When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Technology Letter

February 28, 2025

Fiat Lux

Featured Trade:

(BITCOIN PRICE A SCARE)

(MSFT), (META), ($BTCUSD)

It’s fascinating that Bitcoin was supposed to be the new currency of the Trump administration, and under those conditions, one might believe the price of Bitcoin will double and triple pretty soon.

The results have been dire since the new President took over, with the price of Bitcoin cratering to $77,000 per coin from $107,000.

These devastating results have caught traders off guard, and many have lost their shirts in the quiet storm.

I don’t really care about Bitcoin personally, and I’m usually not in the business of recommending the product, but I do care what it signals about liquidity and the risk on/off sentiment.

The tariffs are starting to scare investors, and we see it in the price of Bitcoin.

Liquidity being pulled can create a cascading effect where nobody knows where the floor is.

Bitcoin could fall a lot further, considering many could just not be bothered to fight through the tariffs and can’t stomach it.

Nobody ever went bankrupt from taking a profit, right?

With all-time highs in many asset classes, it is almost as if Trump thinks he is playing with house money to push through aggressive strategies that put enormous trade pressure on other countries.

It’s a political calculus that fosters uncertainty, and many know that markets hate uncertainty, especially tech stocks.

On the heels of a good Nvidia earnings report, we have received a sell on the news price action, and that is very negative to the overall tech sector.

Year to date, we stand 3.5% in the red, but looking to March expiration, I believe this is a short 3-week buying opportunity until the next bevy of geopolitical chaos.

I recommend keeping your portfolio small for the time being and let the trade rhetoric pass through until you go big.

