(GOOG), (GOOGL), (TEM), (IBM), (IRTC)

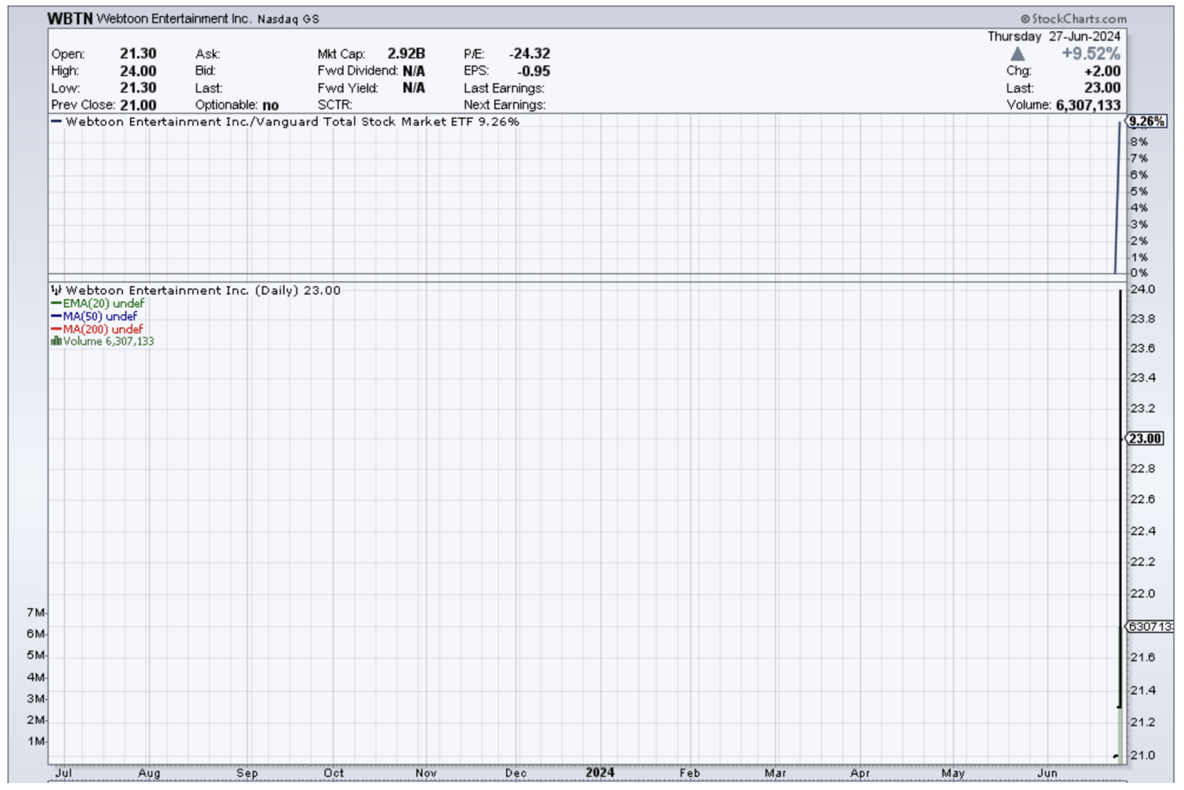

Ever heard the saying, "Follow the money"? Well, Google's parent company, Alphabet (GOOG) (GOOGL), is throwing some serious cash at a hot new AI player, Tempus AI (TEM). This isn't just any tech startup; they've recently IPO'd, and their stock is already soaring.

What's got Google so hot and bothered? Let's dive in.

Tempus AI, brainchild of serial entrepreneur Eric Lefkofsky (yes, the Groupon guy), is revolutionizing healthcare with their "intelligence diagnostics."

Notably, Lefkofsky isn't exactly a rookie when it comes to building successful businesses. He's got a proven track record, having also co-founded Lightbank (a venture capital firm), InnerWorkings, Mediaocean, Echo Global Logistics, and Pathos AI.

Alright, let's circle back to Tempus AI.

You know, this isn't some run-of-the-mill, stick-you-with-a-needle, and-call-it-a-day kind of blood test. Nope, Tempus AI is shaking things up with something that feels like it's straight out of a sci-fi flick—but it's as real as it gets.

Essentially, it’s like having a healthcare detective who can analyze your entire medical history, genetic profile, and even your lifestyle choices to uncover the secrets hidden within your own body. That's what Tempus AI is all about.

They're not just diagnosing diseases. The company is predicting them before they even happen, giving you the power to take control of your health and make informed decisions about your treatment.

