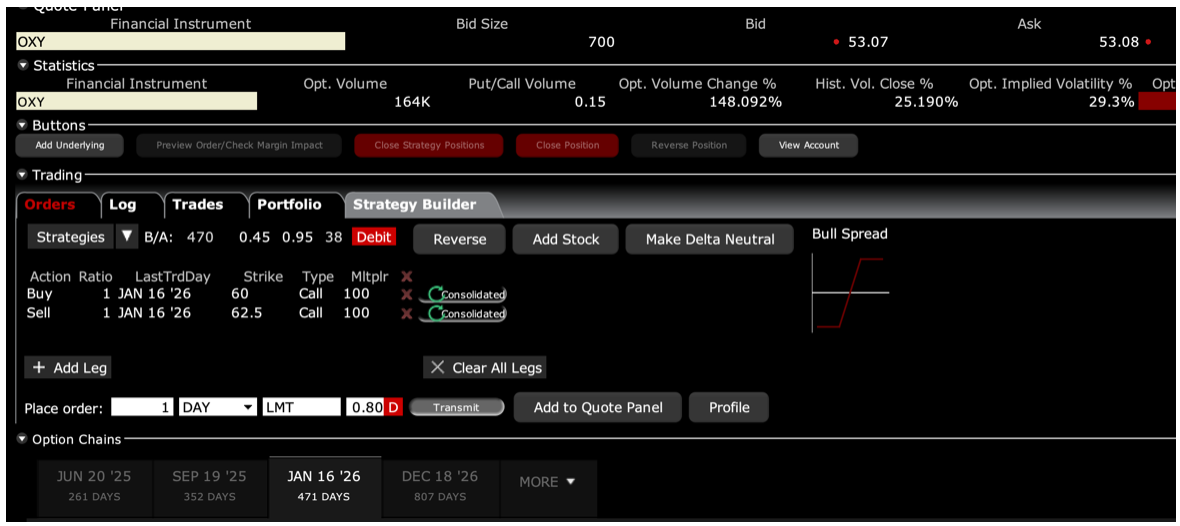

Trade Alert - (SLB) – BUY

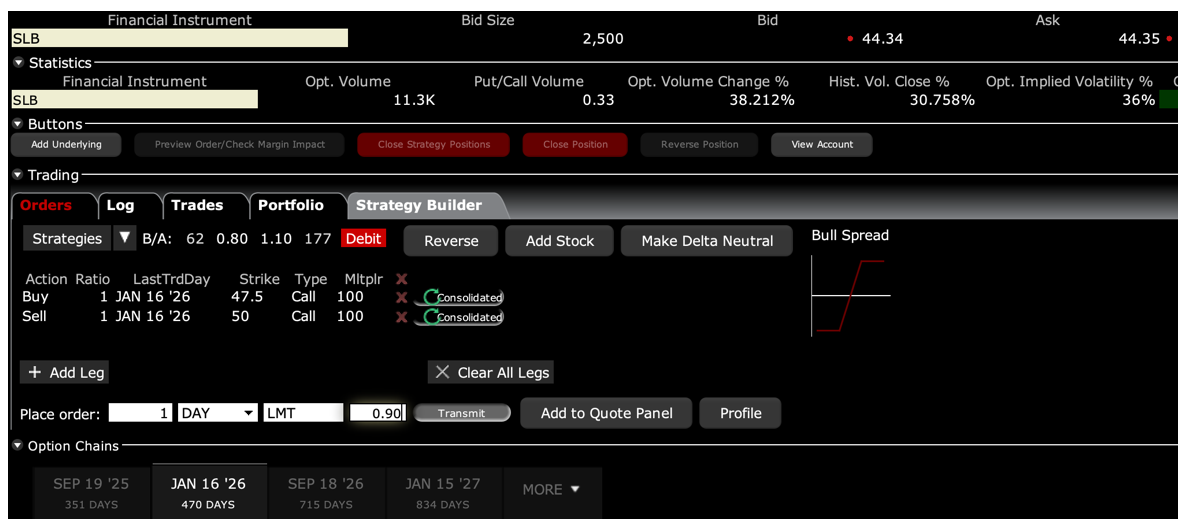

BUY the Schlumberger (SLB) January 2026 $47.50-$50 out-of-the-money vertical Bull Call spread LEAPS at $0.90 or best

