When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Biotech and Healthcare Letter

June 10, 2025

Fiat Lux

Featured Trade:

(THIS BIOTECH'S OBITUARY WAS PREMATURE)

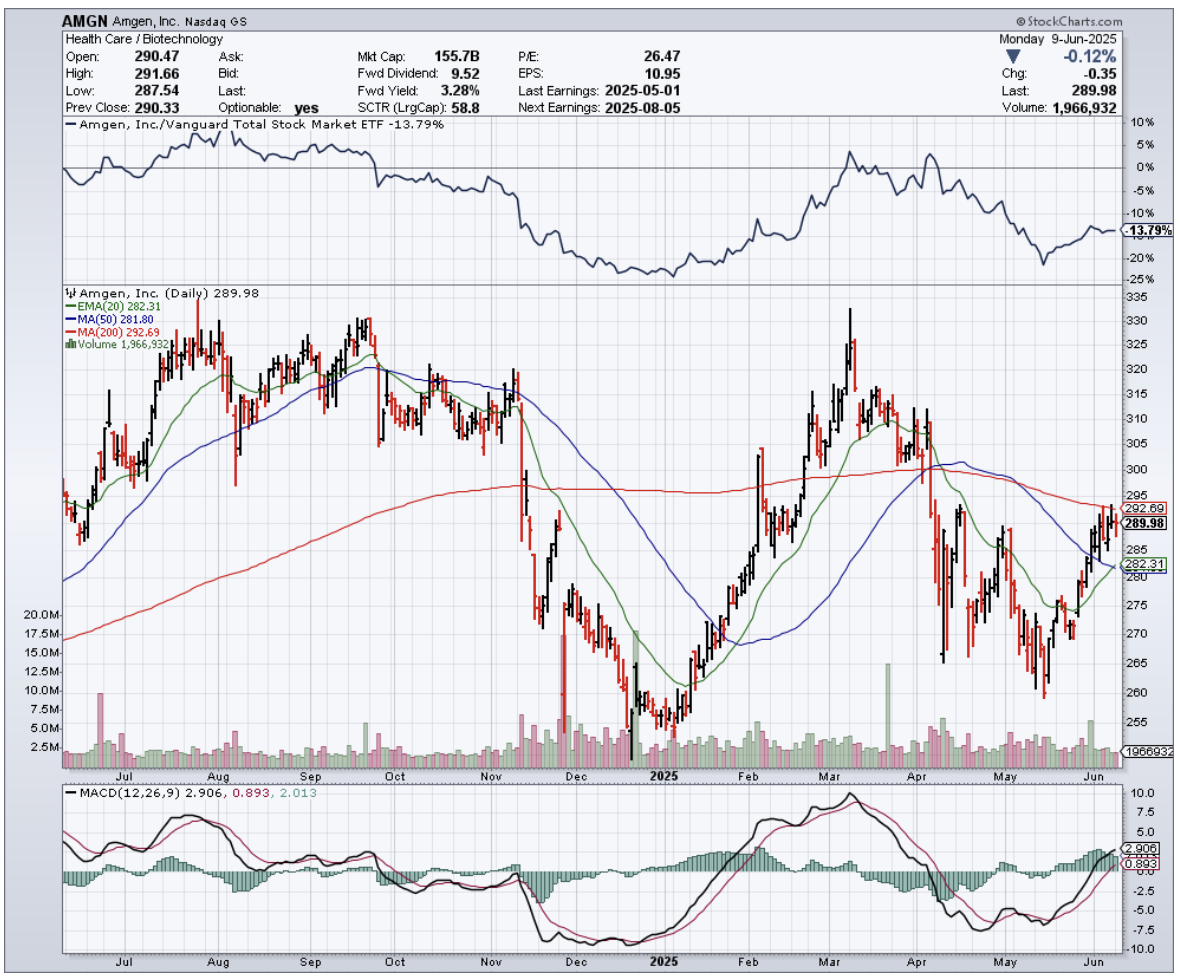

(AMGN)

Last Tuesday, while stuck in airport security behind a family debating whether insulin syringes count as "liquids," I had an epiphany about Wall Street's chronic inability to see past quarterly earnings reports.

Here was life-saving biotechnology reduced to a TSA checkbox, while across the terminal, CNBC was breathlessly explaining why Amgen's (AMGN) "patent cliff" makes it uninvestable. Sometimes the best opportunities hide in plain sight, disguised as disasters.

