When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

(AUSTRALIA IS CONFLICTED ABOUT ITS APPROACH TO ENERGY)

May 10, 2024

Hello everyone,

I recently heard Sky News host, Rita Panahi interview Ian Plimer, a geologist. Plimer talked about the types of energy Australia has at its disposal and the damage wind and solar are doing to the environment.

Plimer pointed out that Australia has a huge supply of gas that is not being used. In Victoria, for example, he said that there is an enormous amount of onshore gas in the Gippsland region that is low in carbon dioxide, and low in mercury, but regulations state that companies cannot drill onshore for gas. Rather they must drill onshore for gas offshore and vice versa. This is creating massive gas shortages in Victoria.

In New South Wales, too, there is also a gas shortage, due to mismanagement. Massive reserves at Narrabri have taken a decade to get that up producing gas for the people.

Eastern Australia relies on Queensland for much of its gas.

Plimer argued that there are thousands of years of gas in Australia and millions of years of uranium.

Six projects have been named to start feasibility studies for Australia’s first offshore wind farms. Plimer was scathing about wind projects because he says they “don’t save anything.” Rather, he says they have a telling negative effect. They “change aviation patterns, change shipping patterns, change fishing patterns, and kill a lot of wildlife.”

Killing the wildlife offshore hides the damage – the death of wildlife, and possibly whales. In effect, it puts the problem out of sight offshore. Interestingly, Plimer noted that elsewhere in the world wind projects are being shut down because of environmental damage.

Beautiful Australian agricultural land is being covered with wind turbine farms. Plimer argued that these wind turbines pollute large rich parcels of land with dangerous chemicals. Instead of disposing of wind turbine blades, he says “We bury them, or we cut them up and bury them in the ground.” He was critical of the fact that there is no industry at all where we can recycle these items.

Furthermore, Plimer details the long-term effects of pollution from solar panels. He stated that solar panels leak out cadmium telluride, and leak out lead, which is left in the soil.

OK, so how damaging is cadmium telluride?

Acute toxicity – oral, category 4

Acute toxicity – dermal, category 4

Acute toxicity – inhalation, category 4

Harmful if swallowed, Harmful in contact with skin, Harmful if inhaled.

Breathing high levels of cadmium damages people’s lungs and can cause death. Exposure to low levels of cadmium in air, food, water, and particularly in tobacco smoke over time may build up cadmium in the kidneys and cause kidney disease and fragile bones. Cadmium is considered a cancer-causing agent.

The United States is the leader in cadmium telluride (CdTe) photovoltaic (PV) manufacturing…due to their efficiency and relatively low manufacturing energy requirements.

Cadmium is recognized as a toxic substance by the United States Environmental Protection Agency (EPA), which set a maximum contaminant level (MCL) for cadmium (Cd) of 0.005 mgL in drinking water. Tellurium (Te) while not regulated by the EPA, has also been shown to have the potential to cause kidney, heart, skin, lung, and gastrointestinal system damage in rats and in humans.

Plimer was very critical of governments, past and present, for their poor decisions regarding effective energy solutions for Australia.

He pointed out that Australia has plenty of energy and it is cheap.

Impact of Wind Turbines:

Visual Pollution

Noise Pollution

Impact on Wildlife

Disturbance to existing ecosystems and land use.

Update to Australia’s future energy direction as of Thursday, May 9, 2024.

New gas fields will be key to the Labour’s government strategy. Gas will become a central part of Australia’s energy and export sectors by 2050 and beyond. The government is backing the energy source as the key to transitioning the energy sector and economy. Environmental and climate groups have condemned the strategy saying it will lead to more emissions, not less.

Responses to Labour’s plan have been mixed.

The Business Council of Australia was supportive, saying the plan struck the right balance ‘” by ensuring Australia can transition to net zero, while also keeping prices down, delivering reliable power supply and retaining jobs.”’

The Australia Institute called the strategy “regressive”, while the federal Greens leader, Adam Bandt, said Labour was “’ threatening its legislative agenda by committing to a future fuelled by fossil fuels.’”

Environmental groups including the Australian Conservation Foundation, Surfers for Climate, Solutions for Climate Australia, Climate Communities Alliance, and Parents for Climate were all disappointed.

Attention will now turn to how Labour plans to meet Australia’s climate targets as it embarks on an expansion of the gas industry.

