When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

(THIS WEEK THE FED WILL SET THE MOOD OF THE MARKETS AS WE SIGN OFF ON 2024)

December 16, 2024

Hello everyone

WEEK AHEAD CALENDAR

MONDAY DEC. 16

8:30 a.m. Empire State Index (December)

9:45 a.m. PMI Composite preliminary (December)

9:45 a.m. PMI Manufacturing preliminary (December)

9:45 a.m. PMI Services preliminary (December)

TUESDAY DEC. 17

8:30 a.m. Retail Sales (November)

8:30 a.m. Capacity Utilization (November)

8:30 a.m. Canada Inflation Rate

Previous: 2.0%

Forecast: 2.2%

9:15 a.m. Industrial Production (November)

9:15 a.m. Manufacturing Production (November)

10 a.m. Business Inventories (October)

10 a.m. NAHB Housing Market Index (December)

Earnings: Amentum Holdings

WEDNESDAY DEC. 18

8:30 a.m. Building Permits preliminary (November)

8:30 a.m. Current Account (Q3)

2:00 p.m. FOMC Meeting

Previous: 4.75%

Forecast: 4.50%

2:00 p.m. Fed Funds Target Upper Bound

Earnings: Micron Technology, Lennar, General Mills

THURSDAY DEC. 19

7:00 a.m. UK Rate Decision

Previous: 4.75%

Forecast: 4.75%

8:30 a.m. Continuing Jobless Claims

8:30 a.m. GDP Chain Price final (Q3)

8:30 a.m. GDP final (Q3)

8:30 a.m. Initial Claims (12/14)

8:30 a.m. Philadelphia Fed Index (December)

10:00 a.m. Existing Home Sales (November)

10:00 a.m. Leading Indicators (November)

11:00 a.m. Kansas City Fed Manufacturing Index (December)

Earnings: Nike, FedEx, Conagra Brands, Darden Restaurants, CarMax.

FRIDAY DEC. 20

8:30 a.m. Core PCE Deflator (November)

8:30 a.m. PCE Deflator (November)

8:30 a.m. Personal Consumption Expenditure (November)

8:30 a.m. Personal Income (November)

10:00 a.m. Michigan Sentiment final (December)

