When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

(SUMMARY OF JOHN’S NOVEMBER 6, 2024, WEBINAR)

November 8, 2024

Hello everyone

TITLE

Trading One Uncertainty for Another

ELECTION OUTCOMES

John says you lose the entire interest rate-sensitive sectors of the economy

Higher inflation

Higher interest rates

Much higher national debt

Govt. shutdowns on Dem house win

Less regulation – full self-driving in US

No environmental control

Accelerated global warming

Extreme labour shortages at low-end hitting agriculture, restaurants, and construction

Democratic control of Congress in 2026

Ukraine withdrawal

Taiwan at risk

Retreat from international commitments

More concentration of wealth at the top

Earlier stock market top

Earlier recession

Earlier stock market crash

All antitrust actions cease

WINNERS AND LOSERS

Winners

Energy

Financials

Crypto

Tesla

Health Insurance

Vladimir Putin

Losers

All interest rate plays

All Bonds

Housing

Real Estate

Construction

TRADE ALERT PERFORMANCE

November +0.30%

Since inception +729.97%

Average annualised return = +51.62%

Trailing One Year Return = +65.56%

PORTFOLIO REVIEW

(JPM) 11/$195/$205 call spread 10%

(NVDA) 12 $117/$120 call spread 10%

(GLD) 12 $235/$240 call spread 10%(Trade closed/Stopped out).

THE METHOD TO MY MADNESS

On Wednesday, we flip from one type of risk to another.

All interest rate plays looking at big sell-offs as John sees it.

US dollar hits one-year high.

Technology stocks still attractive for long term.

Stand by and wait for the initial election euphoria to pass.

Energy rallies on deregulation, but not oil supply.

Wait patiently now to see where the money flows.

THE GLOBAL ECONOMY – SURE THING

Nonfarm payroll collapses at 12,000, down sharply from September and below the Dow Jones estimate for 100,000.

The headline unemployment rate held at 4.1% in line with expectations.

The BLS noted that the Boeing strike likely subtracted 44,000 jobs in the manufacturing sector, while hurricanes also likely held back the total.

It makes a 25-bps interest rate cut on Wednesday a sure thing.

Personal Consumption Expenditures Price Index Rose in September, up 0.3%, which remains above the central bank’s target.

Q3 GDP comes in weak, with real gross domestic product grew at a hardy 2.8%.

Consumer Sentiment hits 6-month high.

