When John identifies a strategic exit point, he will send you an alert with specific trade information on what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

August 12, 2024

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD or THE ROUND TRIP TO NOWHERE), plus (A VISIT TO TRINITY),

(ROM), (TQQQ), ($VIX), (TLT), (SLRN), (CAT), (AMZN), and (BRK/B). (NVDA), (TSLA), (AAPL), and (META), ($INDU), (TSLA), (DHI), (DE), (AAPL), (JPM), (DE), (GLD), (DHI)

I am writing this to you from the airport in Vilnius, Lithuania, which is under construction. The airport is packed because people are flying all planes to Paris to catch the closing ceremony of the 2024 Olympics. There is also the inflow of disappointed Taylor Swift fans returning from three concerts in Vienna, Austria that had been canceled due to terrorist threats. Some 150,000 tickets had to be refunded.

It is hard to focus on my writing because every 30 seconds, a beautiful woman walks by.

And I am told at my age I am not supposed to learn. I should know better.

Well, that was some week!

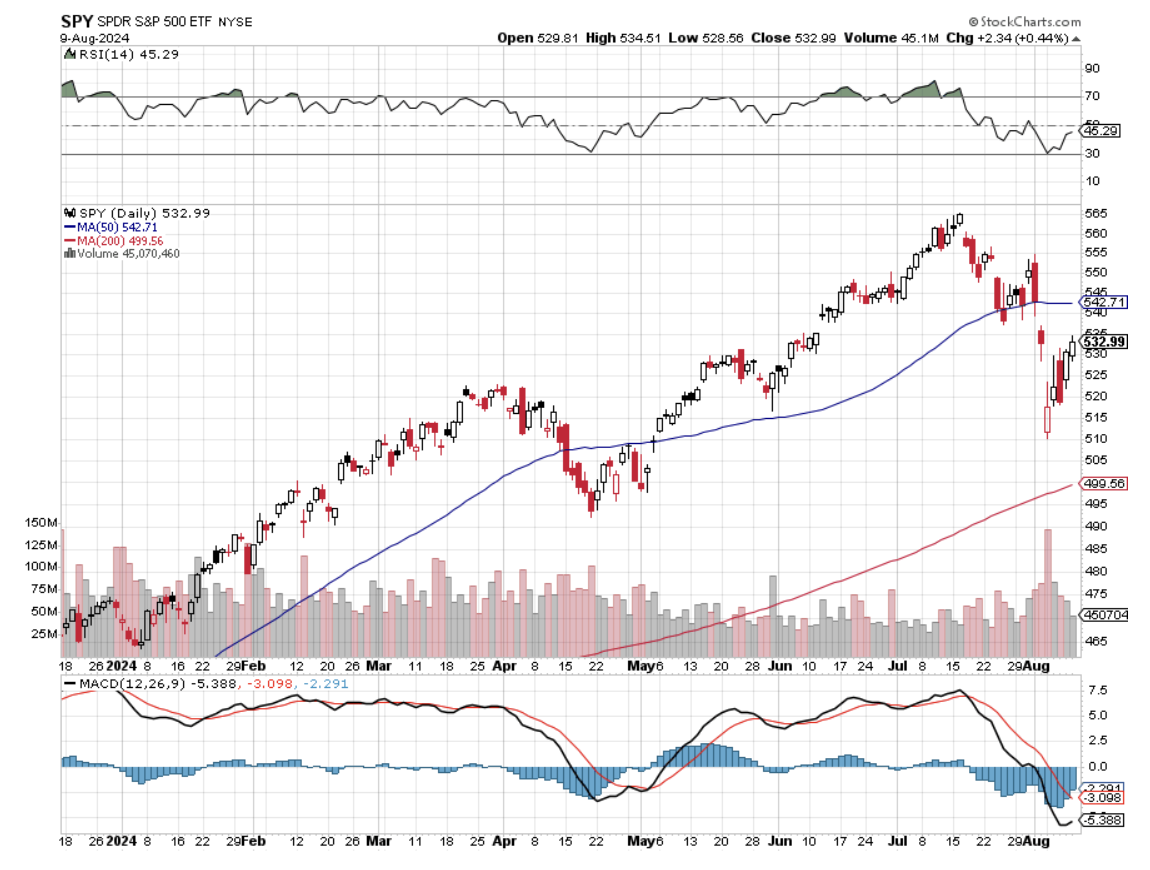

If you had taken a ten-day cruise to Alaska, you would wonder what all the fuss was about, for last week the stock market was basically unchanged. The worst day in two years, down 3%, followed by the best, up 2 ½% amounts to a big fat nothing burger.

It all reminds me of one of those advanced aerobatics classes I used to take. I was busier than a one-armed paper hanger, sending out some 13 trade alerts in all.

