Mad Hedge Technology Letter

May 13, 2024

Fiat Lux

Featured Trade:

(BUY THE TOURIST PLATFORM TECH STOCK)

(ABNB), (EXPE)

Mad Hedge Technology Letter

May 13, 2024

Fiat Lux

Featured Trade:

(BUY THE TOURIST PLATFORM TECH STOCK)

(ABNB), (EXPE)

Any type of selloff in Airbnb (ABNB) shares will be short-lived as we approach the summer Olympics and European soccer summer tournament.

Global Events of a month-long will get people out of their homes and spending their cash.

These premium events will move the needle for Airbnb revenue-wise in Europe.

The heart of world travel is Western Europe so it’s convenient that these mega-events are in France and Germany and not in some backwater.

Better luck next time if you haven’t locked up your Airbnb in Germany or France by now.

Travelers even have the option to stay through September and enjoy the annual Oktoberfest in Bavaria.

There isn’t lodging to be found in Western Europe in the summer months and even though the economy is starting to weaken around the edges, we are still in for another summer of travel post-pandemic style.

Tourists are splurging like there is no tomorrow held up by the higher income bracket.

Italy is famous for hosting 8 million Americans per year and is otherwise known as Americans' favorite European destination.

That number is poised to balloon to 12 million by 2030 and that means revenue growth for Airbnb as Italian Airbnb’s are rampant everywhere you go in Italy.

As for the company, the business model has been doing great ever since CEO and Founder Brian Chesky put a tight leash on expenses after being caught wrongfooted during the pandemic.

The stock sold off on the earnings even with the nice beat and the Mad Hedge tech letter executed a call spread on the underlying shares.

Weak guidance has been a hallmark of this past earnings season as the economy softens.

Management needs a lower bar to jump over for later this year.

Revenue increased 18% year over year to $2.14 billion last quarter, ahead of the $2.06 billion consensus.

The surge in profit margins was due in part to a shift in the Easter holiday to the first quarter, strong interest income, and leverage from its revenue growth and cost discipline.

The stock is now down 13% from its year-to-date peak and at its lowest point in close to three months.

Airbnb competes with hotels and other types of overnight accommodations, but its closest competitors are other home-sharing platforms like Expedia's VRBO.

But Airbnb already dominates the home-sharing niche with a leading market share among those platforms, and the company appeared to strengthen its position in the first quarter. Revenue at Expedia (EXPE) increased 8% in the period, while its B2C division which includes VRBO was up just 3%.

Competitors have been unable to overcome the powerful network effect present on Airbnb's platform, allowing it to continue growing its lead.

The shareholder returns program is beefing up.

The company continues to return capital to shareholders, buying back $750 million in stock last quarter. With $2.5 billion in total share repurchases over the past year,

Airbnb has reduced its shares outstanding by nearly 3% over that period. While 3% might not sound like much, this strategy compounds over time, and Airbnb should be able to increase buybacks as profits grow.

Additionally, the company is benefiting from higher interest rates as it's on track to generate close to $1 billion in interest income this year, giving it a significant boost on the bottom line.

I’m betting on an uptick in shareholder interest in the short term at these price levels.

I was a little uncomfortable chasing it higher from $170, but $150 is more reasonable and I do believe the Fed pivot tailwinds could catapult us into profits with this trade.

“He does not possess wealth; it possesses him.” – Said Benjamin Franklin

(REITS ARE DUE FOR A TURNAROUND SOON)

May 13, 2024

Hello everyone.

Week ahead calendar

Monday, May 13

Switzerland Consumer Confidence

Previous: -38

Time: 3:00am ET

Tuesday, May 14

8:30 a.m. Producer Price Index (April)

UK Unemployment Rate

Previous: 4.2%

Time: 2:00am ET

Earnings: Home Depot, Charles Schwab

Wednesday, May 15

8:30 a.m. Consumer Price Index (April)

Previous: 3.8%

8:30 a.m. Hourly Earnings (April)

8:30 a.m. Average Workweek (April)

8:30 a.m. Empire State Index (May)

8:30 a.m. Retail Sales (April)

10 a.m. Business Inventories (March)

10 a.m. NAHB Housing Market Index (May)

Earnings: Progressive, Cisco.

Thursday, May 16

8:30 a.m. Building Permits preliminary (April)

8:30 a.m. Continuing Jobless Claims (05/04)

8:30 a.m. Export Price Index (April)

8:30 a.m. Housing Starts (April)

8:30 a.m. Import Price Index (April)

8:30 a.m. Initial Claims (05/11)

8:30 a.m. Philadelphia Fed Index (May)

9:15 a.m. Capacity Utilization (April)

9:15 a.m. Industrial Production (April)

9:15 a.m. Manufacturing Production (April)

China Retail Sales

Previous: 3.1%

Time: 10pm ET

Earnings: Take-Two Interactive Software, Applied Materials, Walmart, Deere.

Friday, May 17

10 a.m. Leading Indictors (April)

Euro Area Inflation Rate (final)

Previous: 2.4%

Time: 5am ET

The economic data this week is rather light apart from the US CPI on Wednesday.