That absurd little scene reminded me of another moment burned into my biotech brain: Tokyo, 1970s, a smoky coffee shop. I once watched a businessman inject insulin with the calm precision of someone adjusting their tie.

It wasn’t dramatic. It was routine. And that’s what made it profound.

That image — cutting-edge science seamlessly woven into daily life — stayed with me. It’s also why Amgen, trading around $289, has me as intrigued today as I was back when calculators were a luxury.

Fast-forward to now: Wall Street is acting like Amgen is headed for biotech hospice care. Nearly 30% of its revenue base is tiptoeing toward patent expirations.

Prolia and Xgeva lost exclusivity in February, and biosimilar vultures are already circling. Enbrel, once a $3.3 billion cash cow, just took a 47% haircut on net pricing, dragging sales down 10% year-over-year.

The numbers look brutal…on paper. But investing based on spreadsheets alone is like judging a Michelin meal by the grocery receipt.

Here’s what the Street is missing: Amgen isn’t waiting for a mercy kill. It’s executing what might be biotech’s most impressive strategic pivot since Genentech discovered you could print money with recombinant DNA.

This is where MariTide comes in. Amgen’s obesity moonshot has been generating buzz since its trials started, and it’s starting to prove that it isn’t just another GLP-1 bandwagon play.

MariTide combines GLP-1 agonism with GIP antagonism into a once-monthly shot. This is a dramatic upgrade from Novo Nordisk’s (NVO) blockbuster, Ozempic, which requires weekly injections.

Think of it as rent once a year instead of weekly: same effect, way less hassle. Analysts are quietly penciling in $5 billion in peak sales.

Then there's olpasiran, which is a small interfering RNA therapy targeting lipoprotein(a) — a heart disease culprit with no current treatments. One in five people carry this risk, and olpasiran showed significant efficacy in the New England Journal of Medicine. This could be a multibillion-dollar market, rivaling the $9.3 billion PCSK9 inhibitor space.

And the delicious irony? Amgen’s discounted cash flow suggests the market expects the company to shrink. Negative 0.4% growth is priced in. But even 2.5% annual growth could yield a 27% upside.

Now, its first quarter results tell a different story. Revenue surged 9% to $8.1 billion. Operating margins improved despite brutal pricing pressure. Management projects 2025 revenue of up to $35.7 billion.

That doesn’t sound like a company preparing for its own funeral.

Smart money agrees. Amgen’s $27.8 billion Horizon acquisition brought Tepezza, a $1.9 billion play for Thyroid Eye Disease, into the fold.

Meanwhile, biosimilar Wezlana, aka the first Stelara lookalike with FDA approval, generated $150 million in its first quarter. These aren’t Hail Marys. They’re calculated, long-term bets.

What makes Amgen irresistible is the combo platter: steady cash flow (a healthy 33.3% free cash margin), ongoing shareholder returns, and moonshot optionality in MariTide and olpasiran.

It's the kind of setup that rewards patience, especially when the market is too distracted to notice the obvious.

It brings to mind something my old biochemistry professors used to say: the most elegant solutions often masquerade as problems until their brilliance clicks into place.

Amgen’s strategy, replacing aging blockbusters with next-gen therapies addressing massive unmet needs, is exactly that kind of misjudged genius. I suggest you buy the dip.

Global Market Comments

June 10, 2025

Fiat Lux

Featured Trade:

(A NOTE ON OPTIONS CALLED AWAY),

(GLD)

Occasionally, I get a call from Concierge members asking what to do when their short positions in options were assigned or called away. The answer was very simple: fall down on your knees and thank your lucky stars. You have just made the maximum possible profit for your position instantly.

We have the good fortune to have Seven spreads left that are deep in-the-money going into the June option expiration in 7 trading days. They are the:

Risk On

(MSTR) 6/$330-$340 call spread 10.00%

(TSLA) 6/$190-$200 call spread 10.00%

Risk Off

(GLD) 6/$275-$285 call spread -10.00%

(AAPL) 6/$220-$230 put spread -10.00%

(QQQ) 6/$540-$550 put spread -10.00%

(TLT) 6/$88-$91 put spread -10.00%

(WPM) 6/$75-$80 call spread -10.00%

In the run-up to every options expiration, which is the third Friday of every month, there is a possibility that any short options positions you have may get assigned or called away.

Most of you have short option positions, although you may not realize it. For when you buy an in-the-money vertical option debit spread, it contains two elements: a long option and a short option.