The Safest and Deadliest Energy Sources

There are vastly divergent views on the impact of different energy sources on the environment. As of 2021, nearly 90% of global CO2 emissions came from fossil fuels. But as we know energy production doesn’t only lead to carbon emissions, it can also cause accidents and air pollution that have a significant toll on human life.

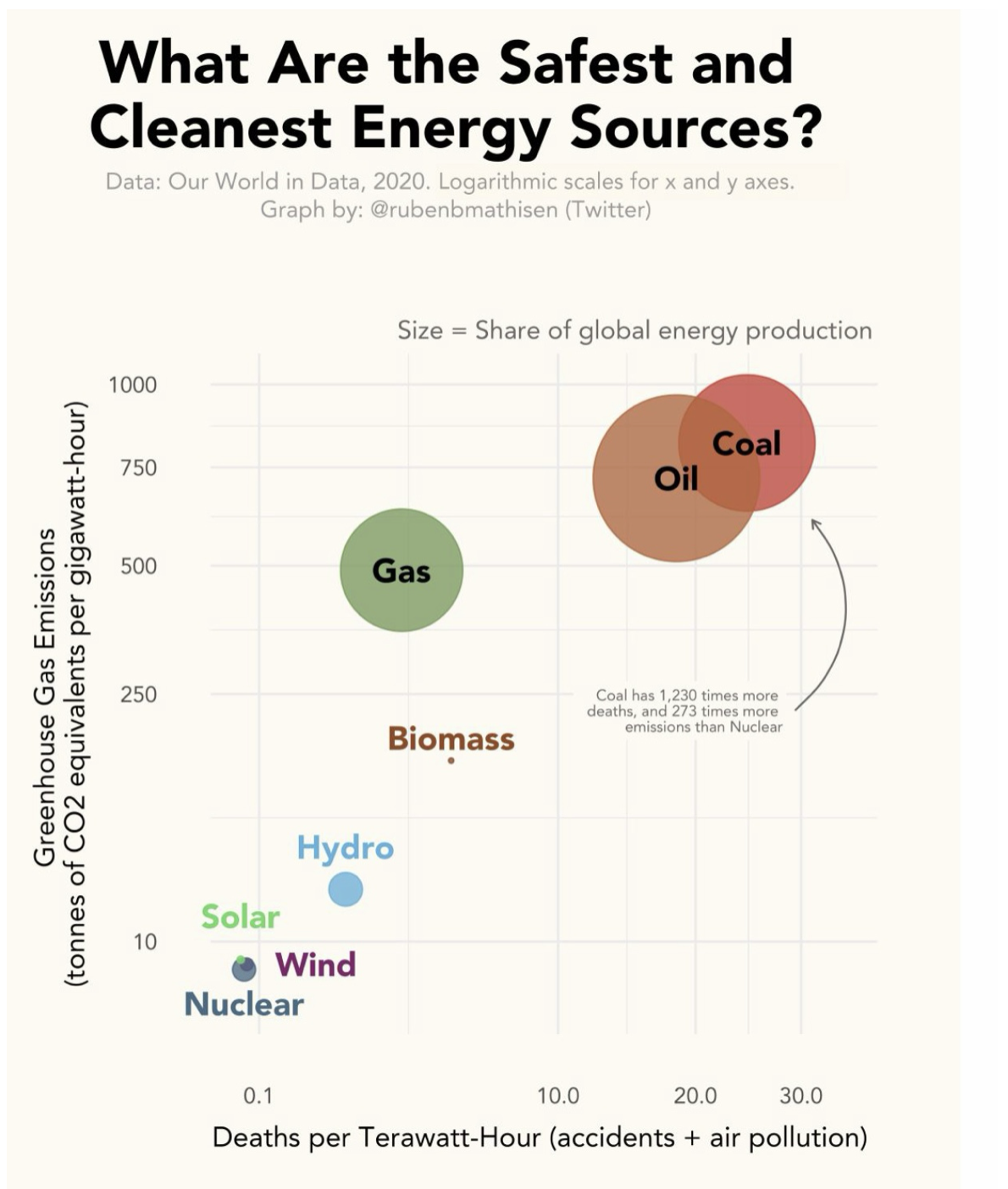

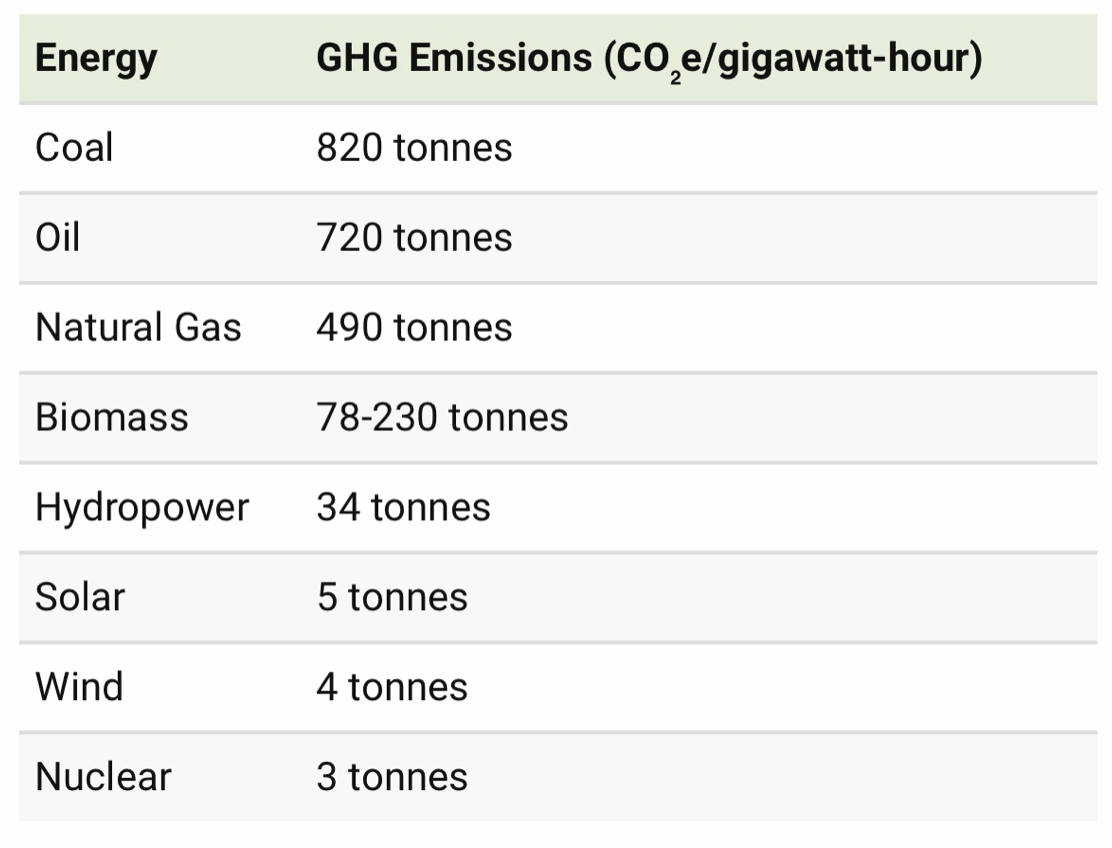

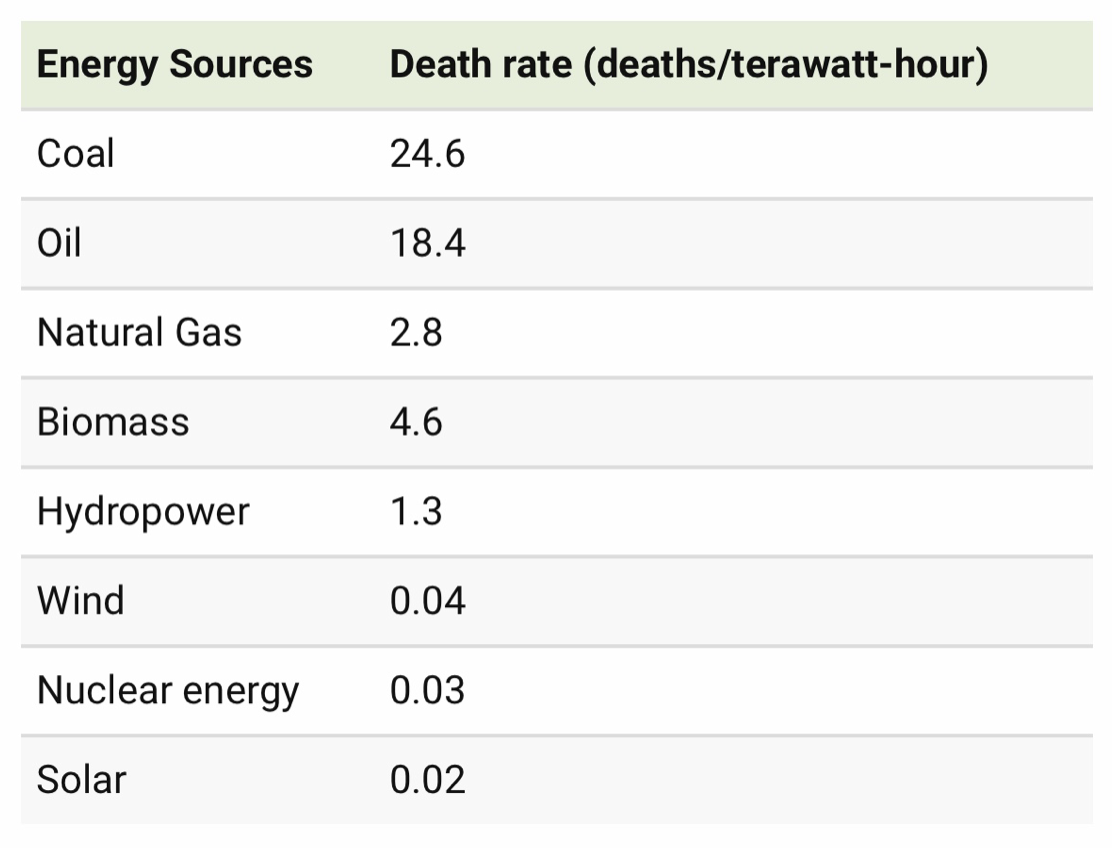

Ruben Mathisen has used data from Our World in Data to help visualize exactly how safe or deadly these energy sources are:

Fossil Fuels are the highest emitters.

Deadly effects

Air pollution or accidents can take human lives when we are generating energy on a massive scale.

According to Our World in Data, air pollution and accidents from mining and burning coal fuels account for around 25 deaths per terawatt-hour of electricity – roughly the amount consumed by about 150,000 EU citizens in one year. The same measurement sees oil responsible for 18 annual deaths, and natural gas causing three annual deaths.

Meanwhile, hydropower, which is the most widely used renewable energy source, causes one annual death per 150,000 people. The safest energy sources by far are wind, solar, and nuclear energy at fewer than 0.1 annual deaths per terawatt-hour.

Depending on who you speak to about energy, opinions will vary widely about the best future path for Australia to follow. There are arguments for and against all energy sources. You will never be able to please everyone. Economics, the environment, and sustainability must all be considered when planning for the future.

Update:

