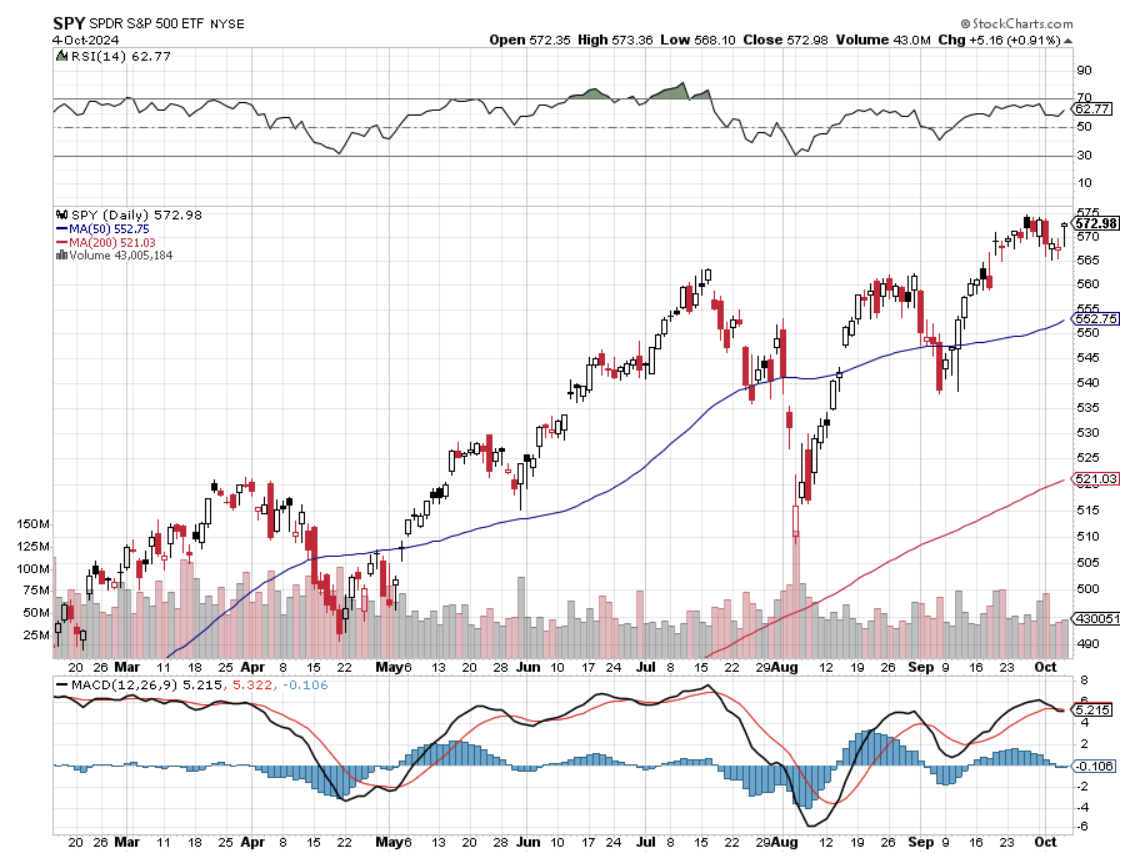

The 6,000 targets for the S&P 500 are starting to go mainstream.

That was my forecast on January 1, back when everyone said I was nuts. The inflation rate is 2.2%, GDP growth is 3.0%, and interest rates are falling sharply, on their way to 3.0% by next summer.

Goldilocks is back, but this time she’s on steroids.

Also helping is that we are in the midst of a global interest rate decline. The US, Europe, China, and Australia are all cutting interest rates at the same time. Japan is the sole exception, which is on the verge of raising rates from 0.25%. All of this has a compounding effect on the health of the global economy.

Long-term market veterans like myself are amazed, astounded, and astonished that here we are on October 7, and instead of testing new lows for the year, we are punching through to new all-time highs. It’s proof that if you live long enough, you see everything.

Some five seconds after Jay Powell cut interest rates by a shocking 0.50%, everyone in the world suddenly realized they had way too much cash and not enough stocks. This is the kind of market you get from that realization, one that doesn’t breathe, take a break, have a correction, nor let in outsiders.

Further confusing matters is that we are witnessing the most contentious presidential elections in history. One party is proclaiming how great the US economy is, while the other is claiming it is the worst ever.