The Real Estate Sector is Oversold

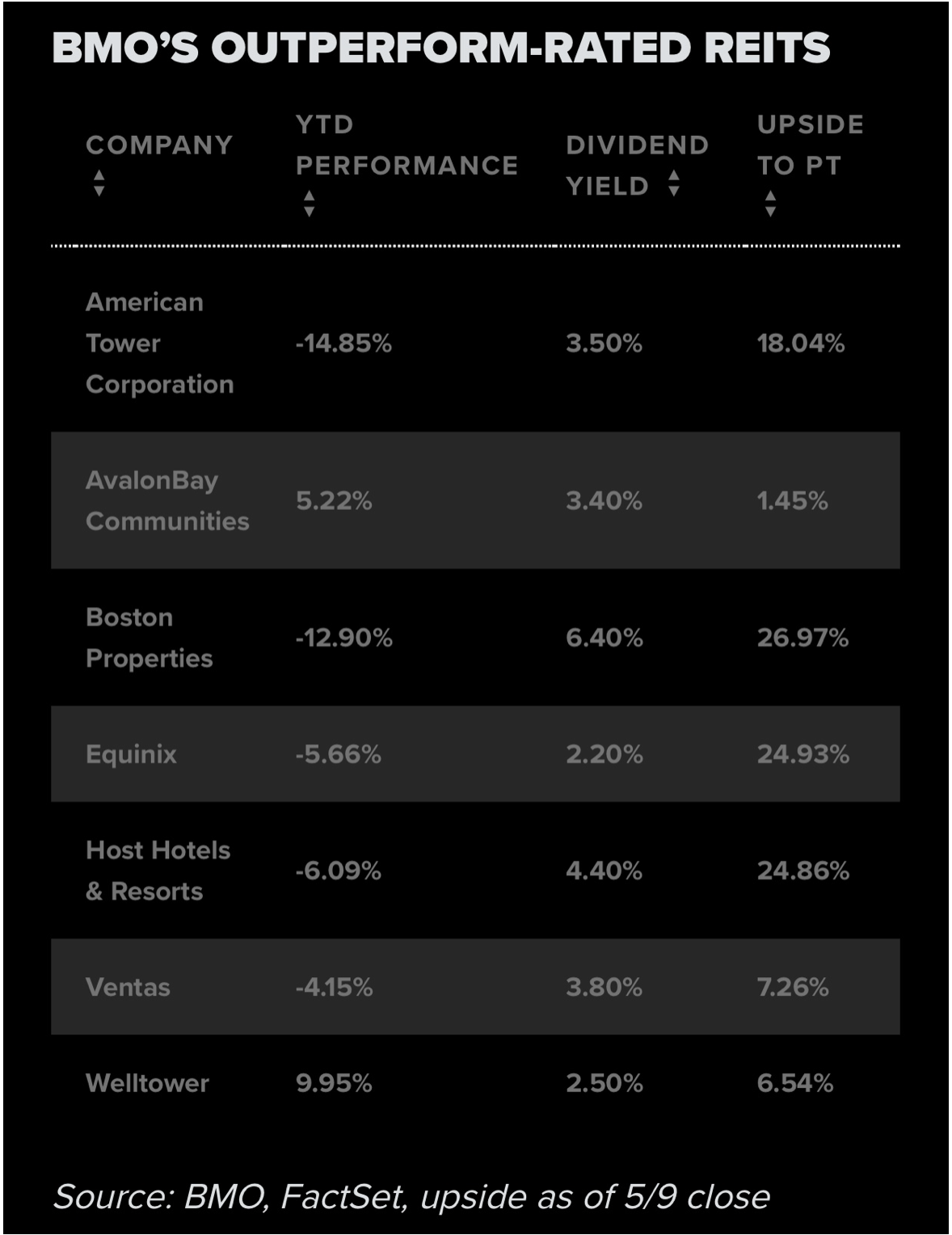

Brian Belski, Chief Investment Strategist, and leader of the Investment Strategy Group at BMO sees opportunity for investors in the real estate sector which is currently oversold.

Belski notes that the REITS sector is the only S&P500 sector that is in the red this year, off 6%.

He believes the sector will turnaround in the coming months and is recommending that investors use the current weakness as a dip buying opportunity.

There are only four other periods, Belski argues, that this sector has showed abnormal underperformance. In the year following such troughs, real estate investment trusts outperformed the S&P500 by about 17%, on average.

Listed here are BMO’s REITS rated to outperform.

These REITS also pay dividends. For example, Boston Properties pays a dividend yield of 6.4%. The company develops, owns, and manages workspaces across the country, including New York and San Francisco. Belski believes there is a slow return to the office taking place.