ON THE RADAR THIS WEEK

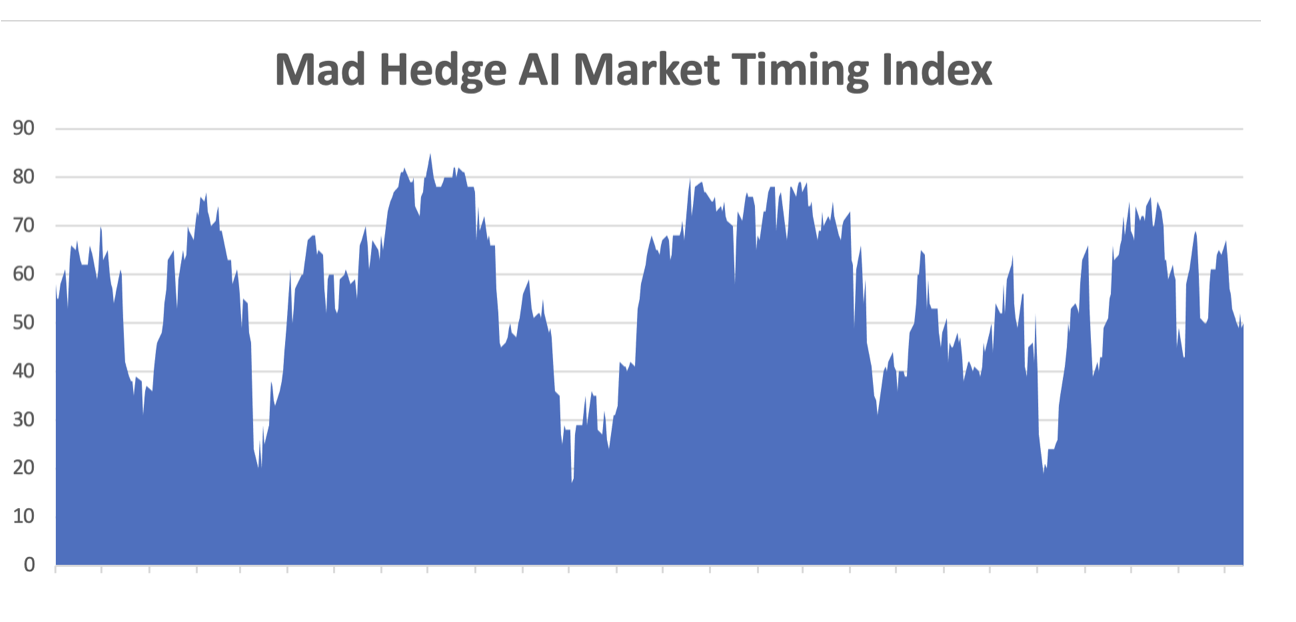

The Federal Reserve policy meeting will set the tone for the markets heading into year-end. It will also shed light on what investors can expect in 2025.

The odds are for a cut in interest rates this week.

But the Fed meeting will also highlight its projections going forward. Markets are pricing in further rate cuts, and if they do take place, we could eventually see the fed funds rate between 3.50% and 4.00%.

In addition to the FOMC, we get the PCE report on Friday. Some investors are concerned about sticky inflation and its effect on the markets, particularly with Trump’s policy promises that include mass deportations and big tariffs imposed on imported goods. We have to wait and see if that talk is real. Even if those policies are introduced, we still don’t know the extent they will be enforced or any detail about the numbers involved. As always, investors need a clear lens into government policies - the devil is in the details – before rational decisions can be made about investments.

THE MARKET PICTURE IN 2025

Strategists are anticipating that the strong rally we have enjoyed in 2024 can continue into early 2025. However, by around mid-year, volatility could return, and a bumpy ride may ensue. I am expecting a 10%-20/25% market correction sometime in 2025. Interestingly, no strategists are suggesting that the market will be lower at the end of 2025 than where it is now. So, that means hold tight and ride the waves.