Those who believed the former description are having a great year. Those who bought the latter are having an awful one, with many owning no stocks at all. Fortunately, election concerns will disappear in four weeks not to return for four years. This is hugely positive for stocks.

But as all steroid users eventually find out, they cause impotence, sterility, and cancer, so enjoy while it lasts. That may be a mid-2025 or 2026 event.

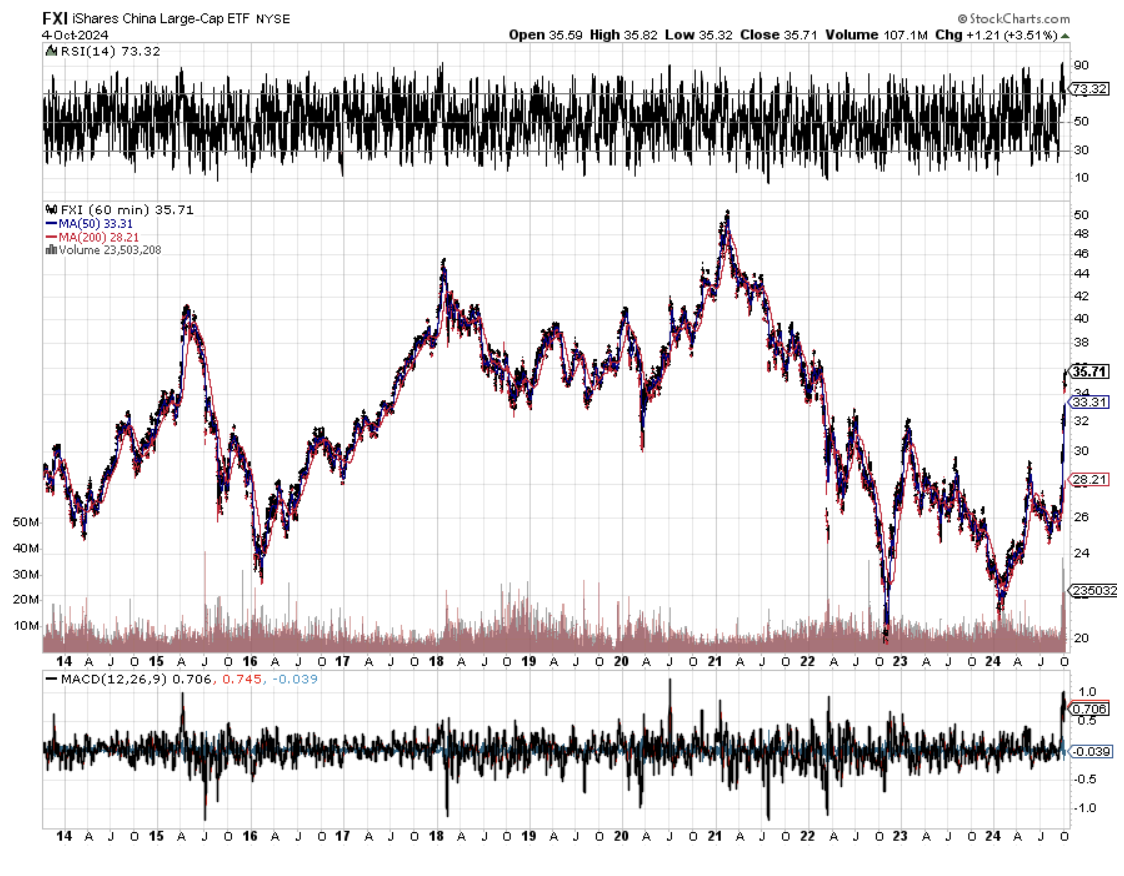

China (FXI) came back with a vengeance. A 25% rise in a stock market in a week is not to be taken lightly, although a lot of this was short covering. Pouring gasoline on the fire is a government promise to buy $1 billion worth of stocks.

The question bedeviling all investors is whether China is a one-hit wonder or is it reborn again. I know that if this stimulus package doesn’t work, they have the resources to follow up with many more. But there is a bigger problem.

Chinese stock markets have not exactly done well since Xi Jinping came into power in 2013. In fact, they are exactly unchanged. During the same period, the (SPY) was up 308%, and the NASDAQ ($COMPQ) was up 525%. Many investors, like my old friend hedge fund legend Paul Tudor Jones, don’t want to touch China until Xi vacates the scene.

