“Volatility will be our traveling companion for a while,” said one strategist.

Mad Hedge Biotech and Healthcare Letter

June 13, 2024

Fiat Lux

Featured Trade:

(THE TORTOISE IN THE BIOTECH RACE THAT’S ABOUT TO CROSS THE FINISH LINE)

(AMGN), (LLY), (NVO), (IMVT), (ARGX)

You know how every golfer dreams of donning the green jacket at the Masters, every chess player longs for the title of Grandmaster, and every football player fantasizes about hoisting the Lombardi Trophy?

Well, healthcare and biotech companies have their own version of the ultimate dream: launching a product that's as successful as the latest weight loss drugs from Eli Lilly (LLY) and Novo Nordisk (NVO).

These two pharma heavyweights have been on an absolute tear, with their shares skyrocketing 611% and 471% respectively over the past five years. It's the kind of rally that'll make your head spin and your wallet sing.

And guess what? The good news just keeps on coming. Analysts have cranked up their forecast for the obesity market. They're now predicting it'll hit a jaw-dropping $130 billion by 2030, up from their previous estimate of $100 billion.

That's an extra $30 billion. I don't know about you, but I call that a pretty sweet cherry on top.

Thanks to this obesity drug frenzy, Lilly has become the world's biggest healthcare company, and Novo Nordisk is now the most valuable company in Europe. It's like watching a couple of underdogs become the kings of the castle overnight.

Now, don't get me wrong, I love a good growth story as much as the next guy, and I wouldn't bet against Lilly or Novo Nordisk. But you know what I like even more? Biotech companies that are flying under the radar. The ones that are quietly innovating and positioning themselves for big things down the road.

That's where Amgen (AMGN) comes in.

I've been singing this company's praises in almost every piece I write, and for good reason. Amgen is one of the most innovative healthcare companies out there, with a massive product portfolio, a robust pipeline, and a balance sheet that's healthier than a triathlete on a kale smoothie diet.

Let me break it down for you. Established biotech companies with strong product portfolios are like fortresses in the business world.

They've got wide moats that are harder to cross than the Strait of Gibraltar. Why? Because bringing a new drug to market costs an arm and a leg.

We're talking anywhere from $314 million to $2.8 billion, depending on who you ask. That's not exactly chump change.

But Amgen? They've got it all figured out. Their portfolio spans a variety of therapeutic areas, including general medicine, oncology, inflammation, and rare diseases.

And in the first quarter of this year, these products helped Amgen rake in a whopping $7.4 billion in revenue, a 22% increase from the same period last year.

Key drugs like Repatha, Evenity, Blincyto, and Tezpire are leading the charge, with growth rates that'll make your head spin.

Repatha alone saw record sales of $517 million, thanks to a 44% increase in volume. And get this: expanded coverage and the removal of prior authorization requirements made the drug more accessible to patients.

It's like Amgen waved a magic wand and made all the red tape disappear.

Still, Amgen isn't just content with dominating the US market. They're taking their show on the road and expanding their international footprint.

Evenity, for example, has become the segment leader in Japan, capturing a staggering 46% of the bone builder market. And Uplinza, Amgen's fastest-growing biologic for a rare neurological disorder called neuromyelitis optica spectrum disorder (NMOSD), has been launched in multiple markets, including Canada.

Speaking of Uplinza, this little powerhouse came to Amgen via their $27.8 billion acquisition of Horizon last year. And let me tell you, it's paying off in spades.

In the first quarter of 2023, sales of Uplinza shot up by roughly 60%. And its smaller sibling, Tavneos, which targets a rare blood vessel disorder, saw a mind-boggling 122% growth.

The good news doesn't stop there. Amgen just released some hot-off-the-press Phase 3 data for Uplinza in another autoimmune condition, bringing it one step closer to yet another FDA approval.

This could put some serious pressure on competitors like Immunovant (IMVT) and argenx (ARGX), who have hit a few speed bumps lately.

Now, I know what you're thinking. "But John, what about the obesity market? Isn't that where the real action is?" Well, let me tell you, Amgen's got its fingers in that pie too.

They've got a unique obesity drug candidate called MariTide, which I talked about in detail last month, and the early clinical trial data suggests that it could blow Eli Lilly and Novo Nordisk's drugs out of the water.

