“Failure is an option here. If things are not failing, you are not innovating enough.”- Said Founder and CEO of Tesla Elon Musk

(SILVER BREAKS OUT FROM ITS APPARENT SLUMBER)

June 9, 2025

Hello everyone

WEEK AHEAD CALENDAR

Monday, June 9

June 9-13 Apple WWDC25

10:00 a.m. Wholesale Inventories final (April)

1:00 p.m. Apple WWDC25 Keynote

8:30 p.m. Australia Consumer Confidence

Previous: 2.2%

Forecast: 2.5%

Tuesday, June 10

2:00 a.m. UK Unemployment Rate

Previous: 4.5%

Forecast: 4.5%

6:00 a.m. NFIB Small Business Index (May)

Earnings: J.M. Smucker Co.

Wednesday, June 11

8:30 a.m. Consumer Price Index (May)

Previous: 2.3%

Forecast: 2.5%

8:30 a.m. Hourly Earnings final (May)

8:30 a.m. Average Workweek final (May)

2:00 p.m. Treasury Budget (May)

Earnings: Oracle

Thursday, June 12

8:30 a.m. Continuing Jobless Claims (05/31)

8:30 a.m. Initial Claims (06/07)

8:30 a.m. Producer Price Index (May)

Previous: -0.5%

Forecast: 0.1%

Earnings: Adobe

Friday, June 13

10:00 a.m. Michigan Sentiment preliminary (June)

Previous: 52.2

Forecast: 52.1

A SILVER BREAKOUT – TIME TO JUMP ON THE SILVER RALLY

Weekly iShares Silver Trust (SLV) chart ($32.68)

Support and resistance lines in the above chart show the movement of silver in the last few years. The divergence shown highlights the beginning of a rally around mid-year 2022, and the following price action arguably formed what could be seen as an inverse head and shoulder pattern. Now, silver has broken topside resistance in June – a seasonal time for the precious metal to rally strongly. (You can also see that silver bottomed in the first quarter of 2020 and then rallied strongly from June onwards), so if silver clears the psychological key level of $35, we could see a mighty move.

The Gold/Silver ratio tells a story.

This ratio measures how many ounces of silver are needed to buy one ounce of gold. Historically, the ratio has oscillated within a broad but predictable range, with long-term averages over a century hovering around 55. When the ratio climbs significantly above that range, it has tended to mean-revert and often with silver staging explosive outperformance.

Currently, as David Bird, a market technician, points out, the ratio remains extremely elevated at 97.70, signalling that silver is deeply undervalued relative to gold. Every time this ratio has reached similar extremes in the past, particularly when adjusted for inflation and real yields, it has preceded a major silver rally. And with silver being the more volatile of the two metals, it tends to benefit the most from these rebalancing moves.

Here, we have patiently waited for a very good set-up: high ratio, confirmed seasonal strength and supportive macro tailwinds.

And sentiment is exactly where you would expect it to be. People have been casting doubts on silver, and becoming frustrated because it has not been “moving” as they have expected. But it is important to understand that silver has been quietly accumulating.

As Bird argues, markets are designed to wear you out, before they pay you out. When any stock grinds sideways for a period, it is more often than not building energy to launch to the upside. And this is why some people just stop out – retail mainly – and eventually lose. Remember, patience is a very important behaviour when trading/investing in the markets.

Recommendation: Buy iShares Silver Trust (SLV), currently priced at ($32.68) if you don’t own it, or you can add to your holding here.

And/or

Option

33/35 call spread

Buy the iShares Silver Trust (SLV) out-of-the-money $33 call

Sell the iShares Silver Trust (SLV) out-of-the-money $35 call

Expiry: September 30, 2025

Max Profit: 131

Max Loss: 69

Cost = 0.69 or best price

No. of Contract = your choice according to your portfolio cash balance. (Prices listed above = 1 contract)

As an example, if I choose 5 contacts on this SLV option spread (at current prices listed), we get the following:

Max Profit = 655

Max Loss = 345

And 10 contracts would equal the following:

Max Profit = 1,310

Max Loss = 690

And/Or

33/36 call spread

Buy iShares Silver Trust (SLV) out-of-the-money $33 call

Sell iShares Silver Trust (SLV) out-of-the-money $36 call

No. of Contracts: your decision

But if you choose 10 contracts:

Max Profit = 2050

Max Loss = 950

Cost = 950

Expiry: October 17, 2025

Trade with care. Just make sure you can sleep at night.