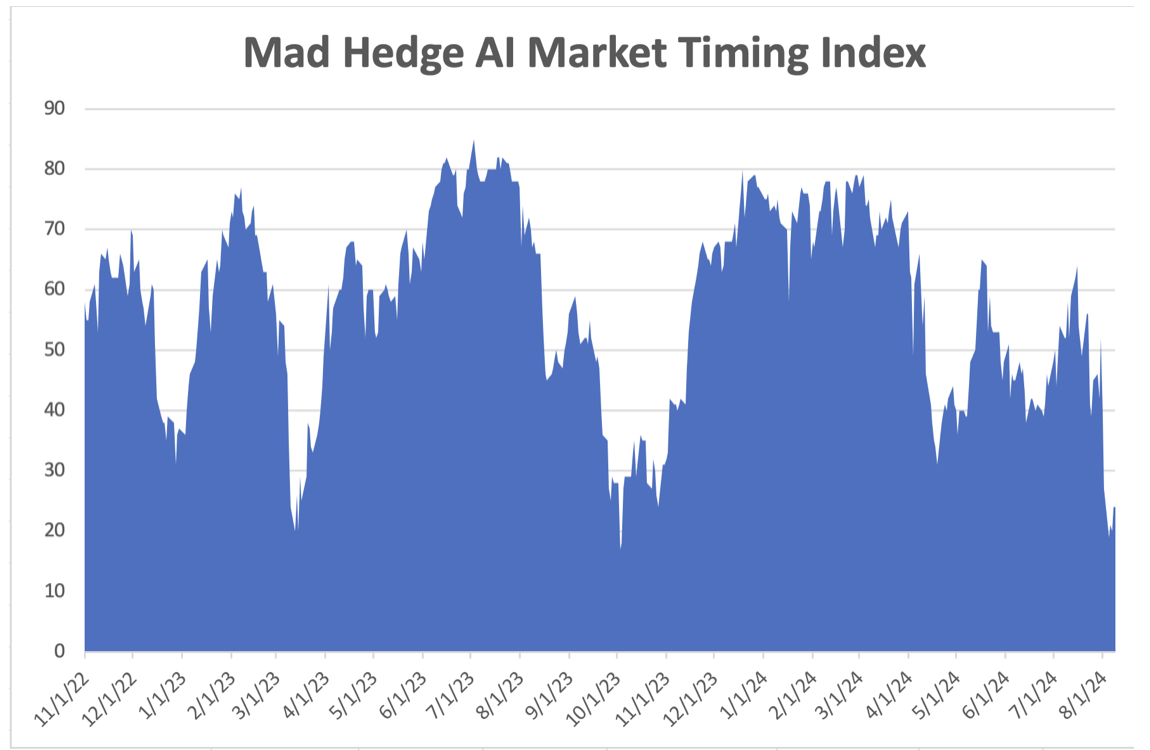

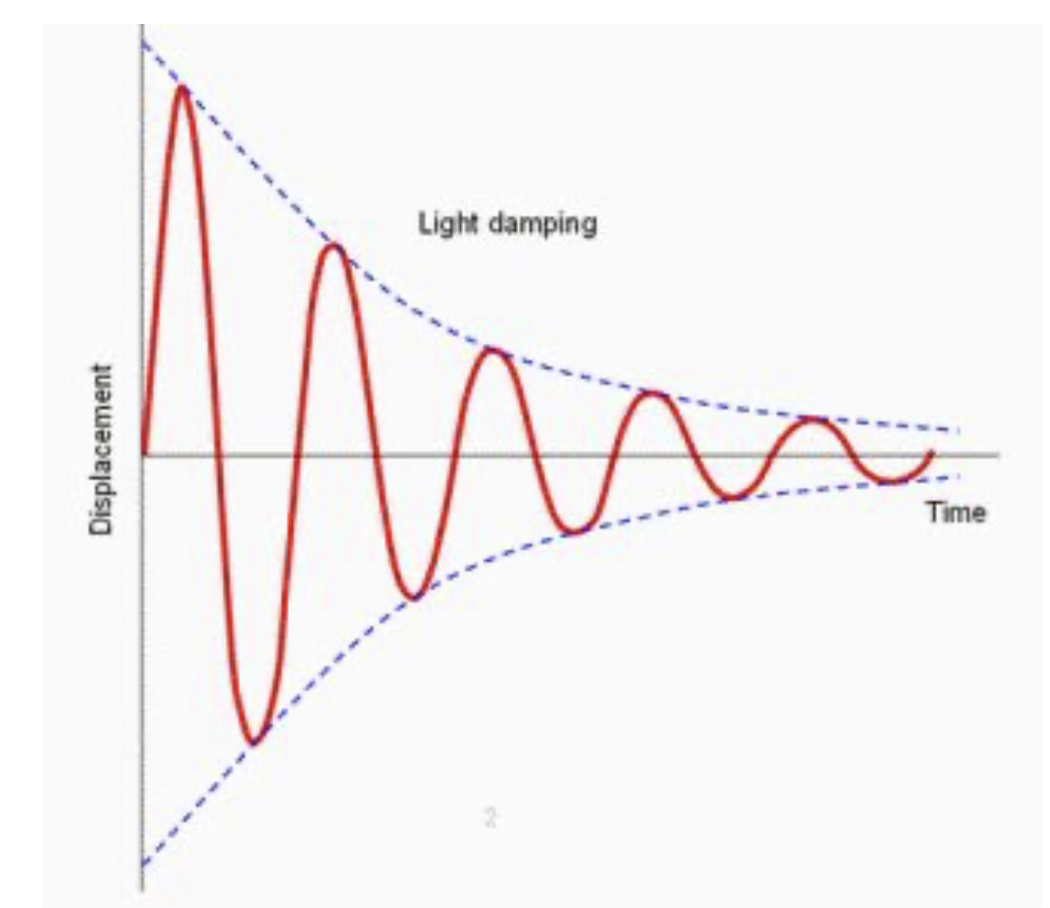

And while the volatility is certainly not over, it is probably at least two-thirds over, meaning that we can step out for a cup of coffee and NOT expect a 1,000 move in the Dow Average by the time we get back.

Is the Bottom IN?

I don’t think so. The valuation disparity between big tech and value is still miles wide. Uncertainty reaches a maximum just before the US presidential election. A bottom for the year is coming, but not quite yet. When it does, it will be the buying opportunity of the year. Watch this space! And watch (ROM) and (TQQQ) too.

The average drawdown per year since 2020 stands at 15%, so with our 10% haircut, the worst is over. What will remain in high volatility? After staying stuck at $12 for most of 2024 and then spiking to $65 in two days, the $20 handle should remain for the foreseeable future.

That is a dream come true and a license to print money for options traders because the higher options prices effectively double the profit per trade. So, expect a lot of trade alerts from the Mad Hedge Fund Trader going forward. That is, until the ($VIX) returns to $36, then the potential profit triples.

Up until July, I had been concerned that the market might not sell off enough to make a yearend rally worth buying into. There was still $8 trillion in cash sitting under the market buying even the smallest dips.

The Japanese took care of that in a heartbeat with a good old-fashioned financial crisis. In hours trillions of dollars’ worth of yen carry trades unwound, creating an unprecedented 14% move UP in the Japanese currency and a 26% move DOWN in the Japanese stock market.

Suddenly, the world was ending. Or at least the financial media thought it was.

Some hundreds of hedge funds probably went under as their leverage is so great at 10X-20X. But we probably won’t know who until the redemption notices go out at yearend.

It couldn’t happen to a nicer bunch of people.

Don’t expect the Fed to take any emergency action, such as a surprise 50 basis point rate cut, to help us out. Things are just not bad enough. The headline Unemployment Rate is still a low 4.3%. Corporate profits are at all-time highs. We are nowhere near a credit crisis or any other threats to the financial system. The US still has the strongest major economy in the world.

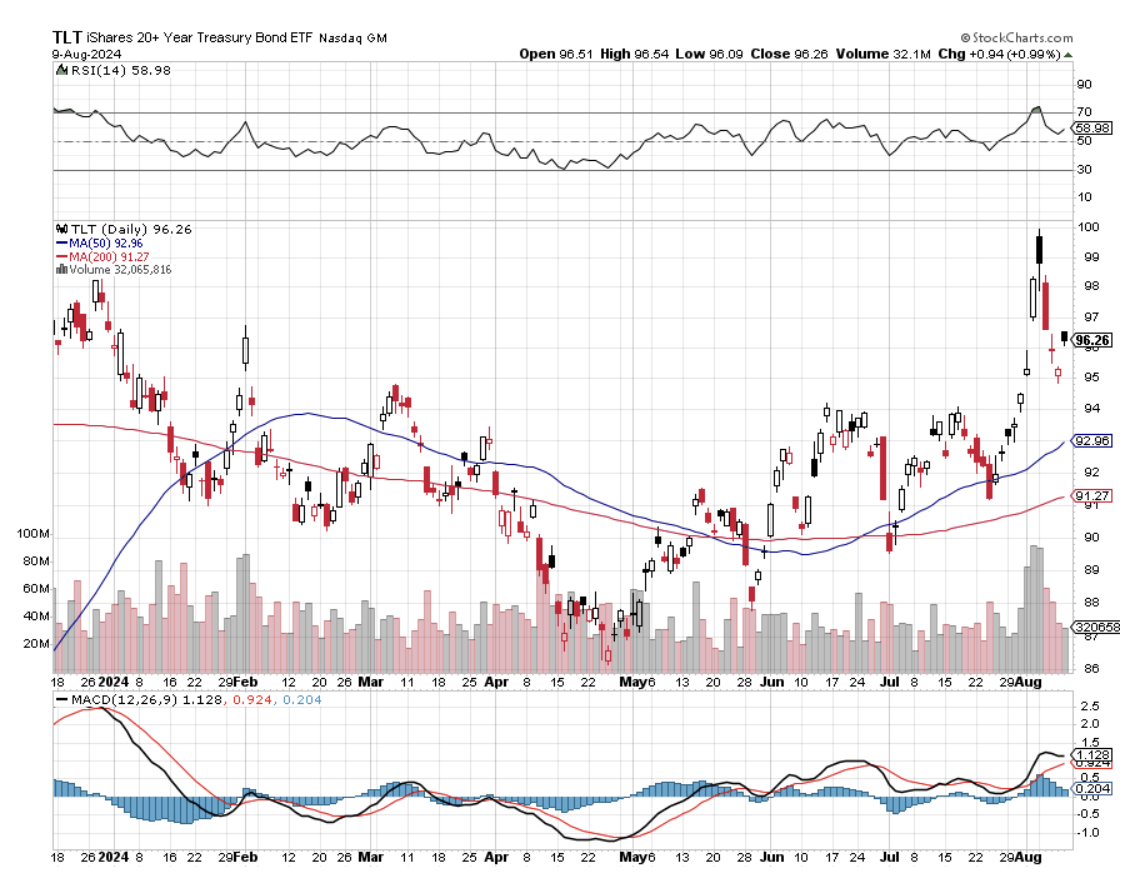

Of course, if you followed my advice and went heavy into falling interest rate plays, as I have been begging you to do for months, last week was your best of the year. The United States US Treasury Bond Fund (TLT) rocketed to a year high at $100. Junk bonds (JNK), REITS (CCI), BB-rated loan ETFs (SLRN), and high-yield stocks (MO) went up even more.

It's still not too late to pile into yield plays because the Fed hasn’t actually cut interest rates YET.

Volatility Index ($VIX) Hits Four-Year High at $65, the most since the 2020 pandemic. That implies a 2% move in the S&P 500 (SPX) every day for the next 30 days, which is $103.42 (SPX) points or $774 Dow ($INDU) points. No doubt, massive short covering played a big role with traders covering shorts they sold in size at $12. Spikes like this are usually great long-term “BUY” signals.

$150 Billion in Volatility Plays were Dumped on Monday. Volatility-linked strategies, including volatility funds and equities trend-following commodity trading advisers (CTAs), are systematic investment strategies that typically buy equities when markets are calm and sell when they grow turbulent. They became heavy sellers of stocks over the last few weeks, exacerbating a market rout brought on by economic worries and the unwind of a massive global carry trade.

