After decades of watching healthcare stocks, I've learned one immutable truth - demographics always win. And right now, demographics are handing UnitedHealth Group (UNH) the keys to the kingdom.

The numbers tell an impressive story. UnitedHealth just reported Q3 2024 revenue of $100.82 billion, up 9.2% year-over-year. That's a billion dollars above what Wall Street expected, even after weathering a nasty cyberattack on their Change Healthcare unit in February.

Let's put this in perspective. By 2031, America's national health expenditure will hit $7.17 trillion - more than the GDP of Japan and Germany combined. This isn't just another growth story.

Besides, having managed hedge fund money through multiple market cycles, I’d like to think that I know the difference between lucky timing and structural advantage. From the looks of how things are going, UnitedHealth has engineered themselves the latter.

The company's UnitedHealthcare segment tells only part of the story, bringing in $74.85 billion in Q3, up 7.2% from last year.

Their Medicare Advantage enrollment grew from 7.65 million to 7.81 million people, while their U.S. commercial health plans expanded from 27.25 million to 29.73 million members.

Yes, they took a hit on their global numbers after selling their Brazilian business - dropping from 5.48 million to 1.34 million customers. But sometimes the best deals are the ones you don't do.

The real story here is Optum and its aggressive push into value-based care.

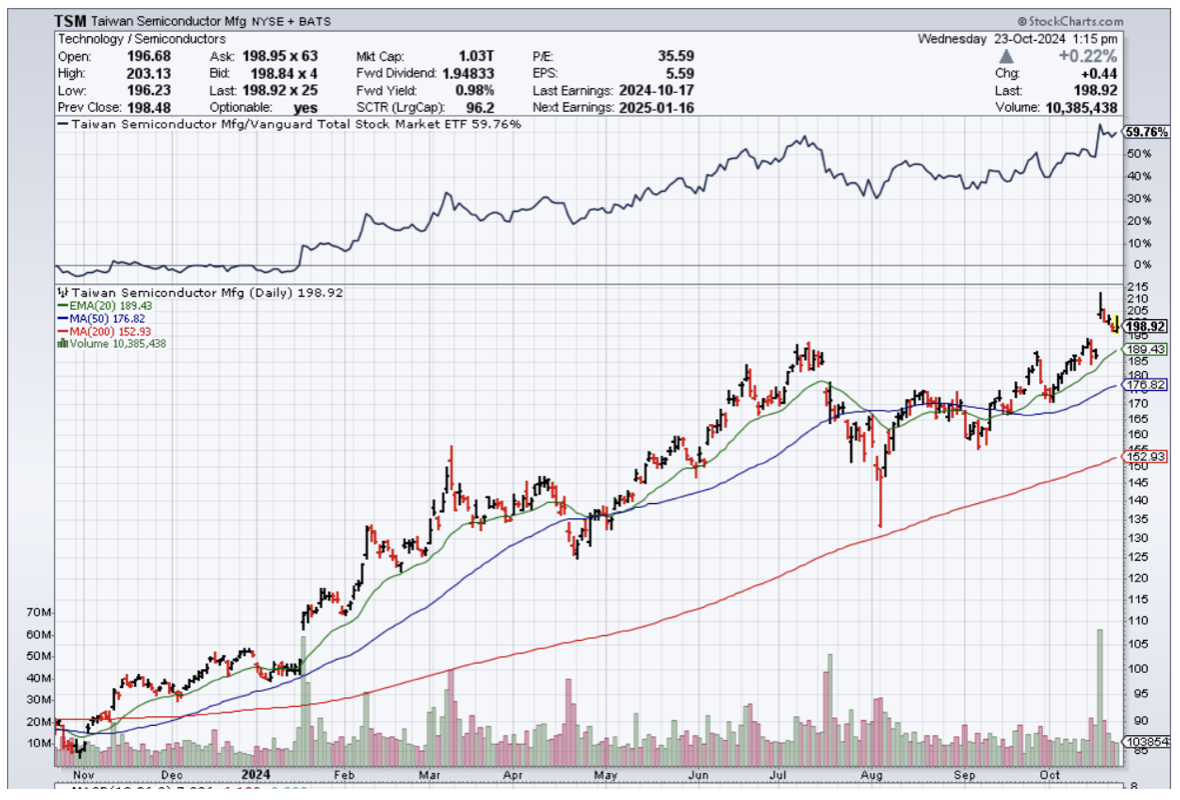

While competitors are still figuring out how to merge technology with healthcare delivery, UnitedHealth has already built a fortress. Their $13 billion acquisition of Change Healthcare wasn't just about processing claims - it was about owning the healthcare data highway.