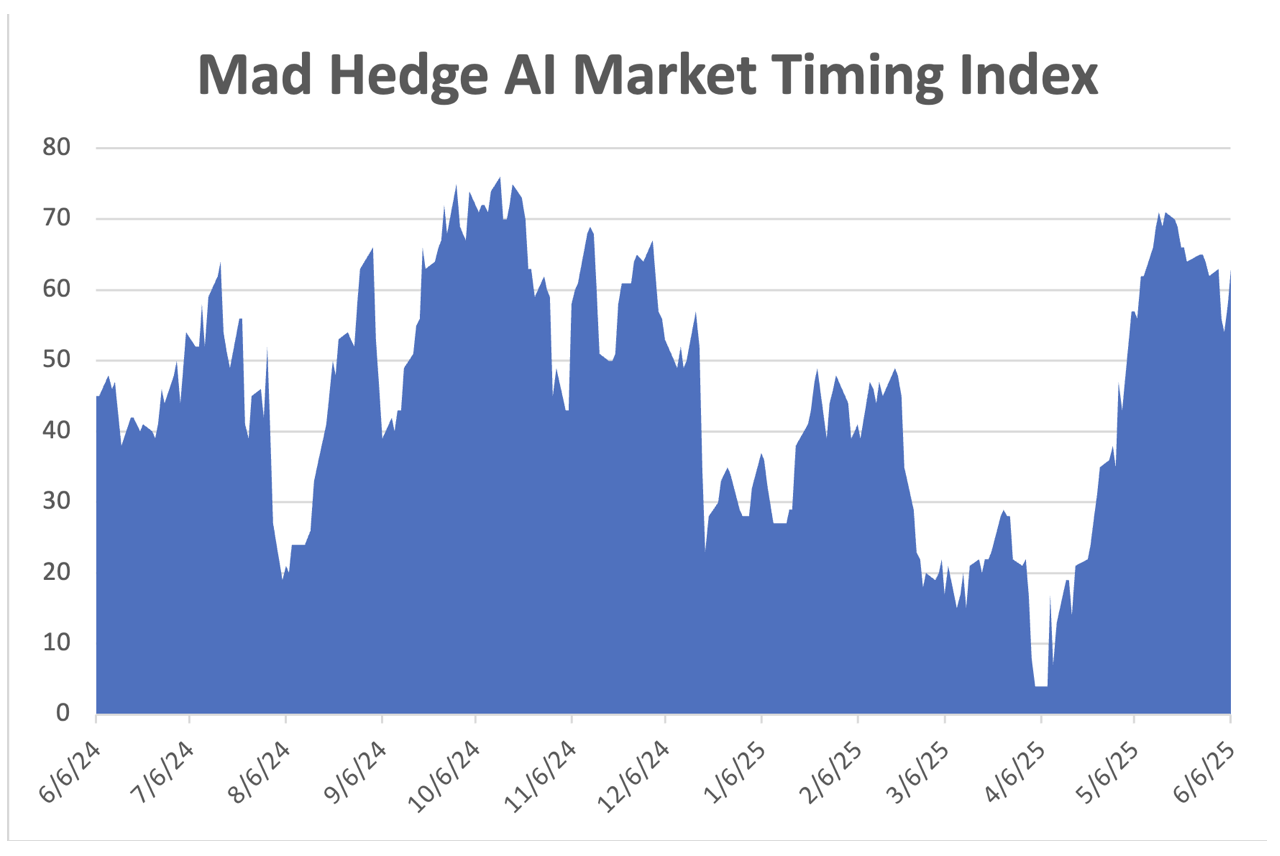

MARKET UPDATE

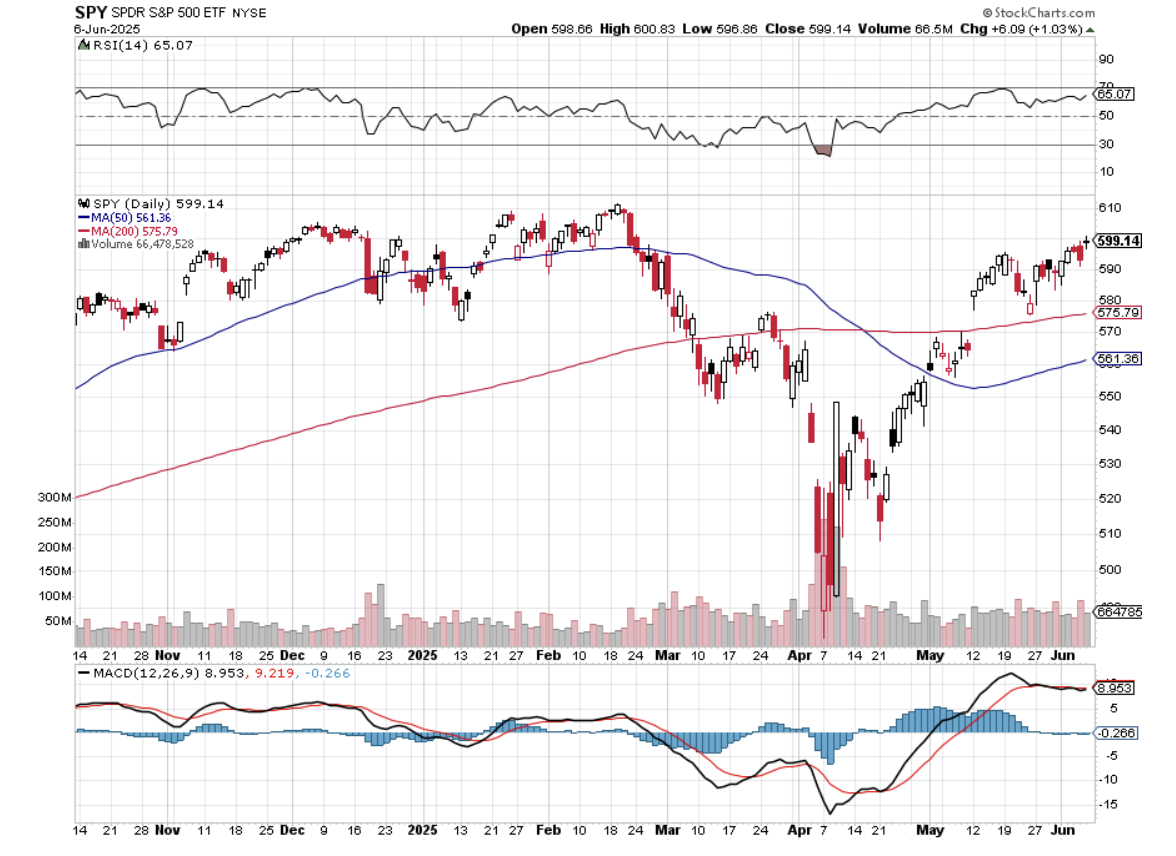

S&P500

The index ended last week at 6000. I am still expecting further movement to the upside in the weeks/months ahead in spite of all the macroeconomic and geopolitical headwinds. Just don’t expect a straight line up.

Resistance: 6025/50 area and 6100.

Support: 5940 area, 5875/90 area, and 5785 area.