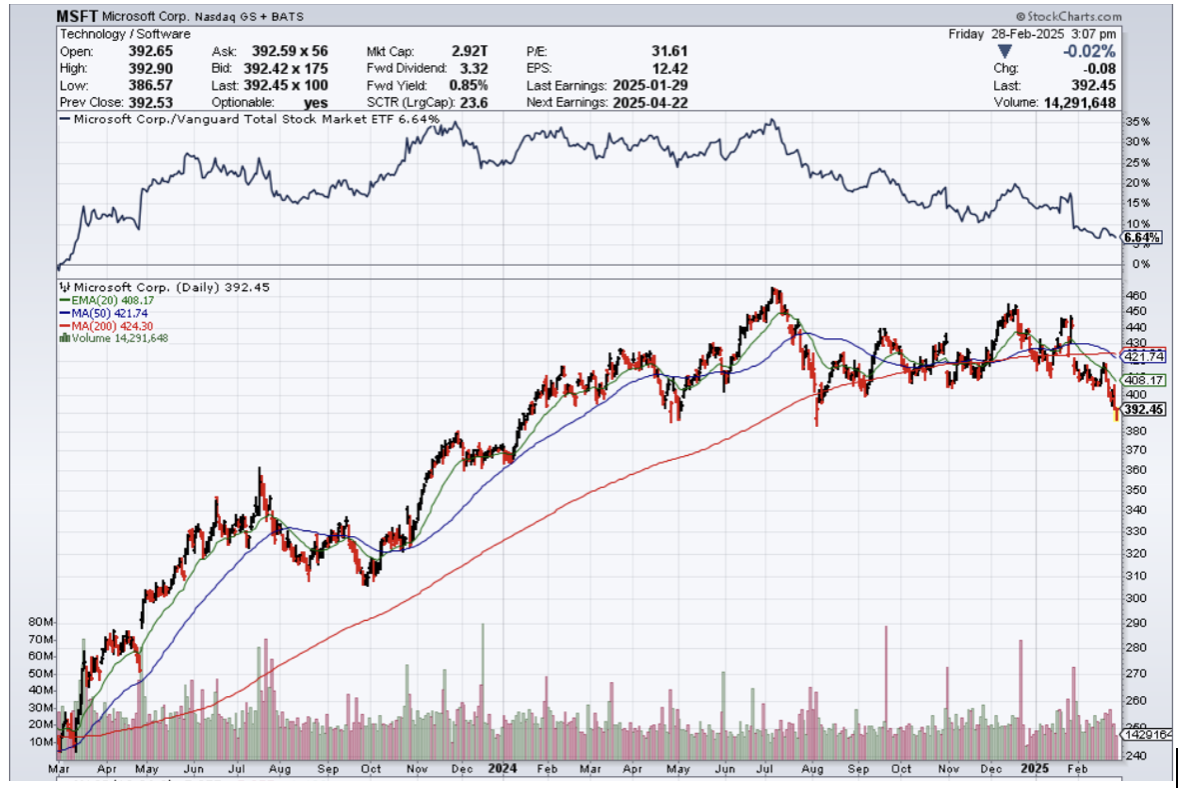

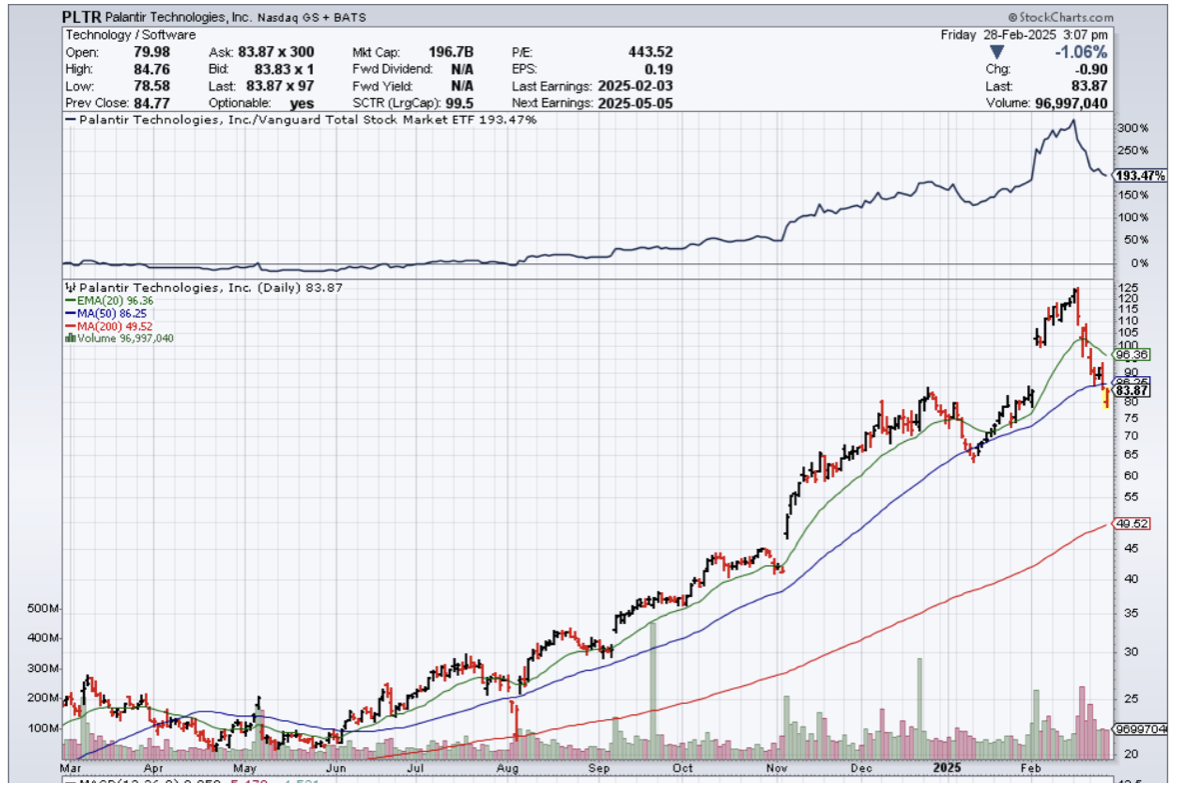

I did execute 2 more bullish positions in Palantir and Microsoft today.

A rout in Bitcoin deepened forced money to the sideline in the face of the most popular Trump trades.

Alt coins also did poorly too with Ether, Polkadot, and XRP all dropping more than 7% in one day.

Remember in 2022 during the crypto winter, when prices plummeted amid rising interest rates and industry woes.

Trump said Thursday that 25% tariffs on Canada and Mexico would come into force from March 4, undermining hopes he might reverse course after a previous delay. He also said Chinese imports would face a further 10% levy, prompting officials in Beijing to promise “all necessary measures” in response.