Weekly Jobless Claims Drop to 233,000, sparking a 500-point rally in the market. It’s a meaningless report, but traders are now examining every piece of jobs data with a magnifying glass.

Commercial Real Estate Has Bottomed, which will be great news for regional banks. Visitations are up big in Manhattan, with Class “A” properties gaining the most attention. New leasing is now exceeding vacations.

Warren Buffet Now Owns More T-Bills than the Federal Reserve. The Omaha, Nebraska-based conglomerate held $234.6 billion in short-term investments in Treasury bills at the end of the second quarter. That compared with $195.3 billion in T-bills that the Fed owned as of July 31. The Oracle of Omaha wisely unloaded $84 billion worth of Apple at the market top.

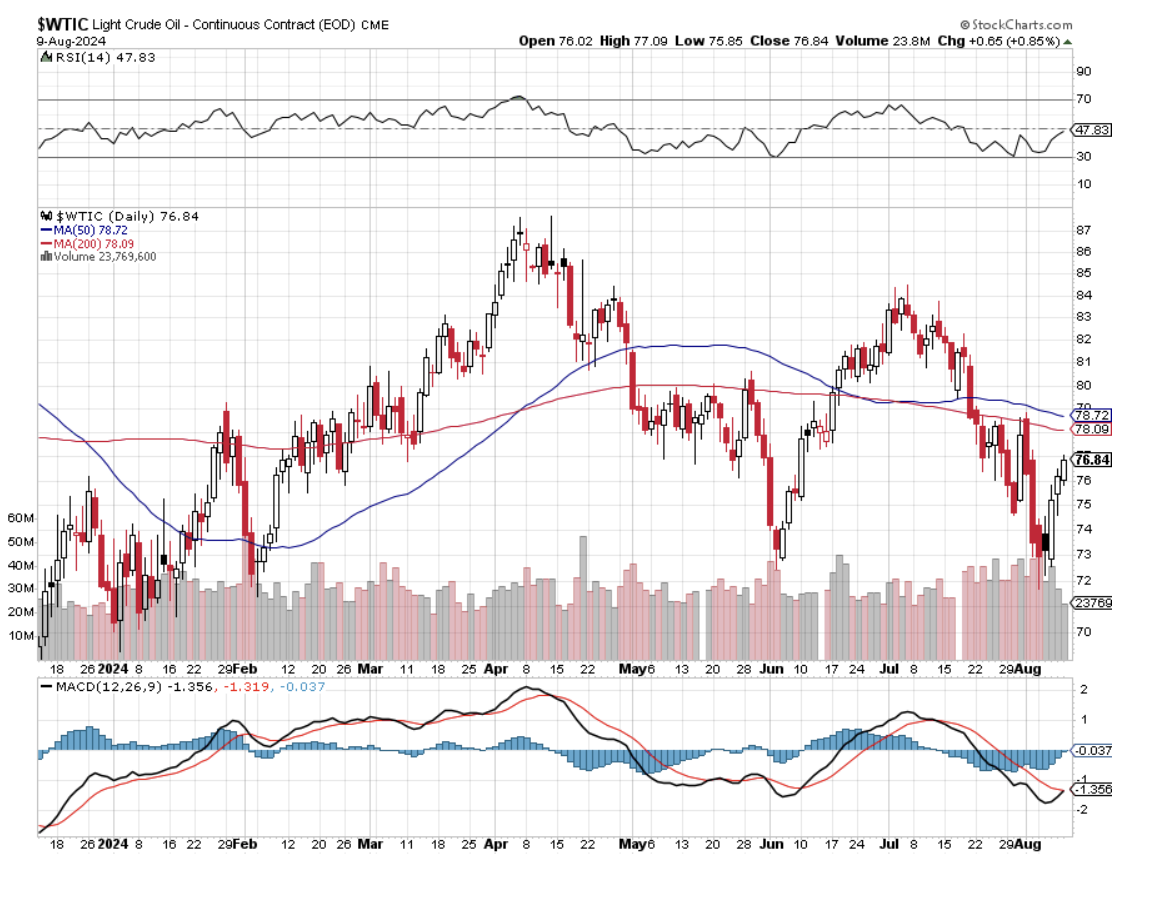

No Recession Here says shipping giant Maersk. U.S. inventories are not at a level that is worrisome says CEO Vincent Clerc, as fears of a recession in the world’s largest economy mount. Chinese exports have helped drive overall container demand in the most recent quarter reported a decline in year-on-year underlying profit to $623 million from $1.346 billion in the second quarter and a dip in revenue to $12.77 billion from $12.99 billion.

A Refi Boom is About to Begin. Mortgage rates in the high fives are now on offer. Over 40% of existing mortgages have rates of over 6%. It’s all driven by the monster rally in the bond market this week which took the (TLT) to $100 and ten-year US Treasury yields down to 3.65%.

Google (GOOG) Gets Hit with an Antitrust Suit, a Federal judge ruling that the company has a monopoly in search, with a 92% market share. The smoking gun was the $20 billion a year (GOOG) paid Apple (AAPL) to remain their exclusive search engine. Apple is the big loser here, which I just sold short.

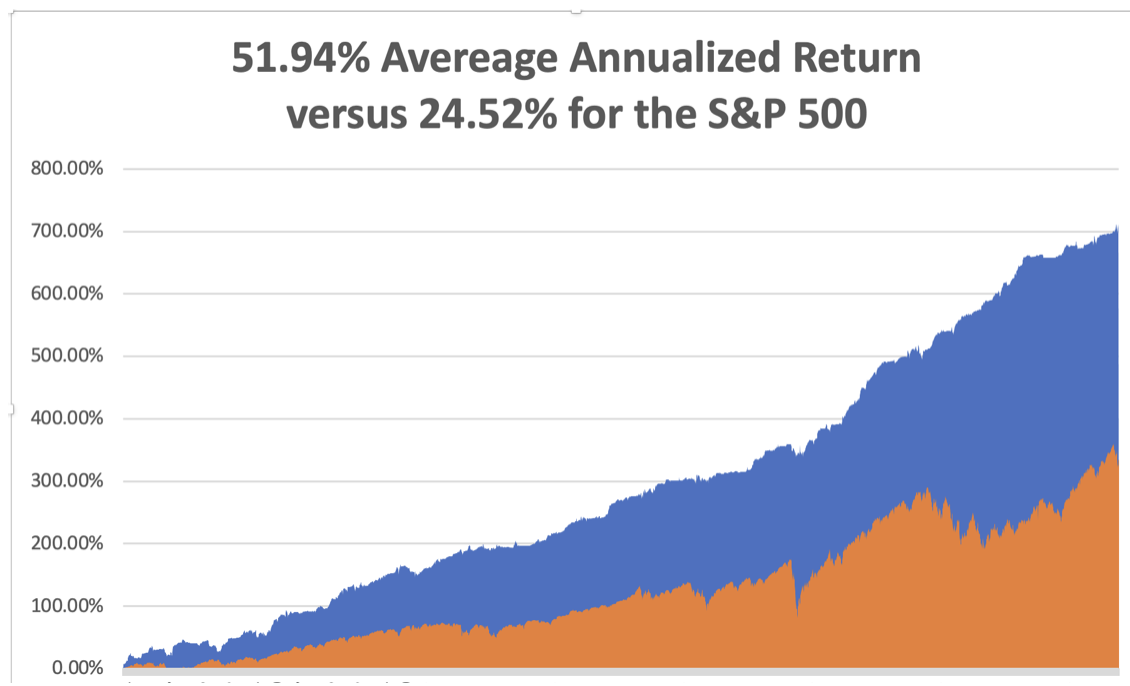

In July we ended up a stratospheric +10.92%. So far in August, we are up by +2.51% My 2024 year-to-date performance is at +33.45%. The S&P 500 (SPY) is up +7.34% so far in 2024. My trailing one-year return reached +51.92.

That brings my 16-year total return to +710.08. My average annualized return has recovered to +51.94%.

