Intuit's Wake Up Call

Intuit Inc. (INTU), one of my favorite domestic cloud plays came to life Friday morning by posting earnings and revenue surpassing estimates.

Cha-Ching!

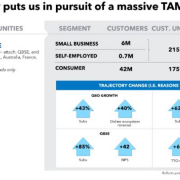

Intuit provides financial management and compliance products and services for small businesses, consumers, self-employed, and accounting professionals.

It’s not the sexiest company, but it does the job.

This is the perfect late economy cycle software stock to hide out while the two largest economies in the world battle it out on the geopolitical level.

And don’t worry, Chinese haven’t found a use case to rip off the software, insulating the products from any international exposure.

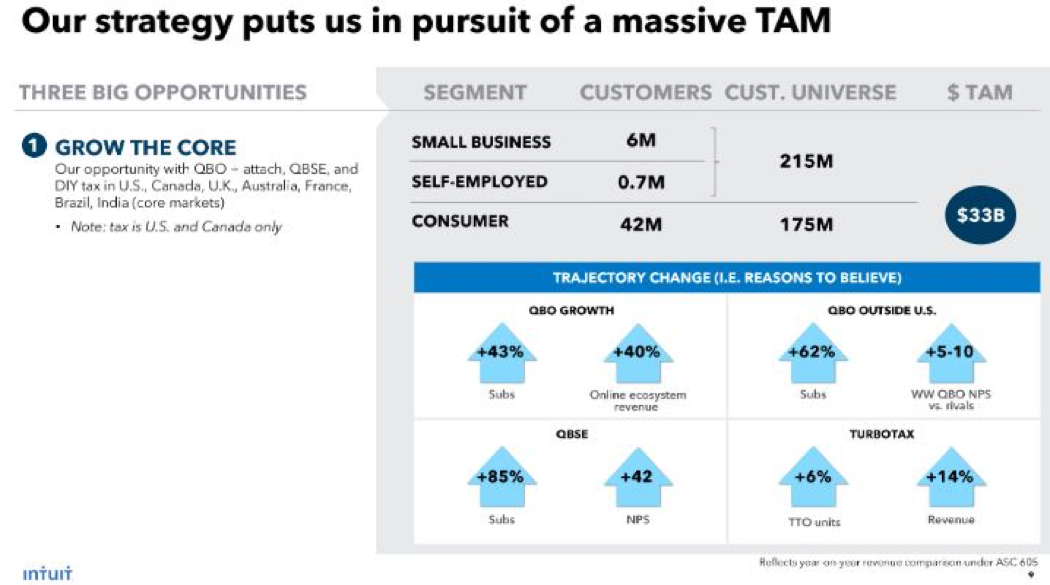

The stock responded in kind shooting up 7% and I have been keen on this name for quite a while.

Its non-GAAP loss was 9 cents per share slimmer than the expected loss of 14 cents.

Profit has improved 800% on a year-over-year basis on revenue grossing $994 million, up 15% from the year-ago quarter’s adjusted revenues.

Total revenue crushed estimates of $961 million by displaying robust momentum in online ecosystem revenues and growth in the consumer business.

We can attribute the startling outperformance to the 33% subscriber surge for QuickBooks Online, which tallied up more than 4.5 million at the end of the fiscal fourth quarter.

The Online ecosystem revenues jumped 35% to $459 million.

The U.S.-based subscribers of QuickBooks Online expanded 25% to more than 3.2 million while international subscribers rose 58% on a year-over-year basis to more than 1.3 million.

Can Intuit squeeze more juice out of the lemon for 2020?

Revenues are expected to register in the range of $7.44-$7.54 billion.

For the full fiscal year, Small Business and Self-Employed group is expected to grow 12-14% year-over-year.

The Consumer Group is expected to increase by 9-10%.

Intuit predicts revenue growth of 10-12% in the range of $1.12-$1.13 billion for the first quarter of fiscal 2020.

Intuit expects Online Ecosystem revenues to grow more than 30%.

There are some parts of this business that are supercharged with more than 30% expansion, hallmarks of a solid growth cloud company.

The reality is that in total, this is a company that is growing around 10% and the 8-10% projected for 2019 was eclipsed with growth of 13%.

Investors cannot expect growth that typifies Amazon Web Services or Microsoft Azure, but this stock remains a reliable yet unspectacular bet on the cloud names to advance.

Accountant software is not a fashionable business, but this software has to be classified as best in show.

If investors are keen on “buy the dip” strategies, this candidate should give one no pause in jumping in headfirst.

This stable cloud stock has tickled the fancy of investors already up 35% year to date and is resilient in times of stress.

The dips are shallow and the up moves impressive, hard not to like this stock.