For far too long, we've been playing a dangerous game of biotech roulette - throwing our hard-earned dough at stocks solely based on who's peddling the latest drugs and vaccines to the biggest crowds.

We tiptoe around those dreaded "patent cliffs", living in fear of the moment our cash cows turn into generic, discount-bin duds overnight.

As I've loudly proclaimed before, Big Pharma is fundamentally a tightrope act - milking those lucrative exclusives for all they're worth while bracing for the inevitable day those monopolies go kaput.

It's an anxiety-inducing cycle, one that's been running the show for decades.

But enough is enough. It's high time we tossed that musty old playbook straight into the trash. Why? Because the reign of Pharma's legacy model is fading faster than my hairline.

A new revolutionary force is taking over – personalized medicine.

Don't kid yourselves, this tectonic shift is the real deal. We're witnessing a paradigm upheaval in how drugs are developed and treatments are administered.

Advanced, genetically-tailored therapies are muscling their way to the frontlines, employing each patient's unique DNA blueprint to craft bespoke care strategies like never before.

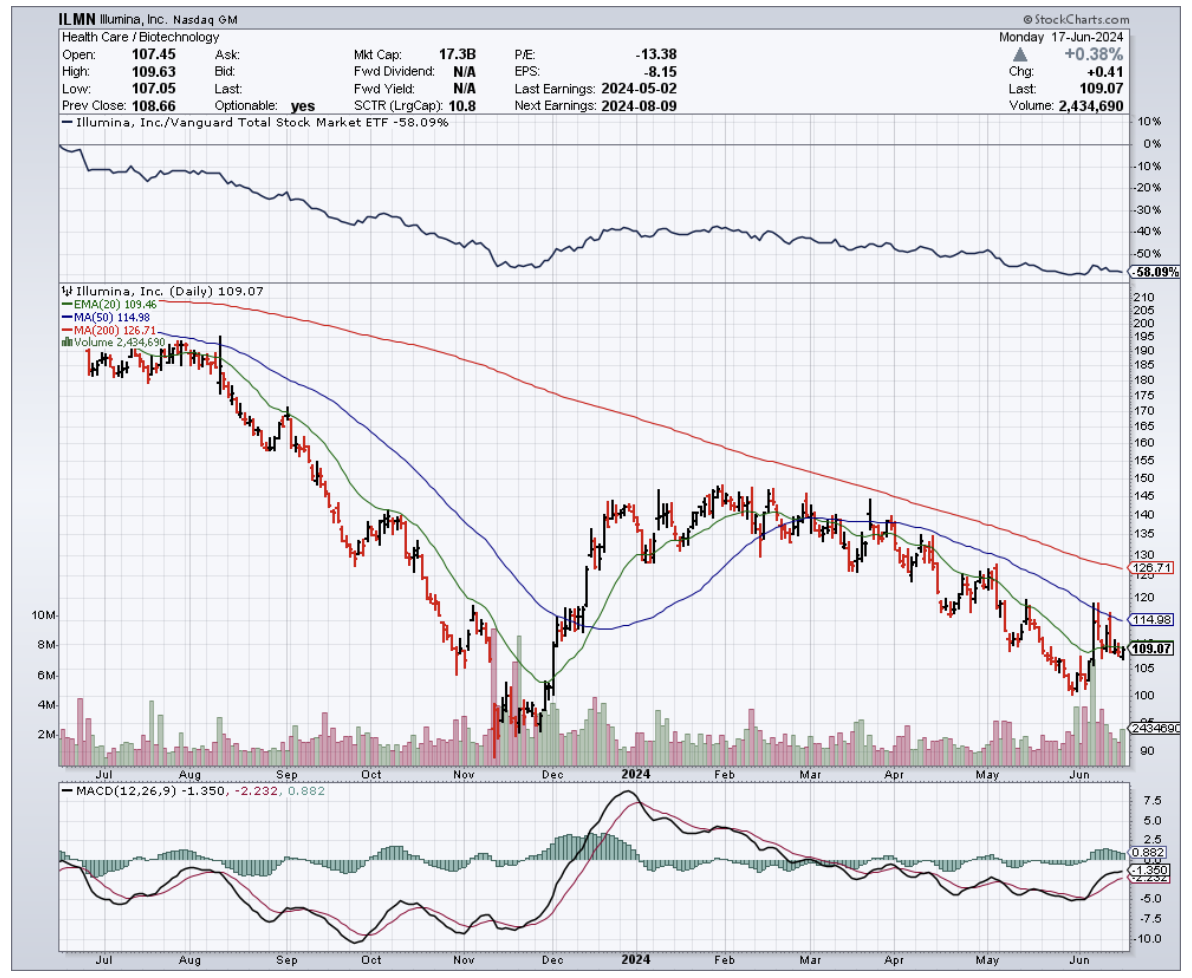

Leading this charge are gene sequencing pioneers like Illumina (ILMN), equipping healthcare with bleeding-edge tech for genetic profiling and research.