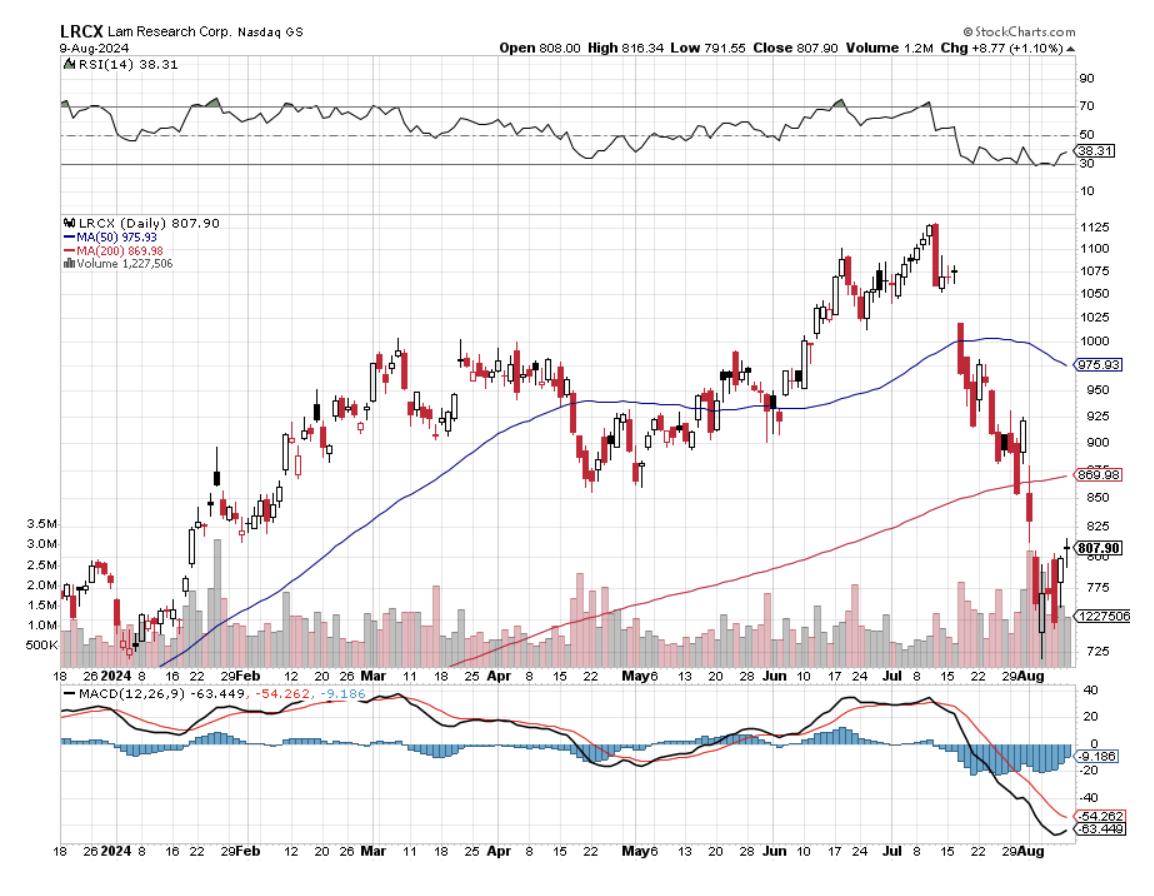

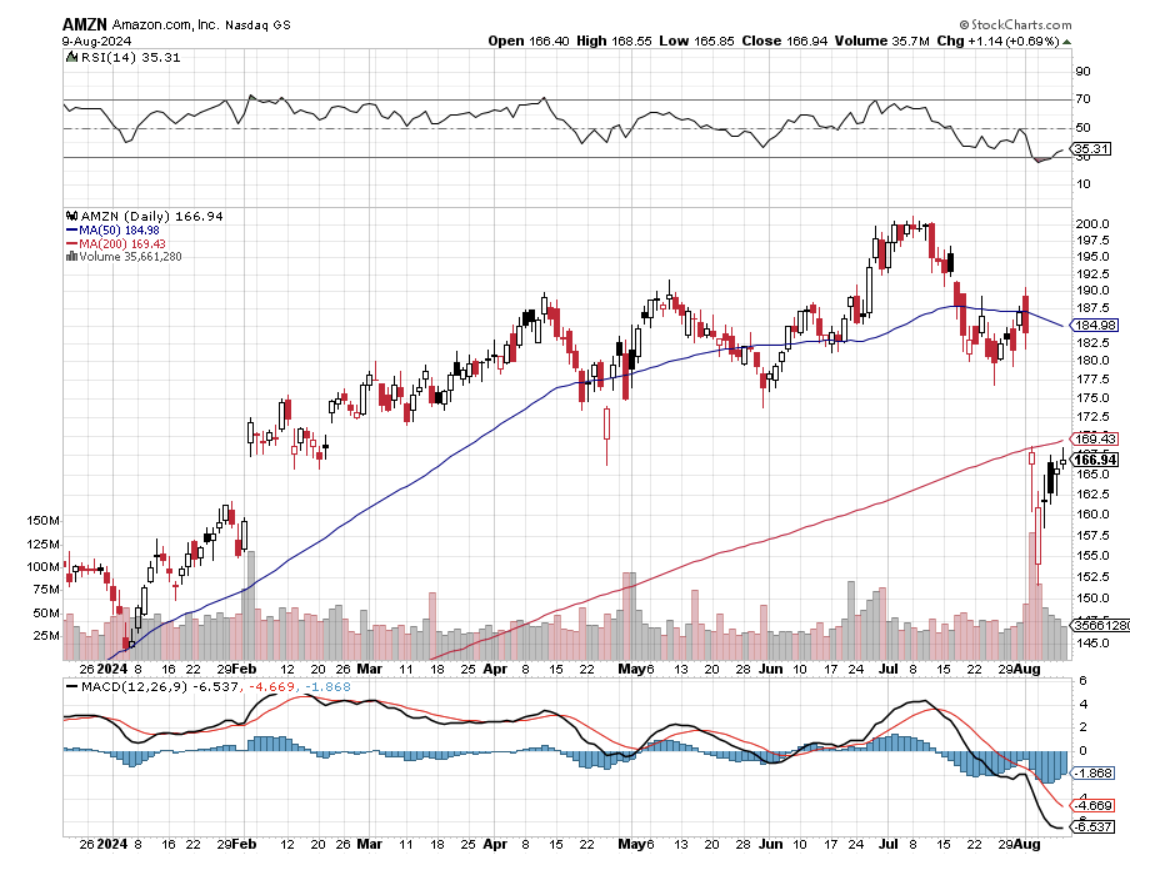

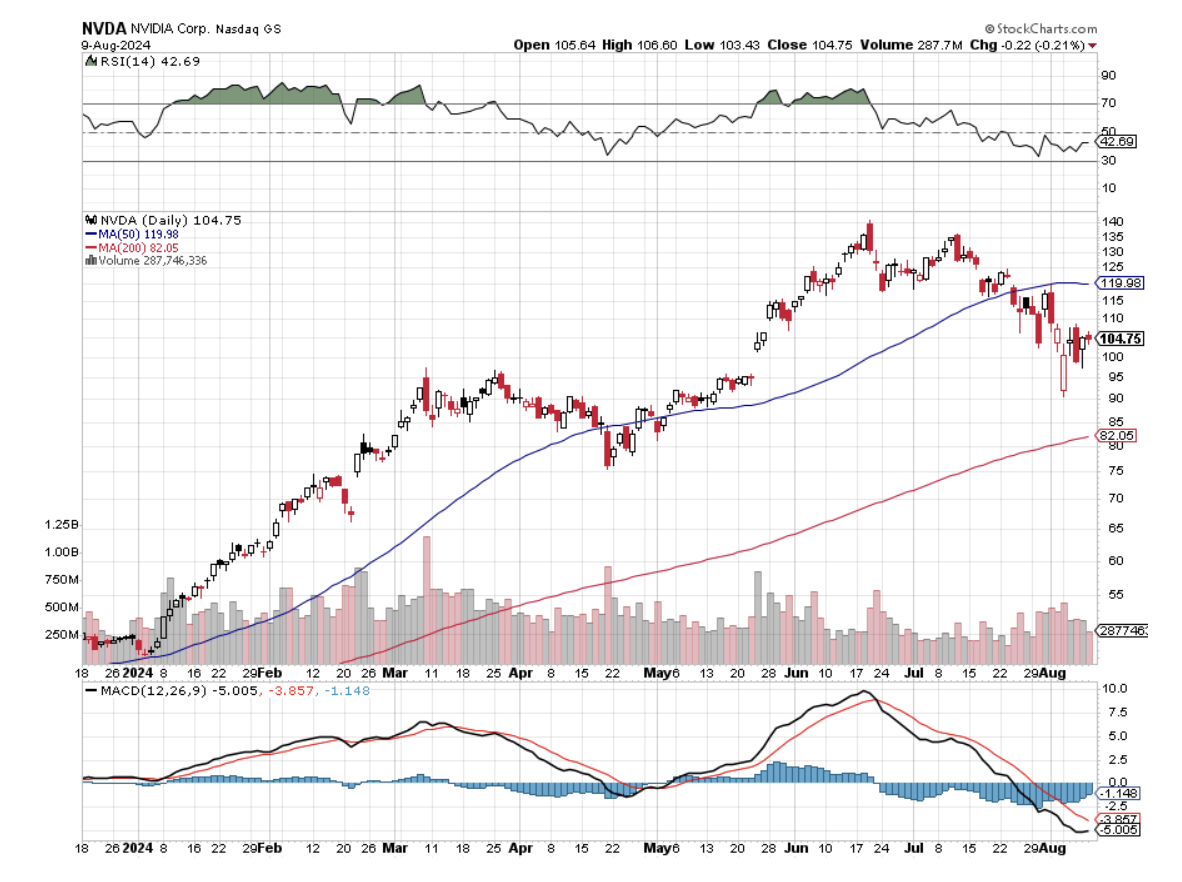

I used the market crash to stop out of three STOP LOSS positions in (CAT), (AMZN), and (BRK/B). When the ($VIX) hit $65 I then made all the losses back when I piled on four new technology longs in (NVDA), (TSLA), (AAPL), and (META). After the Dow Average ($INDU) rallied 2,000 points and volatility was still high I then pumped out short positions in (TSLA), (DHI), (DE), (AAPL), and (JPM). I stopped out of my position in (DE) at breakeven.

This is in addition to existing longs in (GLD) and (DHI), which I will likely run into the August 16 option expiration.

Some 63 of my 70 round trips, or 90%, were profitable in 2023. Some 48 of 66 trades have been profitable so far in 2024, and several of those losses were really break-even. That is a success rate of 72.73%.

If you were wondering why I was sending out so many trade alerts out last week it is because we were getting months’ worth of market action compressed into five days. Make hay while the sun shines and strike while the iron is hot!

Try beating that anywhere.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age or the next Roaring Twenties. The economy decarbonizing and technology hyper accelerating, creating enormous investment opportunities. The Dow Average will rise by 600% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, August 12 at 8:30 AM EST, the Consumer Inflation Expectations is out.

On Tuesday, August 13 at 9:30 AM, the Producer Price Index is published.

On Wednesday, August 14 at 8:30 AM, the new Core Inflation Rate is printed.

On Thursday, August 15 at 8:30 AM, the Weekly Jobless Claims are announced. Retail Sales are also printed.

On Friday, August 16 at 8:30 AM, Building Permits are disclosed. We also get the University of Michigan Consumer Sentiment. At 2:00 PM, the Baker Hughes Rig Count is printed.

As for me, with the overwhelming success of the Oppenheimer movie, I thought I’d review my long and fruitful connection with America’s nuclear program.

When the Cold War ended in 1992, the United States judiciously stepped in and bought the collapsing Soviet Union’s entire uranium and plutonium supply.

For good measure, my client George Soros provided a $50 million grant to hire every Soviet nuclear engineer. The fear then was that starving scientists would go to work for Libya, North Korea, or Pakistan, which all had active nuclear programs. They ended up here instead.

That provided the fuel to run all US nuclear power plants and warships for 20 years. That fuel has now run out and chances of a resupply from Russia are zero. The Department of Defense attempted to reopen our last plutonium factory in Amarillo, Texas, a legacy of the Johnson administration.

But the facilities were deemed too old and out of date, and it is cheaper to build a new factory from scratch anyway. What better place to do so than Los Alamos, which has the greatest concentration of nuclear expertise in the world?

Los Alamos is a funny sort of place. It sits at 7,320 feet on a mesa on the edge of an ancient volcano so if things go wrong, they won’t blow up the rest of the state. The homes are mid-century modern built when defense budgets were essentially unlimited. As a prime target in a nuclear war, there are said to be miles of secret underground tunnels hacked out of solid rock.

You need to bring a Geiger counter to garage sales because sometimes interesting items are work castaways. A friend almost bought a cool coffee table which turned out to be part of an old cyclotron. And for a town designing the instruments to bring on the possible end of the world, it seems to have an abnormal number of churches. They’re everywhere.

I have hundreds of stories from the old nuclear days passed down from those who worked for J. Robert Oppenheimer and General Leslie Groves, who ran the Manhattan Project in the early 1940s. They were young mathematicians, physicists, and engineers at the time, in their 20’s and 30’s, who later became my university professors. The A-bomb was the most important event of their lives.