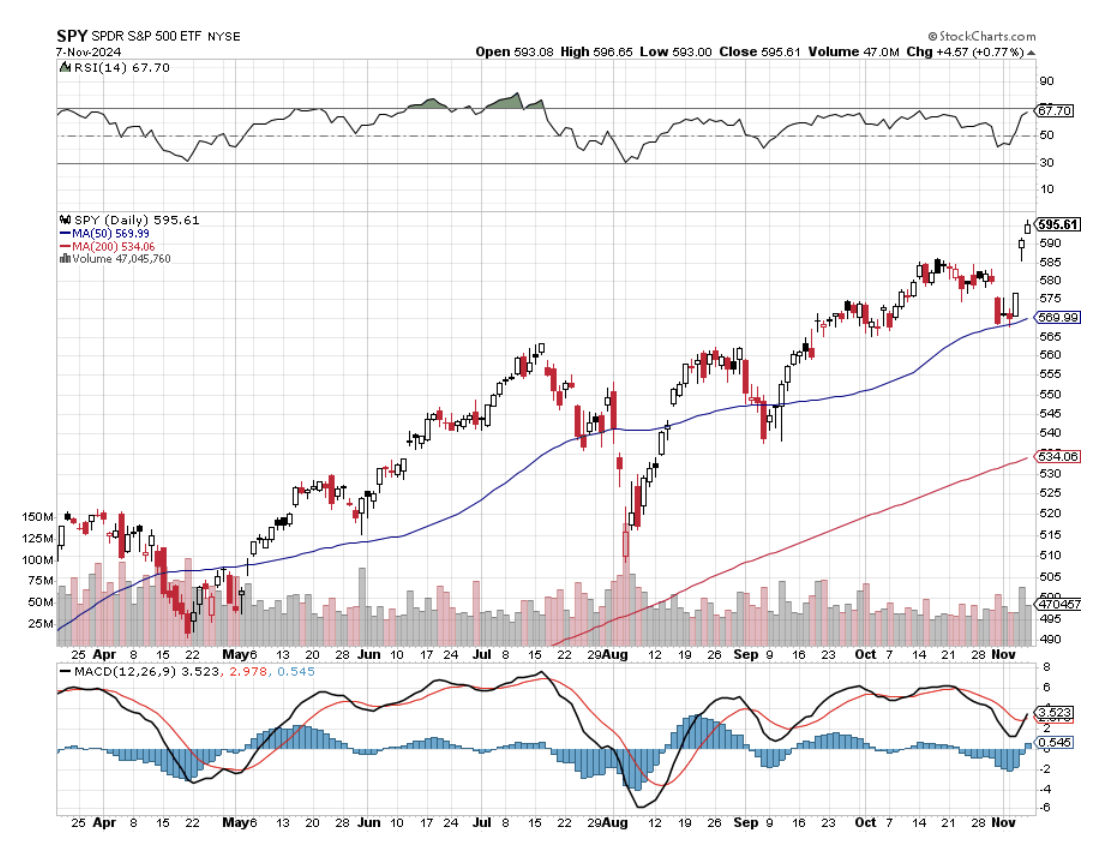

STOCKS – POST ELECTION MELT UP ARRIVES

Money Market Funds see massive pre-election inflows as investors seek to avoid promised post-election violence.

Nvidia tops $3.5 trillion as shares hit a new all-time high at $144.45. It looks like it’s on a run to $150, then $160.

Apple iPhone Sales are lagging, according to a leading analyst, with a drop in 10 million orders expected, down to 84 million units.

McDonald's kills two in E. Coli Outbreak, linked to quarter pounders. Avoid (MCD).

Hedge Funds ramping up risk going into the election with more equity leverage in their portfolios than they had in the beginning of the year, indicating higher risk appetite.

IMF cuts Global Growth Forecast, seeing wars and protectionism posing threats to expansion.

BONDS – ELECTION PLAY

Bonds plunge anticipating a Trump win, with the (TLT) down $10 from the recent high.

If he does win, expect another $10 decline to $82. If Harris wins, expect a $10 rally.

This is the best election trade out there.

It’s a choice between Harris, who will increase the deficit by $2.5 trillion, or Trump, who will increase it by $15 trillion.

Either way, the bond market loses.

Bond Yields soar above 4.32% yield, on fears of massive deficit spending by a future Donald Trump. Estimates of his deficits over four years go as high as $15 trillion.

Buy (TLT), (JNK), (NLY), (SLRN), and REITS on this dip.

FOREIGN CURRENCIES – US DOLLAR REBORN

Dollar hits two-month high on rising US interest rates. Ten-year Treasuries have risen from 3.55% to 4.35%.

Harris rise in the polls is killing the US dollar as the prospect of falling interest rates improves.

Lower interest rates make the US dollar much less attractive to traders and investors.

This may be the last chance to sell short the US dollar at a high price.

The long-term downtrend in the dollar is still intact.

There is no way the dollar can stand up to cuts down to 3.5% by summer.

Buy (FXA), (FXE), (FXB), (FXC), and (FXY)

ENERGY AND COMMODITIES – OIL CRASH

Oil crashes 5% as the Israeli retaliation on Iran avoided oil facilities.

Fusion is going commercial in San Francisco with a German company, Focused Energy.