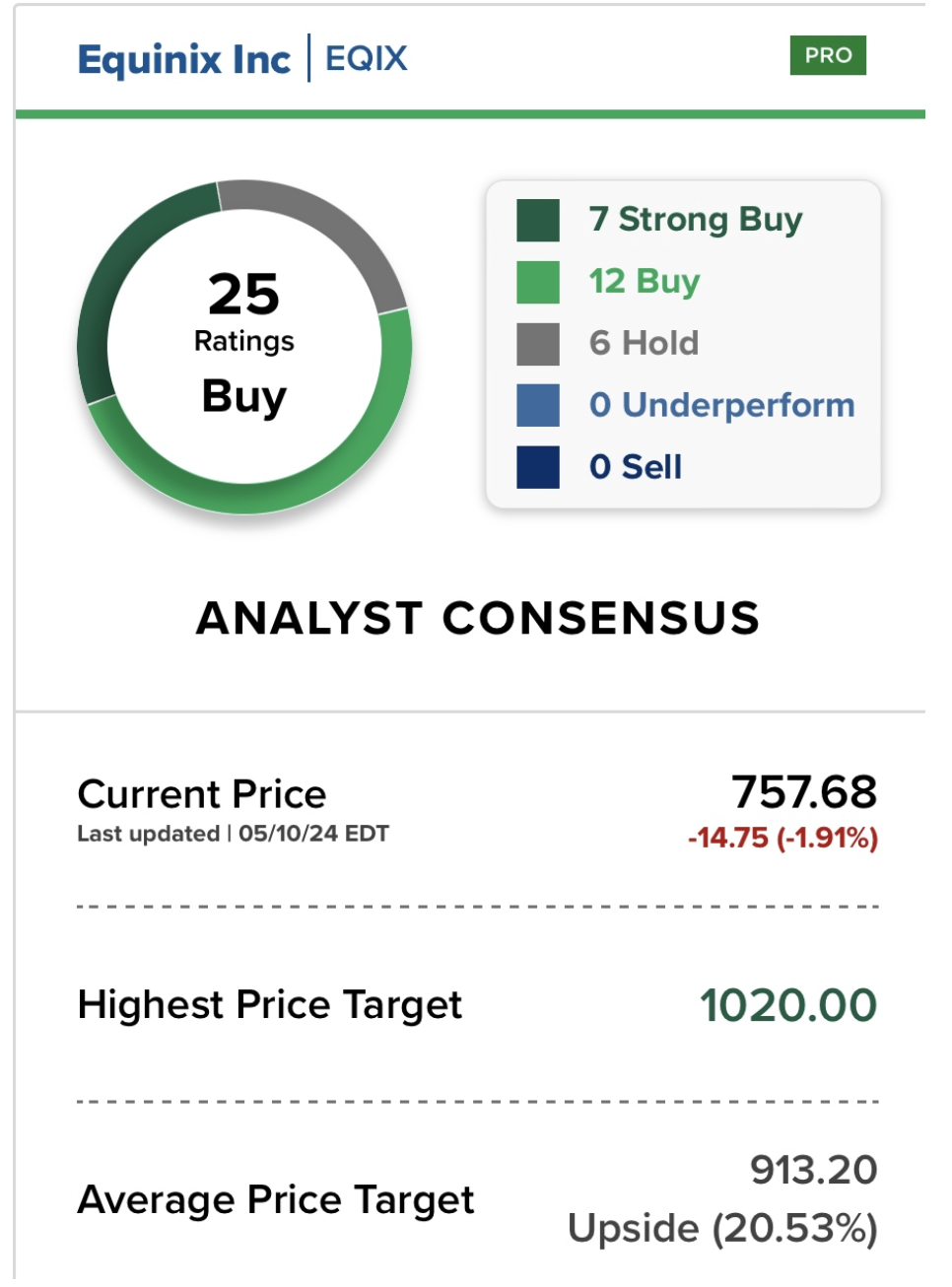

Data Centre REIT, Equinix, will benefit immensely from the rapidly developing landscape of AI. In a statement, CEO Charles Meyers said that “digital initiatives will drive long term revenue growth and operational efficiency.” If BMO’s price target is any guide, Equinix has 25% upside ahead.

Ventas is also down about 4% year to date. The company’s investments include senior housing communities, which stand to benefit from the aging population. The stock which yields 3.8% has roughly 7% upside to BMO’s price target.

Host Hotels & Resorts, which owns luxury and upper-upscale hotels is down nearly 6% this year. Like Equinix, BMO’s price target sees it rallying 25%. This company has a 4.4% dividend yield. Earlier this month, the company posted a revenue beat, and upped its full-year funds-from-operations and revenue guidance.

Market Update:

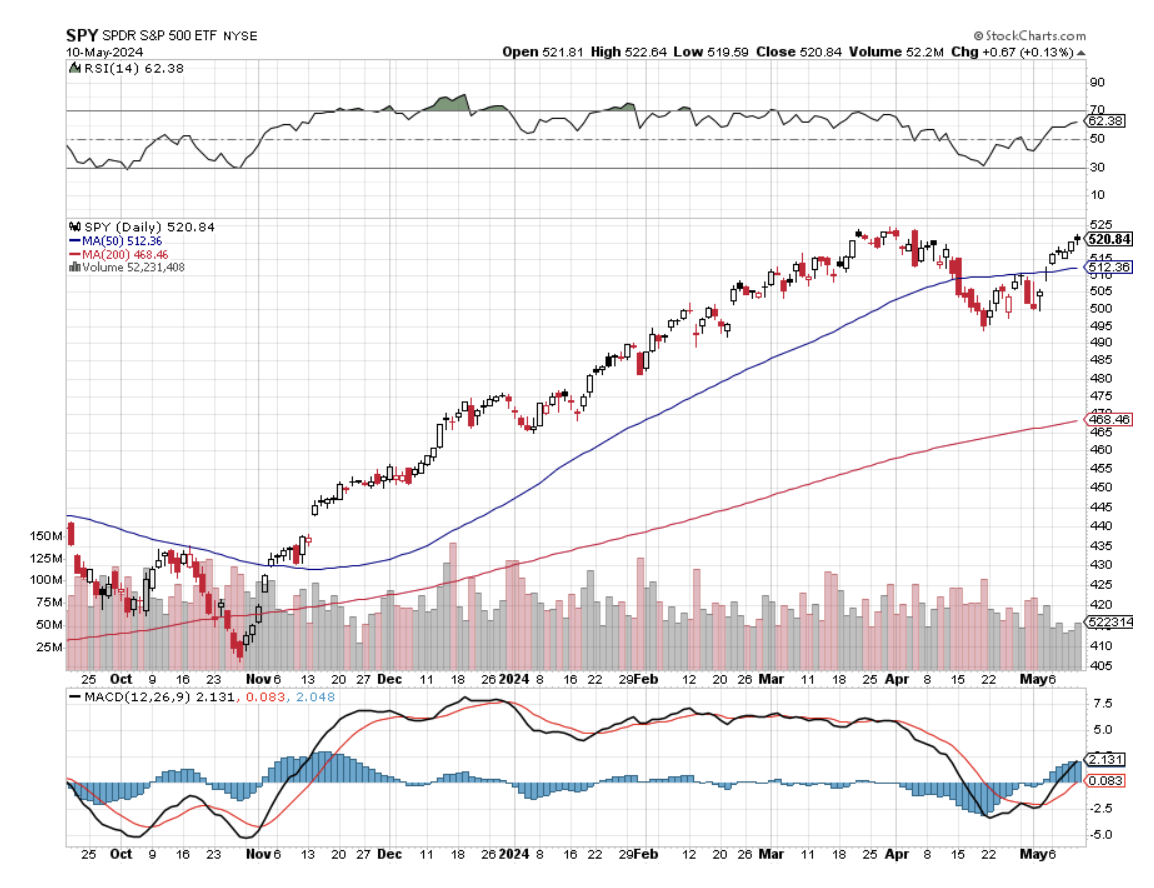

S&P500 – Bull market in progress. The market is still interpreted to be undergoing a final 5th wave advance onto new highs for the year (around 5,700).

