(THE BASICS ON BONDS)

November 29, 2024

Hello everyone

What are Bonds?

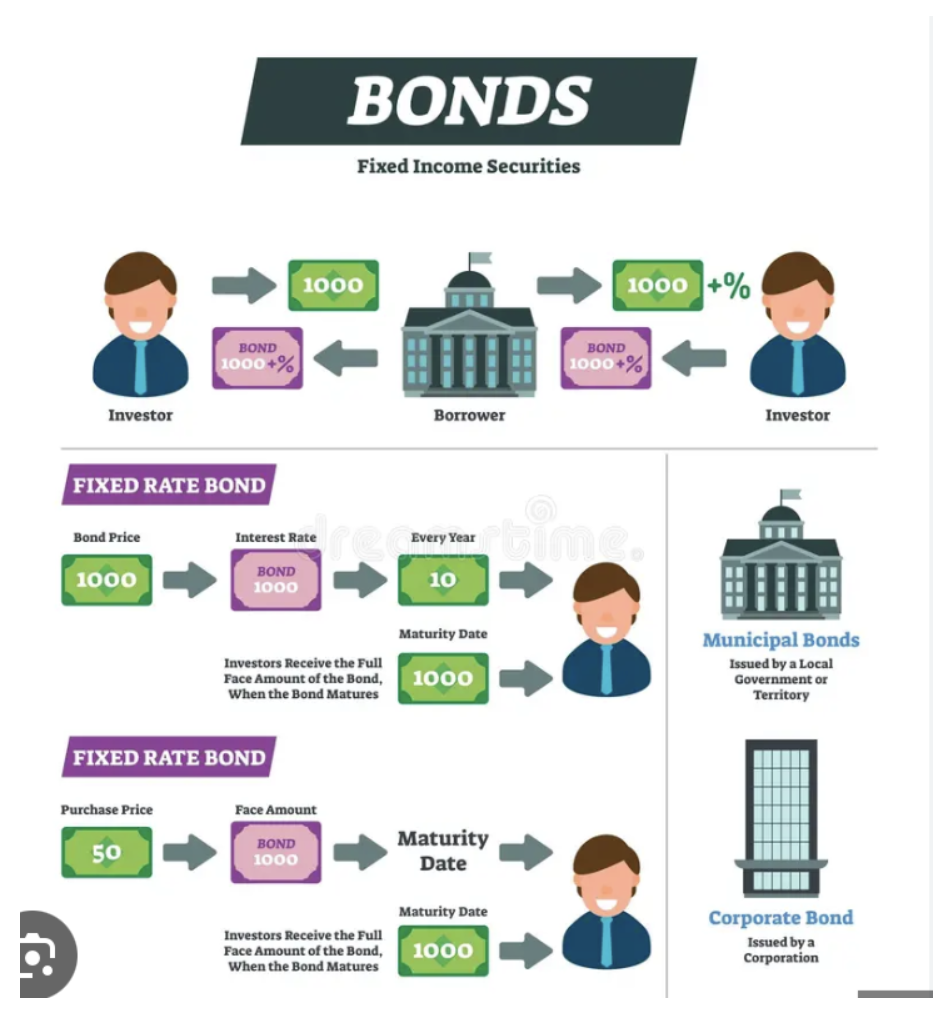

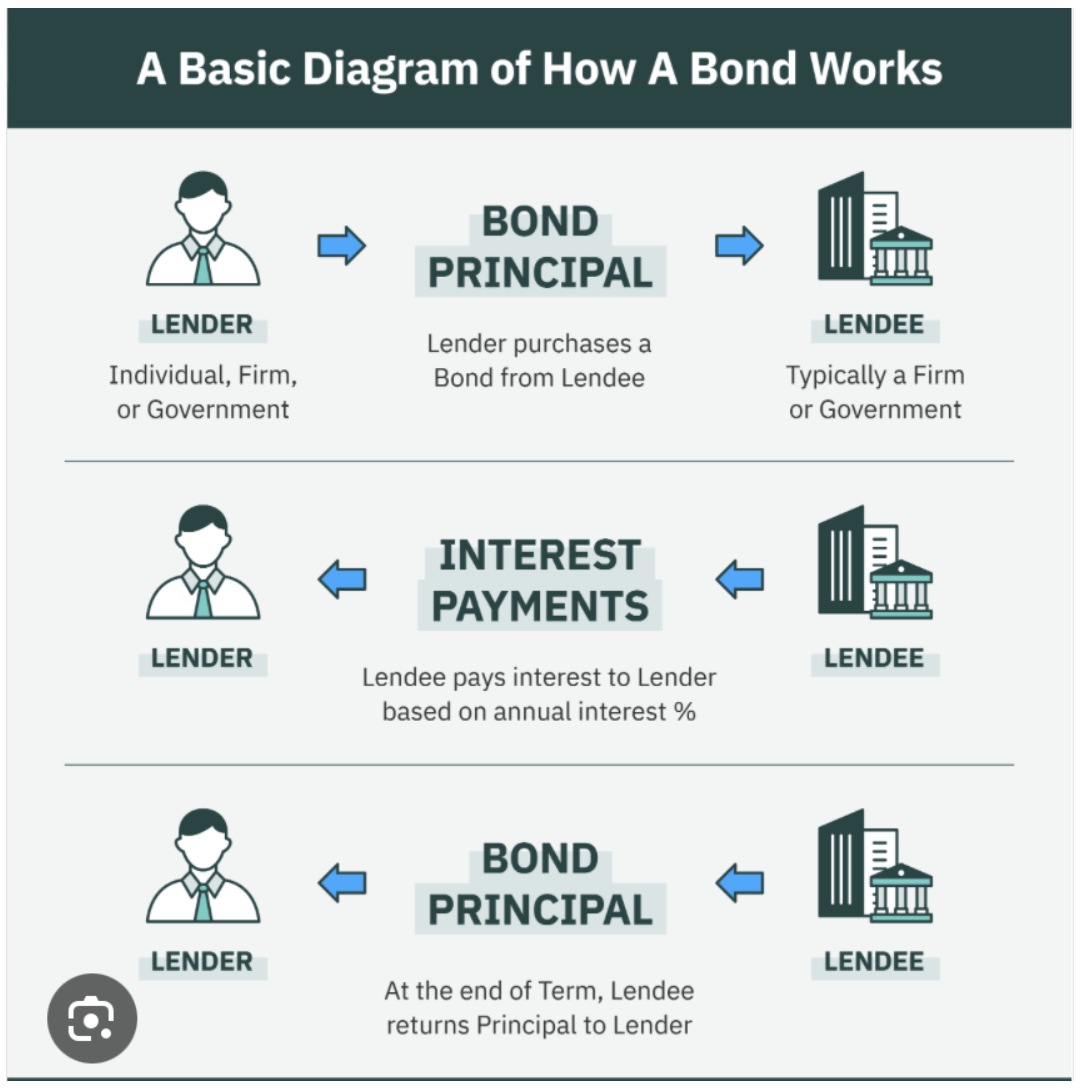

Bonds are instruments used by companies and governments when they need to raise money in the form of a loan.

If, for instance, a company issues a Bond and the investor buys the bond, the company gives a promise to repay the money at an agreed-upon interest rate.

Bonds are issued at the par value of $1000, which is the standard.

