When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Biotech and Healthcare Letter

April 18, 2024

Fiat Lux

Featured Trade:

(A RARE OPPORTUNITY OR A PROBLEMATIC DEBT-ACLE?)

(AMGN), (LLY), (NVO)

Remember Gordon Binder and his "Science Lessons?" Well, Amgen (AMGN) seems to be re-reading a few chapters from the book by its legendary former CEO.

Their nearly $28 billion buyout of Horizon Therapeutics (HZNP) screams blockbuster ambition, but it also means they loaded up on debt like it's going out of style. This HAD better work.

Why the gamble? Horizon brings heavyweight rare disease drugs like Tepezza to the table. Sales have been flatlining near $2 billion, but Amgen smells potential. With the indication just expanded and a measly few percent of patients treated, there's room to run...if they can find those patients. That's the tricky part with rare diseases.

Other gems like Uplizna round out the deal. Now, it's all about whether Amgen can make this expensive new portfolio pay.

Let’s take a look at Amgen’s 2024 pipeline. The biotech’s goals this year center on a few key drugs – some acquired, some homegrown.

Tepezza and Uplizna are all about finding those elusive rare disease patients and expanding market access. We're not just talking sales growth here... it's about proving their ability to dominate this niche.

In their "General Medicine" department, there's Olpasiran in Phase 3. A stellar Phase 2 could mean over a BILLION in sales if it gets the green light. But Phase 3, as we know, is where the tough questions get asked.

Over in Oncology, I’m keeping an eye on Tarlatamab, Lumakras, Blincyto, and Nplate. They're the revenue drivers of the future, with Tarlatamab aiming for billions by the 2030s.

Lumakras was supposed to be a star, but it's a bit slow out of the gate. Then there's Blincyto – already raking in the big bucks with nearly 50% year-on-year growth. This one's HOT.

Nplate's a blockbuster with almost $2 billion in sales, but US government orders make it a tad volatile. Tezspire is another potential star, flirting with the billion-dollar mark.

Bottom line? Amgen is hustling to build a diverse portfolio for the long haul.

Crunching the numbers, Amgen's 2024 guidance looks strong, boosted by that Horizon acquisition.

They're projecting about $33 billion in revenue and decent EPS. Tax breaks and low capital expenditures are sweet bonuses.

But...remember that debt. It's over $60 billion on the long-term books. Luckily, Amgen locked in good rates on those bonds, but that interest bill? It's a beast they'll have to tame eventually.

Amgen’s shareholder returns are mostly a chunky 3%+ dividend, not much to write home about. The real magic depends on those high-powered sales teams turning the rare disease business into a cash machine and seeing those other drugs deliver. If it happens, cash flow will surge, and everyone will get fatter payouts.

As for the biggest threat to Amgen’s future? The ever-changing, cash-hungry beast that is the biotech industry.

Amgen's constantly fighting patent expirations, forcing them to pump cash into R&D just to stay ahead. You hit some home runs, like the crazy new weight loss drugs driving skyrocketing revenues as seen in the success of Eli Lilly (LLY) and Novo Nordisk (NVO), but more often, you strike out. This is why long-term investors in Amgen should strap in for a bumpy ride.

Overall, Amgen's got a unique mix of assets. And that Horizon Therapeutics move? Bold but calculated. It gives them a boatload of rare-disease drugs and pairs them with top-notch sales teams.

Plus, there's a bunch of promising candidates in their pipeline. The biotech world is an industry where success is never guaranteed, BUT Amgen's got the potential to keep knocking it out of the park. If they do, those shareholder returns should get a whole lot sweeter. I suggest you buy the dip.

Global Market Comments

April 18, 2024

Fiat Lux

Featured Trade:

(APRIL 16 BIWEEKLY STRATEGY WEBINAR Q&A),

(GLD), (GLD), (GE), (GM), (NVDA), (TSLA), (ARKK), (MS), (GS)

Below please find subscribers’ Q&A for the April 16 Mad Hedge Fund Trader Global Strategy Webinar, broadcast from Key West, Florida.

Q: If Elon Musk died, would you sell Tesla (TSLA)?

