The Market Outlook for the Week Ahead, or Alarm Bells are Ringing

There is not a single hedge fund manager out there today who doesn’t believe that stock markets are on the verge of a very sharp selloff.

Earnings are falling. Europe is tipping into recession. The money supply is shrinking at a dramatic pace (see chart below). And government borrowing will double this year as compared to last. Yet the major indexes are 5% of an all-time high with valuations at an 18X multiple, the high end of the historic range.

You may be wondering why a correction, if not a new bear market, hasn’t already started yet. Every trader on Wall Street is nervously awaiting a China trade deal, possible weeks away, that they can all sell into, including me. The China negotiations have robbed traders of a decent short side entry point for a year now.

You may think I am being excessively cautious with these views. However, US equity mutual funds have suffered eleven straight weeks of outflows worth $80 billion, an all-time record. You really wonder what is supporting the market here. Are we in for a “Wiley Coyote” moment?

Who is left to buy the market? Short coverers, algorithms, and corporations buying back their own shares. There are in effect no real net investors.

One can’t help but notice the constantly worsening in the economic data that took place last week. Was this all happening in response to the December stock market crash? Or is it heralding a full-blown recession that has already started?

This is all backward-looking data, in some cases as much as two months. But what followed the December crash? The January government shut down which we already know pared 75 basis points off of Q1 GDP growth. That’s why companies announced middling earnings for Q4 but horrendous guidance for Q1.

December Retail Sales came in at a disastrous ten-year low. If you’re looking for an early recession indicator, this is a big one. Maybe it’s because the prices are falling so fast?

The NY Fed slashed Q1 GDP estimates to below 2% with more cuts to come. Trade war uncertainty cited as the number one reason.

Consumer Spending is slowing. That means the recession is near. Fund managers are universally moving into defensive and value stocks. So, should you.

Car Sales fell at the fastest rate in a decade, as US Manufacturing Output drives off a cliff. There is also a subprime crisis going on here, if you haven’t heard.

Amazon (AMZN) told New York City to drop dead as it canceled plans to build a second headquarters in New York, thanks to opposition from a local but vociferous minority. Some 25,000 jobs went down the toilet. More likely, they don’t want to expand their business right ahead of a recession. Jeff Bezos can see into the future infinitely better than you and I can.

You have to take Jeff’s thoughts seriously. Amazon added more square feet in the US than any other company last year, bringing the total to 288 million square feet. That is a staggering 28 World Trade Centers. Do they know something we don’t?

In the meantime, American Personal Debt is soaring, hitting a new apex at $13.5 trillion. Some 9.1% of this is already delinquent, and credit cards are being canceled at an alarming pace.

Business Confidence hit a two-year low, and Consumer Confidence hits an eight-year low. It seems a government shutdown and a stock market crash are not good for business. Now that stocks are up, will confidence return?

Inflation hit a one year low, with the Consumer Price Index coming in at only 1.9%. It means the next recession will bring deflation.

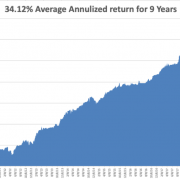

The Mad Hedge Market Timing Index is entering danger territory with a reading of 70 for the first time in five months. Better start taking profits on those aggressive leveraged longs you bought in early January. Your best performers are about to take a big hit. The market has since sold off 500 points proving its value.

There wasn’t much to do in the market this week, given that I am trying to wind my portfolio down to 100% cash as the market peaks.

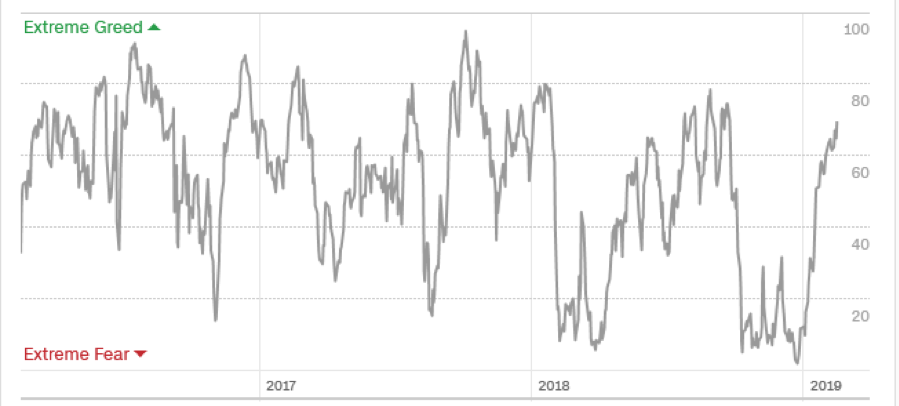

February has so far come in at a hot +3.31%. My 2019 year to date return leveled out at +12.79%, boosting my trailing one-year return back up to +34.12%.

My nine-year return clawed its way up to +312.93%, another new high. The average annualized return ratcheted up to +34.12%.

I am now 90% in cash and 10% long gold (GLD), a perfect downside hedge in a “RISK OFF”. We have managed to catch every major market trend this year, loading the boat with technology stocks at the beginning of January, selling short bonds, and buying gold (GLD).

Government data is finally starting to trickle out now that the government shutdown is over.

On Monday, February 18 was Presidents Day and the markets were closed.

On Tuesday, February 19, 10:00 AM EST, the Homebuilders Index is released.

On Wednesday, February 20 at 2:00 AM EST, Minutes from the January FOMC meeting are released. How dovish are they really?

Thursday, February 21 at 8:30 AM EST, we get Weekly Jobless Claims. At 10:00 AM, Existing Home Sales are out.

On Friday, February 22, there will be a half a dozen public Fed speakers suggesting that interest rates will go up, down, or sideways. The Baker-Hughes Rig Count follows at 1:00 PM.

As for me, I’ll be digging out from the massive series of snowstorms that hit me at my Lake Tahoe Estate. Snowfall this season has so far hit 50 feet and is challenging the 70-foot record from three years ago.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader