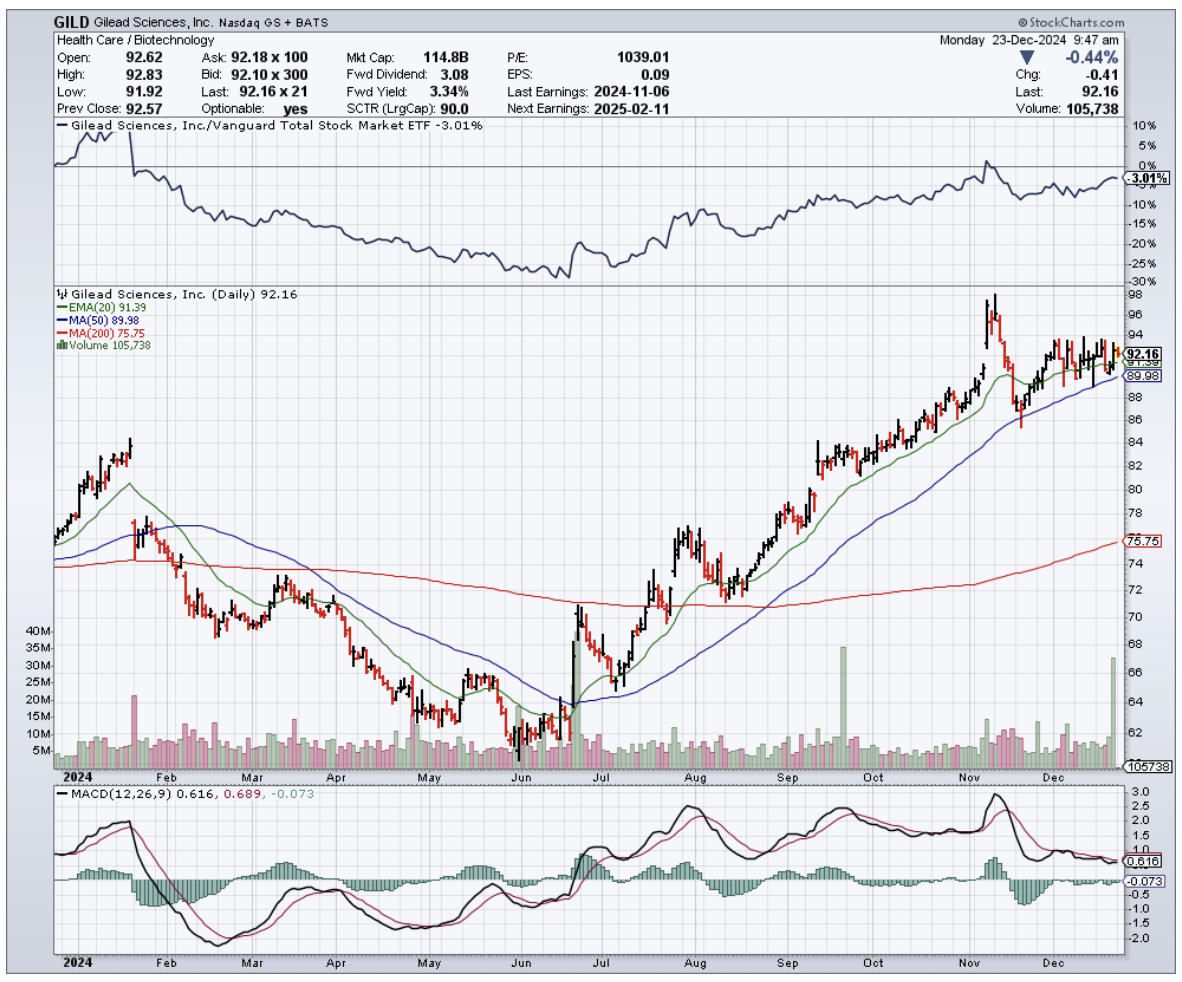

I found myself gridlocked in Bay Area traffic a few days ago, inching past Gilead's (GILD) sprawling Foster City headquarters, when my phone lit up with a call from an old friend at Goldman.

“Alright, tell me—what’s the real story with biotech this year?” she asked, her tone hovering somewhere between curiosity and exasperation. “Half my portfolio feels like a masterstroke, the other half... well, let’s just say it’s testing my patience.”

As I watched a Tesla (TSLA) weave through traffic like it was auditioning for a Fast & Furious reboot, I smiled.

Biotech has always been a bit of a high-stakes chess game—brilliance in one corner, chaos in another, and always a few surprises lurking behind the next move.

“Let me break it down for you,” I said, steering the conversation as carefully as I did my car through the bumper-to-bumper maze.

First, the winners are crushing it, and I mean crushing it. Gilead (GILD) finally cracked the code on HIV treatment, developing what's essentially a vaccine that doesn't require popping pills like they're Tic Tacs.

My contacts in clinical development tell me the Phase 3 data in cisgender women is nothing short of spectacular. With a $6 billion annual market potential by 2028, this isn't just another incremental advance - it's the kind of breakthrough that makes everyone in biotech salivate.

Then there's Wave Life Sciences (WVE) and their RNA editing technology. Remember when we thought CRISPR was the only game in town? Well, Wave just showed us there's more than one way to edit a gene.

Their liver-targeting therapy is the first successful RNA editing in humans - think of it as spell-check for your DNA, but reversible. The market's currently at $1.1 billion, but with 35% CAGR through 2030, this train is just leaving the station.

