When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

(THE IMPACT OF RECENT ELECTIONS IN INDIA AND MEXICO ON EMERGING MARKETS)

June 10, 2024

Hello everyone,

Last week the Bank of Canada and the European Central Bank cut their rates for the first time in many years. Contrarily, The Fed and the Bank of Japan are expected to maintain current rates at their meetings this week. Perhaps more significant than the rate decision itself is the Fed’s updated projections on interest rates, and the timing of cuts. The dialogue here may well drive the markets for the next few weeks. The release of May’s CPI inflation data on the day of the June FOMC meeting could result in market volatility, particularly if it deviates from expectations.

Week ahead calendar

Monday, June 10

1 p.m. 3-year Treasury note auction.

9:30 p.m. ET Australian Business Confidence

Previous: 1

Tuesday, June 11

6 a.m. NFIB Small Business Index (MAY)

1 p.m. 10-year Treasury note auction

2:00 a.m. ET UK Unemployment Rate

Previous: 4.3%

Earnings: Casey’s General Stores

Wednesday, June 12

7 a.m. Weekly mortgage applications (week ended June 7)

8:30 a.m. Consumer price index (May)

2 p.m. FOMC policy announcement

Previous: 5.5%

2:30 p.m. Fed Chair Jerome Powell holds news conference

Earnings: Broadcom, Dave & Buster’s

Thursday, June 13

8:30 a.m. Weekly jobless claims (week ended June 8)

8:30 a.m. Producer price index (May)

Previous: 0.5%

1 p.m. 30-year Treasury bond auction

Previous: 0.5%

Earnings: Adobe, Signet Jewellers, John Wiley

Friday, June 14

8:30 a.m. Import/export prices (May)

10 a.m. University of Michigan consumer sentiment index (preliminary, June)

12:00 a.m. ET JP Interest Rate Decision

Previous: 0.1%

Recent election results in India and Mexico surprised many emerging market investors. The stock markets in both countries saw big swings in the aftermath of the initial election results.

As the election results are finalized and the changes take place, the countries could have a large impact on emerging markets exchange-traded funds, which have had a solid start to 2024.

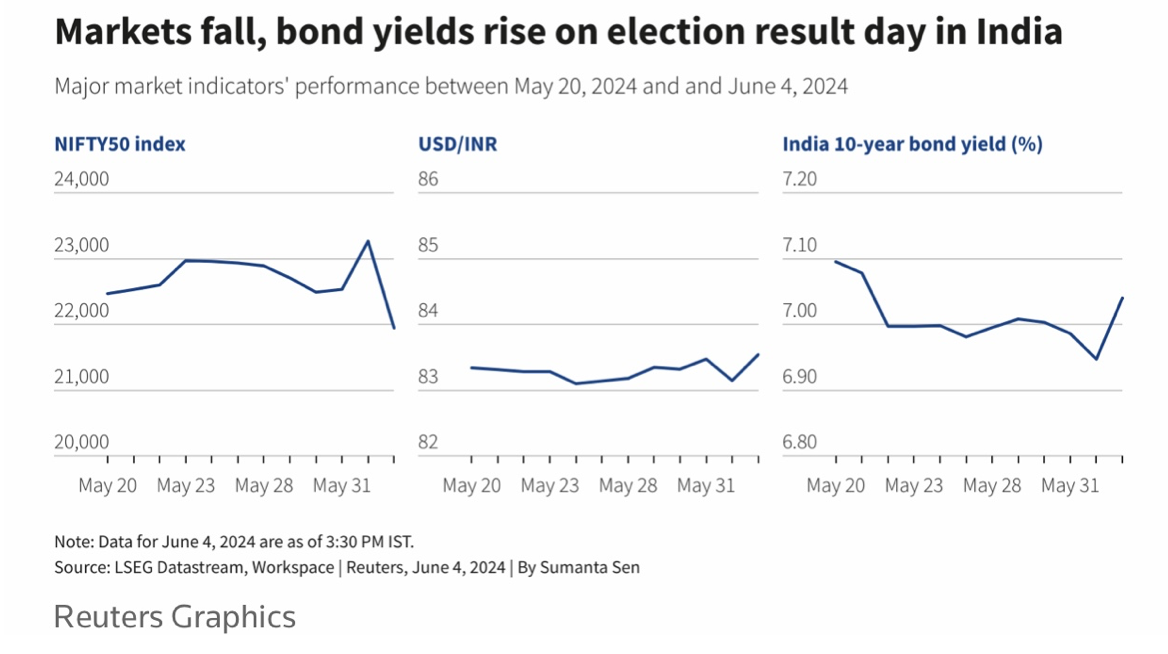

India’s Prime Minister Narendra Modi has declared victory in his re-election campaign. Despite this, his party had a weaker showing at the polls and lost seats in parliament.