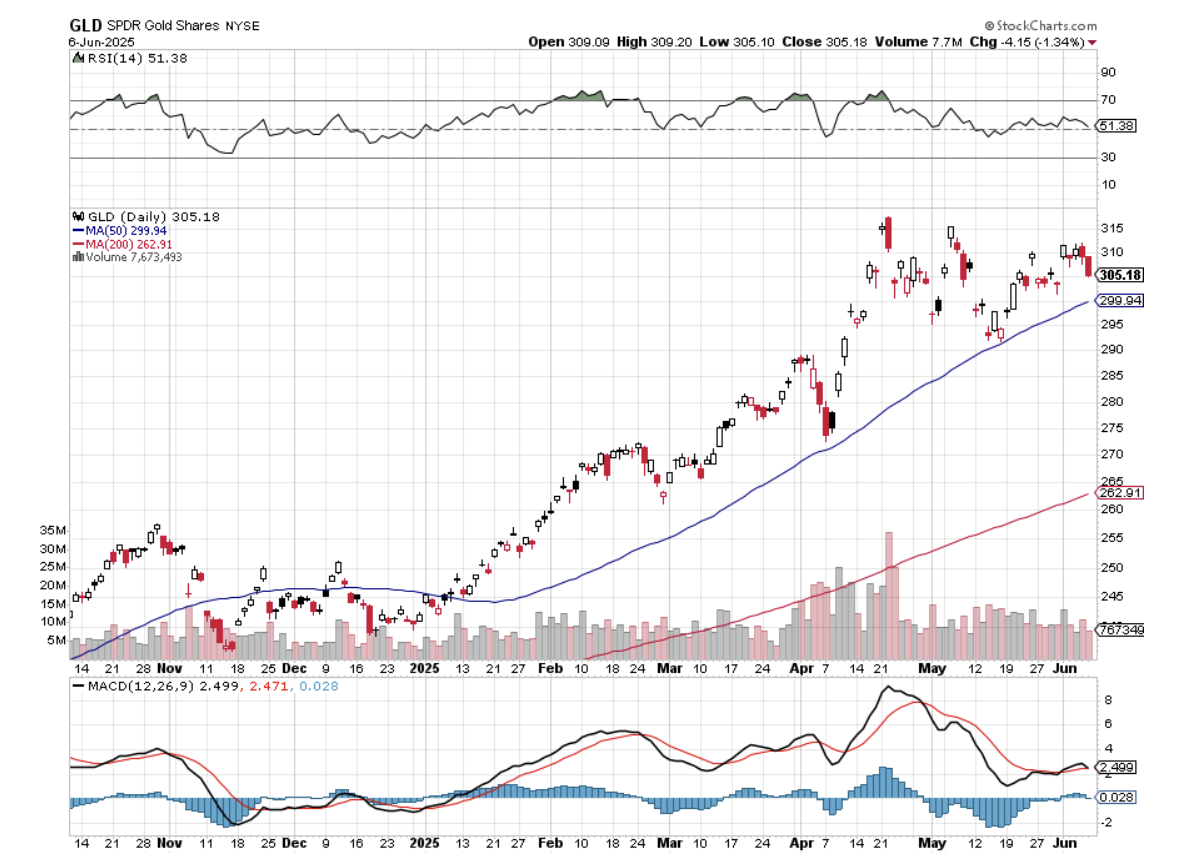

GOLD

Since late April, we have seen gold moving in ranges. This movement is characteristic of a larger topping behaviour, which is still playing out. The market is overbought, which is a big-picture negative. This movement also typifies slowing momentum.

Resistance: $3403/13/$3370 (recent high) and $3425/50 area

Support: $3307/17, $3239, and $3190 area. We need to see a close below $3000 to confirm that this medium-term rally has ended.

BITCOIN

Bitcoin is correcting after reaching a new high of 112k. This top could be in place for a month or more before we see bitcoin rally again. We may see some consolidation before further lows are made. MACD is also showing a sell signal on the daily.

Resistance: 105.4/105.9 and 107.8k

Support: 102.6/103k and 100k (recent low)

HISTORY CORNER

ON JUNE 9

QI CORNER

Guillermo Flor (Venture Capital Investor @GoHub Ventures)

AI is creating the biggest opportunity to create wealth in history, but it’s also creating a huge gap for people who don’t learn to use it.

SOMETHING TO THINK ABOUT

Cheers

Jacquie

Global Market Comments

June 9, 2025

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or THE BLIND MAN’S MARKET)

(GOOGL), (MSFT), (NVDA), (JPM), (V), (AAPL), (GLD), (MSTR), (SPY), (AAPL), (QQQ), (TLT), (WPM), (SLV), (SIL), (AGQ)

Last week, the markets ignored a collapsing bond market, exploding national debt, global shooting wars, trade wars, tariff chaos, rapidly weakening economic data, and the shredding of our international relations. It’s a lot like 1999, when every news headline was taken as yet another reason to buy more tech stocks, most of which are no longer with us.

Only a blind man would be establishing new longs up here. How can this madness take place? What happens when someone hands the market a pair of glasses? Markets are priced for perfection, but we live in anything but a perfect world.

The explanation is very simple. Investors have been focusing on promised corporate tax cuts, some 100% of which will go into stock buybacks. It explains why the biggest buyback companies, like Alphabet (GOOGL), Microsoft (MSFT), Nvidia (NVDA), JP Morgan (JPM), and Visa (V), have seen the best performance since the April 9 bottom. Only in the case of Apple (AAPL) have gigantic share buybacks kept their shares falling more, instead of rising.