Unfortunately, I couldn’t relay this precious unwritten history to anyone without a security clearance. So, it stayed buried with me for a half century, until now.

Some 1,200 engineers will be hired for the first phase of the new plutonium plant, which I got a chance to see. That will create challenges for a town of 13,000 where existing housing shortages already force interns and graduate students to live in tents. It gets cold at night and dropped to 13 degrees F when I was there.

I was allowed to visit the Trinity site at the White Sands Missile Test Range, the first visitor to do so in many years. This is where the first atomic bomb was exploded on July 16, 1945. The 20-kiloton explosion set off burglar alarms for 200 miles and was double to ten times the expected yield.

Enormous targets hundreds of yards away were thrown about like toys (they are still there). Half the scientists thought the bomb might ignite the atmosphere and destroy the world but they went ahead anyway because so much money had been spent, 3% of US GDP for four years. Of the original 100-foot tower, only a tiny stump of concrete is left (picture below).

With the other visitors, there was a carnival atmosphere as people worked so hard to get there. My Army escort never left me out of their sight. Some 78 years after the explosion, the background radiation was ten times normal, so I couldn’t stay more than an hour.

Needless to say, that makes uranium plays like Cameco (CCJ), NextGen Energy (NXE), Uranium Energy (UEC), and Energy Fuels (UUUU) great long-term plays, as prices will almost certainly rise and all of which look cheap. US government demand for uranium and yellow cake, its commercial byproduct, is going to be huge. Uranium is also being touted as a carbon-free energy source needed to replace oil.

At Ground Zero in 1945

What’s Left of a Trinity Target 200 Yards Out

Playing With My Geiger Counter

Atomic Bomb No.3 Which was Never Used on Tokyo

What’s Left from the Original Test

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

“The entire market is trading like a biotech stock,” said Steve Weiss, a portfolio manager.

(REGN), (MRNA), (BLK), (GS), (LMT), (NOC), (IBM), (GOOGL), (TRMB), (TSLA), (GM), (FDX), (UPS), (MSFT), (NVDA), (AI), (PLTR)

"In the world of AI, we're not in Kansas anymore, Toto," I muttered to myself as I stared at the latest headlines about OpenAI's Project Strawberry. Buckle up, Dorothy, because if you thought AI was already shaking things up, we're about to take a technicolor trip into a world where machines don't just crunch numbers - they reason like Einstein on steroids.

Sam Altman and OpenAI are teasing us with "strawberries" again. But this isn't farmer's market gossip.

We're talking about Project Strawberry, or Q* as the insiders call it, OpenAI's shot at artificial general intelligence (AGI) – AI that could outperform humans in most economically valuable tasks.

In fact, some OpenAI employees are so confident, they're betting their bottom dollar that Q* could be the AGI breakthrough we've all been waiting for.

Now, here's where it gets as exciting as finding a bull market in a sea of bears. Q* has been flexing its mathematical muscles, solving problems at a grade-school level.

You might think, "Big deal, my calculator can do that." But hold your horses. This isn't just about crunching numbers; it's about reasoning.

And that's where the investment landscape starts to shift dramatically. While your run-of-the-mill AI is busy predicting the next word in a sentence, Q* is laying the groundwork for revolutionizing scientific research and God knows what else.

Let's explore how some of the major players could harness this potential.

Imagine Regeneron Pharmaceuticals (REGN) and Moderna (MRNA) using this tech to turbocharge drug discovery. We could be looking at new wonder drugs hitting the market faster than you can say "artificial intelligence."

Or picture BlackRock (BLK) and Goldman Sachs (GS) wielding Q*'s mathematical prowess to create financial models so sophisticated they make Warren Buffett look like he's using an abacus.