MARKET UPDATE

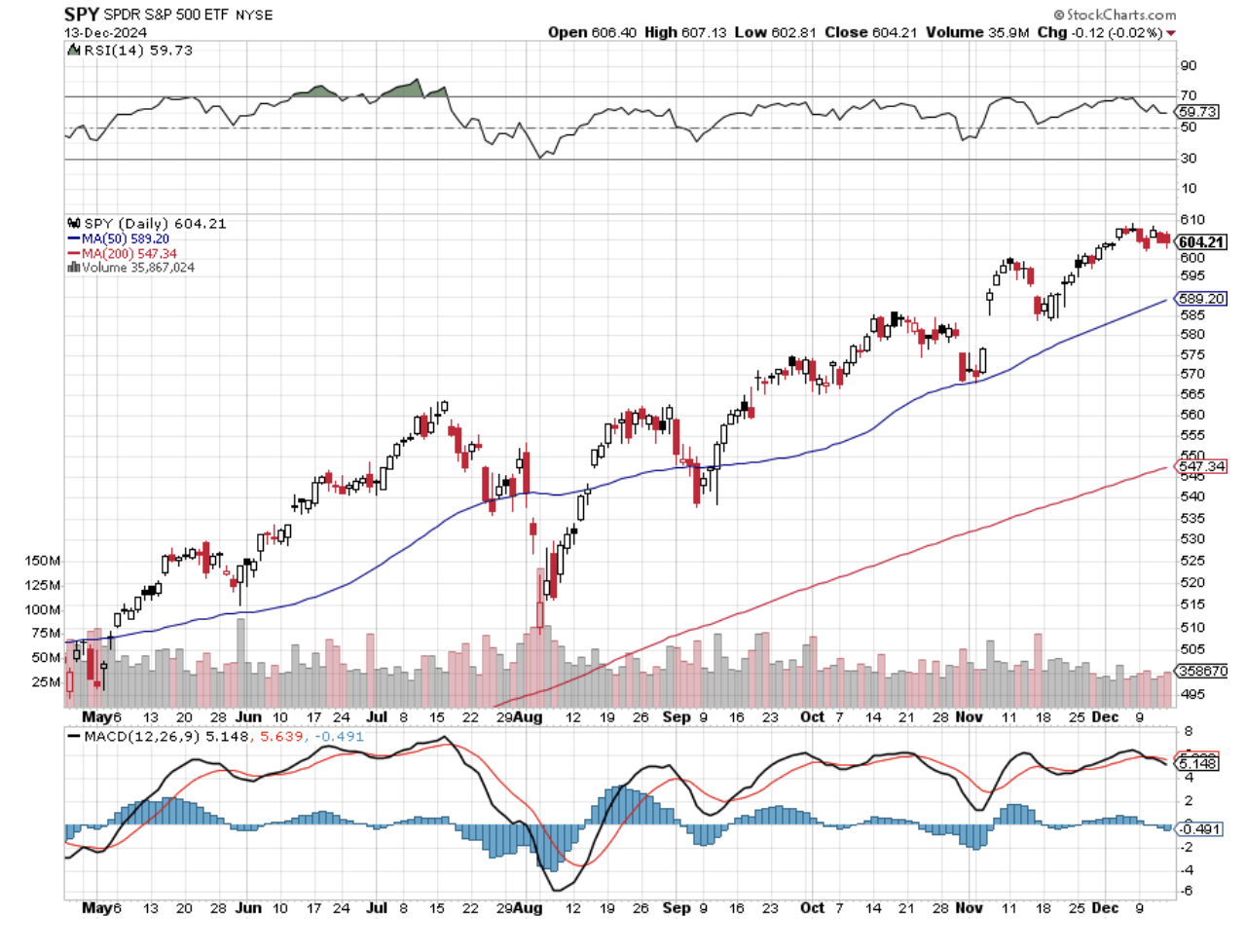

S&P500

Uptrend continues. Even though we have plenty of risk hanging over the market, including bearish technical, the market can still trend higher. A short-term pullback would probably find support over the next few weeks as markets traditionally perform well towards year-end.

Resistance: $6090/$6120

Support: $6025/$5970

GOLD

Gold is choppy and is undergoing a correction. And this correction could take some time. As I said last week, we could see $2,400 and even $2,200 before a low is found. That being the case, you could look at selling calls on precious metals’ stocks. Barrick Gold (GOLD) is a suggestion here.

Resistance: $2720/$2730

Support: $2630/$2590

BITCOIN

As I write this, Bitcoin is sitting above $105k. Next stop is the $109k area. Last week, Bitcoin thrashed around the $100k mark. Some people believe this zone marks a top for Bitcoin, but I believe it is merely a pit stop on the way to higher targets.

Support: $94000/$94,500/$90,000/$90,750

QI CORNER

Solution: quit buying from these companies and support local businesses.

SOMETHING TO THINK ABOUT

Cheers

Jacquie

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

December 16, 2024

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD or CATCHING THE NEXT MARKET TOP), plus (A LIFETIME OF FLIGHT INSTRUCTION),