Optum's revenue jumped 12.5% to $63.79 billion, with their pharmacy division surging 18.5% to $34.21 billion. They processed 410 million prescriptions in Q3 alone - that's 30 million more than last year.

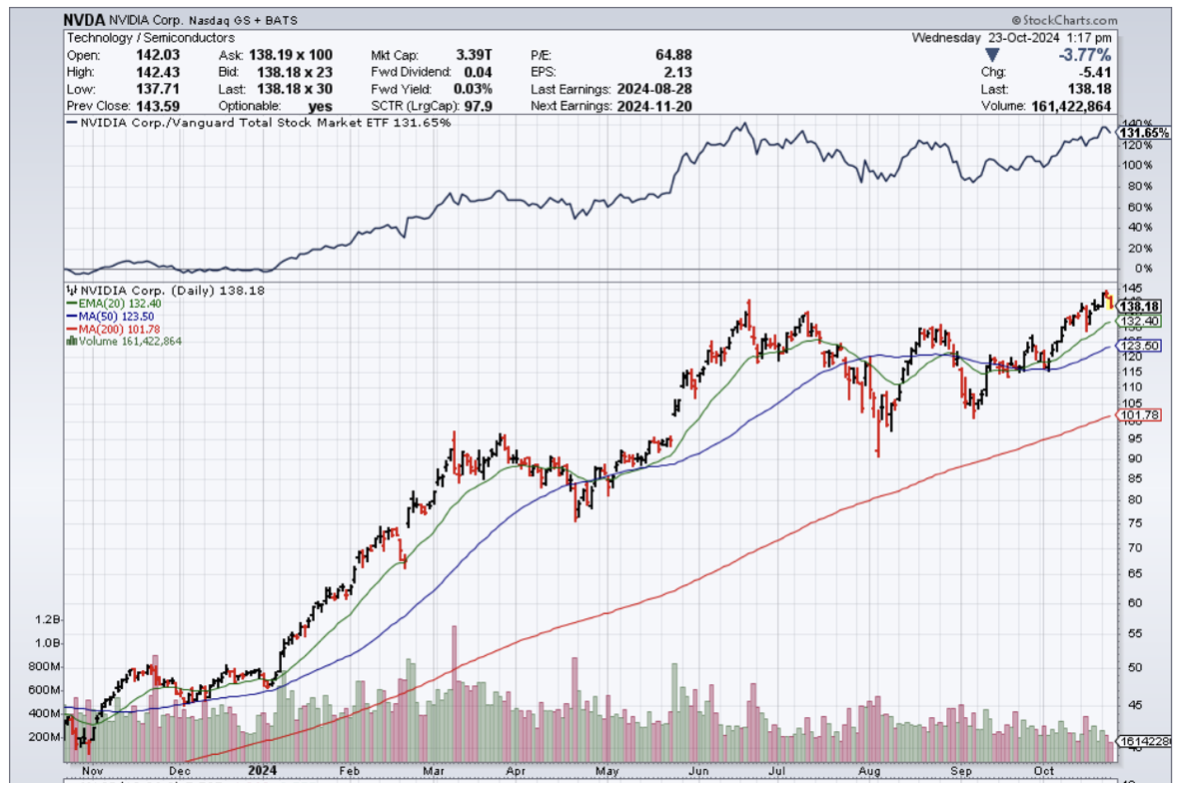

What Wall Street is missing is UnitedHealth's positioning for the post-COVID healthcare landscape. They're not just riding the telehealth wave - they're reshaping it.

Their OptumRx digital platform now handles 80% of all prescription transactions, while their virtual care visits have grown tenfold since 2019.

In fact, the regulatory environment plays into their hands.

While smaller players struggle with Medicare Advantage rate adjustments and value-based care requirements, UnitedHealth's scale and technology infrastructure turn these challenges into opportunities.

Their compliance systems and data analytics capabilities give them a moat that gets wider every quarter.

Wall Street expects Q4 revenue between $100.48 billion and $104.14 billion. Their P/S ratio of 1.41x looks rich compared to Humana (HUM) at 0.29x and Elevance Health (ELV) at 0.57x. But in this market, scale and execution command a premium.

Looking ahead, I see UnitedHealth hitting $552 billion in revenue by 2028. The catalysts are clear: aging demographics, rising chronic disease management post-COVID, and the unstoppable march toward value-based care.

Their Q3 non-GAAP EPS of $7.15 beat estimates by 12 cents. By 2028, I expect EPS to reach $44, with their P/E ratio dropping from 22.75x to 12.99x.

