When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

November 13, 2024

Fiat Lux

Featured Trade:

(DON’T GET SCAMMED BY THE MUTUAL FUNDS),

(TESTIMONIAL)

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Biotech and Healthcare Letter

November 12, 2024

Fiat Lux

Featured Trade:

(MEDTECH’S TRUMP CARD)

(RMD), (STE), (TNDM), (JNJ), (BDX), (MDT), (BSX), (SYK), (ZBH)

After seeing Trump sweep back into office, my phone's been ringing off the hook with one question: "What happens to my portfolio now?"

Look, I've been around this circus since covering Reagan in the White House press corps, and I can tell you that market hysteria rarely matches reality.

But this time, we need to pay attention - especially in the $567 billion medtech industry that's about to face some serious disruption.

What's different now? Trump's not just talking about those 10% to 20% blanket tariffs anymore - he's dead serious about slapping a potential 60% tariff on Chinese imports.

And after spending years watching supply chains twist themselves into pretzels during COVID, this is going to hit different.

To understand just how big this could be, let's look at what's really at stake here.

In vitro diagnostics makes up 18% of the medtech industry, and cardiology devices are sitting at $75 billion in 2024, expected to hit $95 billion by 2028.

Those aren't just numbers on a page - they represent real money that could take a serious hit. If these tariffs go through, we're looking at a 3.2% hit to S&P 500 earnings per share in 2025.

And it gets worse - add another 1.5% drop if our trading partners decide to play hardball with retaliatory tariffs.

Given all this, where should you put your money? The answer lies in looking at who's already ahead of the curve.

Well, established players like Johnson & Johnson (JNJ) and Becton Dickinson and Co. (BDX) are looking increasingly shrewd with their local-for-local manufacturing strategy.

They might not give you the same adrenaline rush as scaling Mount Everest, but they're solid holds in this environment.

