Mad Hedge Technology Letter

March 24, 2025

Fiat Lux

Featured Trade:

(23ANDME GETS DUMPED)

(ME)

Mad Hedge Technology Letter

March 24, 2025

Fiat Lux

Featured Trade:

(23ANDME GETS DUMPED)

(ME)

Tech is full of ideas swept into the dustbin of history, and 23andMe is just another blatant example of it.

Mr. Market decides the fate of these public companies and nobody else.

Remember they went public when there was more money than common sense.

Interest rates were low and half-baked tech ideas were getting funded left and right.

That was back when things like Hollywood used to be relevant.

Fast forward to today and 23andMe is done and dusted.

They filed for bankruptcy protection in the US to help sell itself.

Many of these mediocre tech companies are falling like dead flies as the thirst to prove profitable has really hit tech as small firms deal with the 1000-pound gorilla in the room.

The company has never flipped a profit.

They could solve the problem of extracting recurring revenue and many customers fled the company after doing their DNA test.

The San Francisco-based company said its chief executive and co-founder Anne Wojcicki was stepping down. She has been pushing for a buyout since April last year but was rebuffed by 23andMe’s board.

The company is still reeling from a huge data breach in 2023 that affected the data of nearly 7 million people, about half of its customers. Revenues have fallen as many of its 15 million customers scramble to delete their DNA data from the company’s archives.

This is a company that can solely exist with some level of trust, and that trust was extinguished in one fell swoops as hackers made out with everything important to the company.

At a time when other tech overlords are headed into the health business, the proverbial goalposts could never be narrower than they are today.

That is bad news for shareholders and bad news for the possibility of a quick turnaround.

Fighting for survival, 23andMe has cut the jobs of 200 people, amounting to 40% of its workforce, and stopped the development of all its therapies in November. Wojcicki’s ambition has been to turn the company into a drug developer.

The CEO will be replaced by its chief financial officer, Joe Selsavage, until a permanent replacement is found but she is staying on the 23andMe board.

It has never been harder to make a profit in Silicon Valley and even though data leaks aren’t a big deal for big tech giants, they are a death sentence for an upstart.

A company like 23andMe never found a way to monetize its business model.

I remember the fad of getting your genes tested to see where you are from, but that spark was met with a big thud.

The truth is, how do you come back from a data leak when that is the sole value of your firm?

The answer is you don’t.

23andMe won’t be able to do much of anything to expand their revenue projections while they are mired in over 30 lawsuits.

Everything they will do will be like walking on a tightrope.

Better to just shut down the company and restart a new one.

It’s hard to believe that in 2021, the company had a stock price of over $320.

Fast forward to today and the stock is trading under $1.

American capitalism is for no faint of heart and 23andMe’s story is a bruising anecdote to what happens when tech firms don’t safeguard their secret sauce.

That sauce has now gone rotten.

(MARKETS ARE DEFINED BY UNCERTAINTY)

March 24, 2025

Hello everyone

WEEK AHEAD CALENDAR

Monday, March 24

8:30 a.m. Chicago Fed National Activity Index (February)

9:45 a.m. PMI Composite preliminary (March)

9:45 a.m. S&P PMI Manufacturing preliminary (March)

9:45 a.m. S&P PMI Services preliminary (March)

Tuesday, March 25

9:00 a.m. FHFA Home Price Index (January)

9:00 a.m. S&P/Case-Shiller comp. 20 Home Price Index (January)

9:05 a.m. New York Federal Reserve Bank President and EO John Williams speaks at the 2025 New York Fed Regional and Community Banking Conference.

9:10 a.m. New York Federal Reserve Bank Director of Research and Head of the Research and Statistics Group Kartik Athreya speaks on the National Economic Outlook.

9:30 a.m. New York Federal Reserve Bank Head of Microeconomics Research and Statistics Group Jaison Abel speaks on the Regional Economic Outlook.