Their balance sheet remains rock solid - net debt/EBITDA ratio below 1.5x, with investment-grade ratings from S&P Global (SPGI), Fitch, and Moody's (MCO).

UnitedHealth also keeps growing its dividend by double digits, maintains a predictable business model, and outperforms competitors like CVS Health (CVS) and Humana on ROE.

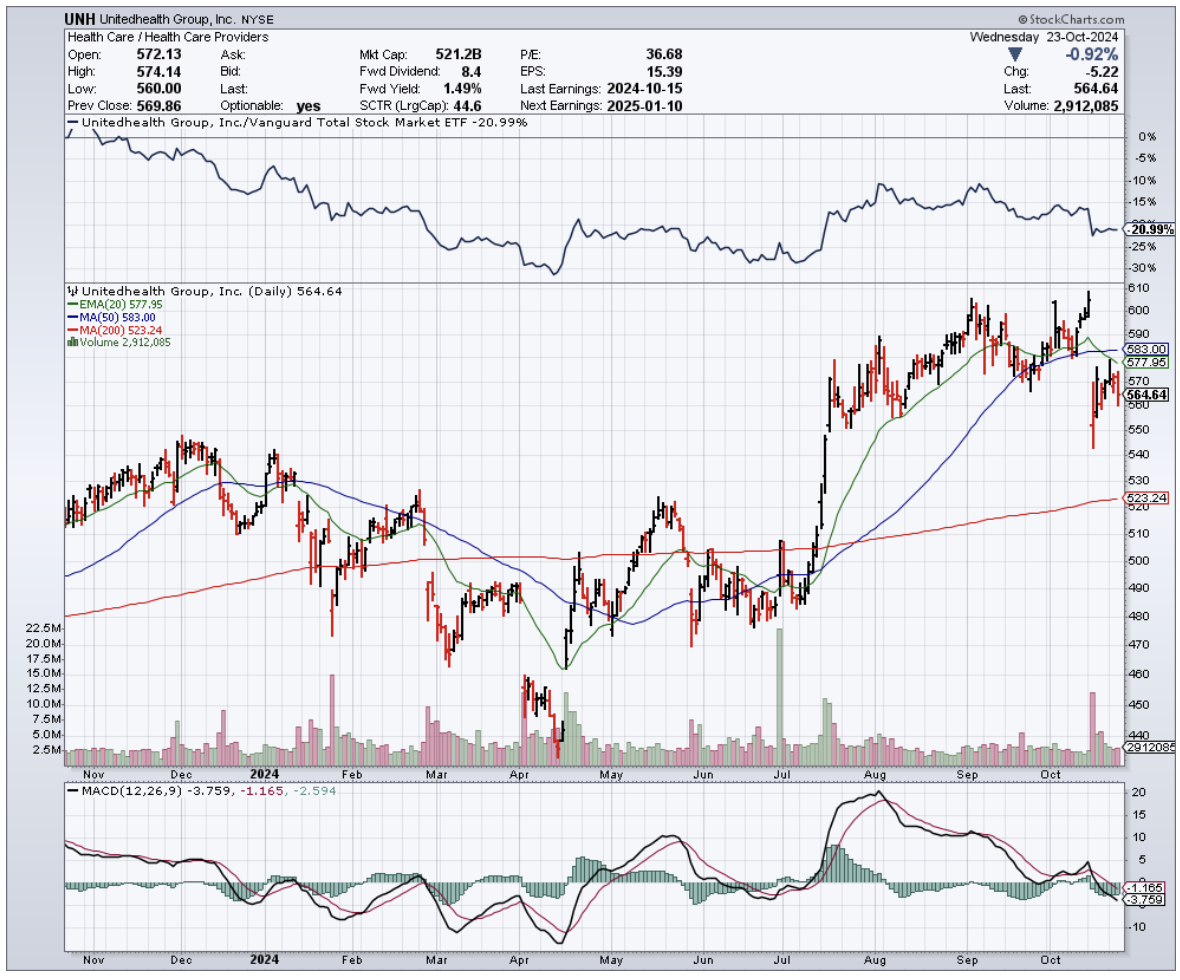

Admittedly, they slightly lowered their 2024 adjusted EPS guidance, spooking some traders. But in my experience, Wall Street's short-term panic creates long-term opportunities.

So, what’s the play here? I suggest you build a position in UnitedHealth now while the stock has pulled back. Scale in gradually if you're concerned about timing, but don't miss this opportunity.

Remember, in the end, this isn't just about healthcare - it's about owning a piece of America's unstoppable demographic destiny. And that's a trend even a skeptic like me can believe in.