A: Yes. A lot of Tesla’s success is because Elon Musk alone can push people to do the impossible, only because he’s the largest shareholder and therefore is in complete control of all of the dozen or so Tesla major operations. Certainly, nobody else would be crazy enough to invest in so many businesses at once, like SpaceX, like the storage business, SolarCity, Nueralink, and AI, and get away with it. But then, very few people are willing to work 24 hours/day, 7 days/week either. Musk is also the world’s greatest risk-taker with his own money. So Elon Musk is a large part of the Tesla added value; if you take him away, it just becomes another General Electric (GE) (or worse, General Motors (GM)).

Q: Are geopolitical risks in the Middle East a threat to the stock market?

A: No. Several people commented in my Monday morning letter that I didn’t even mention the Middle East, and that’s because it has no market impact beyond a day. Nobody could care less. All we can do is feel sorry for all the civilians who are dying on both sides. In my lifetime, every geopolitical crisis has been a “BUY” in the stock markets, and in all risk assets. In the old days, it used to take them a month or two to figure it out, now it takes a few hours, so you just get one down day, everybody buys into that low, and markets continue up. Far more impact on the market these days is the inflation rate because that's what the Fed is looking at and they’re the ones who have their hands on the interest rate throttle. And even if inflation does stay where it is now, they’ll still have to eventually cut rates because otherwise the half of the economy that is dependent on interest rates will be destroyed. The other technology half doesn’t really care because they’re all positive cash flow, so they benefit from high interest rates.

Q: How do you select your spread prices?

A: I look at the bid-offer spread in the market, I send you a screenshot of that bid-offer spread, and then I move 5 or 10 cents off the bid side of the market. Normally, if you tighten the spread at the bid side, you will get filled on that order, and if you don’t, just leave it in there, and the second the market trends down you’ll get filled, or if you leave it the next day you’ll get filled. Remember that the second I put out a trade alert, algorithms take it up to the offered side of the market, but algorithms have to go 100% cash by the end of the day and dump all their positions, so if you leave an order in until the end of the day, often you get filled unless there’s been a major market move.

Q: Will gold continue higher?

A: Yes it will. For a start, it isn’t selling off with other risk assets in the recent correction. (GLD) only dropped $10 from an intra-day high of $225, and even though the Fed may not be cutting interest rates today, their next move will be a cut, even if that's in 3, 6, or 9 months. So, people are buying gold for that reason. Also, historically, it’s cheap relative to other asset classes such as stocks and bonds. On top of that, you have China and Russia buying record amounts of gold to bypass the Western financial system. They’ve done that for many years and it’s finally created a big short position on the market. Oh, and they’re not making gold anymore—the amount of gold being mined has been declining now a decade as the costs of mining gold rise.

Q: Why is inflation staying so high?

A: One of the reasons is that there were huge gaps in the supply/demand system due to COVID-19 still being addressed three years after the fact. That created price spikes and all kinds of unexpected consequences. Also, a lot of the government stimulus, or “COVID money,” hasn’t been spent yet; it’s still out there at the contract level and is still being committed. Even if you signed a contract two years ago, it can take two years to get a major construction project started with the planning, design, etc. Rule of thumb in dealing with all governments: everything happens slowly. All over the country, there are construction projects starting using the Federal stimulus money, so that also creates inflation when you have $3 trillion in new spending. That’s what your local traffic jam is all about. Here in Key West, they are rebuilding the Atlantic side waterfront, and that has to cost billions of dollars, far beyond what the locals could afford. But the major component of inflation, which is labor, is flatlining now. We are seeing a lot of one-time-only increases in pay going through, and then there won’t be any after that for a long time. Rising rents are a big problem now.

Q: Can you explain the market timing index?

A: The profit predictor updates itself every time we do a mouse click for all the different algorithms to kick in and generate a new number, and every piece of research we send out has an updated market timing index in it. So, if you get all of our services with Mad Hedge Hot Tips, the Global Trading Dispatch, the Trade Alerts, etc., we’re sending out at least ten updates a day for the market timing index. Suffice it to say, the more services you buy, the more updates you get on the market timing index.

Q: Will (USO) oil sell off on peace in the Middle East?

A: Well actually we’re seeing that today—we’re getting a selloff on the highs after Israel did not launch a tit-for-tat retaliation on the missile attacks from Iran. On the day they do, you will see prices go back up again. But the goal here is to dial back responses. The rule of thumb in defense for the US is: when somebody attacks you, you attack back with twice the force. That way you discourage any further retaliation from the enemy. That certainly is how our nuclear response is designed, and it’s pretty successful because only the US has the ability to execute unlimited increases in military response.

