When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

(A MARKET CAUGHT IN THE CROSSHAIRS: WHICH WAY NOW?)

February 21, 2025

Hello everyone

Walmart's profit growth has slowed. Just how healthy is the American consumer?

Mass sackings are happening now. When people are employed, they spend. When people are not employed, they stop spending. It’s simple really.

The AI trade is motoring along; green shoots will take time to show. Competition is healthy. But is U.S. AI tech expenditure sustainable, and is its extent warranted? Deep Seek came out of nowhere as a wake-up call to U.S. tech elites.

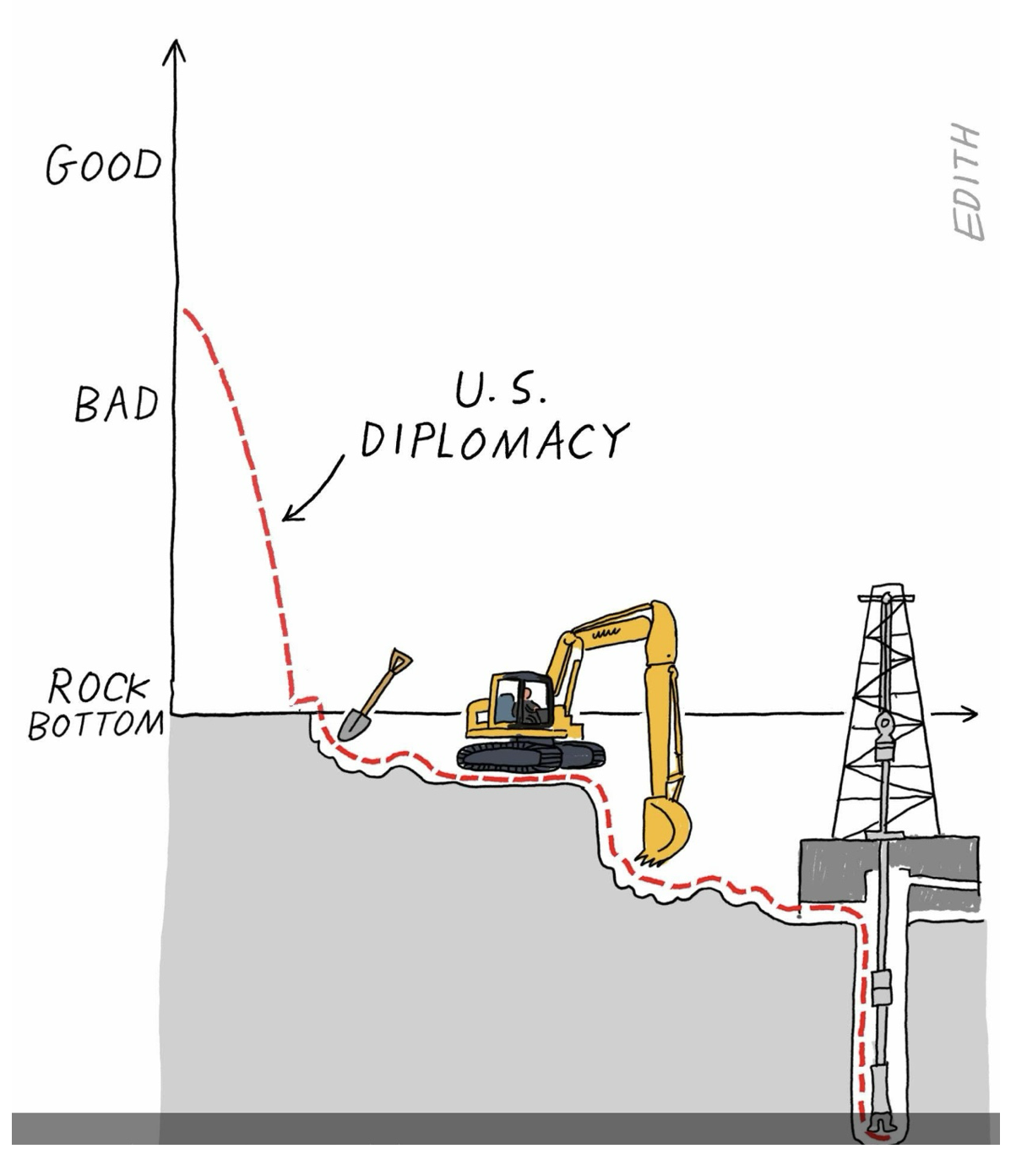

A chaotic U.S. administration is taunting the world about tariffs. Trying to pin Trump down on his policies and plans going forward is akin to trying to catch a fish by hand in the ocean.