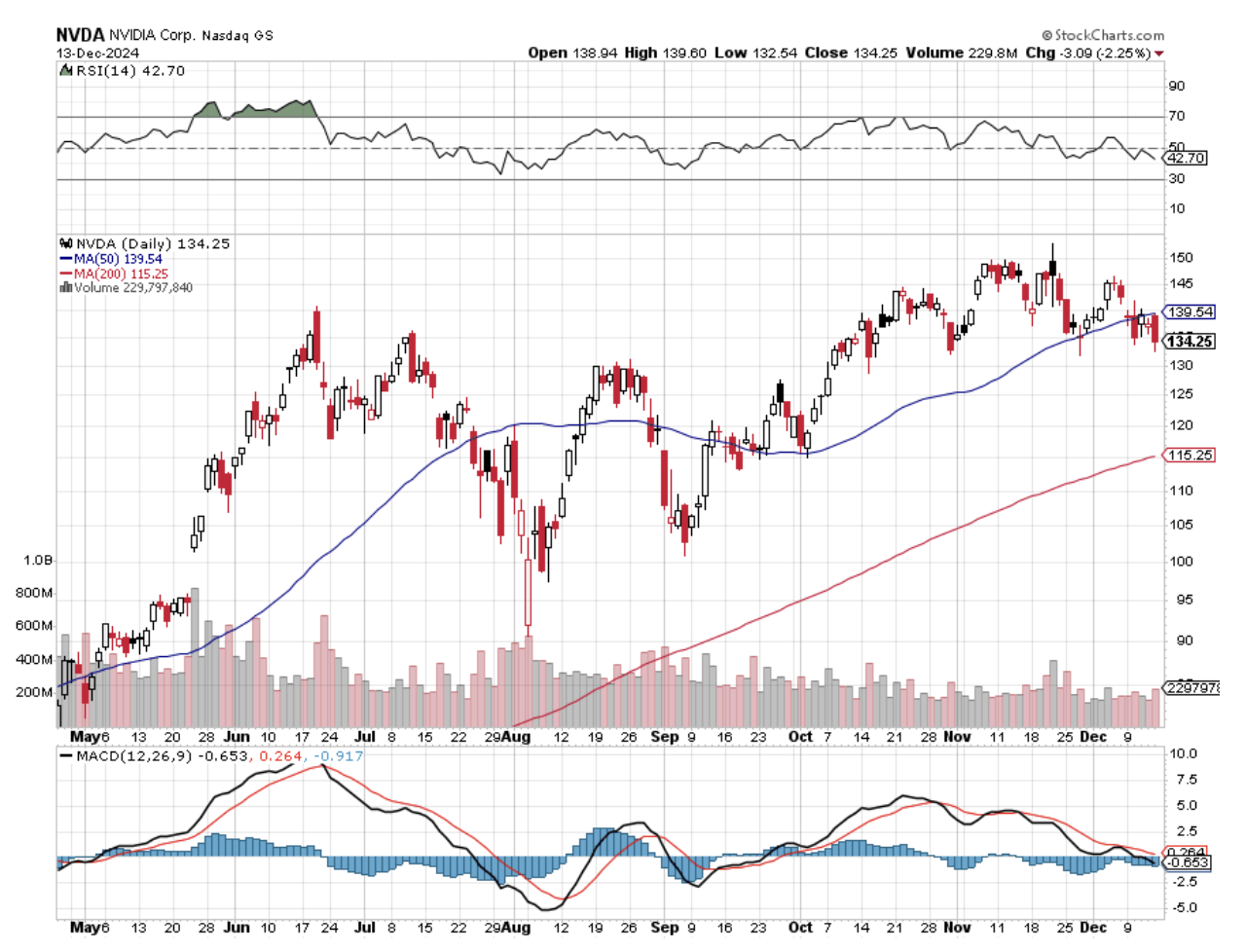

(JPM), (NVDA), (BAC), (C), (CCJ), (MS), (BLK), (TSLA)

We all learned as children how to win at “Merry Go Round.” All you have to do is remember to sit down when the music stops playing.

We are now entering a market with the greatest uncertainty since the pandemic. This is when expansive election promises meet harsh reality. And the new president has to attempt to deliver on his almost uncountable promises with a one-seat majority in the House of Representatives, the smallest in history.

In 2025, you are going to have to work twice as hard to make half the money with double the volatility. Markets like this are the sweet spot for Mad Hedge Fund Trader, which makes money in all market conditions. We are entering 2025 with a 30X multiple for NASDAQ, near a record high. Since 2012, the value of the Magnificent Seven has exploded from $1 trillion to $18 trillion, and you are buying, or at least staying long, on top of that move.

Amidst all the euphoria, someone failed to notice that the Republicans actually lost two seats in the House, and two more were given away in cabinet appointments. They probably don’t realize that Republicans die faster than Democrats because they are, on average, ten years older.

There are also more Democratic women who, on average, live six years longer than men. That means the slim majority will be gone in six months. Am I the only one who pays attention to demographics?

No House means no money to do anything. Many of the new administration’s proposals cost enormous amounts of money. My ancestors came from Missouri before they moved to California during the gold rush in 1849, which is known as the “Show me” state.

Show me.

So, in my early take on the New Year, look for a 10%-15% rally in stocks led by the same old sectors during the first half of 2025. Buy election winners and sell the losers. Artificial intelligence is accelerating faster than ever, and that is going on independent of Washington. Embrace the bubble. Call it the “pre-reality” rally.

