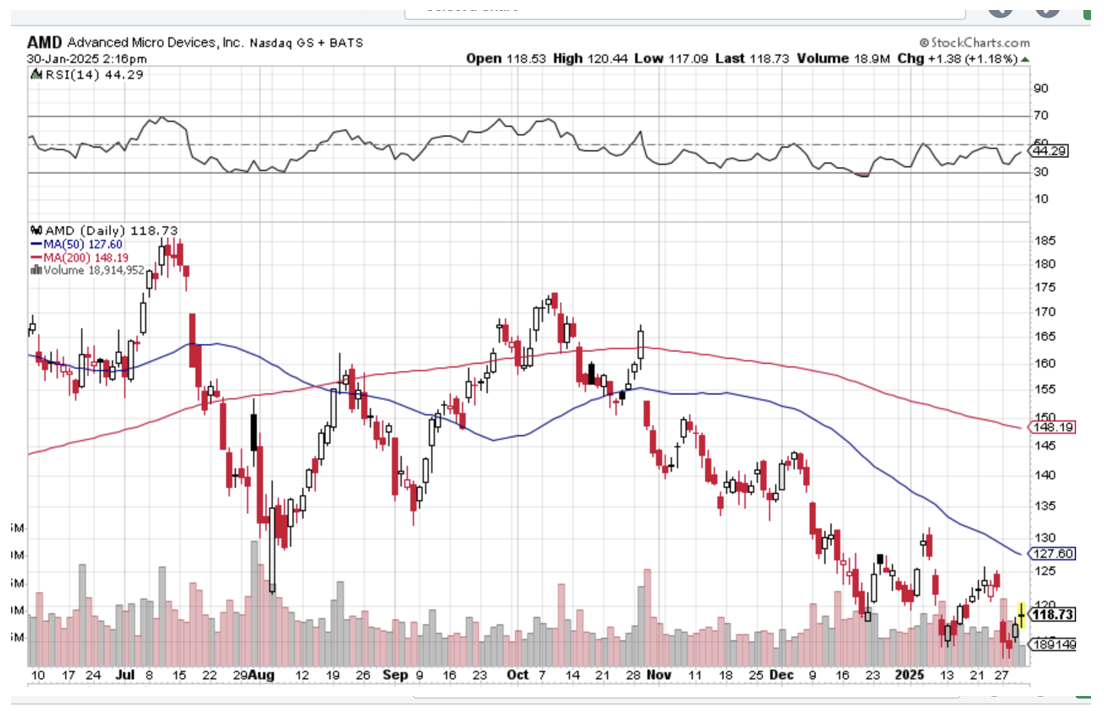

(NVDA), (MSFT), (GOOG), (AMZN), (META), (AAPL)

Back in 1976, during one of my assignments, a senior Chinese economist offered me a cup of tea and shared something Deng Xiaoping had once told them—words I’ve never forgotten: "It doesn't matter if the cat is black or white, as long as it catches mice."

I found myself thinking about that conversation last week as I watched a small Chinese AI company, DeepSeek, snatch $1.2 trillion worth of mice right out from under Silicon Valley’s nose.

Earlier this month, a small Chinese AI lab called DeepSeek managed to vaporize $1.2 trillion in market value by doing something rather inconvenient: proving you don't need billions to build competitive AI models.

Their founder, Liam Wenfeng, probably wasn't trying to start a panic. He just wanted to show that his team could match OpenAI's capabilities at 5% of the cost.