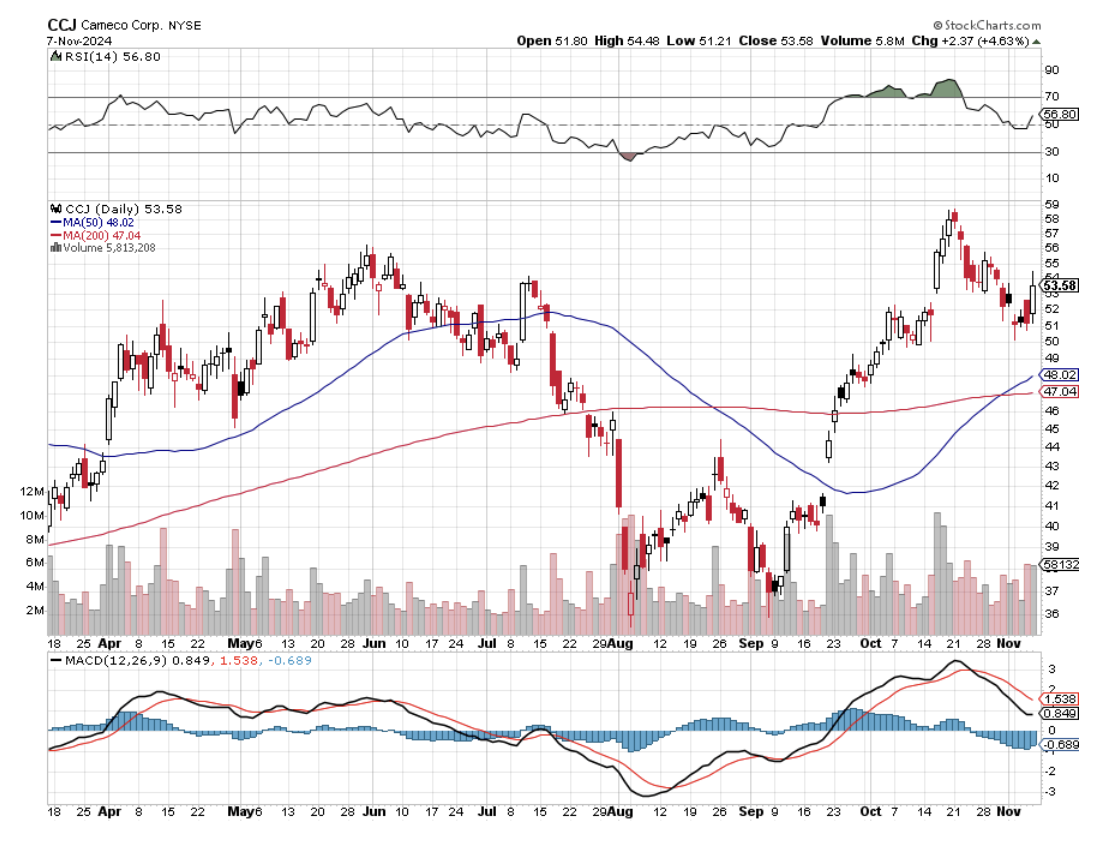

US Nuclear Regulatory Commission has new nuclear move, sending all stock plays into a tailspin.

It’s a great opportunity to buy (CCJ) and (VST) on the dip.

