Mad Hedge Biotech and Healthcare Letter

December 3, 2024

Fiat Lux

Featured Trade:

(EYE SPY THE NEXT BIG THING)

(LCTX), (RHHBY), (ALPMY), (ADVM), (EDIT), (RGNX)

Who knew that the path to restored vision would involve recycling?

Not the kind where you sort plastics from paper, but the fascinating world of cellular hand-me-downs, where scientists are taking stem cells - nature's ultimate blank slate - and transforming them into made-to-order eye parts.

While most medical breakthroughs involve pills, patches, or the occasional well-placed zap of electricity, doctors have managed something far more incredible: they've successfully restored vision in multiple patients by essentially giving their eyes a cellular renovation via stem cell transplants.

But before you picture entire eyeballs being swapped out like lightbulbs, let me explain: We're talking about precision repair work at the cellular level, particularly targeting the notorious troublemakers of the vision world - macular degeneration and corneal damage.

The numbers behind this story are enough to make your eyes pop (sorry, couldn't resist).

Nearly 20 million Americans over 40 are currently living with age-related macular degeneration (AMD). That's more people than the entire population of New York City, all dealing with various stages of vision loss.

Break it down further, and you've got 18.34 million people with early-stage AMD and 1.49 million with the late-stage version, according to those number-crunchers at JAMA Network.

And once you hit 75, your chances of having AMD jump to nearly 30% - not exactly the golden years surprise package anyone's hoping for.

Here's where things get interesting - and by interesting, I mean expensive.

The National Eye Institute estimates that vision loss costs the U.S. about $139 billion annually. That's not just medical bills. It's everything from lost productivity to the cost of assistance devices and support services.

To put this in context, $139 billion could buy every resident of California a lifetime supply of carrots - though that wouldn't help their eyesight nearly as much as stem cell therapy.

Speaking of which, the stem cell therapy market, currently valued at a modest $456 million (pocket change in pharmaceutical terms), is expected to bulk up considerably, growing at a clip of 25.23% annually from 2025 to 2030.

By 2032, we're looking at a market worth $56.15 billion. That's what financial types call a growth opportunity, and what I call a lot of zeros.

Now, let’s take a look at the companies betting big on this cellular vision quest.

Lineage Cell Therapeutics (LCTX) is developing something called OpRegen, which sounds ominous but is actually a therapy using retinal pigment epithelium cells.

They must be onto something because Roche’s (RHHBY) Genentech liked it enough to throw $670 million at them in a collaboration deal.

Then there's Astellas Pharma (ALPMY), working on their own vision-restoration treatment, and Adverum Biotechnologies (ADVM), which is taking a slightly different approach with gene therapy.

Editas Medicine (EDIT) is getting even fancier, using CRISPR technology - think molecular scissors for DNA - to snip out the bad bits causing blindness.

Regenxbio (RGNX) rounds out our vision-quest dream team with their work on something called RGX-314, which uses viral vectors to deliver therapy (think of it as FedEx for genes).

The whole field of regenerative medicine, currently a $13.3 billion industry, is expected to grow exponentially, with projections showing a 23.3% annual growth rate by 2030.

That's significant considering the vision restoration market alone is worth $30 billion globally, with plenty of room to expand. Of course, that’s assuming these treatments make it through the regulatory obstacle course.

For one, there's the FDA to convince, manufacturing challenges to solve (turns out, growing eye cells at scale is tricky), and the ever-present question of who's going to pay for it all.

But given the alternative - a future where millions more lose their vision to degenerative diseases - the motivation to solve these challenges is crystal clear.

For those watching this space, I advise adding these names to your watchlist. After all, the future of vision care isn't just about getting better glasses or contact lenses anymore - it's now about regrowing the parts of the eye that wear out.

And that's a vision worth keeping an eye on (last eye pun, I promise).

Global Market Comments

December 3, 2024

Fiat Lux

Featured Trade:

(THE MAD HEDGE DECEMBER TRADERS & INVESTORS SUMMIT IS ON!)