Bond yields are rising. Has 7% entered your mind?

What about the possibility of interest rate rises sometime this year? Start thinking about it.

Geopolitics is red hot – stakes are high as allies are being toyed with.

And the market is caught in the crosshairs.

And yet, investors are still hoping for another record high for stocks in 2025.

What universe are they in?

Uncertainty rules the stage presently. On the one hand, we can understand that the markets are in a healthy consolidation pattern – a healthy pause – after the robust market movements last year, and that bumpiness will be the new normal going forward.

On the other hand, we should be mindful of the whirlwind of factors that could buffet the market – Trump policies, Fed policy, earnings, a not-so-healthy American consumer, & the really big unknown – geopolitics.

My recommendation: put sell-stops on all your stock holdings.

QI CORNER

Linas Beliunas

This is huge! Microsoft just made a breakthrough in quantum computing and unveiled its first quantum chip Majorana 1

Majorana 1 is a quantum computing chip marking Microsoft's first use of topological qubits. These qubits are special because they use the shape or structure of the material, rather than individual particles, to store information, making them less prone to errors.

The wild part?

The chip relies on a new material called a top conductor, which can create a unique state of matter to host Majorana particles - exotic particles that are their own antiparticles.

Right now, it has eight of these topological qubits, but Microsoft’s goal is to scale up to a million qubits on a chip no bigger than your palm.

This is a huge deal because quantum computers need to be both reliable and large-scale to tackle real-world problems that classical computers can’t handle, like breaking encryption or simulating molecular interactions for new drugs.

Topological qubits are designed to be more error-resistant while current qubits are very sensitive to their surroundings, leading to mistakes.

If Microsoft succeeds, it could speed up the timeline for practical quantum computing from decades to years, opening doors in fields like:

- Cryptography: Breaking current encryption, pushing for new quantum-resistant methods.

- Drug Discovery: Faster simulation of molecular interactions, speeding up medicine development.

- Artificial Intelligence: Enhancing AI & machine learning with faster, more powerful computations.

- Climate Modeling: Better predictions through detailed simulations, aiding climate change strategies.

We're living in the golden age of tech innovation.

Fascinating times.

AUSTRALIAN CORNER

Chinese warships are in the Tasman Sea

Chinese warships are performing live firing exercises in the Tasman Sea (200 miles off the east coast of Australia). International airlines, flying between Australia and New Zealand have been warned, and most have diverted around the area.

Australian military ships and planes have been monitoring the Chinese ships for days as they pass in international waters off the coast of the Australian east coast.

Australia sees this event as a provocative act and is watching closely.

SOMETHING TO THINK ABOUT

Cheers

Jacquie

Global Market Comments

February 21, 2025

Fiat Lux

Featured Trade:

(THE DEATH OF THE FINANCIAL ADVISOR)

About one-third of my readers are professional financial advisors who earn their crust of bread telling clients how to invest their retirement assets for a fixed fee.

They used to earn a share of the brokerage fees they generated. After stock commissions went to near zero, they started charging a flat 1.25% a year on the assets they oversaw.

So it is with some sadness that I have watched this troubled industry enter a long-term secular decline, which seems to be worsening by the day.

Some miscreants steered clients into securities solely based on the commissions they earned, which could reach 8% or more, whether it made any investment sense or not. Some of the instruments the recommended were nothing more than blatant rip-offs.

Knowing hundreds of financial advisors personally, I can tell you that virtually all are hardworking professionals who go the extra mile to safeguard customer assets while earning incremental positive returns.

That is no easy task given the exponential speed with which the global economy is evolving. Yesterday’s “window and orphans” safe bets can transform overnight into today’s reckless adventure.

Look no further than coal, energy, and the auto industry. Once a mainstay of conservative portfolios, all of these sectors have or came close to filing for bankruptcy.

Even my own local power utility, Pacific Gas & Electric Company (PGE), filed for Chapter 11 in 2001 because they couldn’t game the electric power markets as well as Enron, and again in 2019 because of liability stemming from wildfires.

Some advisors even go the extent of scouring the Internet for a trade mentoring service that can ease their burden, like the Diary of a Mad Hedge Fund Trader, to get their clients that extra edge.

