (NVDA) alone gave up 10% on Friday. The next stop is the 200-day moving averages, which are far, far away. If those hold this is just a correction. If they don’t the bear market is back.

Biggest Treasury Bill Auction in History is a Huge Success, at $69 billion for a two-year paper with a 4.898% yield. That is almost a risk-free government-guaranteed 10% yield in two years. Another $70 billion of five-year notes go on sale today. Half of this is going to foreign investors and central banks. Faith in America and the US dollar remains strong. Who else’s bonds would you rather buy? Passage of the Ukraine aid bill was probably a help. Wait for (TLT) to bottom.

Visa Pops on Earnings Beat, continuing as the powerhouse that it has been for years. Reported at $4.7 billion, showing a 10% increase year-over-year, slightly above the estimate of $4.943 billion. Visa is a call option on the growth of the Internet. Buy (V) on dips.

Apple China Sales Dive, by 19% as Chinese switch to cheaper Huawei phones for nationalism reasons. It’s also another sign of a slow Chinese economy. China remains one of the company’s biggest markets, but business there has grown harder after Beijing escalated a ban on foreign devices in state-backed firms and government agencies. Avoid (AAPL) until the turnaround.

Alphabet Earnings Beat Delivers Monster 10% Move, recovering a $2 trillion market cap. It also announced its first-ever dividend and a $70 billion share back, the second largest after Apple. Buy (GOOGL) on dips.

March New Home Sales Jump, by 8.1% when only 1.1% is expected, to 693,000. The median price of a home sold fell to $430,700 as builders pulled back on incentives like those cherry cabinets. It’s an uphill slog with those 7.0% mortgage rates.

CDC Birth Data Fall to Lowest Level Since the Great Depression, 1.1 births per 1,000 people. That is well below the Great Depression levels. Only 3,664,292 new Americans were born in 2021. It means there will be a shortage of consumers in 20 years so be out of stock by then. The good news is that Covid deaths have fallen from 4,000 per day to only 19 a day since January 2020.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age or the next Roaring Twenties. The economy decarbonizing and technology hyper accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, April 29, at 10:30 AM EST, the Dallas Fed Manufacturing Index is announced.

On Tuesday, April 30 at 9:00 AM, S&P Case Shiller National Home Price Index is released.

On Wednesday, May 1 at 2:00 PM, the ADP Private Employment Change report will be published

On Thursday, May 2 at 8:30 AM, the Weekly Jobless Claims are announced.

On Friday, May 3 at 8:30 AM, the April Nonfarm Payroll Report is announced. At 2:00 PM, the Baker Hughes Rig Count is printed.

As for me, I have wanted to visit Cuba for decades. But relations with the US have run hot and cold over the years and whenever I had the time and money to go, the was a chill on, sometimes an extreme one.

So when I arrived in Key West and learned they were offering Cuba tour packages, I jumped at the chance. Unfortunately, you need to book three months in advance so that option was out.

Then I thought, “Why not fly there myself?” After payment of some hefty fees, commissions, and some outright bribes, I scored a Cuban visa and an aging Britten-Norman Islander twin built in the UK some 40 years ago. It was perhaps the smallest twin I have ever flown, with two minuscule 270 horsepower engines.

Although it was only 90 miles to Cuba, I had to load up with full tanks. Cuban aviation fuel is often contaminated with sludge or water and is unsafe to use. Losing both engines over shark-infested waters doesn’t fit in with my retirement plan. So I needed enough 100LL avgas to make the round drip, which meant skipping breakfast to stay within my weight limitations.

It was a clear and balmy morning when I received my clearance for takeoff, the sky dotted with fluffy white cumulus clouds. Of course, I had to skirt the Bermuda Triangle to get there, but no worries.

Amazingly Cuban air traffic control spoke English. Soon, the green hills of Cuba appeared on the horizon, and I received the words I will never forget: “N686KW you are cleared for landing in Havana.” I haven’t felt like that since I last landed in Moscow.

Much to my surprise, I found other US aircraft there as I was parked near jets from Southwest and American Airlines. I was greeted by an immigration officer who escorted me into the country, putting my Spanish skills to the test.

I had some concerns that I might be arrested in case Russia put me on a wanted list due to my recent work in Ukraine. But my fears proved unwarranted. You see, you get paranoid in your old age. A private car, a French Citroen van, a driver, and a government guide were waiting for me outside the airport.