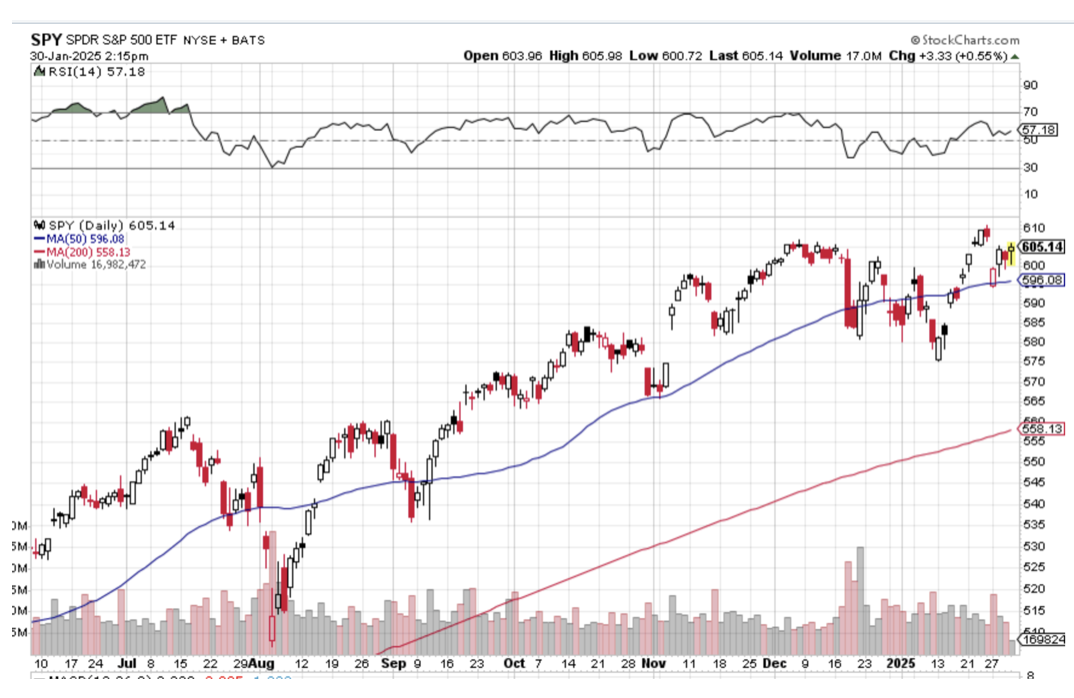

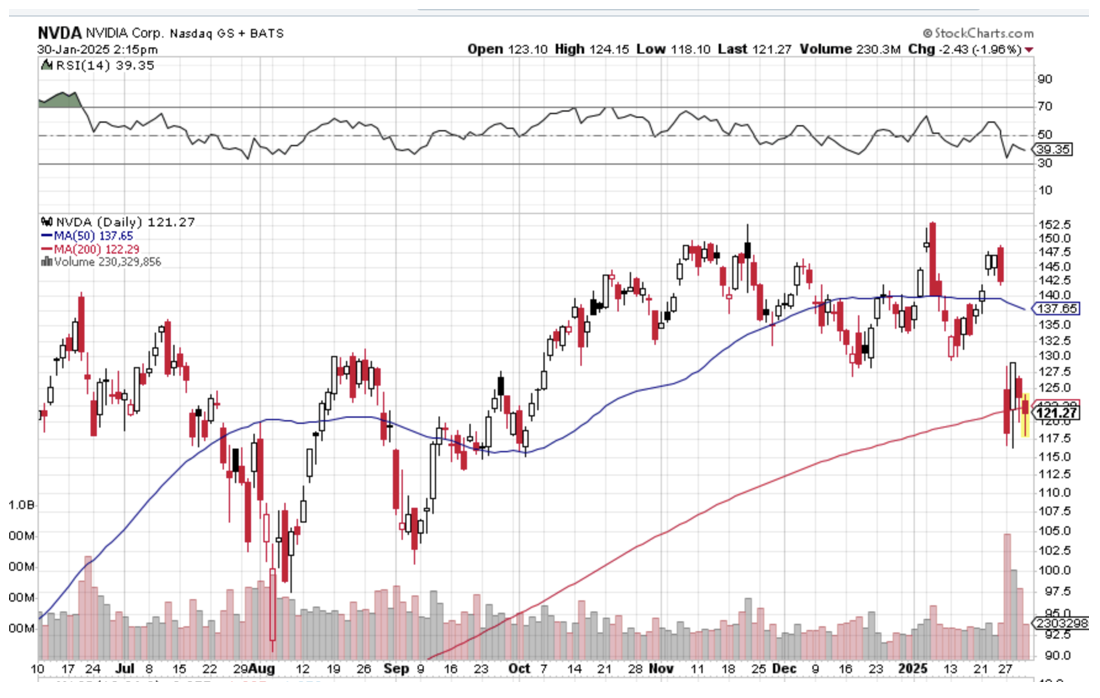

The market reaction was swift and brutal. Nvidia (NVDA), everyone's favorite AI golden child, watched its stock plummet 17% in early trading.

The tremors hit the entire tech sector: Microsoft (MSFT) down 3.5%, Alphabet (GOOG) dropped 3%, and Amazon (AMZN) shed 2.4%.