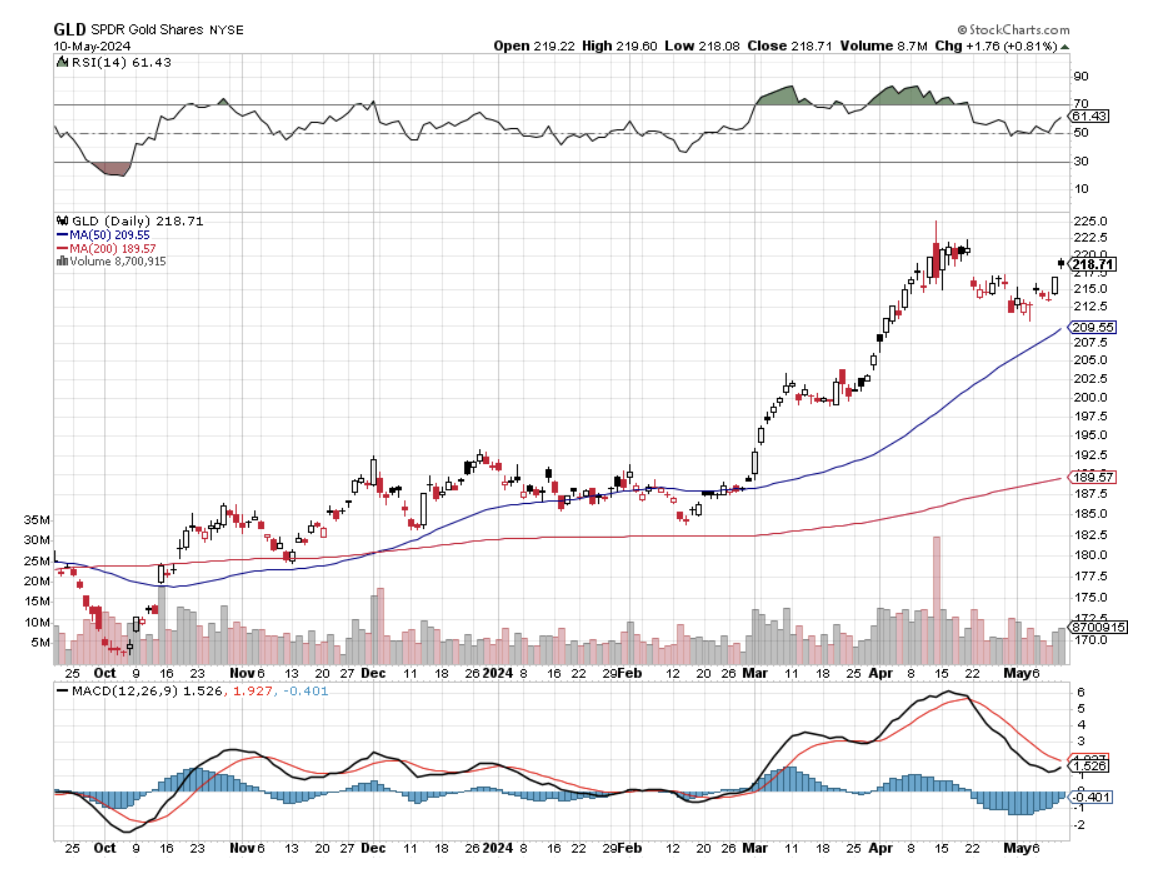

GOLD – New highs are ahead. Looking for a rally to around an initial target of 2400 and then onto 2500-2550.

BITCOIN – Waiting for the next advance. Support lies around $60k/$59k. Looking for an upside target around $80k in the next several weeks to months.

QI Corner

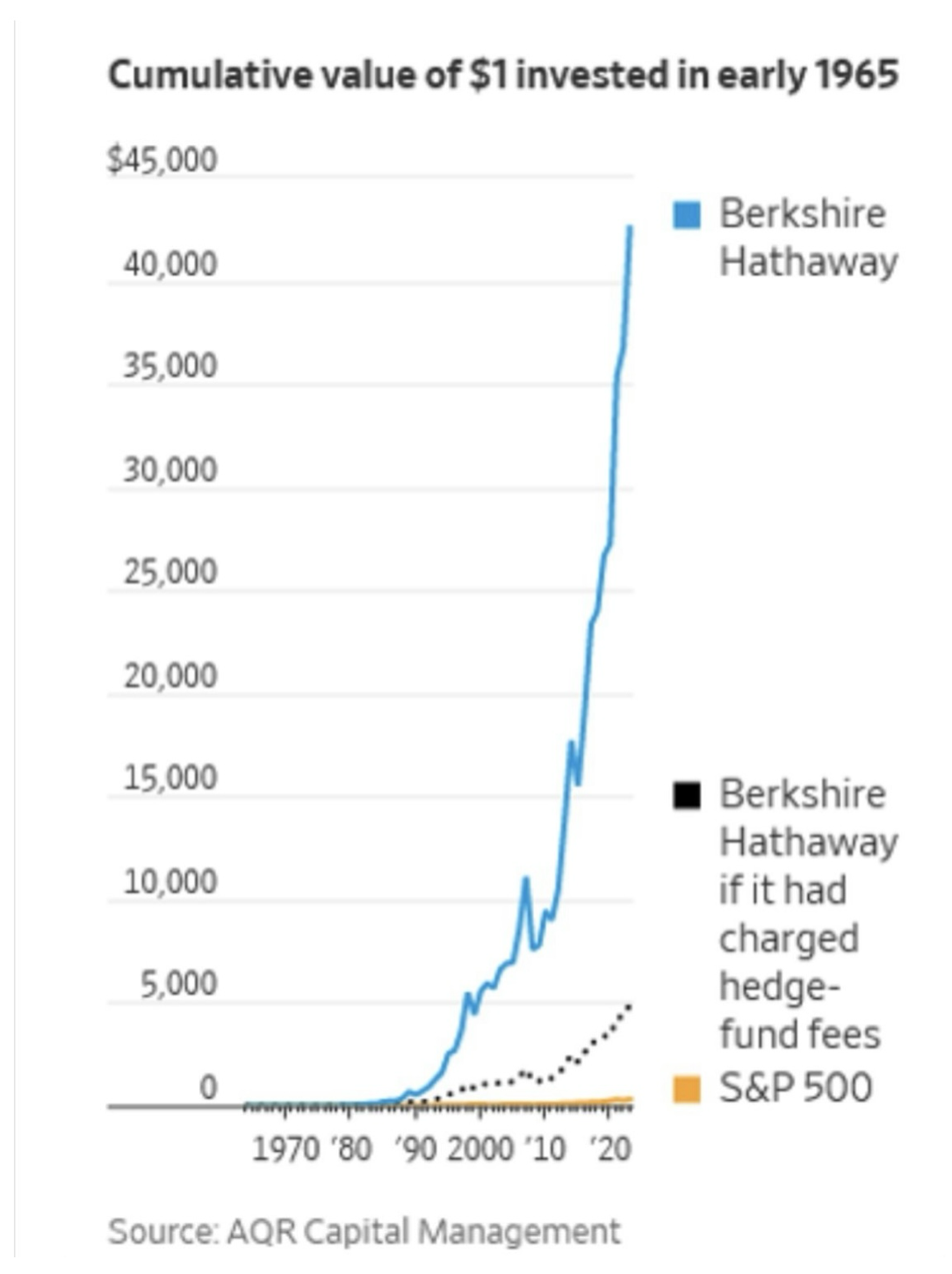

Fees make all the difference.