The selloff underscores a swift change of fortunes for what was previously one of the most popular Trump trades in global markets: buying Bitcoin on the expectation that the president’s crypto-friendly approach would lead to a broad rally.

Traders are still waiting for Trump to come up with concrete steps for the sector, including a Bitcoin stockpile.

Trump has already made a few changes that have pleased crypto bulls, including putting crypto advocates in key positions. The Securities and Exchange Commission, which embarked on a year-long crackdown under former Chair Gary Gensler, has also closed investigations into several crypto outfits in recent weeks.

Readers shouldn’t get too rattled by the geopolitics.

More often than not, the bluster serves as a good entry point into tech stocks.

I do believe 2025 will be the year of volatility, and buying on these big dips is a big part of our benefit to it.

“We are the first species capable of self-annihilation.” – Said CEO of Tesla Elon Musk

(SUMMARY OF JOHN’S FEBRUARY 26, 2025 WEBINAR)

February 28, 2025

Hello everyone

TITLE

The Last Glass of Kool-Aide

THE HIGHLIGHTS

A five-year bull market is coming to an end.

Economic growth will slow in 2025, and risks rise.

Inflation is about to rear its ugly head once again.

Interest rate cuts are over, and the next Fed move may be a rise.

Stock valuations are at a 26-year high, and uncertainty is exploding …a toxic combination.

We may have a few more months of the bull left. After that, look out below.

Even bear markets can produce winners. Let Mad Hedge show you where they are.

WINNERS & LOSERS

Winners

Energy

Financials – Banks & Brokers

Domestic Manufacturing

Crypto

Tesla

Losers

All interest rate plays

All bonds

Housing

Real Estate

Construction

Importers

Precious Metals

US automakers

Pharmaceuticals

Agriculture

Restaurants

Cruise lines

Retailers

TRADE ALERT PERFORMANCE

February MTD = +0.96%

Since inception = +758.65%

Trailing One Year Return = +83.45%

Average Annualized Return = +49.92%

PORTFOLIO REVIEW

Risk On

(GS) 3/$580-$590 call spreads

(JPM) 3/$235-$245 call spread

Risk Off

NO POSITIONS

THE METHOD TO MY MADNESS

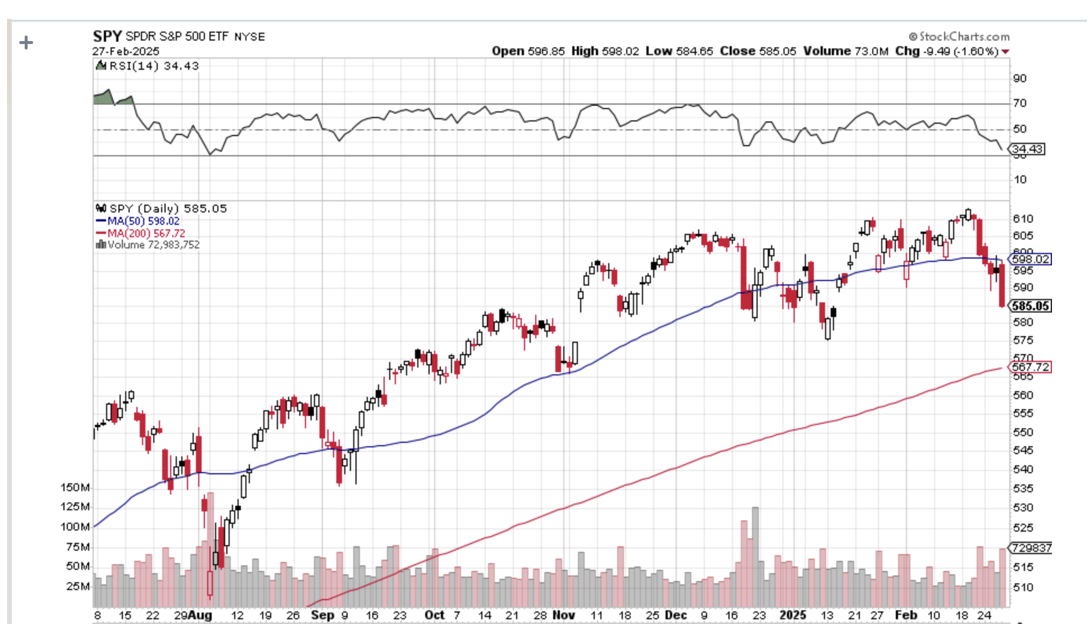

2025 has lost all gains.

