Trade Alert - (SH) – BUY LEAPS

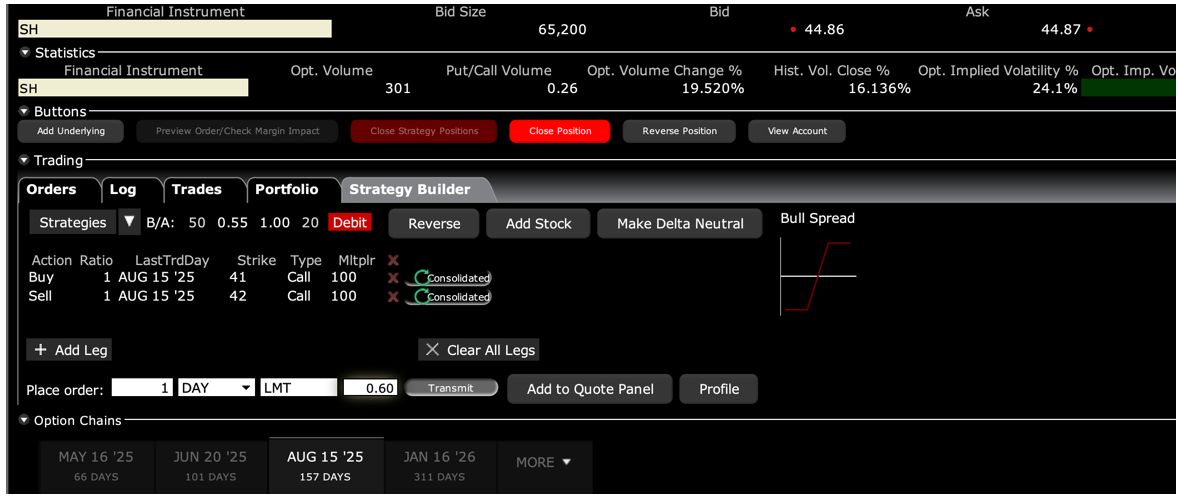

BUY the ProShares S&P 500 ETF LEAPS (SH) August 2025 $41-$42 in-the-money vertical Bull Call debit spread LEAPS at $0.60 or best

If we get any kind of rally over the next few days, you need to add this position, which offers a 66.66% profit in five months.