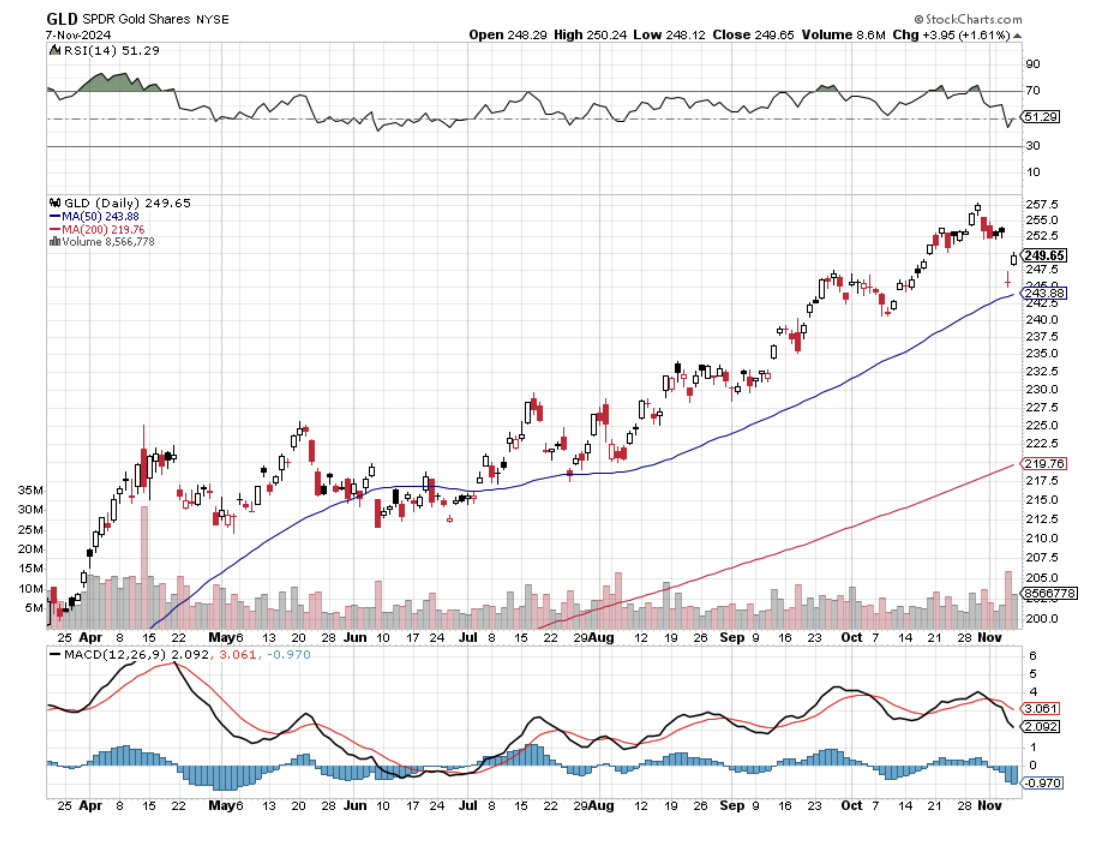

PRECIOUS METALS – NEW HIGHS

Silver and Gold – consolidating until a post-election upside breakout to new all-time highs.

The white metal is a predictor of a healthy recovery and a solar rebound.

Newmont Mining dives 7% after missing Wall Street expectations for third-quarter profit.

Money pours into Gold ETF’s taking gold up to new highs, at $2,761 an ounce, as hedge funds pour in.

Seasonals for the barbarous relic are now the most positive of the year.

Gold holding up in the face of big interest rate rises shows it only wants to go up.

Escalation of Middle East war is very pro-gold.

Buy (GLD), (SLV), (AGQ), and (WPM) on dips.

REAL ESTATE – PRE-ELECTION FREEZE

Virtually all real estate transactions have ceased over pre-election fears.

But they will resume on any post-election fall in interest rates.

Pending Home Sales jump 7.4% on a signed contract basis, the highest since March.

New Home Sales Jump 4.1% in September at 738,000 seasonally adjusted unit on a signed contract basis

The median home price rose to $426,300.

This despite a roller coaster month on interest rates, falling to 6.0% for the 30-year, then jumping back up to 7.0%.

Existing Home Sales drop 1% in September, a 14-year low, down to 3.84 million units annualized.

