When I first arrived on Wall Street during the early 1980s, some of the old veterans who worked through the 1929 stock market crash were just retiring and passed their stories on to me before they left.

One was my old friend, Sir John Templeton, founder of the Templeton funds, who often hosted me for dinner at his antebellum-style mansion at Lyford Cay in the Bahamas. John told me he was really excited when hired in ‘29 to handle the surge of brokerage business. After that, things got really boring for a decade.

The volatility we are experiencing now has many similarities to that epic event. In some ways, it's far worse. The 1929 downturn was spread over 34 months.

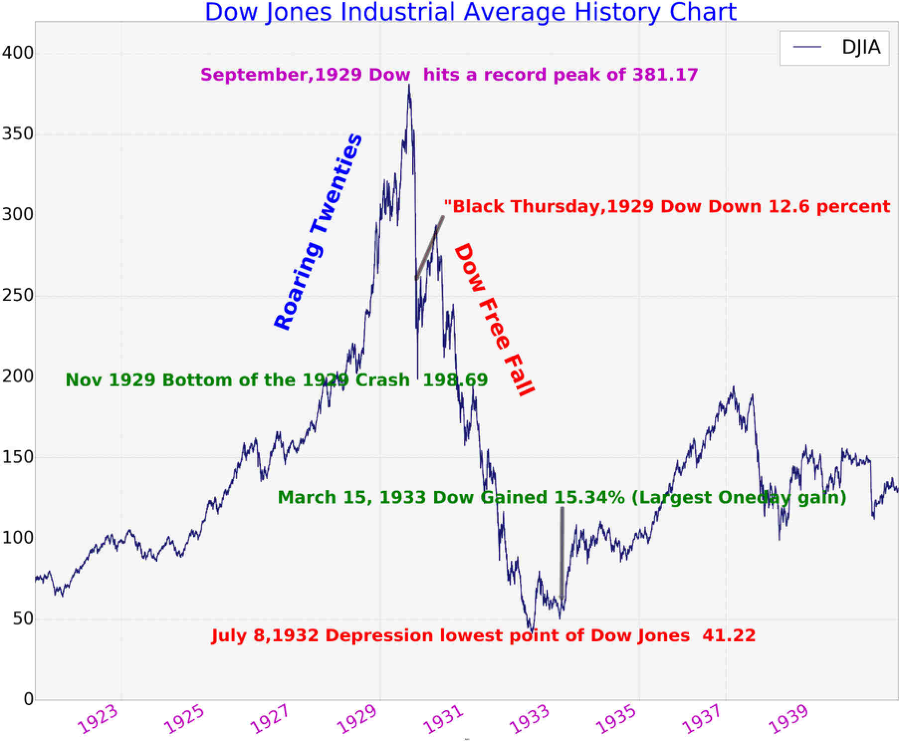

We all know about the Roaring Twenties, with flappers, bathtub gin, and a soaring stock market. Then, individuals could buy on ten to one margin. The high-flying tech stocks of the day, like RCA Radio, General Motors (GM), and Ford (F), soared. From 1921 to 1929, the Dow Average rocketed six-fold. The working class was sucked in.

Industry followed suit, taking the sign of rising stocks as proof of an economic boom. They massively boosted production in all sectors. That meant they went into the Great Depression loaded to the gills with inventory.

The Dow Average peaked on September 3, 1929, at 381. A slow burn of profit-taking ensued. Suddenly, a cascading waterfall of SELL orders hugely accelerated on “Black Monday” when the Dow plunged by 13%. It was followed by “Black Tuesday” when stocks lost another 13%.

Margin calls triggered a run on the banks as investors tried to withdraw cash to cover rampant cash calls. This spawned a financial crisis where eventually 4,000 banks went under.

By November, the Dow had fallen by 48% to 198. JP Morgan stepped in to stabilize the market, prompting a short-term rally. It was to no avail, with many retail investors seeing this as their last chance to sell. The market continued its slide, eventually hitting bottom at 41, or down an astonishing 89% from the top by July 8, 1932. The market then moved sideways in a wide 150-point range until the outbreak of WWII. It didn’t recover its 1929 peak until 1959.

A few years ago, I had lunch with the former governor of the Federal Reserve (click here), who did his PhD dissertation on the causes of the Great Depression. The big mistake the Fed made then was to raise interest rates to damp down stock speculation. They ended up destroying the economy, inadvertently making the depression far deeper and longer.

The world has learned a lot about central banking since those dark days. For a start, the theory of Keynesianism has been adopted whereby governments borrow and spend during economic downturns and run balanced budgets or surpluses during good times.

The modern Fed won’t be making the same mistake twice. During the last bear market, the Fed almost immediately took interest rates down to zero. Our central bank has also responded with monetary stimulus that is a large multiple of what we saw in 2008-09, essentially buying everything that was out there in fixed-income land.

My grandfather never participated in the stock boom of the 1920’s. He never found a broker he could trust. When the market crashed, he had to finish his basement in Brooklyn, New York, so that several relatives who had lost their homes could move in. We lost many equity investors for good in the 2008-09 crash. No doubt we will lose many more in this cycle.

What did Grandpa do with his money? He poured it all into real estate, including the land on which the Bellagio Hotel was eventually built, which he picked up for $500 an acre. His estate sold it in the 1970’s for $10 million.

Grandpa never bought a stock during his entire life.