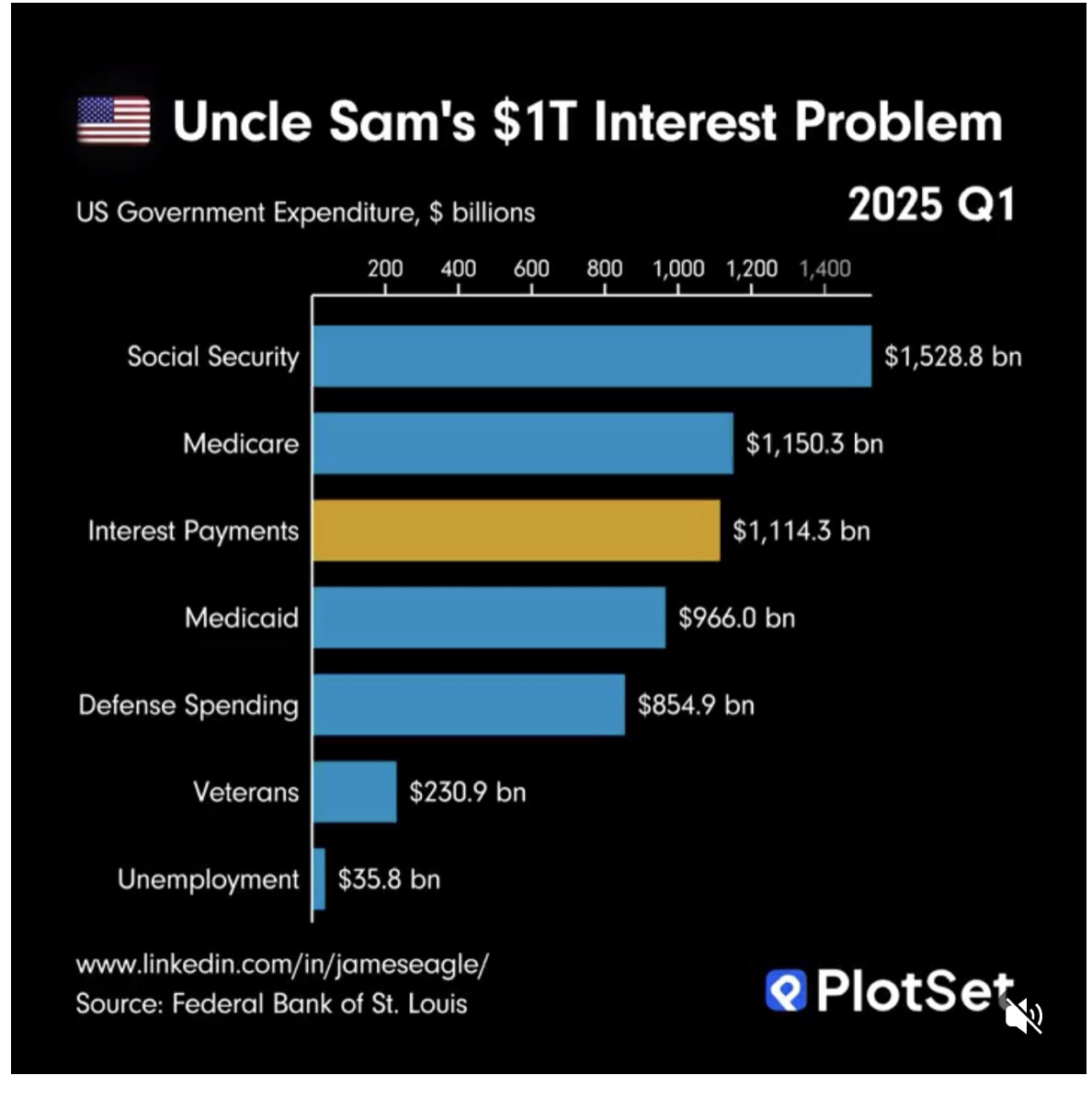

In fiscal year 2024, the U.S. federal government collected approximately $530 billion in revenue from corporate income taxes. This accounted for 11% of the total federal government revenue collected in FY2024, which was roughly $5 trillion. If the corporate tax rate drops from 21% to 15% as the House budget bill proposes, that would free up a further $151 billion for more stock buying.

And that’s just the appetizer. Add in other proposed tax breaks, such as the expensing of capital investment entirely in the year the money was spent. That takes the total corporate tax breaks rise to a mind-numbing $664 billion, all of which will go into stock buybacks. That’s on top of the $1.2 trillion in buybacks budgeted for this year.

And that’s your entire bull case right there.

Corporations made all-time high profits in 2024 and haven’t even been asking for tax cuts. Their origins are purely ideological.

Some 100% of this will be borrowed from future generations. It is amazing how short-term the view of this administration is. By adding $3 trillion to the deficit, the strategy seems to be “Play now and pay later,” except that later we will be broke. We are eating all of our seed corn. It’s like there has been a hostile takeover of the US economy by an asset-stripping vulture fund.

Another explanation for the endless bull is that the muscle memory for both individual and institutional investors for the past 16 years has been to “Buy the dip”. Despite a brief two-month dip during the 2020 Pandemic and a six-week heart attack this year, this strategy has worked the entire time.

Institutions are still underweight equities. No serious professional bought into the rapidly weakening fundamentals for the US economy. If you back out the previous month’s revisions, the May Nonfarm Payroll Report came in at only 44,000 jobs. Weekly Jobless Claims are at an 8-month high. Q2 corporate profits are expected to be down 25%-50%. Yet earnings multiples are back at all-time highs.

It’s starting to look like a 1999 stock market. The worse the news gets, the more stocks people want to buy.

It’s not an outlook you bet the ranch on. It’s an accident waiting to happen. Look what happened in February the last time we saw these 22X valuations. But the market sees what it wants to see.

There is one minor chink in this argument. If the China negotiations blow up and we go back to another triple-digit business-killing tariff level, we double top immediately, and the (SPX) goes back and retests the lows at 4,800.

You tell me what’s going to happen.

I’ve made most of my money this year on the short side, the first time since 2008. By cherry picking studious timing with (AAPL), (TSLA), (MSTR), and (NVDA) and hedging your shorts with gold and silver longs, you can make money even when indexes rise, such as the art of the hedge fund manager (see below).

Buy low/sell high, it’s my new investment strategy. I’m thinking of patenting it. Sell high, buy back low also works.

My silver call (SIL), (SLV), (AGQ) unfolded nicely last week, the white metal picking up a quick 10% to rise to a new 13-year high. We may get some profit taking here as silver has far more industrial demand than gold, so the recession will be a drag. But the long-term bull market is on, so buy dips from here on. $50 here we come.

Tesla provided us with a nice windfall on Thursday, with some of the most chaotic options trading in market history. On the week, the shares dropped by an incredible $85, or 23.2%. More importantly, the implied volatility for the options soared from 59% to 85%, with some strike prices closing as high as 105%.

What happened was that long-term Tesla bulls were writing out-of-the-money calls against their positions to soften the blow, mitigate risk, and lower their average cost. Cascading market orders to sell calls drove implied volatilities to unbelievable levels. As a result, I was able to cover my shorts at great prices and open up news longs at even better prices.

Traders live for events like these.