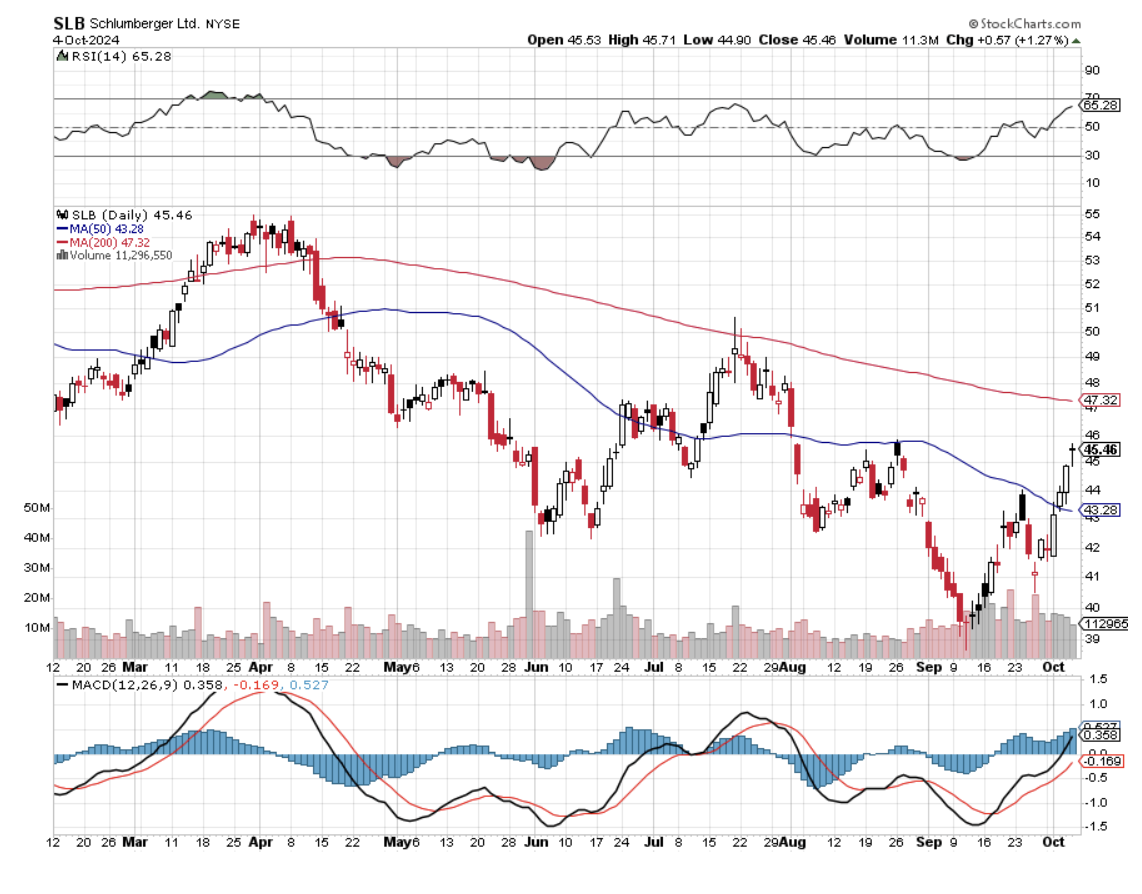

In any case, if you want to play China, the best risk-adjusted plays are not there but here in the US. Any US blue chip oil play (OXY) (SLB) would be a great choice, as China is the world’s largest oil consumer. Oil happens to be the cheapest and worst-performing sector in the stock market. And you don’t have to worry about a CEO getting rolled up in a carpet and disappearing for a few years, as has happened in the Middle Kingdom. At least here, you get all the US investor protections.