Indian stocks have been a global outperformer under Modi; however, the election result disturbed some traders. The iShares MSCI India ETF (INDA) fell 6% on Tuesday as the results became clearer. The rupee dropped 0.5% against the dollar which, although not groundbreaking, was its biggest fall in 16 months.

Analysts do not believe economic growth will be impacted by Modi’s lacklustre party performance at the polls. Coalition governments have been stable in the past, but one main negative may be achieving consensus on major reforms. Indian stocks have rebounded after initially selling off. From a technical standpoint, the rally appears to be largely intact, according to analysts.

At brokerage Emkay Global, analysts said that difficult but potentially beneficial changes to land and labor policies, along with privatization of some of India’s big state-run firms, were now “off the table”.

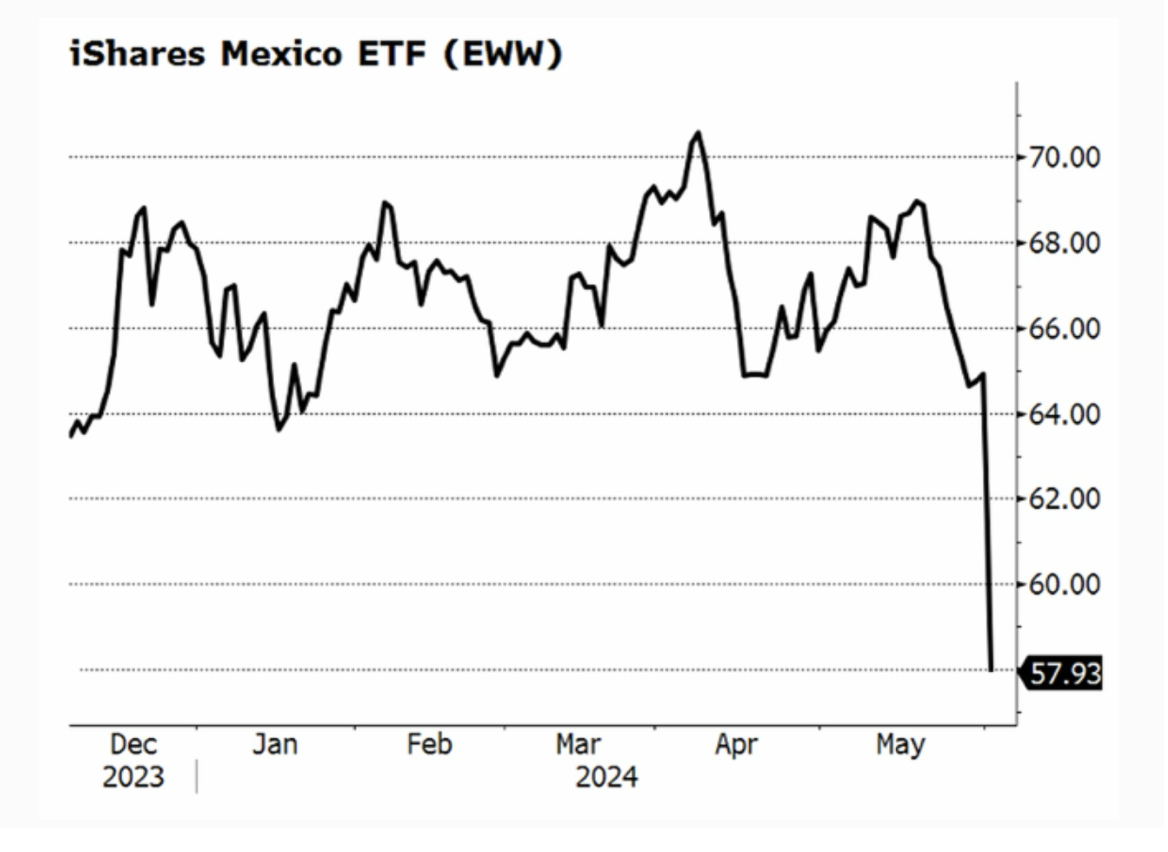

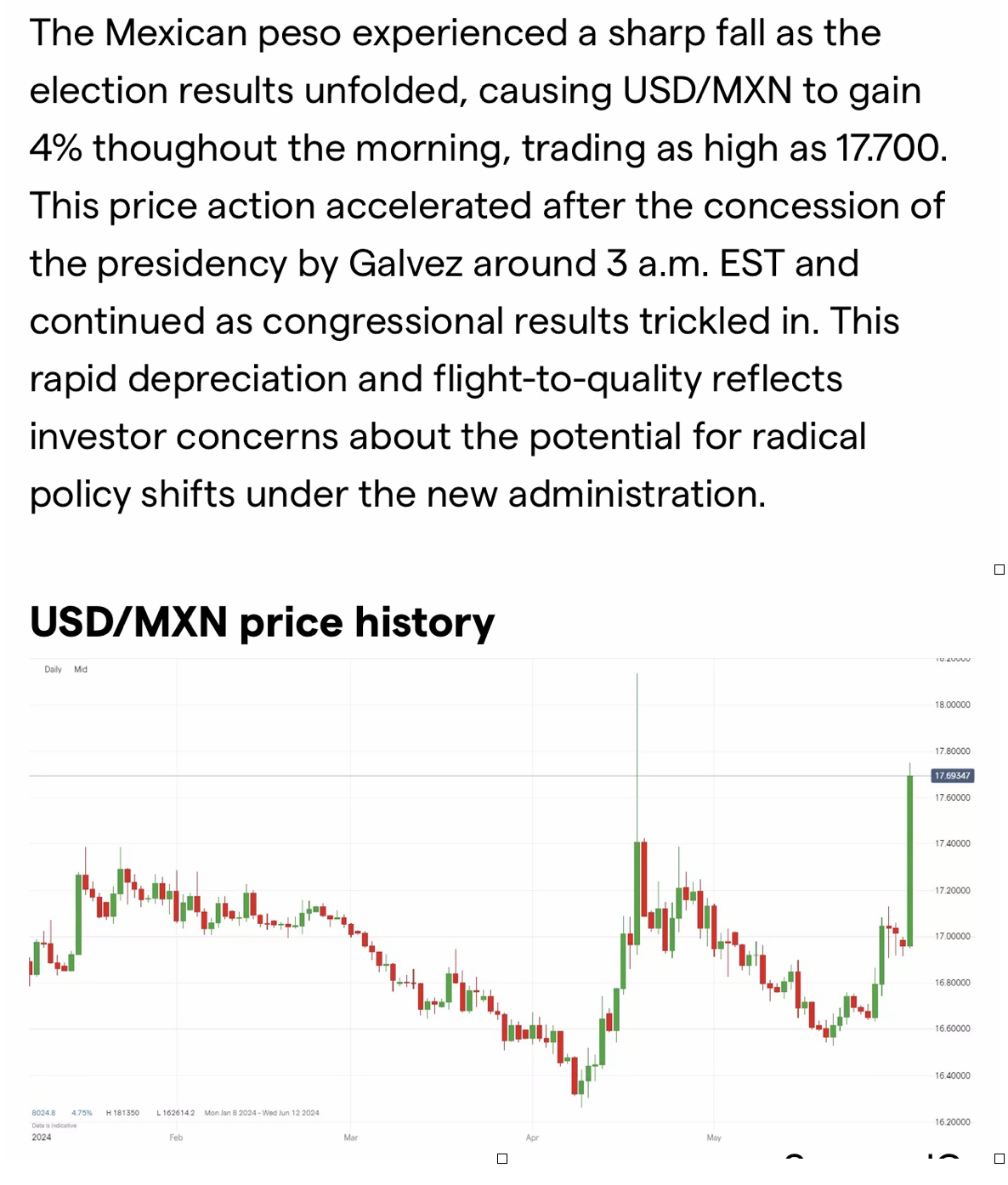

In Mexico, the favored candidate won, but the margin was a surprise. Claudia Sheinbaum won the presidency, and her party’s performance is arguably strong enough to put it close to a large enough majority in the legislature to pass constitutional changes.

The initial market reaction was negative. The iShares MSCI Mexico ETF (EWW) fell 10% last Monday after the initial election results, and the peso dropped sharply against several major currencies. It was the worst day for Mexican stocks since the Covid-19 shock in 2020.