TRADE SHEET

Stocks – stand aside

Bonds – stand aside

Commodities – stand aside

Currencies – stand aside

Precious Metals – stand aside

Energy – stand aside

Energy – stand aside

Volatility – sell over $30

Real estate – stand aside

NEXT STRATEGY WEBINAR

12:00 EST WEDNESDAY, NOVEMBER 20

From Lake Tahoe, Nevada

Cheers

Jacquie

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

November 8, 2024

Fiat Lux

Featured Trade:

(NOVEMBER 6 BIWEEKLY STRATEGY WEBINAR Q&A),

(CCJ), (LMT), (VST), (RTX), (CCI), (GLD), (SLV), (TLT), (NVDA), (OXY), (FXA), (FXE), (FXB), (FXC)

Below, please find subscribers’ Q&A for the November 6 Mad Hedge Fund Trader Global Strategy Webinar, broadcast from Lake Tahoe, Nevada.

Q: What do we do in the market now in view of the Trump Victory?

The driving theme of the market has completely changed overnight. Falling interest rate plays are dead. The new theme is deregulation. The good news is that there are a lot of cheap deregulation plays out there, especially in financials. Deregulation is also a factor with (NVDA), where the government was lining up for an antitrust suit. New nuclear stocks like (CCJ) and (VST) also do well with a lighter regulatory touch.

Q: How will the defense industry perform under Trump?

A: Poorly. If we cease supplying Ukraine with weapons and withdraw from our international commitments, there’s no need for weapons at all. We’ll just have to be happy with the 50-year-old weapons that we have right now. And, of course, that's one of the reasons why Putin was such a big supporter of Trump. Avoid (LMT) and (RTX). Other stocks were already selling off as Trump rose in the polls.

Q: Will housing be a loser with the housing shortage?

A: Yes, it will, because you won’t find home buyers if they don’t have any money—if interest rates and mortgage payments are too high, those buyers are absent from the market. They can’t afford to step up to the current price levels and mortgage levels.

Q: Do you really think the Fed may not cut interest rates?

A: All of the announced Trump policies are highly inflationary, and one of the Fed’s primary missions is to control inflation. But, it comes down to: is the Fed going to look forward or look back? Historically, it is very much a “look back” organization, so they will probably wait on their higher interest rates. And that is what uncertainty is all about; all of a sudden, you go from very firm convictions of what’s going to happen next—what stocks to buy, what sectors to play—to “I don’t know!”. With a Harris win, at least you had some certainly. With Trump, we don’t know what he really wants to do, can do, or be allowed by the courts. It will take time to figure all this out.

Q: Why did none of these issues occur during Trump’s first term?

A: Well, virtually all of Trump’s first term, interest rates were at zero because the Fed was still doing quantitative easing, trying to recover from the ‘08 financial crisis, but also recovering from the pandemic. The amazing thing about the Biden administration is that the stock market did so well during the 5% interest rates that prevailed practically for his entire term.

Q: Do you have a “BUY” target for iShares 20+ Year Treasury Bond ETF (TLT) on the downside after the Trump win?

A: The answer is we are going to retest the low of the year, which is $82 in the TLT, and last time I checked, we were at $89.78—so down seven points. But again, we now have a lame-duck government, so no dramatic action with a split Congress. We basically have until January 20th, when the new government comes in, to find out what they will actually try to do. I think you'll find that the “campaign Trump” and the “in-office Trump” are two totally different people.

Q: Okay, what about the iShares 20+ Year Treasury Bond ETF (TLT) LEAPS position you put out two weeks ago? Should we sell or hold?

A: Well, if you want to be cautious, go cash—sell. But this is a LEAPS that has another 15 months to expiration, and there's a pretty decent chance we'll be going into recession sometime next year, especially if interest rates and inflation take off. That could make your LEAPS trade very attractive—it could drive interest rates down to 3.5%, which is virtually where they were in September. Since September, bonds have basically given up their entire rally for the year on the possibility of a Trump win. So, you know, would I put on that trade today? No. Will I put it on at $82, I probably will. We'll just have to see what the new world looks like.

Q: What's the direction for gold (GLD) and silver (SLV)?

A: Down. Those two plays were dependent on falling interest rates, which are now gone. Now that they're going back up again, it kind of trashes the entire gold-silver trade. So, at some point, gold will drop to a point where the flight to safety bid offsets the fear of rising interest rates. You still have a lot of Chinese savings in gold going on and central bank buying. That's where you get back in. Where that is is anybody's guess.