Suddenly, I found myself in a strange new world. A darkly tanned people wore tired polyester clothes. Everyone was rail thin and the only obese people I saw were foreign tourists. There was an incredible variety of vehicles on the road, including ancient cars from Russia, China, Poland, and Japan. Apparently, Chevrolet had a great year in Cuba in 1956 because no American cars have entered the country since then and they are everywhere.

We headed straight for Earnest Hemingway’s Cuban home, known as Finca Vigia, or “Lookout Farm” built in 1886 on a hilltop overlooking Havana. The building was falling apart and showed large cracks, but going inside I was transported in time back to 1960, when Hemingway left the property ahead of the Cuban Revolution.

Finca Vigia has been untouched since. The walls are covered with an assortment of hunting trophies from Africa, including springboks, cape buffalo, lions, and leopards. They were collections of African spears and gun cases. Mounted on the walls were paintings of bullfights in Spain, cartoons about Hemingway, and family photos.

Magazine racks were stuffed with the 1960 issues of Life, Look, and The Saturday Evening Post. The National Geographic issues looked positively prehistoric. And there were thousands of books. Anyone who read his books would recognize all of this.

Hem, as his friends called him, bought the property in 1940 for $8,000, living there with wife three for five years, the famed war correspondent Martha Gellhorn, and wife four, Time magazine reporter Mary Welsch, who became his widow.

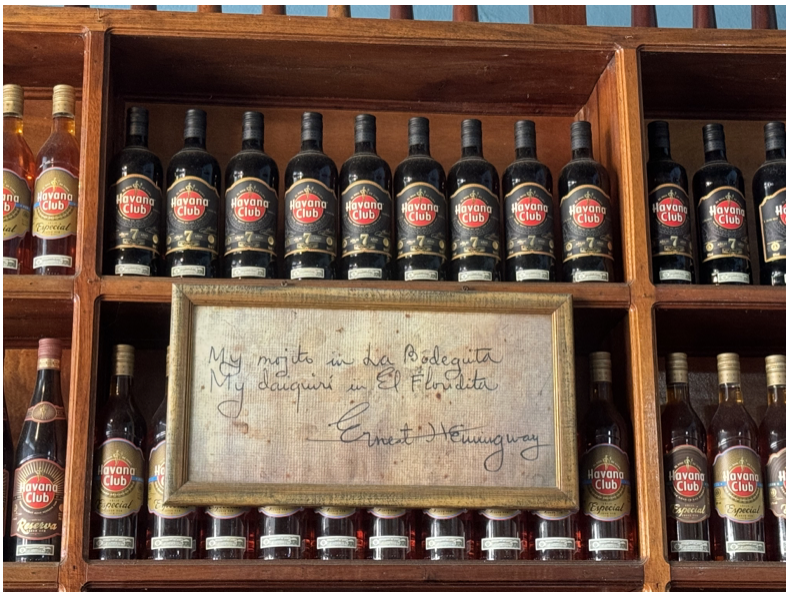

After passing on a Che Guevara T-shirt in the gift shop, I enjoyed a glass of freshly squeezed sugar cane juice. Then I headed into Havana, escorted by my guide, Eliar. The trip turned into a Hemingway bar crawl. I visited the well-known La Floridita, which made Hem’s favorite Daiquiri, La Bodegita, which mixed the best mojito and had lunch at his favorite roof terrace restaurant.

Cuba has long been one of the worst-managed countries in the world, second only to North Korea, and I learned why after grilling my guide all day about economic conditions. It’s 11.2 million people earn a per capita of $11,255, with 71% living below the poverty line. The real figure is a third of that as there are now 300 pesos to the US dollar, not the fictitious 120 that the government pretends.

When the Soviet Union collapsed in 1992, generous subsidies ended and Cuba quickly lost 33% of its GDP. With some of the richest farmland in the world, it imports 80% of its food and is currently suffering a food crisis. Even the bottled water I drank came from Panama.

Oil accounts for 100% of its energy supply which mostly comes from Russia and is paid for with raw sugar. Cuba’s largest exports are tobacco, nickel, and zinc most of which are exported to China. China also provided $11 billion in loans which Cuba promptly defaulted on.

The country would have been much better off if only Fidel Castro had accepted an offer from the Washington Senators to play US major league baseball in the early 1950s. Cuba is officially one of the last communist countries in the world, with Russia and China abandoning it years ago. After reforms in the 1990s, what they now practice is an odd mixture of communism and capitalism, with the government and the private sector competing side by side.

