When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

March 7, 2025

Fiat Lux

Featured Trade:

(FOUNDING THE DIARY OF A MAD HEDGE FUND TRADER)

The Diary of a Mad Hedge Fund Trader is now celebrating its 15th year of publication.

During this time, I have religiously pumped out 3,000 words a day, or 18 newsletters a week, of original, independent-minded, hard-hitting, and often wickedly funny research.

I spent my life as a war correspondent, Marine Corps combat pilot, Wall Street trader, and hedge fund manager, and if you can’t laugh after that, something is wrong with you.

I’ve been covering stocks, bonds, commodities, foreign exchange, energy, precious metals, real estate, and even agricultural products.

You’ve been kept up on my travels around the world and listened in on my conversations with those who drive the financial markets.

I also occasionally opine on politics, but only when it has a direct market impact, such as with the recent administration's economic and trade policies. There is no profit in taking a side.

The site now contains over 20 million words, or 30 times the length of Tolstoy’s epic War and Peace.

Unfortunately, it feels like I have written on every possible topic at least 100 times over.

So, I am reaching out to you, the reader, to suggest new areas of research that I may have missed until now, which you believe justify further investigation.

Please send any and all ideas directly to me at support@madhedgefundtrader.com, and put “RESEARCH IDEA” in the subject line.

The great thing about running an online business is that I can evolve it to meet your needs on a daily basis.