(IT’S GROUNDHOG DAY)

(LAUNCHING "TRADING OPTIONS FOR BEGINNERS”

(SPY), (TLT), (TBT), (VIX), (VXX), (GLD), (SLV)

The election is over and a brave new world lies before us.

But the Fed may soon stop raising interest rates, inflation is rising, and tech stocks are flat-lining! Can a stock market crash be far behind?

What should you do about it?

Attend the Mad Hedge Traders & Investors Summit from December 3 - 5. Learn from 24 of the best professionals in the market with decades of experience and the track records to prove it. They are offering a smorgasbord of successful trading strategies.

Every strategy and asset class will be covered, including stocks, bonds, foreign exchange, precious metals, commodities, energy, and real estate.

Get the tools to build an outstanding performance for your own portfolio.

Best of all, by signing up you will automatically have a chance to win up to $100,000 in prizes.

Usually, access to an exclusive conference like this costs thousands of dollars. You can attend for free!

Listening to this webinar will change your life! To register, please click here.

It is always the sign of a great hedge fund manager when he makes money while he is wrong.

I have seen this throughout my life, trading with clients and friends like George Soros, Julian Robertson, Paul Tudor Jones, and David Tepper.

And wrong I certainly was in 2024.

I thought Trump would lose the election.

Then, I thought that markets would rocket no matter who won. Only the sector leadership would change.

How about one out of two?

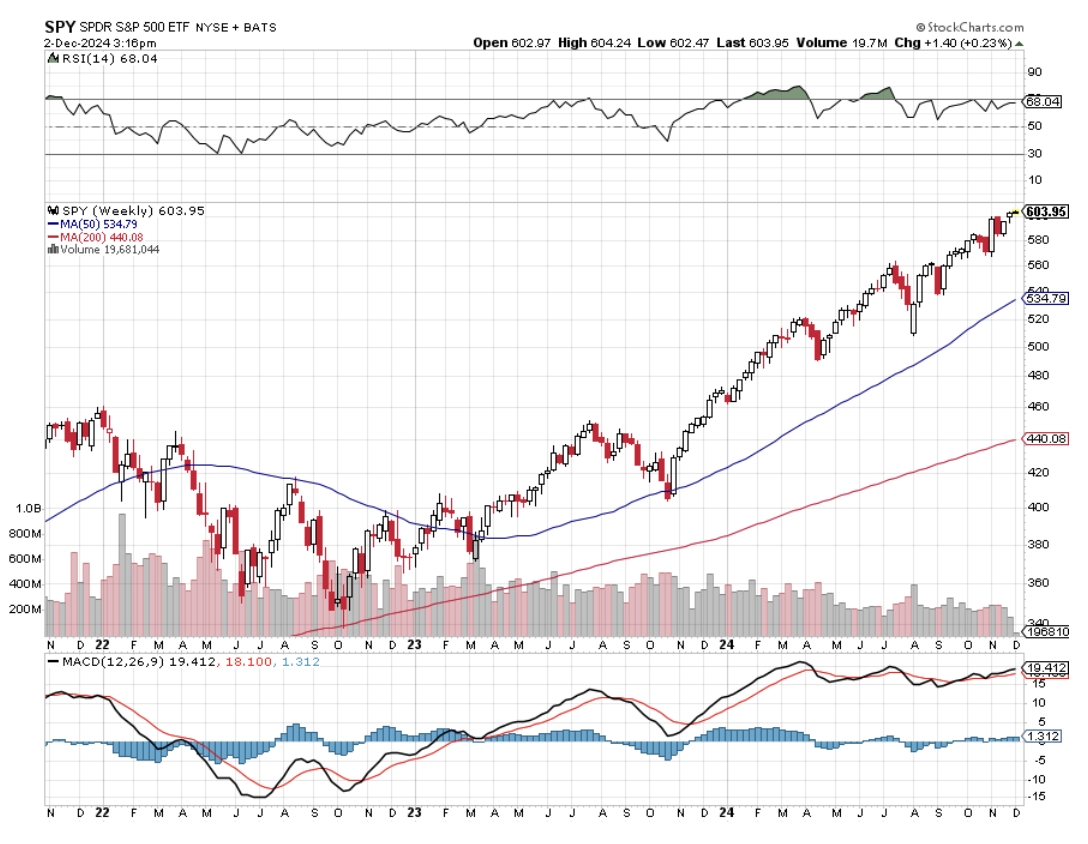

The big question is: “Is a stock market crash now in front of us?” The answer is absolutely yes. It’s only a question of how soon.