With thousands fleeing the country every year the real estate market has collapsed. You can buy a two-bedroom apartment in Havana for $30,000. Flying over the countryside at low altitude you fund vast expanses of agricultural land undeveloped for want of machinery and parts. There is unused labor everywhere. Cuba should be one of the richest countries in the world with all those beaches. The tourism possibilities are enormous. But with a 60-year trade and investment ban from the US, nothing can happen.

American credit cards and cell phones don’t work, so I brought in $200 in ones. You can’t bring back to the US the country’s only two worthy exports, rum and cigars. But there are buskers everywhere and by the end of the trip, I ended up giving it all away in tips. I did OK with the food, but only ate overcooked meals in high-end restaurants. Salads were out of the question but drink all the local beer and rum you can.

I ended my trip with a tour of the enormous Revolution Square where Fidel Castro used to give four-hour speeches to one million. One area the government did not skimp on spending was on the massive ministry buildings that surround the square. It seems the image of a strong government, especially the police, is essential in a workers’ socialist paradise.

Then it was back to the airport where surprisingly I obtained immediate clearance for takeoff. No passport stamps, as the government wanted to leave no evidence of my visit in an American passport. I returned to Key West just in time to catch a magnificent sunset over the Gulf of Mexico. US customs recognized my face and waved me right through.

Damn! Should have picked up some of those $5 bottles of rum.

It's all just another day in the life of John Thomas.

At Hemingway’s Cuban Home

A Look Back into 1960

Where Hem Wrote “Old Man and the Sea”, Standing

Hemingway’s Office

I passed on Che

Meeting an Old Friend for a Round at Floridita

Mixing it up with the Locals

One of Cuba’s Only Exports

Looks Like Chevy had a Great Year in 1956

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

“I think the market is going to get slammed this summer. The Fed is bad for financials, the dollar is a problem for industrials, and commodities are a problem for everybody,” said Scott Nations, president of NationShares.

(MSFT), (NVDA)

Forget a moonshot — Microsoft (MSFT) and OpenAI are shooting for the stars with their latest collaboration on a supercomputer so massive, it makes your standard tech project look like child's play.

Codenamed Stargate, this behemoth is poised to shake up the AI world with a projected investment ranging from $100 billion to $115 billion. The cosmos is the limit for this 2028 launch that isn't just a big deal — it's a mega deal.

Now, let's unpack this a bit.

Microsoft, a titan of tech, alongside AI maverick OpenAI, plans to pour more than $100 billion into Stargate. Why? To cut the cord with Nvidia (NVDA) and perhaps start a new chapter in the tech saga that every big player in AI is itching to rewrite.

And while the details are as tight as Fort Knox, we know this much: Stargate is the grand finale of a five-phase odyssey currently in its third act.

Imagine building something 100 times pricier than a massive data center — that's Stargate for you. This isn’t just a splurge; it’s an investment into what could redefine the boundaries of AI capabilities.

With such a hefty tag, the project's budget is set to dwarf Microsoft’s capital spending in 2023 by more than three times.

But there’s more brewing at Microsoft’s labs. Even before Stargate’s grand debut, there’s a plan for a smaller sibling supercomputer earmarked for 2026, part of the phase four prep work.

For the shrewd investors among us, this opens a golden door, particularly through Arm Holdings (ARM). Here’s why.

Think of Arm as the invisible giant of the tech world. They don't manufacture chips themselves, but their ingenious designs are the brains behind practically every smartphone on Earth and a whopping half of the world's CPUs.

They're basically the Michaelangelo of chip design – sculpting the blueprints for the technology that powers our digital lives.

But here's the real kicker: Arm's business model is a cash-generating machine. They license their designs to major chip manufacturers like Qualcomm (QCOM) and Samsung, who then pay Arm royalties every time a chip based on their design is produced. It's an impressive cash cow, with Arm raking in a steady stream of income via royalties as their tech infiltrates more and more devices.

Now, here's where things get even more interesting for Arm.

Microsoft's AI ambitions, fueled by this beast of a supercomputer, are a perfect match for Arm's expertise. Microsoft needs custom chips that can handle the immense demands of this project without draining the power grid.

And who makes the world's most energy-efficient chips for super complex tasks? You guessed it – Arm.

This isn't just a hunch.

Last November, Microsoft unveiled Azure Cobalt, its first AI-focused chip born from Arm's Neoverse CSS platform. This wasn't a one-off experiment – Cobalt proves Microsoft is shifting towards custom AI processors for better efficiency, a trend that likely continues with Stargate.

And that means dumping traditional, power-hungry GPUs in favor of Arm's sleek designs.