After that, look for a give-back of some, if not all, of this rally. Tax cuts and spending increases will explode the National Debt well beyond the current $36 trillion. Inflation will return. Interest rates will rise. A trade war will exact a high price. Perhaps two million small businesses will go under, thanks to their loss of cheap supplies from China. Antitrust law will only be enforced against the left coast Magnificent Seven, and everyone else will get a free pass.

And now it’s my turn to deliver you a harsh reality. Every recession and stock market in my lifetime has started during a Republican administration, and I am pretty old. The causes are always the same. The expectation of tax cuts and hands-off on regulation creates over-investment and excessive leverage that always ends in tears. When that peaks, stocks crash, and a recession ensues.

Except that this time, it’s different. The incoming administration promises to sow the seeds of its most destructive policies, a trade war, and massive tax cuts during a booming economy that explodes the deficit and inflation “on day one.” That means we could see an earlier recession than a later one. That is when the music stops playing.

That is fine with me. I make more money in down markets than I do in up markets. That is because I get the hockey stick effect of falling share prices, rising volatility, and soaring options premiums to play on the downside.

As for you, I’m not so sure. I don’t have to run faster than the bear to survive, just faster than you.

It could be a great year to “Sell in May and Go Away.” I’m already booking summer cruises on Cunard (https://www.cunard.com/en-us).

A lot of readers have been asking about my take on the sudden collapse of the Bashar al Assad regime in Syria in the context of my nearly 60 years of experience in the region. I have never been to Syria; just viewed it from a distance from the Golan Heights in Israel.

The one-liner here is that it is a huge win for the US and the West and a huge loss for Russia, Iran, and the main terrorist groups.

It ejects Russia from the Middle East for the time being after making massive 50-year investments there in military support. Syria will default on all of its billions of dollars in debts to Russia. Russia built the enormous Aswan Dam on the Nile, then saw defaults here, too, when Egypt sided with the West after the Camp David Accords.

Russia built the world's third largest military in Iraq, with 5,000 tanks, which the US then completely destroyed in the first Gulf War, where I participated. Their failure in Afghanistan caused the collapse of the Soviet Union. Russia has lost its only Mediterranean port at Aleppo, and its ships there have already been withdrawn. At this point, there must be a lot of unemployed Middle East experts in Moscow.

Iran has been fighting a proxy war against Israel and the US through Hamas, Hezbollah, and Syria for 45 years, which it has just ignominiously lost. It used to supply Gaza with weapons by trucking them through Syria and loading them on ships. It now has to go all the way around Africa, and there is no one there to take them anyway.

The cost of this victory to the US has been zero: no money, no troops, no heavy equipment. Sometimes, doing nothing is the right thing. The cost to Russia and Iran has been exponential.

Of course, in the Middle East, be careful what you wish for because you might end up getting something far worse. Assad may have just been replaced with another anti-western terrorist group. That is why President Biden has directed the complete destruction of all arms stockpiles in Syria, with the assistance of Israel and Turkey. We have their exact latitude and longitude in seconds. Better there to be no weapons and have an incoming regime that is toothless in Syria than having them fall into the hands of the next terrorist group. There are no defenders in Syria at the moment.

Finally, I was amazed to see Assad’s extensive classic and race car collection, the ultimate symbol of modern dictators. Can I make a bid on the 1956 Cadillac? To where and who do I send my offer?