But, as always, there's more to this story.

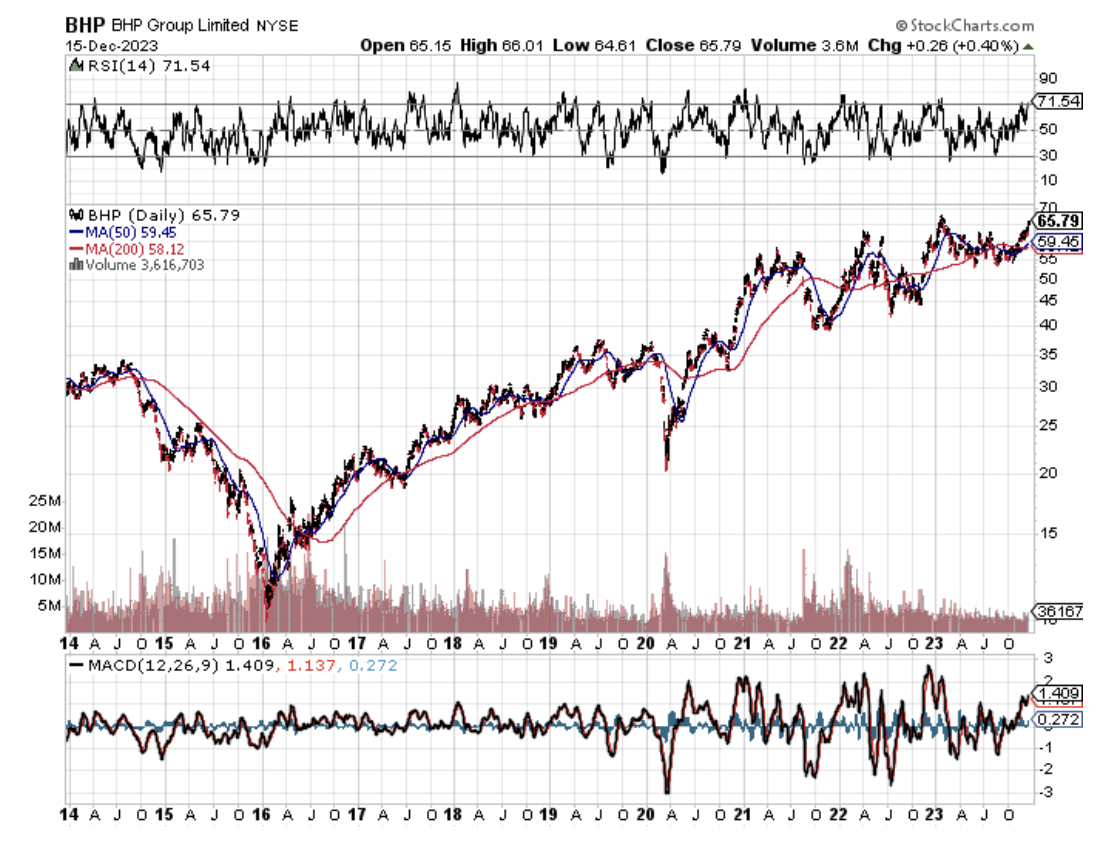

While Tempus AI is undoubtedly making waves, it's not the only player in the AI-driven healthcare arena. Established giants like IBM (IBM) Watson Health and iRhythm Technologies (IRTC) are also vying for dominance in this rapidly expanding market.

IBM Watson Health, backed by IBM's global clout, has been a major force in the field. They've been pouring money into AI research and development, tackling everything from electronic health records to cancer diagnostics.

But even with IBM's deep pockets, their broader health segment has hit a few snags, prompting them to rethink their strategy.

