Compassion for humanity – that’s all we need – this is the only trait corporate Americans need for bosses like him to employ humans over AI filmmaker Tyler Perry.

That’s all a tall order for corporate tech ($COMPQ) in Silicon Valley which usually prefers not to prioritize compassion for humanity over profits.

That’s bad news for tech workers and we got more confirmation of this trend with Tesla (TSLA) CEO Elon Musk cutting 600 white-collar corporate jobs from the Fremont, California office.

Elon is usually one to be on the forefront of the curve and he isn’t late with the firing means we are just in the first innings of it.

An interview with Tyler Perry led him down the rabbit hole of the future of AI and it wasn’t pretty if you are a W2 worker.

As it relates to implanting AI, the one irrefutable conclusion he could make was that human workers would lose out at the expense of the bosses who would gain.

Over the past four years, Tyler Perry had been planning an $800 million expansion of his studio in Atlanta, which would have added 12 soundstages to the 330-acre property.

Now, however, those ambitions are on hold — thanks to the rapid developments he’s seeing in the realm of artificial intelligence, including OpenAI’s text-to-video model Sora, which debuted on Feb. 15 and stunned observers with its cinematic video outputs.

His productions might not have to travel to locations or build sets with the assistance of technology.

His expansions are currently and indefinitely on hold because of the quick developments of AI.

He might not need to invest in anything at all except some AI additive technology.

Perry said the job losses in his industry could range from writers, actors, sound specialists, builders, designers, architects, and so on.

Human actors are on the chopping block and the only digestible content that will be saved from the bloodbath is live sports which is why premium content like the NFL, soccer World Cup, and Alabama college football fetch astronomical numbers to license these games.

None of that will be replaced by AI, but much of the best of the rest will and the hundreds and thousands of jobs will sink with them.

Perry also described a situation in which he used AI which kept him out of makeup for hours.

In post and on set, he was able to use this AI technology to avoid ever having to sit through hours of aging makeup.

The movie industry won’t need to negotiate with the actor's or writers' unions again, because they are dispensable.

What will happen in tech?

Google and Apple will build products but with much less staff involved.

Compensation expense is about to drop precipitously without warning.

Remember that the dive into AI won’t be a drip, but a waterfall because once one figures out a way to optimize the technology, everyone else follows suit.

The copycats come out of the woodwork and reverse engineering takes hold.

If you thought that Congress is responsible to save the workers then you’ll be waiting for a long time.

Tech executives have been lobbying Washington for a generation, and I believe they will take the side of management.

And in any case, if the government does get involved, they usually make regulations too onerous to hire humans making the situation worse.

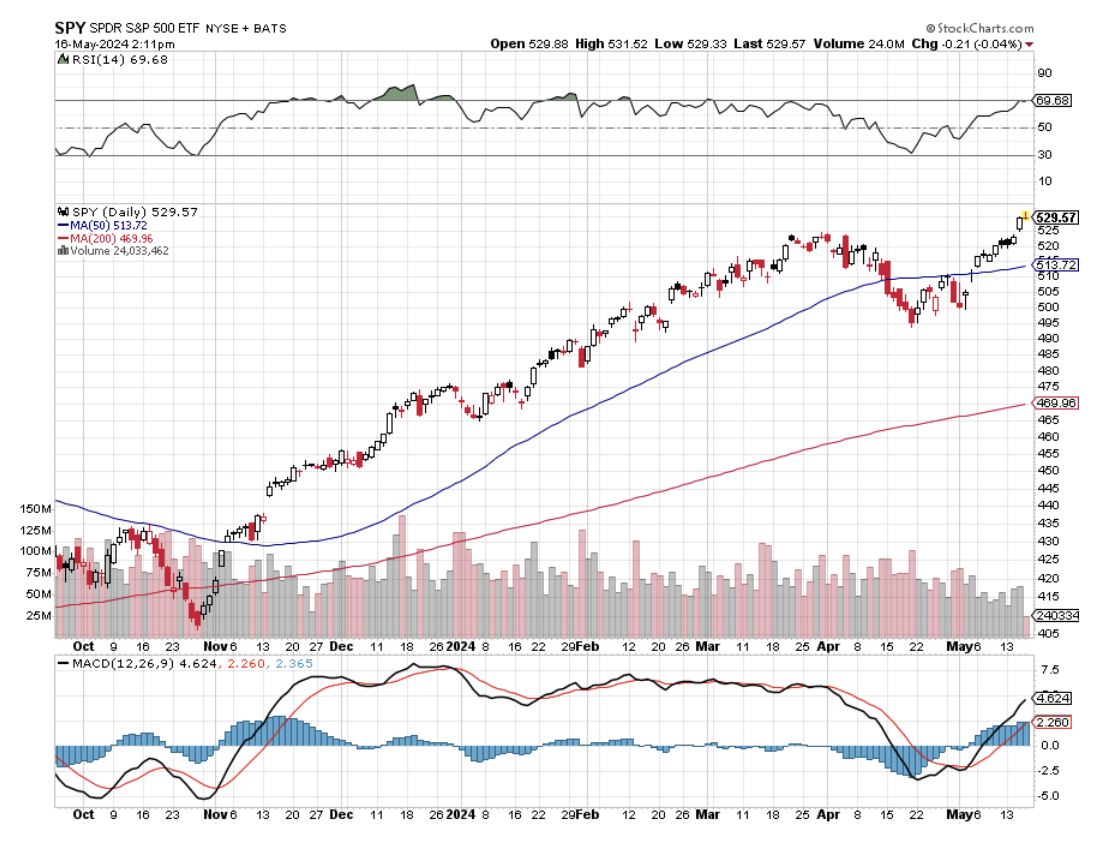

What does this mean for tech stocks?

They go higher.

Expenses will take a meaningful dive, dividends and buybacks go up with more cash on hand, and tech stocks comprise an even larger percentage of the overall market.

We have sunny days ahead for the tech sector.

AI WILL HAVE A BIG IMPACT IN THE MOVIE INDUSTRY