Q: Is Starlink a Tesla company?

A: Starlink is owned by SpaceX, which is an independent company owned by Elon Musk and several venture capitalists, but of course, Elon Musk is the largest shareholder. Space X is worth about $180 billion these days with several large government contracts. It’s why Elon Musk became a US citizen (foreigners are not allowed to launch our top-secret military satellites).

Q: How far-in-the-money do you go in your spread purchases?

A: It’s totally driven by the volatility of the individual stock. If you have a boring stock, you only go 5% in the money in order to earn enough money to make it worth it. If you have high volatility stocks like Tesla (TSLA) or Nvidia (NVDA) which both have options implied in the mid-40%s, you can get away with 20% in-the-money and still make a decent profit one month out. As you can tell, I tend to gravitate towards the highest volatility stocks in the market that are liquid.

Q: Will the 10% staff cut at Tesla hurt the stock?

A: Staff cuts mean bigger profits because you’re reducing the overhead by 10%. Staff cuts in almost every other technology company have been positive for the stocks for this reason. So I would say no, and Tesla has bigger problems than staff cuts like the nuclear winter going on in EV sales.

Q: Why won’t Nvidia (NVDA) go down?

A: Well, it’s because it has such a lead against all competitors. And, you know, in any other industry you’d just go hire the staff or buy the division in order to get it to hold in the market—you can’t do that with Nvidia because they’re all rich and have stock options priced at the $1 or $2 level to lock them in for life. The CEO Jensen Huang is now the sixth richest man in the world.