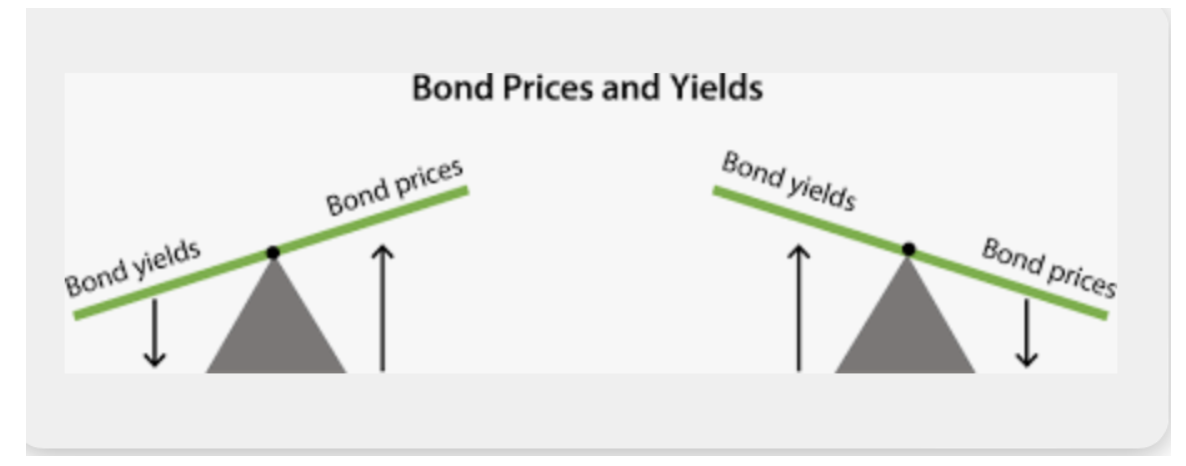

The Interest rate depends on several factors.

One of the most important is the Credit Rating.

The lower the credit rating, the higher the risk and the higher the interest paid.

The U.S. government has never defaulted on a bond, so they are considered a very low credit risk, and therefore, they have a low interest rate.

A Bond states three things:

Par value, also called face value, its coupon rate, which is stated as a percentage of par and its maturity date.

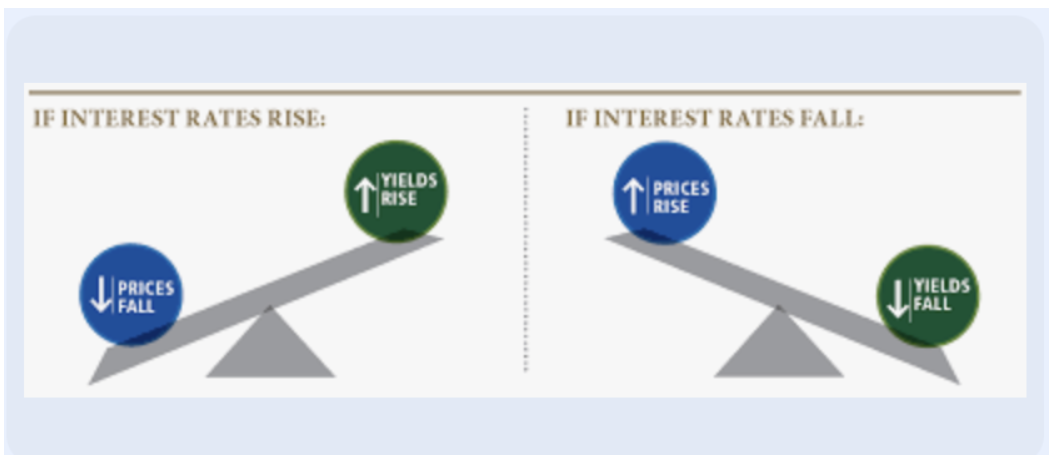

What is the coupon rate for bonds?

The coupon rate is just another term for the bond’s interest rate.

In other words, it’s the cash that the borrower will pay periodically to the bondholder.

The face value is the lump sum that the borrower is promising to pay at the maturity date.