And it doesn’t end there. Lockheed Martin (LMT) and Northrop Grumman (NOC) could use Q*'s brainpower to calculate missile trajectories that would make NASA green with envy.

Let's not forget IBM (IBM) and our old friend Alphabet (GOOGL) - they're betting big on quantum computing, and Q* could be the secret sauce that makes those quantum bits dance.

And if climate change got you down? Companies like Trimble (TRMB) could harness Q*'s capabilities to model climate patterns so accurately you'll know whether to pack sunscreen or an umbrella for your vacation next year.

As for all you Tesla (TSLA) and General Motors (GM) bulls out there, imagine self-driving cars with the reasoning power of a math genius. Your morning commute could become smoother than a well-aged scotch.

Even logistics giants like FedEx (FDX) and UPS (UPS) could use Q*'s mathematical magic to optimize their supply chains. Your packages might start arriving before you even realize you need them.

But we can't talk about AI without giving credit to the major tech players who are pushing it forward.

Microsoft (MSFT) is sitting pretty as OpenAI's sugar daddy. They've already plugged OpenAI's tech into Azure, and in Q2 2023, their AI-driven revenue in Azure shot up faster than a SpaceX rocket - we're talking 150% year-over-year growth.

If Project Strawberry delivers the goods, Microsoft will be first in line at the AI buffet.

Then there's Nvidia (NVDA), the company making the brains that power these AI behemoths. In Q3 2023, their data center revenue, fueled by AI hunger, exploded to $14.51 billion - that's a 279% year-over-year jump, folks.

As Project Strawberry and its AI cousins evolve, Nvidia's hardware will be hotter than beach sand in July.

Don't count out Alphabet either. While they're not in bed with OpenAI, they're no slouch in the AI department. Their Google Cloud platform saw revenue grow 22% year-over-year to $8.4 billion in Q3 2023.

As this AI arms race heats up, expect Alphabet to double down on their AGI efforts faster than you can say "Hey Google."

For those of you with a taste for smaller players, keep an eye on C3.ai (AI). These folks are serving up enterprise AI solutions like hotcakes at a lumberjack convention.

In Q2 fiscal 2024, they reported revenue of $73.2 million, up 17% year-over-year. If Project Strawberry proves its mettle, C3.ai could be swamped with clients faster than a trendy restaurant on Valentine's Day.

And let's not overlook Palantir Technologies (PLTR). Their big data analytics could get a serious boost from advancements in AI reasoning.

They reported Q3 2023 revenue of $558 million, up 17% year-over-year. If Project Strawberry's math skills translate to better data crunching, Palantir could be offering insights sharper than a samurai's sword.

With the global AI market projected to hit $407 billion by 2027, the AI revolution is here, serving up opportunities juicier than a prime rib at Peter Luger's.

As I said, we're not in Kansas anymore. Project Strawberry and its kind promise a world where AI doesn't just process, it ponders.

It's a brave new world, and it'll take more than ruby slippers to navigate. But for those willing to embrace the yellow brick road of innovation, the emerald city of profit awaits.

Just remember, in this Oz of AI, keep your wits sharp, your courage strong, and your heart big. Because in the end, there's no place like a well-informed portfolio. Now, if you'll excuse me, I've got some flying monkeys - I mean, market trends - to watch.

Mad Hedge Technology Letter

August 9, 2024

Fiat Lux

Featured Trade:

(WARNING SIGNS LITTER THE TECH NARRATIVE)

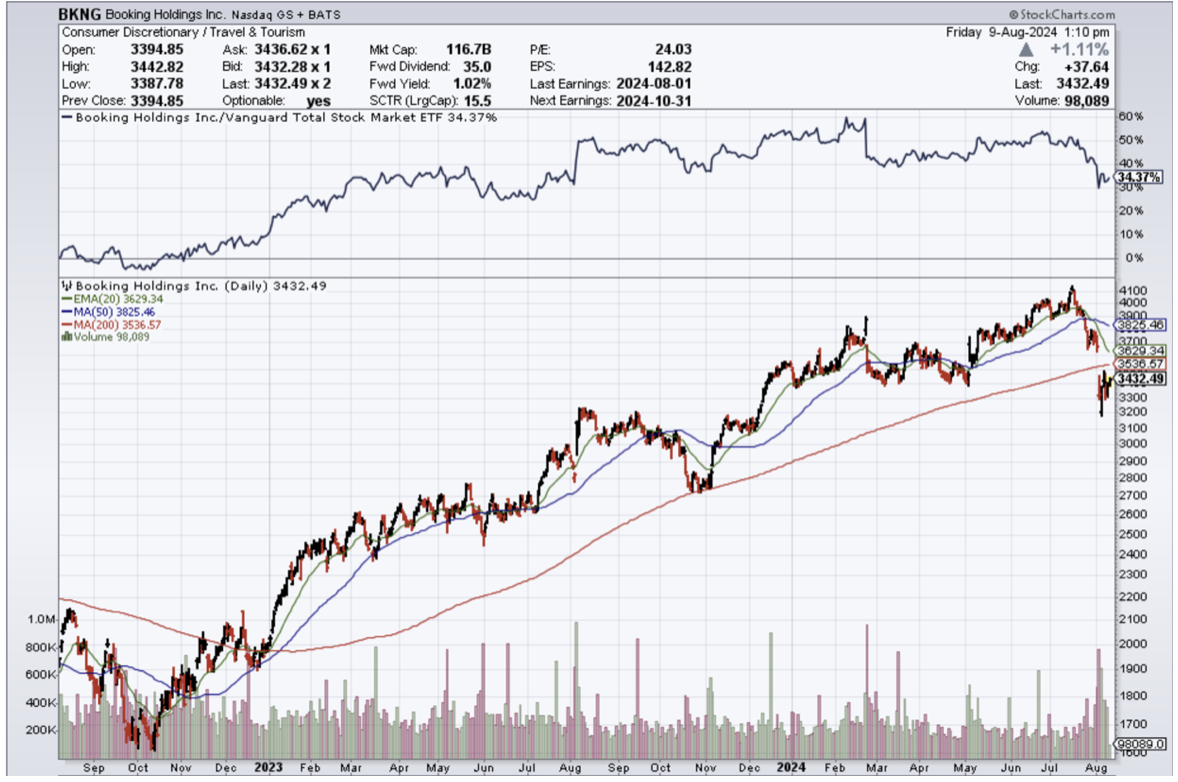

(ABNB), (BKNG), (EXPE)

It was early.

The real recession doesn’t kick into gear for another quarter or so.

This was just a quick fake-out.

The bond market freaking out and pricing in 1.25% Fed Funds’ cuts was a generous gift to tech stocks.

Why do I say that?

It is a dip in which we can get into tech prices at cheaper prices – probably the last time before the U.S. election.

We are starting to receive confirmation from many earnings reports that the consumer is starting to get cold feet.

The pullback in consumer strength runs the whole gamut from home improvement to restaurant eating.

I cover tech and the weakness is multi-pronged stemming from hardware to software.

The latest to ring the alarm about sluggish consumer spending was the digital accommodation platform Airbnb (ABNB).

Airbnb earned sales of $2.7 billion for the same quarter last year and now they have told investors that for next year they plan to target $2.5 billion of sales.

The culprit blamed by Airbnb management is the American consumer.

Americans are shortening their Airbnb stays and soon they could be sacrificing Airbnb altogether. Although we aren’t at that point yet, US consumers simply can’t stomach this new wave of price increases for the cost of living, and reigning back discretionary travel is this logical item to shave from the budget.

The second quarter continued a trend of decelerating bookings growth for Airbnb. The total value of all bookings through Airbnb grew 11% year over year to $21.2 billion for the three-month period. That's down from 12% booking growth in Q1, 15% growth in the final quarter of 2023, and 17% growth in September-ended third quarter of 2023.

In 2022 and 2023, Airbnb, Booking Holdings (BKNG), and Expedia Group (EXPE) benefited from a bounce-back in travel after the harsh lockdowns prevented many types of travel in 2020 and into 2021. So-called revenge travel powered strong sales growth for the companies. But the picture appears to be shifting.

It is hard to see the US consumer just bouncing back with a V-shaped trajectory and that could affect Airbnb sales.

Reports out of high costs states like Washington and New York peg $150,000 per year in income as “lower middle class.”