Traditional financial managers have been under siege for decades.

Commissions have been cut, expenses increased, and mysterious “fees” have started showing up on customer statements.

Those who work for big firms, like UBS, Morgan Stanley, Goldman Sacks, UBS, Merrill Lynch, and Charles Schwab, have seen health insurance coverage cut back and deductibles raised.

The safety of custody with big firms has always been a myth. Remember, all of these guys would have gone under during the 2008-09 financial crash if they hadn’t been bailed out by the government. With deregulation now rampant, you can count on it happening again.

The quality of the research has taken a nosedive, with sectors, like small caps, no longer covered. My research is now focused on, you guessed it, the Magnificent Seven.

What remains offers nothing but waffle and indecision. Many analysts are afraid to commit to a real recommendation for fear of getting sued, or worse, scaring away lucrative investment banking business.

And have you noticed that after Dodd-Frank, two-thirds of brokerage reports are made up of disclosures?

Many advisors have, in fact, evolved over the decades from money managers to asset gatherers and relationship managers.

Their job is now to steer investors into “safe” funds managed by third parties that have to carry all of the liability for bad decisions (buying energy plays in 2014?).

The firms have effectively become toll-takers, charging a commission for anything that moves.

They have become so risk averse that they have banned participation in anything exotic, like options, option spreads, (VIX) trading, any 2X leveraged ETFs, or inverse ETFs of any kind. When dealing in esoterica is permitted, the commissions are doubled.

Even my own newsletter has to get a compliance review before it is distributed to clients, often provided by third parties to smaller firms.

“Every year they try to chip away at something”, one beleaguered advisor confided to me with despair.

Big brokers often hype their own services with expensive advertising campaigns that unrealistically elevate client expectations.

Modern media doesn’t help either.

I can’t tell you how many times I have had to convince advisors not to dump all their stocks at a market bottom because of something they heard on TV, saw on the Internet, or read in a competing newsletter warning that financial Armageddon was imminent.

Customers are force-fed the same misinformation. One of my main jobs is to provide advisors with the fodder they need to refute the many “end of the world” scenarios that seem to be in continuous circulation.

In fact, a sudden wave of such calls has proven to be a great “bottoming” indicator for me.

Personally, I don’t expect to see another major financial crisis until 2032 at the earliest, and by then, I’ll probably be dead.

Because of all of the above, about half of my financial advisor readers have confided in me a desire to go independent in the near future, if they are not already.

Sure, they won’t be ducking all these bullets. But at least they will have an independent business they can either sell at a future date or pass on to a succeeding generation.

Overheads are far easier to control when you own your own business, and the tax advantages can be substantial.

A secular trend away from non-discretionary to discretionary account management is a decisive move in this direction.

There seems to be a great separation of the wheat from the chaff going on in the financial advisory industry.

Those who can stay ahead of the curve, both with the markets and their own business models, are soaking up all the assets. Those who can’t are unable to hold on to enough money to keep their businesses going concerns.

Let’s face it, in the modern age, every industry is being put through a meat grinder. Thanks to hyper-accelerating technology, business models are changing by the day.

Just be happy you’re not a doctor trying to figure out Obamacare.

Those individuals who can reinvent themselves quickly will succeed. Those that won’t will quickly be confined to the dustbin of history.

It’s Not as Good as it Used to Be

“The car business is hell,” said founder Elon Musk, when announcing he would sleep in the Fremont Tesla factory until Model S production reached 2,500 units a week.

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Biotech and Healthcare Letter

February 20, 2025

Fiat Lux

Featured Trade:

(PORTFOLIO MANAGEMENT DURING PAIN MANAGEMENT)

(VRTX), (DSNKY), (AZN), (GILD), (SNY), (GSK), (JNJ), (BMY), (LLY)

During physical therapy last week - still working on that Russian bullet in my hip from Ukraine - I was going through pharmaceutical pipeline data on my laptop. Between resistance exercises, I spotted something that made me forget about the pain entirely. After decades of tracking biotech launches, I rarely see numbers that make me sit up straight. But these did exactly that.

My analysis shows a potential $29 billion boom in annual sales by 2030 from the biggest drug launches expected in 2025. That's not a typo - we're looking at almost double last year's forecast of $15.2 billion. And while my therapist kept telling me to focus on my exercises, I couldn't take my eyes off these projections.