Northern Lights

Cheers

Jacquie

Global Market Comments

May 13, 2024

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or THE GREAT AMERICAN GOLDEN AGE HAS ONLY JUST BEGUN and SWIMMING WITH THE SHARKS)

(AAPL), (NVDA), (META), (GLD), (GOLD), (SLV), (WPM), (MSFT), (NVDA), (TLT), (FCX), (FXI), (BRK/B)

The Bull Market has Five More Years to Run, with S&P 500 growing earnings at 10% a year for the foreseeable future. Last year brought in $222 per share, 2024 will see $250, 2025 $270, and $300 for 2026. The Great American Golden Age has only just begun.

Profit margins will expand to all-time record highs. Falling interest rates and a weak dollar will boost exports to a recovering Europe and Japan. Inflation should hit the Fed’s 2% in 2025 as AI chatbots replace workers at a breakneck rate, cutting costs dramatically as they already have at some firms. The future is happening fast. Buy everything on dips, even bonds.

The stock market couldn’t even manage a 10% correction in April. We got a measly 6.10% instead. It’s all about the economy, stupid. Leftover massive Covid spending and the $280 billion CHIPS Act have created a tidal wave of cash surging through the system with much of it ending up in stocks.

The top eight tech companies (the Magnificent Seven plus Netflix (NFLX)) accounting for 30% of the entire market cap are only getting stronger. The (SPY) has a current price-earnings multiple of 20X with the Big 8 and 17X without them going forward. It’s not cheap but better than a poke in the eye with a sharp stick.

Boring old high-yielding utilities will become a big play as the electric power grid has to triple in size to accommodate the voracious appetites of EV’s and AI. And as we have already seen in California and much of the country, utilities have no reservations about raising prices.

We are back to normal with interest rates, returning to pre-financial crisis levels. Certainly, a stock market at all-time highs is happy with rates. The real concern here is that the Fed DOES cut rates too fast to bail out the loan-dependent half of the economy and the US Treasury as well. That could trigger a melt-up in stocks that would make the last six months pale in comparison and make my own $6,000 target for the (SPX) look ridiculously conservative.

There is also a major generational change in demographics underway. Previous retiring generations, having experienced the Great Depression, hoarded savings and were a drag on the economy. The Baby Boomers are spending like there is no tomorrow because after going through COVID-19, there might not BE a tomorrow. The Boomers have thus turned into the greatest job creators of all time through their spending.

I’ve seen them everywhere in recent weeks in Florida, Cuba, Ecuador, the Galapagos Islands, Panama, and of course, San Francisco where a Big Mac Happy Meal costs $11. What they don’t spend is being passed on to Gen Xers and Millennials, creating a $75 trillion wealth transfer, the largest in history. A lot of this is going into stocks as well. Wonder where all that “meme stock” money is coming from?

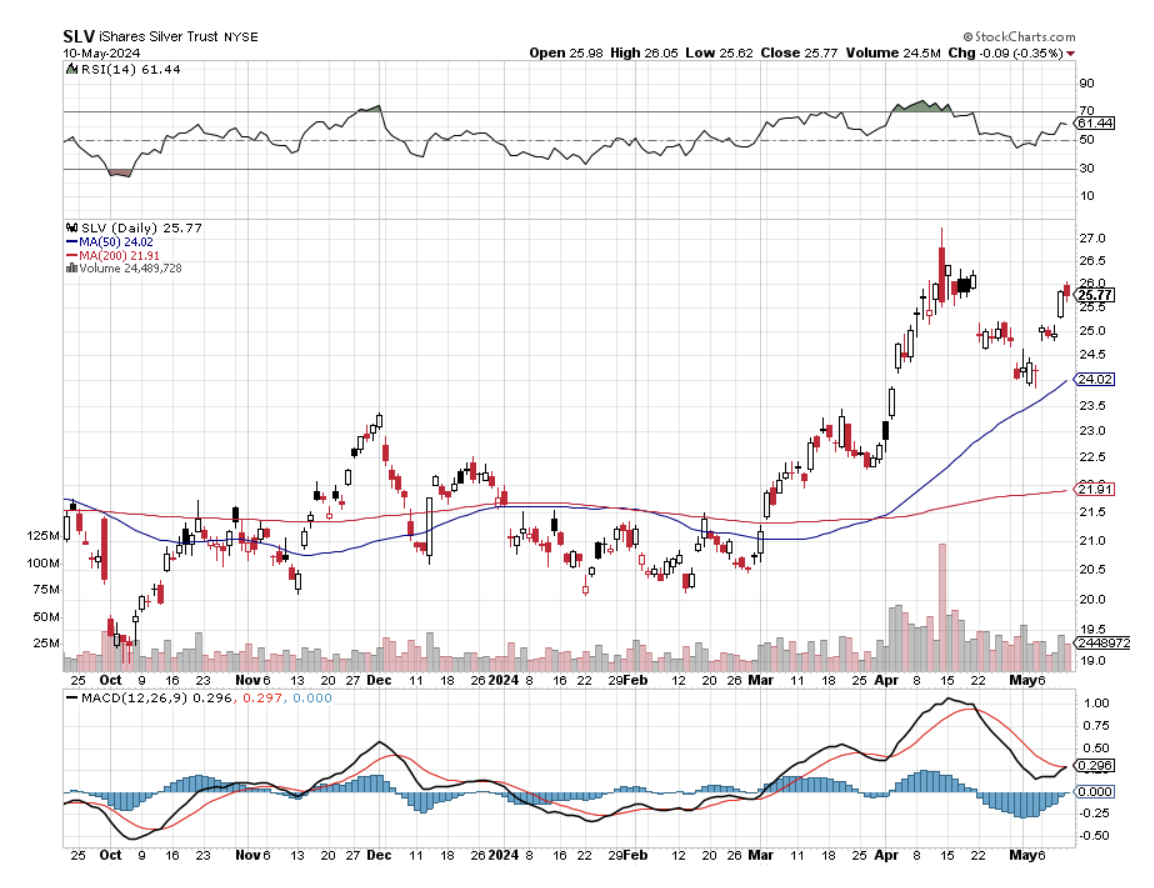

And from the “Department of I Told You So”, notice that precious metals were on an absolute tear last week, with gold (GLD) up 4.78% and silver posting a gob-smacking 7.40%. The new demand that I was aware of but had no hard data on finally became public. Solar Panels are Driving Global Silver Demand in an unprecedented fashion. Global investment in solar PV manufacturing more than doubled last year to around $80 billion.