Opening Trade

10-9-2024

expiration date: January 16, 2026

Number of Contracts = 1 contract

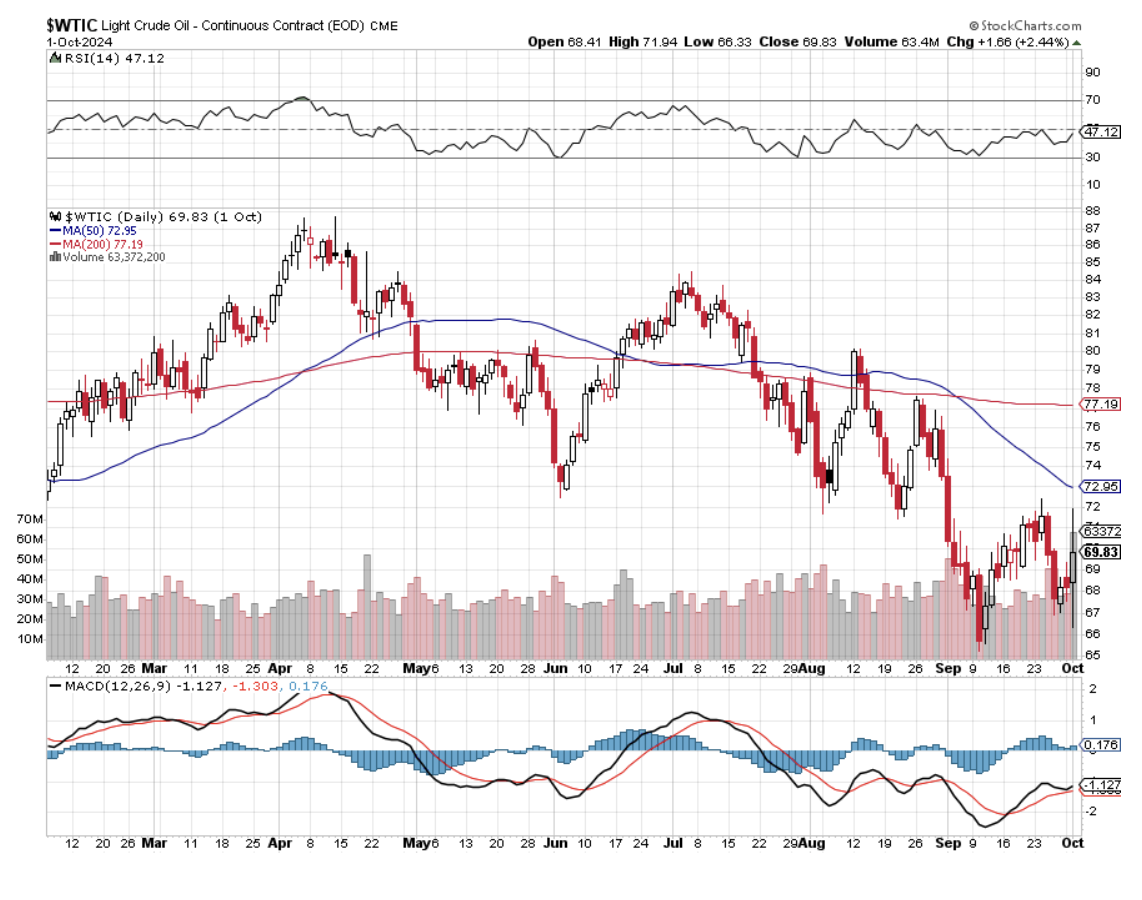

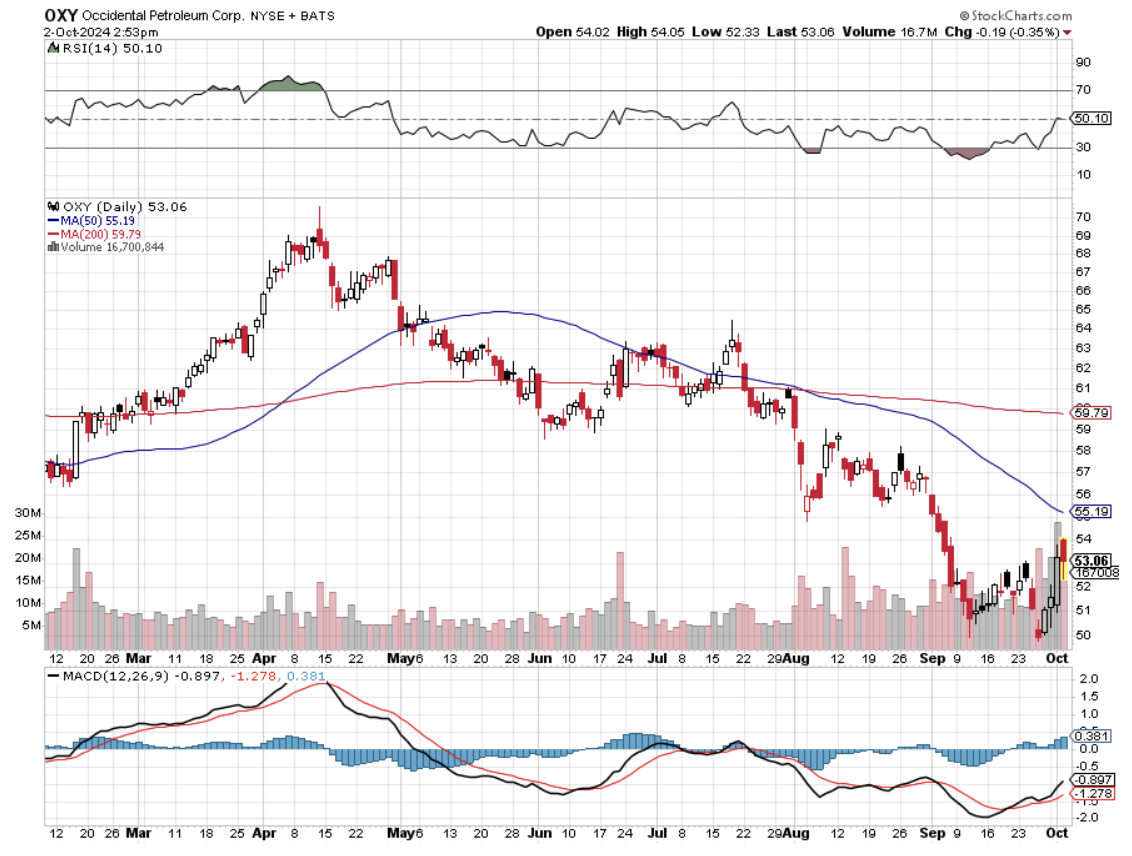

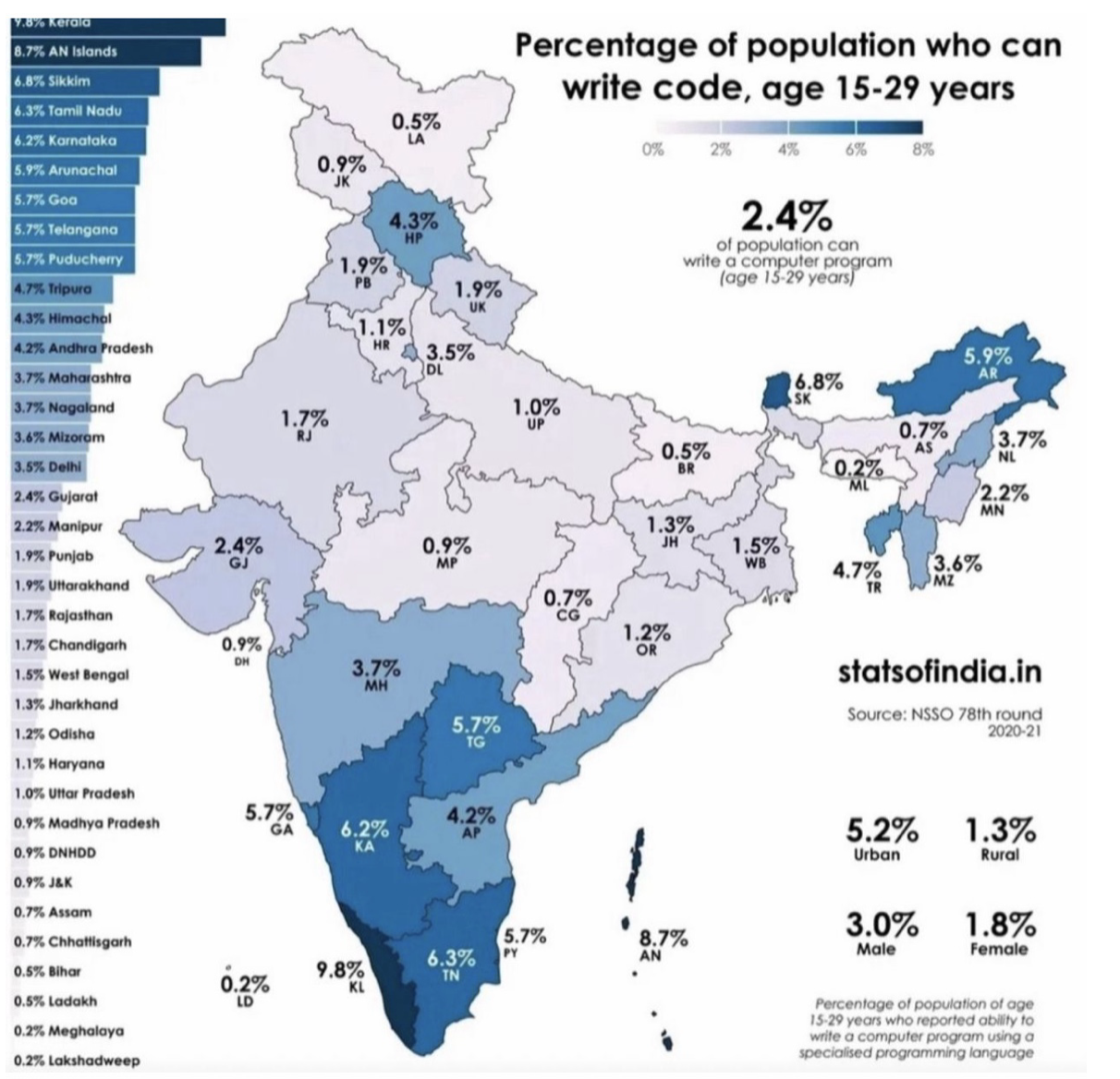

China certainly brought out a big bazooka with its massive stimulus package last week. If this one proves inadequate, they can bring out many more. Government agencies have also promised to invest $1 billion into Chinese stock markets. China is no longer the poor country I knew 50 years ago. For a start, they own $869 billion worth of US Treasury bonds.

And what is the best leverage China plays out there?

Oil.

It just so happens that energy is virtually the only cheap sector in the stock market and the worst stock market performer of 2024.

Oil consumption in China amounted to 16.6 million barrels per day in 2023, up from 15 million barrels daily in the prior year. That is 17.2% of the 96.4 million barrels in global oil production last year. Between 1990 and 2023, figures increased by more than 14 million barrels per day, up from 1 million barrels a day.