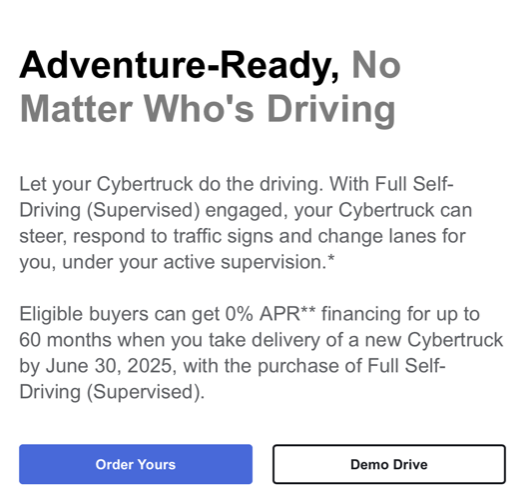

In the meantime, the value of my 2018 Model X P100D has shrunk this year from $65,000 to $35,000, according to Kelley Blue Book (click here.) I can’t park on the street in San Francisco for fear of having a swastika scratched on the side. And Tesla is offering me a brand new CyberTruck for $80,000, down 33% from the launch price, with zero percent financing for five years, lifetime free charging, and free full self-driving. They have 20,000 of them.

Brand destruction is a cruel master.

My very long-term target for Tesla is $4,600. So I shouldn’t mind buying the stock at $180, which I did on Friday. At the moment, it is a money-losing car company with potential businesses in Robotaxis, xAI, robots, and solar energy, that don’t actually exist yet. You’re essentially buying the dream. But the dream has been working for 15 years with my average share cost of $2.35. We just have to get Elon Musk to focus on engineering instead of politics.

It’s easy to see how legions of traders make a living solely trading (TSLA) options.

Any Buyers?

By the way, if you’re looking for rare earths play, look at Las Vegas-based MP Materials. Morgan Stanley just recommended the stock as their best play in the sector, causing it to soar 50% in a week.