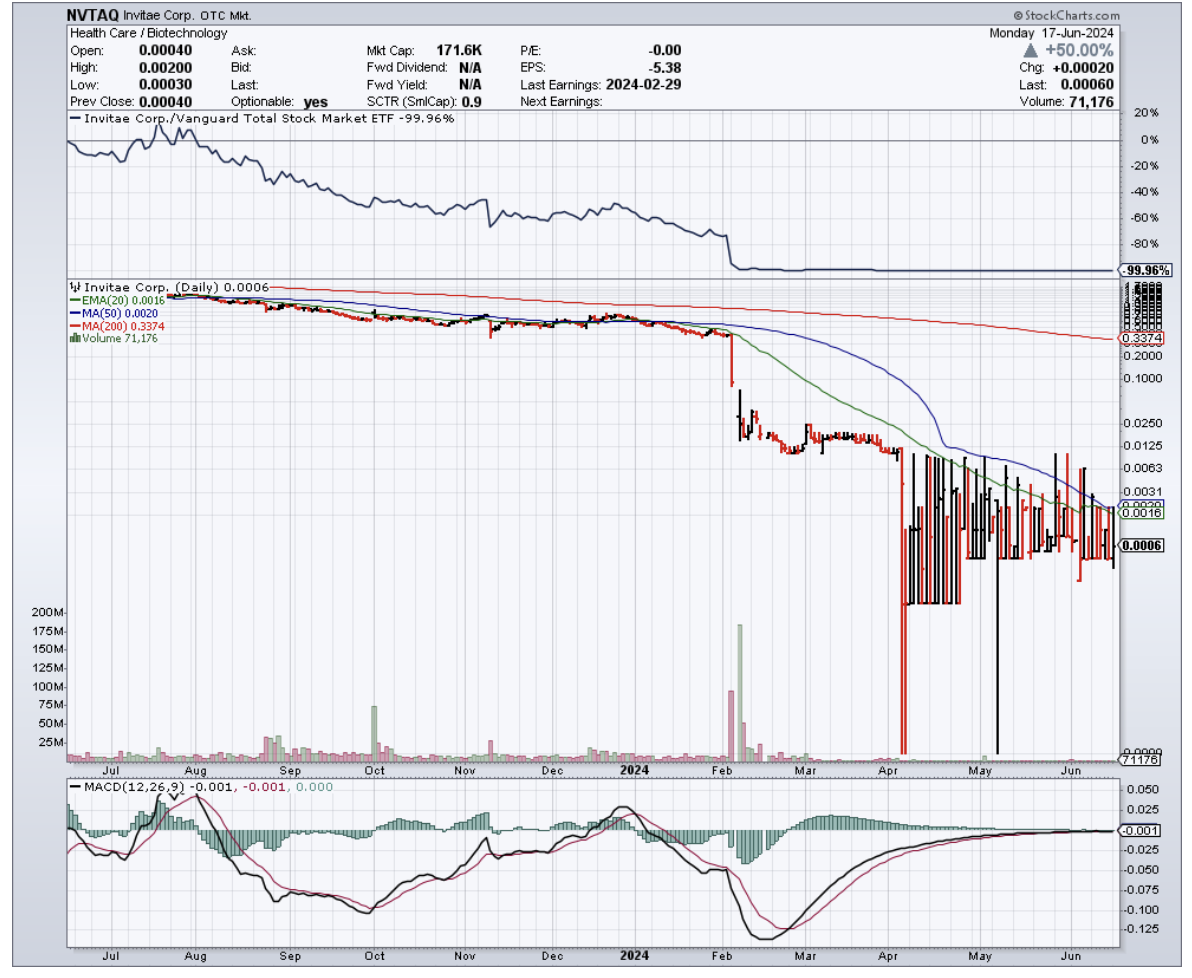

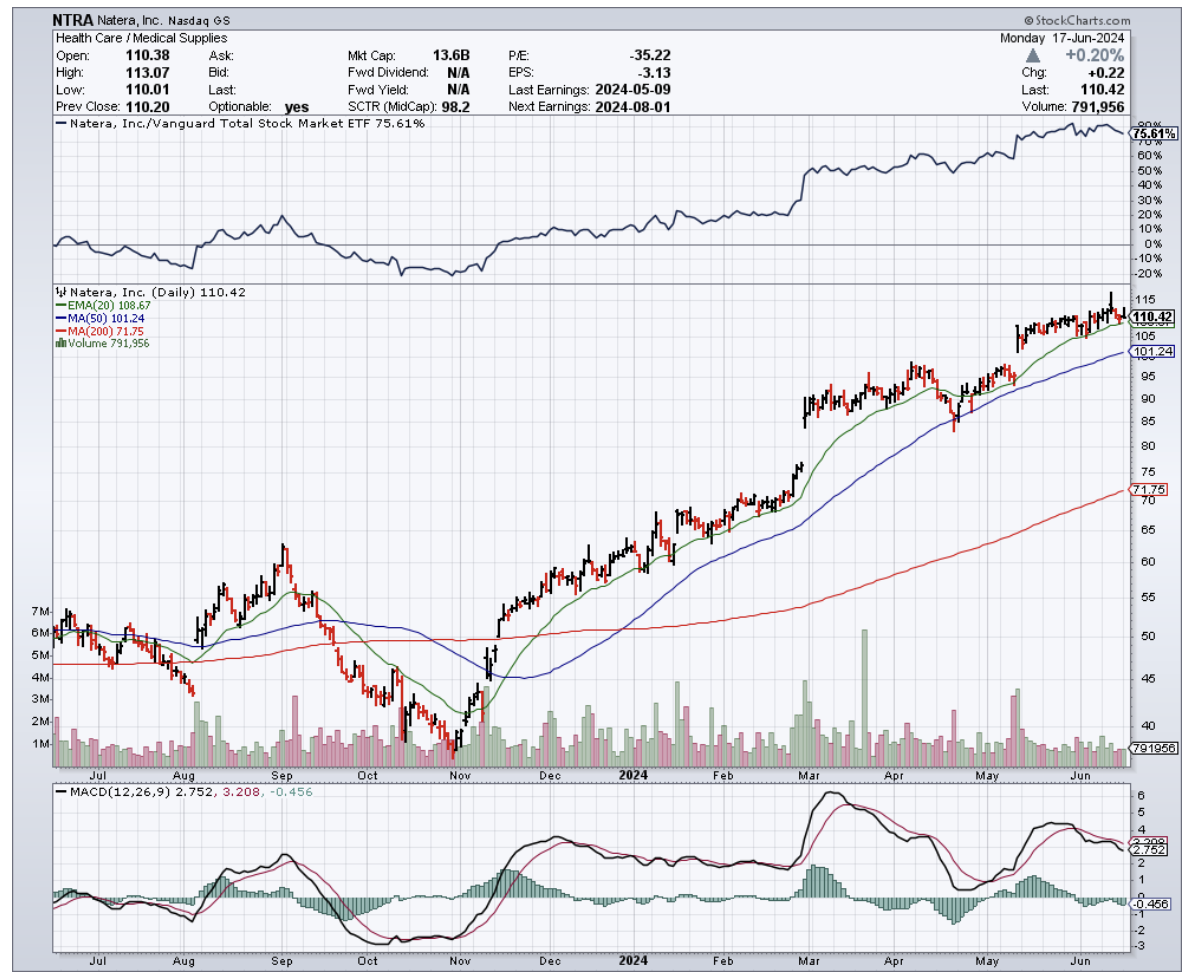

Companies like Invitae (NVTAQ) and Natera (NTRA) are making genetic intel accessible and actionable for diagnosing and treating inherited nightmares like cancer and heart disease. This isn't a drill, people. It’s the new reality.

But the innovation train doesn't stop there. Guardant Health (GH) is upping the ante with its non-invasive blood tests that capture tumor genetic data, allowing physicians to map treatment plans without those pesky, invasive procedures.

And let's hear it for Exact Sciences (EXAS), championing molecular diagnostics to laser-focus cancer regimens based on each person's biological fingerprint.

Speaking of cancer, we'd be remiss not to spotlight the game-changing progress happening on the personalized medicine front.

At the latest American Society of Clinical Oncology shindig, the best oncology minds showcased their latest advancements in tailored treatments.

Get this – over the last four years, over a third of the FDA's new drug approvals were personalized meds. With the White House doubling down, those numbers are only going up.

Obviously, personalized medicine is this century's gold rush. In fact, a global biopharma race is already underway, and everyone’s practically frothing at the mouth.

After all, this half-trillion-dollar market is barreling towards the $1 trillion mark by 2031.