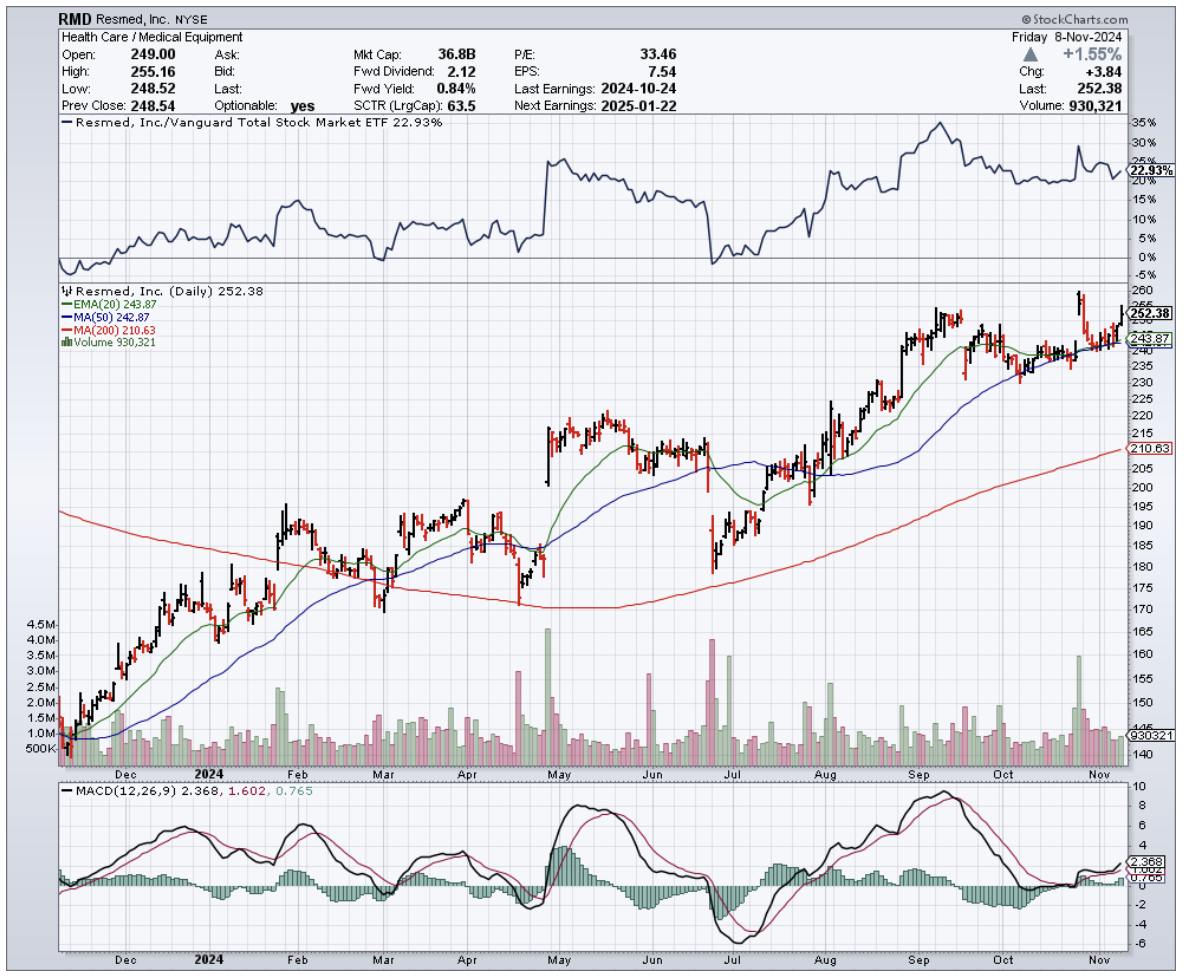

But they’re not the only companies securing their positions. ResMed (RMD), for instance, just posted third-quarter sales up 11% to $1.22 billion, with adjusted earnings jumping 34% to $2.20 per share.

That's not just good numbers - that's a company that knows how to execute regardless of who's in the White House.