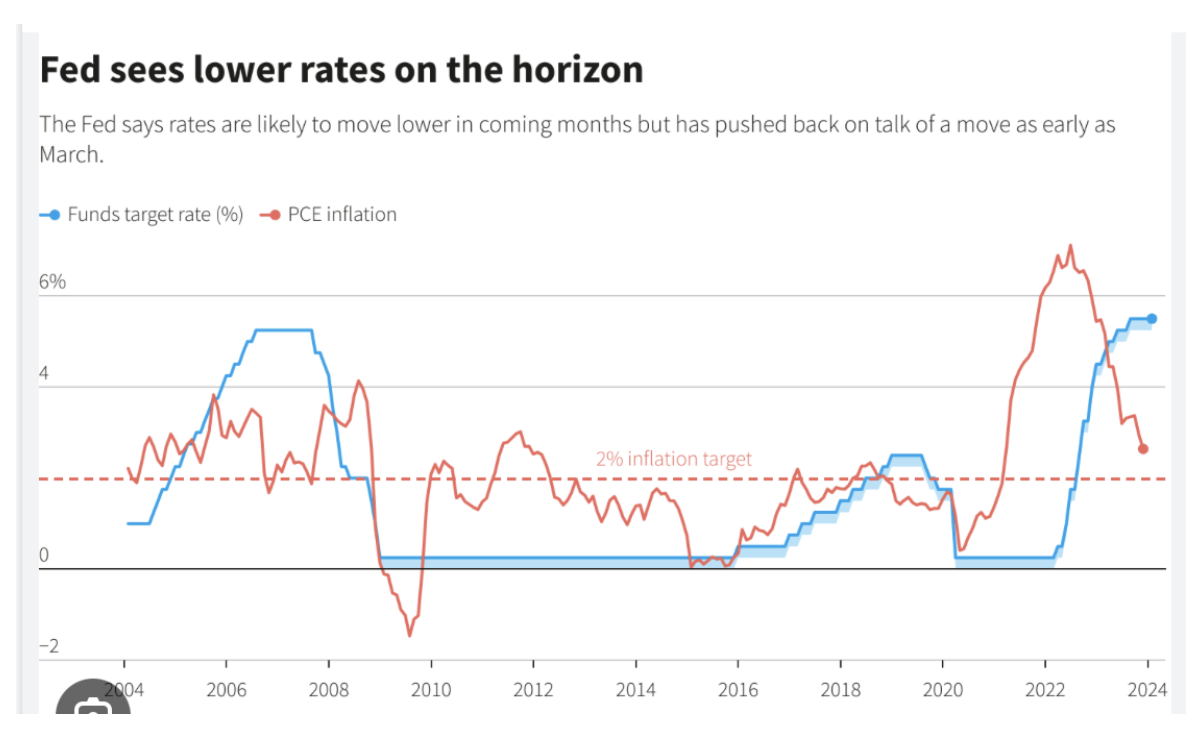

Global Central Banks are not taking their cues from the Fed.

When it comes to central banking, everyone assumes the Federal Reserve takes the leadership role, and global counterparts follow. Well, it looks like events are shaping up somewhat differently now.

Most recently, the Riksbank, Sweden’s Fed equivalent has approved a quarter percentage point reduction (Wednesday), with an indication that two more cuts could be in the pipeline before the end of the year should the inflation outlook hold.

It was the first time the Riksbank had cut since 2016 and took its main policy rate down to 3.75%. Meanwhile, the Fed’s rate has been locked between 5.25% - 5.5% after a series of 11 hikes that began in March 2022.

In March, this year, the Swiss National Bank also reduced its key rate.

Reductions from the Bank of England and European Central Bank are expected to come next, possibly within a month. Bank of America strategists think the BOE could even cut in June, given the dovish buzz from BOE Governor Mark Bailey and others. Otherwise, August is a likely time for the rate cut.

Should all these central banks take concrete action on their dovish chatter, and inflation and economic growth slow in the U.S. the Fed could find itself in an uncomfortable spot.

A slowdown in inflation and/or in activity in the U.S., will highlight a growing rate differential between the U.S. and other countries, and perhaps become a factor that will encourage the Fed to follow the global trend toward lower rates.

Central banks are not taking their cues from the Fed. Christine Lagarde made clear that “we are data-dependent...[and] we have to make our decisions. Hence, we are not Fed-dependent.”

To sum up, if either demand starts to fall and/or core services inflation slows, the Fed is likely to begin its own cutting cycle.

Zoom Recording of April 30, 2024

The Zoom recording is in two parts.

I had technical issues with the videos I wanted to show you, so they are part of the second recording I did. Additionally, the Excel spreadsheet of all the stocks/options recommended will be shown in this recording as well.

I hope you enjoy the presentation.

Part 1

Part 2

https://www.madhedgefundtrader.com/jacquie-munro-meeting-replay-april-2024/

Cheers,

Jacquie

Global Market Comments

May 10, 2024

Fiat Lux

Featured Trade:

(A DIFFERENT VIEW OF THE US)

Mad Hedge Biotech and Healthcare Letter

May 9, 2024

Fiat Lux

Featured Trade:

(A HIGH-RISK, HIGH REWARD BIOTECH PLAY)

(CRSP), (VRTX), (DNA)

Ah, the "golden age of biotech" — remember when that was the phrase du jour? Well, it might not be on everyone’s lips these days, but let me tell you, the biotech arena still holds some golden tickets for those with an eye for long-term gems.

These hotbeds of innovation aren’t just cooking up your everyday aspirin; they’re on the front lines battling the big beasts like rare diseases and crafting cures that might have seemed like sci-fi a few decades ago.

So, why should we keep our wallets ready for biotech? Simple: life-saving meds aren't exactly impulse buys at the checkout counter. People need these drugs, economy be darned. And that, my friends, brings us to a biotech belle of the ball: Crispr Therapeutics (CRSP).

Now, if you’re hunting for the disruptors of the disruptors, cast your eyes on CRISPR/Cas9 gene-editing technology. And leading the charge? Crispr Therapeutics, of course. Their new FDA-approved therapy, Casgevy? Think of it as a microscopic search-and-replace function for your genes, pinpointing the exact spot that needs fixing. Snipping out a faulty gene? Child's play for CRISPR.