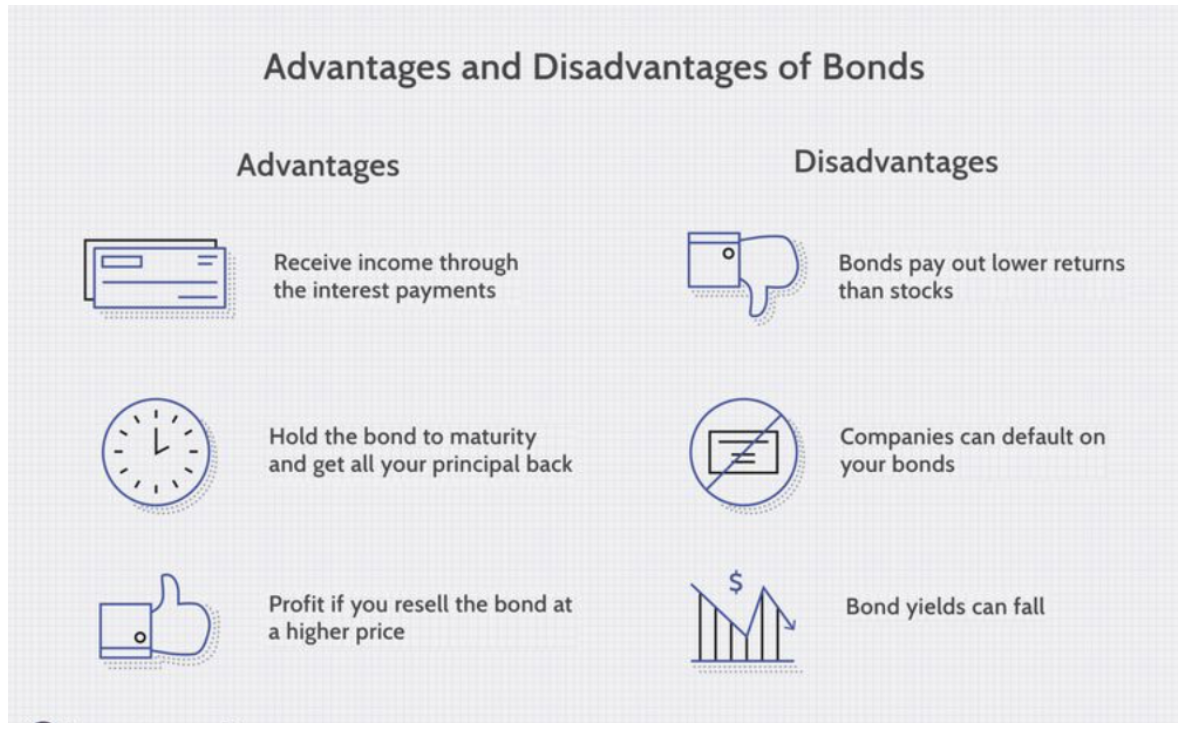

At the end of the term, you get the principal back.

You can also sell your bond to another person on the bond market.

How do you buy a bond?

Depending on the type, you can purchase bonds through brokers or exchange-traded funds or from the U.S. government at Treasury Direct. You may need to have at least $1,000, the typical starting face value for most bonds.

Comparing bonds and stocks

Let’s draw a comparison between stocks and bonds. When you buy a stock, you own some of the company. When you buy a bond, you are making a loan to a company (or the government), but you do not own any of the company.

Types of Bonds

U.S. Treasury Bonds

The most important bonds are the U.S. Treasury bills, notes, and bonds issued by the Treasury Department. They are used to set the rates for all other long-term fixed-rate bonds. The Treasury sells them at auction to fund the operations of the federal government.

These bonds are also resold on the secondary market. They are the safest since they are guaranteed by the United States government. That means they also offer the lowest return. They are owned by almost every institutional investor, corporation, and sovereign wealth fund.

Savings Bonds

Savings bonds are also issued by the Treasury Department. These bonds are meant to be purchased by individual investors. They are issued in low enough amounts to make them affordable for individuals.

Agency Bonds

Quasi-governmental agencies, like Fannie Mae and Freddie Mac, sell bonds that are guaranteed by the federal government.

Municipal Bonds

Municipal bonds are issued by various cities. They are tax-free but have slightly lower interest rates than corporate bonds. They are slightly riskier than bonds issued by the federal government. Cities occasionally do default.

Corporate Bonds

Corporate bonds are issued by all different types of companies. They are riskier than government-backed bonds, so they offer higher rates of return. They are sold by the representative bank.

There are three types of corporate bonds:

Junk bonds or high-yield bonds are corporate bonds from companies that have a chance of defaulting. They offer higher interest rates to compensate for the risk.

Preferred stocks are technically stocks, but they act like bonds. They pay you a fixed dividend at regular intervals. They are slightly safer than stocks in case of bankruptcy.

Holders get paid after bondholders but before common stockholders.

Certificates of deposit are like bonds issued by your bank. You essentially loan the bank your money for a certain period for a guaranteed fixed rate of return.

QI CORNER

SOMETHING TO THINK ABOUT

Cheers

Jacquie