Q: Any thoughts on Crown Castle International (CCI)?

A: It is an interest-rate play. We did really well with CCI from April to September, when the 10-year treasury went from 4.5% to 3.5%. Run that movie in reverse, and it doesn't do very well. We've had a big sell-off on (CCI) this morning. So it's getting killed on the prospect of rising rates and inflation.

Q: Do smaller stocks do better under Trump?

A: No. Smaller stocks are much more dependent on interest rates than large stocks because they're very heavy borrowers at high rates. So, any rally there should be sold into.

Q: Should I bet the ranch on crypto here?

A: Absolutely not. $6,000 is where you should have bet the ranch on crypto, not at $75,000. Crypto is barely moving today, despite promises by Trump to completely deregulate the sector. So, no, I am definitely not a buyer of crypto here.

Q: What about the gold trade alert that I sent out yesterday?

A: That was on the assumption that Harris would win, and she didn't. If you want to be conservative, get out of the position now. We have five weeks to expiration on that position, so it really depends on where gold finds its bottom—it could hold up here or a little bit lower, and we'll still be at the max profit. If we go into free fall, I'm going to just stop out of the position and write that one off as me being too aggressive before the election when I had the perfect positions going into it, being long JP Morgan (JPM) and Nvidia (NVDA).

Q: Is the Occidental Petroleum (OXY) spread okay?

A: For energy, I would say yes, probably. But we'll have to see how sustainable this current rally is.

Q: So, wait on the currency plays, like (FXA), (FXE), (FXB), and (FXC)?

A: Absolutely, yes. It's another wait for the dust to settle trade.

Q: What will the price of crude oil do from here?

A: Probably go down more with large new supplies coming out of the U.S.

Q: Why are financial stocks up huge?

A: Deregulation. Financials are among the most regulated industries in the world. If you don't believe me, try running a hedge fund someday, where they're breathing down your neck every five seconds for audits, reports, and so on. They also win on the revenue side with restrictions coming off mergers and acquisitions with the end of antitrust enforcement.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, select your subscription (GLOBAL TRADING DISPATCH, TECHNOLOGY LETTER, or Jacquie's Post), then click on WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Biotech and Healthcare Letter

November 7, 2024

Fiat Lux

Featured Trade:

(COPENHAGEN’S CASH COW)

(NVO), (LLY), (AMGN), (RHHBY), (PFE)

The first time I visited Denmark, my taxi driver had an unusual conversation starter.

"You know what's our biggest company?" he asked, navigating Copenhagen's rain-slicked streets. "Not LEGO, not Maersk. It's the diabetes people." He was right.