But Amgen isn't just about cutting-edge drugs and international expansion. They're also rewarding their shareholders with cold, hard cash.

Last December, they hiked their dividend by 5.6%, and they're now paying out $2.25 per share every quarter.

That translates to a juicy 3% yield, and it's backed by a payout ratio that's lower than a limbo stick at a beach party.

Plus, Amgen's been raising its dividend like clockwork, with a five-year compound annual growth rate of 9.6% and 12 consecutive annual hikes. That's the kind of consistency that'll make any investor smile.

Overall, it’s clear that Amgen is a standout in the biotech world, plain and simple.

Besides, this company isn’t some Johnny-come-lately to the biotech game. They've been in this fight since the beginning, and their very name is proof of their founding principles. In fact, “Amgen” is a fancy-pants word for "applied molecular genetics."

That's right, when they picked that name back in 1980, they were already knee-deep in the groundbreaking science of genetic engineering, cooking up new therapies that would change the face of medicine as we know it.

So here’s my advice. When the chips are down and the stakes are high, you can never go wrong to bet on the OG of applied molecular genetics. Buy the dip on Amgen.

Global Market Comments

June 13, 2024

Fiat Lux

Featured Trade:

(THE TWO CENTURY DOLLAR SHORT)

(UUP)

(INTC), (AMD), (QCOM), (NVDA)

I'm at my annual Silicon Valley poker night, trading barbs and bluffs with some of the biggest names in tech. The whiskey is flowing, the cigars are lit, and the pot is growing faster than a startup's user base.

Suddenly, the conversation takes a turn. One of the chip industry bigwigs, flush with a recent win, starts going on about how AI PCs are going to change the game.

Before I know it, the whole table is buzzing. CEOs are swapping stats, CTOs are arguing about architectures, and the VCs are practically salivating at the thought of the potential returns.

Being the grizzled veteran of the group, I lean back and take it all in. I've heard this kind of talk before - the next big thing, the revolution that's going to change everything. But something about this feels different.

As the night wears on and the stakes get higher, I can't shake the feeling that these AI PCs are more than just smoke and mirrors.

The numbers are just too damn compelling - a market set to soar from $225 billion in 2024 to over $270 billion by 2028, with a staggering compound annual growth rate of 44%.

It's the kind of growth that would make even the most seasoned investor's heart skip a beat.

But it's not just the money that's got me intrigued. It's the potential for these machines to fundamentally change the way we live and work.

Imagine a world where your computer is more than just a tool - a partner in crime that can help you solve problems, generate ideas, and even write that Great American Novel you've been putting off for years.

A world where the line between human and machine intelligence blurs, and the impossible becomes possible.

And the heavyweights of the chip world - Intel (INTC), Advanced Micro Devices (AMD), Qualcomm (QCOM), Nvidia (NVDA) - they're all in on the action, racing to stake their claim in this new frontier of computing.

They've been throwing around buzzwords like "revolutionary" and "game-changing" like they're going out of style, and they're backing it up with some serious muscle.

In fact, the personal computing devices market, which includes AI PCs, is predicted to see a rise in shipments reaching 398.6 million units in 2024, up 2.6% from the previous year.

That's a sign that the market is ready to embrace AI capabilities within personal and commercial computing spaces.

And let's not forget about the recent PC market recovery. A 3.2% year-on-year growth in PC shipments was reported in the first quarter of the year, after two years of weak sales following the work-from-home boom during the pandemic.

Needless to say, the stage is set for AI PCs to take the market by storm.

But perhaps the most exciting thing about the AI PC revolution is the way that it's going to reshape the global tech landscape.

In China, Lenovo (LNVGY) estimates that 54.7% of all new PCs sold in 2024 will be AI PCs, and that number is set to jump to a jaw-dropping 84.6% by 2027.

Clearly, this isn't just a US phenomenon - it's a global movement that's going to change the way we think about computing forever.

As the night winds down and the chips are cashed in, I can't help but feel a sense of excitement. The AI PC revolution might just be the real deal, and I'll be damned if I'm going to miss out on the action.

So the next day, I do what any self-respecting tech investor would do: I start making calls, cashing in favors, and doing my homework.