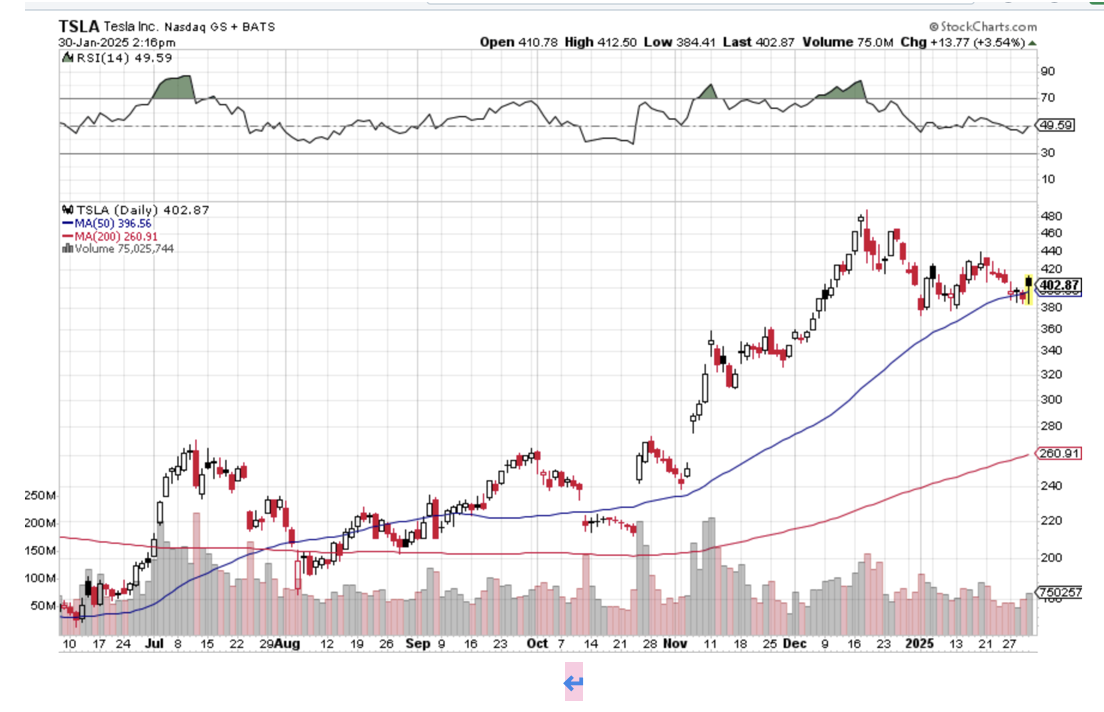

Even Meta (META) took a 1.4% hit. Apple (AAPL), being Apple, somehow managed to gain 1.2%. There's always one kid in class who has to be different.

Let's talk about what DeepSeek actually did. Their R1 model, built for a mere $5.57 million using Nvidia's H800 chips, is matching OpenAI's GPT-4 in math, coding, and reasoning benchmarks.

They used pure reinforcement learning - basically letting the AI figure things out on its own rather than holding its hand through the process. And it worked.

The timing is almost comical. Just as OpenAI's Sam Altman was at the White House announcing the $500 billion Stargate Project, DeepSeek showed up with their bargain-basement solution that performs just as well.

Even Nvidia had to acknowledge the achievement, calling it an "excellent AI advancement." When your competitors start complimenting you, you know you've struck a nerve.

But here's what Wall Street might be missing: this isn't just about cost reduction.

DeepSeek released their model under an MIT license, meaning anyone can study, modify, and expand it. They're not just competing - they're changing the rules of the game.

What should we do? First, take a deep breath.

Despite this disruption, the fact remains that the Magnificent 7 and U.S. tech companies are playing a longer game, focused on artificial general intelligence with an ecosystem that DeepSeek "cannot come close to." This could actually increase demand for computing resources - cheaper AI often leads to more AI usage, not less.

The $2 trillion of capital expenditure expected over the next three years isn't going away. If anything, this development might accelerate it.

When technology gets cheaper, people tend to use more of it, not less. Just ask anyone who remembers when long-distance calls cost a fortune.

For investors, this looks more like a buying opportunity than a reason to panic. I've seen enough market disruptions to know that the initial reaction is usually overdone.

The AI infrastructure build-out is just getting started, and cheaper development costs could actually expand the market rather than shrink it.

Keep your eyes on DeepSeek, though. The tech giants will need to adapt - either by making their own processes more efficient or by finding new ways to add value. Competition has a funny way of improving everyone's game.

And somewhere in Beijing, I imagine there's a tech executive reciting that old proverb about cats and mice, knowing they just caught the biggest mouse of all - Wall Street's attention.

Some market lessons never get old, even if the cats keep changing their colors.