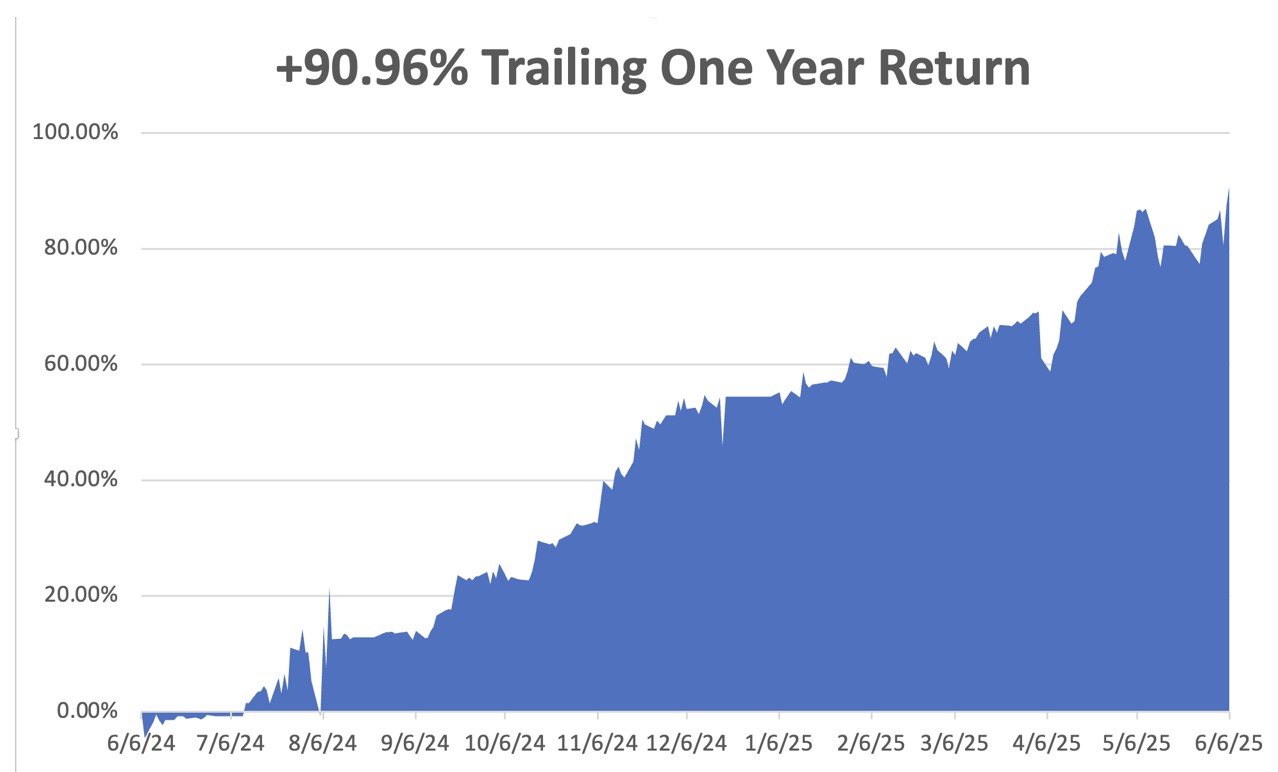

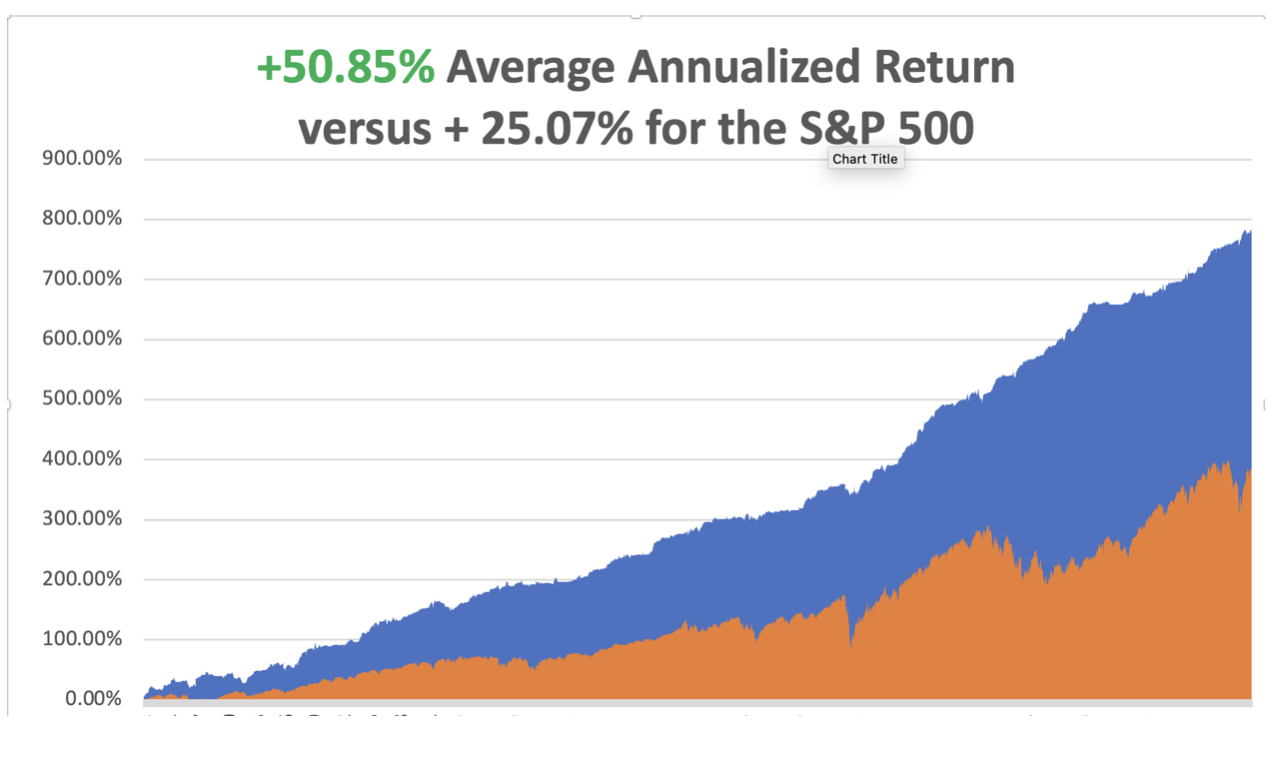

My June performance rocketed up to +6.59%, taking us to new all-time highs on all metrics. That takes us to a year-to-date profit of +36.28%. My trailing one-year return exploded to a record +90.96%. That takes my average annualized return to +50.84% and my performance since inception to +788.18%.

It has been another week in an active market. I added a new long in Wheaton Precious Metal (WPM), taking advantage of a major upside breakout in silver. I also added a short in the (TLT), betting that the next US Treasury auction will go badly. I took profits in short positions in (TSLA) and (MSTR).

The Mad Hedge Technology Letter took profits in a long position in Palo Alto Networks (PANW). That leaves me a shrinking 60% “RISK OFF” in (GLD), (SPY), (AAPL), (TLT), and (WPM), 30% long in (MSTR) and (TSLA), and 10% cash.

Some 63 of my 70 round trips in 2023, or 90%, were profitable. Some 74 of 94 trades were profitable in 2024, and several of those losses were really break-even. That is a success rate of +78.72%.

Try beating that anywhere.

Nonfarm Payroll Report comes in weak. Nonfarm payrolls increased 139,000 last month after a combined 95,000 in downward revisions to the prior two months for a net gain of only 44,000. The unemployment rate held at 4.2%, while wage growth accelerated. Friday’s report narrowly exceeded forecasts, bolstering bulls who were primed for disappointment after data this week raised doubts about the buoyancy of American hiring.

US Trade Deficit Shrinks at the Fastest Rate in History, as imports collapse, a classic sign of a deteriorating economy. The rush of imports to beat the tariffs ended. The trade gap contracted by a record 55.5% to $61.6 billion, the lowest level since September 2023, the Commerce Department’s Bureau of Economic Analysis said on Thursday. Data for March was revised to show the trade deficit having widened to an all-time high of $138.3 billion rather than the previously reported $140.5 billion.

Worker Productivity is Collapsing, at a faster pace than initially thought in the first quarter, driving labor costs sharply higher at a time when businesses are already facing rising costs from tariffs on imported goods. Nonfarm productivity, which measures hourly output per worker, decreased at a 1.5% annualized rate last quarter, the Labor Department’s Bureau of Labor Statistics said on Thursday.

That was revised down from the previously reported 0.8% pace of decline and marked the first drop since the second quarter of 2022.

Silver Hits a 13-Year High, at $35 an ounce, and is catching up with gold quickly. Known both as a safe-haven asset and a vital industrial metal, silver has surged 24% so far in 2025. Industrial uses account for more than half of global silver demand, according to the Silver Institute industry association. $50 here we come!

U.S. Economic Output (GDP) will Fall as a Result of New Tariffs on Foreign Goods, the non-partisan Congressional Budget Office said on Wednesday. The CBO said the tariffs, which have been challenged in court cases, will raise the costs of consumer and capital goods while increasing inflation.

ADP Hits Two-Year Low, as new hiring grinds to a halt. Sectors including business services, education, and health shed jobs, pointing to a weakened demand for workers. Private-sector payrolls increased by 37,000 last month, lower than all estimates. That marked the second month in a row when the figures were well below expectations. After a strong start to the year, hiring is losing momentum.

US Factory Orders Dive, New orders for U.S.-manufactured goods dropped sharply in April, and business spending on equipment appeared to have lost momentum at the start of the second quarter as the boost from front-loading of purchases ahead of tariffs faded.

ISM Nonmanufacturing PMI drops to one-year low, down 49.9, indicating an economic contraction. Tariff uncertainty complicates business planning and affects financial guidance. Supply chain bottlenecks and tariffs drive inflation concerns. Yet another recession indicator.

Housing Stocks Plunge to One-Year Lows, on yesterday’s spike in long bond and mortgage rates. Construction spending collapsed in April, down 0.9%, for both single and multifamily homes. Another red flag for the economy.