I'm not just looking for the next big win - I'm looking for the companies that are going to define the future.

Will it be Intel, with its decades of experience and unmatched expertise in the PC market? Will it be AMD, the scrappy underdog that's been nipping at Intel's heels for years?

Will it be Qualcomm, the mobile chip giant that's looking to make a splash in the PC world? Or will it be Nvidia, the graphics powerhouse that's been quietly building an AI empire behind the scenes?

Only time will tell, but one thing's for sure: the AI PC arms race is on, and I'm ready to saddle up and join the charge. Because if there's one thing I've learned in all my years in the Valley, it's that fortune favors the bold - and the well-informed.

So keep your eyes on the heavy hitters like Intel, AMD, Qualcomm, and Nvidia. They're the ones to watch in this AI PC revolution. And you can bet your bottom dollar that I'll be keeping my ear to the ground, ready to pounce on the next big thing.

Mad Hedge Technology Letter

June 12, 2024

Fiat Lux

Featured Trade:

(WHAT WILL DROPPING INFLATION DO TO TECH STOCKS?)

($COMPQ), ($TNX), (CPI)

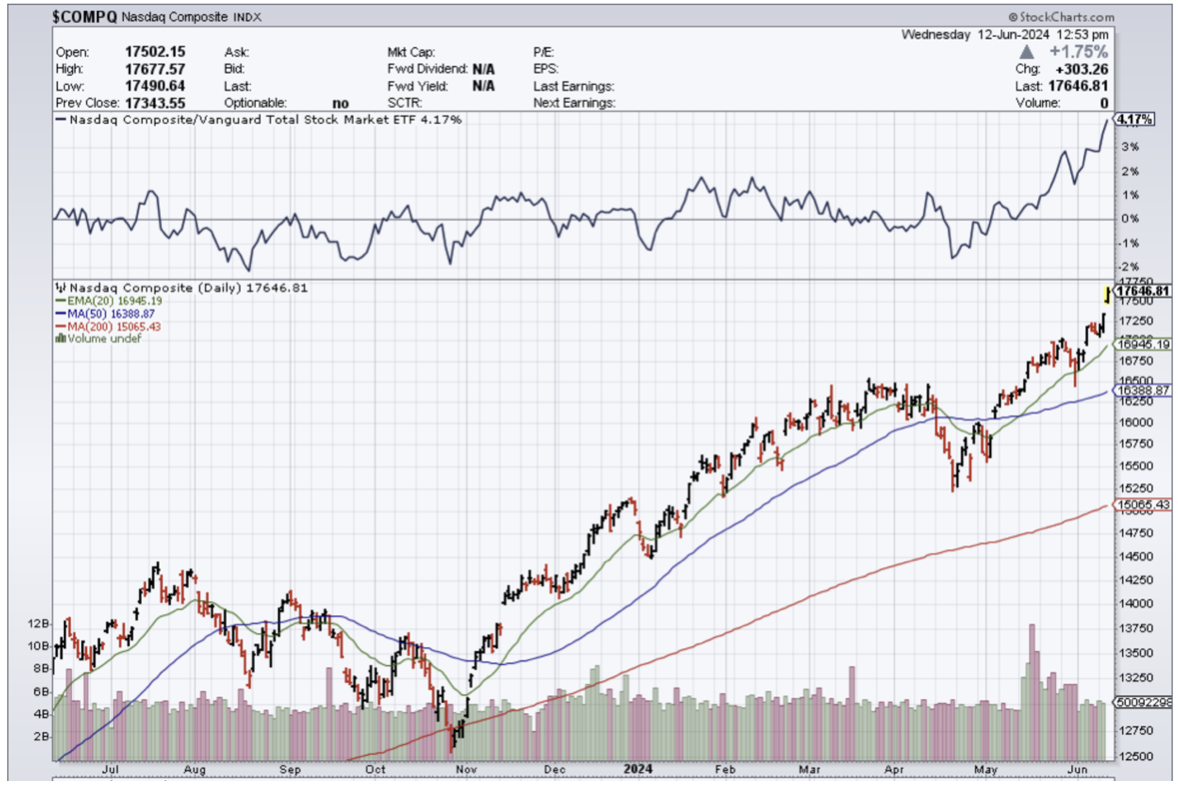

It’s “all systems go” for tech stocks ($COMPQ) as the latest inflation report offers us juicy morsels of data laying out a more attractive backdrop for tech companies in the short term.