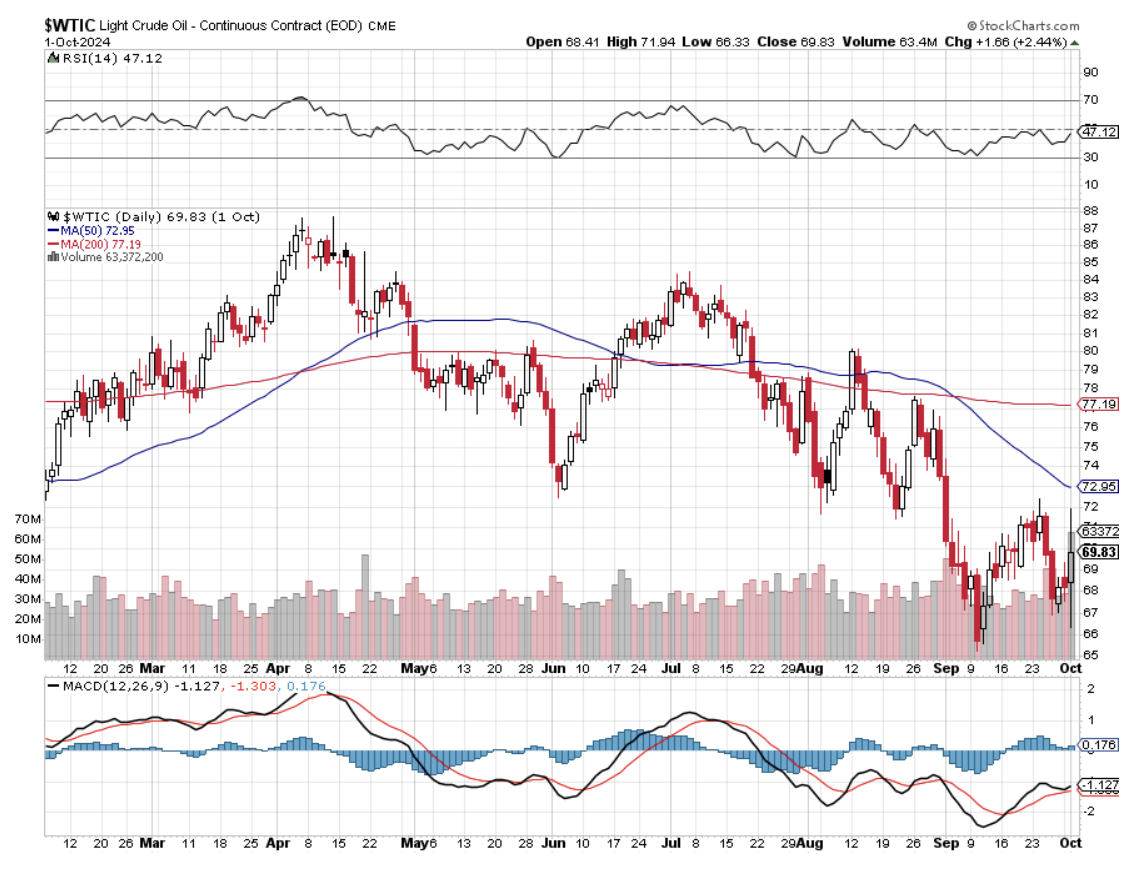

It has been China’s lagging economy that has dragged down the price of West Texas Intermediate Crude by 31%, from $94 a barrel to $65. China has published GDP growth figures this year of 5%, but most who know China well believe the real figure is close to zero. Get China back in business, and we could revisit $94 in no time.

We have just seen a healthy 34% correction in the shares of California-based oil major Schlumberger (SLB), and I am starting to salivate.

If you don’t do options, buy the stock. My target for (SLB) in 2025 is $65, up 20.3%.

I am therefore buying the Schlumberger (SLB) January 2026 $47.50-$50 out-of-the-money vertical Bull Call spread LEAPS at $0.90 or best

DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES.

Simply enter your limit order, wait five minutes, and if you don’t get done, cancel your order and increase your bid by 10 cents with a second order.

This is a bet that Schlumberger (SLB) will not fall below $50.00 by the January 16, 2026 option expiration in 15 months.

To learn more about the company, please visit their website at https://www.slb.com

Don’t pay more than $1.30 or you’ll be chasing on a risk/reward basis.

Please note that these options are illiquid, and it may take some work to get in or out. Executing these trades is more an art than a science.

Let’s say the Schlumberger (SLB) January 2026 $47.50-$50 out-of-the-money vertical Bull Call spread LEAPS at $0.90 are showing a bid/offer spread of $0.90-$1.50. Enter a good-until-cancelled order for one contract at $0.90, another for $1.00, another for $1.10, another for $1.20, and so on. Eventually, you will enter a price that gets filled immediately. That is the real price. Then, enter an order for your full position at that real price.

Notice that the day-to-day volatility of LEAPS prices is minuscule, less than 10%, since the time value is so great, and you have a long position simultaneously offset by a short one.

This means that the day-to-day moves in your P&L will be small. It also means you can buy your position over the course of a month just entering new orders every day. I know this can be tedious but getting screwed by overpaying for a position is even more tedious.

Look at the math below, and you will see that a 13.79% rise in (SLB) shares over 15 months will generate a 177% profit with this position, such is the wonder of LEAPS. That gives you an implied leverage of 12.84:1 Across the $47.50-$50 space. LEAPS stands for Long Term Equity Anticipation Securities.

(SLB) doesn’t even have to get to a new all-time high to make the max profit. It only has to get back to $50.00, where it traded in July.

Here are the specific trades you need to execute this position:

Buy 1 January 2026 (SLB) $47.50 calls at………….………$5.60

Sell short 1 January 2026 (SLB) $50.00 calls at…………$4.70

Net Cost:………………………….………..………….…..............$0.90

Potential Profit: $2.50 - $0.90 = $1.60

(1 X 100 X $1.60) = $160 or 177% in 15 months.

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled from Interactive Brokers.

If you are uncertain on how to execute an options spread, please watch my training video on “How to Execute a Vertical Bull Call Debit Spread” by clicking here at

https://www.madhedgefundtrader.com/ltt-vbcs/

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.