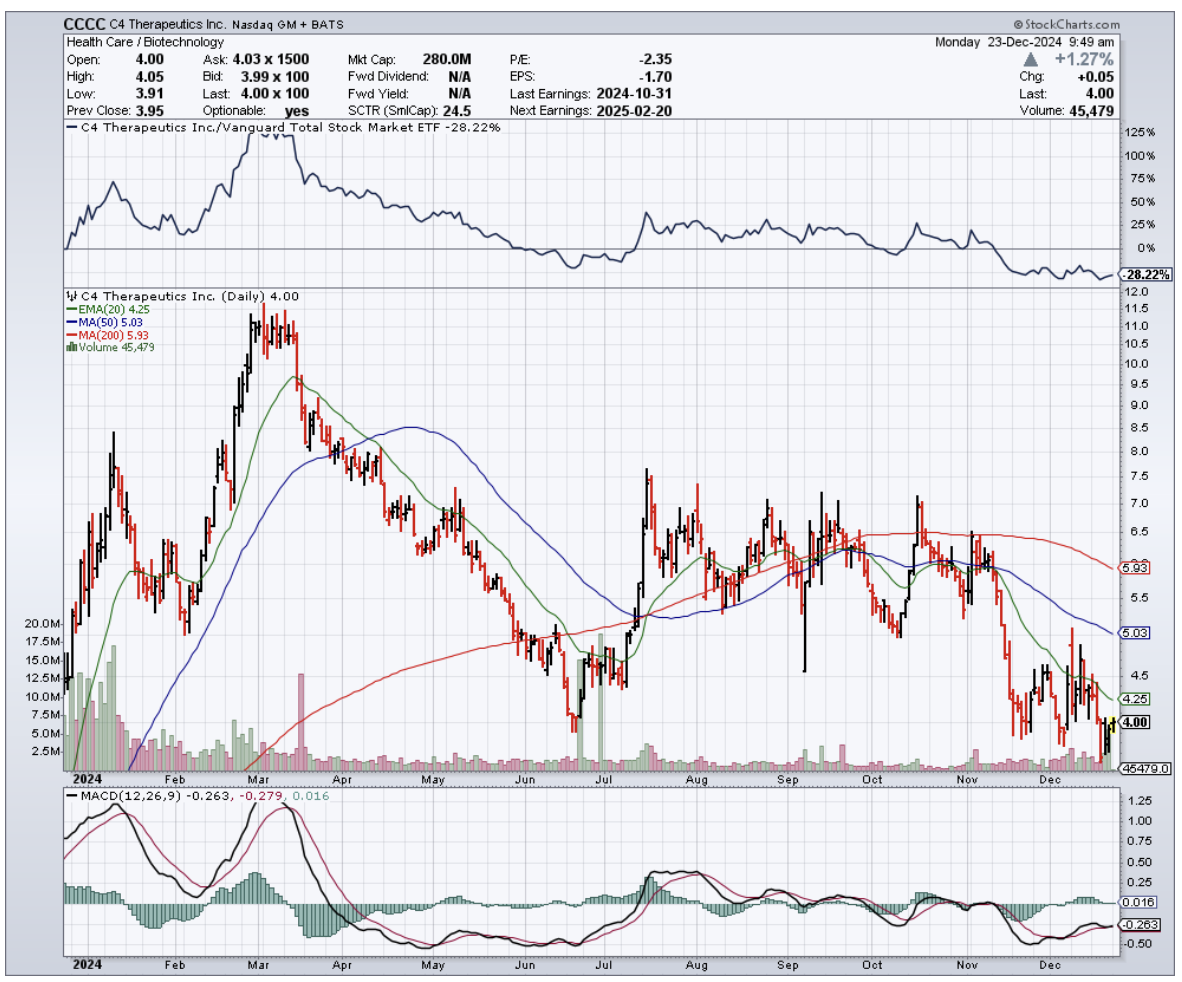

Speaking of trains leaving stations, molecular glue developers like C4 Therapeutics (CCCC) are watching Big Pharma back up the Brink's truck.

We're talking $8 billion in licensing deals this year alone. After all, when Roche (RHHBY) drops $300 million upfront - not milestone payments, mind you, but cold hard cash - you know they've seen something special in the data room.

But here's where it gets interesting, and I had to pull over at this point in the conversation because my friend wasn't going to like what came next.

CRISPR stocks? Down 20%. Editas (EDIT) and CRISPR Therapeutics (CRSP) are learning that revolutionary science doesn't always translate to revolutionary returns.

My friend Janet at the Fed might be talking about higher rates, but these companies are bleeding cash faster than a Silicon Valley startup's WeWork budget.

The obesity market? Unless your name is Eli Lilly (LLY) or Novo Nordisk (NVO), you're probably not having a great time.

Only three startups cleared $100 million in funding this year. In biotech terms, that's like trying to build a house with pocket change.

The global market's sitting at $4.1 billion, but it's more crowded than a San Francisco coffee shop during a tech conference.

And don't get me started on Walmart (WMT) and CVS (CVS) trying to play doctor. They thought they could disrupt traditional healthcare with their “get your physical next to the garden tools” model.

The result? A combined loss of $250 million and a wave of clinic closures.

The lesson here is clear: just because you can sell lightbulbs and Band-Aids in the same aisle doesn’t mean you should try to diagnose strep throat next to the automotive department.

A kid in a modded Subaru WRX cut me off as I wrapped up the call, but I left my friend with this: In biotech, timing is everything.

Gilead and Wave are showing us that patience pays off when the science is solid. Meanwhile, CRISPR stocks remind us that even the most promising technology needs good timing and deep pockets.

So, watch those clinical trial results like a hawk, and keep an eye on where the venture money's flowing.

But most importantly, remember what my old mentor used to say: "In biotech, you're not just betting on the science - you're betting on the scientist, the CFO, and sometimes, just sometimes, on whether people are ready to get their flu shot next to the garden center."

Now, where's that highway patrol when you need them?