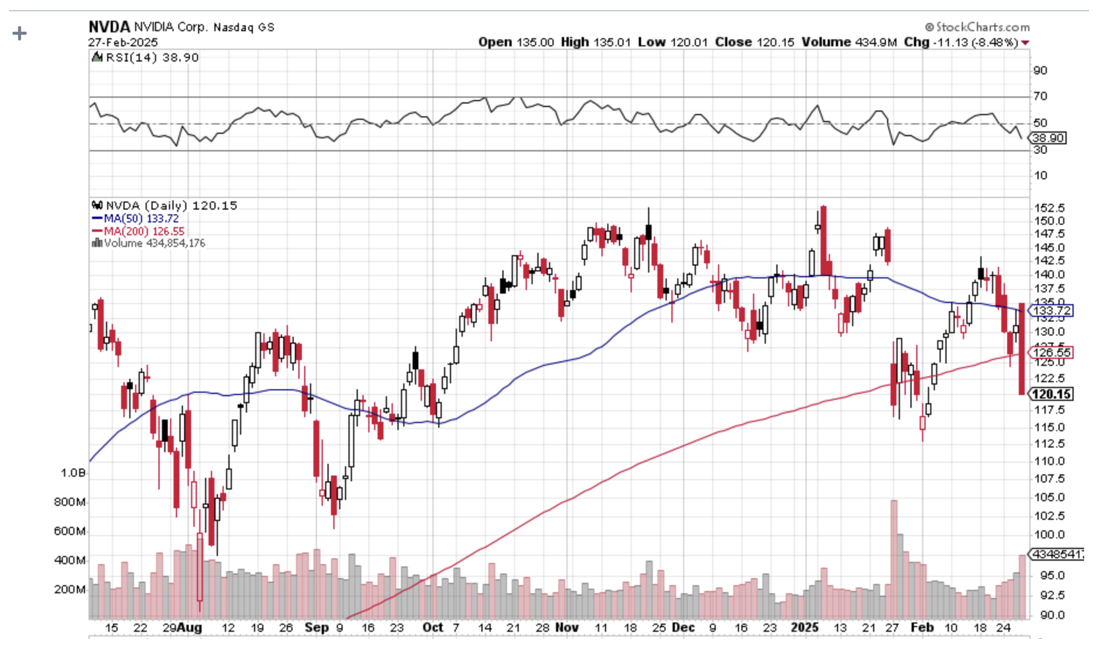

Market has gone from low risk to high risk overnight, with the leading names like (NVDA) and Tesla (TSLA) taking the biggest hits.

All interest rate plays remain dead in the water – homebuilders, bonds, and REITS.

Deregulation plays will continue to be bought, including banks, brokers, and money managers.

US dollar finally takes a break on falling rates.

Big technology stocks get crushed by Deep Seek and trade wars.

Energy sells off on Deep Seek as well – no power needed.

Buy financial as the only sure thing this year.

THE GLOBAL ECONOMY – ROLLING OVER

Government shutdown on March 14

Economic data has flipped from mixed to universally bad.

Core Inflation rate comes in red hot at 0.50%.

PPI comes in hot.

Consumer sentiment nosedives to a 30-year low.

Early recession indicators are collapsing, like FedEx, down 7% today.

Washington DC's economy is in recession. Unemployment claims are up 400%

U.S. Retail Sales dropped sharply.

U.S. Manufacturing Production unexpectedly fell.

STOCKS – NEW JITTERS

Technology stocks destroyed on rapidly deteriorating economic data. NASDAQ is now down in 2025.

Market confidence is eroding by the day.

Momentum has died, and the market has been over-rewarding momentum stocks.

Biggest de-grossing in two years has started, cutting back of total positions – longs and shorts.

Nvidia tells all with earnings on Wednesday – watch for selloff on great earnings.

Morgan Stanley warns customers to cut stock exposure.