There has also been a huge migration shift from wealth moving out of blue states to red states in the hope of maintaining purchasing power through these high inflation times.

The fact of the matter is that $35 trillion in Federal debt is the most important topic for this upcoming U.S. President Election, but this topic has been completely sidelined from the national discourse.

This surely means higher debt down the road and a further deterioration in the US consumer profile.

Tech companies with large moats around their business models will get through these times, but for Airbnb, they don’t have this type of moat because consumers don’t necessarily need to travel. Consumers do need to eat, sleep, and drive a car to work.

They can simply just delay travel for a few years before they reload financially.

It is high time to unload stocks like Airbnb even if they are leaders in the home-sharing sub-sector in tech.

Airbnb shares are down around 32% in the past few months highlighting the need for overly expensive tech stocks to adjust to the new reality.

I do believe there is another leg down in shares before an optimal window to buy on the dip presents itself, but that appears to be around $90-$100 per share.

“Apple doesn't do hobbies as a general rule.” – Said CEO of Apple Tim Cook

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

(DON’T GET TOO COMFY – MORE CHOP & CHURN IS ON THE HORIZON)

August 9, 2024

Hello everyone.

ARE WE THERE YET?

Historically, it is rare for markets to put in correction lows in August. September and October are more likely to see an eventual bottom. So, be ready for equity market volatility in September.

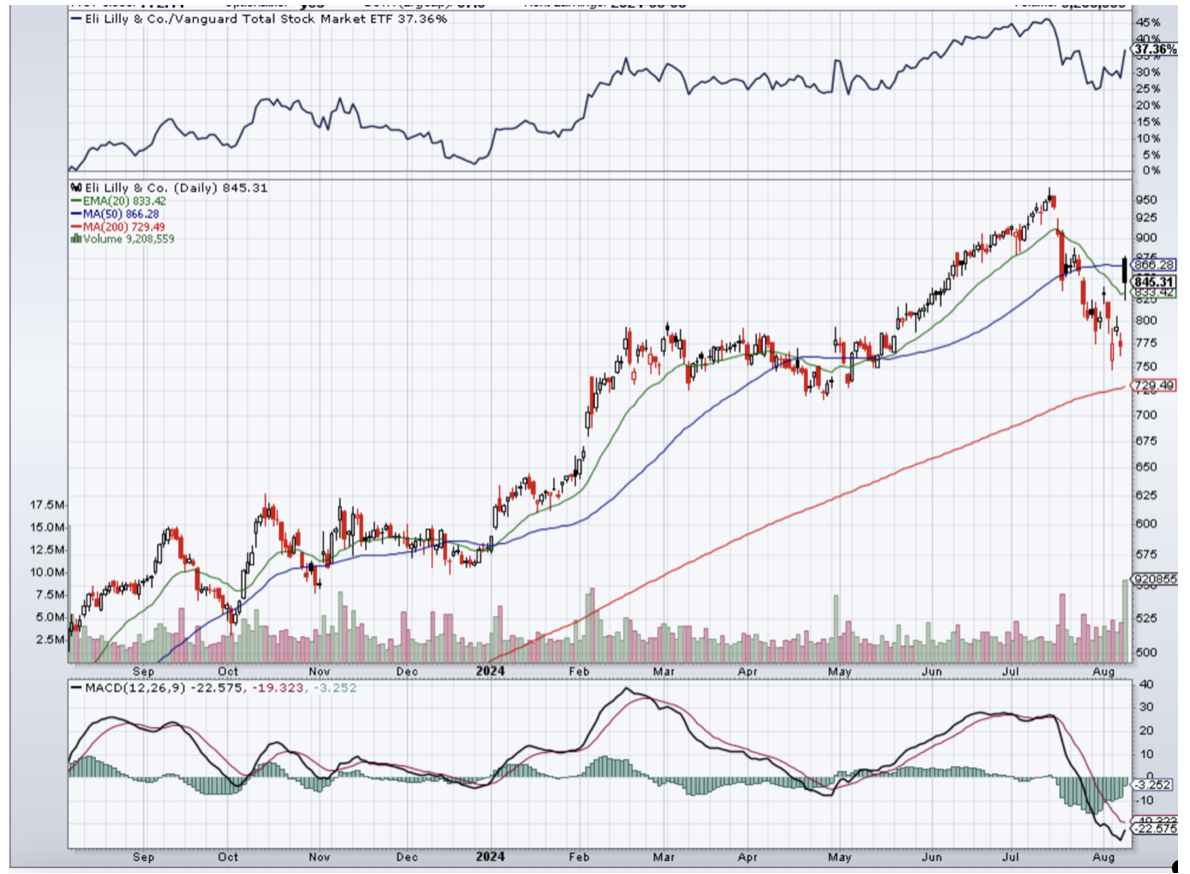

ELI LILLY(LLY)

Eli Lilly reported impressive second quarter earnings. Mounjaro, a prescription medication for Type 2 diabetes, and Zepbound, a prescription medicine for weight loss are two drugs by Eli Lilly seeing incredible demand. In its first full quarter in the U.S. market, Zepbound brought in $517.4 million in revenue. In the second quarter, it generated $1.24 billion in U.S. revenue.

Obesity affects nearly 42% of adults in the U.S. according to the latest data from the Centres for Disease Control and Prevention.

The demand for weight loss drugs in on the rise around the world. The global market for obesity medication is expected to hit $105 billion in 2030, according to Morgan Stanley’s research. That’s up from the firm’s forecast in September of $77 billion.

Drug manufacturers like Eli Lilly and Novo Nordisk, the pharmaceutical company that makes Ozempic and Wegovy, are racing to meet that demand. Both companies are investing billions to build new manufacturing plants to boost supply of the popular medications.

Eli Lilly was founded in 1876 and became a publicly traded company on the New York Stock Exchange in 1952.

$1000 invested in Eli Lilly 10 years ago would now be worth $13,143, an estimated percentage increase of 1,214%.

The lesson here is don’t try and attempt to use a company’s short-term performance to predict how well or how poorly it may do in the future. There will always be market fluctuations. The key is to stay the course and let the growth narrative unfold over time.

This is an item of interest, not a suggestion to buy (LLY) right now. But (LLY) is an excellent stock to hold for the long term.