Just how many seats the ruling party ends up controlling may take some time to ascertain. Of some concern is the idea that the Morena party’s strong mandate may lead to market-unfriendly policies, including constitutional reforms that could negatively impact the business environment. The adverse market reaction to the results also represents fears by investors regarding increased state control over critical sectors, and expanded social welfare programs that could strain the budget. (the party is guaranteeing all workers receive 100% of their final salary as a pension, despite lacking a clear financing mechanism, and has included social programs which include universal pensions for seniors and scholarships for students).

Maintaining a stable and predictable business environment is essential if Sheinbaum’s administration wants to forge ties with foreign investors and grow the domestic economy. Mexico has benefited from nearshoring opportunities since the COVID-19 pandemic; the country became an attractive destination for U.S. companies relocating their supply chains closer to home. Any policy change that disrupts the nearshoring trend affects foreign investment in Mexico and will impact the currency and the domestic economy.

The energy sector is also wary. Concerns about protectionist policies that favour state-owned enterprises over private and foreign investments could also deter foreign investment and impact market confidence.

MARKET UPDATE

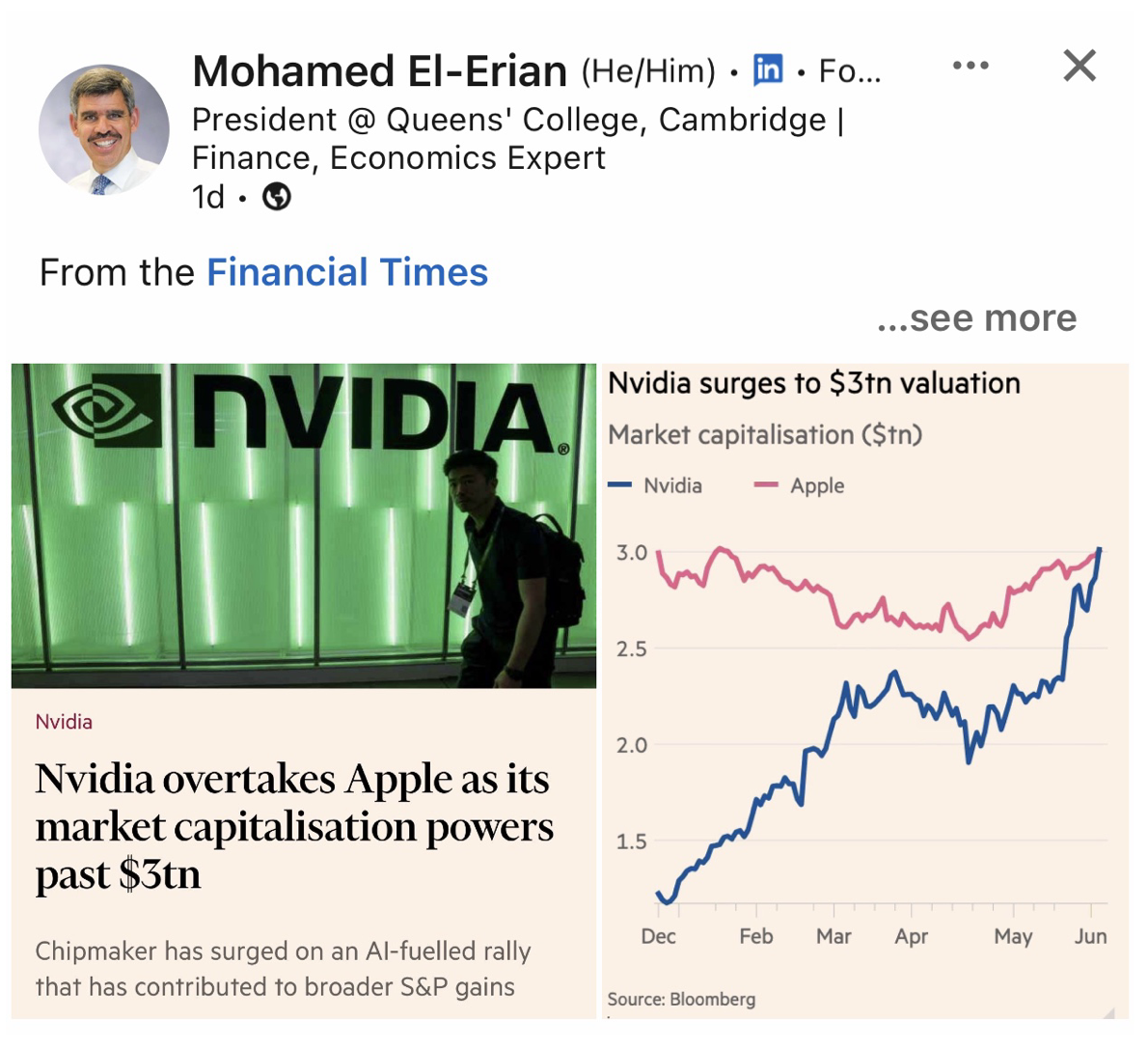

S&P 500 -we are in a 5th wave advance. Targets include 5432 level and 5752 max. (If you are a short to medium-term trader/investor, you should be looking to take some profit from your positions. For example, you could look at selling 20% or 30% of your Nvidia (NVDA) holdings stock position and the same with your T-Mobile (TMUS) stock holding).