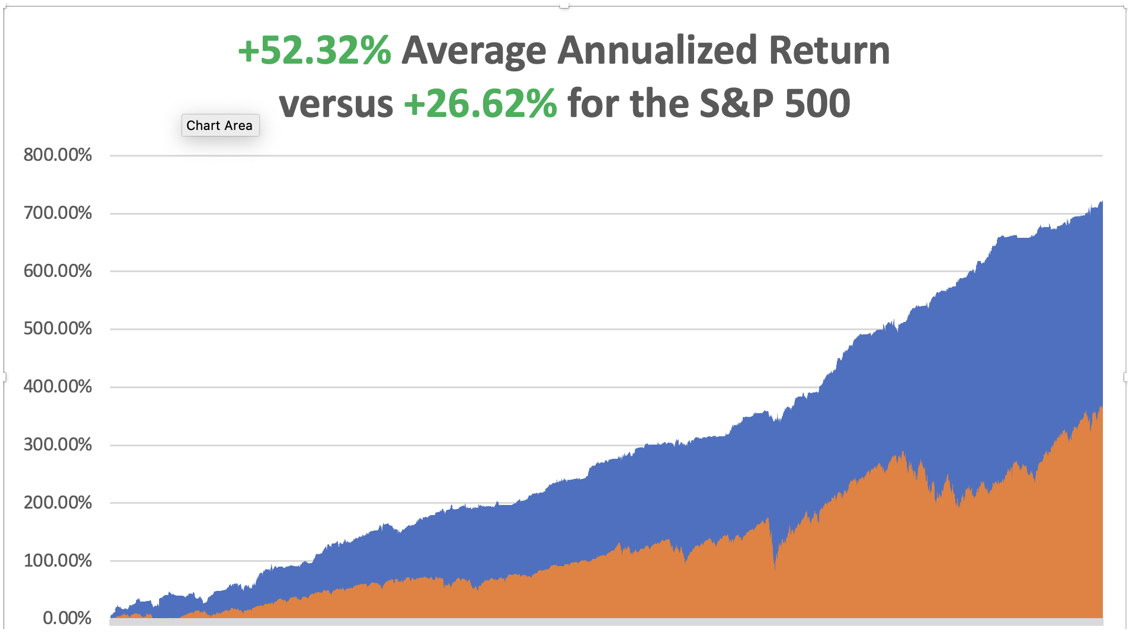

We closed out September with a blockbuster +10.28% profit. My 2024 year-to-date performance is at +44.97%. The S&P 500 (SPY) is up +19.92% so far in 2024. My trailing one-year return reached a nosebleed +62.77. That brings my 16-year total return to +721.60. My average annualized return has recovered to +52.32%.