10:00 a.m. Consumer Confidence (March)

Previous: 98.3

Forecast: 94.0

10:00 a.m. New Home Sales (February)

10:00 a.m. Richmond Fed Index (March)

10:15 a.m. New York Federal Reserve Bank Head of the Supervision Group Dianne Dobbeck moderates panel discussion: Views from Community Bank C-suite

Earnings: McCormick & Co

Wednesday, March 26

3:00 a.m. UK Inflation Rate

Previous: 3.0%

Forecast: 2.9%

8:30 a.m. Durable Orders preliminary (February)

Earnings: Dollar Tree

Thursday, March 27

8:30 a.m. Continuing Jobless Claims (03/15)

8:30 a.m. GDP final (Q4)

Previous: 3.1%

Forecast: 2.3%

8:30 a.m. Initial Claims (03/22)

8:30 a.m. Wholesale Inventories preliminary (February)

10:00 a.m. Pending Home Sales Index (February)

11:00 a.m. Kansas City Fed Manufacturing Index (March)

Friday, March 28

8:30 a.m. PCE (February)

Previous: 2.5%

Forecast: 2.7%

8:30 a.m. Personal Income (February)

8:30 a.m. Michigan Sentiment final (February)

10:00 a.m. Fed Vice Chair for Supervision Barr discusses at the 2025 Banking Institute, Charlotte, North Carolina

The market has a cloud of uncertainty hanging over its head.

Trump’s policy agenda is driving markets – and they are showing an unsteadiness as they endeavour to navigate the dynamic landscape.

Investors won’t get clarity on tariffs until April 2 when the number of levies is expected to take effect.

Those worried about a worst-case scenario have allocated more toward Treasurys and gold, as well as other liquid defensive areas.

Also, on deck this week are key economic reports. PCE and several sentiment surveys are also set to be released. The data should be quite telling about the consumer’s health and the perceived impact of Trump’s tariffs.

Economists expect more signs of stalling inflation in the Personal Consumption Expenditures (PCE) release due Wednesday. Economists expect annual “core” PCE – which excludes the volatile categories of food and energy – to have clocked in at 2.7% in February, up from the 2.6% seen in January. Over the prior month, economists project “core” PCE at 0.3% unchanged from January.

Inflation remains a big hurdle for consumers, and the sticky price pressures are likely to linger longer than expected.

MARKET UPDATE

S&P500

The index remains higher from the Mar 13th low at 5505. The bounce could continue. Any break over $5790/15 area would argue at least another few weeks of gains, while remaining below argues further downside. The long-term view of a major top remains. Any bounce, even a deep bounce, will be seen as a correction & part of the significant topping pattern.

Resistance: $5745/$5825

Support: $5500/10 area

GOLD

Gold is overbought after the recent surge since November. Nearing the end of this rally – rising risk of a top for at least several months. We may see marginal new highs and/or more consolidation before the topping formation is complete.

Resistance: $3058/63

Support: $2988/$2951/$2915

BITCOIN

Bitcoin is still undergoing a correction. There is scope for more choppiness and further lows first, before we see new highs.

Resistance: $87.0/$87.5K and $$90.9k/$92/$93k

Support: $79/$80 and $76/$77/$74.

QI CORNER

HISTORY CORNER

On March 24

SOMETHING TO THINK ABOUT

Cheers

Jacquie

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

March 24, 2025

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD or THE SPECIAL NO CONFIDENCE ISSUE)

(GM), (SH), (TSLA), (NVDA), (GLD), (TLT), (LMT), (BA), (NVDA), (GOOGL), (AAPL), (META), (AMZN), (PANW), (ZS), (CYBR), (FTNT), (COST)

(AMGN), (ABBV), (BMY), (TSLA), GM), (GLD), (BYDDF)

It’s official: Absolutely no one is confident in their long-term economic forecasts right now. I heard it from none other than the chairman of the Federal Reserve himself. The investment rule book has been run through the shredder.

It has in fact been deleted.

That explains a lot about how markets have been trading this year. It looks like it is going to be a reversion to the mean year. Forecasters, strategists, and gurus alike are rapidly paring down their stock performance targets for 2025 to zero.

When someone calls the fire department, it’s safe to assume that there is a fire out there somewhere. That’s what Fed governor Jay Powell did last week. It raises the question of what Jay Powell really knows that we don’t. Given the opportunity, markets will always assume the worst, that there’s not only a fire, but a major conflagration about to engulf us all. Jay Powell’s judicious comments last week certainly had the flavor of a president breathing down the back of his neck.