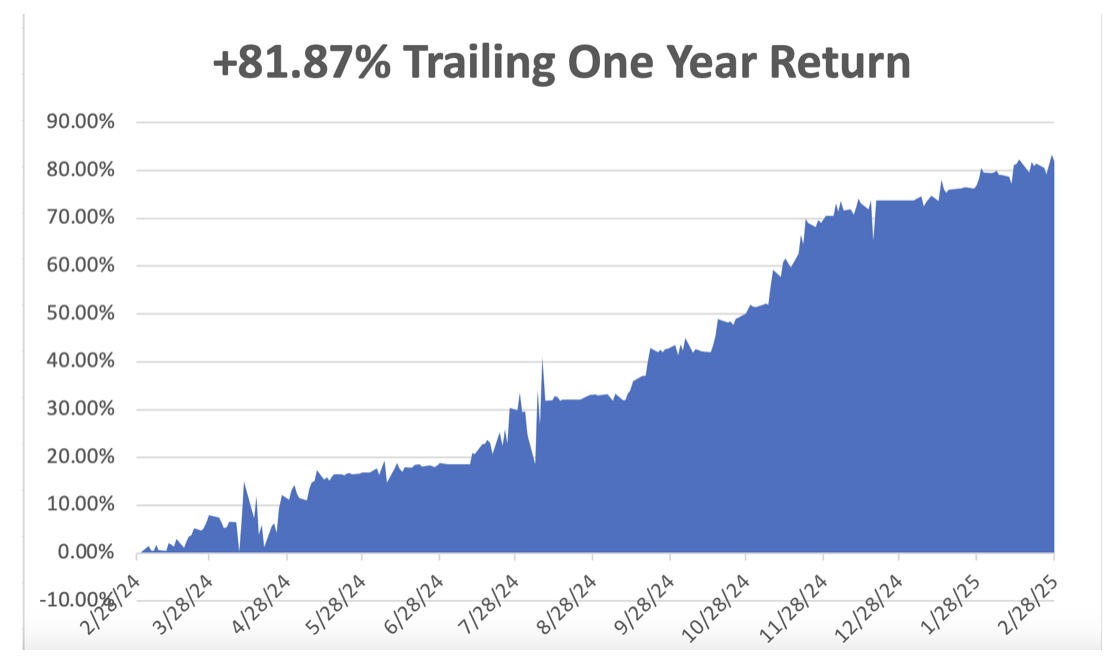

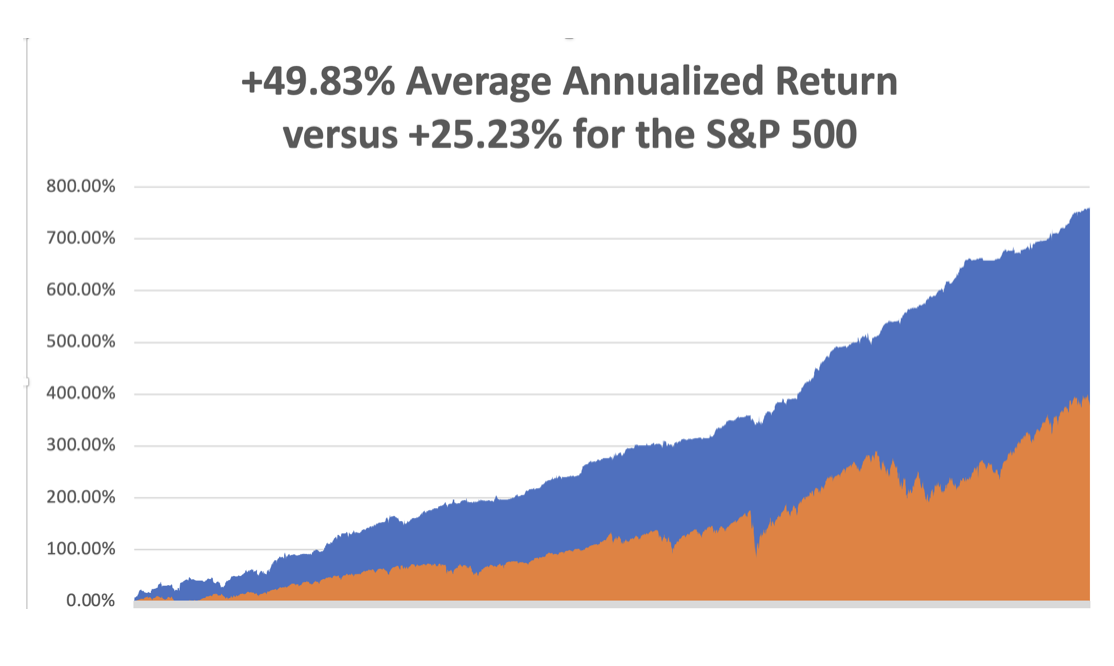

Many of the new products and services that I have introduced since 2008 have come at your suggestion. That has enabled me to improve the product’s quality, to your benefit. Notice how rapidly my trade alert performance is going up, now annualizing at +47% a year.

This originally started out as a daily email to my hedge fund investors, giving them an update on fast market-moving events. That was at a time when the financial markets were in free fall, and the end of the world seemed near.

Here’s a good trading rule of thumb: Usually, the world doesn’t end. History doesn’t repeat itself, but it certainly rhymes.

The daily emails gave me the scalability that I so desperately needed. Today’s global mega enterprise grew from there.

Today, the Diary of a Mad Hedge Fund Trader and its Global Trading Dispatch is read in over 140 countries by 30,000 followers. The Mad Hedge Technology Letter, the Mad Hedge Biotech & Health Care Letter, Mad Hedge AI, and Jacquie’s Post also have their own substantial followings. And the daily Mad Hedge Hot Tips is one of the most widely read publications in the financial industry.

I’m weak in distribution in North Korea and Mali, in both cases due to the lack of electricity. But that may change.

One can only hope.

If you want to read my first pitiful attempt at a post, please click here for my February 1, 2008 post.

It urged readers to buy gold at $950 (it soared to $2,200) and buy the Euro at $1.50 (it went to $1.60).

Now you know why this letter has become so outrageously popular.

Unfortunately, I also recommended that they sell bonds short. I wasn’t wrong on that one, just early- about eight years too early.

I always get asked how long will I keep doing this?