Miners are expanding their operations and ramping up production as prices for the precious metal climb to decade highs, sending gross revenues to the moon. Demand for silver from the makers of solar PV panels, particularly those in China, is forecast to increase by almost 170% by 2030, to roughly 273 million ounces—or about one-fifth of total silver demand.

That’s a lot of silver. Buy (SLV) and (WPM) on dips.

So far in May, we are up +4.14%. My 2024 year-to-date performance is at +18.75%, a new all-time high. The S&P 500 (SPY) is up +10.48% so far in 2024. My trailing one-year return reached +35.79% versus +30.58% for the S&P 500.

That brings my 16-year total return to +695.38%. My average annualized return has recovered to +51.83%.

I stopped out of short positions for small losses in (AAPL) and (NVDA) last week. I took profits on my long in (META). I am running my longs in (GLD) and (SLV) and my shorts in (MSFT) and (NVDA) into the Friday, May 17 options expiration. The only new position I added last week was a short in the (TLT).

Some 63 of my 70 round trips were profitable in 2023. Some 27 of 37 trades have been profitable so far in 2024.

Weekly Jobless Claims Hit a Nine Month High at 233,000, the bitter fruit of persistently high interest rates. New York City public school workers such as bus drivers are allowed to apply for benefits during winter and spring breaks, which tend to boost weekly claims numbers. Claims also picked up in California, Indiana, and Illinois.

Underwater Home Mortgages are Soaring, with the South taking the biggest hit. Roughly one in 37 homes are now considered seriously underwater in the US and that share is much higher across a swath of southern states. Nationally, 2.7% of homes carried loan balances at least 25% more than their market value in the first few months of the year. That’s up from 2.6% in the previous quarter. It’s another cost of high rates.

Online Retail Spending Up 7%, during the January-April period YOY. Cheaper items are seeing the fastest growth. Consumer discretionary spending has been in focus over the past several months, as sticky inflation has forced shoppers in various categories to trade down to more affordable products. It’s another sign of a modest slow, 1.6% growing economy.

Morgan Stanley (MS) Pushes Back Rate Cut Expectations to September. I couldn’t agree more. You see this in the $4 rally in bonds since last week. Sell short (TLT) for the very short term.

TikTok Sues the US Government, claiming its first amendment rights have been violated in a ban imposed on Congress. They will probably win. The national security threat posed by millions of dancing teenagers has never been showed. It’s just another talking point for technology-ignorant politicians egged on by Facebook (META) and other competitors. No one ever said the people in Silicon Valley were nice.

Social Security Trust Fund to Go Broke by 2035, according to US Treasury estimates. I knew they wouldn’t pay me after 55 years of contributions. Medicare is in less bad shape, not running out until 2036, a five-year extension. Retirees, the baby boomers, and exceeding new contributors, the Gen Xers. Expect your taxes to go up to fill the gap.

Berkshire Hathaway Delivers Blockbuster Earnings in Q1, thanks to a $9 billion pop in (AAPL) stock last year. Buffet just cut his massive position by 13% and will cut more. Total 2023 profits came in at a mind-numbing $93 billion. The company — whose divisions include insurance, the BNSF railroad, an expansive power utility, Brooks running shoes, Dairy Queen and See’s delivered a sharp swing from its $22 billion loss in 2022 because of the bear market. Its vast insurance operations that include Geico car insurance and reinsurance reported $5.3 billion in after-tax earnings for 2023, thanks to steep premium increases which we have all felt. Sell (AAPL), buy (BRK/B).

Bond Investors are Making a Killing, with the US Treasury paying out $900 billion in interest in 2023. That’s double the annual cost of the past decade. Remember those coupons? That’s another reason for the Fed to cut rates soon, to lessen this backbreaking burden on the government. After being held hostage by zero-rate policies for almost two decades, US Treasuries are finally reverting to their traditional role in the economy. Bonds are becoming respectable again after a long winter. Buy (TLT) on dips.

China Home Sales Plunge by 47%, as the real estate crisis deepened, indicating that a recovery may be far off. But when it does bounce back, expect all commodities to hit record highs. Buy (FCX) on dips.