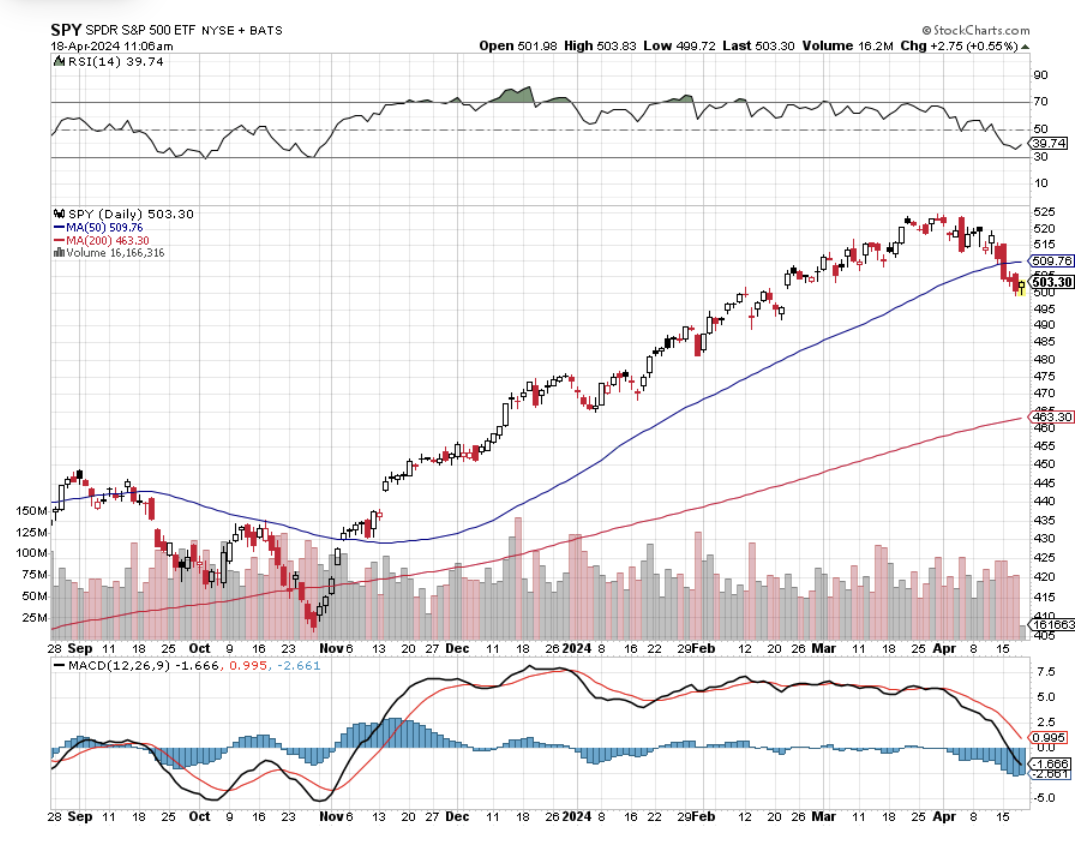

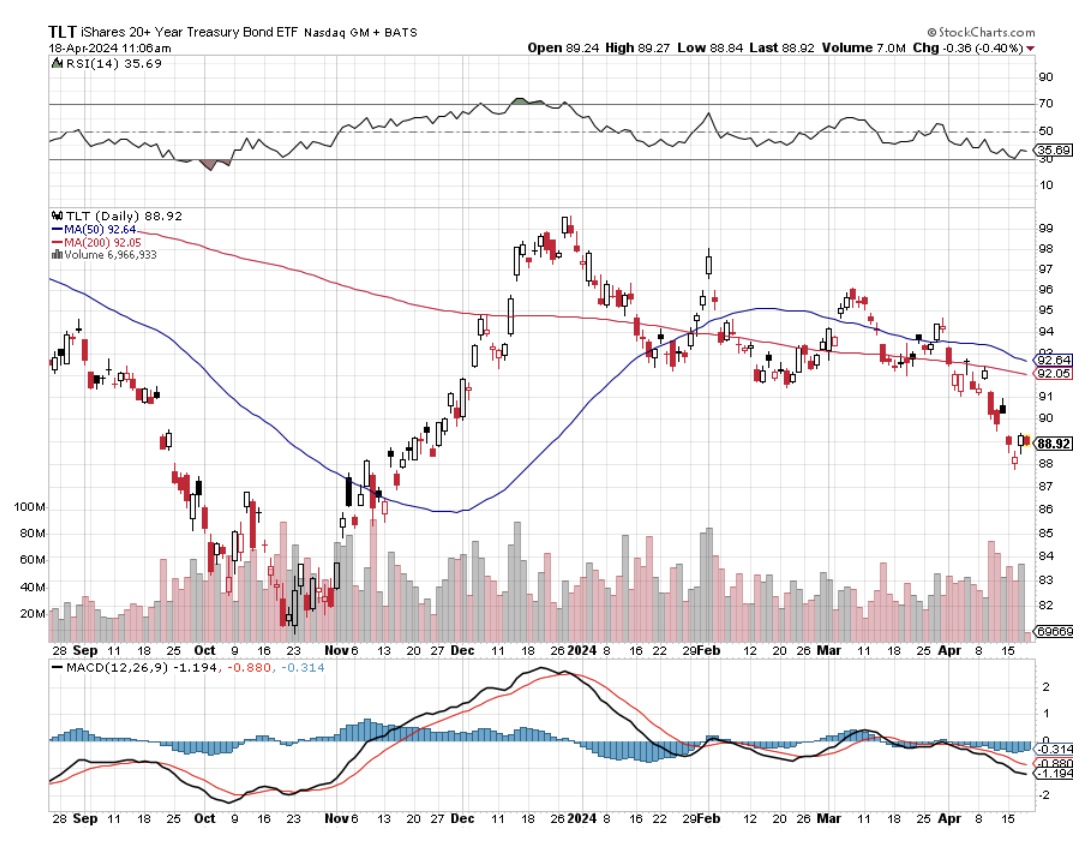

Q: Why have bonds failed to rally with the rest of the market?

A: Because the Fed isn’t cutting interest rates any time soon and bonds are dependent on the level of interest rates, which means they will rise once the Fed does cut.

Q: Should I buy Goldman Sachs Group (GS) on their great earnings report?

A: Yes, trading volumes look good for the rest of the year and that is how brokerage houses make their crust of bread. Buy Morgan Stanley (MS) too. It’s a better quality company with less dependence on trading revenues and more on fee income. After all, they hired me!

Q: Should I buy Cathie Woods’s Ark Innovation ETF (ARKK) fund here?

A: Absolutely not. Highly leveraged funds and the most leveraged stocks are the last thing you buy on market tops. That is a market bottom play, and the last real market bottom we had was in October.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, select your subscription (GLOBAL TRADING DISPATCH, TECHNOLOGY LETTER, or Jacquie's Post), then click on WEBINARS, and all the webinars from the last 12 years are there in all their glory

Good Luck and Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

2024 Key West Thinking of the Next Trade Alert

“When you’re running budget deficit of $1.6 trillion and you’re going to cut $38 billion out of it, if you were a bellhop you wouldn’t accept that as a tip,” said my former colleague at Morgan Stanley, Byron Wien of hedge fund giant Black Rock.