I am already collecting Social Security, so that deadline came and went. My old friend and early Mad Hedge subscriber, Warren Buffet, is still working at 94, so that seems like a realistic goal. And my old friend, Henry Kissinger, is still hard at it at 100 years old.

Hiking ten miles a day with a 50-pound pack, my doctor tells me I should live forever. He says he spends all day trying to convince his other patients to be like me, and the only one who actually does it is me.

The harsh truth is that I don’t know how to NOT work. Never tried it, and I never will.

The fact is that thousands of subscribers love me for what I do, pay for me to travel around the world first class to the most exotic destinations, eat in the best restaurants, fly the rarest historical aircraft, and then say thank you. I even get presents (keep those pounds of fudge and bottles of bourbon coming!).

Given the absolute blast I have doing this job, I would be Mad to actually retire.

Take a look at the testimonials I get on an almost daily basis, and you’ll see why this business is so hard to walk away from (click here).

In the end, you are going to have to pry my cold, dead fingers off of this keyboard to get me to give up.

Fiat Lux (let there be light).

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Biotech and Healthcare Letter

March 6, 2025

Fiat Lux

Featured Trade:

(THE DANISH DILEMMA)

(LLY), (NVO)

I was having dinner with a group of Mad Hedge Fund Trader readers in Salt Lake City the other week.

One, a successful financial advisor who's been following my market calls for years, posed a question that got the whole table talking: "Between Eli Lilly (LLY) and Novo Nordisk (NVO), which horse should I bet on in this weight loss drug race?"

It's the kind of direct question I appreciate. No beating around the bush, just cut straight to the investment thesis.

And the question couldn't have come at a better time—I'd spent the previous months analyzing the shifting dynamics between these two pharmaceutical powerhouses.

For those who haven't been following the battle between Eli Lilly and Novo Nordisk closely, you've been missing one of the most fascinating corporate duels in recent memory.

The American challenger has been steadily gaining ground against the Danish heavyweight in the GLP-1 market—drugs that were originally developed for diabetes but have become blockbusters for weight loss.

What's particularly interesting is the momentum shift that began in May 2024, with Lilly's upward trajectory continuing through February while Novo Nordisk's stock halted its precipitous decline at a critical juncture.

While bargain hunters are picking through NVO's wreckage, I'm skeptical we'll see a mass migration back to the Danish giant. Here's why.

First, there's the Trump factor. Our newly reinstalled president hasn't been subtle about demanding pharma companies shift production capacity back to American soil or face potential tariffs.

This presents a much bigger problem for Novo Nordisk than for Lilly.

The Indiana-based Lilly has a well-diversified manufacturing footprint, including substantial domestic capacity, while NVO relies heavily on non-U.S. production.

Years spent covering the White House taught me one thing: when a president threatens tariffs, smart investors listen—even if those threats haven't materialized yet.

Trump's policy shifts can come suddenly and dramatically. I've seen enough administration policy pivots over decades to know that being caught flat-footed when the music stops is a recipe for portfolio pain.

Beyond geopolitical considerations, Lilly's Zepbound (their branded weight loss medication) has been steadily gaining share in new prescriptions, showing more robust efficacy than Novo's offerings, and—in a savvy competitive move—is priced at a relative discount. It's a triple threat that's steadily eroding Novo's first-mover advantage.

But what's really impressive about Lilly's position is that they aren't putting all their eggs in the weight loss basket.

They've made solid advances in immunology and oncology, with a diverse pipeline that doesn't rely solely on incretin-based growth drivers.

This brings to mind a conversation I had with a pharmaceutical executive while flying my Ercoupe to an industry conference last weekend.

"The companies that survive long-term in this industry," he told me, "never let themselves become dependent on a single breakthrough, no matter how big."

Meanwhile, Wall Street has been revising upward its estimates for the total addressable market for weight loss drugs, anticipating expanded indications, sustained consumer adoption, and penetration into markets outside the U.S.

This strengthens the bull case for Lilly while simultaneously raising concerns about Novo Nordisk's ability to maintain its market leadership.