And in this blossoming field, outfits like Thermo Fisher (TMO) and Qiagen (QGEN) are indispensable, provisioning crucial tools and services.

Thermo covers the full genetic research and diagnostics gamut, while Qiagen specializes in sample prep and molecular testing – two linchpins for delivering personalized therapies.

But it's not just the upstart trailblazers making waves. Biotech titans like Novartis (NVS), Roche (RHHBY), and AstraZeneca (AZN) are going knees-deep into advanced, commercially-viable personalized treatments – especially in oncology, where understanding Individual genetic mutations can literally mean life or death.

Let's pour one out for the real pioneers here, too – groundbreakers like CRISPR Therapeutics (CRSP), Editas Medicine (EDIT), and Fate Therapeutics (FATE).

These mavericks are lighting up the gene editing and cell therapy arenas, hand-crafting hyper-personalized treatments that smite genetic diseases at the source.

Now, for those of you eagerly wondering where to splash your investment cash, I suggest you don't fall into the trap of banking solely on the next patented "winner" therapy.

Those old-school patent monopolies that once ruled the roost? Their significance is waning rapidly.

With the flurry of personalization tech out there, it's a Wild West – one company churns out a new treatment, another can swiftly follow suit.

Patent feuds and skyrocketing costs loom on the horizon like storm clouds. The gravy train of eternal patent profits is running out of steam.

But make no mistake, this arms race isn't cooling off anytime soon. The battleground's scope is simply shifting. It's no longer just about formulating the latest miracle drug – it's about delivering unbeatable services and customer experiences.

Because here's the cold hard truth – the biggest roadblock to getting these revolutionary therapies to patients is obtaining all the genetic data and personal insights needed to make it happen.

Healthcare providers are going to need to invest heavily in new data management systems, training, and education just to keep pace with these rapidly evolving personalized meds.

The pharma players that thrive? They're the ones going beyond prioritizing drug development to obsessing over best-in-class customer service and care delivery.

They'll cement customer loyalty, forge lasting partnerships – and in doing so, actualize personalized medicine's boundary-shattering promise. Those are the winners I'm betting big on.

So wake up and smell the coff-gene. The personalized biotech goldrush is kicking into high gear.

And those wise enough to stake an early claim? Well, let's just say they'll be dishing out more than genetics-guided therapy – they'll be minting a new generation of biotech fortunes.