The numbers tell a compelling story. Leading the pack is Vertex Pharmaceuticals' (VRTX) cystic fibrosis treatment Alyftrek, which snagged its FDA approval ahead of schedule in late 2024. They're looking at $8.3 billion in annual sales by 2030. As someone who's studied market-moving data across Asia and Wall Street, I know transformative numbers when I see them.

What really catches my attention is Vertex's pricing strategy. They've set Alyftrek's annual list price at $370,269, about 7% higher than their previous treatment Trikafta's $346,048. The drug expands Vertex's CF franchise into 31 additional mutations, potentially treating about 150 new CF patients in the U.S. alone. That's the kind of market expansion that creates blockbusters.

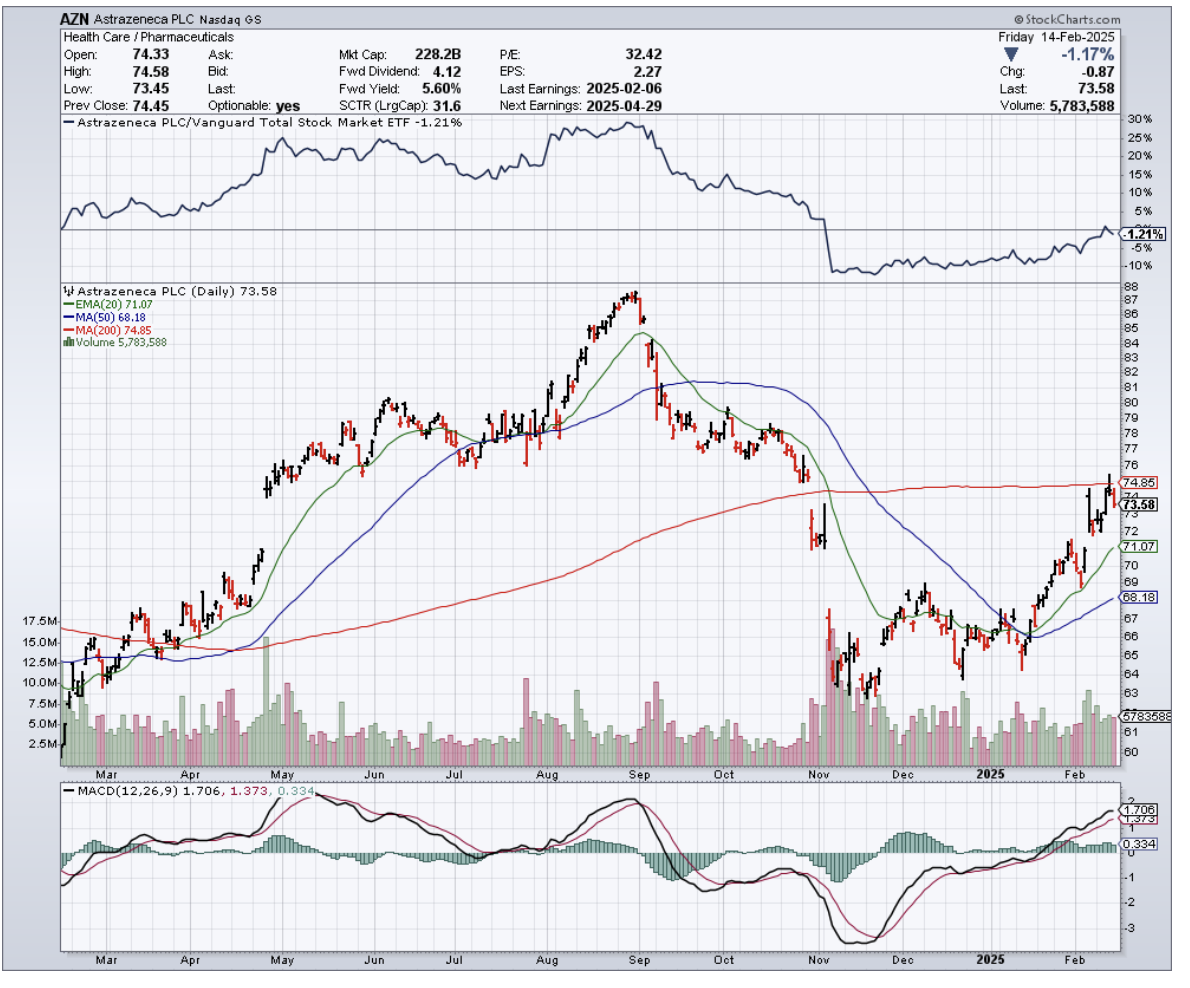

The second spot belongs to Daiichi Sankyo (DSNKY) and AstraZeneca's (AZN) Datroway, projected for nearly $6 billion in 2030 sales. They've already secured their first FDA approval this January for breast cancer. But here's what you need to watch: the bigger opportunity lies in lung cancer. While they faced setbacks in 2023, including patient deaths that intensified doubts, they're now advancing toward first-line treatment data in the second half of 2025. The AVANZAR trial could open up a major market opportunity, particularly if they can leap ahead of Gilead's (GILD) Trodelvy.

Speaking of opportunities, Vertex appears again with suzetrigine, their non-opioid pain management drug targeting both acute and neuropathic pain. With a January 30th FDA decision date looming, they're aiming to become "the first novel pain mechanism to reach the market for decades." My analysis points to just under $3 billion in annual sales by 2030. As someone who knows a thing or two about pain management these days, I can tell you that new approaches without addiction potential are pharmaceutical gold.