Speaking of market leadership, Lilly's oral GLP-1 receptor agonist Orforglipron could be submitted for regulatory approval in late 2025, potentially beating Novo's next-generation product to market.

If commercialized in 2026 as anticipated, it could further disrupt Wegovy's (Novo's weight loss drug) market position.

Some might argue that Lilly's outperformance against Novo since mid-2024 has already priced in these advantages.

But a closer look at Lilly's valuation suggests the market still isn't fully convinced of the company's growth potential.

Is this caution warranted? Perhaps. Wall Street doesn't expect Lilly's current surge in revenue growth to continue through 2027.

Lilly's management has indicated pricing will likely remain stable, but the broader expectation is that medium-term pricing may remain muted or even decline, especially as Novo's products face pricing negotiations by 2027.

This could pressure Lilly's market position, particularly given the relatively high prices in U.S. markets.

We should anticipate a more competitive landscape after 2027 as other competitors enter the weight loss drug market, though market share dynamics should remain relatively stable through 2030.

Let's talk valuation. Lilly is trading at a forward non-GAAP P/E of 37.8x, almost double its sector peers. That sounds expensive until you realize it's more than 10% below its five-year average.

More tellingly, when accounting for earnings growth prospects, Lilly's PEG ratio of 1.13 is almost 40% below the sector median.

Translation? The market hasn't gone full FOMO on Lilly yet, despite its recent outperformance of the S&P 500. In fact, price action suggests growing conviction that the stock is poised to retest its all-time highs.

Lilly weathered two setbacks in 2024 as the market questioned whether it could credibly challenge Novo's dominance.

Yet the stock found firm support above the $700 level in August, November, and again in January, confirming my belief that this support zone is rock-solid, attracting value-conscious buyers who recognize Lilly's growth potential relative to its valuation.

The breakout above the $840 zone (December highs) marks a decisive move that validates the bull case.

And while the outlook beyond 2027 remains murky, the market's restraint in valuing Lilly gives investors who've been watching from the sidelines another opportunity to board this train before it leaves the station.

"So what's your call?" pressed the advisor, who like many in his field has been forced to dump expensive research analysts while still needing solid investment ideas for his growing client base.

The rest of the table, a mix of successful entrepreneurs and self-taught traders, leaned in to hear my response.

"If you're picking between the two for a long position, Lilly is the clear choice," I replied. "They've got the edge on domestic production, they're better insulated from potential tariffs, they have a more diverse pipeline, and the market momentum is clearly in their favor."

As the waiter cleared our plates, one of the younger traders at the table asked about price targets. I tapped my wineglass thoughtfully with my pen—a habit that drives my wife crazy.

"The breakout above $840 was significant," I said. "If the fundamentals hold, which I believe they will, we could see a return to all-time highs before the bears even realize what hit them."

This led to a spirited debate about pharmaceutical valuations that lasted well past dessert.

It's these impromptu investment summits that remind me why I still travel the country meeting readers, despite having technically "retired" years ago.

The collective wisdom and diverse perspectives always sharpen my own thinking.

When the check arrived, someone joked that talking about weight loss drugs had made them lose their appetite.

“Not Lilly,” I quipped. “They're happily eating Novo's lunch”

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

March 6, 2025

Fiat Lux

Featured Trade:

(A REFRESHER COURSE AT SHORT SELLING SCHOOL),

(SH), (SDS), (PSQ), (DOG), (RWM), (SPXU), (AAPL), (TSLA),

(VIX), (VXX), (IPO), (MTUM), (SPHB), (HDGE)

Some asset classes are reflecting the fact that we are already in a full-blown recession, while others are not. In case I am wrong and we DO go into a recession, knowing how to sell short stocks will be a handy skill to have.

It will become essential to be knowledgeable about all the different ways to add downside protection.

While you are all experts in buying stocks, selling them short is another kettle of fish.

I, therefore, think it is timely to review how to make money when prices are falling. I call it Short Selling School 101.