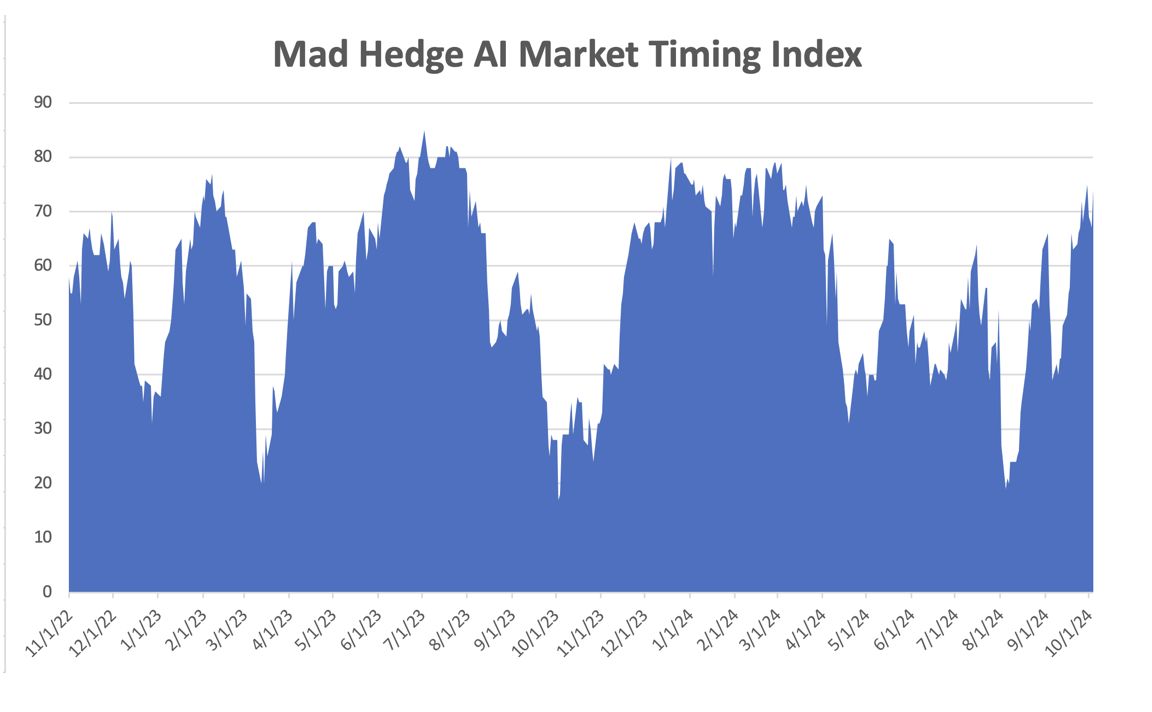

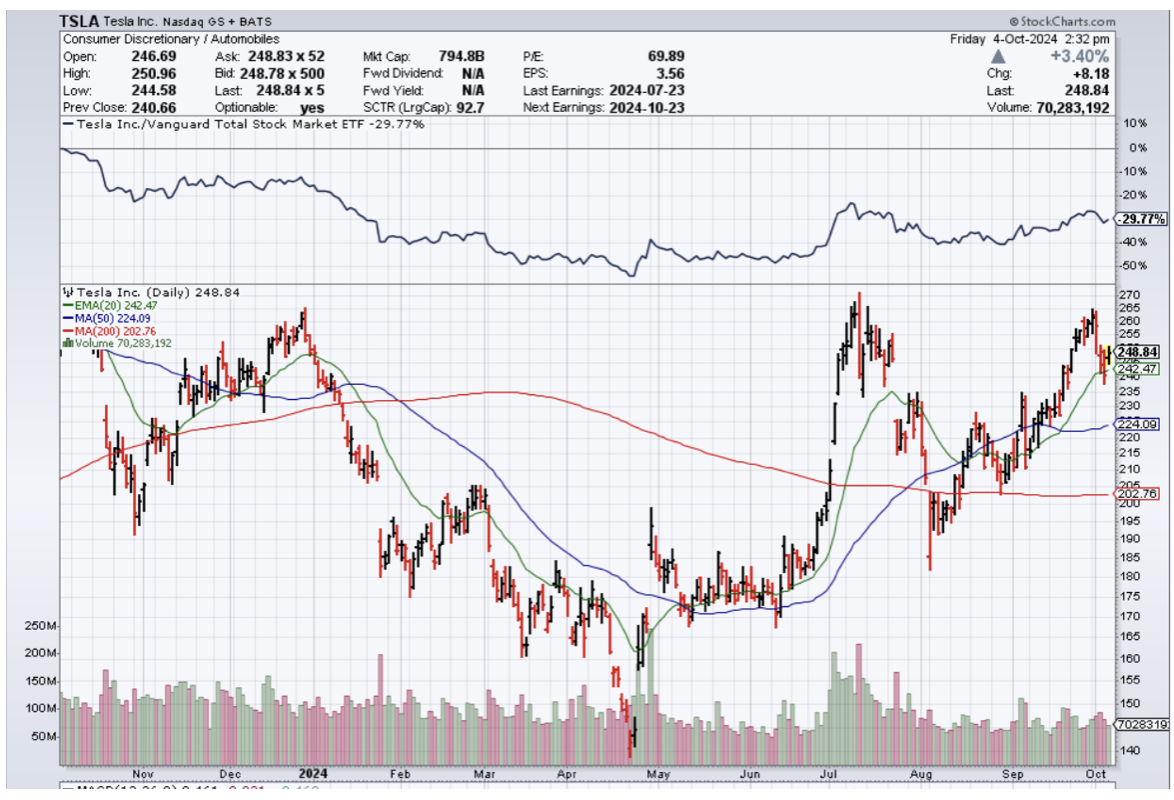

With my Mad Hedge Market Timing Index at the 70 handles for the first time in five months, it was a good week to take profits. I sold longs in (CCJ) and (TSLA) and covered a short in (TLT). I stopped out of my long in (TLT) because of the blowout September Nonfarm Payroll Report on Friday.

This is what we’ve got left:

Risk On

(NEM) 10/$47-$50 call spread 10.00%

(TSLA) 10/$200-$210 call spread 10.00%

(DHI) 10/$165-$175 call spread 10.00%

Risk Off

NO POSITIONS 0.00%

Total Net Position 30.00%

Some 63 of my 70 round trips, or 90%, were profitable in 2023. Some 58 of 77 trades have been profitable so far in 2024, and several of those losses were really break evens. Some 16 out of the last 17 trade alerts were profitable. That is a success rate of +75.32%.

Try beating that anywhere.

September was Great, but October is Looking Tough, right on the doorstep of the November 5 election and the market waiting for another interest rate cut on November 6. I think I’ll run out the positions I have into the October 18 options expirations, then wait for the market to come to me. I am up too much this year to take on needless risk.