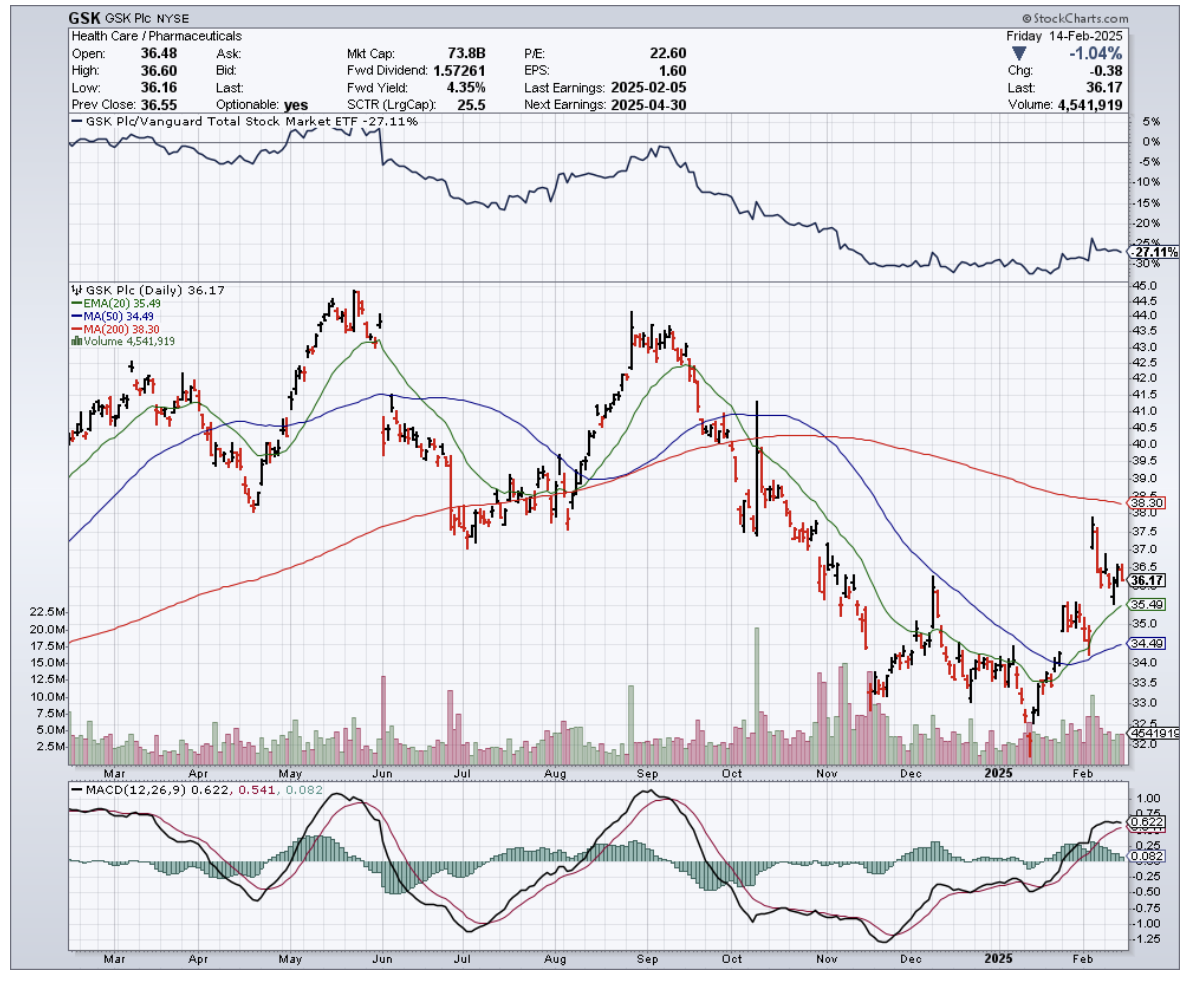

The pattern here is clear: we're seeing a concentration of breakthrough therapies across multiple high-value indications. From Sanofi's (SNY) tolebrutinib for multiple sclerosis to GSK's (GSK) depemokimab for severe asthma, which reduced asthma exacerbations by 54% compared to placebo, these aren't just incremental improvements - they're potential market reshaping events.

Looking ahead, we've got Johnson & Johnson's (JNJ) nipocalimab for myasthenia gravis, which could be the start of multiple autoimmune disorder approvals. GSK's meningococcal vaccine is targeting peak sales of $2.4 billion across its portfolio. Even Innovent and Eli Lilly's mazdutide for diabetes and obesity is showing promise in the Chinese market.

Will all these projections materialize? That's the $29 billion question. But even if only half hit their marks, we're looking at one of the most significant years for pharmaceutical launches in recent memory. The smart money is watching these developments closely, particularly in companies with multiple promising candidates.

Speaking of watching closely - my therapist is giving me that look again. Time to get back to those exercises. But between you and me, a potentially historic year in pharmaceutical launches is a lot more interesting than leg lifts. And with $29 billion in projected sales on the horizon, the pain in my portfolio might be easier to manage than the one in my hip.

The market will be watching these launches carefully. So should you.

Global Market Comments

February 20, 2025

Fiat Lux

Featured Trade:

(HOW TO HEDGE YOUR CURRENCY RISK),

(FXA), (UUP),

(TESTIMONIAL)

Let’s say you absolutely love a stock but despise the currency of the country it comes from.