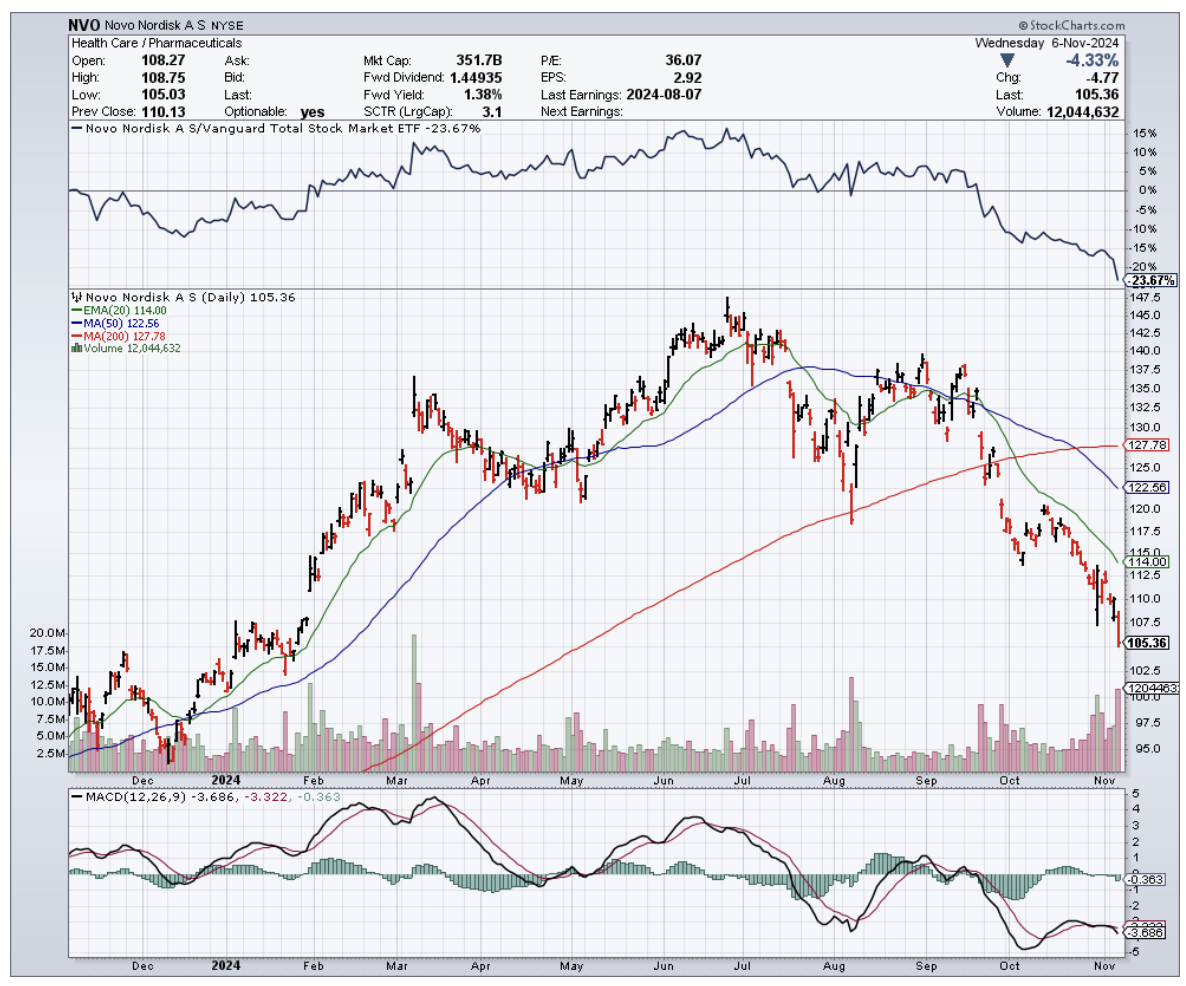

Novo Nordisk (NVO), which began in the 1920s with a borrowed insulin recipe and a dream of treating diabetes, has morphed into Denmark's crown jewel of pharmaceuticals.

The company that once extracted insulin from cow pancreases (collected by the truckload from local slaughterhouses) is now making the kind of money that would make a Viking raid look like pocket change.

In the third quarter of 2024 alone, Novo Nordisk reported a 21% profit surge to 27.3 billion Danish kroner (that's $2.45 billion for those of us who don't speak currency converter).

The star of this financial show? A drug called Wegovy, whose sales have skyrocketed to 17.3 billion kroner in Q3, leaving analysts' predictions in the dust like a marathoner who's found an extra gear.

But before we pop the champagne (or the sugar-free sparkling water, given the company's focus), let's peek behind the Danish curtain.

The story of Novo Nordisk is like watching a high-wire act at the circus - thrilling, precisely executed, but with plenty of observers holding their breath about what could go wrong.

But, it's now a far cry from the days when company founders Harald and Thorvald Pedersen would personally deliver insulin to local pharmacies by bicycle.

The company has carved out its empire in the rather unglamorous-sounding GLP-1 receptor agonist market.