But it's not just about the electricity bill. Microsoft saw a performance jump of up to 40% with Cobalt – showing that efficient doesn't mean weak. With the massive energy needs Stargate will have, Arm's chips are looking like a winning bet.

Now, let's talk numbers — everyone's favorite part.

Arm's earnings are expected to skyrocket, with projections suggesting a near 45% annual growth over the next five years.

Starting from a fiscal 2024 earnings base of $1.19 per share, this growth could catapult earnings to about $7.63 per share.

Do the math with the Nasdaq-100’s forward earnings multiple, and you might see Arm's stock price soaring to $208 in five years — a sweet 69% jump from today.

But let’s spice this up a bit. If Stargate fuels an even higher demand for Arm's tech, these figures could be just the conservative baseline.

For investors looking to tap into the AI boom, grabbing a slice of Arm now might just be the smartest play before it rockets to new heights.

So, as we gear up for Stargate’s 2028 launch, keep your eyes on the stars — or in this case, the supercomputers and the chips that power them.

Microsoft and OpenAI are on to something big, and it’s not just about tech. It’s about shaping the future of AI. And who wouldn’t want a front-row seat to that?

Mad Hedge Technology Letter

April 26, 2024

Fiat Lux

Featured Trade:

(WHAT STAGFLATION MEANS FOR THE FUTURE OF TECH STOCKS)

(GDP), (PCE), ($COMPQ)

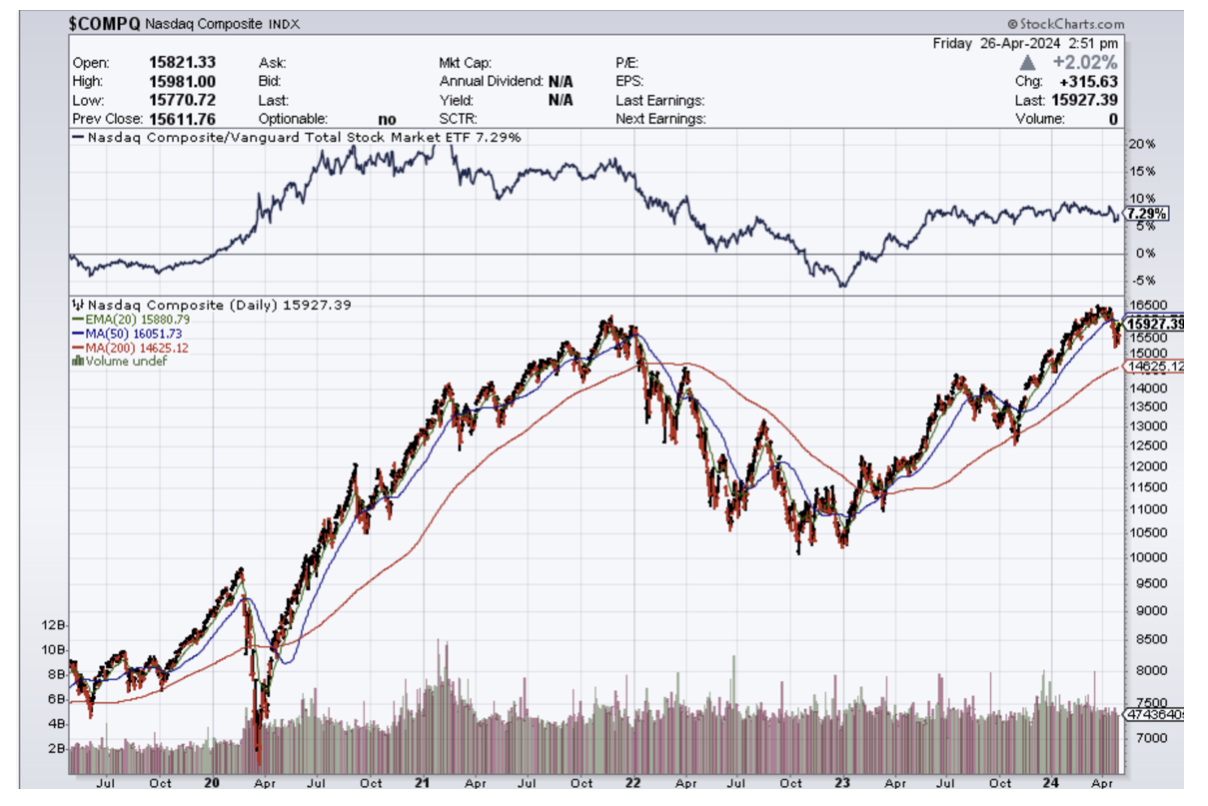

Stagflation has reared its ugly head and yes it’s not here yet, but the risk it will hit us can’t be ignored at this point.