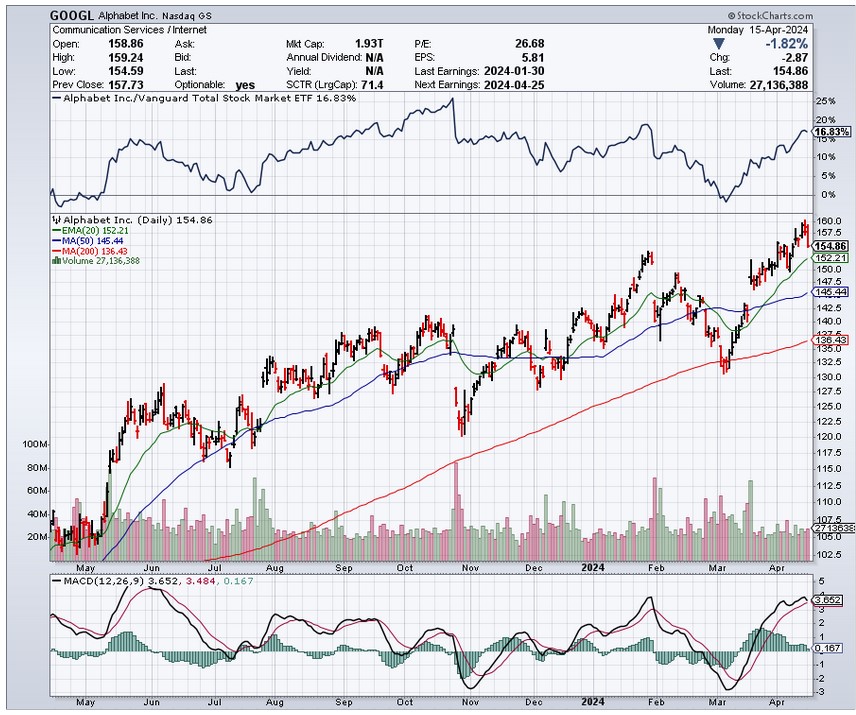

(GOOGL), (MSFT), (NVDA)

Forget all that boring "narrow AI" stuff Google (GOOGL) DeepMind keeps pumping out to wow the geeks. They can predict proteins better than I can fold a fitted sheet and their game bot clobbered my neighbor’s teenage son at Fortnite. But who cares, right?

The real question every investor should be asking about DeepMind is this: "When are they finally going to deliver this AGI thing they promised?"

Turns out, the nerds just might be getting their act together. Shane Legg, Google DeepMind's top AI guy, says there's a 50/50 chance we'll see Artificial General Intelligence (AGI) by 2028.

Other big names in the space, like OpenAI's Sam Altman, are predicting a timeframe of four or five years max.

Now, I don't believe in magic, but from what I hear, AGI would kind of be like magic. We're talking machines that can learn, adapt, and think pretty much like a human – maybe even better.

And unlike all this specialized AI – protein-folding here, Go-mastering there – AGI would be versatile. It’s capable of learning, adapting, and solving problems just like an actual person, or maybe even better.

It'd be the universal problem-solver, the ultimate Swiss army knife of intelligence. We could stick it in everything from our phones to self-driving cars and watch the sparks fly.

Naturally, everyone's lining up to cash in. Who wouldn’t? Just look at the numbers: the whole market is projected to blow up to $1.3 TRILLION in the next 10 years – from practically nothing today.

If they're right, this stuff could completely change everything in the tech world, from software to ads to giant servers running the show. Actually, if these AGI predictions come true, it'll make the dot-com boom of the 90s look like a lemonade stand.

And, as always, I've got my eye on the stocks that could make us rich. So, who are the emerging leaders of the AGI pack?

Obviously, Google (or Alphabet, whatever we're calling them this week) is top of the list. Their DeepMind crew is legendary, cracking AI problems left and right.

They built these things called "transformers" which are basically the brains behind those freaky-good chatbots like ChatGPT.