I don’t think we are going to crash to new lows from here, maybe drop only 10% at worst. So some of the most aggressive bearish strategies described below won’t be appropriate.

If you have big positions in single stocks, like Apple (AAPL), you can execute the same kind of strategy. Selling short the Apple call options to hedge an existing long in the stock looks like the no-brainer here. You should sell one option contract for every 100 shares you own.

There is nothing worse than closing the barn door after the horses have bolted or hedging after markets have crashed.

No doubt, you will receive a wealth of short-selling and hedging ideas from your other research sources and the media right at the next market bottom.

That is always how it seems to play out, great closing the barn doors after the horses have bolted.

So I am going to get you out ahead of the curve, putting you through a refresher course on how to best trade falling markets now, while stock prices are still rich.

I’m not saying that you should sell short the market right here. But there will come a time when you will need to do so.

Watch my Trade Alerts for the best market timing. So here are the best ways to profit from declining stock prices, broken down by security type:

Bear ETFs

Of course, the granddaddy of them all is the ProShares Short S&P 500 Fund (SH), a non-leveraged bear ETF that is supposed to match the fall in the S&P 500 point for point on the downside. Hence, a 10% decline in the (SPY) is supposed to generate a 10% gain in the (SH).

In actual practice, it doesn’t work out like that. The ITF has to pay management operating fees and expenses, which can be substantial. After all, nobody works for free.

There is also the “cost of carry,” whereby owners have to pay the price for borrowing and selling short shares. They are also liable for paying the quarterly dividends for the shares they have borrowed, around 2% a year. And then you have to pay the commissions and spread for buying the ETF.

Still, individuals can protect themselves from downside exposure in their core portfolios by buying the (SH) against it (click here for the prospectus). Short-selling is not cheap. But it’s better than watching your gains of the past seven years go up in smoke.

Virtually all equity indexes now have bear ETFs. Some of the favorites include the (PSQ), a short play on the NASDAQ (click here for the prospectus ), and the (DOG), which profits from a plunging Dow Average (click here for the prospectus).

My favorite is the (RWM) a short play on the Russell 2000, which falls 1.5X faster than the big cap indexes in bear markets (click here for the prospectus).

Leveraged Bear ETFs

My favorite is the ProShares Ultra Short S&P 500 (SDS), a 2X leveraged ETF (click here for the prospectus). A 10% decline in the (SPY) generates a 20% profit, maybe.

Keep in mind that by shorting double the market, you are liable for double the cost of shorting, which can total 5% a year or more. This shows up over time in the tracking error against the underlying index. Therefore, you should date, not marry, this ETF, or you might be disappointed.

3X Leveraged Bear ETF

The 3X bear ETFs, like the UltraPro Short S&P 500 (SPXU), are to be avoided like the plague (click here for the prospectus).

First, you have to be pretty good to cover the 8% cost of carry embedded in this fund. They also reset the amount of index they are short at the end of each day, creating an enormous tracking error.

Eventually, they all go to zero and have to be periodically redenominated to keep from doing so. Dealing spreads can be very wide, further adding to costs.

Yes, I know the charts can be tempting. Leave these for the professional hedge fund intraday traders for which they are meant.

Buying Put Options

For a small amount of capital, you can buy a ton of downside protection. For example, the April (SPY) $182 puts I bought for $4,872 on Thursday allows me to sell short $145,600 worth of large cap stocks at $182 (8 X 100 X $6.09).

Go for distant maturities out several months to minimize time decay and damp down daily price volatility. Your market timing better be good with these because when the market goes against you, put options can go poof and disappear pretty quickly.

That’s why you are reading this newsletter.

Selling Call Options

One of the lowest risk ways to coin it in a market heading south is to engage in “buy writes.” This involves selling short call options against stock you already own but may not want to sell for tax or other reasons.