Meta to Buy Nuclear Power from Constellation (CEG), as AI energy demand soars. The parent company of Facebook, Instagram, and WhatsApp signed a 20-year contract to buy 1,121 megawatts from Constellation’s Clinton plant starting in mid-2027, when a state subsidy expires. Constellation, the biggest US nuclear operator. Buy (CCJ) on dips.

Money is Fleeing Equity Funds. U.S. equity funds faced a second successive weekly outflow in the week through May 28 as tariff threats from and concerns over rising borrowing costs prompted investors to cut exposure to U.S. assets. Investors pulled a net $5.46 billion worth of capital from U.S. equity funds during the week, adding to the previous week’s $11.02 billion net sales, data from LSEG Lipper showed.

OPEC Plus is Ramping Up Production. The world’s largest group of oil producers, OPEC+, stuck to its guns at a Saturday online meeting with another big increase of 411,000 barrels per day for July as it looks to wrestle back market share and punish over-producers. Having spent years curbing production – more than 5 million barrels a day (bpd) or 5% of world demand – eight OPEC+ countries made a modest output increase in April before tripling it for May, June, and now July. Avoid all energy plays.

My Ten-Year View – A Reassessment

We have to substantially downsize our expectations of equity returns in view of the election outcome. My new American Golden Age, or the next Roaring Twenties, is now looking at multiple gale-force headwinds. The economy will completely stop decarbonizing. Technology innovation will slow. Trade wars will exact a high price. Inflation will return. The Dow Average will rise by 600% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old. My Dow 240,000 target has been pushed back to 2035.

On Monday, June 9, at 8:30 AM EST, the Wholesale Inventories are printed.

On Tuesday, June 10, at 7:30 AM, the Redbook Retail Sales is announced.

On Wednesday, June 11, at 1:00 PM, the Core Inflation Rate is released.

On Thursday, June 12, at 8:30 AM, the Weekly Jobless Claims are disclosed. We also get the Producer Price Index.

On Friday, June 13, at 7:30 AM, we get the University of Michigan Consumer Sentiment. At 1:00 PM, the Baker Hughes Rig Count is published.

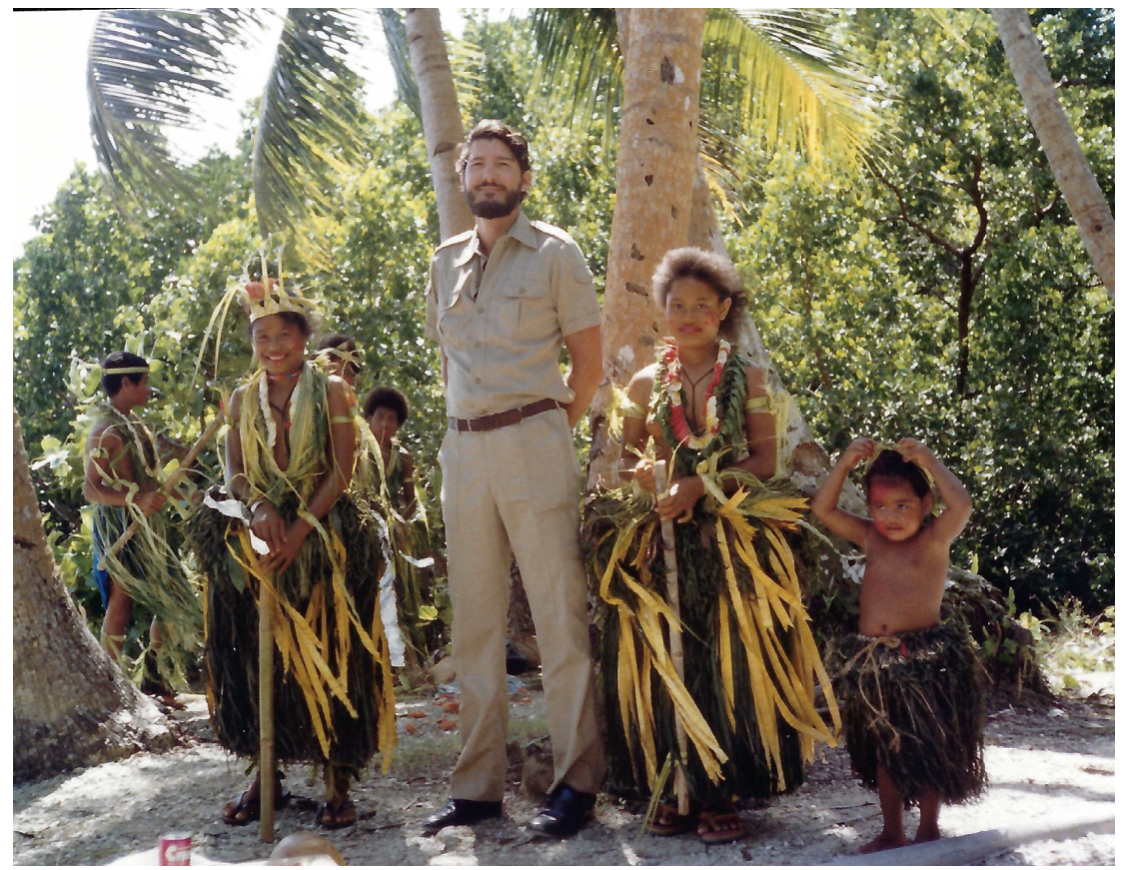

As for me, I didn’t know what to expect when I landed on the remote South Pacific Island of Yap in 1979, one of the Caroline Islands, but I was more than pleasantly surprised.

Barely out of the Stone Age, Yap lies some 3,000 miles west of Hawaii. It was famed for the ancient lichen-covered stone money that dotted the island, which had no actual intrinsic value.

The value was in the effort that went into transporting them. With some cylindrical pieces larger than cars, geologists later discovered that they had been transported some 280 miles by outrigger canoe from the point of origin sometime in the distant past. Since Yap had no written language, there are no records about them, only folktales.

I often use the stone money of Yap as an example of the arbitrariness of fiat money. Who’s to say which is more valuable: a 500-pound piece of rock or a freshly printed $100 Benjamin from the US Treasury?