Gold – retracement in progress. Support lies around the $2,252/$2,220 level. Extended corrective weakness could target $2175 support area. If you don’t have any gold stocks or silver stocks, this retracement provides you with a great opportunity to scale in. Look at (GLD), (WPM), and (SLV).

Bitcoin – short-term retracement. Possibly testing low/mid $60k over the coming days. If you are interested in Bitcoin, this corrective pullback is the time to scale in.

QI CORNER

MY CORNER

Hiking in Reno before the summer heat sent temperatures soaring.

Cheers,

Jacquie

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

June 10, 2024

Fiat Lux

Featured Trade:

(PLEASE SIGN UP NOW FOR MY FREE TEXT ALERT SERVICE RIGHT NOW)

From Customer Service to Data-Driven Insights

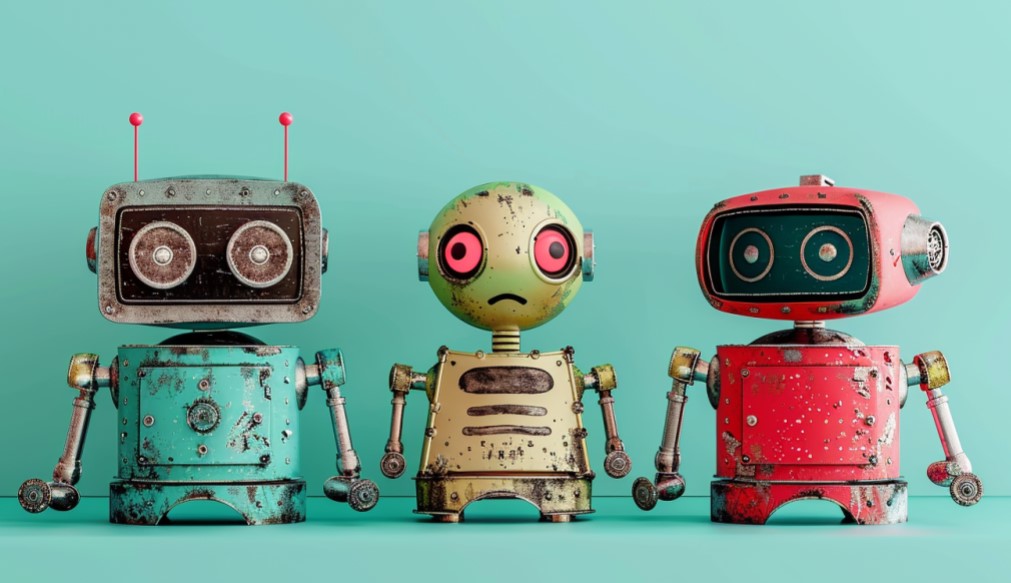

Chatbots have evolved from rudimentary tools designed to handle basic customer service inquiries to sophisticated AI-powered conversationalists capable of generating vast amounts of valuable data. Companies like OpenAI, Microsoft, and Google are investing heavily in this technology, not just for its customer service capabilities, but also for the wealth of information it provides.

A New Era of Data Mining

Chatbot conversations offer a unique window into customer behavior, preferences, and pain points. Unlike traditional surveys or focus groups, chatbots can engage with thousands, even millions, of customers simultaneously, generating a massive dataset that can be mined for valuable insights.

This data is not only vast but also diverse. Chatbots can be deployed across various industries, from e-commerce and healthcare to finance and education, capturing a wide range of customer interactions. This diversity allows for a more nuanced understanding of customer behavior and preferences across different contexts.