This isn't just about editing genes willy-nilly. This technology, honed and shepherded through the halls of academia, now bears the fruit of a Nobel Prize in Chemistry in 2020 — a tip of the hat to one of CRISPR Therapeutics’ founders, Charpentier.

With exclusive rights to this CRISPR/Cas9 tech, they’re not just playing in the minor leagues; they’re major league players with the FDA-approved Casgevy aimed at tackling sickle cell disease (SCD).

If you’re feeling more cautious, however, then Vertex Pharmaceuticals (VRTX) might be a steadier ride. It’s a bigger boat with more therapies on the market.

But if you’re feeling a bit more Maverick, a direct bet on Crispr Therapeutics could be your kind of play. Smaller in size, sure, but with a direct line to the gains (or pains) from Casgevy, and boy, does biotech love a high stakes game.

So, what does throwing your chips in with CRISPR entail? Let's unwrap this.

First off, their Casgevy is a pioneering ex vivo CRISPR-Cas9 therapy—think of it as a pit stop where cells are tuned up outside the body before being put back in the race. It’s already got the green light from the FDA for not one, but two heavy hitters: sickle cell disease and transfusion-dependent beta-thalassemia (TDT).

But here’s the rub: despite these big wins, CRISPR’s stock has been more or less jogging in place for five years. Why? It seems the market’s giving the side-eye to the commercial rollout of these therapies. But hold up—shouldn’t the stock be climbing as these treatments start to hit the market?

Well, the game here is more marathon than sprint. We're talking about a potential addressable market for these treatments that’s just aching to be tapped into. But there’s a catch—the price tag is a whopper at $2.2 million a pop. That’s a lot of zeroes.

Now, let’s do some napkin math.

If CRISPR could corner the market on all SCD and TDT patients across the US and EU, we're looking at a ballpark figure of around $38.6 billion in potential revenue. And here's the kicker: the real puzzle is figuring out how many of these folks will actually get treated with Casgevy, given the steep costs and varied insurance landscapes.

Yet, if CRISPR can snag just a slice of this market, even with a high discount rate factored in for all the risk, the numbers start to look pretty tasty.

Imagine if they treated all these patients over a decade—ka-ching! That’s an NPV (net present value) that could potentially justify CRISPR’s current market cap all on its own.

Overall, investing in CRISPR Therapeutics could be akin to buying a stake in Genentech (DNA) back in the day—before they hit the biotech jackpot.

With Casgevy already approved and more potential blockbusters in the pipeline, CRISPR isn't just about today’s gains; it’s about betting on a biotech future that could be as revolutionary as the invention of the wheel—if the wheel could edit your DNA, that is.

What’s the verdict then? If you’re game for a ride on the wild side of biotech with a company that’s rewriting the genetic code of healthcare, CRISPR Therapeutics might just be the stock to watch. So buckle up because it’s going to be an exciting ride.

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

May 9, 2024

Fiat Lux

Featured Trade:

(DECODING THE GREENBACK),

(BRING BACK THE OLD ASSET ALLOCATION RULES)

(TLT), (JNK), (HYG), (REIT), (BKLN)

In a move that could revitalize its growth strategy, Apple is reportedly developing its own line of dedicated artificial intelligence (AI) chips. This strategic shift comes amidst a broader slowdown in the tech sector and aims to enhance Apple products and services in a future dominated by AI-powered innovation.

The AI Imperative

Apple's interest in developing in-house AI chips reflects the growing recognition that AI is becoming essential for competitive technology products and services. AI fuels features like photo and image classification, voice assistants, personalized recommendations, and advanced computational photography. Currently, Apple relies on chips from suppliers like Qualcomm and Nvidia to power the AI capabilities of its devices. However, by developing its custom AI silicon, Apple could gain significant advantages:

- Performance and Power Efficiency: Apple could tailor its AI chips specifically for the workloads and computational needs of its devices, potentially leading to significant gains in AI performance while optimizing power usage.

- Tighter Integration: In-house AI chips would allow Apple to have deeper integration across its hardware and software, enabling seamless and more sophisticated AI-driven experiences.

- Cost Savings: Reducing reliance on third-party chip suppliers could potentially lead to cost savings over time, strengthening Apple's profit margins.