You decide.

The natives were a gentle and friendly people. They wore grass skirts purely for the benefit of Western visitors. They preferred to walk around as nature made them.

There was no hotel on the island at the time, so I was invited to stay with a local chief (picture below).

One of my hosts asked if I was interested in seeing a Japanese Zero fighter. Yap wasn’t invaded by the US during WWII because it was bypassed by MacArthur on his way to the Philippines. The Japanese troops were repatriated after the war, but most of their equipment was left behind. It was still there.

So it was with some anticipation that I was led to a former Japanese airfield that had been abandoned for 35 years. There, still in perfect formation, was a squadron of zeroes. The jungle had reclaimed the field, and several planes had trees growing up through their wings.

The natives had long ago stripped them of anything of value, the machine guns, nameplates, and Japanese language instruments. But the airframes were still there, exposed to the elements and too fragile to move.

During my stay, I came across an American Peace Corps volunteer desperate for contact with home. A Jewish woman in her thirties, she had been sent there from New York City to teach English and seemed to have been forgotten by the agency.

I volunteered for the Peace Corps. myself out of college, but it turned out they had no need for biochemists in Fiji, so I was interested in learning about her experience. She confided in me that she had tried wearing a grass skirt to blend in, but got ants on the second day. We ended up spending a lot of time together, and I got a first-class tour of the island.

Suffice it to say that she was thrilled to run into a red-blooded American male. I wish I had taken a picture of her, but the nearest color film processing was back in Honolulu, and I had to be judicious in my use of film.

The highlight of the trip was a tribal stick dance put on in my honor around an evening bonfire among much yelping and whooping. It was actually a war dance performed with real war clubs, and their furiousness was impressive.

I had the fleeting thought that I might be on the menu. Cannibalism had been practiced here earlier in the century. During the war, when starvation was rampant, several of the least popular Japanese soldiers went missing, their bodies never found. When men come screaming at you with a club in the night, your imagination runs wild.

Alas, I could only spend a week on this idyllic island. I was on a tight schedule courtesy of Air Micronesia, and deadlines beckoned. Besides, there was only one plane a week off the island.

It was on to the next adventure.

A Few New Friends

Large Denomination Stone Money

My Accommodation

A Neglected Japanese Zero

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

“In the first Trump administration, he was surrounded by buffers. In this administration,n he is surrounded by accelerators,” said my old friend, New York Times columnist Thomas Friedman.

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Technology Letter

June 6, 2025

Fiat Lux

Featured Trade:

(BUYER BEWARE)

(TIKTOK)

Sometimes the best way to become successful at investing in technology stocks is to avoid the black swan or the big disaster.

I hate to say it, but investment risk has never been higher.

One question that keeps getting rehashed that I thought I might take time to address is the rise of the TikTok influencer-adviser.

According to a brief Google search, TikTok, known in China as Douyin, is a video-sharing social networking service owned by the Chinese company ByteDance.

The social media platform is used to make a variety of short-form videos, from genres like dance, comedy, and education, that have a duration from three seconds to one minute.

Unfortunately, for serious retail investors lately, content has migrated into high-stakes themes like financial education and financial advising, giving rise to content that is produced by video creators to get a piece of the financial industry.

Naturally, this has brought down the quality of the financial content on the internet to historic lows simply because most of the content is marginal at best.

These promulgators often preach about their status as “trading gurus” and often leverage the hype of digital currencies to claim they are fully invested in “crypto assets” and urge anyone reading to become one of their new “cult followers.”

They are also usually paid to market a “bulletproof” financial app or certain crypto asset to avid followers without properly disclosing that they are being paid for the advertisement.

This behavior is being encouraged by the TikTok algorithms who order this type of misleading content at the top of searches simply because it gets more hits being a click-bait type of content.

The more outlandish the videos become, gloating about get-rich-quick schemes and 1,000% daily returns, the higher up in the search queries they usually populate when filtered through TikTok algorithms.

These accounts are known as financial “influencers” and post 100s of such videos every month featuring fraudulent success or minimizing the difficulty of profiting through trading and a mix or mash of everything in between.

Even some proclaim to have unlocked the holy grail of trading and “guarantee” 100% returns or your money back.

Another speaking point they like to touch on is how video watchers can “also” afford wealthy lifestyles without having to work, at least in the traditional way.

To dumb down the travails of investing and trading to something easier than pouring a glass of water is a lie.

Many of these novice investors are duped into paying for exorbitant services that are nothing more than promotional buzz offering hyped-up marketing language as specific trading advice.

Unfortunately, US regulators have turned a blind eye to what is happening on this nefarious Chinese platform, and imitators are spawned daily and are certainly incentivized to do so.

While I must admit that regulating this type of behavior on TikTok is incredibly messy, to leave this unchecked will result in massive fraud for the little guy that I try to help.

The justification for ignoring these TikTok “influencers” is because there is even worse cybercrime taking place out there, and the content these influencers are peddling straddles the gray areas of the law.

But it’s not enough, and readers need to understand the heightened risks of diving feet first into these TikTok polar vortexes where you just get whipped around unknowingly.

Pre-emptively protecting your portfolio by avoiding these TikTok trading gurus is the order of the day.

As we enter the 2nd half of 2025, taking tabs of the fallout has been epic.

The TikTok crypto marketers were largely being sponsored by crypto exchange FTX.

They were peddling FTX’s own digital currency that was made out of thin air.

Anyone trading in this FTX in-house digital coin known as FTT lost most of their money as the CEO of FTX, Sam Bankman-Fried, was extradited back to the United States and found guilty in court.

FTX’s FTT coin went from $40 at the beginning of 2022 to 80 cents on December 30, 2022, highlighting the dangers of listening to fake crypto “trading gurus” on TikTok pushing FTT coin like there is no tomorrow.

Stay vigilant and happy trading and remember, there is no free lunch in trading.

It’s hard work earning your crust of bread.

BUYER BEWARE

“There are two kinds of companies, those that work to try to charge more and those that work to charge less. We will be the second.” – Said CEO and Founder of Amazon Jeff Bezos

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.