At this point, we only know what Trump said. And as we all know, what Trump says and does, or can do are totally different things. It all adds a new and constant source of unknowns for the market.

Of course, it helps to have a half-century of trading experience, too. I like to tell my beginning subscribers, “Don’t worry, after the first 50 years, this gets easy.”

Except easy it is not, going into the next several couple of years.

In a few months, it will be Ground Hog Day, and Punxsutawney Phil will call the weather for the next six weeks from his hilltop in Gobbler’s Knob, Pennsylvania.

For the financial markets, it could mean six more MONTHS of winter.

Nobody wants to sell because they believe in a longer-term bull case going into yearend.

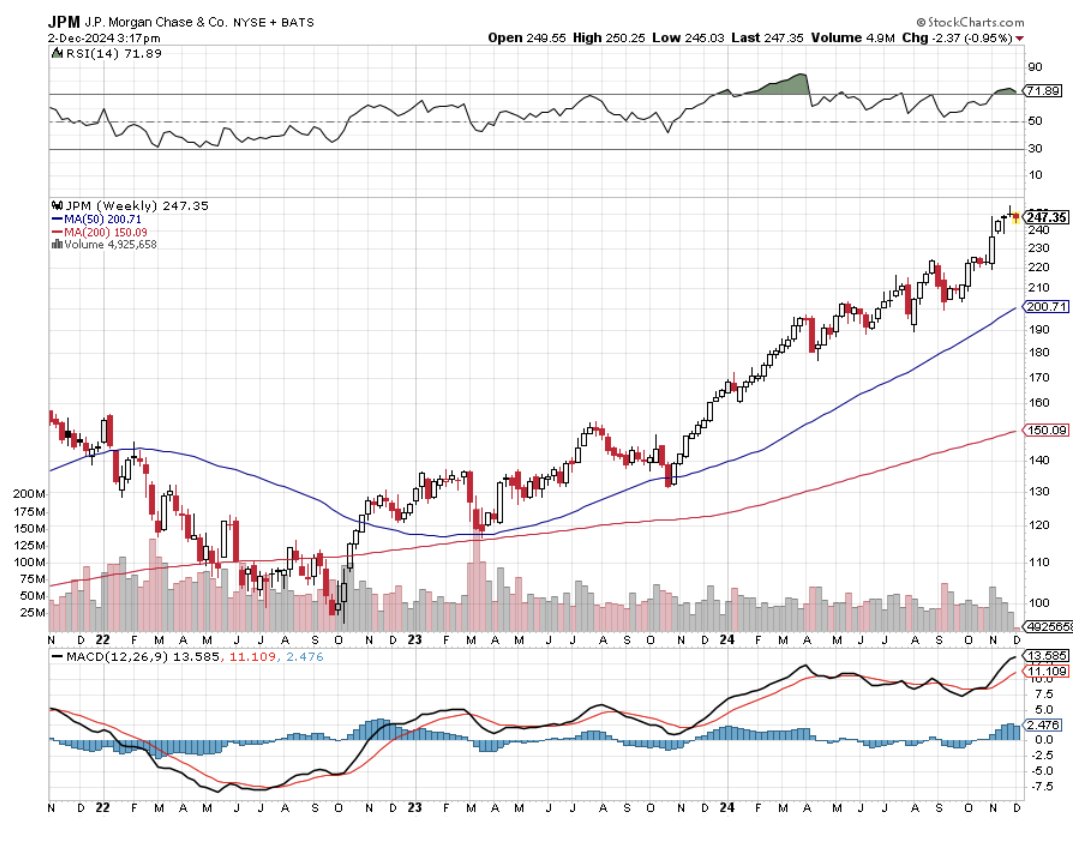

In the meantime, they are buying deregulation plays (JPM), (GS), (BLK), and Tesla (TSLA) as a hedge against the next Tweet.