- Competitive Differentiation: Proprietary AI chips would allow Apple to differentiate its products with unique AI capabilities not found in competing devices.

A History of Chip Innovation

Apple has a proven record of developing its own custom chips, particularly its A-series and M-series chips that power iPhones, iPads, and Macs. These chips have consistently demonstrated superiority in performance and energy efficiency compared to off-the-shelf solutions. Building on this success, Apple appears poised to apply its chip-design expertise to the burgeoning realm of AI acceleration.

The Market Context

News of Apple's AI chip development emerges during a challenging time for the tech industry. The global economic slowdown, rising inflation, and supply chain disruptions have contributed to a market slump, with major tech companies experiencing slowing growth and declining stock prices. In response, many companies, including Apple, are scrutinizing their costs and investments focusing on high-potential areas.

Investing in AI represents a strategic bet for Apple. The global AI chip market is expected to witness explosive growth in the coming years, fueled by applications across various industries, including autonomous vehicles, healthcare, and smart manufacturing. By establishing a significant presence in AI hardware, Apple would position itself to capture a substantial portion of this burgeoning market.

The Competitive Landscape

Apple's foray into AI chips intensifies competition in an increasingly crowded field. Tech giants like Google and Amazon have already developed custom AI chips for their cloud computing services and devices. Meta (formerly Facebook) is also heavily invested in the development of AI chips aimed at powering its Metaverse ambitions. Traditional chipmakers like Nvidia and Intel are equally committed to maintaining their dominance in AI hardware development.

Potential Impact on Apple's Ecosystem

Should Apple successfully develop its AI chips, the implications for its products and services would be notable:

- Enhanced Siri and AI-powered features: More powerful AI capabilities could supercharge Siri, making the voice assistant more intelligent and responsive, and unlock new AI-driven features across Apple's devices.

- Computational Photography and Videography: AI-powered cameras on future iPhones and iPads could take mobile photography and videography to new heights through image processing and computational effects.

- Augmented Reality (AR) Breakthroughs: On-device AI could enable new possibilities in AR, facilitating the development of more immersive and intelligent AR experiences.

Challenges and Considerations

Apple's path to becoming a leader in AI hardware won't be without challenges:

- The complexity of AI Chip Design: Designing high-performance AI chips requires specialized expertise and significant research and development expenditure.

- Talent Acquisition: Apple will need to attract and retain top engineers in the highly competitive field of AI chip design.

- Execution Risk: Successful execution is vital. Even with the right resources, there's always the risk that new chip projects may face delays or fail to achieve their desired performance targets.

Getting in on the AI market might be more important than ever for Apple, given the recent lackluster stock performance issues the company has seen.

Mad Hedge Technology Letter

May 8, 2024

Fiat Lux

Featured Trade:

(THE TECH STOCK HAS MORE ROOM TO RUN)

(ANDREESSEN HOROWITZ)

There is more room for stocks to extend themselves to the upside, which is great news for many who think we might be reaching the last gasp up in tech.

We aren’t there yet and the longest late-cycle bull market continues.

It certainly isn’t over - we received some timely commentary from one of the most prominent venture capital firms in technology, Andreessen Horowitz.

The company isn’t afraid to tell the truth.

Sometimes that means sticking in where it really hurts like a jab to the gut in an industry where most people get their feelings hurt quite easily.

I understand the bravado partly results from the mountains of success that have preceded them, but nonetheless, it is refreshing to hear from successful people who have their pulse on the tech sector.