If the market goes sideways or falls, and the options expire worthless, then the average cost of your shares is effectively lowered. If the shares rise substantially, they get called away, but at a higher price, so you make more money. Then you just buy them back on the next dip. It is a win-win-win.

Selling Futures

This is what the pros do, as futures contracts trade on countless exchanges around the world for every conceivable stock index or commodity. It is easy to hedge out all of the risk for an entire portfolio of shares by simply selling short futures contracts for a stock index.

For example, let’s say you have a portfolio of predominantly large-cap stocks worth $100,000. If you sell short 1 September 2021 contract for the S&P 500 against it, you will eliminate most of the potential losses for your portfolio in a falling market.

The margin requirement for one contract is only $5,000. However, if you are short the futures and the market rises, then you have a big problem, and the losses can prove ruinous.

But most individuals are not set up to trade futures. The educational, financial, and disclosure requirements are beyond mom-and-pop investing for their retirement fund.

Most 401Ks and IRAs don’t permit the inclusion of futures contracts. Only 25% of the readers of this letter trade the futures market. Regulators do whatever they can to keep the uninitiated and untrained away from this instrument.

That said, get the futures markets right, and is the quickest way to make a fortune if your market direction is correct.

Buying Volatility

Volatility (VIX) is a mathematical construct derived from how much the S&P 500 moves over the next 30 days. You can gain exposure to it by buying the iPath S&P 500 VIX Short-Term Futures ETN (VXX) or buying call and put options on the (VIX) itself.

If markets fall, volatility rises, and if markets rise, then volatility falls. You can, therefore, protect a stock portfolio from losses through buying the (VIX).

I have written endlessly about the (VIX) and its implications over the years. For my latest in-depth piece with all the bells and whistles, please read “Buy Flood Insurance With the (VIX)” by clicking here.

Selling Short IPOs

Another way to make money in a down market is to sell short recent initial public offerings. These tend to go down much faster than the main market. That’s because many are held by hot hands, known as “flippers,” don’t have a broad institutional shareholder base.

Many of the recent ones don’t make money and are based on an as-yet unproven business model. These are the ones that take the biggest hits.

Individual IPO stocks can be tough to follow to sell short. But one ETF has done the heavy lifting for you. This is the Renaissance IPO ETF (click here for the prospectus). As you can tell from the chart below, (IPO) was warning that trouble was headed our way since the beginning of March. So far, a 6% drop in the main indexes has generated a 20% fall in (IPO).

Buying Momentum

This is another mathematical creation based on the number of rising days over falling days. Rising markets bring increasing momentum, while falling markets produce falling momentum.

So, selling short momentum produces additional protection during the early stages of a bear market. Blackrock has issued a tailor-made ETF to capture just this kind of move through its iShares MSCI Momentum Factor ETF (MTUM). To learn more, please read the prospectus by clicking here.

Buying Beta

Beta, or the magnitude of share price movements, also declines in down markets. So, selling short beta provides yet another form of indirect insurance. The PowerShares S&P 500 High Beta Portfolio ETF (SPHB) is another niche product that captures this relationship.

The Index is compiled, maintained, and calculated by Standard & Poor's and consists of the 100 stocks from the (SPX) with the highest sensitivity to market movements, or beta, over the past 12 months.

The Fund and the Index are rebalanced and reconstituted quarterly in February, May, August, and November. To learn more, read the prospectus by clicking here.

Buying Bearish Hedge Funds

Another subsector that does well in plunging markets is publicly listed bearish hedge funds. There are a couple of these that are publicly listed and have already started to move.

One is the Advisor Shares Active Bear ETF (HDGE) (click here for the prospectus). Keep in mind that this is an actively managed fund, not an index or mathematical relationship, so the volatility could be large.

Oops, Forgot to Hedge

(CLS), (MSFT), (GOOG), (GOOGL), (NVDA)

I was driving back from Salt Lake City a few weeks ago when I got a call from a former Concierge Service client who runs a drone manufacturing business.