I’ll tell you what this means for tech stocks as well.

I won’t say that I told you so but this could have been seen from a thousand miles away.

The persistent increase in federal debt spent like a drunken sailor doesn’t mean anything until it means a lot this time around.

Remember that all that “job growth” came in the form of mostly government jobs and part-time workers adding more part-time jobs to pay for the cost of life.

Now the numbers finally prove this as inflation stays sticky and growth has curtailed with the U.S. Real gross domestic product (GDP) rising just 1.6% from a year ago in the first quarter, which is a sizeable miss from 3.4% growth seen in the fourth quarter of last year.

Meanwhile, the Federal Reserve’s favorite inflation gauge—the core personal consumption expenditures (PCE) price index, which excludes more volatile food and energy prices—surged from 2% in the fourth quarter of 2023 to 3.7% in the first three months of this year.

I believe we are in the early throes that will usher us down a path of increasing inflation and lower growth which is the summation of stagflation.

Even with stagflation, certain tech companies will still grow, and do well.

Drowning in federal debt - now in the many trillions and skyrocketing each day.

It now also has a landing spot besides Ukraine and that’s in the form of more American inflation.

Prices will go up and adding more government jobs won’t bring down inflation.

Then the big question becomes, does the Fed save the dollar or save the US economy?

When the rubber hits the road, I do believe the Fed will choose to save the economy over the purchasing power of the Americans.

This means that the price of a loaf of bread will give you sticker shock because a dollar in 2024 will be worth a lot less in 2025 and beyond.

But the important thing is to save the economy and the biggest growth element to the US economy is, you guessed it right, tech stocks.

Tech stocks will outperform during a time of stagflation because even if most of the rest of the economy is doing poorly, tech will still navigate around these tougher times.

The Fed has essentially crippled purchasing power with its “transitory inflation” blunder, and I don’t think they have the guts to take down the stock market in an election year.

Therefore, I do expect interest rate cuts to take place later this year, and that will put a floor under tech stocks and marry up that with the AI narrative one must love the end-of-year prospects for Nvidia, Microsoft, Google, and Amazon.

Get ready for the medium term because it’s most likely to involve the “bet on the Fed pivot” rally which will take us to the next up leg in the Nasdaq.

Readers should take solace in the fact that tech stocks will go up in stagflationary environment, but of course, tech stocks have that extra mojo when rates and inflation are low.

"As government expands, liberty contracts." – Said Former US President Ronald Reagan

(TECH OF THE FUTURE: THE WORLD IN 2050)

April 26, 2024

Hello everyone,

The economic landscape at present is a little uncomfortable, to say the least. Investors’ perceptions about interest rates, inflation, and employment stability are being influenced by data the Fed is watching closely. In turn, the interpretation of this data is causing volatility in the market. We are in a long-overdue correction, which should take the froth out of the huge market rally we have recently experienced.

Tech stocks, overall, have been brought back to earth. It certainly does not mean the tech sector is dead. It’s just resting. Five, ten, twenty, thirty years in the future, we will look back on this correction as a blip. Technology will keep advancing and take tech stocks along for the ride.

So, what exactly do those tech advancements look like? An insight into some of the tech of the future shows just what is ahead of us.

Future of Education

We will probably see a shift to more interactive method of learning. Online learning platforms to more personalized learning experiences alongside the incorporation of virtual and augmented reality. The traditional lecture-based, note-taking methods may be replaced by an emphasis on collaboration and problem-solving to better prepare for the workplace.

In schools, we could see biometric scanning upon check-in, which will streamline registration. 3-D printers will be a standard appliance both in the home and at school. They will be an essential learning aid for teachers, facilitating the task of teaching complex concepts.

Learning systems driven by artificial intelligence (AI) will have been integrated into the school environment by 2050. Personalized learning experiences will consider learning styles and create adaptive assessments that adjust in real-time based on performance. AI may predict a student’s future performance, allowing teachers to step in before a student falls behind in a particular area. Furthermore, AI will ensure students receive immediate feedback with suggested areas for improvement, thereby tailoring to a student’s strengths and weaknesses.