It's interesting that a government that ran on deficit reduction pressured the Fed to end quantitative tightening. That’s easing the money supply through the back door.

For those unfamiliar with the ins and outs of monetary policy, let me explain to you how this works.

Since the 2008 financial crisis, the Fed bought $9.1 trillion worth of debt securities from the US Treasury, a policy known as “quantitative easing”. This lowers interest rates and helps stimulate the economy when it needs it the most. “Quantitative easing” continued for 15 years through the 2020 pandemic, reaching a peak of $9.1 trillion by 2022. For beginners who want to know more about “quantitative easing” in simple terms, please watch this very funny video.

The problem is that an astronomically high Fed balance sheet like the one we have now is bad for the economy in the long term. They create bubbles in financial assets, inflation, and malinvestment in risky things like cryptocurrencies. That’s why the Fed has been trying to whittle down its enormous balance sheet since 2022.

By letting ten-year Treasury bonds it holds expire instead of rolling them over with new issues, the Fed is effectively shrinking the money supply. This is how the Fed has managed to reduce its balance sheet from $9.1 trillion three years ago to $6.7 trillion today and to near zero eventually. This is known as “quantitative tightening.” At its peak a year ago, the Fed was executing $120 billion a month quantitative tightening.

By cutting quantitative tightening, from $25 billion a month to only $5 billion a month, or effectively zero, the Fed has suddenly started supporting asset prices like stocks and increasing inflation. At least that is how the markets took it to mean by rallying last week.

Why did the Fed do this?

To head off a coming recession. Oops, there’s that politically incorrect “R” word again! This isn’t me smoking California’s largest export. Powell later provided the forecasts that back up this analysis. The Fed expects GDP growth to drop from 2.8% to 1.7% and inflation to rise from 2.5% to 2.8% by the end of this year. That’s called deflation. Private sector forecasts are much worse.

Just to be ultra clear here, the Fed is currently engaging in neither “quantitative easing nor “quantitative tightening,” it is only giving press conferences.

Bottom line: Keep selling stock rallies and buying bonds and gold on dips.

Another discussion you will hear a lot about is the debate over hard data versus soft data.

I’ll skip all the jokes about senior citizens and cut to the chase. Soft data are opinion polls, which are notoriously unreliable, fickle, and can flip back and forth between positive and negative. A good example is the University of Michigan Consumer Confidence, which last week posted its sharpest drop in its history. Consumers are panicking. The problem is that this is the first data series we get and is the only thing we forecasters can hang our hats on.

Hard data are actual reported numbers after the fact, like GDP growth, Unemployment Rates, and Consumer Price Indexes. The problem with hard data is that they can lag one to three months, and sometimes a whole year. This is why by the time a recession is confirmed by the hard data, it is usually over. Hard data often follows soft data, but not always, which is why both investors and politicians in Washington DC are freaking out now.

Bottom line: Keep selling stock rallies and buying bonds and gold (GLD) on dips.

A question I am getting a lot these days is what to buy at the next market bottom, whether that takes place in 2025 or 2026. It’s very simple. You dance with the guy who brought you to the dance. Those are:

Best Quality Big Tech: (NVDA), (GOOGL), (AAPL), (META), (AMZN)

Big tech is justified by Nvidia CEO Jensen Huang’s comment last week that there will be $1 trillion in Artificial Intelligence capital spending by the end of 2028. While we argue over trade wars, AI technology and earnings are accelerating.

Cybersecurity: (PANW), (ZS), (CYBR), (FTNT)

Never goes out of style, never sees customers cut spending, and is growing as fast as AI.

Best Retailer: (COST)

Costco is a permanent earnings compounder. You should have at least one of those.

Best Big Pharma: (AMGN), (ABBV), (BMY)

Big pharma acts as a safety play, is cheap, and acts as a hedge for the three sectors above.