Nonfarm Payroll Report Comes in Hot, as US employers added 254,000 jobs in September, topping economists’ estimates. The payroll gain, the biggest advance since March, was led by leisure and health care. The headline Unemployment Rate fell to a three-month low of 4.1%.

Interactive Brokers Starts US Election Forecast Trading on the heels of a federal court ruling in their favor. The following Forecast Contracts on US election results will be available:

*Will Kamala Harris win the US Presidential Election in 2024?

*Will Donald Trump win the US Presidential Election in 2024?

Plus a dozen other election outcomes. The opening bids were 49% for Harris and 50% for Trump.

The port Strike is Settled with a 62% six-year settlement. The bananas were rotting. 54 container ships queued outside ports, risking shortages. The Strike cost the U.S. economy $5 billion/day. Shipping stocks tumble across Asia and Europe. Expect the US to move to full automation, where Europe went 30 years ago.

EC Imposes 45% Tariffs on Chinese EVs in a desperate bid to save the local car industry. The Commission, which oversees the bloc's trade policy, has said it would counter what it sees as unfair Chinese subsidies after a year-long anti-subsidy investigation, but it also said on Friday it would continue talks with Beijing. Expect the same to follow in the US.

A possible compromise could be to set minimum sales prices.

Hedge Funds Stampede into China on news that government agencies promised to pour $1 billion into local stock markets. Chinese equities saw the largest net buying ever from hedge funds last week, marking the most powerful weekly purchase on record, according to Goldman Sachs prime brokerage data.

Weekly Jobless Claims Climb to 225,000, not straying too far from a four-month low touched in the prior week. That is an increase from an upwardly-revised mark of 219,000 last week, data from the Labor Department showed on Thursday. Economists had anticipated 222,000.

Will This Crisis Take Gold to $3,000? Almost certainly, yes, given the way the barbarous relic traded yesterday. Buy all gold (GLD), plays on dips, the metal, ETFs, futures, and miners.

Tesla Bombs, with Q3 deliveries down flat, but the shares fell only 5%. Total deliveries came in at 462,890, while total production was 469,796. YOY Tesla is facing increased competitive pressure, especially in China, from companies like BYD and Geely, along with a new generation of automakers, including Li Auto and Nio.

US Car Makers Get Slaughtered, with Stellantis stock falling by double digits after the Jeep maker cut its 2024 financial guidance, citing deteriorating industry dynamics and Chinese competition. The warning, amid similarly negative news from other car makers, also dragged down shares of (F) and (GM). Avoid the auto industry except for (TSLA).