The Mad Hedge Tech portfolio has benefited from this “bet on the Fed pivot” trend to great effect and I took profits on my Micron June bull call spread.

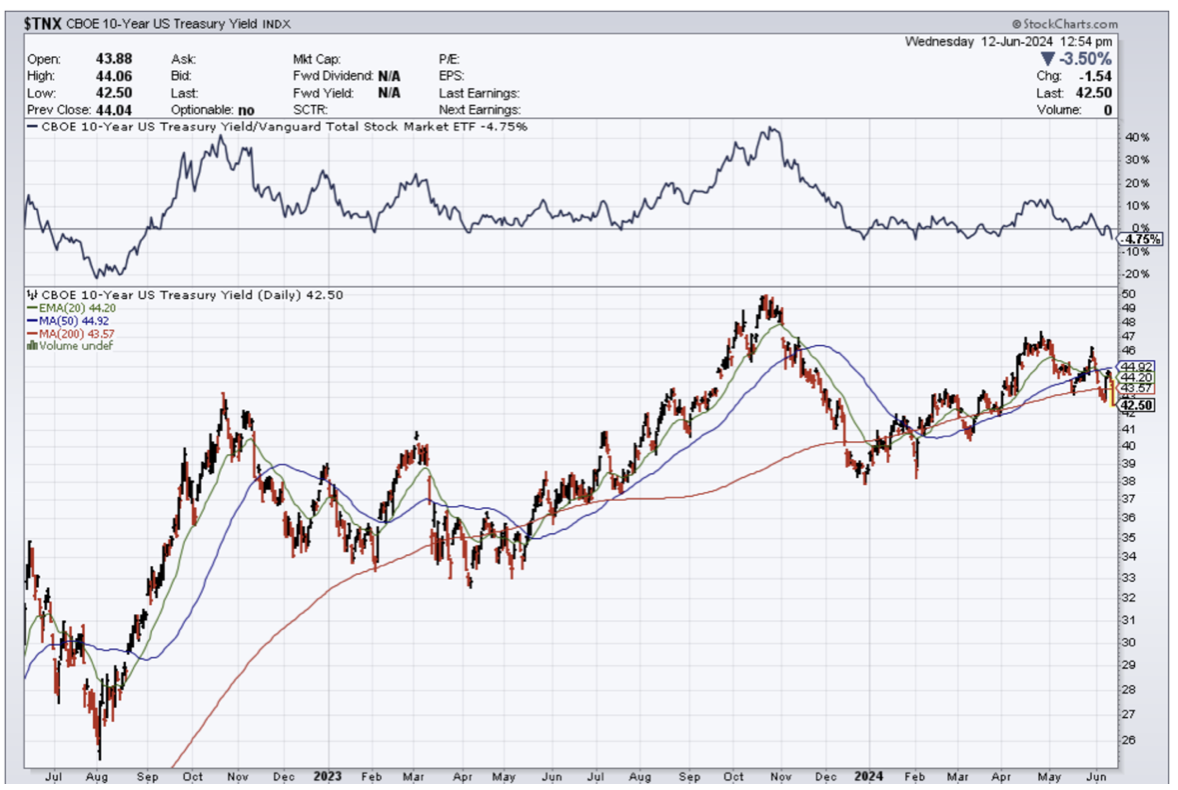

Remember that short-term rates ($TNX) are the most important variable to whether certain stocks go up and down in the short term.

Long term, the story could be very much different.

A higher-than-consensus report would have resulted in a red day for tech stocks, a pullback of commodities, bond yields spiking, and the dollar launching into the orbit.

We got the inverse of that and this is a strong signal that tech stocks will be like a stallion bolting out the back of the stable because tech stocks are the biggest winners of a lower rate environment.

The Consumer Price Index (CPI) remained flat over the previous month and rose 3.3% over the prior year in May — a deceleration from April's 0.3% month-over-month increase and 3.4% annual gain in prices.