March is now up +2.92% so far. That takes us to a year-to-date profit of +12.29% in 2025. That means Mad Hedge has been operating as a perfect -1X short S&P 500 ETF since the February top. My trailing one-year return stands at a spectacular +82.50%. That takes my average annualized return to +51.12% and my performance since inception to +764.28%.

It has been another busy week for trading. I had four March positions expire at their maximum profit points on the Friday options expiration, shorts in (GM), and longs in (GLD), (SH), and (NVDA). I added new longs in (TSLA) and (NVDA). This is in addition to my existing longs in the (TLT) and shorts in (TSLA), (NVDA), and (GM).

Some 63 of my 70 round trips, or 90%, were profitable in 2023. Some 74 of 94 trades have been profitable in 2024, and several of those losses were really break-even. That is a success rate of +78.72%.

UCLA Andersen School of Business announced a “Recession Watch,” the first ever issued. UCLA, which has been issuing forecasts since 1952, said the administration’s tariff and immigration policies and plans to reduce the federal workforce could combine to cause the economy to contract. Recessions occur when multiple sectors of the economy contract at the same time.

Retail Sales Fade, with consumers battening down the hatches for the approaching economic storm. Retail sales rose by less than forecast in February and the prior month was revised down to mark the biggest drop since July 2021.

This Has Been One of the Most Rapid Corrections in History, leaving no time to readjust portfolios and put on short positions.

The rapid descent in the S&P 500 is unusual, given that it was accomplished in just 22 calendar days, far shorter than the average of 80 days in 38 other examples of declines of 10% or more going back to World War II.

Home Builder Sentiment Craters to a seven-month low in March as tariffs on imported materials raised construction costs, a survey showed on Monday. The National Association of Home Builders/Wells Fargo Housing Market Index dropped three points to 39 this month, the lowest level since August 2024. Economists polled by Reuters had forecast the index at 42, well below the boom/bust level of 50.

BYD Motors (BYDDF) Shares Rocket, up 72% this year, on news of technology that it claims can charge electric vehicles almost as quickly as it takes to fill a gasoline car. BYD on Monday unveiled a new “Super e-Platform” technology, which it says will be capable of peak charging speeds of 1,000 kilowatts/hr. The EV giant and Tesla rival say this will allow cars that use the technology to achieve 400 kilometers (roughly 249 miles) of range with just 5 minutes of charging. Buy BYD on dips. It’s going up faster than Tesla is going down.

Weekly Jobless Claims Rise 2,000, to 223,000. The number of Americans filing new applications for unemployment benefits increased slightly last week, suggesting the labor market remained stable in March, though the outlook is darkening amid rising trade tensions and deep cuts in government spending.

Copper Hits New All-Time High, at $5.02 a pound. The red metal has outperformed gold by 25% to 15% YTD. It’s now a global economic recovery that is doing this, but flight to safety. Chinese savers are stockpiling copper ingots and storing them at home distrusting their own banks, currency, and government. I have been a long-term copper bull for years as you well know. New copper tariffs are also pushing prices up. Buy (FCX) on dips, the world’s largest producer of element 29 on the Periodic Table.

Boeing (BA) Beats Lockheed for Next Gen Fighter Contract for the F-47, beating out rival Lockheed Martin (LMT) for the multibillion-dollar program. Unusually, Trump announced the decision Friday morning at the White House alongside Defense Secretary Pete Hegseth. Boeing shares rose 5.7% while Lockheed erased earlier gains to fall 6.8%. The deal raises more questions than answers, in the wake of (BA) stranding astronauts in space, their 737 MAX crashes, and a new Air Force One that is years late. Was politics involved? You have to ask this question about every deal from now on.

Carnival Cruise Lines (CCL) Raises Forecasts, on burgeoning demand from vacationers, including me. The company’s published cruises are now 80% booked. Cruise lines continue to hammer away at the value travel proposition they are offering. However, the threat of heavy port taxes from the administration looms over the sector.

My Ten-Year View – A Reassessment

We have to substantially downsize our expectations of equity returns in view of the election outcome. My new American Golden Age, or the next Roaring Twenties is now looking at multiple gale-force headwinds. The economy will completely stop decarbonizing. Technology innovation will slow. Trade wars will exact a high price. Inflation will return. The Dow Average will rise by 600% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old. My Dow 240,000 target has been pushed back to 2035.