We could see a repeat of the first half of 2017 when markets rocketed and then died.

This is what a Volatility Index (VIX), (VXX) is screaming right in your face, kissing the $13 handle.

The never-ending tweets are eroding the bull case by the day.

So, we’re at war with Canada now? Wait! I thought it was Mexico? No, it’s France. If it’s Tuesday, this must be Belgium.

And our new ally? Russia!

Even the Federal Reserve is hinting in yesterday’s statement that it is going into “RISK OFF” mode, possibly postponing a December interest rate cut indefinitely.

Unfortunately, that completely sucks the life out of our short Treasury bond trade (TLT), (TBT) for the time being, a big earner for us earlier this year.

Flat to rising interest rates also demolish small caps and other big borrowers (homebuilders, real estate, REITs, cruise lines).

The market is priced for perfection, and if perfection doesn’t show, we have a BIG problem.

All of this leads up to the good news that followers of the Mad Hedge Fund Trader enjoyed almost a perfect month in November.

Trade Alert Service in November

(DHI) 11/$135-$145 call spread

(GLD) 12/$435-$340 call spread

(TSLA) 12/$3.90-$400 put spread

(JPM) 11/$195-$205 call spread

(CCJ) 12/$41-44 call spread

(JPM) 12/$210-$220 call spread

(NVDA) 12/$117-$120 call spread

(TSLA) 12/$230-$240 call spread

(TSLA) 12/$250-$260 call spread

(TSLA) 12/$270-$275 call spread

(MS) 12/$110-$115 call spread

(C) 12/$60-$65 calls spread

(BAC) 12/$41-$44 call spreads

(VST) 12/$115-$120 call spread

(BLK) 12/$950-$960 call spread

The net of all of this is that 2024 is looking like a gangbuster year for the Mad Hedge Fund Trader, up 18.96% in November and 72.00% YTD, compared to only 26.62% for the S&P 500.

It seems that the harder I work, the luckier I get.

Hanging With David Tepper

(AMZN), (NVDA), (GOOG), (MSFT), (AAPL), (CRM), (ORCL), (IBM), (TSLA)

In 1956, Elvis Presley's "Heartbreak Hotel" topped the charts, teenagers swooned, and parents worried about the decay of civilization.

That same year, a group of scientists at Dartmouth College coined the term "artificial intelligence," boldly predicting human-level machine intelligence within a generation.

Seven decades later, I'm debating with Google’s Gemini about whether a hot dog qualifies as a sandwich. (For the record, Gemini’s argument about structural integrity and bread-to-filling ratios was disturbingly convincing.)

I've analyzed markets for decades, but what's happening now makes those early dot-com days look positively quaint.

Amazon (AMZN) just dropped $4 billion into a startup called Anthropic bringing their total investment to $8 billion.

But Amazon isn't just throwing cash around for fun. They're rolling out custom-designed chips called Trainium and Inferentia to power Anthropic's AI systems through AWS.

Essentially, this move is a direct challenge to Nvidia's (NVDA) GPU dominance in the AI space.

Anthropic, founded in 2021 by OpenAI defectors, has rocketed from startup to major player with stunning speed.

In 2023, Google (GOOG) spotted their potential early and invested $500 million. Now with Amazon's backing, they've got serious muscle.

Considering the massive potential of the AI space, it’s not surprising that the tech giants are picking sides.

Amazon, Anthropic, and Alphabet form one power group, combining Amazon's cloud infrastructure, Anthropic's AI expertise, and Google's massive data resources.

Microsoft (MSFT) and OpenAI make up another, leveraging their Azure cloud platform and GPT technology to dominate enterprise AI solutions.