Opening Trade

3-11-2025

expiration date: August 15, 2025

Number of Contracts = 1 contract

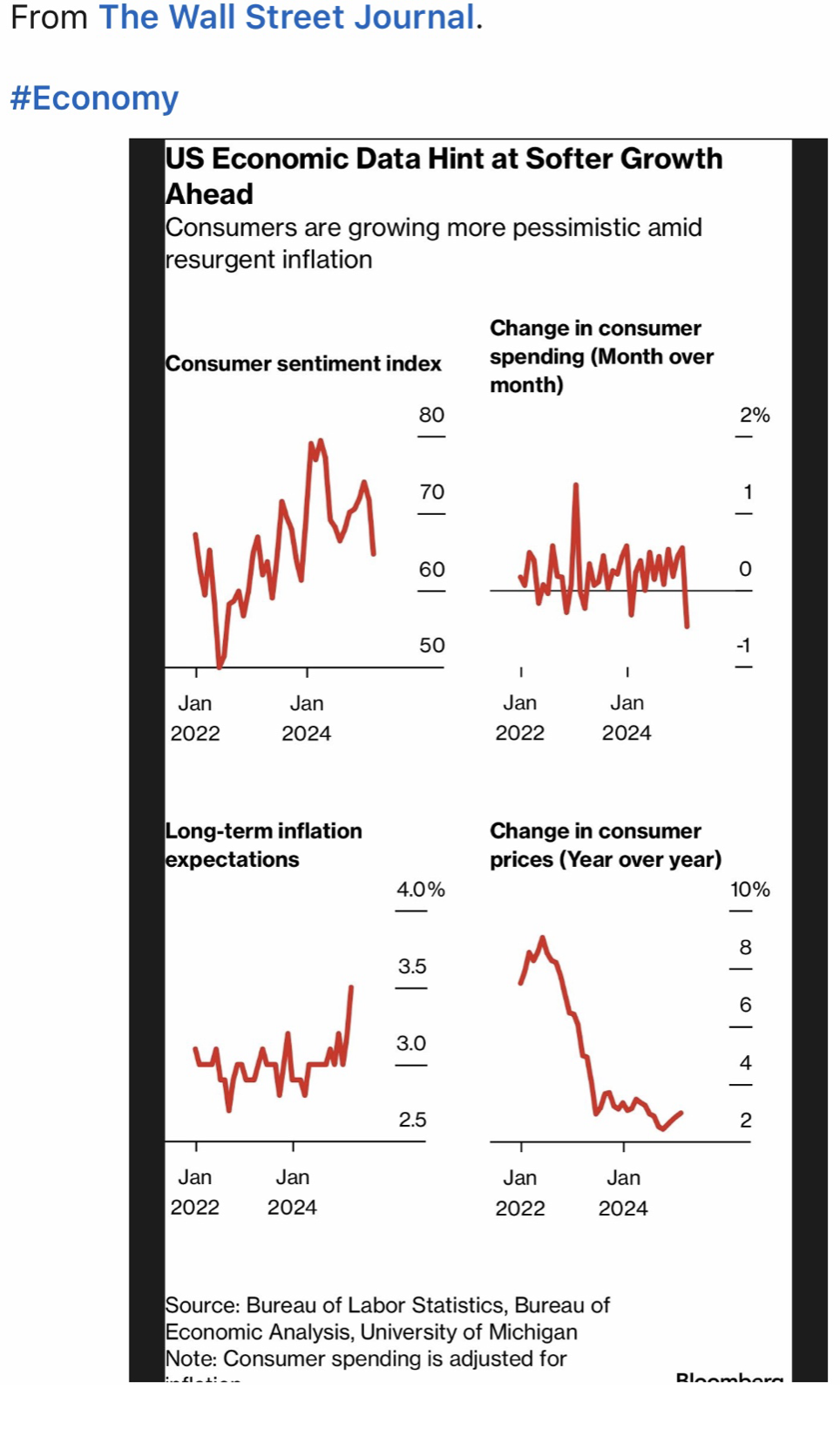

I spent the weekend shopping for downside protection for US equity portfolios, and this is the best one I could find. There are a lot of them designed to do nothing more than pick your pocket, but I think I found a good one.

If the last two weeks have been painful for your long-only portfolio, this is a way to protect it from additional losses. It may also help you sleep better at night. It will also reduce the day-to-day volatility of the net asset value of your account. But like all insurance policies these days, it doesn’t come cheap.

The best thing about this LEAPS is that if we close anywhere above the upper $42 strike price by expiration in five months, you double your money.

Not bad.

Ideally, you will add this position on a day when the stock market is up and the early players are taking profits.