On Monday, March 24, at 8:30 AM EST, the S&P Global Flash PMI is announced.

On Tuesday, March 25, at 8:30 AM, the S&P Case Shiller National Home Price Index is released.

On Wednesday, March 26, at 1:00 PM, the Durable Goods are published.

On Thursday, March 27, at 8:30 AM, the Weekly Jobless Claims are disclosed. We also get the final report for Q1 GDP.

On Friday, March 28, the Core PCE is released, and important inflation indicator. At 2:00 PM, the Baker Hughes Rig Count is printed.

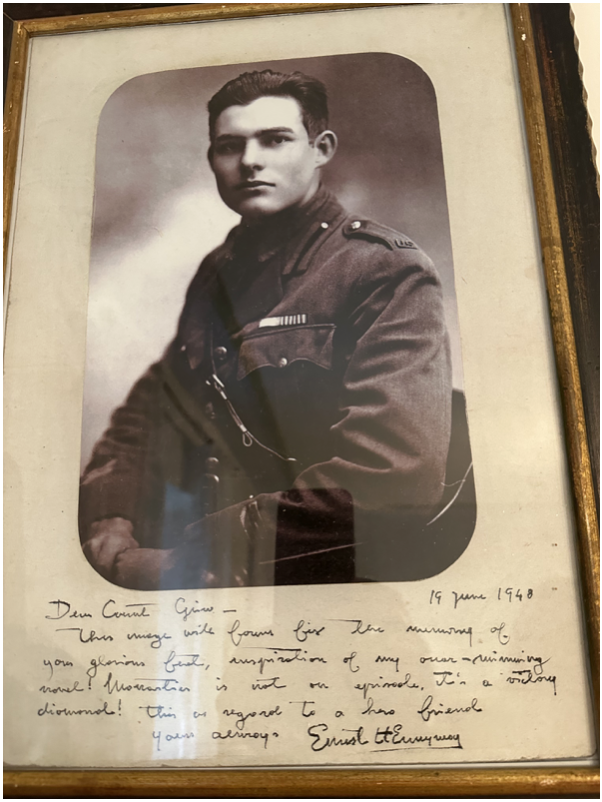

As for me, I received calls from six readers last week saying I remind them of Ernest Hemingway. This, no doubt, was the result of Ken Burns’ excellent documentary about the Nobel Prize-winning writer on PBS last week.

It is no accident.

My grandfather drove for the Italian Red Cross on the Alpine front during WWI, where Hemingway got his start, so we had a connection right there.

Since I read Hemingway’s books in my mid-teens I decided I wanted to be him and became a war correspondent. In those days, you traveled by ship a lot, leaving ample time to finish off his complete work.

I visited his homes in Key West, Cuba, and Ketchum Idaho.

I used to stay in the Hemingway Suite at the Ritz Hotel on Place Vendome in Paris where he lived during WWII. I had drinks at the Hemingway Bar downstairs where war correspondent Ernest shot a German colonel in the face at point-blank range. I still have the ashtrays.

Harry’s Bar in Venice, a Hemingway favorite, was a regular stopping-off point for me. I have those ashtrays too.

I even dated his granddaughter from his first wife, Hadley, the movie star Mariel Hemingway, before she got married, and when she was also being pursued by Robert de Niro and Woody Allen. Some genes skip generations and she was a dead ringer for her grandfather. She was the only Playboy centerfold I ever went out with. We still keep in touch.

So, I’ll spend the weekend watching Farewell to Arms….again, after I finish my writing.

Oh, and if you visit the Ritz Hotel today, you’ll find the ashtrays are now glued to the tables.

As for last summer, I stayed in the Hemingway Suite at the Hotel Post in Cortina d’Ampezzo Italy where he stayed in the late 1940’s to finish a book. Maybe some inspiration will run off on me.

Good Luck and Good Trading

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

“Getting information off the Internet is akin to trying to sweep back the ocean with a broom,” said Ray Kurzweil, director of engineering at Google.