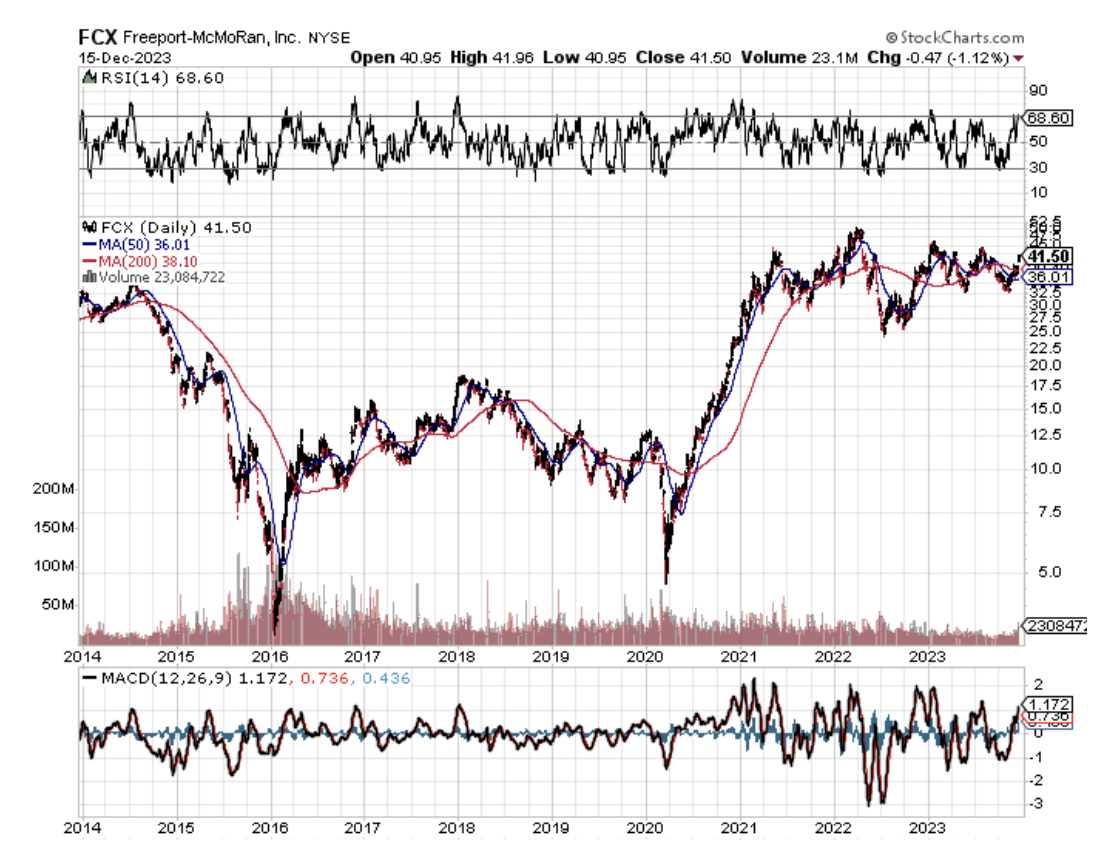

Then there's iRhythm Technologies, a specialist in cardiac monitoring. Their Zio patch technology, which uses AI to detect a wide range of heart arrhythmias, has been a big hit with cardiologists.

They raked in $265 million in revenue in 2023, a healthy jump from the previous year. However, like many growing companies, they're still working towards profitability.

So, where does Tempus AI fit into this picture?

Well, their explosive revenue growth of 183% from 2022 to 2023 certainly puts them in the spotlight. While they're starting from a smaller base than the big guys like IBM, their rapid expansion is a sign of strong market acceptance. But remember, they're not profitable yet, either.

Still, it's not just Google who's drinking the Kool-Aid.

Tempus AI's reach extends far beyond Google's investment. Their products have been used by roughly 95% of the top 20 biggest public biopharmaceutical companies in the world.

They've forged partnerships with more than 200 biopharma companies, and over 7,000 physicians across the country are using their technology.

Even more impressive, over 65% of U.S. academic medical centers have adopted Tempus AI's products. Talk about a vote of confidence.

Now, let's get to the most interesting part: should you invest in Tempus AI?

Well, their personalized approach to diagnostics, backed by Google's deep pockets and the overwhelming support from the medical community, could give them a real edge. But as with any investment, there's always risk involved.

That is, if you're risk-averse, this stock might not be your cup of tea. It's volatile, and they're still working on that whole "turning a profit" thing.

Meanwhile, companies like IBM offer stability but might not deliver the same explosive growth. As for iRhythm, they’re focused on a niche market. In comparison, Tempus AI is aiming for a broader reach.

So, for those with an appetite for risk, the potential rewards are tantalizing. Tempus AI is tapping into a massive market, with estimates topping $70 billion for their oncology and neuropsychiatry products alone.

Well, the use of AI in healthcare is still in its infancy, but Tempus AI is already a major player. They've got the tech, the team, and the financial backing from a tech titan. If you're an aggressive investor looking to ride the AI wave, Tempus AI might just be your golden ticket.

Remember, though, that the use of AI in healthcare is still in its infancy. A lot of things can still change, and another leader might emerge. But hey, if Google's putting their money where their mouth is, Tempus AI is certainly worth a closer look.