The short options can get “assigned,” or “called away” at any time, as it is owned by a third party, the one you initially sold the put option to when you initiated the position.

You have to be careful here because the inexperienced can blow their newfound windfall if they take the wrong action, so here’s how to handle it correctly.

Let’s say you get an email from your broker telling you that your call options have been assigned away. I’ll use the example of the in-the-money SPDR Gold Shares SPDR (GLD) May $275-$285 vertical BULL CALL debit spread, which you bought at $9.00 or best on May 6.

For what the broker had done, in effect is allowed you to get out of your call spread position at the maximum profit point 7 trading days before the May 17 expiration date. In other words, what you bought for $9.00 on May 6 is now worth $10.00, a gain of 11.11%!

All you have to do is call your broker and instruct them to exercise your long position in your (GLD) June 275 calls to close out your short position in the (GLD) June $285 calls.

This is a perfectly hedged position, with both options having the same expiration date, the same number of contracts in the same stock, so there is no risk. The name, number of shares, and number of contracts are all identical, so you have no net exposure at all.

Calls are the right to buy shares at a fixed price before a fixed date, and one option contract is exercisable into 100 shares.

To say it another way, you bought the (GLD) at $275 and sold it at $285, paid $9.00 for the right to do so for 33 trading days, so your profit is $1.00, or ($1.00 X 100 shares X 12 contracts) = $1,200. Not bad for a 33-day defined, limited risk play.

Sounds like a good trade to me.

Callaways most often happen in the run-up to a dividend payout. If you can collect a full monthly or quarterly dividend the day before the stock registration dates by calling away someone’s short option position, why not? In fact, a whole industry of these kinds of strategies has arisen in recent years in response to the enormous growth of the options market.

(GLD) and most tech stocks don’t pay dividends, so callaways are rare.

Weird stuff like this happens in the run-up to options expirations like we have coming.

A call owner may need to buy a long (GLD) position after the close, and exercising his long May 205 call is the only way to execute it.

Adequate shares may not be available in the market, or maybe a limit order didn’t get done by the market close.

There are thousands of algorithms out there that may arrive at some twisted logic that the calls need to be exercised.

Many require a rebalancing of hedges at the close every day, which can be achieved through option exercises.

And yes, options even get exercised by accident. There are still a few humans left in this market to make mistakes.

And here’s another possible outcome in this process.

Your broker will call you to notify you of an option called away, and then give you the wrong advice on what to do about it. They’ll tell you to take delivery of your long stock and then post additional margin to cover the risk.

Or they will tell you to sell your remaining long option position at whatever price you can get, wiping out most, if not all, of your great profit. This generates the maximum commission for your broker.

Either that, or you can just sell your shares on the following Monday and take on a ton of risk over the weekend. This generates oodles of commission for the brokers but impoverishes you.

There may not even be an evil motive behind the bad advice. Brokers are not investing a lot in training staff these days. It doesn’t pay. In fact, I think I’m the last one they really did train 50 years ago.

Avarice could have been an explanation here, but I think stupidity and poor training, and low wages are much more likely.

Brokers have so many legal ways to steal money that they don’t need to resort to the illegal kind.

This exercise process is now fully automated at most brokers, but it never hurts to follow up with a phone call if you get an exercise notice. Mistakes do happen.

Some may also send you a link to a video on what to do about all this.

If any of you are the slightest bit worried or confused by all of this, come out of your position RIGHT NOW at a small profit! You should never be worried or confused about any position tying up YOUR money.

Professionals do these things all day long, and exercises become second nature, just another cost of doing business.

If you do this long enough, eventually you get hit. I bet you don’t.

Calling All Options!

“All we need to know about crude right now is that we have it coming out of our ears, both here and in the Middle East, and that’s why it’s headed to $60,” said Scott Nations, president of the options trading firm, NationsShares.

Global Market Comments

June 9, 2025

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or THE BLIND MAN’S MARKET)

(GOOGL), (MSFT), (NVDA), (JPM), (V), (AAPL), (GLD), (MSTR), (SPY), (AAPL), (QQQ), (TLT), (WPM), (SLV), (SIL), (AGQ)

“In the first Trump administration, he was surrounded by buffers. In this administration,n he is surrounded by accelerators,” said my old friend, New York Times columnist Thomas Friedman.

Global Market Comments

June 6, 2025

Fiat Lux

Featured Trade:

(PLEASE SIGN UP NOW FOR MY FREE TEXT ALERT SERVICE RIGHT NOW)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.