Inflation has remained stubbornly above the Federal Reserve's 2% target on an annual basis.

Fed officials have categorized the path down to 2% as "bumpy," while other recent economic data has fueled the Fed's higher-for-longer narrative on the path of interest rates.

On Friday, the Bureau of Labor Statistics showed the labor market added 272,000 nonfarm payroll jobs last month, significantly more additions than the 180,000 expected by economists. Wages also came in ahead of estimates at 4.1%, although the unemployment rate rose slightly to 4% from 3.9%.

Notably, the Fed's preferred inflation gauge, the so-called core PCE price index, has remained particularly high. The year-over-year change in core PCE, closely watched by the Fed, held steady at 2.8% for the month of April, matching March.

The Fed has been unbelievably late in controlling inflation, but that market doesn’t care and tech stocks care less as the AI narrative has been able to supersede anything and everything.

The market is controlled and dictated to by a bunch of algorithms.

Food up 2% after a double is in fact a “victory” to the algorithms even if the middle class in the United States has felt the heavy brunt of it.

It is probably accurate to say that tech stocks are in a world of their own and the price action certainly behaves as if this is the case.

What does this all mean?

Get ready for higher-tech share prices.

Lower rates will help emerging tech companies tap the debt market to fund operations.

Many smaller tech firms don’t have the privilege to tap a multi-trillion dollar balance sheet for cash whenever they want.

In the short-term, except the AI stocks to gap up yet another leg as the market prices at lower rates for companies that hardly need it.

Talk about having your cake and eating it too – this would be it!

For the best of the rest, it helps but won’t move the needle in terms of catching up to big tech, but this should stimulate the investors on the sidelines nudging them to handpick certain stocks that have been ignored during the time of high rates.

Either way, the Fed has really put itself in a box here and without even killing inflation to the 2% mandate.

The markets fully expect the Fed to cut once or twice by the end of the year.

Whether this decision is political or not, the new developments have put a floor under many high-quality tech names.

Consequently, the second half of the year should see some ample returns in tech stocks that preside over good business models.

“Never spend your money before you have earned it.” – Said Thomas Jefferson

(APPLE LAUNCHES ITS AI VISION)