The Cruise business gets crushed on warnings of new taxes.

Lockheed Martin (LMT) dives 8% on a cautious outlook spurred by our new government, with defence spending to be cut in half.

EV and hybrid sales reach a record 20% of US vehicle sales in 2024, but subsidies are about to disappear.

Tesla is currently adrift amidst falling sales with no leader.

John suggests cleaning out your portfolio and build cash.

Walmart is a good economic indicator. Watch this stock.

THE ULTIMATE HEDGE – Defensive stocks only go down at a slower rate

90-day US T-bills (Warren Buffet owns $300 billion)

Government guaranteed principal

Endless liquidity, trade like water

100% collateral value for margin

Lock in guaranteed income

Can be sold at any time to earn full interest

Will survive any bear market

Ask your broker how to buy

JOHN’S S&P 500 DOWNSIDE TARGETS

$595 = -5.0% 1st support

$565 = -8.8% 2nd support

$535 = -17.1% 3rd support

THE BENEFITS OF DEREGULATION

Cuts Costs

Increases profits

Opens up new markets

Grows the industry

Increases innovation

Drives stock prices high

However, deregulation has costs:

It increases misrepresentations and fraud

Increases theft

Increases bankruptcies

Consumers are left holding the bag

Don’t forget to sit down when the music stops playing – it’s every man for himself.

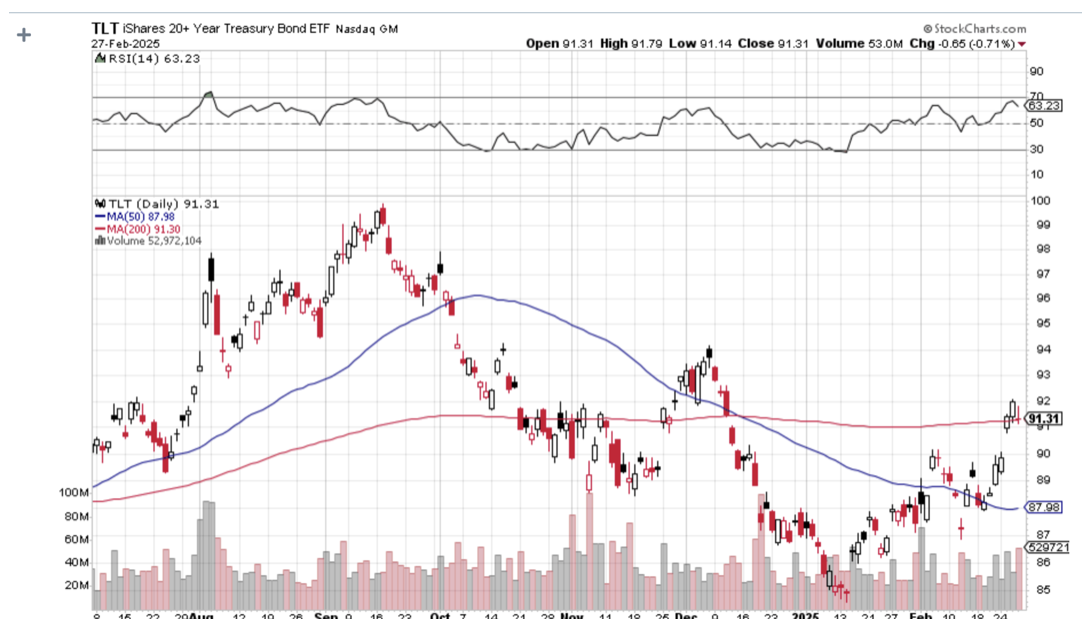

BONDS – TOAST

The deficit is the big election loser – all government actions so far will increase the deficit.

The National debt is about to explode, from $35 trillion to $45 trillion.

Interest payments on the national debt already top $1 trillion per year and will become the largest budget item, topping Social Security at $1.2 trillion.

Government borrowing will become much more difficult than the last time Trump was President, when the deficit was only $20 trillion.

It all depends on inflation, which is likely to rise sharply in response to increased spending, tax cuts, labour shortages, and trade wars.

So the best case for bonds is that the (TLT) chops around here.

The worst case is that we retest new multiyear lows at $79.