(MRVL), (MSFT), (NVDA), (META), (AVGO)

Back in 1981, when I was tramping through the backcountry of Japan researching semiconductor factories, a wise old engineer told me something I've never forgotten: "Young man, in technology, the custom always beats the commodity."

Four decades later, watching Marvell Technology's (MRVL) strategic pivot to custom AI silicon, that weathered engineer's words are ringing in my ears.

The recent tech selloff triggered by Microsoft's (MSFT) canceled data center leases sent most chip stocks tumbling. The market, doing what it does best, threw the baby out with the bathwater.

While the herd was stampeding for the exits, I was busy loading up on MRVL shares. Wall Street's short-term memory loss is your gain, folks.

Marvell delivered a knockout 27% year-over-year growth in Q4'25, and that's just the appetizer. The main course is coming as their custom silicon strategy hits full stride.

Let me tell you why this matters.

Remember when Nvidia was just "that gaming chip company" before it became the AI powerhouse worth more than most countries' GDP? Marvell is following a similar trajectory but with a crucial difference - they're not trying to be everything to everyone.

They're the special forces team designing precision instruments for the AI revolution while Broadcom (AVGO) plays the role of the 800-pound gorilla servicing hyperscalers. Different animals, different hunting grounds, both eating very well.

Here's what the nervous nellies are missing: management is betting the farm on data center product development, expecting to blow past their $2.5b AI systems revenue target for eFY26.

When executives redirect R&D dollars like this, they're not guessing – they're following customer purchase orders. I've been in this business long enough to know that's the financial equivalent of smoke signals from the Vatican - big news is coming.

Need more evidence? I've got it straight from the engineering trenches.

During my tech conference rounds last month, three different chip engineers cornered me to rave about Marvell's 800G PAM and 400ZR DCI products.

If that sounds like alphabet soup to you, just know this: they're selling tomorrow's technology while competitors are still perfecting yesterday's.

Their Electro-Optics products and Teralynx Ethernet switches aren't just growing – they're flying off the shelves.

Meanwhile, the Meta Platforms (META) partnership they announced in Q4'25 is pure gold.

With Meta planning to drop $60-65b in eFY25 on Llama 4 development, Marvell just secured a VIP pass to the most expensive tech party of the decade.

So what does all this mean for Marvell's numbers? Let's get concrete.

For Q1'25, I'm forecasting $1.9b in revenue with EPS of $0.62/share. Their margins will expand throughout eFY26 as volumes ramp up.

Financially, Marvell is rock solid. They closed FY24 with $948mm in cash, $4b in debt, and a leverage ratio of 1.58x – their best position since Q4'23. In fact, Fitch upgraded their credit rating to BBB with a stable outlook.

In layman's terms: the books look cleaner than a surgeon's operating room.

Yes, inventories increased to 111 days on hand ($1,030mm). Normally, I'd raise an eyebrow at this. But in today's supply-chain-from-hell environment, extra inventory is like having an extra gas tank in the desert – suddenly the smartest idea ever.

I rang up a hyperscaler CTO friend last week (no names, but his company has more users than most countries have citizens).

His take? "General-purpose computing for AI is like using a sledgehammer to hang a picture. We're moving to custom solutions wherever possible." That's Marvell's sweet spot.

MRVL shares have been beaten like a rented mule, creating an entry point with fair value at $204/share by my analysis. Even my conservative case gets you to $157 – still double today's price.

This reminds me of standing atop Mount Fuji with a Japanese tech CEO in 1978.

Looking down at Tokyo, he explained how his company was shifting from consumer electronics to specialized components the world's biggest brands couldn't manufacture themselves.

Those who spotted that transition early made fortunes. Specialized excellence always commands a premium – in mountaineering, in technology, and certainly in today's custom silicon market.

Mad Hedge Technology Letter

March 21, 2025

Fiat Lux

Featured Trade:

(TECH BURNS DOWN ON TV)

(TSLA), (ROBO-TAXI)

Mad Hedge Technology Letter

March 21, 2025

Fiat Lux

Featured Trade:

(TECH BURNS DOWN ON TV)

(TSLA), (ROBO-TAXI)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.