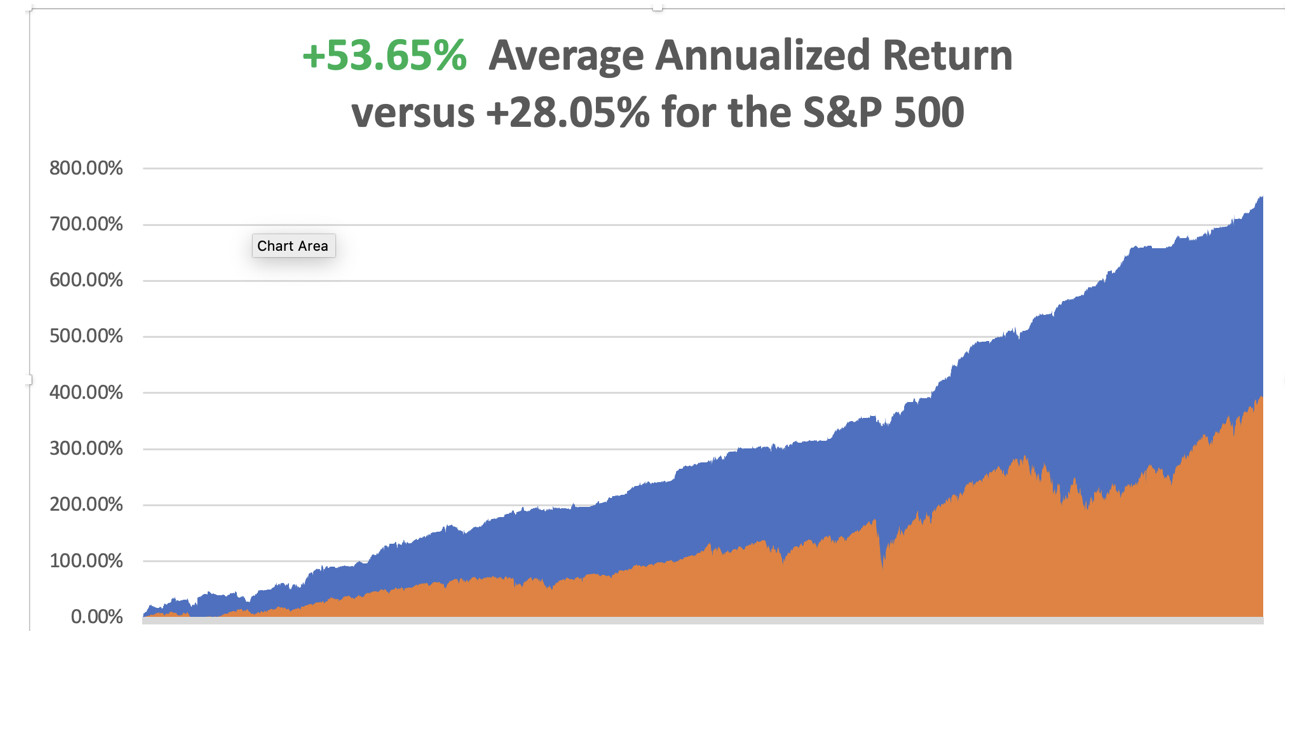

In December, we have gained +2.53%. My 2024 year-to-date performance is at an amazing +74.53%. The S&P 500 (SPY) is up +26.62% so far in 2024. My trailing one-year return reached a nosebleed +75.21%. That brings my 16-year total return to +751.16%. My average annualized return has recovered to an incredible +53.65%.

My bet that the market wouldn’t drop below pre-election levels proved wildly successful. As a result, all of my long positions will expire at max profit. They are anywhere from 7% to 70% in the money. That includes (JPM), (NVDA), (BAC), (C), (CCJ), (MS), (BLK) and a triple long in (TSLA). My largest position was a triple weighting in Tesla, which went up the most. This is the first time I have been able to pull this off in the 16-year history of the Mad Hedge Fund Trader.

Some 63 of my 70 round trips, or 90%, were profitable in 2023. Some 74 of 94 trades have been profitable so far in 2024, and several of those losses were really break evens. That is a success rate of +78.72%.

Try beating that anywhere.

My Ten-Year View – A Reassessment

When we have to substantially downsize our expectations of equity returns in view of the election outcome, my new American Golden Age, or the next Roaring Twenties, is now looking at a headwind. The economy will completely stop decarbonizing. Technology innovation will slow down. Trade wars will exact a high price. Inflation will return. The Dow Average will rise by 600% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old. My Dow 240,000 target has been pushed back to 2035.

On Monday, December 16, at 8:30 AM EST, the S&P Global Flash PMI is out.

On Tuesday, December 17 at 8:30 AM, the Retail Sales are published.

On Wednesday, December 18, at 8:30 AM, the Building Permits are printed.

On Thursday, December 19 at 8:30 AM, the US GDP Growth Rate is announced.

On Friday, December 20, Core PCE is printed. It is effectively the last trading day of the year as the BSDs take off on vacation, and the “B” team sticks around to handle the low-volume holiday trading. At 2:00 PM, the Baker Hughes Rig Count is printed.