Apple's (AAPL) pulled off an exclusive deal to bring ChatGPT to iPhones - because apparently, Siri needed some company. This move signals that AI will be the next major battleground in consumer tech.

The November numbers reflect these strategic moves.

Amazon's roughly at $206, buoyed by investors betting on their AI infrastructure play. Microsoft commands $423, their OpenAI partnership driving cloud revenue growth. Alphabet sits at approximately $171, their diverse AI portfolio attracting long-term investors.

Nvidia, despite Amazon's chip rebellion, holds steady at $135 – proof that the AI boom needs more than just one chip supplier.

And the ripple effects are transforming every sector.

IBM's (IBM) Watson has evolved from winning Jeopardy! to analyzing medical data, opening up a $500 billion healthcare AI market.

Oracle (ORCL) finally made databases interesting – words I never thought I'd type. They’re leveraging AI to automate complex data operations, capturing enterprise clients from traditional providers.

Salesforce (CRM) embedded AI so deeply in their platform that their software predicts customer needs before customers even have them. I tested this claim. It knew I wanted to upgrade before I did. Unnerving.

Tesla's (TSLA) AI is teaching cars to distinguish between fire hydrants and pedestrians.

As someone who's had close encounters with both, I appreciate the effort. Though I'm still waiting for AI that can successfully negotiate with traffic cops.

So, how do you get a piece of the action? Consider keeping a close eye on industry leaders like Amazon and Microsoft for their cloud AI dominance, Alphabet for its research prowess, and Nvidia for AI hardware leadership.

And don't overlook IBM, Oracle, and Salesforce for enterprise AI applications. Adding these names to your watchlist could position you well as the AI revolution unfolds.

Needless to say, the stakes here are unprecedented. My first tech investment was in a company making faster floppy disk drives.

Now, I'm watching firms develop artificial minds that outthink teams of PhDs. The money flowing into AI makes those early internet investments look like spare change in a couch. And the pace is only accelerating.

The AI movement isn't approaching – it's here, changing our world faster than rock and roll transformed music.

We've got front-row seats to the biggest show since the internet. As Elvis would say, "It's now or never" for AI investing. Just make sure you don't end up at Heartbreak Hotel.

Mad Hedge Technology Letter

December 2, 2024

Fiat Lux

Featured Trade:

(STICK WITH ENTERPRISE TECH IN 2025)

(HPE), (DELL), (TSLA), (NVDA)

Although, on the surface, tech stocks might be performing quite well, we need to talk about an imminent issue that could affect them.

I would even say that I am quite surprised by how the year is panning out.

There was so much uncertainty going into this year, and the election was a brutal contest that was bitterly fought.

However, the election gave us a clear winner, triggering a short-term tsunami of capital into tech stocks with the likes of Tesla (TSLA) leading the charge.

Even institutional money from heavyweights like Blackrock and others poured into tech stocks like there was no tomorrow.

TSLA is up today again on more stock upgrades.

If one ever needed a skinny variety of reliable tech stocks, then investing capital in Nvidia, Tesla, and perhaps Netflix or a Meta would be a solid foundation.