Don't let the clunky name fool you - this market was worth a hefty $36.79 billion in 2023 and is growing faster than bacteria in a petri dish, with projections showing a 21.65% annual growth rate from 2024 to 2030.

By 2031, we're looking at a potential $150 billion market, with obesity treatments accounting for $90 billion of that pie.

Novo Nordisk's triple threat - Wegovy, Ozempic, and Rybelsus - have been dominating this space like a scientific dream team.

Not bad for a company that once had to import porcine intestines from China to keep up with insulin production in the 1960s.

But success attracts competition like moths to a flame, and the flames are getting crowded.

Enter Eli Lilly (LLY), strutting into the party with Mounjaro, which raked in $1.5 billion in Q2 2024 sales alone - a 71% quarterly growth that probably caused some sleepless nights in Denmark.

Meanwhile, Amgen (AMGN) and Viking Therapeutics (VKTX) are cooking up their own weight-loss concoctions in their respective labs.

Viking's oral GLP-1 drug is particularly interesting - imagine taking a pill instead of giving yourself a shot. For needle-phobic patients, that's like choosing between a day at the spa and a day at the dentist.

Speaking of setbacks, Novo Nordisk recently had to wave the white flag on ocedurenone, their hoped-for kidney disease drug.

After spending $1.3 billion to acquire it from KBP Biosciences (ouch), the phase 3 trial results came back with all the excitement of a flat sofa.

The company had to write off $816.5 million - the kind of number that makes accountants reach for the antacids.

Now they're left with just one CKD program based on semaglutide, the same ingredient that makes Wegovy, Ozempic, and Rybelsus tick. It's a reminder that even in the age of sophisticated molecular modeling and AI-driven drug discovery, pharmaceutical development can still be as unpredictable as Danish weather.

As if that weren't enough to keep executives up at night, Hims & Hers Health (HIMS) is preparing to crash the party with a generic version of liraglutide (the secret sauce in Novo's older drugs Victoza and Saxenda) as soon as 2025.

While these older medications contribute less than 10% to Novo's revenue, it's like watching the first raindrops of what could become a storm.

The ghosts of those early insulin-producing pancreases might be chuckling at how history repeats itself - from fighting for insulin patents in the 1920s to defending weight loss drug territory today.

The company's stock currently trades at a forward P/E ratio of 33.2x, with analysts expecting a 22.4% annual earnings growth through 2025.

That's the kind of valuation that makes value investors break out in hives - 37 times trailing earnings and 12.95 times trailing sales means this stock is priced like a luxury handbag, where any scuff could send the price tumbling.

For those eyeing Novo Nordisk like a dessert cart at a weight-loss clinic, the decision isn't simple.

The company's dominance in the GLP-1 market is impressive, but with competitors like Eli Lilly, Amgen, and Pfizer (PFE) circling like hungry sharks, and Roche's (RHHBY) recent acquisition of Carmot Therapeutics adding another player to the mix, the waters are getting choppy.

The prudent move? Current shareholders might want to hold onto their tickets for this roller coaster ride while keeping a white-knuckled grip on the safety bar.

New investors might want to wait in line until the price becomes more reasonable - like waiting for the post-holiday sale at a luxury boutique.

And for those looking to spread their bets, Eli Lilly, Amgen, and Roche offer alternative ways to play in this space, each with their own mix of risk and potential reward.

Anyway, going back to that taxi driver in Copenhagen? He had one more thing to say: "Those Novo people, they started with dead cows and now they're making drugs from bacteria in giant steel tanks. Who knows what they'll do next?"

Indeed, from slaughterhouse pancreases to billion-dollar weight loss drugs, Novo Nordisk's story reads like a scientific fairy tale. But in the world of biotech investing, even fairy tales need solid earnings reports.

For now, this Danish giant continues to prove that sometimes the best investment stories start with someone asking, "What if we could do this better?" - even if "this" means figuring out how to get insulin from a cow pancreas.

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.