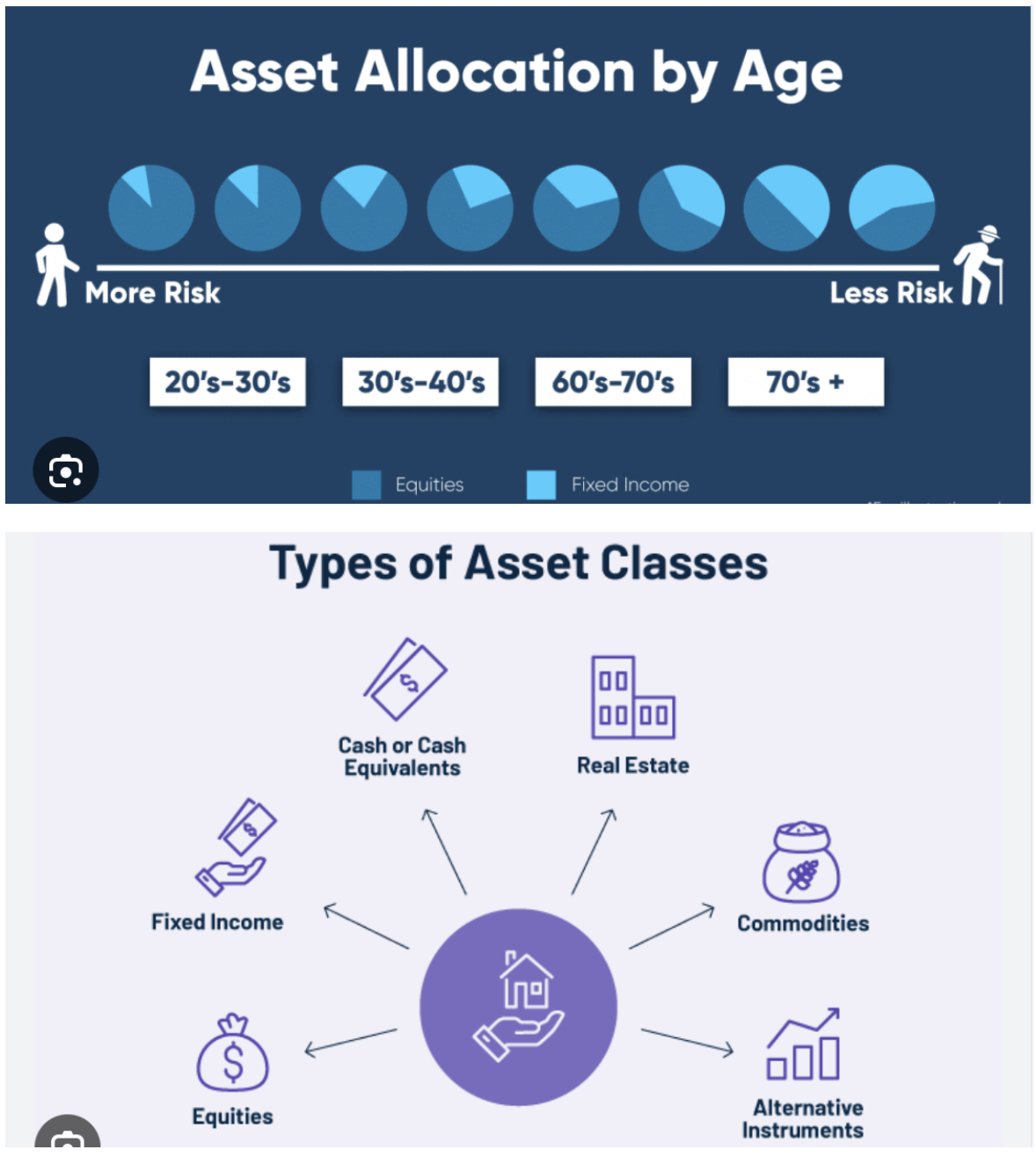

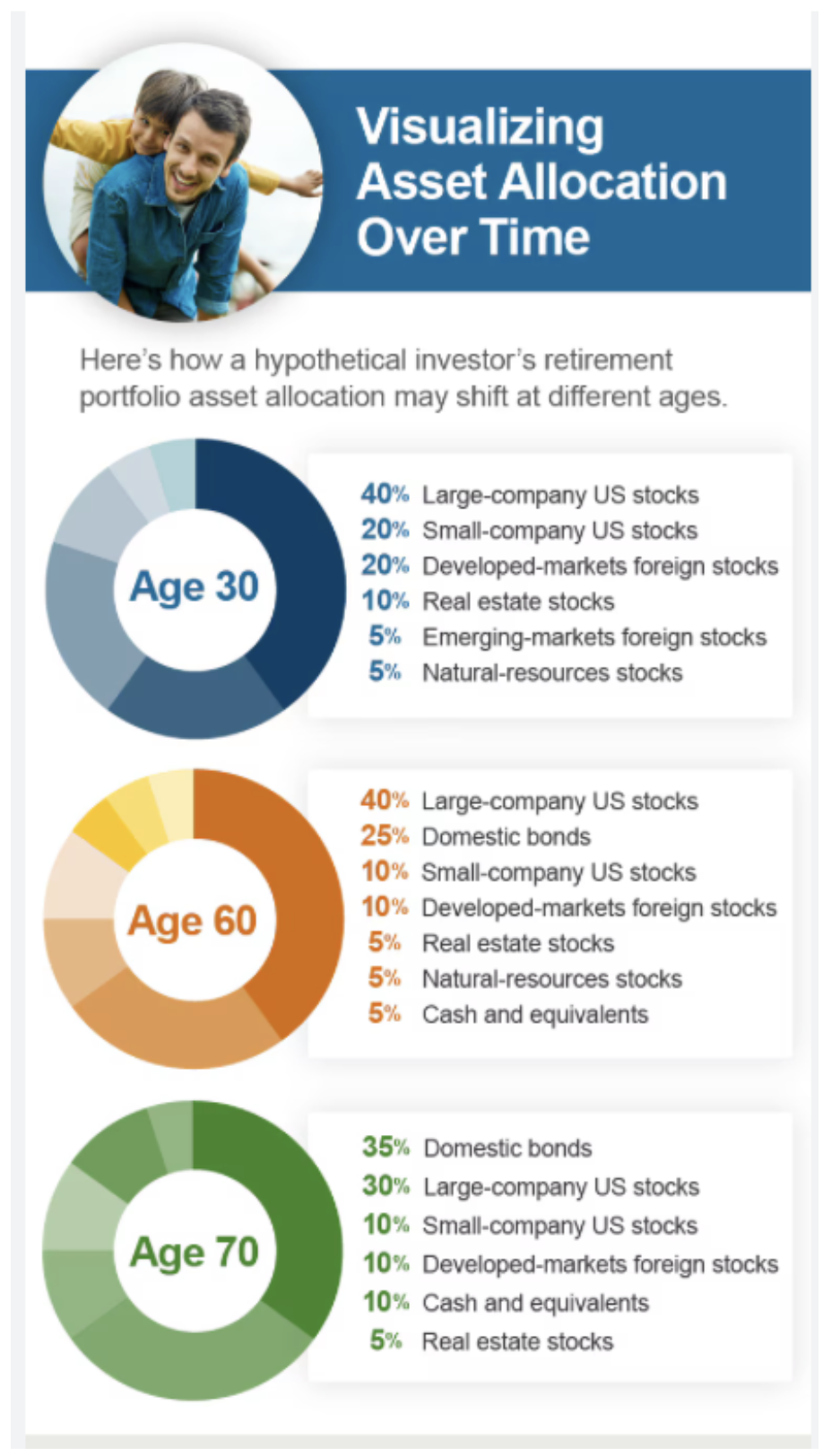

WHAT SHOULD MY PORTFOLIO LOOK LIKE?

An illustration of asset classes and allocations by age.

It is different for everyone.

So, one example does not fit all.

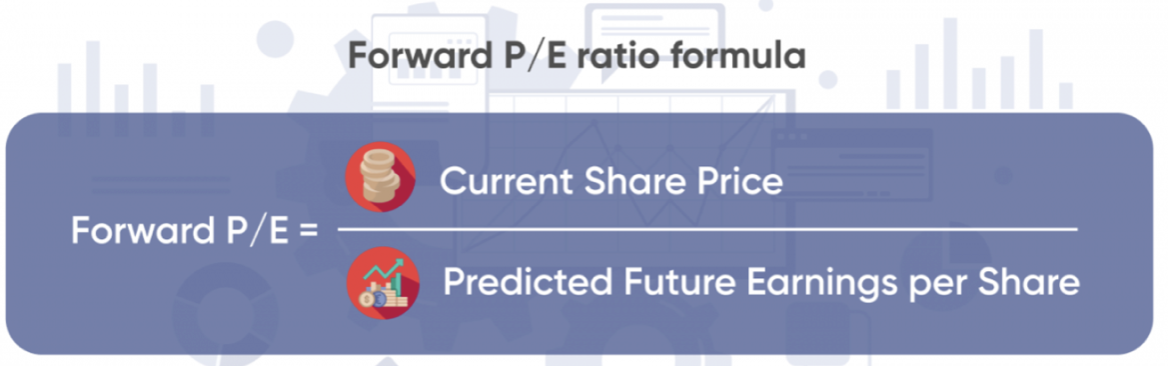

WHAT IS… FORWARD PRICE/ EARNINGS RATIO?

The forward price/earnings ratio is a measurement of value. It is found by dividing a stock’s most recent price by next year’s earnings per share estimate for the entire year. If that estimate is unavailable, then the estimate for the full current fiscal year is used.

For a better understanding of what forward price-to-earnings means, let’s look at an example. Let’s say a company’s current stock price is $25. Analysts estimate an EPS of $1.50 for the next quarter. Its forward P/E ratio would be 25/1.5=16.

Difference between forward P/E and trailing P/E

The main difference between standard P/E and the forward price-to-earnings definition is that the former uses actual EPS that has already been reported by a company, whereas the latter uses the EPS estimate.

The standard P/E is used to evaluate whether a company is overvalued or undervalued, whereas forward P/E ratio determines future estimated value.

Let’s look at an example. If the current price of a stock is $8 with the EPS of $1, and its earnings are expected to double in the next year to $2, the forward P/E ratio will be 4x, or half of the company’s value when it earned $1.

If the forward P/E is lower than the current P/E, analysts expect earnings to increase. On the other hand, when the forward P/E is higher than the current P/E ratio, analysts expect earnings to decrease.

QI CORNER

SOMETHING TO THINK ABOUT…

Cheers

Jacquie

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.