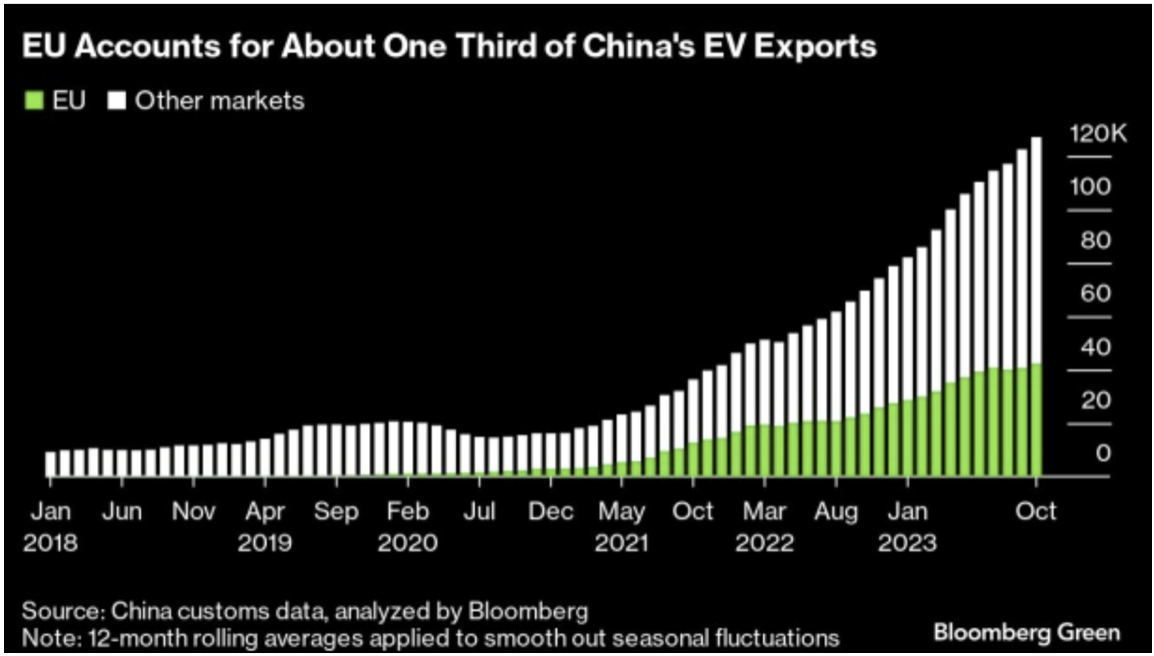

Biden Piles on the Foreign Tariffs, announcing new China tariffs aimed at the EV Industry that is currently decimating Europe. Europe is in danger of giving away its edge in cars to the Chinese and a proactive response would ensure American car manufacturers can stand up to the low-priced onslaught.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age or the next Roaring Twenties. The economy decarbonizing and technology hyper accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, May 13, at 10:30 AM EST, the Consumer Inflation Expectations are announced.

On Tuesday, May 14 at 8:30 AM EST, Producer Price Index for April is released.

On Wednesday, May 15 at 8:30 AM EST, the Consumer Price Index is published

On Thursday, May 16 at 8:30 AM EST, the Weekly Jobless Claims are announced.

On Friday, May 17 at 8:30 AM the Monthly Options Expiration takes place at the close.

At 2:00 PM the Baker Hughes Rig Count is printed.

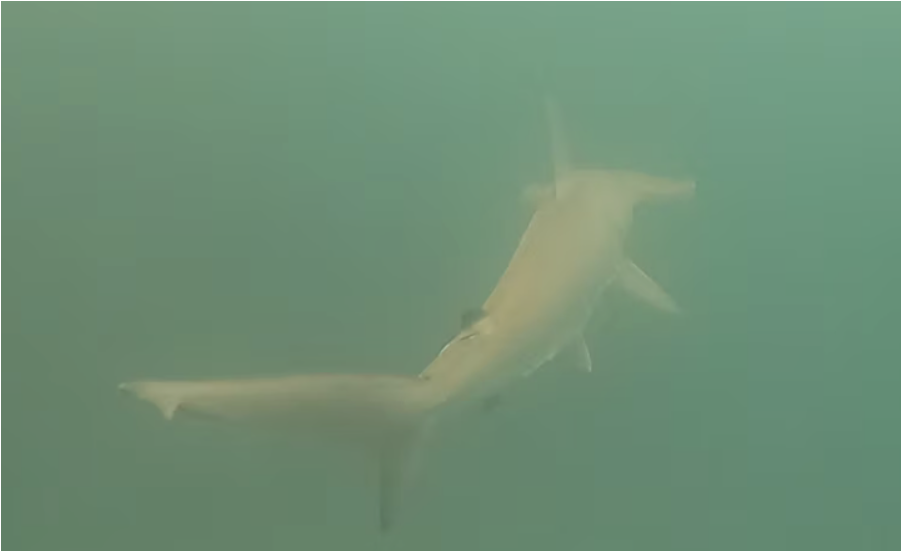

As for me, I will never forget the words from my underwater guide: “Stay where you are and the current will bring the sharks to you.”

Is that something we want, I queried in my fractured Spanish. “Don’t worry”, he answered, “The sharks are vegetarians.” Yes, but did anyone tell the sharks that they were vegetarians?

Sure enough, two six-foot-long hammerhead sharks hungrily swam by me within feet in the green murk, not even pausing to give me the time of day. They swam so close that one almost slapped me in the Face with his tailfin. I guess I wasn’t on the menu that day, not even as a special.

Fortunately, I brought a GoPro underwater video with me and filmed the whole thing. Otherwise, you wouldn’t believe me for a second (click here for the link.)

Such was the high point of my week in the Galapagos Islands last week, a remote archipelago of 13 volcanic islands some 600 miles west of Ecuador, 2 degrees South Latitude in the Pacific Ocean. Sitting in my beachfront house in San Cristobal, I worked all morning, knocking out some eight trade alerts on the week, and explored every afternoon.

It was bliss.

You scientists out there will already know the Galapagos Islands as the place where Charles Darwin landed in 1835 on the HMS Beagle and collected the data that led to the Theory of Evolution and the concept of the Survival of the Fittest. (It was all about black Finches, now known as Darwin’s finches, of which I saw hundreds).

Darwin was at first widely ridiculed, as are the creators of all new revolutionary advances. Critics highlighted his close relationship with monkeys. Now it’s required reading for all high school students. While I was there a reproduction of the Beagle sailed in from Holland to celebrate the 200th anniversary of Darwin’s discoveries….11 years early.

The Galapagos Islands are not an easy place to get to. It was a four-hour flight from Miami to Quito in Ecuador, the worlds third highest airport at 9,500 feet. A lot of transients get altitude sickness. Then an hour's flight to Guayaquil on the coast where the Ecuadorian drug trade is run and another hour to San Cristobal. When I tried to visit here in the 1970’s there was only one ship a week and no planes.

Galapagos connected to the outside world just last year when Space X’s Starlink service initiated a 200mb/sec service. With that, I can trade stocks as if I were in downtown Manhattan. This is true for virtually every remote location in the world now, the consequences of which we have yet to imagine. I set up a Starlink in Ukraine last October while under fire and the Russians never were able to jam it.

The Ecuadorian government has gone through great lengths to keep the Galapagos Islands a pristine eco-tourism destination and they have largely succeeded. I counted only one Cessna G5 jet at the airport. Incoming luggage is X-Rayed for foreign fruit and sniffed for drugs by German Shepherds. Residents are limited to a tiny southwestern sliver of San Cristobal island and the rest is a national park.

A friend charitably turned down a $20 million offer from the Four Seasons international hotel chain for his 120 acres of land there. There are not a lot of places in the world left where you can walk out of your front door to a deserted beach unscarred by footprints. Yet, it offers Ecuadorian prices, about one-third of those found in the US.

I think you should visit there.

HMS Beagle, kind of

55 Years of Trading and Finally my Own Beach!

Let the Current Bring the Sharks to You

Chillin with the Crew

My New Office

The View from Home

My New Neighbors

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

(MSFT)

Let's gather around the tech bonfire and chat about Microsoft's (MSFT) latest blockbuster move—a whopping $3.3 billion data center right in the heart of southeastern Wisconsin. Yep, you heard that right, billions with a “B.”