Avoid (TLT), (JNK), (NLY), (SLRN), and REITS

FOREIGN CURRENCIES – TAKING A VACATION

Dollar backs off two year- high, on falling US interest rates. Ten-year US Treasuries have dropped from 4.88% to 4.40%.

But the greenback is coming back.

Higher for longer interest rates mean higher for longer US dollar.

Don’t sell the UD dollar until the next recession is on the horizon.

Avoid (FXA), (FXE), (FXB), (FXC), and (FXY)

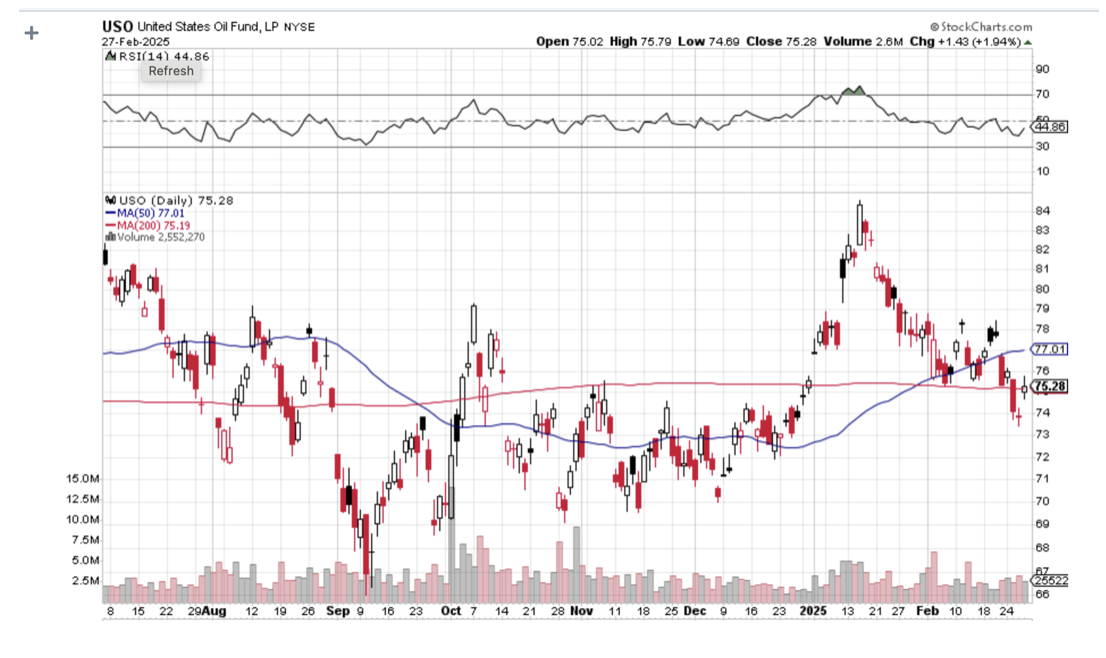

ENERGY & COMMODITIES

Deep Seek shock trashes all nuclear energy plays on fears that the new orders will be cancelled, as the extra power will no longer be needed.

New AI programming uses 1% of the chips and, therefore, 1% of the power.

Nothing could be further from the truth. Buy all nuclear plays on this dip.

Bank lifted on new natural gas export facilities in four years, reversing a Biden-era climate initiative.

Many analysts expect an oversupplied oil market this year after demand growth slowed sharply in 2024 in the top-consuming nations: the U.S. and China.

The EIA said it expects Brent crude oil prices to fall 8% to an average $74 a barrel in 2025, then fall further to $66 a barrel in 2026.

PRECIOUS METALS – A NEW LEG

Falling interest rates have given gold a new lease on life.

The opportunity cost of owning gold has fallen sharply.

Central bank buying never stopped.

Now, silver is starting to play catch-up.

Gold is still the favoured saving means by Chinese who don’t trust their own currency, banks, or government.

That’s why the metals have outperformed the miners, which the Chinese don’t buy.

Buy (GLD), (SLV), (AGQ), and (WPM) on dips.

REAL ESTATE – STAY AWAY

Existing Home Sales crater, on a closing contract basis, was down 4.9% in January to 4.09 million units.

Terrible weather was a factor.

