Investors should rejoice after hearing the great news from Meta (META) management.

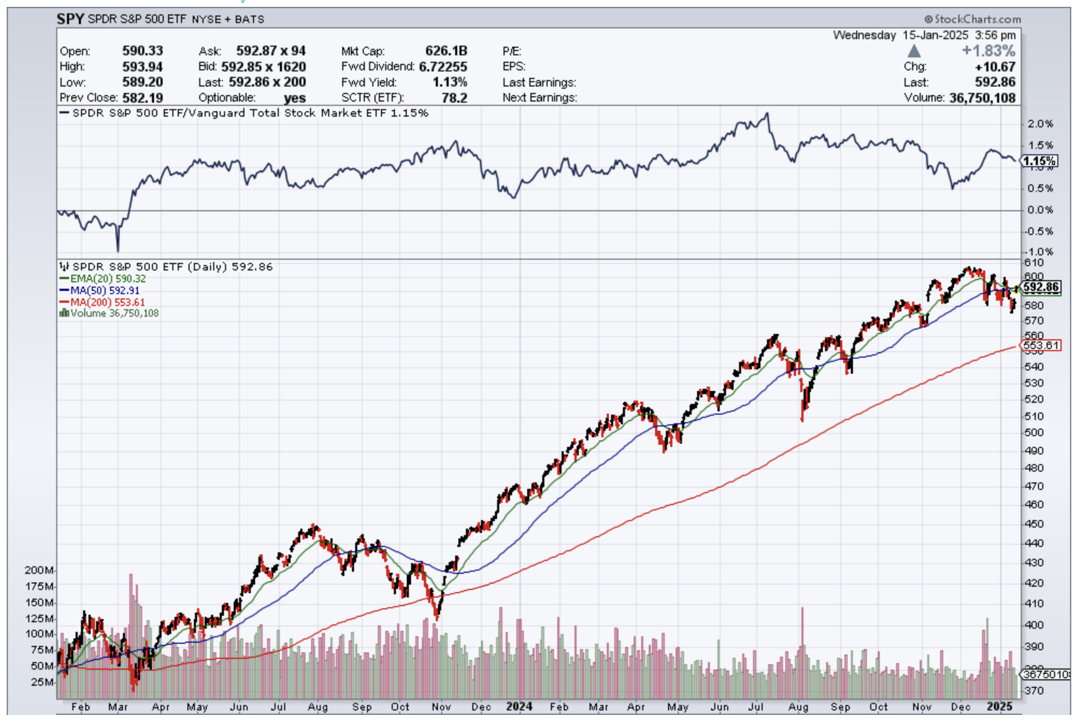

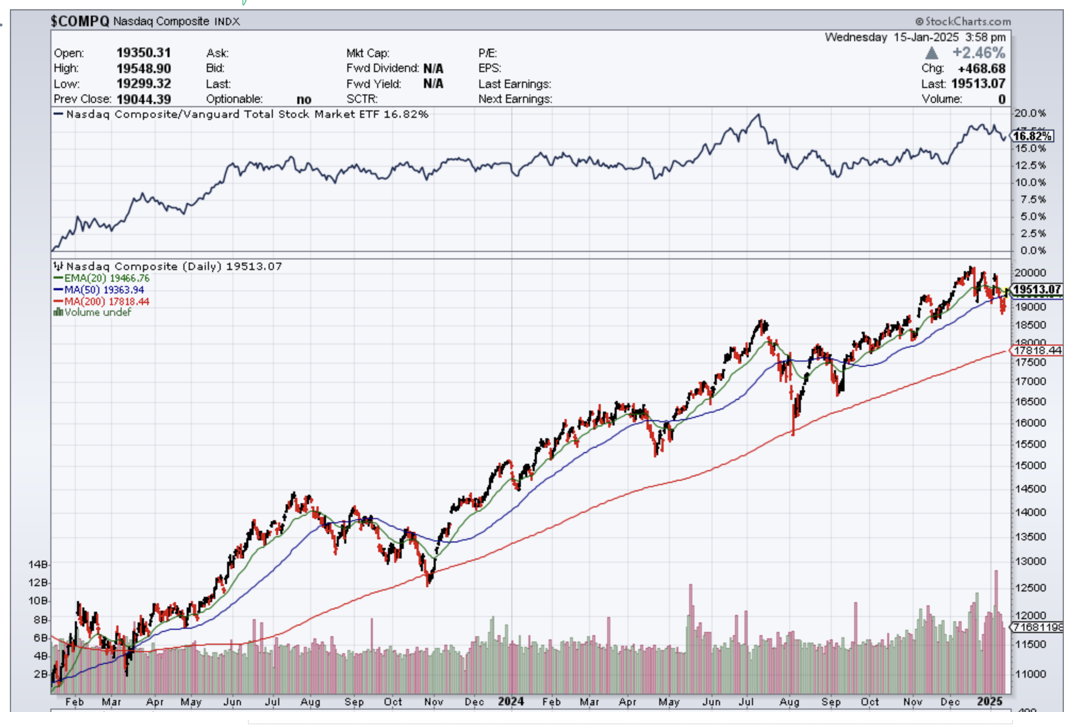

This year has started off with a bang.

The stock price will be the outsized winner of the new staffing policy.

Meta Founder Mark Zuckerberg is targeting Meta's low performers. In an internal memo announcing staff cuts, the CEO told employees to prepare for an "intense year."

Zuckerberg is bringing the heat by announcing a fresh round of cuts aimed at managing low performers.

All those H1-B foreign workers making half a salary are probably on the cutting board unable to justify a half salary.

Meta has been widely known to aggressively add from the H1-B transfer portal to snap up Indian workers for a fraction of the cost of an American national.

Along with the H1-B workers, there will be a 100% removal of the fact-checking division.

Zuckerberg announced that he would do away with “fact-checking” all together and luckily, he will not need that entire division to tell me what the Menlo Park, California truth is anymore.

The company reportedly plans to exit roughly 5% of the lowest performers. Meta said it plans to backfill the roles with existing staff members.

Meta said U.S. employees impacted by the cuts would be notified by February 10.

Zuckerberg has also announced that he is trashing the DEI (diversity, equity, and inclusion) hiring trend which is surprising since it diametrically opposes what Meta has stood for in the past.

It is arguable that Meta has never stood for anything, but it pays to play on the right team when they are in charge of the government and the ultimate control of how businesses operate.

It's the latest round of cuts in Zuckerberg's self-proclaimed efficiency drive.