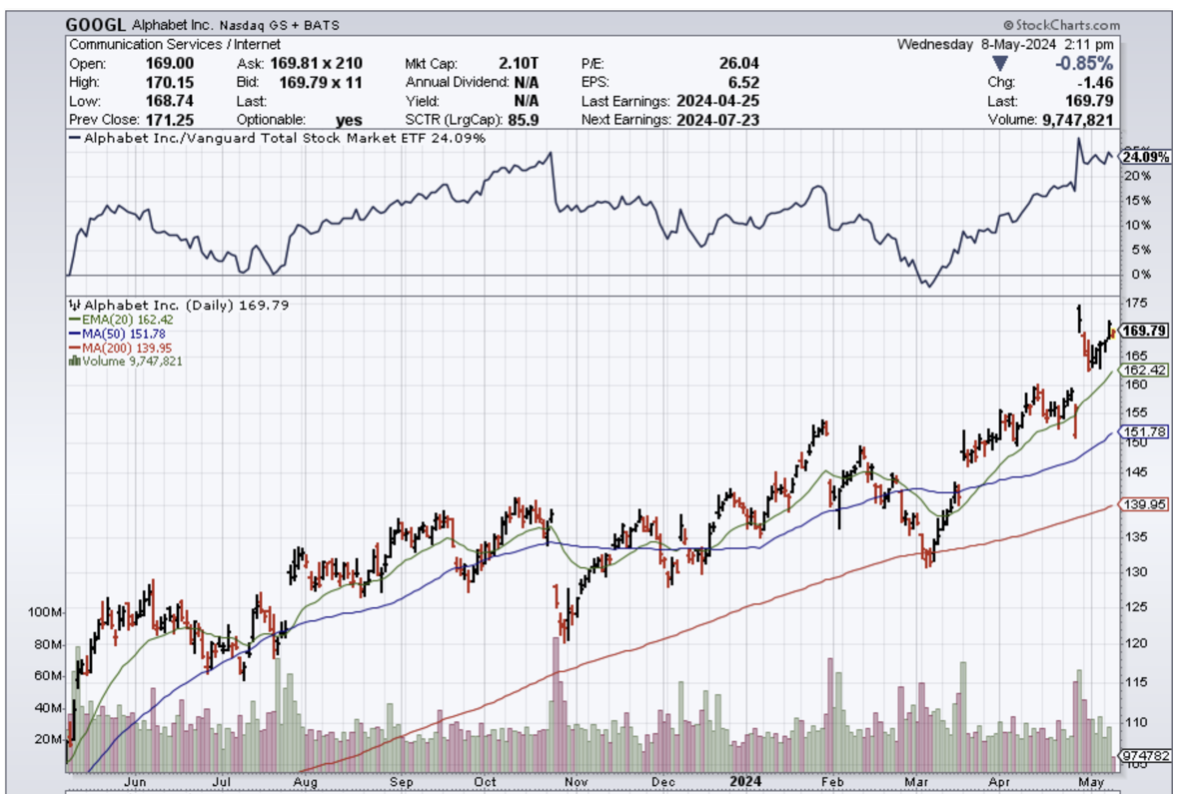

Google might be among corporate America's favorite success stories, but some people aren't convinced Big Tech is operating as efficiently as it could be.

There is still a lot of frittering away in Mountain View, California or that is what Andreessen Horowitz has to say.

The venture capitalist firm said that most Google workers don’t really do anything.

What do I mean by that?

To do nothing “except complete a 10-minute task every now and again” is what they said.

Some workers used their weekdays to learn how to scuba dive or go for a Thai massage because there wasn’t much for them to do in the office.

Companies retaining a bloated headcount with people who don't actually help drive the company forward shows how profitable these companies are.

When push comes to shove and a recession slams us blindly, Google will know what to do with these workers.

The company later said a “bunch of people” in large corporations are working “BS jobs.”

“Anyone who works in a 10,000+ person or larger white-collar job company knows that a bunch of the people can probably be let go tomorrow and the company wouldn’t really feel the difference, maybe it’d even improve with fewer people inserting themselves into things.”

Much of the vendetta against tech workers isn’t all justified, but I do believe it is more about the top 10% carrying the load for the other 90%.

The top end of the talent pool is so brilliant, they are leading $2 trillion companies and that doesn’t happen with a bunch of morons, does it?

However, another trend I have noticed is that America could be running out of talent after exhausting India and China while work visas have never been harder to procure.

After getting rid of the bad workers, will there be those superstars that move the window and that is a big doubt moving forward.

Talking with people in the know, there is great uncertainty with the direction of big tech as nobody understands what will really succeed the smartphone.

The smartphone was that one vehicle of profit that all companies knew they had to make money from and now what is next?

Is it a virtual reality with all those goofy headsets giving people headaches?

Companies are pouring billions into figuring out what the next iPhone is and it’s more like throwing paint on the wall and seeing what sticks.

Luckily, the tech bull market should continue but many companies are facing existential threats due to lack of innovation and lack of top-end employee talent.

If innovation somehow takes a wild turn away from the AI path, many companies could blow up.

Until then, buy the dip in GOOGL until a black swan hits the industry or sub-sector. They have many ways to keep the stock from going down like their newly minted dividend which is a first in the company.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.