Real-World Applications

Leading tech companies are already leveraging chatbot data to drive business value. OpenAI, for example, uses the data generated by its ChatGPT model to continuously improve its performance and fine-tune its responses.

Microsoft is also using chatbot data to enhance its products. In a recent announcement, the company revealed that it is using chatbot conversations to improve the accuracy of its Bing search engine.

Google, meanwhile, is using chatbot data to personalize its services. The company's LaMDA model, for example, can analyze chatbot conversations to understand individual preferences and deliver tailored recommendations.

Ethical Considerations

While the potential benefits of chatbot data are undeniable, there are also significant ethical considerations. Privacy is a major concern, as chatbots often collect sensitive personal information. Companies must ensure that this data is handled responsibly and that users are informed about how their data is being used.

Bias is another important issue. AI models, including chatbots, can perpetuate and even amplify existing biases in the data they are trained on. This can lead to discriminatory outcomes, such as unfair treatment of certain customer groups. Companies must take steps to mitigate bias in their chatbot models and ensure that they are fair and equitable for all users.

A Growing Trend

Despite these challenges, the trend of using chatbot data for business intelligence is only set to grow. According to a recent report by Gartner, "By 2025, customer service organizations that embed AI in their multichannel customer engagement platform will elevate operational efficiency by 25%."

This growing adoption of AI in customer service is expected to further fuel the generation of chatbot data, providing companies with even more opportunities to gain valuable insights into their customers.

The Future of Chatbot Data

As AI technology continues to evolve, the potential applications of chatbot data are vast. Chatbots could be used to predict customer churn, identify potential sales leads, or even detect emerging market trends.

However, the full potential of chatbot data is yet to be realized. As companies continue to invest in this technology and develop new ways to analyze and utilize this data, we can expect to see even more innovative applications in the future.

Conclusion

Chatbot conversations are no longer just a means to an end; they are a valuable source of business intelligence that can drive growth, innovation, and customer satisfaction. By harnessing the power of AI, companies can unlock a wealth of untapped potential and gain a significant competitive advantage in the digital age.

The future of chatbot data is bright, but it is important to remember that with great power comes great responsibility. Companies must prioritize ethical considerations and ensure that chatbot data is used in a way that benefits both businesses and consumers alike.

Mad Hedge Technology Letter

June 7, 2024

Fiat Lux

Featured Trade:

(HEWLETT PACKARD – REMEMBER THEM?)

(HPE), (SMCI), (NVDA), (ORCL), (DELL)

Artificial intelligence is not always the golden ticket, but some legacy companies, they are using this trend to springboard themselves back to relevancy.

Look at companies like Dell (DELL) or Oracle (ORCL) – they epitomize what I am talking about.

For years, these certain legacy tech firms were crowbarred into this narrow definition of some aging enterprise software company that was from yesteryear.

It was true back then but some have changed.

Hewlett Packard (HPE) is another Silicon Valley brand name that has reinvented itself for artificial intelligence and its stock price has reaped the dividends.

The stock has exploded to the $20 per share range after languishing in the teens for years.

HPE latest report was topped up with its better-than-expected revenue fueled by sales of servers built for artificial intelligence work.

The strong performance was due to the company’s server business, which generated revenue of $3.87 billion.

Sales of AI-oriented systems doubled from the first quarter to more than $900 million.

Increased demand and better availability of high-powered semiconductors from Nvidia (NVDA) led to an increase in AI systems sales.

HPE would be a good way to play the catch-up trade in AI servers compared with its peers in the server space, including Dell Technologies (DELL) and Super Micro Computer (SMCI).

HPE’s current backlog for AI systems is now $3.1 billion.

This is the first quarter HPE has broken out AI server revenue and investors likely welcome the increased disclosure.

The AI-server ramp-up is finally materializing.

The full-year forecast is underwhelming given the increased AI business, suggesting other business lines, such as networking, are dragging down the results.

I am not saying that HPE is the finished article right now and is a pure AI play. I am not. They have a lot to work on and that might be a generous statement to even say that.

There is still plenty to dislike about HPE who are saddled with legacy businesses that barely move the needle.

However, if HPE smartly harnesses resources right, I do believe they could eventually turn into an above-average AI play.

At this point, many tech companies view the participation of AI or not as an existential matter.

Many companies will get left behind and swept into the dustbin of history.

When the biggest tech companies in the world talk about AI constantly on their earnings call, it is not a head fake. This is the real deal so get with the program.