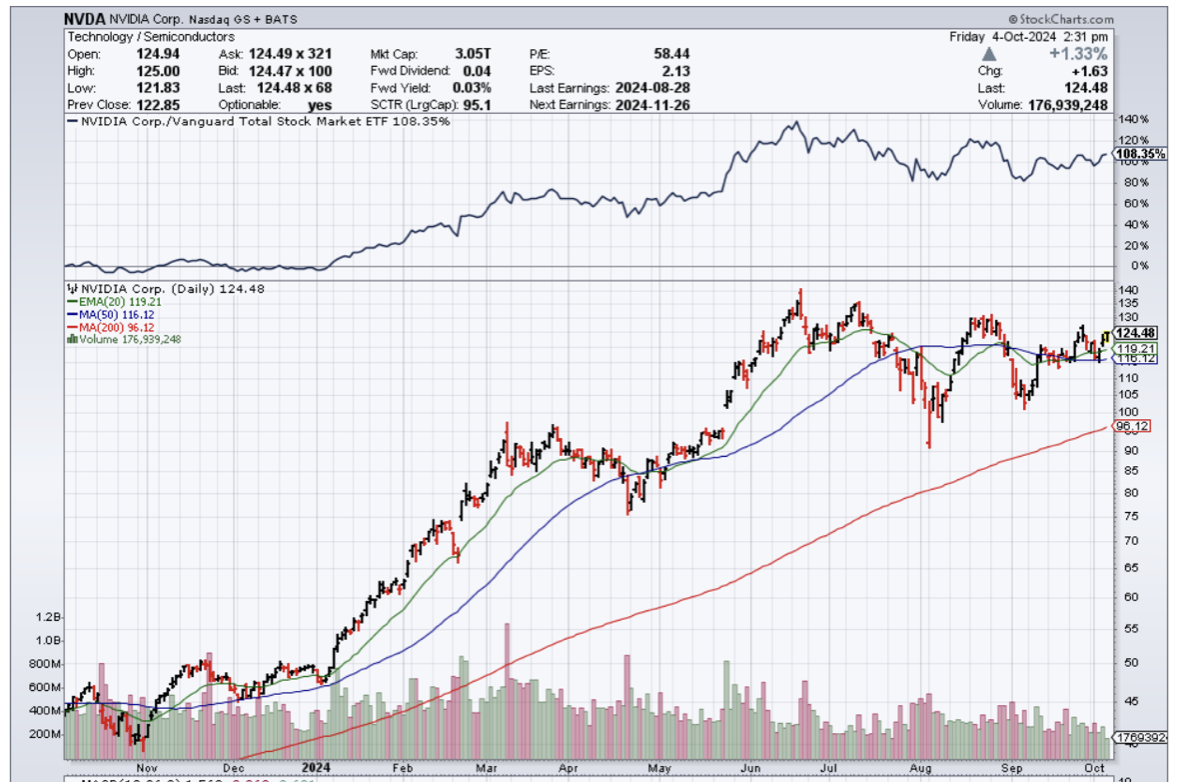

Nvidia Still has more to Run, so says Samantha McLemore, the founder and Chief Investment Officer of Patient Capital Management. Nvidia has been crushing every quarter for a year. CEOs want to make the decision to invest more [in AI] rather than getting caught behind. She doesn’t see the bull market ending soon. Current operating profit margins are 65%. Buy (NVDA) on dips.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age or the next Roaring Twenties. The economy is decarbonizing, and technology hyper accelerating, creating enormous investment opportunities. The Dow Average will rise by 600% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, October 7 at 8:30 AM EST, Used Car Prices are out

On Tuesday, October 8 at 6:00 AM, the NFIB Business Optimism Index is released.

On Wednesday, October 9 at 11:00 PM, the Fed Minutes from the last meeting is printed.

On Thursday, October 10 at 8:30 AM, the Weekly Jobless Claims are announced. We also get the Consumer Price Index.

On Friday, October 11 at 8:30 AM EST, the Producer Price Index and the University of Michigan Consumer Price Index are announced. At 2:00 PM, the Baker Hughes Rig Count is printed.

As for me, dentists find my mouth fascinating as it is like a tour of the world. I have gold inlays from Japan, cheap ceramic fillings from Britain’s National Health, and loads of American silver amalgam, which are now going out of style because of their mercury content.

But my front teeth are the most interesting as they were knocked out in a riot in Paris in 1968.

France was on fire that year. Riots on the city’s South Bank near Sorbonne University were a daily occurrence. A dozen blue police buses packed with riot police were permanently parked in front of the Notre Dame Cathedral, ready for a rapid response across the river. They did not pull their punches.

President Charles de Gaulle was in hiding at a French air base in Germany. Many compared the chaos to the modern-day equivalent of the French Revolution.

So, of course, I had to go.

This was back when there were five French francs to the US dollar, and you could live on a loaf of bread, a hunk of cheese, and a bottle of wine for a dollar a day. I was 16 years old.

The Paris Metro cost one franc. To save money, I camped out every night in the Parc des Buttes Chaumont, which had nice bridges to sleep under. When it rained, I visited the Louvre, taking advantage of my free student access. I got to know every corner. The French are great at castles….and museums.

To wash, I would jump in the Seine River every once in a while. But in those days, not many people in France took baths anyway.

I joined a massive protest one night, which originally began over the right of men to visit the women’s dorms at night. Then the police attacked. Demonstrators came equipped with crowbars and shovels to dig up heavy cobblestones dating to the 17th century to throw at the police, who then threw them back.

I got hit squarely in the mouth with an airborne projectile. My front teeth went flying, and I never found them. I managed to get temporary crowns, which lasted me until I got home. I carry a scar across my mouth to this day.

I visited the Left Bank again just before the pandemic hit in 2019. The streets were all paved with asphalt to make the cobblestones underneath inaccessible. I showed my kids the bridges I used to sleep under, but they were unimpressed.

But when I showed them the Mona Lisa at the Louvre, she was as enigmatic as ever. The kids couldn’t understand what the fuss was all about.

Everyone should have at least one Paris in 1968 in their lifetime. I’ve had many and am richer for it.

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

1968 in Paris

2019 in Paris on Top of the Eiffel Tower