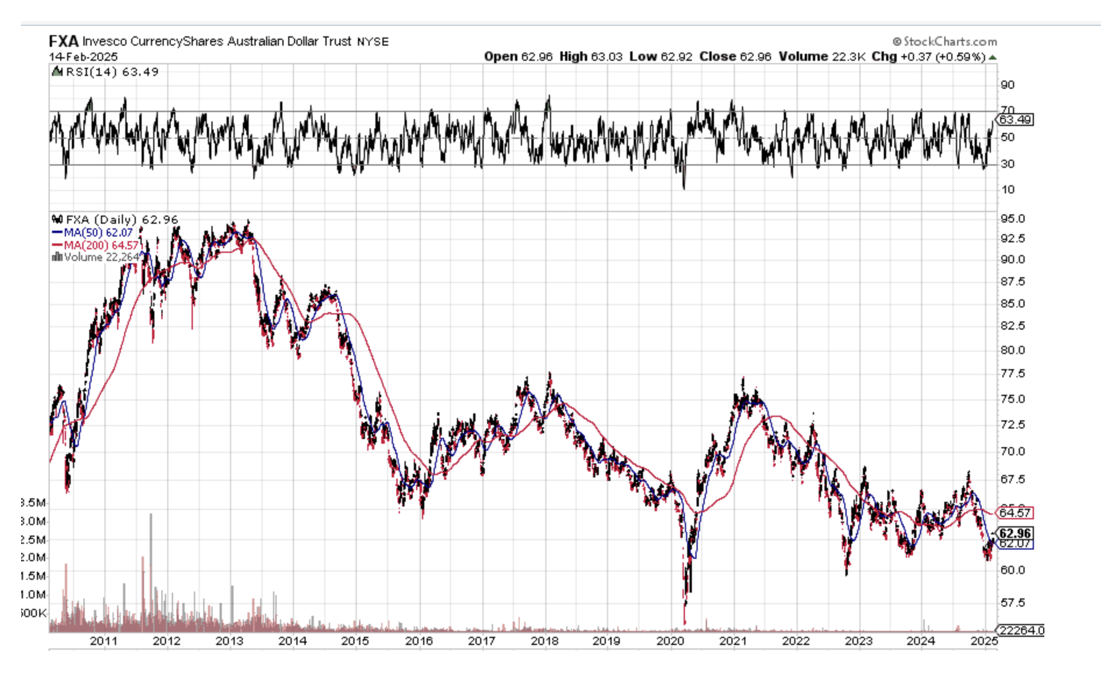

The United States comes to mind. The US Federal Reserve is about to commence with a policy of cutting interest rates that could last a year. That means the greenback is about to become the weakest currency in the world. Look at the ten-year chart below, and you’ll see that a major double bottom for the Aussie may be taking place.

Most American technology stocks are likely to gain 30% or more over the next two years. However, it’s entirely possible that the US dollar declines by 30% or more against the Australian (FXA) and Canadian (FXC) dollars during the same period. Making 30% and then losing 30% leaves you with precisely zero profit.

There is a way to avoid this dilemma that would vex Solomon. Simply hedge out your currency risk. I’ll use the example of the Australian dollar, as we have recently had a large influx of new subscribers from the land down under.

Let’s say you want to buy AUS$100,000 worth of Apple (AAPL), the world’s most widely owned stock.

Since Apple is listed on the New York Stock Exchange, its shares are denominated in US dollars. When you buy Apple in Australia, your local broker will automatically buy the US dollars for your account to settle this trade in the US, taking out a small commission along the way. You are now long US dollars, thus creating a currency risk.

Getting rid of this currency risk is quite simple. You need to offset your US dollar long with a US dollar short of equal value. Long dollars/short dollars give the Australian investor a currency-neutral position. The US dollar can go to hell in a handbasket, and you won’t care.

There are several financial instruments with which you can do this. Buying Invesco Currency Shares Australian Dollar Trust ETF (FXA) is the easiest. This ETF invests 100% of its assets in long Australian dollar/short US dollar futures and overnight cash positions.

I’ll do the math for you on the final hedged position, assuming that the Australian dollar is worth 70 US cents.

BUY AUS$100,000 long US dollars X US$0.70 cents/dollar = US$70,000.

US$70,000/$210 per share for Apple = 333 Apple shares

BUY US$70,000/$70 (FXA) price = US$1,000 shares of the (FXA)

Thus, by owning AUS$100,000 shares of Apple shares and 1,000 shares of the (FXA) you have completely removed the currency risk in owning Apple. You have, in effect, turned Apple into an Australian dollar-denominated stock. Apple can rise, the US dollar will fall, and you will make twice as much money in Australian dollars.