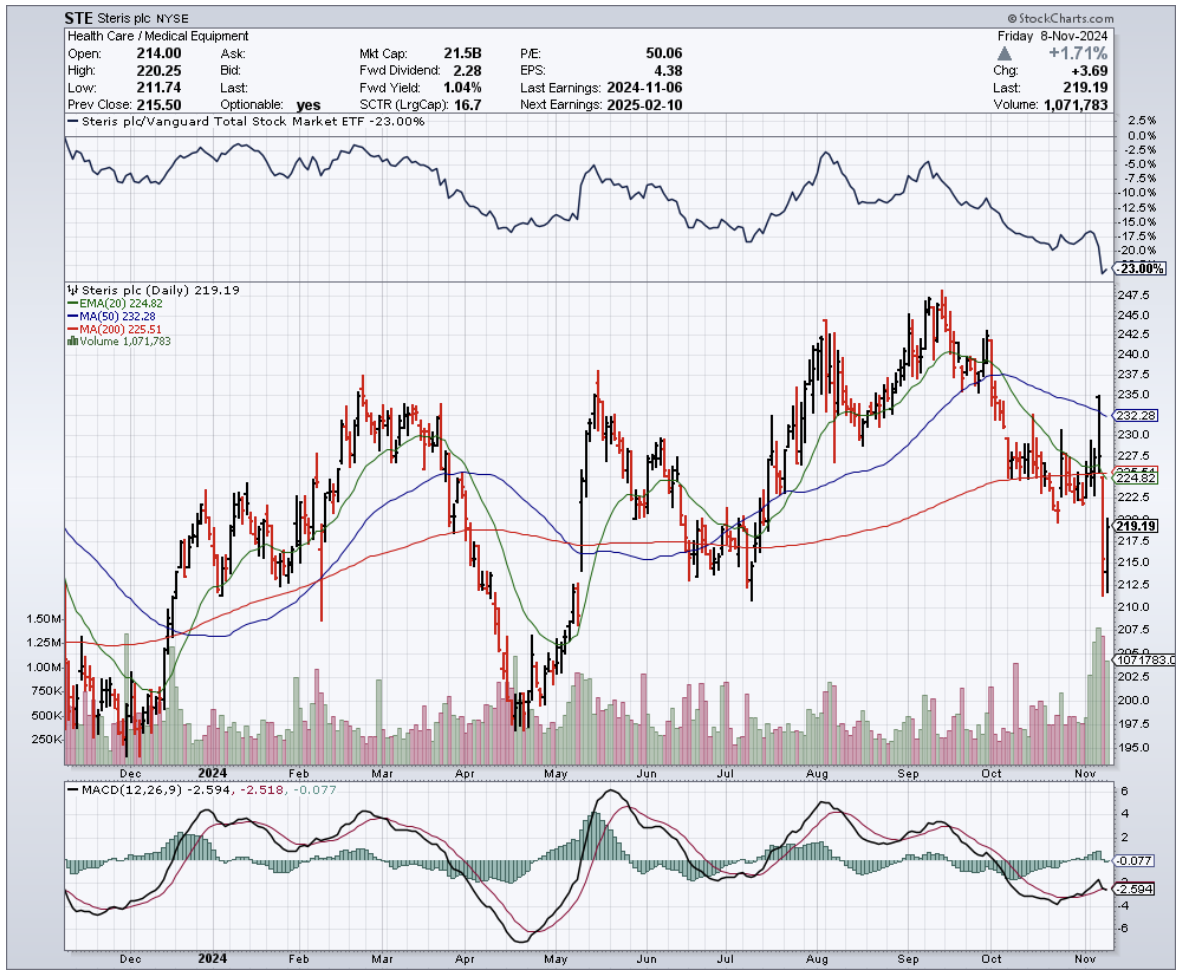

In the same vein, Steris deserves attention. Their "front-shoring" strategy in Malaysia isn't just smart - it's prescient. After years of covering Asia for The Economist, I can spot smart positioning when I see it.

Now, let's talk about some of the bigger players in the room. Medtronic (MDT), our industry giant, is giving me pause.

Sure, they're a global leader, but their heavy reliance on Chinese manufacturing and components is about to become a serious headache under these new tariffs.

Same story with Boston Scientific (BSX) - they've got manufacturing facilities in China that could turn from assets to liabilities pretty quickly.

Stryker (SYK) and Zimmer Biomet (ZBH) are in the same boat, but with a twist. Both companies have been smart enough to spread their supply chains globally, but they're still catching enough Chinese exposure to make me nervous.

When those tariffs hit their component costs, watch their margins. This isn't just about bottom lines - it's about how much wiggle room these companies have to absorb higher costs without passing them on to hospitals and patients.

On the flip side, I'm watching companies like Tandem Diabetes Care (TNDM) with growing concern.

Their heavy Asian supply chain exposure under Trump's trade policies is going to be about as comfortable as my MIG-25 flight at 90,000 feet - and trust me, that wasn't comfortable at all.

But, what’s really telling is where the smart money is flowing.

Keep your eyes on three key trends that are reshaping the industry: supply chain resilience, M&A activity (now up 18% to $57.7 billion), and digital transformation.

About 30% of medtech companies are getting serious about digitizing their operations - and they're the ones to watch.

So, here's my bottom line: Trump's return is going to shake up medtech, but not every tremor is an earthquake.

The winners in this new landscape will be companies that have already diversified their manufacturing outside China, built up strong balance sheets to absorb these tariff impacts, and proven they can adapt - like ResMed and Steris have shown us.

The real champions will be those making serious investments in digital transformation. These are the companies that won't just survive Trump's trade policies - they'll thrive under them.

And if you're still holding onto companies with heavy Chinese exposure?

Well, let's just say it might be time to look for higher ground - and I'm speaking as someone who's made that call at both 20,000 feet on Everest and during the 2008 crash.

The medtech industry isn't going anywhere - people will always need medical devices. But which companies thrive under Trump's second term? That's going to depend on who's prepared for the storm and who's still standing in the open.

Now, if you'll excuse me, I've got some vintage wine to open. Making sense of these markets is thirsty work.

Global Market Comments

November 12, 2024

Fiat Lux

Featured Trade:

(WHY YOUR OTHER INVESTMENT NEWSLETTER IS SO DANGEROUS)

Palantir Technologies Inc. (PLTR), the data analytics software company once known primarily for its clandestine government contracts, is riding high on the artificial intelligence (AI) wave. The company's stock has more than doubled this year, fueled by surging demand for its AI-powered platforms and a string of impressive financial results.

This surge places Palantir among the biggest stock market winners of the generative AI boom, solidifying its position as a key player in this transformative technology. Investors are clearly taking notice, betting that Palantir's unique approach to AI will translate into continued growth and market dominance.

AI at the Core of Palantir's Success

Palantir's success story is deeply intertwined with the rise of AI. The company's two flagship platforms, Gotham and Foundry, have evolved into powerful AI engines capable of analyzing massive datasets and delivering actionable insights. Gotham, originally designed for defense and intelligence applications, excels at uncovering hidden patterns and connections within complex data. Foundry, geared towards commercial clients, empowers businesses to operationalize their data for improved efficiency and decision-making.

"Palantir has been building towards this AI moment for years," says [Quote from a relevant industry analyst or Palantir executive]. "Their platforms are uniquely positioned to handle the complexities of AI, and they have a proven track record of delivering results for both government and commercial clients."