Self-driving cars

We have all heard about the crashes because of self-driving cars, which have often made headline news. In decades to come, self-driving cars could well make our roads safer, and reduce deaths and injuries from car accidents. The insurance industry will surely be impacted by this change. This AI could also change our lifestyles as well. The grind of the daily commute will be more comfortable and less taxing on the body, and consequently, it may even change where we choose to live. Overall, AI will make our transportation systems both safer and more efficient, as AI-powered systems will coordinate traffic flows.

Plants will charge your iPhone.

Forests are set to become the energy stations of the future. Bioo is a clean-tech company capable of generating electricity from plant photosynthesis.

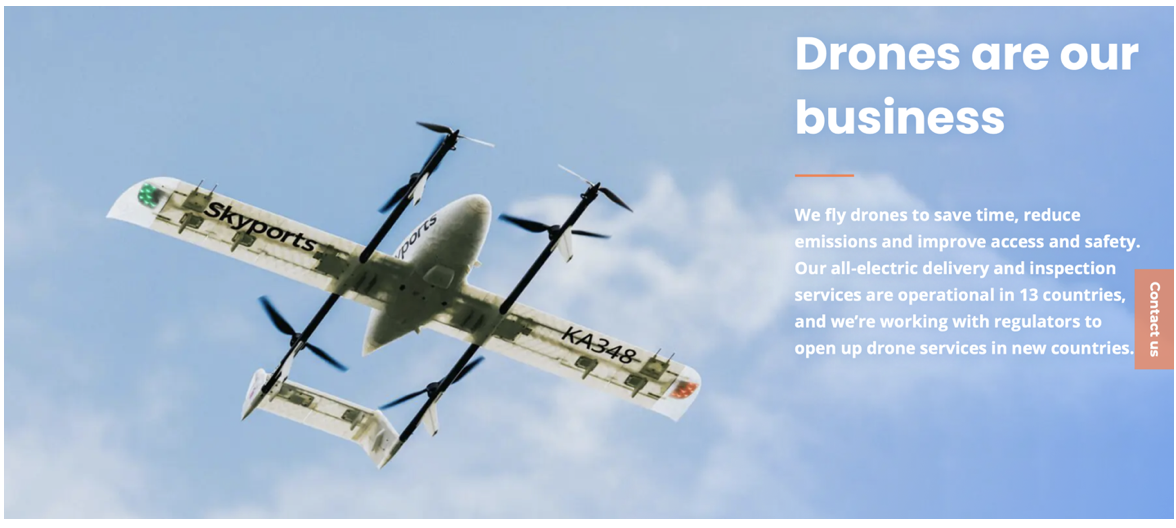

Delivery Drones

By 2050 the urban skyline will probably be buzzing with drones delivering all manner of things from books to medical supplies to food. I wonder how noisy that will be?

Ocean Thermal Energy

Ocean thermal energy is one of the world’s largest renewable energy sources, and it has been relatively untapped to date. However, a company called Bluerise is working on creating an energy breakthrough by generating utility-scale electricity through Ocean thermal energy conversion. It is believed it will be able to outcompete fossil fuel-based generation and other renewables that require storage and grid balancing. It will play a crucial role in the future energy mix being one of the very few constant energy sources, available day, and night, year-round.

Health Wearables

Wristbands tracking our movement came about in 2009 when the Fitbit Tracker debuted. Since then, many watches can now monitor our movement, our sleep, our heart rate, and other health data. By 2050, wearables may eliminate the annual physical because they will be loaded with sensors that transmit vital health data, hence giving us warning signs of health issues. Nanobots and wearable devices will monitor and enhance our mental and physical health continuously. Necklaces and wristbands that reduce inflammation and pain may also be common items. This will revolutionize healthcare, making it more personalized and proactive.

Augmented Reality and Virtual Reality

By 2050 technology will be seamlessly integrated into our everyday lives. AR and VR will be commonplace transforming how we work, learn, and interact.

The Job Landscape will be ‘smart’.

Half of the world’s current jobs are unlikely to exist in 2050. The jobs that will be on offer haven’t been invented yet. AI and smart assistants will be commonplace. Robots will play a significant role in the workplace as they can perform many human jobs. Everything will be ‘smart’ – connect and data-driven. This will lead to a big shift in the job market, with a greater emphasis on roles that require human creativity and emotional intelligence. Employers will need to become responsible for creating a life-long learning culture at work, so their staff can take ownership of their professional development, thereby staying up to date with skills and knowledge as their workplace transforms.

Update: On Wednesday I wrote about the metals sector and mentioned a copper stock that was worth looking at - Solaris Resources Inc (SLSR). Yesterday It rose 0.29 cents, a total of 8.49%.

Cheers,

Jacquie

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.