Plus, those Google guys have more money than sense, throwing $2 billion at some AGI startup called Anthropic.

Next up is OpenAI – the ones behind ChatGPT – who've got a nice, tight relationship with Microsoft (MSFT). Big money, and the brains to use it.

If OpenAI really does crack AGI wide open, you can bet Microsoft will be figuring out how to put that super-brain to work on everything from their cloud servers to those talking paperclips that live in Word documents.

Finally, you can't talk about AI without mentioning Nvidia (NVDA), the chip guys. Their graphics processors (GPUs) are the gold standard for anything AI-related, and they're only going to get more important if AGI takes over the world. I wouldn't be surprised if AGIs of the future were actually building Nvidia's chips. It's that meta!

But before you spend all your hard-earned cash on AGI, here’s a reality check. Of course, there's always the chance this is just another overhyped tech fad.

Some of the smartest folks in the business think it'll be decades before AGI is a reality, and even then, it might take a while for the really useful applications to show up.

And while the potential is mind-boggling, the stocks we're talking about are already trading as if AGI is guaranteed to happen next year. That could lead to some serious short-term pain if things don't go as planned.

Here's the thing, though: If those AI eggheads are right, AGI could be the biggest thing since, well, the internet. And if we're smart, patient (boring, I know), and invest in the right companies, the potential returns could be life-changing.

So, I suggest you keep these stocks on your watchlist. I'm personally watching these stocks like a hawk. Every pullback is another chance to load up. Trust me, this train is leaving the station, and you don't want to be left behind.

Mad Hedge Technology Letter

April 17, 2024

Fiat Lux

Featured Trade:

(AI AND LOWER EMPLOYEE WAGES)

(TSLA)

Students hoping to become bankers shouldn’t study finance, they should dive into programming.

This is the big takeaway from how investment banks are run these days.

Gone are the moments when finance degrees were the hottest commodity, now it is all about generative AI.

Artificial intelligence (AI) could replace the equivalent of 300 million full-time jobs, a report by investment bank Goldman Sachs says.

It could replace a quarter of work tasks in the US and Europe but may also mean new jobs and a productivity boom.

And it could eventually increase the total annual value of goods and services produced globally by 7%.

Generative AI, able to create content indistinguishable from human work, is "a major advancement", the report says.

Silicon Valley is keen to promote investment in AI in not only the United States but in a way that will ultimately drive productivity gains across the global economy.

The report notes AI's impact will vary across different sectors - 46% of tasks in administrative and 44% in legal professions could be automated but only 6% in construction and 4% in maintenance, it says.

Journalists will therefore face more competition, which would drive down wages unless we see a very significant increase in the demand for such work.

Consider the introduction of GPS technology and platforms like Uber (UBER). Suddenly, knowing all the streets in London had much less value - and so incumbent drivers experienced large wage cuts in response, of around 10% according to our research.

The result was lower wages, not fewer drivers.

Over the next few years, generative AI is likely to have similar effects on a broader set of creative tasks.

According to research cited by the report, 60% of workers are in occupations that did not exist in 1940.

However, other research suggests technological change since the 1980s has displaced workers faster than it has created jobs.

Nobody understands how the technology will evolve or how firms will integrate it into how they work.

Lower wages and higher output are a perfect recipe for higher technology share prices and that is exactly what we will get.

Currently, we are experiencing a mild pullback from the AI mania, but that is simply because it got too far ahead of its skis.

I am quite disappointed in the price action in a stock like Tesla (TSLA) which announced a major cut to its global workforce to trim costs.

The staff cut of 10% could result in exactly what I mentioned more output for less pay, but in terms of hiring more workers, they have decided to force fewer workers to do more.

This type of management behavior doesn’t usually pan out well, because it usually leads to an employee rebellion and cratering employee satisfaction.

They will certainly be a major investor in AI chips to outfit their EV cars, but they have signaled to investors that they are experiencing trouble reaching that “2nd wave” of incremental buyers for their car.

Tech as a whole is not in trouble, but individual companies will find an imbalance treatment to their stock.

The AI pixie dust might have leveled off in the short term, and the broader tech market is being dragged down by a confluence of headwinds like spiking interest rates, geopolitical strive, beaten-up consumers, and diminishing addressable market revenue.

I do believe in the AI hype, but these trends don’t go up in a straight line and need time to digest which often results in short-term pullbacks.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.