As for me, in the seventies, Air America was not too choosy about who flew their airplanes at the end of the Vietnam War. If you were willing to get behind the stick and didn’t ask too many questions, you were hired.

They didn’t bother with niceties like pilot licenses, medicals, passports, or even real names. On some of their missions, the survival rate was less than 50%, and there was no retirement plan. The only way to ignore the ratatatat of bullets stitching your aluminum airframe was to turn the volume up on your headphones.

Felix (no last name) taught me to fly straight and level so he could find out where we were on the map. We went out and got drunk on cheap Mekong Whiskey after every mission just to settle our nerves. I still remember the hangovers.

When I moved to London to set up Morgan Stanley’s international trading desk in the eighties, the English had other ideas about who was allowed to fly airplanes. Julie Fisher at the London School of Flying got me my basic British pilot’s license.

If my radio went out, I learned to land by flare gun and navigate by sextant. She also taught me to land at night on a grass field guided by a single red-lensed flashlight. For fun, we used to fly across the channel and land at Le Touquet, taxiing over the rails for the old V-1 launching pads.

A retired Battle of Britain Spitfire pilot named Captain John Schooling taught me advanced flying techniques and aerobatics in an old 1949 RAF Chipmunk. I learned barrel rolls, loops, chandelles, whip stalls, wingovers, and Immelmann turns, everything a WWII fighter pilot needed to know.

John was a famed RAF fighter ace. Once, he got shot down by a Messerschmitt 109, parachuted to safety, took a taxi back to his field, jumped into his friend’s Spit, and shot down another German. Every lesson ended with a pint of beer at the pub at the end of the runway. John paid me the ultimate compliment, calling me “a natural stick and rudder man,” no pun intended.

John believed in tirelessly practicing engine off-landings. His favorite trick was to reach down and shut off the fuel, telling me that a Messerschmitt had just shot out my engine and to land the plane. When we got within 200 feet of a good landing, he turned the fuel back on, and the engine coughed back to life. We practiced this more than 200 times.

When I moved back to the US in the early nineties, it was time to go full instrument in order to get my commercial and military certifications. Emmy Michaelson nursed me through that ordeal. After 50 hours of flying blindfolded in a cockpit, you get very close with someone.

Then came flight test day. Emmy gave me the grim news that I had been assigned to “One Engine Larry,” the most notorious FAA examiner in Northern California. Like many military flight instructors, Larry believed that no one should be allowed to fly unless they were perfect.

We headed out to the Marin County coast in an old twin-engine Beechcraft Duchess, me under my hood. Suddenly, Larry shut the fuel off, told me my engines failed, and that I had to land the plane. I found a cow pasture aligned with the wind and made a perfect approach.

Then he asked, “How did you do that?” I told him. He said, “Do it again,” and I did. Then he ordered me back to base. He signed me off on my multi-engine and instrument ratings as soon as we landed without bothering with the rest of the test. Emmy was thrilled.

I now have to keep my many licenses valid by completing three takeoffs and landings every three months. I usually take my kids and make a day of it, letting them take turns flying the plane straight and level.

On my fourth landing, I warn my girls that I’m shutting the engine off at 2,000 feet. They cry, “No, Dad, don’t.” I do it anyway, coasting in bang on the numbers every time.

A lifetime of flight instruction teaches you not only how to fly but how to live as well. It makes you who you are. Thus, my insistence on absolute accuracy, precision, risk management, and probability analysis. I live my life by endless checklists, both short and long-term. I am the ultimate planner, and I have a never-ending obsession with the weather one week out.

It passes down to your kids as well.

Julie became one of the first female British Airways pilots, got married, and had kids. John passed on to his greater reward many years ago. There are no surviving Battle of Britain pilots left. The last one passed away this year. Emmy was an early female hire as a United pilot. She married another United pilot and was eventually promoted to full captain. I know because I ran into them in an elevator at San Francisco airport ten years ago, four captain’s bars adorning her uniform.

Flying is in my blood now, and I’ll keep flying for life. I can now fly anything anywhere and am the backup pilot on several WWII aircraft for air shows, including the B-17, B-24, and B-25 bombers, the P-51 Mustang fighter, and, of course, Supermarine Spitfires.

Captain John Schooling would be proud.