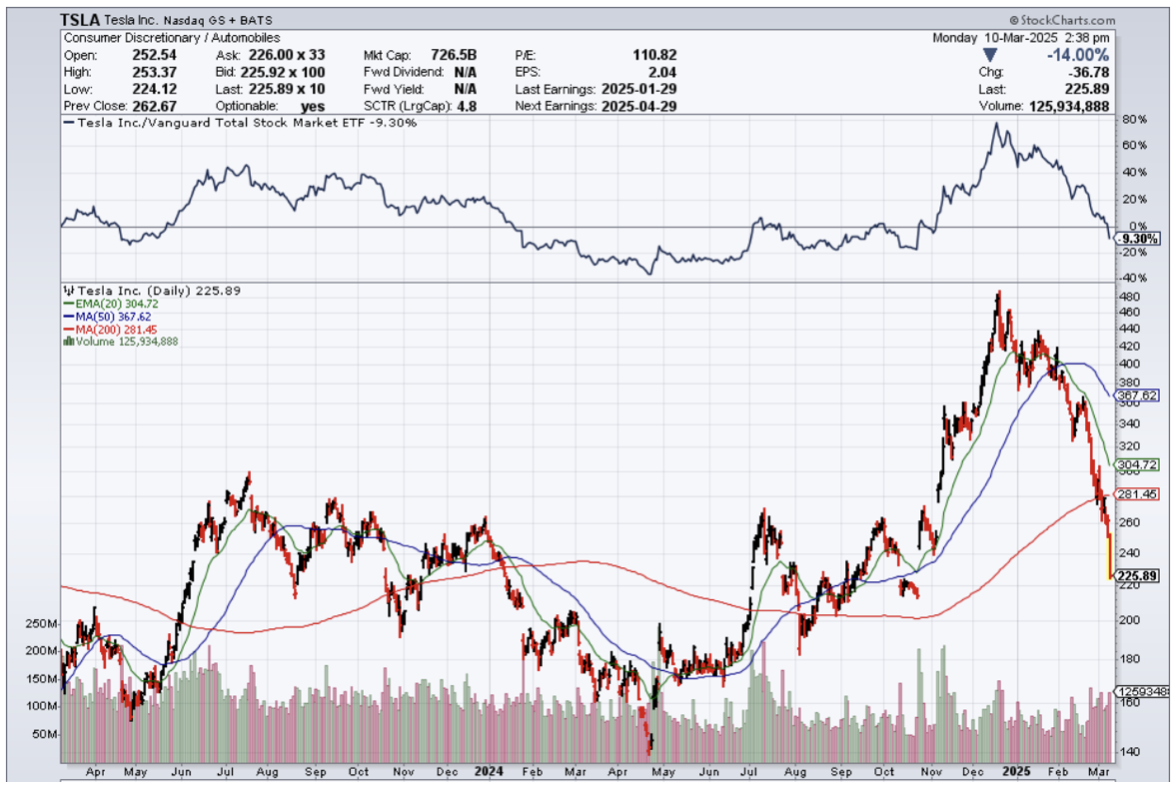

The ProShares S&P 500 (SH) is an inverse ETF that rises in value when the index falls on a one-to-one basis. Its current NAV is $863 million. It makes an excellent hedge for tech-heavy stock portfolios, with a hefty 32.6% exposure to the sector and 7% in Apple (AAPL) alone. If the (SPY) drops by 15% from here by the August 16 option expiration, this fund should rise by 10% to over $46.

I am therefore buying the ProShares Short S&P 500 ETF (SH) August 2025 $41-$42 in-the-money vertical Bull Call spread LEAPS at $0.60 or best.

DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES.

Simply enter your limit order, wait for a few hours, and if you don’t get filled, cancel your order and increase your bid by 5 cents with a second order.

This is a bet that ProShares S&P 500 ETF (SH) will not fall below $42 by the August 15, 2025 option expiration in a little more than 5 months.

There is a catch.

Inverse ETFs have their own special problems and are ideally designed to be traded intraday. They are not cheap. There can be tracking errors, although the (SH) has tracked pretty well over time. There is a contango because the fund managers have to borrow money at around a 6% annual interest rate to buy the futures contracts that the fund invests in.

You also have to cover the cost of paying dividends for the S&P 500, now at a 1.2% annualized rate. There is a derivative risk in that the futures contracts that the fund buys, in theory, could default.

You also have a compounding risk because the fund is reset at the end of every day. That means that if the (SPY) goes up and down frequently over a short period of time, the value of the (SH) will fall.

All in all, the S&P 500 has to drop about 5% by August 16 just to cover all of the costs associated with this short position.

I did take a close look at another ETF, the ProShares Ultrashort S&P 500 ETF (SDS), a leveraged -2X short ETF. The problem here is that with twice the short position, you are paying twice the expenses. The borrowing cost goes from 6% to 12% annualized, and the short dividends go from 1.2% to 2.4%. The (SPY) would have to drop a lot just to cover these expenses unless the drop happens immediately.

It’s great for catching short, sharp selloffs. If you bought the (SDS) on February 18 bottom, you would have made a quick 12% profit on a 6% decline in the (SPY). But for a five-month hold, you are giving up the first 12% move to expenses.

To learn more about the (SH) ETF, please visit their website at https://www.proshares.com/our-etfs/leveraged-and-inverse/sh

Don’t pay more than $0.70, or you’ll be chasing on a risk/reward basis.

Please note that these options are illiquid, and it may take some work to get in or out. Executing these trades is more an art than a science.

Let’s say the Proshares S&P 500 ETF (SH) August 2025 $41-$42 in-the-money vertical Bull Call debit spread LEAPS are showing a bid/offer spread of $0.40-$0.60. Enter a good-until-cancelled order for one contract at $0.50, another for $0.55, another for $0.60, another for $0.65, and so on. Eventually, you will enter a price that gets filled immediately. That is the real price. Then, enter an order for your full position at that real price.

Notice that the day-to-day volatility of LEAPS prices is miniscule, less than 10%, since the time value is so great, and you have a long position simultaneously offset by a short one.

This means that the day-to-day moves in your P&L will be small. It also means you can buy your position over the course of a month just by entering new orders every day. I know this can be tedious but getting screwed by overpaying for a position is even more tedious.

Look at the math below, and you will see that no move in (SH) shares over 6 months will generate a 100% profit with this position, such is the wonder of LEAPS. LEAPS stands for Long Term Equity Anticipation Securities.

Here are the specific trades you need to execute this position. You must place an order for this single vertical debit spread.

Buy 1 August 2025 (SH) $41 calls at………….………$5.60

Sell short 1 August 2025 (SH) $42 calls at…………$5.00

Net Cost:………………………….………..……………......$0.60

Potential Profit: $1.00 - $0.60 = $0.40

(1 X 100 X $0.40) = $40 or 6.67% in 5 months.

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of Interactive Brokers.

If you are uncertain on how to execute an options spread, please watch my training video on “How to Execute a Vertical Bull Call Debit Spread” by clicking here at

https://www.madhedgefundtrader.com/ltt-vbcs/

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually, or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts goes out, prices can be all over the map.