Inventories are up 17% YOY and 3.5% on the month.

All cash sales hit 29%.

The average price of a home is at an all-time high at $396,800, up 4.5% YOY.

Homebuilders are panicking over tariff prospects.

US Q4 profits hit three year - high.

U.S. Retail Sales dropped sharply.

TRADE SHEET

Stocks – buy the next big dip, sell rallies

Bonds – sell rallies

Commodities – stand aside

Currencies – stand aside

Precious Metals – buy dips

Energy – buy nuclear dips

Volatility – sell over $30

Real Estate – stand aside

NEXT STRATEGY WEBINAR

12:00 EST Wednesday, March 12, 2025

Cheers

Jacquie

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

February 28, 2025

Fiat Lux

Featured Trade:

(FEBRUARY 26 BIWEEKLY STRATEGY WEBINAR Q&A),

(BTC), (NVDA), (TSLA), (BRK/B), (JNK), (TLT), ($WTIC)

Below, please find subscribers’ Q&A for the February 26 Mad Hedge Fund Trader Global Strategy Webinar, broadcast from Incline Village, NV.

Q: Isn’t this just a cyclical thing? Don’t all bull markets come to an end?

A: Yes, they do. But this time around, it looks like the market is being pushed off a cliff. I guess you have to say that uncertainty is the new element here. Depending on who you talk to, uncertainty is either at a 5-year high, a 30-year high, or a 96-year high (the 1929 crash). Suffice it to say that with the election results being so close (it was the 3rd closest election in history), that means essentially half of all voters are going to be pissed off no matter what happens. It’s a no-win situation. Plus, you go in with multiples at—depending on how you measure them—30-year highs or 96-year highs and dividend yields at all-time lows. A lot of these stocks have gotten stupidly expensive and are begging for a selloff. That is not a good environment to ratchet off the uncertainty.

Q: Should I buy Bitcoin (BTC) on the dip since it’s down about 15 or 20% from the highs?

A: Absolutely not. If you’re going to take a flyer, it was when it was at $6,000, not at $90,000. You can always tell when an asset class is topping because suddenly, I get a bunch of people asking if they should buy it. I've been getting that from Bitcoin all year, and the answer is absolutely not. We're looking for value here, and there's no value to be found anywhere. With Bitcoin, the question you really have to ask is: What happens when Trump leaves office? Does Bitcoin become regulated again? The answer is probably yes, so if the entire rally from $50,000 to $108,000 was based on deregulation, what happens when you re-regulate? So, no thank you, Bitcoin.

Q: Should I sell Tesla (TSLA) and Nvidia (NVDA) LEAPS?

A: It depends on your strike prices, if you're still deep in the money, I would hang on. I think the worst case is Nvidia drops to maybe $100 and Tesla drops to maybe $250. What you should have done is take profits 3 months ago when these things were at all-time highs. I did. Whenever you get up to 80% or 90% of the maximum potential profit on profit LEAPS, you should take that, especially if you have more than a year to run to expiration, because they will go to money heaven if you get a correction like this. Leave the last 10% for the next guy. So yes, I would be de-risking, you know, give all your portfolios a good house cleaning and get rid of whatever you’re not happy to keep for the next several years.

Q: What about LEAPS on financials?

A: I do think financials will come back; it’s just a question of how far they’ll drop first, and you can see I put my money where my mouth is with two financial LEAPS for the short term.

Q: Apple (APPL) expects to increase its dividends. Should I buy the stocks?

A: Actually, Apple has gone down the least out of any of the magnificent 7, but they all tend to trade as a bunch. Apple’s had a terrific run since last summer. Those are the ones that will get paired back the most. So it’s nice to get a dividend, but it’s no reason to buy a stock because you can wipe out a year’s worth of a dividend in a single day’s negative trading.

Q: What do you think of Chinese tech stocks?

A: I think they’re peaking out here; the same with Europe—they’ve had this tremendous rally this year NOT because of the resurgence of Chinese or European economies. It’s happening because of the uncertainty explosion in the United States and the fact that these European and Chinese stocks all got insanely cheap—well into single-digit price-earnings multiples. So, people are just readjusting a decade and a half long short positions in these areas. I don’t see a sustainable bull market in China or Europe based purely on fundamentals. This is just a trading play, which you’ve already missed, by the way—the big move has happened.