There are many different types of semiconductors with different levels of sophistication, from simple chips in kitchen appliances to cutting-edge graphics processing units (GPUs) used in artificial intelligence (AI) applications, as well as cryptocurrency mining.

In many of these use cases, semiconductor chips will need an AI server to act as storage for the data or some other similar function.

The data produced is substantially greater than analog chips and of higher quality.

We are still in the early innings of the AI revolution, so it is important to know which stocks possess an upward trajectory in terms of business models and sub-sectors.

In 2024, semiconductor chips and AI server stocks have made their stamp in the tech world and aren’t going away.

Remember that the trend is your friend and I wouldn’t fight this one. It’s a massive trend to fight and be on the wrong end.

Moving forward, I believe HPE will make meaningful optimization decisions to amplify its AI server business while minimizing its legacy divisions to the benefit of the future share price.

If they can somewhat achieve these results, the stock should easily rise by 3X.

“Life is fragile. We're not guaranteed a tomorrow so give it everything you've got.” – Said CEO of Apple Tim Cook

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

(THE AI GENIE IS OUT OF THE BOTTLE – ARE HUMAN RIGHTS AT STAKE?)

June 7, 2024

Hello everyone,

A recent report from the UN is shining a spotlight on the risks of generative AI. The report explores 10 human rights that generative AI may adversely impact.

The paper says that “the most significant harms to people related to generative AI are in fact impacts on internationally agreed human rights” and lays out several examples for each of the 10 human rights it explores: Freedom from Physical and Psychological Harm; Right to Equality Before the Law and Protection against Discrimination; Right to Privacy; Right to Own Property; Freedom of Thought, Religion, Conscience, and Opinion; Freedom of Expression and Access to Information; Right to Take Part in Public Affairs; Right to Work and to Gain a Living; Rights of the Child; and Rights to Culture, Art, and Science.

There is already talk about generative AI’s impact on creative professions. This report discusses this issue and how it can be used to create harmful content from political disinformation to nonconsensual pornography and CSAM (child sexual abuse material). Over 50 examples in the report illustrate the potential human rights violations, which creates an alarming picture of what’s at stake as companies rush to develop, deploy, and commercialize AI.

The report also asserts that generative AI is both altering the current scope of existing human rights risks associated with digital technologies and has unique characteristics that are giving rise to new types of human rights risks. For instance, the use of generative AI for armed conflict and the potential for multiple generative AI models to be fused together into larger single-layer systems that could autonomously disseminate huge quantities of disinformation.

Of some concern is the idea that “other potential risks are still emerging and, in the future, may represent some of the most serious threats to human rights linked to generative AI.

One particular risk the report brings to light surrounds the Rights of the Child. “Generative AI models may affect or limit children’s cognitive or behavioral development where there is over-reliance on these models’ outputs, for example when children use these tools as a substitute for learning in educational settings. These use cases may also cause children to unknowingly adopt incorrect or biased understandings of historical events, societal trends, etc.”

The report also notes that children are especially susceptible to human rights harms linked to generative AI because they are less capable of discerning between synthetic content and genuine content, identifying inaccurate information, and understanding they’re interacting with a machine.

Let’s think of children and social media for a moment. They were given daily access to social media without virtually any transparency or research into how it might impact their development or mental well-being. It’s well known that children have been harmed by social media companies’ apparent lack of guardrails surrounding the technology. This issue came to light earlier this year when the CEOs of Meta, Snapchat, TikTok, X, and Discord testified before Congress in a heated hearing that looked at social media’s role in child exploitation as well as its contribution to addiction, suicide, eating disorders, unrealistic beauty standards, bullying, and sexual abuse. It’s been shown that children were treated as guinea pigs on Big Tech’s social media platforms; repeating those mistakes with generative AI would be shameful.

The Right to Work and to Gain a Living was also covered in the report and showed interesting findings. Of note was the fact that economics, labor markets, and daily work practices could be drastically altered by Generative AI. The future may include employers using generative AI to monitor workers, and the idea that workers engaged in labor disputes with employers may be at heightened risk of being replaced with generative AI tools.

How we implement the technology will be important as well as the guardrails – or lack thereof – we put around it. Perhaps the most significant takeaway is the understanding that Generative AI as a technology won’t commit these human rights violations independently, but rather powerful humans acting recklessly to prioritize profit and dominance will.

The May Monthly Zoom Meeting recording will be sent out next week.

QI CORNER

Cheers,

Jacquie

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.