There are a few problems with this precise trade. The liquidity in the (FXA) is not great, especially during US trading hours. Understandably, the bulk of Aussie liquidity takes place during Australian business hours.

There are other instruments with which you can hedge out the currency risk of Apple or any other US dollar-denominated investment.

You can take out your own short dollar position in the futures market. You can ask your bank to create a short position in the US dollar in the cash market. Or, you can simply ask your broker to hedge out your US dollar currency risk, for which they will charge you another small commission.

Hedging out currency risk is not only free; the market will pay you to do it. That’s because Australian dollar overnight interest rates at 1.00% are lower than US dollar overnight interest rates at 2.50%. By shorting the Aussie against the buck, you get to keep this 1.50% interest differential.

You don’t have to be Australian to want your Apple shares denominated in Australian dollars. In fact, hedge funds do this all day long. They pursue a strategy of keeping their long position in the world’s strongest securities (Apple) and their short positions in the world’s weakest securities (the US dollar). This, by the way, is also the strategy of the Mad Hedge Fund Trader. It’s called “global long/short macro.”

The better ones often make money on both sides of the equation, with the longs rising and the shorts falling. You can do the same on your own personal online trading platform.

I should urge a word of caution here. What happens if you hedge out your US dollar risk, and the dollar continues to appreciate? Then you will get none of the gains from that appreciation and will end up losing money in Australian dollars if Apple shares remain unchanged.

In the worst case, if both Apple and the Aussie could go down, this accelerates your losses. So, currency hedging can be a double-edged sword. Yes, this may be irrational given the fundamentals of Aussie and Apple. But as any experienced long-term trader will tell you, “Markets can remain irrational longer than you can remain liquid.”

Many thanks to John Maynard Keynes.

Looks Like a Good Bet to Me

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.