So, why Wisconsin, and why now? Well, it turns out Microsoft's got a pretty hefty checklist: lots of land, enough juice to power a small country, and a workforce that's ready to roll up its sleeves.

Plus, Wisconsin had the sweet sense to pass a bill last year that cuts the sales tax on all that pricey data center equipment. Smart, right?

Now, before you think this is just another tech giant planting a flag and calling it a day, let me paint you the bigger picture.

This isn't just about storing bytes and bits. Microsoft is laying down some serious roots here, aiming to turn the local scene into a buzzing hive of tech activity. They're not just building a data center; they're looking to inject some Silicon Valley-style innovation into the local economy.

Microsoft is eyeing 2,300 construction jobs getting cooked up by 2025, followed by 2,000 high-tech positions that'll keep the lights on long-term. That's a lot of jobs, and even more lunches at the local diners, if you catch my drift.

According to the U.S. Chamber of Commerce, data centers can generate up to $33.8 million in economic activity for every 100 jobs created.

Now, multiply that by the 4,300 jobs Microsoft is bringing to the table, and you've got a recipe for some serious economic growth.

On top of these, Microsoft is also kicking off a tech training fiesta with Gateway Technical College. They're setting up something called a Data Center Academy, aiming to certify roughly 1,000 students within five years. This is a big deal for the local workforce, as it provides a clear path to high-paying jobs in a rapidly growing industry.

Now, let's talk brass tacks and silicon chips for a second.

The tech world's hunger for data centers is practically insatiable, thanks to our good friend AI. You know, artificial intelligence? The stuff that powers everything from your smartphone's snarky assistant to those creepy-realistic chatbots.

As AI gets smarter, it needs more power. Like, a LOT more.

In fact, according to the International Data Corporation (IDC), global spending on AI is expected to double from $50.1 billion in 2020 to more than $110 billion by 2024. That's a lot of dough, and a big chunk of it will be going towards building and maintaining data centers.

And here's an interesting fact: Data centers in the U.S. gobbled up over 4% of the nation's electricity in 2022.

By 2026, we're looking at a jump to 6%. That's a lot of zeros on the electric bill. But it's not just about the power consumption.

Data centers also require a ton of land and infrastructure, which is why companies like Microsoft are always on the lookout for prime locations like southeastern Wisconsin.

Now, let's not forget the cherry on top. This new site is where dreams (and maybe some iPhones) were supposed to take shape under Foxconn's grand plans during the Trump administration. But that didn't quite pan out.

Microsoft, seizing the opportunity, scooped up the land in 2023 for a cool $50 million. It's tangible proof of Microsoft's savvy business sense and their ability to spot a good deal when they see one.

And because no tech story is complete without a dash of future gazing, Microsoft isn't stopping at Wisconsin.

They've got their eyes set on global domination—well, in the AI and infrastructure space, at least—with plans to sink billions more in Germany, Japan, Malaysia, and the U.A.E.

This global expansion is a clear sign that Microsoft is betting big on AI and the future of data centers. So, what's the takeaway here?

Well, Microsoft's big bet on Wisconsin is more than just a tech move; it's a strategic play that could set the stage for the next wave of AI innovations. And for the locals? It's potentially a game-changer for the job market and regional economy.

With the global AI market expected to grow at a compound annual growth rate of 42.2% from 2020 to 2027, investing in companies like Microsoft that are front and center could be a smart move for your portfolio.

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Technology Letter

May 10, 2024

Fiat Lux

Featured Trade:

(CHINESE TARIFFS AT THE FOREFRONT)

(EV)

Tariffs on Chinese EVs skyrocketing by 400% are just another example of the federal government getting in the way once again as the current administration limps to the November starting line.

These levies are directed at everything central to producing EVs like the battery and the car itself.

I understand that the point is to protect EV companies at home, but tariffs don’t work and in almost every case, the end price to consumers rises painfully.

It’s not any better over the Atlantic so this frees us China to innovate and get ahead with government support.

The Chinese are playing the long game.

This review of Chinese tariffs was triggered by the administration before it, and it just smacks of inefficiency to me. It only took 4 years to finish the review as infighting took hold and the glacial pace finally ended with a decision.

In fact, Biden's $7.5 billion investment in EV charging has only produced 7 stations in two years, per Washington Post.

Where did the rest of the money go?

My guess is carrying out a raft of economic surveys isn’t cheap when there are no guard rails in price setting.

Maybe the thousands of consultants giving their 2 cents to keep that bureaucratic machine humming in Washington made a dent with another few billion invoices.

I’ll at least give it to the White House that they were able to produce 7 and not 1 or 2.

A billion dollars per EV charger is not good enough in 2024 while the Chinese forge ahead with their technological prowess.

The Chinese tariff rate on electric vehicles is expected to quadruple from roughly 25% to 100% plus an additional 2.5% duty would apply to all automobiles imported into the US.

The EU launched an EV subsidy investigation in October that may lead to additional tariffs by July as well.

The tariffs would likely have little immediate impact on Chinese firms since its world-beating EV manufacturers have steered clear of the US market due to tariffs.

Its solar companies mostly export to the US from third countries to avoid curbs, with US firms seeking higher tariffs on that trade, too.

The move comes after Biden last month proposed new 25% tariffs on Chinese steel and aluminum.

Protecting the American EV sub-sector feels like a situation in which China is outcompeting American EV companies and the government is directly reacting to that in an emotional way.

My guess is that it won’t work.

China will be able to circumnavigate these tariffs easily. It’s impossible to put the genie back in the bottle once it is out.

The only way American EVs will find a solution is to innovate itself away from the competition and that will be tough with the level of interruption by the Federal government.

Sooner or later, these better-made Chinese cars will find themselves in Europe and America on a grand scale.

If the government would get out of the way, tech companies would be forced to innovate or die.

A main strategy of stopping the Chinese from selling to you is a wack-a-mole strategy and the products will eventually arrive,

I am strongly bearish the American EV sub-sector at this point.

This is another tech sub-sector that has turned stale, similar to the streaming sub-sector where I just took profits in a bearish Roku trade.

Why doesn’t the admin go after the Chinese unrealized profits while they’re conjuring up some more tariffs? I wouldn’t put it past them.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.