(GOOG), (MSFT), (SMR), (OKLO), (BWXT), (LEU)

When Albert Einstein unlocked the mysteries of energy with E=mc², he probably didn't imagine we'd be using that energy to train algorithms to suggest better cat videos. Still, he actually might have appreciated this cosmic irony.

This was, after all, the same genius who cut a special cat door in his study just so his beloved Tiger could come and go as he pleased. (Trust me, after watching my own cat spend 20 minutes contemplating a closed door while completely ignoring the $200 cat flap I installed—a trade that's currently showing a negative ROI—I deeply understand Einstein's problem-solving mindset.)

But while Einstein only had to power one cat door, today's AI systems are consuming enough juice to power several small countries.

Right now, in the United States, data centers—those humming temples of computational power—are gobbling up about 3-4% of the country's total electricity supply.

Hold onto your utility bills, though, because by 2030, thanks to our ever-expanding AI ambitions, that number is expected to surge to a whopping 11% to 12%.

The International Energy Agency is watching this trend with raised eyebrows, projecting that global data center electricity demand will more than double between 2022 and 2026.

The numbers are stark: By 2026, AI operations will devour over 340 terawatt-hours of electricity annually.

Major tech companies aren't waiting for a crisis. Google (GOOG), trading at roughly $170.49, has already teamed up with Kairos Power on small modular reactors (SMRs), with their first 500-megawatt reactor coming online in 2030.

Microsoft (MSFT), at about $423.46, went even bolder, signing a 20-year deal to revive Three Mile Island's reactor through Constellation Energy. Yes, that Three Mile Island.

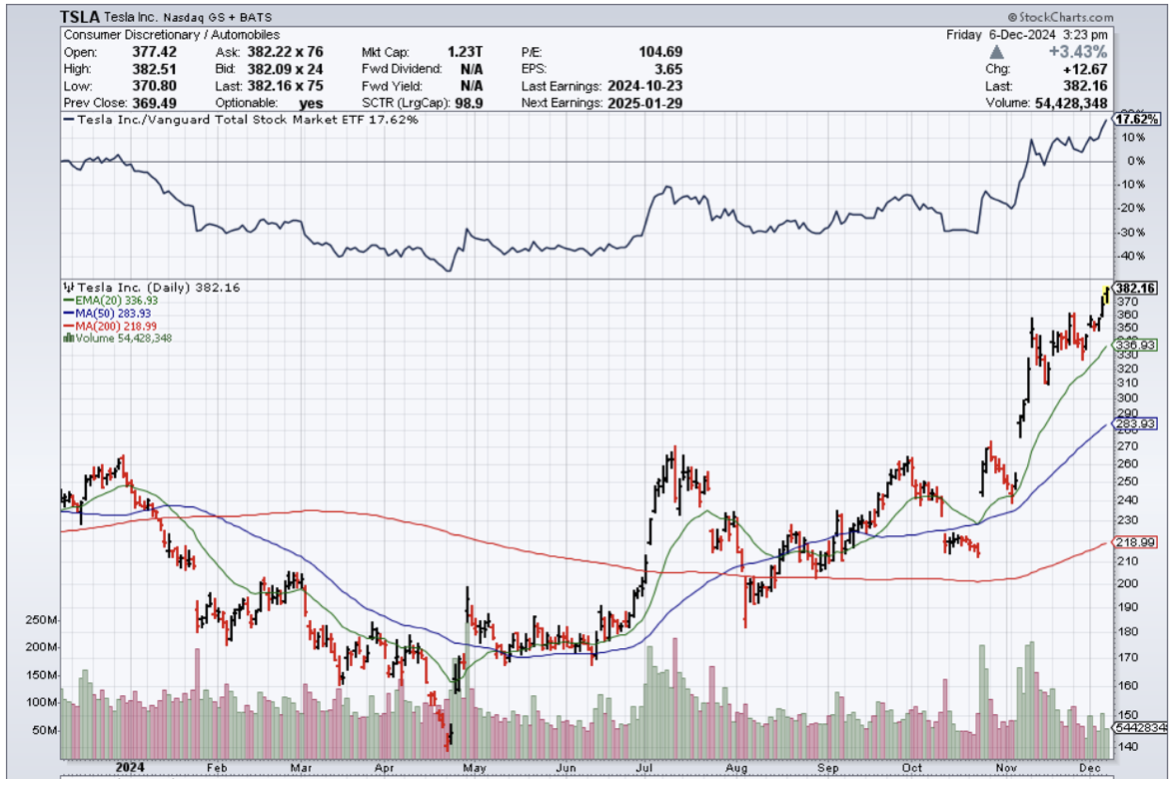

The market's reaction tells the story. NuScale Power Corporation (SMR) is up an eye-popping 481% this year, while Oklo Inc. (OKLO), with OpenAI's Sam Altman backing them, has gained 88%.

Even the old guard of nuclear power is seeing renewed interest, with BWX Technologies (BWXT) up 62% and Centrus Energy Corp (LEU) climbing 25%.

And these aren't just environmental plays - though the carbon-free power certainly helps with the PR.

What really has tech giants excited is nuclear power's reliability: constant, unwavering energy that solar and wind just can't match.

For AI operations that need to run 24/7, that's the difference between a smooth operation and a very expensive headache.

The regulatory landscape is shifting, too. The Nuclear Regulatory Commission is streamlining SMR approvals, creating faster paths to market for companies like NuScale and Oklo.

Early investors in these nuclear firms are playing a fascinating double game. They're betting the government will continue streamlining regulations while AI's voracious appetite for power keeps growing.

Of course, not everyone's thrilled about this nuclear renaissance. The ghosts of Three Mile Island, Chernobyl, and Fukushima still haunt public perception.

But here's what might surprise the skeptics: according to the World Nuclear Association, nuclear power has caused fewer fatalities per unit of energy generated than any other power source.

In fact, nuclear's death rate of 0.07 deaths per terawatt-hour makes it safer than solar (0.02-0.06), wind (0.04), and significantly safer than coal (24.6).

Even more interesting: France, which gets 70% of its electricity from nuclear power, has some of the lowest carbon emissions and electricity costs in Europe.

The new small modular reactors are even safer, with passive safety systems that automatically shut down without human intervention or external power.

Still, some environmentalists argue we should stick to wind and solar. Noble idea, but here's the reality: when your AI systems are consuming electricity like a small nation, you can't afford to be picky about your power source.

The tech giants have done the math, and nuclear power, with its steady, carbon-free output, is looking less like a last resort and more like the only option.

Even Einstein knew when to make things simple—his cat needed a door, so he cut one. Today's AI leaders are taking the same practical approach to their energy needs.

For those watching this space, this creates a rare opportunity: a chance to back companies that are using century-old physics to power tomorrow's technology.

After all, sometimes the most profitable solutions are staring you right in the face—or in this case, purring quietly in your nuclear-powered data center.

Time to do the math... and maybe cut a few doors of our own.