Strong Financials Fuel Investor Confidence

Palantir's recent financial performance has further bolstered investor confidence. The company recently raised its annual revenue forecast for the third time this year, driven by strong demand for its AI capabilities. In the third quarter of 2024, Palantir reported a 30% year-over-year jump in revenue, reaching $726 million. This growth was fueled by a 40% surge in US government contract revenue, which now accounts for 44% of the company's total sales.

"The numbers speak for themselves," says [Quote from a financial analyst or portfolio manager]. "Palantir is demonstrating that its AI solutions are in high demand, and they are translating that demand into tangible financial results. This is a company that is firing on all cylinders."

Key AI Initiatives Driving Growth

Palantir's AI-powered solutions are being deployed across a wide range of industries, driving growth and transforming operations:

- Defense and Intelligence: Palantir continues to be a vital technology provider for defense and intelligence agencies, leveraging AI for target identification, threat prediction, and battlefield intelligence.

- Healthcare: The company's AI platform is being used to accelerate drug discovery, optimize clinical trials, and improve patient outcomes by analyzing vast amounts of medical data.

- Finance: Palantir's AI solutions help financial institutions detect fraud, manage risk, and personalize customer experiences by identifying patterns and anomalies in financial transactions.

- Energy: AI-powered predictive maintenance and optimization tools are being deployed in the energy sector to enhance efficiency, reduce downtime, and improve safety.

- Manufacturing: Palantir's AI is used to optimize supply chains, improve quality control, and predict equipment failures in the manufacturing industry, leading to increased productivity and reduced costs.

Strategic Partnerships Expand Palantir's Reach

Palantir has forged strategic partnerships with key players in the technology industry to expand its AI ecosystem and reach new customers:

- IBM: Palantir and IBM have partnered to integrate Palantir's Foundry platform with IBM's hybrid cloud capabilities, enabling clients to deploy AI solutions more efficiently and securely.

- Amazon Web Services (AWS): Palantir has deepened its collaboration with AWS, making its Foundry platform available on AWS Marketplace and leveraging AWS's global infrastructure for scalability and reliability.

- Microsoft Azure: Palantir's Foundry is also available on Microsoft Azure, providing clients with more deployment options and access to Azure's AI and machine learning services.

- Fastly: Palantir has partnered with Fastly, an edge cloud platform provider, to enhance the performance and security of its AI applications, ensuring low latency and high availability.

Navigating Challenges and Embracing Opportunities

While Palantir's AI-driven growth trajectory appears promising, the company faces several challenges:

- Competition: The AI market is intensely competitive, with established tech giants like Google, Microsoft, and Amazon investing heavily in AI research and development.

- Ethical Concerns: Palantir's work with government agencies and its involvement in sensitive areas like surveillance and data privacy have raised ethical concerns among some investors and the public.

- Dependence on Government Contracts: Although Palantir is successfully expanding its commercial business, a significant portion of its revenue still comes from government contracts, which can be subject to political and budgetary uncertainties.

Despite these challenges, Palantir has significant opportunities for future growth:

- Expanding Commercial Business: The company's continued expansion into the commercial sector holds immense potential for revenue diversification and long-term growth, as businesses across all industries seek to leverage AI for competitive advantage.

- Innovation in AI: Palantir's ongoing investment in research and development will drive further innovation in AI, enabling the company to stay ahead of the curve and develop new solutions to address emerging challenges.

- Strategic Acquisitions: Palantir has a history of strategic acquisitions that have enhanced its technological capabilities and expanded its market reach. The company may continue to pursue acquisitions to strengthen its AI portfolio and accelerate its growth.

The Future of Palantir in the Age of AI

Palantir is well-positioned to capitalize on the growing demand for AI solutions. The company's strong data foundation, proven AI platforms, and strategic partnerships provide a solid foundation for future growth. By continuing to innovate, expand its commercial business, and address ethical concerns, Palantir can solidify its position as a leader in the AI revolution and deliver strong returns for investors.

As AI continues to reshape industries and transform the way we live and work, Palantir's role in this technological revolution is likely to become even more significant. The company's ability to harness the power of AI for the benefit of both government and commercial clients will be key to its continued success in the years to come.

Mad Hedge Technology Letter

November 11, 2024

Fiat Lux

Featured Trade:

(SHORT TERM MOMENTUM BREATHES LIFE INTO TECH STOCKS)

($COMPQ), (TSLA)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.