Q: Doesn’t it seem like the unemployment claim numbers are being told more truthfully now?

A: Nothing could be further from the truth. The unemployment claims are collected by the states and then collated by the federal government—the Bureau of Labor Statistics. I've been hearing for 50 years that the government rigs the statistics it publishes. The way you'll see that is when you get a major divergence between government data and private sector data, which we have a lot of. When they diverge, you'll know the government is fudging the data. I have a feeling they may be faking the inflation data in the not-too-distant future.

Q: Should I buy Tesla (TSLA) on the dip?

A: Absolutely not. There is no indication that the rot at the top of Tesla has ended. You basically have a company that’s leaderless and rudderless, with falling sales in China and Europe and a boycott going on in Europe against all Tesla products. Sales down 50% year on year isn't an economic thing, it’s a political thing. Suddenly, Europe doesn't like Elon Musk's politics since he’s advocating the destruction of their economies and interfering in their elections. This is why CEOs of public companies should NEVER get involved in politics—once you voice an opinion, you lose half of your customers automatically. But at a certain point, no amount of money you lose can move the needle with Elon Musk; he’s too rich to care about anything and has said as much.

Q: How much cash should I have?

A: It depends on the person. I am watching the markets 12 hours a day. I can go 100% cash and be 100% invested tomorrow. You, I'm not so sure. A lot of you have heavy index exposures, so it really is different for each person. How much do you want to sleep at night? That's what it really comes down to. Are we going to have a big recession or not? That is the question plaguing investors right now.

Q: What are your thoughts on Berkshire Hathaway (BRK/B)?

A: Buy the dips. I mean it's, you know, 50% cash right now, so it's a great place to hide out if you're a conventional money manager who isn't allowed to own cash or more than 5% cash. So yeah, I think we could go higher. Just expect a 5% correction when Warren Buffet dies. He’s 95.

Q: Why buy SPDR Bloomberg High Yield Bond ETF (JNK) and not iShares 20+ year Treasury Bond ETF (TLT)?

A: JNK has a yield that is now almost 2.3% higher than the (TLT), and that gives you a lot of downside protection, you know, a 6.54% yield. That is the reason you buy junk.

Q: Why have you changed your opinion on the markets when you've been bullish for the last many years?

A: I have a Post-it note taped to my computer monitor with a quote from John Maynard Keynes: “When the facts change, I change. What do you do, sir? The answer is very simple: the principal story of the market up until the end of last year was the miracle of AI and how it was going to make us all rich. Now, the principal story of the market is the destruction of government spending, the chaos in Washington, and tariffs. That is not an investor-friendly backdrop on which to invest. The government is 25% of the GDP, and if you cut back even a small portion of that, even just 5%, that is called a recession, ladies and gentlemen, and nobody wants to own stocks in a recession. And this is all happening with valuations at all-time highs, so it is a very dangerous situation. Suffice it to say, the Trump that campaigned and the Trump we got are entirely different people with far more extreme politics. The market is just figuring that out now, and the conclusion is the same everywhere: sell, sell, go into cash, hide. Certain markets trade at rich premiums, while uncertain markets trade at deep discounts. Guess what we have now.

Q: Isn’t $65-$77 a barrel the new trading range for crude oil ($WTIC)?

A: This has recently been true, but if we go into recession, that breaks down completely, and we probably go to the $30s or $40s, and a severe recession takes us to zero. So that is a higher risk play than you may realize; that is where the charts can get you into big trouble if you ignore the fundamentals.

Q: Do you expect interest rates to drop?

A: No, they have dropped 50 basis points this year on a weak dollar and declining confidence, and the US Treasury has issued almost no long-term bonds this year. So that has created a bond shortage, which has created a temporary shortage and a fall in long-term interest rates. That will change as soon as the new budget is passed, and the earliest that can happen is March 14th. After that, we may get a new surge in interest rates as the government becomes a big seller of bonds once again, which will drive up interest rates massively. The Treasury has to issue $1.8 trillion in new bonds this year just to break even, and now it has only 10 months to do it. So there may be a great short setting up here in the (TLT), and of course, we’ll let you know when we see that.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.