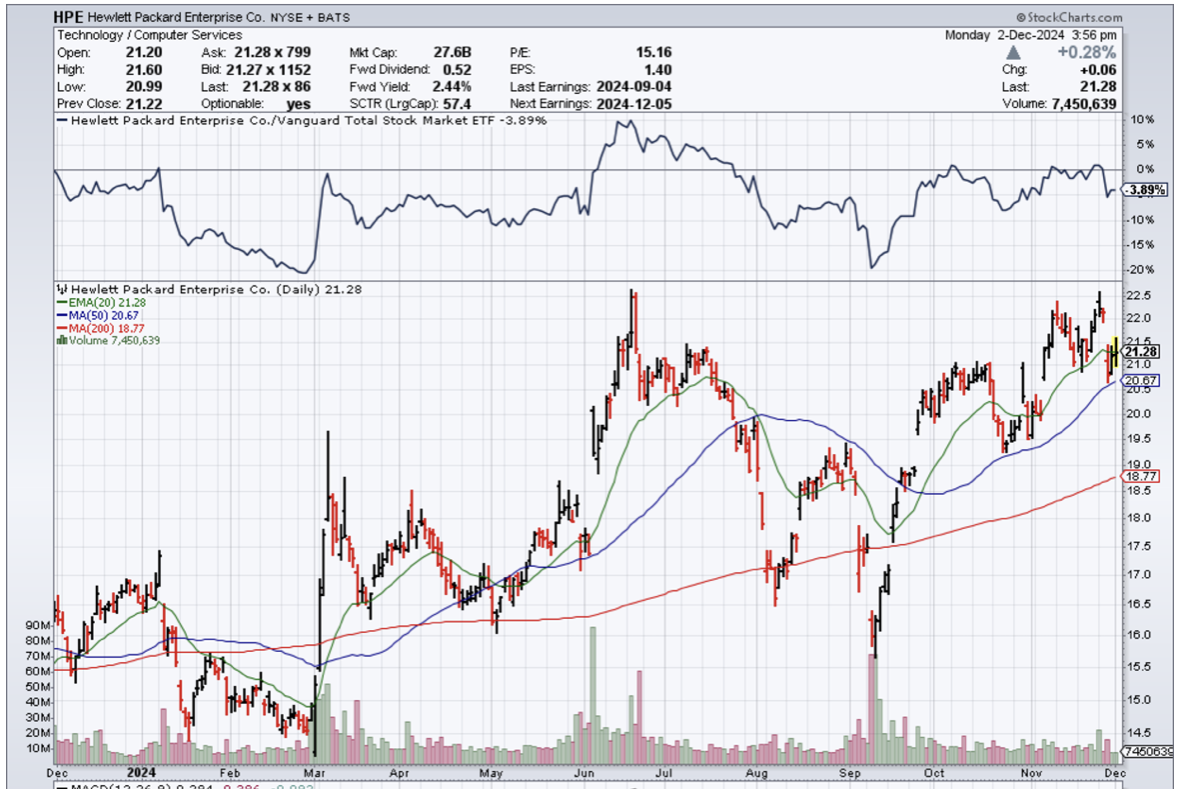

It is not only the Midas touch in the tech world, with management at HP and Dell saying the computer and laptop business isn’t all too hot.

Revenue generated by Dell’s (DELL) PC business declined 1% to $12.1 billion in the fiscal third quarter, falling short of estimates. While sales in HP’s (HPE) PC unit rose 2% to $9.59 billion, missing forecasts.

The PC refresh cycle is pushing into next year (2025), said Dell management.

HP Chief Executive Officer Enrique Lores said in an interview that the release of Microsoft’s new edition of Windows software hasn’t fueled PC sales from corporate clients as quickly as in previous releases.

The market had seen a historic decline in recent years after a burst of demand for new laptops in the early months of the pandemic when students and corporate employees were stuck at home. While signs of a rebound began to materialize this year, shipments again dipped in the third quarter.

This type of narrative has been put in motion by the crowd who think a new administration and their immigration stance will cause rampant inflation in wages.

No doubt, a lot of changes will take place in the next 50 days and after, and that type of uncertainty could deliver us a sharp selloff if short-term pain is sensed by the market.

Comments from Best Buy already set a very low bar even lower, as the recession that was supposed to take place in 2018 could be sneaking up on us.

The unemployment rate is forecasted to peak at 4.4% and has been steadily trending higher, highlighting the weakening of the US consumer.

There is a good chance that in 2025, retail tech will be in a recession before enterprise tech and enterprise tech stocks will be the last bastion of a narrowing market growth.

The key signal to focus on is a big Bitcoin sell-off that could trigger a flight to safety.

As long as market action stays orderly, I expect the pain trade to go higher in tech stocks in an uneven way, and I would avoid any tech stocks directly connected to American retail shoppers.

“AI will be the best or worst thing ever for humanity.” – Said Elon Musk

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.