January 29, 2010

January 29, 2010

Featured Trades: (McCARTHY HEARINGS),

(GOLD), (ABX), (PCY), (LQD)

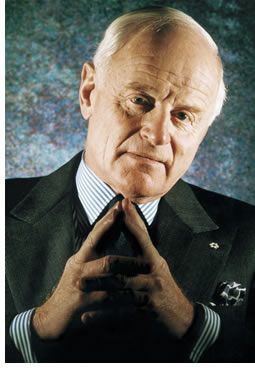

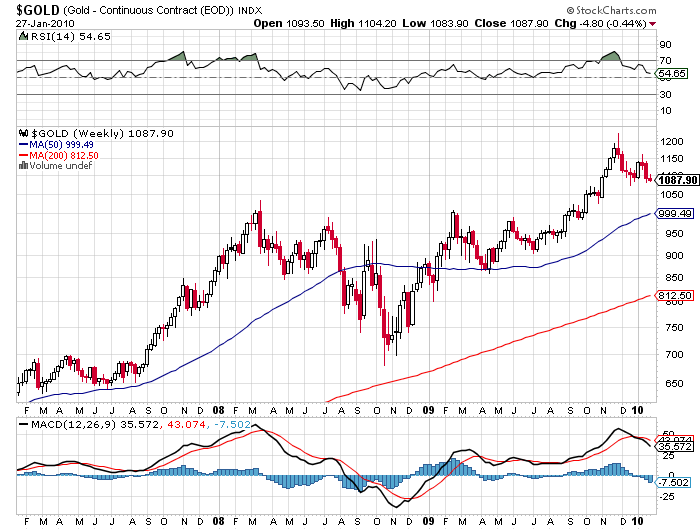

2) If you are wondering about the long term prospects for gold, just ask the guy who has the biggest bet in the market. That would be Peter Munk, founder and CEO of Barrick Gold (ABX). His company produced the 8 million ounces of the barbaric relic last year, has the world?s largest reserves, and mined 6 billion ounces of copper as a sideline. In September, Munk set the cat among the pigeons when his company announced that it would take off its gold hedges at a cost of $5 billion. The move provided the launching pad for a 25% spike up in gold to a new all time high. Munk?s confident explanation was that the long term future of the yellow metal was so secure that the hedges were no longer needed to smooth out his company?s earnings. No other asset class was up every year for the past decade. Investors are so scared from the events of the financial crisis, with banks dropping like flies and fund managers blowing up right and left, that it will influence their investment decisions for decades. That means building a core holding of gold to protect against the next crisis, whether it ever comes or not. Munk recommended against short term trading the shares of gold miners, but to keep a permanent asset allocation to the sector. Uncertainty is rising, is now a permanent feature of the investment landscape, and a short term rally in the stock market isn?t going to change that. The rise of middle class gold buyers in emerging markets is also something that isn?t going away in our lifetime. ?They make cheap suits in China, but not cheap gold,? he said. Munk?s comments reconfirm my own view that we may see some sideways action in precious metals for six months before the next blast up to a new high, getting us closer to my own target of $2,300. Better take another look at gold futures, coins, bullion, the ETF (GOLD), and ABX shares themselves.

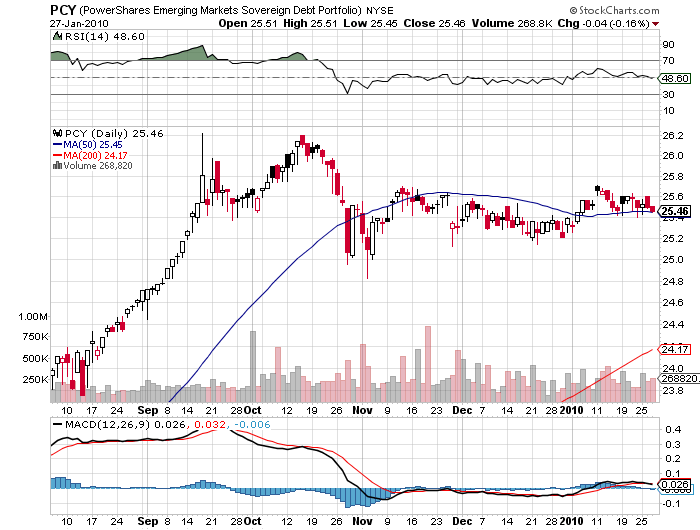

3) Last year, I suggested emerging market sovereign debt ETF?s as safe, high yielding investments in which to hide out in case the equity markets swoon again. The stock mrket looked pretty grizzly last week, so let?s see how they performed. The Invesco PowerShares Emerging Market Sovereign Debt ETF (PCY), which has 40% of its assets in Latin American bonds and 31% in Asia, was more or less unchanged. The two year old fund now boasts $451 million in market cap and pays a handy 6.29% dividend. This beats the daylights out of the one basis point you currently earn for cash, the 3.65% yield on 10 year Treasuries, and still exceeds the 5.37% dividend on the iShares Investment Grade Bond ETN (LQD), which buys predominantly single ?A? US corporates. The big difference here is that the countries that make up the PCY have a much rosier future of credit upgrades to look forward to. It turns out that many emerging markets have little or no debt, because until recently, investors thought their credit quality was too poor. No doubt a history of defaults in Brazil and Argentina in the seventies and eighties is at the back of their minds. Not so for the US, which has bond issuance going through the roof, and downgrade noises growing ever louder. A price appreciation of 125% over the past year tells you this is not exactly an undiscovered concept. Still, it is something to keep on your ?buy on dips? list.

. Since everything else Charles forecast is coming true, you better listen to his interview on Hedge Fund Radio one more time by clicking here

QUOTE OF THE DAY

?To stand back and let it burn is irresponsible,? said Treasury secretary

Tim Geithner during congressional hearings.