June 12, 2024

Hello everyone,

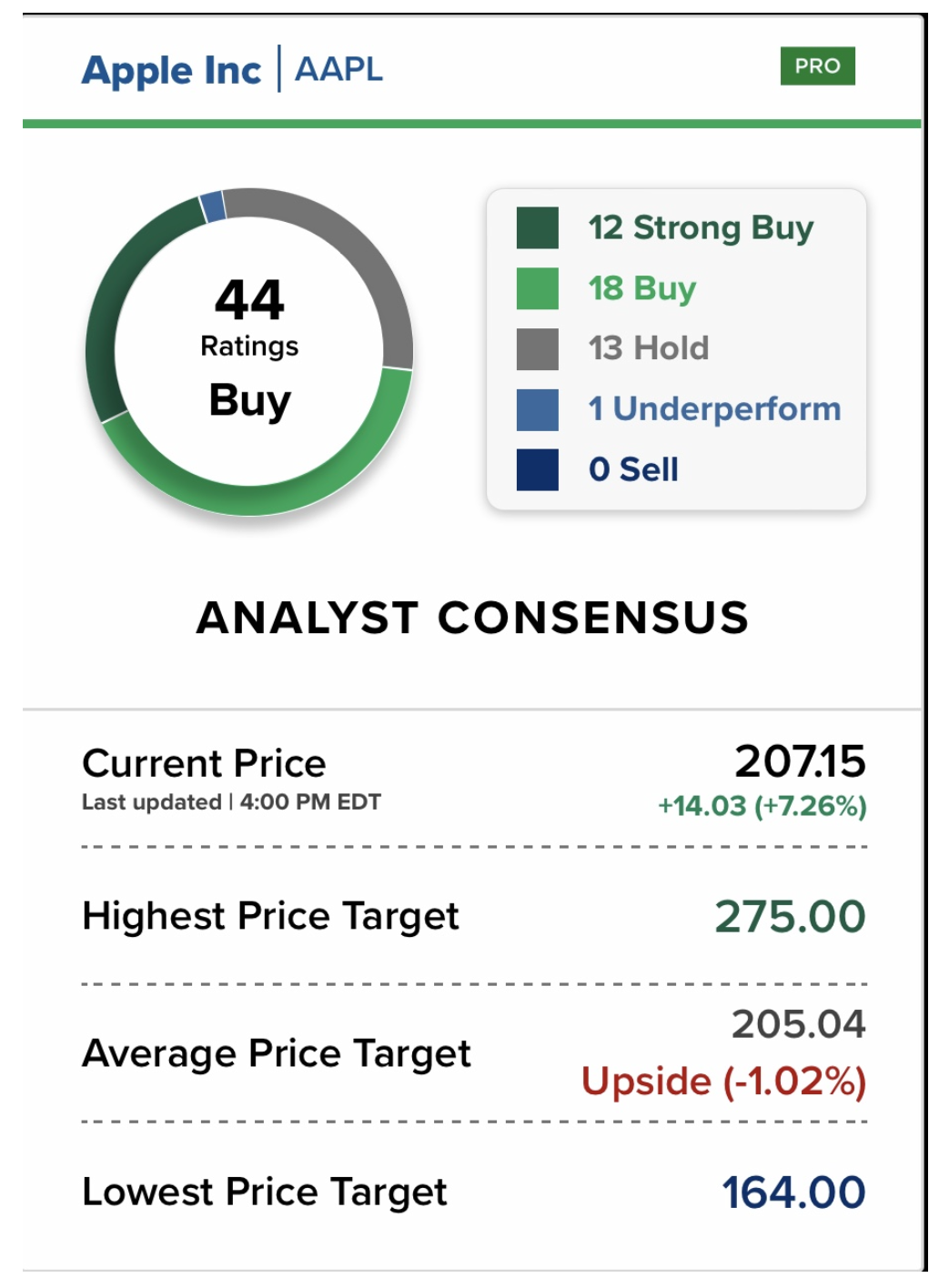

The Worldwide Developers Conference on Monday saw Apple debut its long-awaited artificial intelligence vision. Shares rose as much as 6.4% on Tuesday to a record high, one day after announcing the company’s AI ideas. Apple’s plan is to integrate generative artificial intelligence into every aspect of its ecosystem with the launch of Apple Intelligence.

The event brought positive reviews from many analysts. The company has been thorough in addressing the privacy issue with on-device capabilities. Analysts see Apple’s emphasis on protecting users’ personal data as a “game changer” as it adds to the users’ confidence. As we all know it is not just about the experience of using AI tools that operate in the open market, but it’s also about tools that understand and protect your personal preferences and data. Michael Ng from Goldman Sachs was “encouraged by the financial implications” of the announcements, noting that new product features should help fuel an iPhone upgrade cycle. The updates also create an opportunity for additional AI monetization down the road.

Bernstein’s Toni Sacconaghi expects Apple’s new features to not only power a stronger device upgrade cycle but also push the company to $8 in earnings per share and potentially convince investors to pay close to the stock’s peak valuation.

However, some analysts expressed doubts about Apple’s AI prospects. Barclay’s analyst Tim Long was skeptical about the AI announcements, describing the features as more of an evolution and not very meaningful. Furthermore, Long viewed the event as not significant from a stock standpoint. UBS analyst, David Vogt does not see the Apple AI strategy leading to a significant iPhone upgrade and described the announcement as underwhelming.

Apple Intelligence will be free for users and will be available in beta (trial) version as part of the iOS 18, iPadOS 18 and macOS in September or October in the English language.

The latest operating system also aims to give users more control with tools to manage who can see their apps, how contacts are shared, and how their iPhone connects to accessories.

Users can now lock an app and for additional privacy can hide it too, moving it to a locked, hidden folder. When the app is locked or hidden, content such as messages or emails within the app is hidden from search, notifications, and elsewhere across the system.

The new software will also introduce new accessibility updates including eye tracking, a built-in option for navigating iPhones with only the eyes.

Apple set to launch AI powered Safari 18

This is not a recommendation to buy Apple right now.

Recording of May 31 Monthly Zoom Meeting

https://www.madhedgefundtrader.com/jacquie-munro-meeting-replay-may-2024/

Cheers,

Jacquie

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.