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Captain John Schooling and His RAF 1949 Chipmunk

A Mitchell B-25 Bomber

A 1932 De Havilland Tiger Moth

Flying a P-51 Mustang

The Next Generation

A Supermarine Spitfire Mark IX

(MSFT), (AMZN), (GOOG), (PLTR), (LMT)

Here's something that would have sounded crazy a few years ago: the US government has suddenly developed an expensive taste for artificial intelligence.

Not just a casual interest, mind you, but the kind of enthusiasm usually reserved for Pentagon hardware projects.

In fact, the Department of Defense is positioning itself to become the most eager AI customer since ChatGPT hit the scene.

While traditional defense giants like Lockheed Martin (LMT) still dominate military hardware contracts, Microsoft (MSFT), Amazon (AMZN), and Google (GOOG) are already expanding their AI data centers.

Though if you ask them directly, they'll probably just call it "infrastructure investment." That sounds better in shareholder meetings.

But the real story here is how companies like Palantir (PLTR) might hit the jackpot.

They've spent years building technology that makes government agencies salivate, and now their patience might finally pay off. The shift is so significant that even traditional defense contractors are probably wishing they'd paid more attention during those early AI briefings.

Speaking of unexpected winners, let's also talk about Tesla (TSLA).

While most electric vehicle companies are bracing for a rough ride under potential policy changes, Tesla's sitting pretty.

It's not just because Elon Musk has friends in high places - though that certainly doesn't hurt. Tesla's built the kind of manufacturing scale that makes government incentives nice to have but not essential for survival.

Add in some potential tariffs that might keep Chinese EVs at bay, and suddenly Tesla's position looks even stronger.

Let's take a quick look at Tesla's autonomous driving program - because this is where things get really interesting.

Internal timelines are getting more aggressive, especially as they're neck-and-neck with Chinese companies in the self-driving race.

When I look at the numbers, I almost have to do a double-take: we're talking about a potential $40-$50 jump in share price and a market cap cruising past $1 trillion if they roll out full autonomy in 2025.

Everyone seems to buy the story - Tesla stock recently shot up 14.8% to $288.53, and I suspect that's just the beginning.

The FTC situation adds another layer to this already complex cake. Their commissioner, Lina Khan, who's been giving tech executives headaches, might be heading for the exit.

The Street's betting that her departure could spark the kind of merger activity we haven't seen since AOL thought buying Time Warner was a good idea.

Meanwhile, Apple (AAPL) presents its own peculiar puzzle. Despite all the tough talk about 60%+ tariffs on Chinese goods, Tim Cook's empire might get special treatment.

It makes sense when you think about it - having 80% of your iPhone production in China tends to focus the mind wonderfully.

As for Amazon, they’re sweating bullets. Their marketplace sellers are more tied to Chinese manufacturing than a factory in Shenzhen.

Which brings us to semiconductors, where the story gets even more complex. Remember the CHIPS Act? It was supposed to be America's answer to Asia's chip dominance.

Now it's caught in political crosswinds, with House Speaker Mike Johnson performing the kind of policy reversal that would make an Olympic gymnast proud - first suggesting repeal, then backing away faster than a cat from a cucumber.

Even Trump jumped into the fray on Joe Rogan's show, calling the chip deal "so bad" it made his trade war look subtle.

His solution? Classic Trump: slap tariffs on imported chips until companies build factories here. It's like using a sledgehammer to hang a picture - effective, maybe, but subtle it ain't.

For those trying to navigate this policy maze, the message is clear: government AI initiatives aren't just another Washington fad. They're reshaping the tech landscape more dramatically than any single company could.

Whether you're looking at cloud providers, chip makers, or AI specialists, understanding these policy shifts isn't optional - it's essential.

I've been watching tech trends since before the iPhone was a twinkle in Steve Jobs' eye, and I'll tell you this much: when government and technology interests align, fortunes are made.

The last time I saw this level of government interest was during the early days of the internet. Back then, everyone focused on the technology. The smart money focused on who was getting the contracts.

Some things never change.

Mad Hedge Technology Letter

December 13, 2024

Fiat Lux

Featured Trade:

(THE AI TRAIN KEEPS CHUGGING)

(DELL), (AAPL), (NVDA)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.