His story is remarkable - what started as a hobby five years ago now generates $40 million in revenue, with military contracts on the horizon promising even more growth.

He keeps telling me that our weekly calls during those crucial early days were what kept him from selling to the first European conglomerate that waved a checkbook in his face.

"You told me to hold out for ten times what they were offering," he reminded me. I don't remember saying that, but who knows?

After thousands of client calls over the years, they tend to blur together. Still, he swears it was my portfolio review that convinced him to plow every nickel of profit back into engineering when his competitors were cashing out.

I'm not about to take credit for his success – the guy's a genius in his own right – but I'd be lying if I said it didn't make my day to hear that. Now he's being bombarded with takeover offers from European and Asian firms desperate for new profit streams at any cost.

That conversation got me thinking about AI stocks and where the real opportunities might be hiding.

AI fever is alive and well on Wall Street. But while tech giants like Alphabet (GOOG) (GOOGL) and Microsoft (MSFT) operate under the shadow of China's DeepSeek, the architects of artificial intelligence systems—from semiconductors to servers to sprawling data centers—have emerged as the winners so far in 2025.

Look no further than Nvidia (NVDA), which saw its sales and profits surge as tech companies threw billions at its advanced chips.

The demand for its Blackwell series alone generated a staggering $11 billion in revenue last quarter. But with its valuation soaring, NVDA is no longer the under-the-radar opportunity it once was.

While Nvidia's dominance is undeniable, the real money in AI isn’t just in chips—it’s in the infrastructure that keeps the entire ecosystem running.

And that’s where Celestica (CLS) comes in. While most investors were fixated on Nvidia, CLS quietly delivered massive gains, positioning itself as a crucial player in AI’s supply chain.

Celestica makes the electronic guts that keep AI data centers running. It’s not as flashy as ChatGPT or robotics breakthroughs, but the companies that build and maintain AI infrastructure are often where the real money is made. It’s the same reason drone component suppliers have been making a fortune while the spotlight stays on the drones themselves.

And the numbers back it up. Celestica reported $2.55 billion in Q4 revenue, an adjusted EPS of $1.11, and a forecast of $10.7 billion in revenue for 2025—a 22% earnings growth rate in a market where consistent growth is getting harder to find.

Yet its valuation remains reasonable, with a PEG ratio of 0.8, meaning investors are paying less per unit of growth compared to sector averages.

In 2025, market volatility has been brutal. Geopolitical tensions, persistent inflation, and Donald Trump’s new tariffs on China helped fuel a 5% Nasdaq drop last week, sending investors into panic mode.

But CLS kept climbing. Over the last three months, while the broader market wobbled, Celestica delivered a nearly 29% gain.

Even better, nine analysts have revised their earnings estimates upward in the last 90 days, with zero downward revisions. That’s the kind of confirmation bias I can get behind.

It’s a strategy I’ve seen pay off before. My former client reinvested in engineering instead of selling out early, betting on long-term value over a quick exit.

Celestica has been following a similar playbook—focusing on becoming an indispensable part of the AI infrastructure rather than competing with the companies making headlines.

While others chase the next big AI breakthrough, Celestica is already supplying the backbone that powers them all.

It currently ranks as the top electronic manufacturing services stock and is among the top 10 technology stocks overall—solid proof to its growing influence in the industry.

And with hyperscaler demand accelerating and AI adoption still in its early innings, Celestica is positioned to become even more critical to the AI revolution in the coming years.

So, where is the next 10-bagger in AI? It's probably not limited to the household names that dominate the headlines.

As I've seen time and again throughout my career, sometimes the most profitable investments are found in the companies building the essential tools for the gold rush, not the miners themselves.

And just like my drone-building client who turned personalized investment advice into a $40 million business by avoiding the quick exit, the real winners in AI will be those who recognize the opportunities hiding in plain sight.

After all, fortunes aren’t made by chasing shiny objects—they’re made by supplying the circuit boards that keep them running.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.