In 2023, the CEO declared a "year of efficiency" at Meta, announcing plans to eliminate 10,000 positions and flatten the company's structure to remove some layers of middle management.

In 2022, the company laid off another 11,000 employees, or roughly 13% of its workforce.

Zuckerberg’s $1 million donation to Former President Donald Trump post-election is ironic given that Meta’s Zuckerberg banned the former President from his platform.

Trump was also banned on Twitter when the platform was led by Jack Dorsey.

Without getting too political, what does this all mean?

It will result in higher profits in the short-term and remember that labor is the costliest line item.

Zuckerberg is forging his own cut expenses at all costs strategy to appease shareholders.

I have lamented the lack of profit drivers available for big tech and projects like Meta’s VR goggles have been a total failure.

When I was at the store and tried on the VR goggles myself, my head got dizzy and my eyes started to burn.

It is hard to believe that the product was allowed to go into the public without more quality control or testing.

Zuckerberg will rest his case on ultimate “efficiency” this year and I can easily see over half of Meta’s staff jettisoned in 2025.

It’s not a good time to search for a job in Silicon Valley, because there are more firings than ever before.

It’s also not the greatest time to live in the state of California, and this to me is Zuckerberg’s initial steps to leave the state with his money, influence, company, and technology just like many before him.

He might just keep his enormous Lake Tahoe lake house for a vacation or 2.

Buy dips in Meta stock before earnings and harvest what the state of California has to offer.